Aetna Medicare Part D

Aetna partnered with CVS to offer Medicare Part D plans through SilverScript. These plans cover your prescription medications.

You can enroll in a SilverScript Part D plan alongside your Original Medicare, with or without a Medicare Supplement plan. However, just because you choose to enroll in a plan through Aetna for Medigap doesnt mean that you must enroll in a Medicare Part D plan through them.

Regardless of which carrier you get your Medigap policy through, Part D through SilverScript may or may not be the best prescription drug coverage for you. It is still important to compare all available Medicare plans to receive the best coverage on your medications.

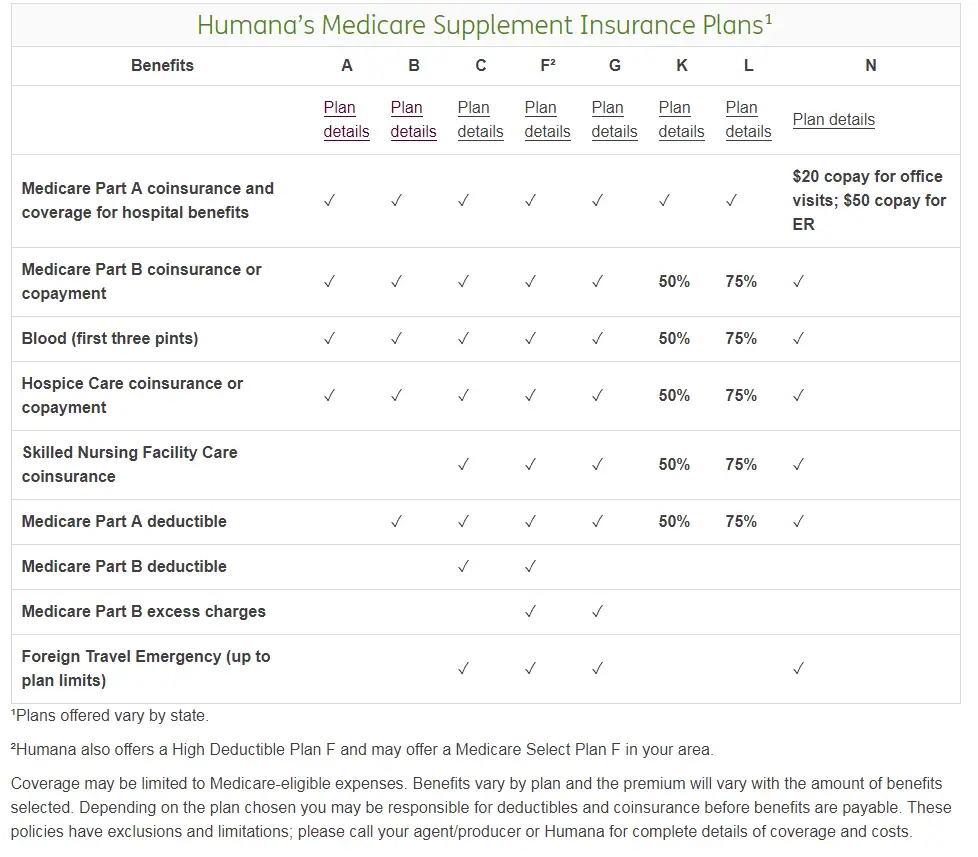

Which Of The Following Would A Medicare Supplement Policy Cover

Medicare Supplement insurance Plan A covers 100% of four things: Medicare Part A coinsurance payments for inpatient hospital care up to an additional 365 days after Medicare benefits are used up. Medicare Part B copayment or coinsurance expenses. The first 3 pints of blood used in a medical procedure.

Changing Part D Plans: The Final Steps

After youve found your new Part D plan and figured out the scheduling with enrollment periods, the rest of the process is pretty simple. You can enroll in your new plan either through Medicares online plan finder tool or by contacting the plan directly. Youll need the following information:

- Your Medicare number

- The policy and group numbers of your current plan

- The dates you want changes to take effect

More good news: You dont have to cancel your old Part D plan. The new plan will give your information to Medicare, then Medicare will inform your soon-to-be-canceled plan. That coverage will automatically end when your new coverage begins.

Recommended Reading: Will Medicare Pay For Ymca Membership

Also Check: Does Medicare Pay For Periodontal Surgery

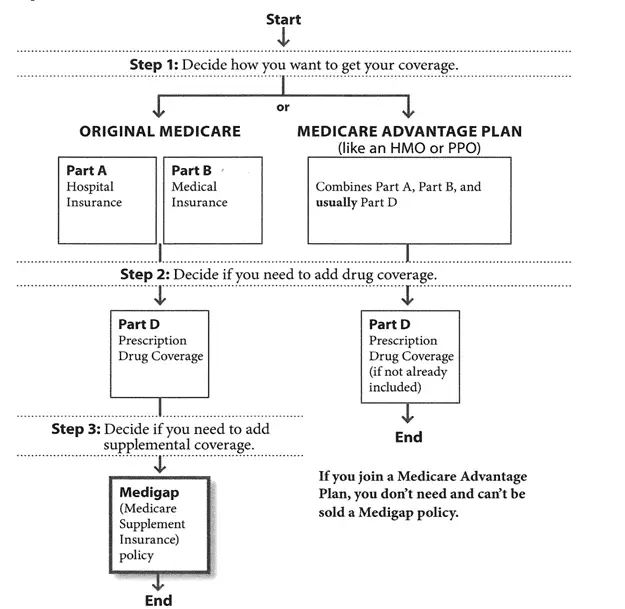

What Is A Medicare Supplement Plan

Medicare supplement plans are one health insurance option for people with Original Medicare. There are standardized Medicare supplement insurance plans available that are designed to fill the gaps left by Original Medicare . These are sold by private insurance companies as individual insurance policies and are regulated by the Department of Insurance. After age 65 and for the first six months of eligibility for Medicare Part B, beneficiaries have an Open Enrollment Period and are guaranteed the ability to buy any of these plans from any company that sells them. Companies cannot deny coverage or charge more for current or past health problems. If you fail to apply for a Medicare supplement within your Open Enrollment Period, you may lose the right to purchase a Medicare supplement policy without regard to your health.

Dont Miss: What Is A Medicare Special Needs Plan

Can You Disenroll From A Medicare Advantage Plan At Any Time

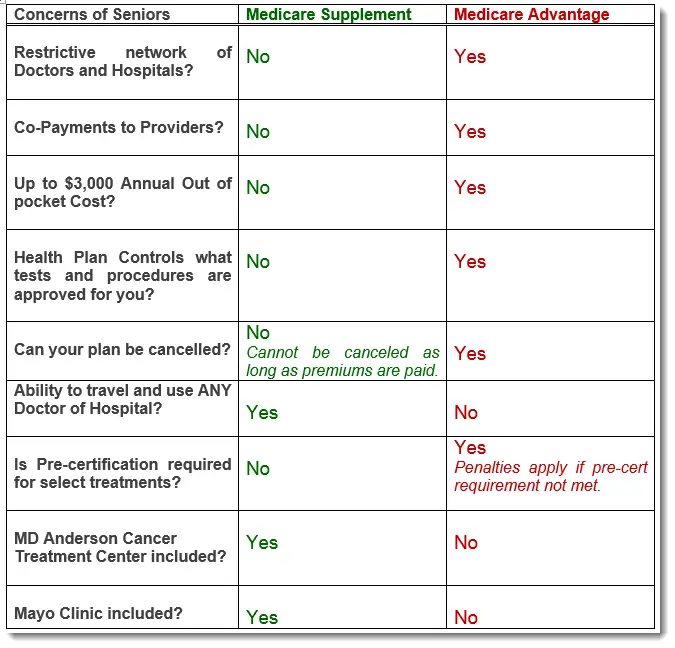

You can drop out of the plan and return to original Medicare, with the right to buy Medigap supplemental insurance, at any time during those first 12 months if you joined the plan straight away when you enrolled in Medicare at age 65, or if you dropped a Medigap policy to join the Advantage plan and this is the first.

You May Like: Does Medicare Pay For Dental Visits

Can I Switch Or Cancel My Medicare Supplemental Plan Anytime

There might be times when you want to switch or cancel your Medigap policy, for example because you are not satisfied with the customer service of your plan provider, the benefits of your plan dont match your medical needs anymore, or your policy is too expensive compared to other available options.

You may find yourself in a situation where you need to switch or cancel your plan for reasons other than dissatisfaction, for example if the provider gos out of business, or stops offering the plan in your area.

What Is A Medicare Prescription Drug Plan

First, lets review some basics about Medicare drug plans.

Medicare is a federally administered health insurance program for those 65 years and older, certain younger people with disabilities, and people with end-stage renal disease. A Medicare prescription drug plan adds prescription drug benefits to your health coverage.

You can either get prescription drug coverage through a Medicare Advantage plan or a stand-alone Medicare plan. Learn more about these two different plans here. And if youre ready to enroll, you can read more here.

Read Also: Does Medicare Cover Depends For Incontinence

When Can My Medicare Supplement Insurance Plan Be Canceled

Medicare Supplement insurance plans are sold by private companies to cover health care out-of-pocket costs that Medicare Part A and Part B do not pay, such as deductibles, copayments and coinsurance. All Medicare Supplement insurance plans issued since 1992 are guaranteed renewable. This means that there are only certain conditions under which your insurance company can cancel your Medicare Supplement insurance plan, such as:

- You stop paying your Medicare Supplement insurance plan premiums.

- You provided false information on the policy application.

- The insurance company becomes bankrupt or insolvent.

Your insurance company cannot drop you for developing a health problem.

If your insurer goes bankrupt or becomes insolvent, you are protected by a guaranteed-issue right and can enroll in another companyâs Medicare Supplement insurance plan without being subject to medical underwriting.

If you bought your policy before 1992, there is a possibility that the insurance company can refuse to renew the policy as long as it gets the stateâs approval. If your policy is canceled, you have the guaranteed-issue right to buy another Medicare Supplement insurance plan without being subject to medical underwriting.

Limited Part A And Part B Drug Coverage

Medicare parts A and B offer limited drug coverage under the scope of hospitalization or outpatient medical care. For example, original Medicare covers some antigens, injectable osteoporosis drugs, end-stage renal disease treatment, and drugs used with durable medical equipment such as a nebulizer. Drugs covered by Parts A and B generally include only those administered by a physician in an office or hospital or for specific conditions at home.

You May Like: How To Sign Up For Medicare In Michigan

Will I Owe A Part D Penalty If I Drop My Medigap Prescription Drug Coverage

A person who delays enrollment in a Part D plan or goes without creditable prescription coverage for more than 63 days may owe a penalty. Medicare requires newly eligible candidates to enroll in Part D during the first available annual enrollment period or adds a recurring penalty to their monthly premium for the remainder of their enrollment.

The penalty multiplies 1% of the national base premium by the number of whole months a recipient goes without creditable coverage or delays enrollment in Part D. In addition to incurring a costly permanent fee, delaying prescription drug coverage can be dangerous for recipients who may suddenly require a critical medication but are uninsured between limited enrollment periods.

What Is A Medigap Plan And Why Should I Buy It

A Medigap plan , sold by private companies, can help pay some of the health care costs Original Medicare doesn’t cover, like copayments, coinsurance and deductibles.

Some Medigap plans also offer coverage for services that Original Medicare doesn’t cover, like medical care when you travel outside the U.S. If you have Original Medicare and you buy a Medigap plan, Medicare will pay its share of the Medicare-approved amount for covered health care costs. Then your Medigap plan pays its share.

Recommended Reading: How Much Does It Cost For Medicare Part C

Can You Cancel Your Benefits At Any Time

You can cancel your individual health insurance plan without a qualifying life event at any time. On the other hand, you cannot cancel an employer-sponsored health policy at any time. If you want to cancel an employer plan outside of the companys open enrollment, it would require a qualifying life event .

Can I Keep My Medigap Policy If I Move Out Of State

I’m moving out of state. You can keep your current Medigap policy no matter where you live as long as you still have Original Medicare. If you want to switch to a different Medigap policy, you’ll have to check with your current or new insurance company to see if they’ll offer you a different policy. If you decide to switch, you may have …

You May Like: Where Do I Apply For Medicare Card

What Is The Open Enrollment Period

The open enrollment period is six months from the date a beneficiary is enrolled in Medicare Part B. During the open enrollment period, a person under 65 and on Medicare disability is only able to purchase Medicare supplement insurance Plans A, D or G. This is a special North Carolina law.

During the open enrollment period, the applicant is guaranteed to be issued a policy. Premiums may be higher for Medicare disability beneficiaries than for Medicare beneficiaries 65 or older. The insurance company may impose a pre-existing condition waiting period, but it cannot be longer than six months. This would include any health condition diagnosed or treated six months prior to the Medicare supplement application. If a person has prior creditable coverage, the waiting period must be waived. Creditable coverage is when the beneficiary has been covered by insurance or Medicaid for six months prior to the effective date of the Medicare supplement insurance policy. When a Medicare disabled beneficiary turns 65 years old, he or she will have a new six-month open enrollment period and be able to purchase any of the standardized Medicare supplement insurance.

For those persons that are retroactively enrolled in Medicare Part B due to a retroactive eligibility decision made by the Social Security Administration, the application must be submitted within a six-month period beginning with the month in which the person receives notification of the retroactive eligibility decision.

What It Means To Pay Primary/secondary

- The insurance that pays first pays up to the limits of its coverage.

- The one that pays second only pays if there are costs the primary insurer didn’t cover.

- The secondary payer may not pay all the remaining costs.

- If your group health plan or retiree coverage is the secondary payer, you may need to enroll in Medicare Part B before they’ll pay.

If the insurance company doesn’t pay the

promptly , your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should’ve made.

Also Check: How To Look Up A Medicare Number

How To Cancel Medicare Part C

If you wish to cancel your Medicare Part C plan, here is one option for cancelling your coverage:

- The Fall Annual Enrollment Period lasts from each year. During this time, you may disenroll from your Medicare Advantage plan and enroll in a different plan, or you can cancel your Medicare Advantage plan and revert back to Original Medicare coverage.

-

You can take advantage of the Medicare Advantage Open Enrollment Period, which runs each year from .

During this time, you can change from one Medicare Advantage plan to another, whether or not either plan includes prescription drug coverage.

You can also disenroll from your Medicare Advantage plan and switch back to Original Medicare . If you switch back to Original Medicare during this period, you can join a Medicare Part D prescription drug plan.

If you enroll in a Medicare Advantage plan during your Initial Enrollment Period , you can switch to another Medicare Advantage plan or cancel your Medicare Advantage plan and return to Original Medicare at any time during the first three months you have Medicare.

You may be able to cancel your Medicare Advantage plan if you qualify for a Special Enrollment Period .

Recommended Reading: Do People Pay For Medicare

How To Get Help Changing Your Medicare Supplement Policy

Many people think Medicare is free. But, there are many costs you need to understand. This is why our recommendation is Medigap coverage.Changing Medicare Supplement insurance can be more complicated than signing up for the first time. At MedicareFAQ, we want to make sure you get the coverage thats right for you, at the best possible price.The best plan for your neighbor may not be the best plan for you, let us help you get the coverage you deserve at a price you can afford.Well give you quotes, answer questions, and help you navigate the application process.Contact us today for a free quote by calling the number you see above. Our team of licensed insurance agents in your state are experts when it comes to Medicare guidelines and best practices.We know your time is valuable if you prefer to compare rates online then fill out our online rate form.

Recommended Reading: What’s The Cost Of Medicare Part D

How Long Do You Have To Buy Back A Medigap Policy

If you drop your Medigap plan because you enrolled in Medicare Advantage, you have special rights to buy back a Medigap policy if youre unhappy with the MA plan: You have 12 months from enrolling in the MA plan to buy back the same Medigap policy if you switch back to Original Medicare. If that policy is no longer available, you can purchase another one.

Can You Renew A Medigap Policy

If you bought your Medigap policy before 1992, it might not be guaranteed renewable. This means the Medigap insurance company can refuse to renew the Medigap policy. But, the insurance company must get the state’s approval to cancel your Medigap policy. If this happens, you have the right to buy another Medigap policy.

Don’t Miss: How Do I Change My Primary Care Physician With Medicare

Cobra Coverage From An Employer Plan

Federal and state law allows people who leave their jobs to continue their employer-sponsored health coverage for a period of time. Be aware of the following:

- You have an eight-month period after your employment ends to enroll in Medicare. If you dont enroll during that eight-month window, you might have to pay a penalty when you enroll.

- If youre in your Medicare initial enrollment period, you must enroll in Medicare during that time to avoid a possible penalty.

- If you dont buy a Medicare supplement policy during your open enrollment period, youll be able to buy some Medicare supplement plans within 63 days of losing your COBRA coverage.

Talk to your employer about COBRA and Medicare eligibility.

Get Help Switching Or Enrolling In A Medicare Advantage Plan

If you would like further help learning how to cancel your current Medicare coverage for a new Medicare Advantage plan, a licensed insurance agent can help guide you through the process.

Learn more about Medicare Advantage plans in your area and find a plan that fits your coverage needs and your budget.

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

The purpose of this communication is the solicitation of insurance. Callers will be directed to a licensed insurance agent with TZ Insurance Solutions LLC, TruBridge, Inc. and/or a third-party partner who can provide more information about Medicare Advantage Plans offered by one or several Medicare-contracted carrier. TZ Insurance Solutions LLC, TruBridge, Inc., and the licensed sales agents that may call you are not connected with or endorsed by the U.S. Government or the federal Medicare program.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Medicare has neither reviewed nor endorsed this information.

Also Check: Is Entyvio Covered By Medicare Part B

What If I Want To Switch My Medicare Supplement Insurance Plan

You may wish to switch Medicare Supplement insurance plans to pay a lower premium or get different coverage. If youâre outside your 6-month Medigap Open Enrollment Period and donât have guaranteed-issue rights, you may not be able to switch, or you may have to answer medical questions and be charged a higher premium. If you find an insurance company willing to sell you a policy, donât cancel your first policy until you are sure that you want keep the new policy. The first 30 days of the new policy is the period where you can decide if you want to keep the new policy. During this period, youâll need to pay the premium for both policies. Beyond this 30-day period, you canât have more than one Medicare Supplement insurance plan.

Keep in mind that a Medicare Supplement insurance plan only works with Medicare. You canât use these plans to pay for Medicare Advantage costs. If you switch from Medicare Part A and Part B to Medicare Advantage, you wonât be able to use your Medicare Supplement insurance plan to pay for any deductibles, copayments or coinsurance associated with the Medicare Advantage plan.

- If you wish to cancel your Medicare Supplement insurance plan, contact your insurance company.

- If you wish to apply outside of your open enrollment period or guaranteed-issue right, remember that you may be denied coverage or charged a higher premium based on your health condition.

Canceling A Marketplace Health Plan When You Get Medicaid

Canceling a Marketplace plan when you get Medicaid or CHIP. Once you get a final determination that youre eligible for Medicaid or the Childrens Health Insurance Program that counts as qualifying health coverage : You should immediately end Marketplace coverage with premium tax credits or other cost

Also Check: Do You Have To Enroll In Medicare

Can You Change Medicare Supplement Plans Anytime

Suppose you have a Medicare Supplement insurance plan, and you want to switch plans outside the OEP described above. In most cases the insurance company can review your medical records and consider your health condition. They can charge you a higher premium or even refuse to accept you as a member.

Certain situations might give you guaranteed-issue rights to change Medicare Supplement insurance plans. There are several situations when you might have guaranteed-issue rights. Here are a few of them:

- You signed up for a Medicare Advantage plan for the first time, and decided you want to drop the plan and buy a Medicare Supplement insurance plan instead.

- You have a Medicare SELECT plan, and youre moving out of the plans service area. Medicare SELECT plans are generally the only Medicare Supplement insurance plans that have provider networks that you might have to use. You can either change to a standardized Medicare Supplement insurance plan with the same or fewer basic benefits than your current plan, or buy any Medicare Supplement Plan A, B, C*, F*, K, or L.

- Youve had your current Medicare Supplement insurance plan for less than six months. If the insurance company agrees to sell you a new policy with the same basic benefits, it cant add conditions related to pre-existing health problems. However, you might have to wait up to six months before the plan covers your pre-existing condition.