Do I Have To Apply For Medicare Part B

If youre under age 65 and already receiving Social Security or Railroad Retirement Board disability benefits, youll be automatically enrolled in Medicare parts A and B when you turn 65. If you dont wish to have Medicare Part B, you can defer it at that time.

If youre not currently receiving these benefits, youll have to actively enroll in Medicare.

Important Medicare Deadlines

Its extremely important not to miss any Medicare deadlines, as this can cause you to face late penalties and gaps in your coverage. Here are the Medicare deadlines to pay close attention to:

- Original enrollment. You can enroll in Medicare Part B 3 months before, the month of, and 3 months after your 65th birthday.

- Medigap enrollment. You can enroll in a supplemental Medigap policy for up to 6 months after you turn 65 years old.

- Late enrollment. You can enroll in a Medicare plan or Medicare Advantage plan from January 1March 31 if you didnt sign up when you were first eligible.

- Medicare Part D enrollment. You can enroll in a Part D plan from April 1June 30 if you didnt sign up when you were first eligible.

- Plan change enrollment. You can enroll in, drop out of, or change your part C or Part D plan from October 15December 7, during the open enrollment period.

- Special enrollment. Under special circumstances, you may qualify for a special enrollment period of 8 months.

How To Find Plans That Offer The Giveback Benefit

Not all MA plans offer this benefit, so you must find a plan that does in order to take advantage of the opportunity. In 2022, these plans are offered in nearly all states, so you may find one close to you.

If you enroll in a plan that offers a giveback benefit, you’ll find a section in the plan’s summary of benefits or evidence of coverage that outlines the Part B premium buy-down. Here, you’ll see how much of a reduction you’ll get. You can also call us toll-free and one of our knowledgeable, licensed agents will answer your questions and explain your options.

Can I Delay Enrolling In Medicare Part B

Some people may get Medicare Part A âpremium-free,â but most people have to pay a monthly premium for Medicare Part B. Because Medicare Part B comes with a monthly premium, some people may choose not to sign up during their initial enrollment period if they are currently covered under an employer group plan .

If you are still working, you should check with your health benefits administrator to see how your insurance would work with Medicare. If you delay enrollment in Medicare Part B because you already have current employer health coverage, you can sign up later during a Special Enrollment Period without paying a late penalty. You can enroll in Medicare Part B at any time that you are still covered by a group plan based on current employment. After your employer health coverage ends or your employment ends , you have an eight-month special enrollment period to sign up for Part B without a late penalty.

Keep in mind that retiree coverage and COBRA are not considered health coverage based on current employment and would not qualify you for a special enrollment period. If you have COBRA after your employer coverage ends, you should not wait until your COBRA coverage ends to sign up for Medicare Part B. Your eight-month Part B special enrollment period begins immediately after your current employment or group plan ends . This is regardless of whether you get COBRA.

This information is not a complete description of benefits. Contact the plan for more information.

Also Check: Does Medicare Pay For Cpap Cleaner Machine

When Can I Enroll In Medicare Part B

If you are receiving retirement benefits before age 65 or qualify for Medicare through disability, generally youâre automatically enrolled in Medicare Part A and Part B as soon as you become eligible.

If you do not enroll during your initial enrollment period and do not qualify for a special enrollment period, you can also sign up during the annual General Enrollment Period, which runs from January 1 to March 31, with coverage starting July 1. You may have to pay a late enrollment penalty for not signing up when you were first eligible.

If youâre not automatically enrolled, you can apply for Medicare through Social Security, either in person at a local Social Security office, through the Social Security website, or by calling 1-800-772-1213 from 8AM to 7PM, Monday through Friday, all U.S. time zones.

Keep in mind that once you are both 65 years or older and have Medicare Part B, your six-month Medigap Open Enrollment Period begins. This is the best time to purchase a Medicare Supplement insurance plan because during open enrollment, you have a âguaranteed-issue rightâ to buy any Medigap plan without medical underwriting or paying a higher premium due to a pre-existing condition**. Once you are enrolled in Medicare Part B, be careful not to miss this one-time initial guaranteed-issue enrollment period for Medigap.

How Much Does Medicare Cost

Original Medicare

Original Medicare is divided into Part A and Part B .

- Part A helps pay for inpatient hospital care, some skilled nursing care, home health care and hospice care.

- Part B helps pay for doctor services, outpatient hospital care, durable medical equipment, home health care not covered by Part A, and other services. Medicare was never intended to pay 100% of medical bills. Its purpose is to help pay a portion of medical expenses. Medicare beneficiaries also pay a portion of their medical expenses, which includes deductibles, copayments, and services not covered by Medicare. The amounts of deductibles and copayments change at the beginning of each year.

Part A – Monthly Premium

If you are eligible, Part A is free because you or your spouse paid Medicare taxes while you were working. You earn Social Security “credits” as you work and pay taxes. For each year that you work, you earn 4 credits.

| $471 | $499 |

You are 65 or older, and you receive or are eligible to receive full benefits fr om Social Security or the Railroad Retirement Board

You are under 65, and you have received Social Security disability benefits for 24 months You are under 65, and you have received Railroad Retirement disability benefits and you meet Social Security disability requirements You or your spouse had Medicare-covered government employment You are under 65 and have End-Stage Renal Disease

Recommended Reading: Is Enbrel Covered By Medicare

What Is The Medicare Part B Late

If you do not sign up for Medicare Part B when you are first eligible, you may need to pay a late enrollment penalty for as long as you have Medicare. Your monthly Part B premium could be 10% higher for every full 12-month period that you were eligible for Part B, but didnât take it. This higher premium could be in effect for as long as you are enrolled in Medicare. For those who are not automatically enrolled, there are various Medicare enrollment periods during which you can apply for Medicare. Be aware that, with certain exceptions, there are late-enrollment penalties for not signing up for Medicare when you are first eligible.

One exception is if you have health coverage through an employer health plan or through your spouseâs employer plan, you can delay Medicare Part B enrollment without paying a late-enrollment penalty. This health coverage must be based on current employment, meaning that COBRA or retiree benefits arenât considered current employer health coverage.

Read Also: Does Medicare Cover Bed Rails

Benefits Of Medicare Part B

Medicare Part B covers a variety of routine healthcare visits and treatments. If you can afford the premiums, then you may want to take advantage of this program, as it could help offset the cost of ongoing medical care. Depending on your eligibility, you may not have a choice when it comes to Medicare Part B.

However, financial need could help you pay for a portion or all of your monthly premiums. Dont hesitate to contact a representative from your local Social Security office to find out more about your unique situation. Just remember to conduct your own research well ahead of time, so that you dont incur unnecessary late fees in the future.

Don’t Miss: Does Medicare Cover Psychological Therapy

Disability & Medicare Eligibility And Enrollment What You Need To Know In 2022

Some people can qualify for Medicare due to disability. In this case, if you have a qualifying disability, you are eligible for Medicare even if you are not yet age 65. To find out if your disability qualifies for disability benefits or for Medicare, youll need to speak with Social Security directly, but in general, you become eligible the 25th month of receiving Social Security Disability Insurance benefits .

If you have a qualifying disability, you must first file for disability benefits through Social Security before you can even be considered eligible for Medicare due to disability. Approval of the request by Social Security is an important first step. It is also important to note that these benefits are different from Supplemental Security Income benefits, and that SSI benefits do not qualify you for Medicare.

When Can You Enroll In Medicare Part B

You can sign up for Medicare Part B during the 7-month period that begins 3 months before your 65th birthday and 3 three months after that birthday.

If you have ALS, you may enroll in Medicare as soon as your Social Security disability insurance goes into effect.

If you have ESRD, you can enroll for Medicare starting on the first day of your fourth month of dialysis. If you do home dialysis, you dont have to wait 4 months and can apply immediately.

You may also apply immediately for Medicare if youre hospitalized for a kidney transplant.

Don’t Miss: How Do I Sign Up For Medicare A

When Can You Enroll In Or Change Medicare Plans

Each year, between October 15 and December 7, the Medicare Open Enrollment Period , also known as the Annual Election Period , is when beneficiaries can review their coverage and make changes to their Medicare plans. The following is achievable at present time:

- Switching from Original Medicare Parts A and B to a Part C plan

- Return to Original Medicare after leaving Medicare Advantage

- Join a Part D prescription medication plan, leave it, or change it.

- Alternate Medicare Advantage programs

During the Medicare Advantage Open Enrollment Periods, if youre a Medicare Advantage plan subscriber, there are additional chances to review your insurance . The first is the yearly window that runs from January 1 through March 31 during which anyone with a Medicare Advantage plan may switch plans. The second is an exclusive Medicare Advantage Open Enrollment Period for new beneficiaries who enroll in an MA plan within the first three months of receiving Medicare. A three-month window for switching plans is provided by the MA OEP. You can: During these times

- Switch to a different Medicare Advantage plan

- Change to Original Medicare and a standalone Part D plan from a Medicare Advantage plan.

When Your Coverage Starts

The date your coverage starts depends on which month you sign up during your Initial Enrollment Period. Coverage always starts on the first of the month.

If you qualify for Premium-free Part A: Your Part A coverage starts the month you turn 65.

Part B : Coverage starts based on the month you sign up:

|

If you sign up: |

|

|---|---|

|

1 month after you turn 65 |

In 2022: 2 months after you sign up Starting January 1, 2023: the next month |

|

2 or 3 months after you turn 65 |

In 2022: 3 months after you sign up Starting January 1, 2023: the next month |

Don’t Miss: Is Medicare Enrollment Required At Age 65

What Does Medicare Cover

Medicare helps pay for certain health care services and durable medical equipment. To have full Medicare coverage, Medicare beneficiaries must have Part A and Part B .

The following is a partial list of Medicare-covered services. The covered services listed below may require payment of deductibles and Co-Payments.

If you have questions about covered services, call Medicare at 1-800-633-4227.

Optional Benefits For Calpers Contracting Agencies

United Healthcare

UnitedHealthcare offers two health plan options for Medicare retirees from contracting agencies: a PPO plan with dental and vision, and a PPO plan without dental and vision. The PPO with dental and vision coverage is available to Medicare-eligible members not covered under their retirement benefits for an additional premium per Medicare member, per month. UHC will bill you directly for this amount.

Kaiser Permanente Senior Advantage

Kaiser Permanente Senior Advantage also offers two health plan options for Medicare retirees from contracting agencies: an HMO plan with a dental option and an HMO plan without a dental option. The plan with the dental option has an additional premium per Medicare member, per month. Delta Dental will bill you directly for this amount.

Recommended Reading: When Is The Earliest You Can Apply For Medicare

Medicare Part B Premiums

Generally, most 2022 Medicare members must pay a monthly Part B premium of $170.10.

Your Part B premium could be higher depending on your income. If your modified adjusted gross income from 2 years ago is above a certain amount, youll pay the standard premium plus whats called an Income Related Monthly Adjustment Amount . To see if this applies to you, look at your past income tax return. Youll find your modified adjusted gross income there.

For most people, paying the premium is simple. Your Part B premium will be automatically deducted from your benefit payment if you get benefits from 1 of these:

- Social Security

- Office of Personnel Management

Can I Opt Out Of Medicare Part B

A. Yes, you can opt out of Part B. (But make sure that your new employer insurance is primary to Medicare. … Medicare insists on an interview to make sure you know the consequences of dropping out of Part Bfor example, that you might have to pay a late penalty if you want to re-enroll in the program in the future.

Read Also: Is Shingrix Vaccine Covered By Medicare

Am I Eligible For Coverage

You become eligible for Medicare-covered hospice care when you meet all of the following requirements:

- Your regular doctor and hospice doctor certify that you are terminally ill and have 6 months or less to live.

- You choose palliative care for comfort instead of treatments to cure your illness or prolong your life.

- You sign a form stating your choice for hospice care instead of treatment-related care.

When you receive hospice care, your comfort is the most important priority. Many different hospice services are available, based on your end-of-life needs. These may include:

- doctor and nursing services

- physical, occupational, and speech therapy

- grief counseling for you and your family members

- short-term inpatient or respite care

While Medicare generally covers almost everything related to hospice care , it doesnt cover living expenses while at home or at another living facility.

How Do I Apply For Medicare Part B

Beneficiaries collecting Social Security benefits when they age into Medicare at 65 will automatically enroll. If this is the case for you, you will receive your Medicare card one to three months before your 65th birthday. If you are not collecting Social Security benefits, you will need to enroll yourself. You can apply for Medicare Part B online, over the phone, or in person.

All beneficiaries will have an Initial Enrollment Period for Original Medicare. Your Initial Enrollment Period begins three months before your 65th birth month and ends three months after you turn 65. If you do not enroll during your Initial Enrollment Period and do not have creditable coverage, you could be subject to a penalty when you decide to enroll in the future.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Also Check: Is Home Health Covered By Medicare

The Cares Act Of 2020

On March 27, 2020, President Trump signed into law a $2 trillion coronavirus emergency stimulus package called the CARES Act. It expands Medicare’s ability to cover treatment and services for those affected by COVID-19. The CARES Act also:

- Increases flexibility for Medicare to cover telehealth services.

- Increases Medicare payments for COVID-19ârelated hospital stays and durable medical equipment.

For Medicaid, the CARES Act clarifies that non-expansion states can use the Medicaid program to cover COVID-19ârelated services for uninsured adults who would have qualified for Medicaid if the state had chosen to expand. Other populations with limited Medicaid coverage are also eligible for coverage under this state option.

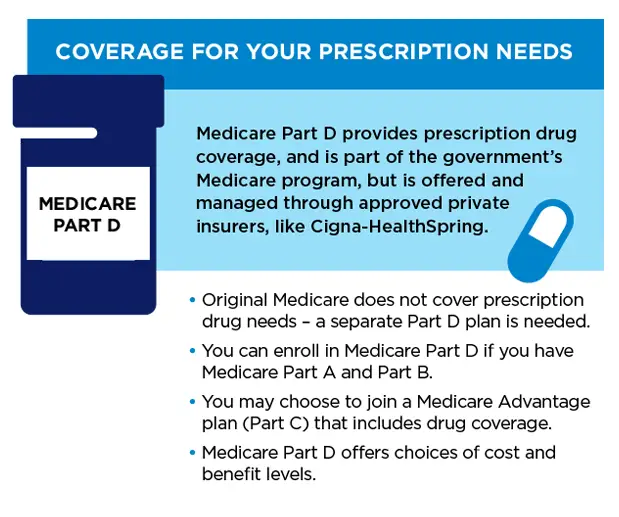

Medicare Part D And Calpers Medicare Health Plans

CalPERS participates in a Medicare Part D prescription drug plan for members enrolled in a CalPERS Medicare health plan.

The standard Part D premium is paid through your CalPERS health insurance premium. If your income exceeds a federal threshold as determined by the SSA, you may be subject to an additional Income Related Monthly Adjustment Amount for Part D prescription drug premiums. You’ll either receive an invoice for the additional amount, or it’ll be deducted from your Social Security benefits. Non-payment of the additional prescription drug premium will result in cancellation of your CalPERS health coverage.

If you enroll in a CalPERS-sponsored Medicare Advantage Plan that includes Part D prescription drug coverage in its benefit package and you are subject to an additional Medicare Part D premium, you must pay the additional Medicare Part D premium, or your health coverage will be canceled. If you re-enroll at a later date, you may incur a federal late enrollment penalty.

Do not enroll in a non-CalPERS Medicare Part D plan. If you do so, CMS will disenroll you from your CalPERS-sponsored Medicare Advantage Plan or Medicare Part D prescription drug plan resulting in cancellation of your CalPERS health coverage and you’ll be responsible for your prescription drug costs.

Don’t Miss: What Are The Parts Of Medicare