How Do I Decide Between Medicare Supplement Plan F And Plan G

Our clients often ask us for help comparing Medicare Plan F vs. Plan G. We understand it can be a tough decision to make. Well help you compare the plans so that you can feel confident in your choice. First, lets take a look at what benefits the two plans cover.

| Medigap Plan Benefits | ||

|---|---|---|

| Part A coinsurance & hospital costs | Yes | |

| Part B coinsurance or copayment | Yes | |

| Part A hospice care coinsurance | Yes | |

| Skilled nursing facility care coinsurance | Yes | |

| Part B deductible | Yes | |

| Foreign travel emergency | Yes | Yes |

Compare Medigap Plan G With Other Medicare Supplement Plans

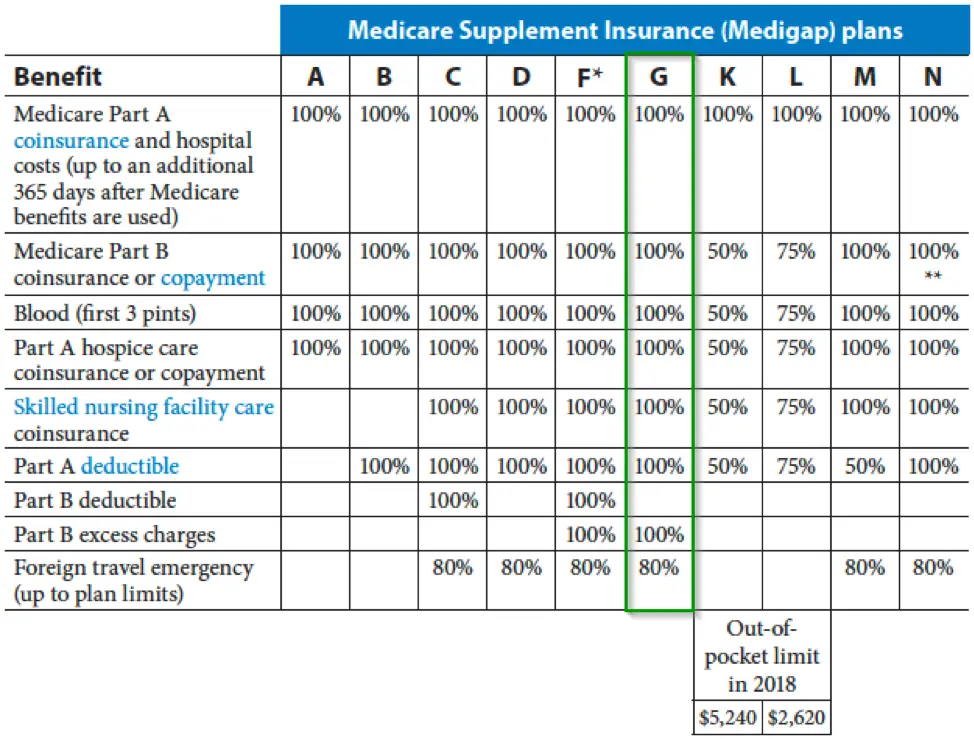

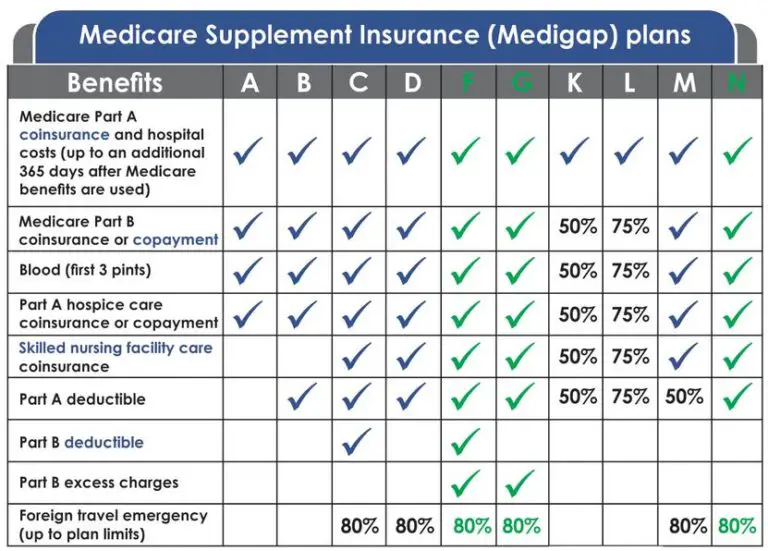

All 10 Medigap policies must follow federal and state laws designed to protect the policy holder. Basic benefit details of each plan letter must be the same no matter where the plan is purchased. Cost is generally the only difference between Medigap policies of the same letter, as the insurance companies may charge different rates for these plans.

What Is The Plan G Deductible In 2021

There are two version of Medigap Plan G: a standard version and a high-deductible version.

The standard version of Plan G has no deductible, which means your Plan G coverage will begin with the very first dollar spent on covered care. The high-deductible version features a deductible of $2,370 that must be met before the plan coverage kicks in.

The tradeoff for the high-deductible version of Plan G is that it typically comes at a lower monthly premium than the standard version of the plan.

Also Check: What Is Medicare Insurance Plans

What Is High Deductible Plan F

The coverage for High Deductible Plan F is nearly the same as Medicare Supplement Plan F, but youre required to satisfy a $2,370 deductible before the plan begins to pay like a normal Plan F. In 2021, you have to pay $2,370 in shared costs before you get the same benefits of regular Plan F. Please note, a High Deductible Plan F also is not available to new Medicare enrollees in 2021.

Help Me Choose A Plan

Not sure what you need? Answer a few questions to help you decide. Get started

Now that youve picked a plan, its time to enroll.

File is in portable document format . To view this file, you may need to install a PDF reader program. Most PDF readers are a free download. One option is Adobe® Reader® which has a built-in screen reader. Other Adobe accessibility tools and information can be downloaded at

You are leaving this website/app . This new site may be offered by a vendor or an independent third party. The site may also contain non-Medicare related information. In addition, some sites may require you to agree to their terms of use and privacy policy.

Also Check: How To Find Out If I Have Medicare

What Are The Eligibility Requirements For Aarp Medicare Supplement Plan G

You must be enrolled in Medicare Part A and Part B before you can apply for Medicare Supplement Insurance Plan G. And you must be at least 65 years old to purchase Medigap in some but not all states. Lastly, you must live in the area that is serviced by the plan. While Medigap can be used anywhere that Original Medicare is accepted, it can only be purchased in the county or zip code in which you reside.

To apply for AARP Medicare Supplement Plan G or any other Medigap plan from AARP, you must be an AARP member. Memberships are $16 per year in 2021 and include a number of savings and discounts on travel, dining, shopping and more.

Which Of These Medicare Supplement Plans Is Right For Me

Medicare Supplement Plan F has the most comprehensive benefits of the three your out-of-pocket Medicare costs with this plan are generally minimal. However, Plan F premiums may also be higher compared to Medicare Supplement Plan G or Plan N. Premiums may vary from one company to the next, even for the same plan.

Medicare Supplement Plan G might be a good choice if youre someone who uses a lot of health-care services each year, but you dont want to pay a high premium. Once you pay your Part B deductible, most of your Medicare out-of-pocket costs may be covered.

Medicare Supplement Plan N has fairly comprehensive benefits, as well, and if youre someone who doesnt visit the doctor a lot, your Medicare out-of-pocket costs will be very low. This plan may also have the lowest monthly premium of the three, depending on the insurance company you choose.

Whatever plan you choose, its usually best to buy it during your Medicare Supplement Open Enrollment Period . Your six-month OEP starts the month youre both 65 or older, and enrolled in Medicare Part B. During this time, you can buy any Medicare Supplement plan sold in your state, and you cant be charged more due to your health status. If you wait until after the OEP, you may be charged more or turned down for coverage if you have a health condition.

New To Medicare?

Becoming eligible for Medicare can be daunting. But don’t worry, we’re here to help you understand Medicare in 15 minutes or less.

Read Also: How Old To Be Eligible For Medicare

Are All Medicare Supplement Plans The Same

People often ask are all Medicare Supplement plans the same?

If the plans have the same corresponding letter, then they are the same. For example, one insurance company is selling a plan F or a plan G and another insurance company selling the same plan F and plan G. The benefits under both of those are the same. Typically, the differences youd encounter would be the deductibles that you would be responsible for, coinsurance, and co-payments.

If you do have questions about different types of Medicare Supplement plans do some investigating. See what plan is going to work best for you. There are a variety of different plans out there. Theres plans F and G also Medicare Supplement K, L, M, and N. Each of these plans provide a separate benefit level. Make sure youre buying the most appropriate plan for you.

What Is Included In Medicare Supplemental Plan G

Medicare Plan G covers almost everything Original Medicare does not. It doesnt extend the scope of care, just the amount of coverage included. Plan G coverage includes excess charges that are left over from the 80% that Original Medicare does not cover, including Part A and Part B copays and Part As deductible. The other big difference: Plan G does not cover the Part B deductible, which needs to be met. However, that payment does count toward the Plan G deductible as well.

The Plan B deductible for 2020 is $203, so youll have to pay at least this much, but that means you can subtract that amount from your expected Plan G deductible as well.

Read Also: Is Keystone 65 A Medicare Advantage Plan

Should I Buy Medicare Supplement Plan F Or G

Your unique health insurance needs, budget, and individual quote will help you determine if Plan F, G or a different Medigap plan is right for you. Each Medigap insurance company has different rates, which are often based on gender, age, zip code, and tobacco status. If you rarely go to the doctor, Plan G may be an attractive option since youre not spending money out-of-pocket towards the deductible. However, if the premium for Plan F is minimal compared to Plan G, it may be the better option. Another thing to consider is that in 2020, Plan F will be going away, however, those who already have Plan F can be grandfathered in to keep it.

If youre looking for another similar option, consider High-Deductible Plan F. It typically has a lower premium than both Medigap Plans F and G, and essentially offers the same coverage however, your deductible would be much higher than both Medigap Plan F and G. For example, your premium may cost less than $50 per month, but your deductible may be as high as $2,200, which you would have to pay out-of-pocket before your plan starts paying.

Learn More About Medigap Plans In Your Area

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

The purpose of this communication is the solicitation of insurance. Callers will be directed to a licensed insurance agent with TZ Insurance Solutions LLC, TruBridge, Inc. and/or a third-party partner who can provide more information about Medicare Advantage Plans offered by one or several Medicare-contracted carrier. TZ Insurance Solutions LLC, TruBridge, Inc., and the licensed sales agents that may call you are not connected with or endorsed by the U.S. Government or the federal Medicare program.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Medicare has neither reviewed nor endorsed this information.

Also Check: How To Check Medicare Status Online

Rates For Medicare Supplement Plan G

While the benefits of Medicare Supplement Plan G remain the same regardless of your insurance company , in some states the premium you pay may vary according to a number of factors, including age, location, gender, and overall health.

Cigna offers competitive rates and, in some states, a 7% household premium discount5 may be available for qualified applicants.

Is Medigap Plan C And Medicare Part C The Same

No. Even though Medigap Plan C and Medicare Part C sound similar, they are very different. Medigap is Medicare Supplemental insurance to help cover costs if you have Original Medicare. Whereas Medicare Part C is an alternative to Original Medicare, combining Parts A, B and sometimes D. Medicare Part C plans may also include additional benefits like dental, vision and hearing.

Recommended Reading: What Age Does Medicare Eligibility Start

Medicare Supplement Plans In Virginia For People Under Age 65

Because premiums are significantly higher for Medicare recipients under the age of 65, Virginia requires Medigap insurers to offer them at least one Medigap plan. Who qualifies for Medicare under age 65? Social Security disability recipients , plus individuals diagnosed with End-stage Renal Disease and permanent kidney failure.

If youre disabled and receiving Social Security benefits, you automatically qualify for SSDI after 2 years. In Virginia, 13% of all Medicare recipients are under the age of 65. Virginia has recently enacted laws to make sure these individuals can take advantage of Medigap plans as well. Still, people under age 65 do pay more.

Medicare recipients in Virginia age 65 or older average monthly premiums anywhere from $100 to $160. Compare that to beneficiaries under the age of 65 who pay from $400 to $650 per month. Diasabled recipients do have access to lower rates when they turn 65.

Insurance companies in Virginia are not required to sell Medigap policies to recipients who are under age 65.

What Plan G Doesnt Cover

As we already stated, Plan G does not cover the Part B deductible. In addition, no Medigap plan, including Plan G, covers routine dental care.

Plan G will cover the coinsurance on any medications covered by Part B, which are usually drugs that are administered in a clinical setting, such as a doctors office or outpatient chemotherapy or infusion center. It does not cover outpatient retail prescriptions, which are covered by Medicare Part D prescription drug plans.

Don’t Miss: What Age Can You Get Medicare Health Insurance

How Do Medicare Supplement Insurance Plans Work With Original Medicare

Medicare Supplement plans work alongside your Original Medicare coverage to help cover some of the costs you would otherwise have to pay on your own. These plans, also known as “Medigap”, are standardized plans. Each plan has a letter assigned to it, and offers the same basic benefits. The basic benefit structure for each plan is the same, no matter which insurance company is selling it to you. Note: The letters assigned to Medicare Supplement plans are not the same things as the parts of Medicare. For example, Medicare Supplement Plan A is not the same as Medicare Part A .

How Much Does Medicare Plan G Cost

The premium you pay for a Plan G policy may depend on where you live, your gender and depending on when you apply for Plan G your health status. According to MedicareSupplement.com, the average monthly premium for Plan G is $122.78 per month.

Its easy to see how Plan G can quickly save you money, depending on the health care services you need. All those Medicare copays and coinsurance costs for supplies and services can add up quickly.

Don’t Miss: Does Kaiser Medicare Cover Dental

Compare These Plans Side

If a “yes” appears, the plan covers the described benefit 100%. If a row lists a percentage, the policy covers that percentage of the described benefit. If a “no” appears, the policy doesn’t cover that benefit.

| Medigap Benefits | ||

|---|---|---|

| Part A: inpatient hospital deductible | No | |

| Part A: skilled nursing facility coinsurance | Yes | Yes |

| Part B: deductible** | ||

| Coverage while in a foreign country | No | |

| State-mandated benefits | Yes |

* The plan pays 100% after you spend $1,000 in out-of-pocket costs for a calendar year.

**Coverage of the Part B deductible will no longer be available to people who are new to Medicare on or after January 1, 2020. However, if you were eligible for Medicare before January 1, 2020 but not yet enrolled, you may be able to get this benefit

Where Can I Buy Medicare Supplement Plan G

You can buy MedSup Plan G and every other MedSup plan from any insurance company that’s licensed in your state to sell Medicare Supplement coverage.

Remember, all Plan G policies must provide the same benefits or coverages. Just like all Plan F policies must provide the same benefits or coverages.

Insurers can and do charge different amounts for the MedSup Plan G policies they sell, though. Dont enroll in the first one you come across while shopping around. Compare the various costs associated with the plans sold in your area before you make your final decision.

Recommended Reading: When Can You Get Medicare Health Insurance

A Closer Look At Medicare

Medicare is a government-run health insurance for people 65 or older, certain people under 65 with disabilities and people of any age with End-Stage Renal Disease .

There are different parts of Medicare that help cover different services. Part A covers the care and treatment of patients in hospitals or other medical facilities. For example:

-

Hospice care

-

Home health care

-

Nursing facility care

Part B covers outpatient care and services. This includes bills for physical therapy, specialist consultations and rehabilitation.

Part B also helps cover preventative services like vaccines and screenings, as well as the cost of wheelchairs and walkers.

The Medicare Part D plan helps with prescription drug coverage. These plans are run by private insurance companies.

What Do Medicare Supplement Plans Cover

Medigap plans will cover the gapsleftover from Original Medicare. Medicare alone has many out-of-pocket costs below is a chart taken from the Medicare and You Guidebook.

Read more about what Original Medicare covers here.

Medicare Supplement plans only cover services that are approved by Medicare. The supplemental is secondary to Medicare. If Medicare doesnt approve your claim, then the Supplement plan will not pay.

Also Check: Does Costco Pharmacy Accept Medicare

How And When To Enroll In Plan G

The best time to enroll in Medigap Plan G or any Medigap plan is during your Open Enrollment Period . Your OEP begins when you turn 65, and your Medicare Part B is effective. Medicare enrollees 65 years or older can purchase a Medicare Supplement Plan at any time, though if you purchase the plan outside of your OEP, you may be subject to health screenings and medical underwriting. However, if you enrol during your OEP, then healthy individuals and those with health conditions alike will pay the same for Medigap Plan G.

If you are less than 65-years old but you have Medicare, you may still be able to enroll in a Medigap plan, depending on where you live. Some states may require Medigap insurance companies to sell Medigap plans to Medicare recipients under the age of 65. However, each state has its own rules for health screenings, rates, and Open Enrollment for Medicare beneficiaries younger than 65. Check with one of our licensed agents today to see if you qualify.

Where Can You Buy Medicare Supplement Plan G

Private insurance companies sell Medigap policies. You can use Medicares search tool to find out which plans are offered in your area. Youll need to enter your ZIP code and select your county to see available plans. Each plan will be listed with a monthly premium range, other potential costs, and what is and isnt covered.

You can also look at the companies that offer each plan and how they set their monthly premiums. Because the cost of a Medigap policy can vary by company, its very important to compare several Medigap policies before selecting one.

You May Like: What Does Original Medicare Mean

Is Plan G The Best Medicare Supplement Plan

It really depends on what you want. Suppose youre looking for a comprehensive basic Medicare Supplement plan. In that case, for coverage that fills in gaps not provided by Original Medicare, Plan G is a good option, especially if you recently became eligible for Medicare and cant sign up for Plan F. However, if you want more bundled coverage or dental or vision coverage, or dont think youll need the benefits Plan G offers , another Medicare Plan might be better for you.