How Do I Pay Premiums For Medicare Part B

If you receive Social Security benefits or Railroad Retirement Board benefits a program that began in the 1930s for the nations railroad workers and is still in effect your Medicare Part B premium is automatically deducted from those benefits, and you wont receive a bill.

If you arent receiving Social Security benefits yet, youll receive a quarterly bill from Medicare for your Part B premium. You have four ways to pay it:

1. Log into your online Medicare account and pay by credit card, debit card or electronic funds transfer from your checking or savings account.

After you log in, select My premiums from the drop-down menu under your name, then Pay Now and choose your payment method and the amount you want to pay. Youll be linked to the U.S. Treasurys secure Pay.gov site to complete your payment.

Keep the confirmation number youll receive as a record that youve paid. Expect your bank to take about five business days to process a transfer from your checking or savings account. Credit card payments are generally processed faster.

2. Sign up for Medicare Easy Pay. With this free service, Medicare automatically deducts the premium payments from your savings or checking account each month. Deductions are made on the 20th of the month or the next business day.

Once your account is established, youll receive a monthly statement letting you know the amount Easy Pay will deduct from your bank account. Your bank statement will show a payment to CMS Medicare Premiums.

Why Are Medicare Costs So High

Americans spend a huge amount on healthcare every year, and the cost keeps rising. In part, this increase is due to government policy and the inception of national programs like Medicare and Medicaid. There are also short-term factors, such as the 2020 financial crisis, that push up the cost of health insurance.

Are Medicare Premiums Paid Monthly Or Quarterly

How often will I get a Medicare bill? If you buy only Part B, youll get a Medicare Premium Bill every 3 months. If you buy Part A or if you owe Part D IRMAA, youll get a Medicare Premium Bill every month.

Can I pay Medicare Part B monthly instead of quarterly?

Part B: If you receive retirement benefits from Social Security, the Railroad Retirement Board or the civil service, your Part B premiums are automatically deducted from your monthly paymentstheres no other option. But if you dont get any of those benefits, Medicare will send quarterly bills.

Do you have to pay a premium for Medicare Part B?

You pay a premium each month for Part B. Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: If you dont get these benefit payments, youll get a bill. Most people will pay the standard premium amount.

Recommended Reading: Does United Healthcare Medicare Supplement Cover Eye Exams

Medicare Part B Costs

Most people pay the standard Part B premium. In 2021, that amount is $148.50.

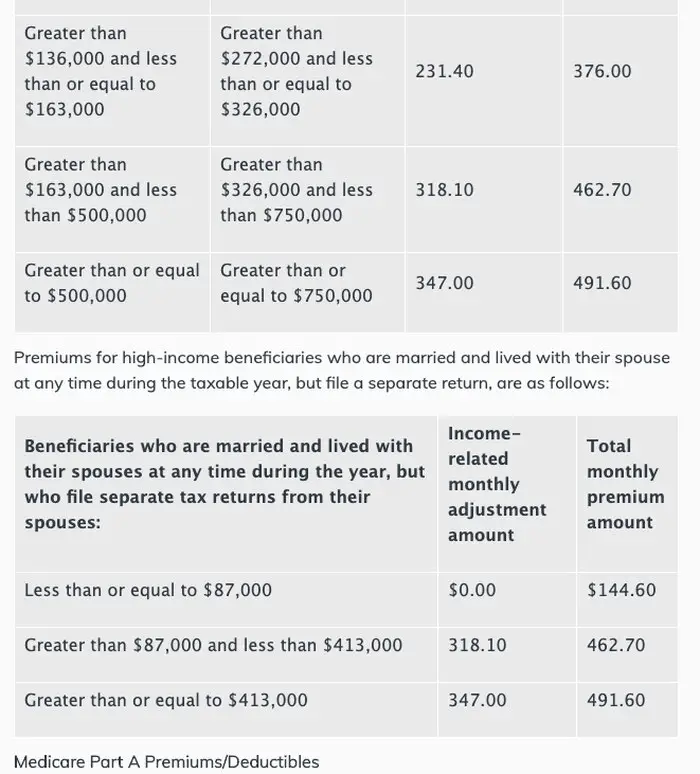

If the modified adjusted gross income you reported on your taxes from 2 years ago is higher than a certain limit, though, you may need to pay a monthly IRMAA in addition to your premium. The maximum you can expect to pay for your Part B premium is $504.90 per month.

Medicare Part B also has out-of-pocket costs associated with it. These include an annual deductible of $203. After youve met your deductible, youll pay coinsurance on most services that Medicare Part B covers. This amount is 20 percent of the Medicare-approved costs of services and supplies.

How Do I Pay Premiums For Medicare Part A

You typically wont pay a premium for Medicare Part A if you or your spouse had Medicare taxes deducted from your pay for 10 years of work. In Medicare speak, thats 40 quarters on the calendar, and they dont have to be continuous.

If neither you nor your spouse worked that long, you can count on a premium payment every month. In 2022, if you or your spouse paid Medicare taxes for 30 to 39 quarters, youll pay $274 a month for Part A . If you or your spouse paid Medicare taxes for fewer than 30 quarters, youll pay $499 a month for Part A .

Medicare will bill you for any Part A premium you owe, and you have the option of paying electronically or by mail. Details are below.

Don’t Miss: Does Medicare Pay For Eyeglasses For Diabetics

Did You Delay Signing Up For Medicare

If you delayed Medicare enrollment and did not qualify for a Special Enrollment Period , your monthly premiums may be higher due to late enrollment penalties.

American citizens qualify for Medicare when they turn 65. You may also qualify before turning 65 if you have a disability, end-stage renal disease , or amyotrophic lateral sclerosis . Your Initial Enrollment Period begins 3 months before your eligibility month and ends 7 months later. So, if your birthday or 65th month of collecting disability is in June, your IEP begins March 1 and ends September 30.

The only people who are automatically enrolled in Medicare are those who were collecting either Railroad Retirement Board or Social Security benefits at least 4 months before their 65th birthday. Everyone else has to apply for Medicare.

In addition, even those who are automatically enrolled in Medicare must choose to join a Medicare Part D prescription drug plan. If you’re late signing up for Original Medicare and/or Medicare Part D, you may owe late enrollment penalties. This amount is added to your Medicare Premium Bill and may be why your first Medicare bill was higher than you expected.

Set Up Online Bill Payment With Your Bank

Set up your one-time or recurring payment correctly with your bank. Enter your information carefully, to make sure your payment goes through on time.

Give the bank this information:

- Your 11-character Medicare Number: Enter the numbers and letters with NO DASHES, spaces, or extra characters. Where to find your Medicare NumberThe letters B, I, L, O, S, and Z arent used in Medicare Numbers. If you see a 0 in your Medicare Number, enter it as a zero, not the letter O.

- Payee name: CMS Medicare Insurance

- Payee address:St. Louis, MO 63179-0355

- The amount of your payment

The bank might mail a paper check even if youve set up an online payment. Why would the bank mail my payment?

Generally, online payments process in 5 business days. If your bank mails a check, it may take longer. Your bank statement will show a payment made to CMS Medicare.

Pay the correct amount

If you want to have automatic payments set up that will update if your premium changes, sign up for Medicare Easy Pay. Get details about Easy Pay.

You May Like: Does Medicare Pay For Biopsy

What About Part C And Part D

Youll pay your Part C or Part D bill directly to the insurance company. Each company has their own preferred methods, and not all companies accept all payment types.

Generally, you should be able to:

- pay online with a debit or credit card

- set up automatic payments

- use your banks automatic bill pay feature

You might also be able to set up a direct deduction for your retirement or disability payments.

You can contact your plan provider to find out what payment options are available. They can also let you know if theres anything you should be aware of with each payment type, such as added fees or time delays.

Medicare Typically Bills In 3

Medicare helps pay for a variety of healthcare services, but it isn’t free. Beneficiaries are responsible for a variety of Medicare costs, including monthly premiums, deductibles, and coinsurance or copayments.

Most Medicare beneficiaries collect Social Security benefits. For these enrollees, Medicare premiums are deducted from their monthly Social Security check. But if you haven’t retired yet, you have to pay your bill directly to Medicare. Or, if you’re what Medicare terms a high earner, you may pay more for Medicare. This page looks at a number of reasons your first Medicare bill may be higher than you expected.

You May Like: Is Medicare Advantage Part C

Is Medicare Free At Age 65

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

When Do I Pay For My Medicare Premiums

If you enroll in Medicare before you begin collecting Social Security benefits, your first premium bill may surprise you. It will be due, paid in full, 1 month before your Medicare coverage begins.

This bill will typically be for 3 months worth of Part B premiums. So, its known as a quarterly bill.

If you have original Medicare , youll continue to receive bills directly from Medicare until you start collecting either Social Security or RRB benefits. Once your benefits begin, your premiums will be taken directly out of your monthly payments.

Youll also receive bills directly from your plans provider if you have any of the following types of plans:

- Medicare Part D, which is prescription drug coverage

- Medigap, also called Medicare supplement insurance

The structure of these bills and their payment period may vary from insurer to insurer.

Social Security and RRB benefits are paid in arrears. This means that the benefit check you receive is for the previous month. For example, the Social Security benefit check you receive in August is for July benefits. The Medicare premium deducted from that check will also be for July.

Read Also: Do You Have To Have Medicare At 65

Medicare Premium Assistance Program

This program helps people eligible for Medicare who have limited income and assets get help in paying the cost of one or more of the following:

- Medicare premium

- Medicare copays

To qualify for MPAP, applicants must be eligible for Medicare and meet basic requirements.

When applying for MPAP, proof of income, resources, age or disability, citizenship or non-citizen status, and other health insurance is required.

No face-to-face interview with the local County Department of Job and Family Services is necessary. Applicants can ask an authorized representative to apply on their behalf.

Is Medicare Part A Free At Age 65

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

Also Check: Do I Really Need A Medicare Advantage Plan

More Answers: Premium Tax Credits

- My eligibility results say Im also eligible for “cost-sharing reductions.” What does that mean?

-

In addition to a premium credit, your income qualifies you to save on the out-of-pocket costs you pay whenever you get health care, like deductibles and copayments. But you get these additional savings only if you buy a plan in the Silver category. Learn about cost-sharing reductions.

- What if my income is too high for a premium tax credit?

-

You can still use the Marketplace to buy a health plan without a premium tax credit. You can also buy a plan outside the Marketplace, where you may find more options.

Ask Bob: Will My Medicare Premiums Be Refunded When I Die

Question

I have never seen anyone address the Medicare payment issue regarding Social Security.

When I turned 65 years old, I had to start paying a three-month premium to Medicare. I was working but my medical insurance company informed me that I had to start making Medicare payments. Those payments were for Medicare coverage for the forthcoming next three months. I was informed that Medicare payments were for the future month, and that Social Security payments were for the prior month.

Does this mean that upon my death my last Social Security payment will NOT have Medicare taken out, or that my beneficiary will get a refund for the last month of Medicare payment that I did not need?

Answer

The short answer is yes, your estate will get a refund for the last months Medicare Part B premium and any Income Related Monthly Adjustment Amounts that you will not need, says Dr. Katy Votava, president of Goodcare.com.

The reason, she explains, is that Social Security retirement benefits are paid one month in arrears. Once a person receives Social Security retirement benefits and is on Medicare, the Medicare B premiums and IRMAA are paid monthly in advance as a deduction from the retirement distribution.

Read Also: Does Medicare Need Pre Authorization

Medicare Waiting Period: Waivers Options And Costs

Medicare Benefits Experts say that people younger than 65 and qualified to access specific benefits may need to wait for 2 years before they can claim Medicare benefits. However, in some cases, Medicare may decide relinquish the waiting period. Medicare made numerous updates to their plan in 1973. One of …

Open Enrollment For Texans With Disabilities

People under age 65 who get Medicare because of disabilities have a six-month open enrollment period beginning the day they enroll in Medicare Part B. This open enrollment right only applies to Medicare supplement Plan A.

Note: People who have Medicare because of disabilities have another open enrollment period during the first six months after turning 65.

Also Check: How To Get A Wheelchair From Medicare

Why Do You Have To Pay For Medicare Part B

Part B is optional. Part B helps pay for covered medical services and items when they are medically necessary. Part B also covers some preventive services like exams, lab tests, and screening shots to help prevent, find, or manage a medical problem. Cost: If you have Part B, you pay a Part B premium each month.

Are Medicare Premiums Paid A Month In Advance

Medicare is made up of multiple parts, and each part may have a monthly premium you’ll need to pay. … If you’re not receiving these benefits, you’ll get a bill for your premiums, either monthly or quarterly, depending on which part of Medicare you’re paying for. These bills are paid in advance of your coverage.

You May Like: How To Apply For Medicare Advantage

Why Is Medicare Sending Me A Bill

If you get help with Medicare costs through a state Medicaid program, such as a Medicare Savings Program, then your Medicare premiums may be paid for by the state. … In this case, your Medicare plan will send you a bill for your premium, and you’ll send the payment to your plan, not the Medicare program.

The Premium Tax Credit

The IRS will soon mail letters on behalf of the Center for Medicare & Medicaid Services, sharing information about obtaining Marketplace healthcare coverage. More information is available in the IRS Statement about Letter 6534.

The premium tax credit also known as PTC is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased through the Health Insurance Marketplace. To get this credit, you must meet certain requirements and file a tax return with Form 8962, Premium Tax Credit .

2021 and 2022 PTC Eligibility. For tax years 2021 and 2022, the American Rescue Plan Act of 2021 temporarily expanded eligibility for the premium tax credit by eliminating the rule that a taxpayer with household income above 400% of the federal poverty line cannot qualify for a premium tax credit.

2021 Unemployment Compensation. If you, or your spouse , received, or were approved to receive, unemployment compensation for any week beginning during 2021, the amount of your household income is considered to be no greater than 133% of the federal poverty line for your family size and you are considered to have met the household income requirements for eligibility for a premium tax credit. Keep any supporting documentation related to receiving or the approval to receive unemployment compensation with your tax return records.

Also Check: Does Medicare Cover Full Body Scans

Medicare Premium Payments By Mail

- Mail your check or money order to Medicare at Medicare Premium Collection Center, P.O. Box 790355, St. Louis, MO 63179-0355. Follow the instructions in your Medicare premium bill and mail your payment to the address listed in the form.

Note: If your Medicare premium bill comes from the Railroad Retirement Board, or if you receive Civil Service benefits, see the information at the end of this article.

Premiums For Other Types Of Medicare Coverage

You may have to pay an additional premium if youâre enrolled in a Medicare Prescription Drug Plan, Medicare Supplement plan, or Medicare Advantage plan. In this case, your plan will send you a bill for your premium, and youâll send the payment to your plan, not the Medicare program. Some Medicare Advantage plans may offer premiums as low as $0. However, remember that regardless of whether you owe a premium for your Medicare plan, youâll need to keep paying your Medicare Part B premium.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealthâs Medicare related content is compliant with CMS regulations, you can rest assured youâre getting accurate information so you can make the right decisions for your coverage.Read more to learn about our Compliance Program.

You May Like: Is Medicare Or Medicaid For Old People

What Is The Medicare Part B Premium For 2021

Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.