Delaying Enrollment In Medicare When Youre Eligible For It Could Result In A Penalty That Will Remain In Effect For The Rest Of Your Life

Your initial window to enroll in Medicare begins three months before the month of your 65th birthday, and ends three months after that month.

While Medicare Part A which covers hospital care is free for most enrollees, Part B which covers doctor visits, diagnostics, and preventive care charges participants a premium. Those premiums are a burden for many seniors, but heres how you can pay less for them.

You Have Private Insurance Coverage Through Your Employer Or A Spouses Employer

When youre eligible for Medicare, you can still have private insurance coverage provided by an employer. Generally speaking, youre eligible for Medicare when you:

- have a qualifying disability

- receive a diagnosis of ESRD or ALS

How Medicare works with your group plans coverage depends on your particular situation, such as:

- If youre age 65 or older. In companies with 20 or more employees, your group health plan pays first. In companies with fewer than 20 employees, Medicare pays first.

- If you have a disability or ALS. In companies with 100 or more employees, your group health plan pays first. When a company has fewer than 100 employees, Medicare pays first.

- If you have ESRD. Your group health plan pays first during a 30-month coordination period. This is regardless of the number of employees your company has or whether youre retired.

Its possible that your company may offer you coverage under a group plan after you retire. This is called retiree coverage. In this case, Medicare pays first and your retiree coverage pays second.

Some health insurance plans, such as Health Maintenance Organization and Preferred Provider Organization plans, require you to use in-network providers. If this is the case with your group health plan and it pays first, you may not be covered by Medicare if you choose to use an out-of-network provider.

Cundo Cubre Medicare Parte D La Insulina

Los planes de medicamentos recetados de Medicare Parte D pueden cubrir la insulina inyectable que no se utiliza con una bomba de infusión de insulina y la insulina inhalada.4 Los planes de la Parte D que participan en el modelo de ahorro para personas mayores de la Parte D, que Humana llama el , también pueden ofrecer opciones de cobertura que incluyen varios tipos de insulina por un copago máximo de $35 para un suministro de 30 días.5

Algunos suministros para diabéticos que Medicare Parte D puede ayudar a cubrir son:6

- Plumas de insulina con o sin insulina incluida

- Dispositivos de insulina inhalada con o sin insulina incluida

Also Check: What Is Troop In Medicare

Recommended Reading: Will Medicare Pay For Lasik Eye Surgery

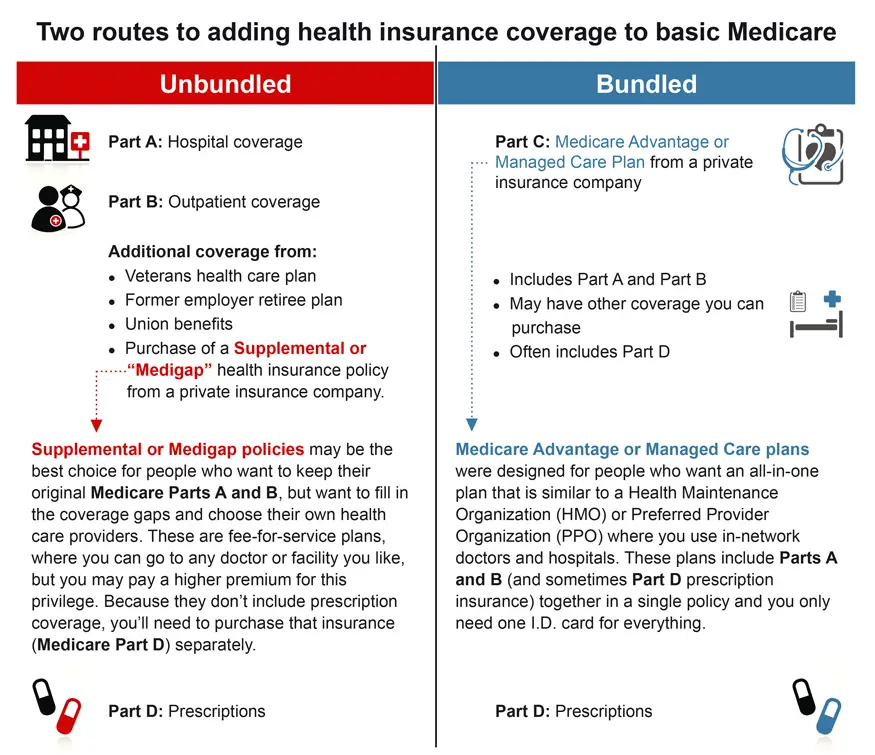

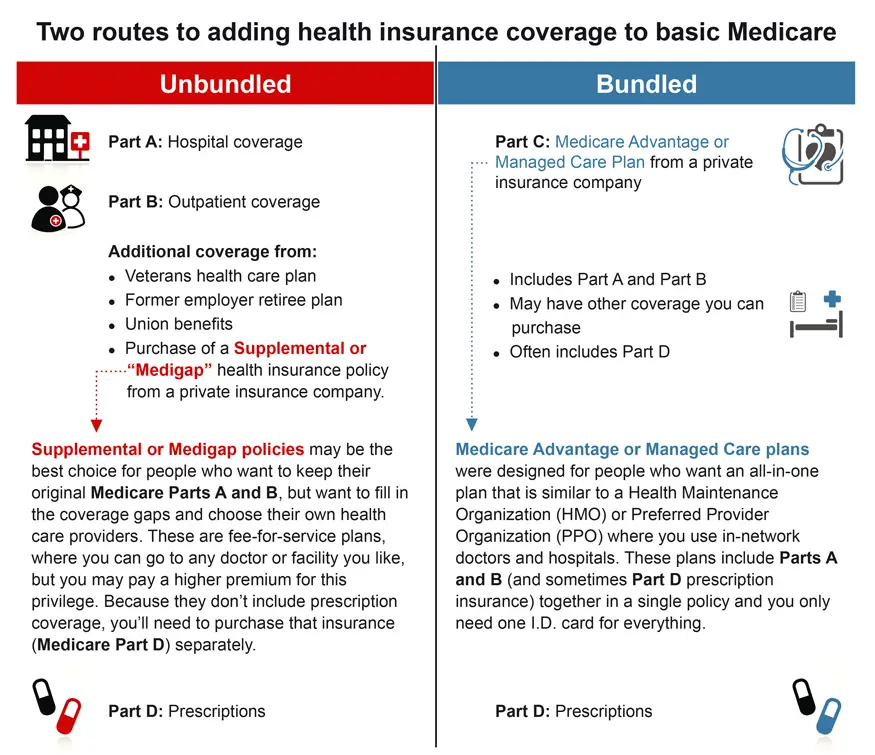

Why Would I Need More Health Insurance If I Have Medicare

Itâs important to understand that Original Medicare, Part A and Part B, doesnât include most prescription drug coverage. If youâd like Medicare prescription drug coverage, you can get it from a private health insurance company that contracts with Medicare.

Besides getting prescription drug coverage, you may have other options when youâre first eligible for Medicare.

When Does Medicare Coverage Start

Medicare coverage is dependent on when you have signed up and your sign-up period. Coverage always starts on the first of the month.

If you meet the criteria for Premium-free Part A, your coverage starts the month you turn 65-years old or the month before if your birthday is the first of the month.

Part B and Premium-Part A plans are dependent on sign-up:

You can also sign up for Premium-free Part A after your 65th birthday. Coverage starts 6 months back from sign-up or when you apply for benefits from Social Security or the Railroad Retirement Board.

After your IEP is over, you can only sign up for Part B and Premium-Part A during the other periods of General Enrollment or Special Enrollment.

For Original Medicare, the General Enrollment Period is Jan. 1 March 31, with coverage beginning on July 1. You may have to pay a monthly late enrollment penalty if you do not qualify for Special Situations.

Under Special Situations or the SEP, you can sign up for Part B and Premium-Part A without paying a late enrollment penalty. Your coverage will start next month. Access your situation and

Don’t Miss: Which Medicare Insurance Is Best

How Much Does Medicare Part A Cost

Medicare Part A is free for those who have paid Medicare taxes for at least 40 quarters. You can buy Medicare Part A if you didnt work enough quarters. The amount youll pay is based on the number of quarters you worked. Those who worked less than 30 quarters will pay $499 per month in 2022. Those who worked at least 30 quarters are eligible for a reduced premium rate of $274 per month.

What Is The Medicare Part B Giveback Benefit

The Medicare Giveback Benefit is a Part B premium reduction offered by some Medicare Part C plans.

If you enroll in a Medicare Advantage plan with this benefit, the plan carrier will pay some or all of your Part B monthly premium. The amount covered can range from 10 cents to the full Part B premium cost .

Recommended Reading: Does Medicare Cover Caregiver Services

Access Your Benefits And Save Money On Drugs

Most HAP plans include prescription drug coverage. We want to make sure you get the pharmacy benefits you need.For the most detailed, up-to-date information about your personal prescription drug coverage, log in and click My Prescription Coverage. You also can browse these resources for your type of plan.

What Is Catastrophic Coverage

If you are young andhealthy, you may consider catastrophic insurance instead of a qualified plan. A catastrophic policy offers verylimited coverage for those under 30 who qualify for a hardship exemption and cant afford qualified health coverage. Catastrophiccoverage offers the same benefits as qualified plans. However, you will need tomeet a high deductible before coverage begins. In 2020, the deductible for catastrophicplans is $8,150.

A catastrophic planmight help with high expenses from a severe illness or accidental injury. Itmight be less helpful with routine health care, however. In these cases, youare unlikely to meet the yearly deductible. This means you would pay all yourhealthcare expenses out of pocket.

Read Also: What Is The Difference Between Medicare Supplemental And Advantage Plans

The Downside Of Delaying Medicare

There are several parts of Medicare that will penalize you for enrolling after your Initial Enrollment Period is over. Also, you may face additional costs if you delay enrolling in a Medicare Supplement plan. Its important to note that only certain plans allow you to delay enrolling in Medicare without facing penalties.

| Increased Premiums | |

| Medicare Supplement Plans | There are no penalties for applying for a Medigap plan after your enrollment period. However, you wont get your best price possible. Thats because you qualify to enroll in a Medigap plan without any medical underwriting during your IEP. After this time has ended, your medical history, age, and other factors can be used to increase your premium. You could also be denied coverage based on your health. |

What Is Private Insurance

Private insurance is offered by health insurance companies.

You can access private insurance through individual or group plans. Many employers offer health coverage as part of their benefit. When health insurance is offered through an employer, the employer will generally pay a portion or all of the premium.

If you purchase individual insurance, you can also access the federal Healthcare Marketplace. There are four tiers of coverage within the Healthcare Marketplace:

- Bronze Plans: Cover 60% of healthcare costs.

- Silver Plans: Cover 70% of costs.

- Gold Plans: Cover 80% of costs.

- Platinum Plans:latcosts.

Deductibles vary based on the plan. Premiums are higher the more coverage you have.

All private plans will structure their coverage differently. You will find a wide variety of structures such as HMOs , PPOs , PFFS and MSAs .

Medicare vs Private Insurance Differences

A good way to understand the differences between Medicare and private Insurance is to look at a side-by-side chart of options offered by each.

| Medicare | |

|---|---|

| This is an add-on to Original Medicare. It can be included in some Advantage plans | These are almost always additional coverages that need to be added. |

What are the Gaps in Medicare?

Part A Gaps

Most people will not pay for Part A because of Medicare taxes taken from their paycheck while they worked. Premium costs are not the concern.

Medicare also does not pay for blood if it is needed while being hospitalized.

Don’t Miss: Does Part B Medicare Cover Dental

More About How Va Health Care Works With Medicare And Other Insurance

This is your decision. You can save money if you drop your private health insurance, but there are risks. We encourage you to keep your insurance because:

- We dont normally provide care for Veterans family members. So, if you drop your private insurance plan, your family may not have health coverage.

- We dont know if Congress will provide enough funding in future years for us to care for all Veterans who are signed up for VA health care. If youre in one of the lower priority groups, you could lose your VA health care benefits in the future. If you dont keep your private insurance, this would leave you without health coverage.

- If you have Medicare Part B and you cancel it, you wont be able to get it back until January of the following year. You may also have to pay a penalty to get your coverage back .

Yes. We encourage you to sign up for Medicare as soon as you can. This is because:

Youll need to choose which benefits to use each time you receive care.

To use VA benefits, youll need to get care at a VA medical center or other VA location. Well also cover your care if we pre-authorize you to get services in a non-VA hospital or other care setting. Keep in mind that you may need to pay a VA copayment for non-service-connected care.

Covered California And Medicare

Transitioning from Covered California to Medicare is an important step. Make sure you take action and keep track of important dates and deadlines to avoid unwanted consequences.

In general, people who are eligible for Medicare even if they do not enroll in it arent eligible to receive financial help to lower the cost of a Covered California health plan.

People who are eligible for Medicare must report their Medicare eligibility to Covered California within 30 days and will usually need to cancel their Covered California. Your Covered California plan wont be automatically canceled when you become eligible for Medicare, even if you enroll in a Medicare plan with the same insurance company. You must cancel your plan yourself at least 14 days before you want your coverage to end by contacting Covered California.

If you are eligible for Medicare and you keep your Covered California plan, you may face serious consequences. For example:

- You may have to pay back all or some of your premium tax credits to the Internal Revenue Service .

- Or, there could be a delay in your Medicare coverage start date. If you dont sign up for Medicare Part B during your initial enrollment period, you will have to wait for the general open enrollment period , and then your coverage wouldnt begin until July of that year.

- In addition, you may have to pay lifetime penalties for late enrollment in Medicare and your premiums may increase by 10 percent or more.

Read Also: When Do I Enroll In Medicare Part D

Should You Have Medicare And Private Insurance Or Should You Delay Medicare Enrollment

If youâre eligible for Medicare and have private health insurance, there may be some situations when it may make sense to delay Medicare enrollment, especially in Medicare Part B. Part B is medical insurance So, you might find yourself paying two monthly premiums â one for your plan and one for Part B â for very similar Medicare coverage.

So, some people choose to keep the group health plan and delay enrollment in Part B. But it really depends on your situation. Before you decide to delay Part B enrollment, call your private insurance plan and ask them how your plan works with Medicare. You can also contact eHealth and ask one of our licensed insurance agents for more details about delaying Part B enrollment.

If you decide to delay Part B enrollment, make sure you sign up as soon as your private insurance coverage ends, so you can avoid a penalty for late enrollment in Part B.

What Is The Cost Of Medicare Part B For 2021

Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

Recommended Reading: Where Can I Get Medicare Information

Medicare Costs Vs Private Insurance Costs

How do Medicare costs compare to private insurance? Medicare Part A is usually free. Part B costs $148.50 per month for most enrollees in 2021. You can delay purchasing Part B if your private insurance is less expensive. You can even bundle this with a Part D prescription drug plan and a Medicare Supplement policy.

What you need to consider is not only the comparison of monthly premiums, but potential out-of-pocket costs. This is where supplemental policies shine. They dramatically limit out-of-pocket expenses depending on what plan you choose

How does Medicare Compare with My Employer-Sponsored Plan?

If you only have Original Medicare, you will find many gaps between the plan and the employer plan you had. But if you bundle that with a Part D prescription drug plan and a Medicare Supplement policy , your coverage will be similar. Often there will be fewer out-of-pocket expenses depending on the type of supplement policy you purchase.

How Does Private Insurance and Medicare Work together?

Are you wondering how private insurance and Medicare work together? If you have private insurance along with Medicare, the two insurance carriers follow a coordination of benefits. This process helps them decide which insurer will pay first.

If the employer plan has 20 or more employees, the group plan will usually pay first. If the employer plan has fewer than 20 employees, Medicare will usually pay first.

Choosing Private Insurance

Medicare Supplement Plans

Plan A

Plan B

Plan C

Plan D

Should I Sign Up For Medical Insurance

With our online application, you can sign up for Medicare Part A and Part B. Because you must pay a premium for Part B coverage, you can turn it down.

If youre eligible at age 65, your Initial Enrollment Period begins three months before your 65th birthday, includes the month you turn age 65, and ends three months after that birthday.

Note: Important Upcoming Change Rules for 2023 and later: If you accept the automatic enrollment in Medicare Part B or if you sign up during the first three months of your IEP, your coverage will start the month youre first eligible. Beginning January 1, 2023, if you sign up during the month you turn 65 or during the last three months of your IEP, your coverage starts the first day of the month after you sign up.

The following chart shows when your Medicare Part B becomes effective in 2022:

| In 2022, if you sign up during this month of your IEP | Your Part B Medicare coverage starts |

|---|---|

| One to three months before you reach age 65 | The month you turn age 65. |

| The month you reach age 65 | One month after the month you turn age 65. |

| One month after you reach age 65 | Two months after the month of enrollment. |

| Two or three months after you reach age 65 | Three months after the month of enrollment. |

The following chart shows when your Medicare Part B becomes effective in 2023:

You May Like: Does Everyone Over 65 Get Medicare

Pros Of Medicare Advantage

On the positive side, Part C plans cannot cover less than Original Medicare does. This means that you cant really lose coverage by going with Part C. However, many Part C plans cover more than Original Medicare, including vision and dental benefits. The cost can also be lower than Original Medicare is.

Medicare Advantage plans can also offer prescription drug coverage. If you end up choosing such a plan, you wont be able to purchase a Part D plan alongside it. If your Part C plan doesnt include prescription drug coverage, then you can still buy a Part D plan to complement your coverage.

Medicare Part D Prescription Drug Plans

Original Medicare does not cover prescription drugs, with very few exceptions. If you need prescription drugs of any kind, you should make sure you have a Part D prescription drug plan.

Part D plans are offered by private insurance companies. This means that they vary in price and coverage, unlike Original Medicare. When you look for a Part D plan, make sure that you look at the plans formulary. This refers to a tiered list of drugs that the plan covers.

Usually, brand-name drugs will be higher on the list and will cost you more out-of-pocket when compared to generic drugs. Plans are defined by their formularies, so never decide on a plan without confirming that the drugs you need are available on their formulary at a cost you can deal with.

Don’t Miss: Do You Really Need Supplemental Insurance With Medicare

Can I Use Medicare Everywhere In The Us

Medicare is widely accepted across the U.S., but its not universal. Original Medicare provides nationwide coverage, whereas Medicare Advantage plans have provider networks that can be limited to a local area. When reviewing plan options from private health insurers, pay close attention to which providers in your area accept Medicare to ensure that you have access to care when you need it.