Medicare Prescription Drug Coverage

Medicare Prescription Drug Plans are sold by private insurance companies approved by Medicare. All people new to Medicare have a seven-month window to enroll in a PDP three months before, the month of and three months after their Medicare becomes effective. The month you enroll affects the PDPs effective date. All people with Medicare are eligible to enroll in a PDP however, unless you are new to Medicare or are entitled to a Special Enrollment Period, you must enroll or change plans during the Open Enrollment Period for Medicare Advantage and Medicare Part D, Oct. 15 through Dec. 7. There is a monthly premium for these plans. If you have limited income and assets/resources, assistance is available to help pay premiums, deductibles and co-payments. You may be entitled to Extra Help through the Social Security Administration. To apply for this benefit contact SHIIP at 1-855-408-1212 or the Social Security Administration at 800-772-1213 or www.socialsecurity.gov.

Shopping For A Health Plan

- Know what youll have to pay. Plans with higher deductibles, copayments, and coinsurance have lower premiums. But you’ll have to pay more out of pocket when you get care.

- Consider things other than cost. To learn a companys financial rating and complaints history, call our Help Line or visit our website.

- Get help. If you buy health insurance from the federal marketplace, you can get free help choosing a plan. Call the marketplace for more information.

- Buy only from licensed companies and agents. If you buy from an unlicensed insurance company, your claim could go unpaid if the company goes broke. Call our Help Line or visit our website to check whether a company or agent has a license.

- Get several quotes and compare coverages. Know what each plan covers. If you have doctors you want to keep, make sure theyre in the plans network. If theyre not, you might have to change doctors. Also make sure your medications are on the plans list of approved drugs. A plan wont pay for drugs that arent on its list.

- Fill out your application accurately and completely. If you lie or leave something out on purpose, an insurance company may cancel your coverage or refuse to pay your claims.

Use our Health plan shopping guide to shop smart for health coverage.

Employer Coverage And Medicare Part D

If your employer group insurance includes creditable prescription drug coverage, you can delay Medicare Part D enrollment with no penalty. In this way, it is similar to Medicare Part B.

Having Medicare with this coverage may not be helpful when you have prescription drug benefits through your employer, as the coverages will not work together. Always compare your group insurance to the benefits and cost of Original Medicare + a Medicare Supplement plan + Medicare Part D. Often, it is more cost-efficient and beneficial to leave group insurance and enroll in Medicare, adding a Medicare Supplement plan and a Medicare Part D plan.

You May Like: Can I Have Humana And Medicare

Does My Current Health Insurance Status Affect Whether I Can Get Va Health Care Benefits

No. Whether or not you have health insurance coverage doesnt affect the VA health care benefits you can get.

Note: Its always a good idea to let your VA doctor know if youre receiving care outside VA. This helps your provider coordinate your care to help keep you safe and make sure youre getting care thats proven to work and that meets your specific needs.

Why I Dropped Obamacare

When I left the corporate world by my own choosing at the end of 2014, I gained several things, including control over my own hours and assignments. But I lost something important: health insurance.

While I was only 33 years old at the time, Ive never been the kind to go without insurance especially when I could afford to have it. I left a steady paycheck behind, but within months I was consistently earning more as a freelance writer and journalist than I ever had in my office job.

To tide me through the first several months of smaller paychecks during the first half of 2015, I elected an insurance plan through the Affordable Care Act which is more well known as Obamacare.

Obamacare did provide me with reduced-cost health insurance that covered all of my basic needs , but the deductibles were through the roof!

I still ended up paying more than $180 per month on a healthcare plan that ordinarily cost $220 per month. And the plan didnt even include any of my usual doctors the ones I liked and had built a rapport with over the years.

As my income increased, my health insurance premiums grew, too, and quickly at that.

Before long, I was paying full price. But, because my income varied from month to month, I still had to report my income on a periodic basis.

Read Also: Can I Draw Medicare At Age 62

Medicare Vs Private Health Insurance: Networks

Medicare is the front-runner when it comes to networks. If you dont want to stick to a limited number of doctors or hospitals, Original Medicare is likely your best option. With Original Medicare, you can go to any provider who accepts the national program. You can keep this flexibility if you add a Medicare Supplement plan, with the additional benefit of lower out-of-pocket costs.

Private health insurance plans have a limited number of offices, hospitals, and healthcare providers that they contract with. These locations and individuals make up a network. If you make a visit outside of your network, unless it is an emergency, you will either have limited or no coverage from your health insurance plan. This can get costly, especially since it isnt always easy for people to know which providers and locations are covered. For example, an in-network hospital may have hired a doctor that is out-of-network for you.

Medicare Part A Costs

The vast majority of Medicare beneficiaries do not have a premium for Part A. However, if you or your spouse did not work the required 40 quarters or 10 years to qualify, the Medicare Part A premium in 2023 is $506. The Part A deductible for inpatient care is $1,600 per benefit period. A benefit period begins the day you’re admitted as an inpatient and continues until you go 60 consecutive days without receiving inpatient care.

Medicare Part A costs also include coinsurance. The amount varies according to the length of your hospital stay.

- Days 1 through 60: $0 per day

- Days 61 through 90: $400 per day

- Days 91 through your lifetime reserve days: $800 per day

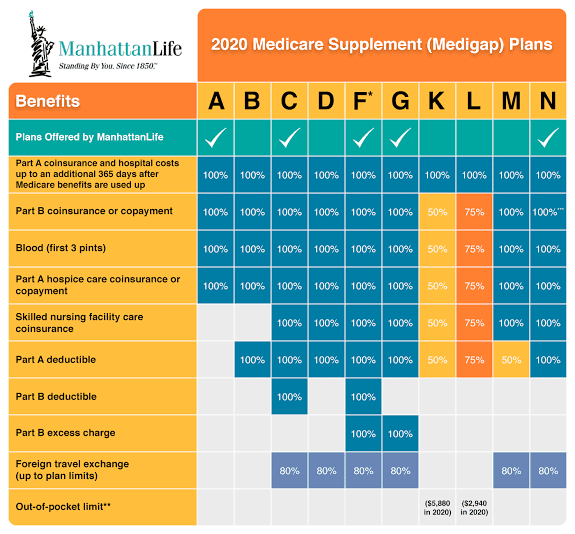

If you don’t have a Medicare Supplement plan , you get 60 lifetime reserve days. Medigap beneficiaries get an additional 365 lifetime reserve days for inpatient care.

Also Check: Does Medicare Pay For A Dermatologist

Do I Enroll In Medicare If My Spouse Has Retiree Coverage

Yes. You can delay signing up for Medicare only if you or your spouse has coverage from a current employer. You need to enroll in Medicare no later than eight months after your spouse stops working or you may have to pay a lifetime late-enrollment penalty when you do enroll in Part B.

That is also the case if your spouse continues his or her employers coverage through the Consolidated Omnibus Budget Reconciliation Act of 1985 , a federal law that requires organizations with 20 or more employees to offer health insurance for up to 18 months after workers leave their job. COBRA doesnt count as active employment, so you must enroll in Medicare during your initial enrollment period to avoid late-enrollment penalties.

Private Health Insurance Rebate

You may be able to get a rebate on what you pay for private health insurance if you:

- earn less than the income threshold

- have a high enough level of hospital cover.

Your income must be within the threshold to get the rebate. It can either:

- reduce your insurance premium

Use the private health insurance rebate calculator to work out your rebate amount on the Australian Taxation Office website.

Read Also: How Does Medicare Work When You Turn 65

Can I Get Retiree Insurance Through My Employer

If you are retiring from your job, your employer may offer you a retiree health insurance plan. Employers aren’t required to provide retiree coverage, and they can change plan benefits, premiums, or even cancel retiree coverage. You may want to consider having retiree coverage and Medicare, or you may choose to only sign up for Medicare.

Because retiree plans can be very different, it is important to talk to your employer about the details of the retiree plan and/or ask for a copy of the plans benefit booklet. You should get the details about what happens to your retiree plan when you become eligible for Medicare and how the plan works with Medicare

For example, when you become eligible for Medicare, most retiree plans actually require you to sign up for Medicare Parts A and B to be covered under the retiree plan.

Generally, Medicare pays first for your medical bills, and your retiree plan coverage pays for additional expenses, such as co-insurance amounts and deductibles. Your retiree plan then acts similar to a Medigap supplemental plan.

Sometimes retiree plans may also include extra benefits, like coverage for extra days in the hospital.

If I Keep My Work Insurance Do I Need To Enroll In Medicare

If you have coverage through a current employer, you are not required to enroll in Medicare Part A and B. Below are some things to keep in mind about each part of Medicare.

Part A: For most people, Part A does not charge a premium. Typically, Part A pays after your work insurance. Part A probably wont pay much of the bill, but doesnt cost anything to have. For that reason, most individuals enroll in Part A at age 65.

Part B: Everyone pays a monthly premium for Part B. Part B typically pays after your work coverage and may not pick up much of the bill. Enrolling in Part B will also start your one-time guarantee to purchase a Medicare Supplement. Once this 6-month time frame starts, it cannot be stopped. For these two reasons, most people wait until their work coverage ends to enroll in Part B.

Part D: Everyone pays a monthly premium for Part D. As long as you have other “creditable coverage,” you do not have to enroll in a Part D plan. Creditable coverage means the insurance is as good as, or better than, a standard Part D plan. Check with your HR department to verify if your policy is creditable coverage. Typically, prescription insurance through work offers better coverage than what you can get through Medicare. For this reason, most people wait until their work coverage ends to enroll in Part D.

Recommended Reading: How To Apply For Medicare In Illinois

How Do I Get Insurance For My Family

You can add your family to a work health plan. If you buy from an insurance company or the marketplace, you can buy a plan that also covers your family.

You can keep your dependent children on your plan until they turn 26. They don’t have to live at home, be enrolled in school, or be claimed as a dependent on your tax return. You can keep married children on your plan, but you cant add their spouses or children to it.

If you have dependent grandchildren, you can keep them on your plan until they turn 25.

Delaying Medicare Parts A & B

If you qualify to delay both Medicare Parts A & B, you can do so without penalty as long as you enroll within eight months of either losing your employer coverage or ceasing to work, whichever comes first. You will enroll during a Special Enrollment Period and will need to also provide written proof of creditable drug coverage to avoid Part D penalties.

Recommended Reading: What Medicare Part D Plan Is Best For Me

Is Private Health Insurance Subsidized By The Government

Yes, in most cases. Employer-sponsored health insurance is subsidized via the tax code, as its typically offered as a pre-tax benefit for employees. Over a ten-year period from 2019-2028, the Congressional Budget Office projects that federal subsidies for employer-sponsored health coverage is projected to be $3.7 trillion .

For private health insurance that people purchase themselves in the individual/family market, the Affordable Care Act created premium subsidies and cost-sharing reductions, which make coverage and care much more affordable than they would otherwise be. The same CBO report projected federal spending of $800 million for premium subsidies over that same ten-year period. But the federal government is no longer funding cost-sharing reductions, which has indirectly resulted in higher federal spending on premium subsidies.

Some people, including those who earn more than 400 percent of the federal poverty level, do not qualify for financial assistance from the federal government. But depending on their circumstances, they may be able to deduct their health insurance premiums on their tax return.

Read Also: Does Medicare Pay For Someone To Sit With Elderly

Do I Need To Sign Up For Medicare When I Turn 65

| Medicare Advantage Plan |

You have 2 months after your job-based insurance ends to join a plan. If you want your plans coverage to start when your job-based insurance ends, sign up for Medicare and join a plan before your job-based insurance ends. |

| Medicare drug plan |

You have 2 months after your job-based insurance ends to join a plan. If you want Medicare drug plan coverage to start when your job-based insurance ends, sign up for Medicare and join a plan before your job-based insurance ends. |

| Medicare Supplement Insurance policy |

You have 6 months after you first get both Part A and Part B to buy a policy. |

Read Also: How Do I Get Free Diabetic Supplies From Medicare

Medicare And Employer Coverage

Medicare coverage includes two parts. Also known hospital insurance, Medicare Part A covers inpatient services received in a hospital or skilled nursing facility as well as hospice care. Medicare Part B is sometimes called medical insurance. It covers outpatient services, like doctor visits, lab work, and durable medical equipment . Together, Parts A and B make up Original Medicare.

You can get prescription drug coverage with a Medicare Part D plan. While joining a Part D plan is optional, if you delay enrollment and don’t have creditable drug coverage elsewhere, you face lifelong late penalties. means a plan that is comparable to Medicare in terms of both price and coverage.

When Can You Sign Up For Medicare

Unless you qualify due to a disability, you’re first eligible to sign up for Medicare during your Initial Enrollment Period . It lasts for 7 months, beginning 3 months before your 65th birthday. So, if you turn 65 in April, your IEP begins on January 1 and ends on July 31.

Unless you began collecting Railroad Retirement Board or Social Security benefits at least 4 months before turning 65, you have to apply for Medicare. You do this through the Social Security Administration by clicking here. You can also call 1-800-772-1213 . Please note that local Social Security offices are closed due to the COVID-19 pandemic. As of August 2020, there is no information on when offices will reopen.

During your Initial Enrollment Period, you can sign up for Medicare Parts A and B, join a prescription drug plan, or enroll in a Medicare Advantage plan.

If you choose to remain with your employer group plan AND your company employs 20 or more people, you’ll qualify for a Special Enrollment Period. This begins on the later of the following dates:

- The date your employment ends

- The date your employee coverage ends

There are dozens of ways to qualify for a Special Enrollment Period. Find the full list and guidelines on Medicare.gov here.

Our Find a Plan tool makes comparing Medicare plans easy. Just enter your location and coverage start date to review options in your area.

Don’t Miss: What Is A Medicare Medigap Plan

Medicare Vs Private Insurance Out

Medicare out-of-pocket costs may include deductibles, coinsurance, monthly premiums, and copays for eligible healthcare treatments, items, and services, including prescription drugs. However, plans that private medical insurers offer generally have various rules about out-of-pocket expenses, including copays.

For example, health plans that private insurance companies administer usually put a limit on out-of-pocket costs, which means that after a person pays a certain amount in coinsurance fees, the insurance covers 100% of the costs for that benefit until the next membership period.

Original Medicare does not have an out-of-pocket maximum. This means that there is no cap on how much healthcare may cost due to copays for services.

The maximum out-of-pocket limit for Advantage plans in 2022 is $8,700 for one person and $17,400 for a family.

You Usually Must Buy A Plan During The Open Enrollment Period

The open enrollment period for marketplace and individual plans is from November 1 to December 15 each year. You can buy at other times only if you lose your coverage or have a life change. Life changes include things like getting married or divorced, having a baby, or adopting a child.

You can sign up for a work health plan when youre first hired or have a major life change. You have 31 days to decide whether you want to join the plan. You might have to wait up to 90 days for your coverage to start. If you join your work plan, you must wait until the next open enrollment period if you decide to drop out or change your coverage. The open enrollment period for work plans might be different from the marketplace period.

Read Also: When Can You Have Medicare

Do I Need Part D If I Have Drug Coverage Through My Spouse

Not necessarily. The rules are different for Medicare Part D prescription drug coverage. As long as you continue to receive creditable prescription drug coverage under the employer plan whether your spouse is still working or retired you do not need to sign up for a Part D plan.

If you lose this coverage at some point, you will then be eligible for a special enrollment period of two months to purchase a Part D plan without incurring a late-enrollment penalty.

Keep in mind

Youll have different decisions to make if the spouse with employer health coverage turns 65 first. If the older spouse enrolls in Medicare instead of keeping the employers insurance, the younger spouse may lose private health insurance coverage. If that happens, a younger spouse may need to find other sources of coverage before turning 65 and becoming eligible for Medicare.

One option is to continue the employers coverage through COBRA, which can last up to 36 months if you lose employer coverage because your spouse becomes entitled to Medicare. Or you can buy a private plan through the Affordable Care Act federal insurance marketplace or through a state that has its own exchange.