I Am Receiving Social Security Disability Benefits

You will be enrolled in Original Medicare automatically when you become eligible for Medicare due to disability. Youll get your Medicare card in the mail. Coverage usually starts the first day of the 25th month you receive disability benefits.

You may delay Part B and postpone paying the premium if you have other creditable coverage. Youll be able to sign up for Part B later without penalty, as long as you do it within eight months after your other coverage ends.

Youll need to inform Medicare of your decision before your Part B coverage starts. Follow the directions on the back of your Medicare card.

Can You Stop And Restart Medicare

If you’re going back to work and can get employer health coverage that is considered acceptable as primary coverage, you are allowed to drop Medicare and re-enroll again without penalties. If you drop Medicare and don’t have creditable employer coverage, you’ll face penalties when getting Medicare back.

You Get Bitten By Cobra

The Consolidated Omnibus Reconciliation Act allows most employees and their family members to continue coverage after their employment ends usually for up to 18 months. But having COBRA benefits does not mean you can safely delay signing up for Part B. Individuals who delay enrolling in Part B because they have COBRA coverage will not receive a SEP to enroll in Part B later.

Furthermore, COBRA carriers may recoup what they paid toward your medical bills when they discover you were eligible for Medicare but not enrolled in it. This is because COBRA plans cover only the portion of your health care claims Medicare wouldnt be responsible for paying even if you dont have Medicare.

COBRA insurers may not know youre eligible for Medicare at first. But by the time your COBRA plan ends, the insurer usually becomes aware of your Medicare eligibility and may begin recouping that Medicare should have paid on first. This usually occurs after the Part B SEP has ended, causing you to wait to enroll in Part B during the general enrollment period from January to March of each year.

Enrolling in Part B during the GEP means Medicare coverage wont begin until July of the year you enroll .

Recommended Reading: Does Medicare Part A Have A Premium

Ways To Drop Coverage

To drop Part B , you usually need to send your request in writing and include your signature.

You pay premiums for any months you have Part B coverage. Your coverage will end the first day of the month after Social Security gets your request.

If youre dropping Part B and keeping Part A, well send you a new Medicare card showing you have only Part A coverage. Write down your Medicare Number in case you need to go to the hospital or get Part A-covered services until your new card arrives.

What do you want to do next?

General Tips For Working Members Age 65 And Older

Four months before your 65th birth month you will receive a letter from CalPERS titled Important Information Concerning Health Coverage at Age 65. This notice contains information regarding the CalPERS Medicare enrollment requirements. We encourage you to carefully review and save this letter for future reference.

We recommend you also review and save all mail received from the Social Security Administration , as it will contain valuable information regarding your Medicare enrollment. You may remain enrolled in a CalPERS Basic health benefits plan until retirement. When you retire, you’ll no longer be eligible to remain in a CalPERS Basic health plan if you are eligible for Medicare Part A at no cost.

You May Like: When Can Someone Apply For Medicare

Youre Still Employed And Pass On Part B

If youre happy with the coverage your employer offers, you may think you dont need to enroll in Medicare. But individuals who work for a small employer should enroll in Part B because that will be their primary insurance coverage.

Employees of large companies do not have to enroll in Medicare. However, if they choose to sign up for Part A and B, Medicare will act as secondary coverage and pay for care after the GHP pays.

*The threshold for being considered a large employer is 100 employees when an individual qualifies for Medicare based on a disability.

Can Medicare Part B Be Suspended

Asked by: Demetris Jenkins

You can voluntarily terminate your Medicare Part B . However, since this is a serious decision, you may need to have a personal interview. A Social Security representative will help you complete Form CMS 1763. … You can also contact your nearest Social Security office

helping maintain the basic well-being and protection of the people we serve

You May Like: Can I Get Medicaid With Medicare

You Have Health Insurance You Want To Keep

If you currently have a health insurance plan that you love either through a job, your spouse, a union, or other source you may wish to continue your current coverage.

Deferring Medicare may save you money on monthly premiums, especially if youre a high-wage earner. If your current insurance is provided through a large group insurer and covers everything that Medicare parts B and D cover, you wont be hit with a penalty if you defer for this reason.

How Do I Get My Medicare Part B Reinstated

How to reenroll in Medicare Part B

How do I change my Medicare Part B effective date?

If changing your initial month of Part B coverage is possible in your case, youll likely need to submit a new form CMS-40B along with any required documentation. You should probably first contact Social Security to see what options are available to you.

How do I check the status of my Medicare Part B application?

Once your application is submitted, you can check on its status by:

Also Check: How Does Medicare Work If You Are Still Working

Key Things To Remember About Cancelling Part B

If you have decided that canceling your Part B coverage is best for you, then canceling should be a breeze. Although we advise you to look at your options in detail, disenrolling will simply be the best option for some people.

The most important things to remember before you start the process are to remember that the process will take time, so you should start early. And, remember to be mindful of enrollment periods, late penalties, and possible gaps in healthcare coverage that you may face as a result of your disenrolling.

What Is The Medicare Part B Special Enrollment Period

The Medicare Part B SEP allows you to delay taking Part B if you have coverage through your own or a spouses current job. You usually have 8 months from when employment ends to enroll in Part B. Coverage that isnt through a current job such as COBRA benefits, retiree or individual-market coverage wont help you qualify for this SEP, but the SEP lasts for 8 months, so you may still qualify if your employment ended recently.

Recommended Reading: What Is The Medicare Out Of Pocket Maximum

What Happens To Medigap When I Return To Work

The rules are tricky. You must have Medicare Part A and Part B to have a Medicare supplement insurance policy, better known as Medigap. So if you disenroll from Part B when you return to work, youll have to drop your Medigap policy too.

But you may have a difficult time getting Medigap coverage again when you reenroll in Medicare after you leave your job. When youre 65 or older, you have a federal right to buy any Medigap policy in your area, regardless of preexisting conditions, within six months of enrolling in Part B. Yet that is a one-time guarantee.

If you drop Part B because you get a new job and reenroll in Part B later, you generally dont get a new Medigap guaranteed issue period, and insurers could deny coverage or charge more if you have preexisting conditions. Some states have guaranteed issue rules different from the federal regulations.

Other rules at small businesses. If you have health insurance from your job that is secondary to Medicare, like many people who go to work for a business with fewer than 20 employees, you may want to drop your Medigap coverage even though you arent dropping Medicare. Your employers coverage will fill in the gaps.

After you leave employment and lose that coverage, you will have 63 days to get a Medigap policy with guaranteed issue rights. But this can happen only if your employers coverage is secondary to Medicare.

Why Would I Be Disenrolled From Medicare Plan B

Medicare may disenroll a person for non-payment of premiums. A person may also disenroll themselves by leaving the plan voluntarily.

Because adequate healthcare coverage is important, the State Health Insurance Assistance program can help a person make informed decisions about Medicare coverage, including looking at different options to Part B.

Read Also: Do You Apply For Medicare Through Social Security

What Are Cob Rules

Coordination of benefits allows plans that provide health and/or prescription coverage for a person with Medicare to determine their respective payment responsibilities (i.e., determine which insurance plan has the primary payment responsibility and the extent to which the other plans will contribute when an …

Healthcare & Medicare Information

NOTE: Information below touches on only a few points of this very complex subject. The Medicare website is a rich source of information and personalized advice.

For more information on the healthcare & Medicare issues facing Americans abroad, see here.

If you already live abroad, you should contact the US Federal Benefits Unit serving the country where you reside for advice. They have direct access to the Social Security files, and have experience with problems specific to people residing outside the US. You can find the Federal Benefits Unit serving your location here: ssa.gov/foreign/foreign.htm .

The single most basic fact to remember is that you are NOT covered by Medicare while living abroad . That said, you may still need to consider enrolling in one or more parts of Medicare.

Workers who have contributed at least 40 quarters to Social Security are eligible for Medicare coverage at age 65 even if your Social Security “full retirement age” is over 65.

Individuals who are eligible for railroad retirement benefits, or who have worked long enough in a US federal, state, or local government job can also qualify for coverage.

Certain other categories of individuals may qualify for one or more parts of Medicare earlier than age 65 or under certain conditions.

For greater detail on qualifying for Medicare, see: faq.ssa.gov/link/portal/34011/34019/Article/3771/What-is-Medicare-and-who-can-get-it

There are a few narrow exceptions to this rule:

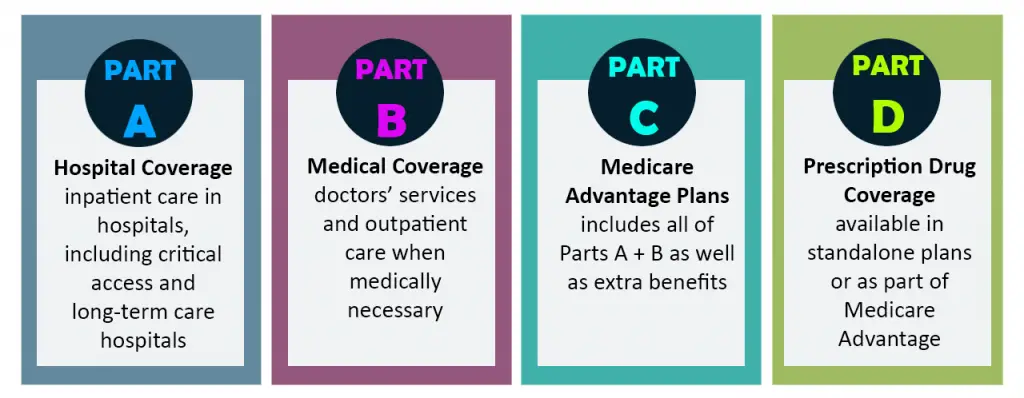

Part A is Hospital Insurance

Read Also: What Is Retirement Age For Medicare

Canceling Part B Because You Cant Afford The Premiums

If you dont have a job with creditable health care coverage but still dont want to pay Part B premiums, use caution. Without health insurance thats as good or better than Medicare, you could start racking up late-enrollment penalties the longer you go without coverage. If you decide to re-enroll in Part B later, these penalties could make your premiums even less affordable.

If you can’t afford your Part B premiums, consider other options before canceling your coverage. You can apply for Medicaid coverage if you’re in a low-income household or have few assets. Medicare also offers several savings programs, which help qualified individuals pay their Medicare expenses.

Can I Opt Out Of Medicare Part B

A. Yes, you can opt out of Part B. (But make sure that your new employer insurance is primary to Medicare. … Medicare insists on an interview to make sure you know the consequences of dropping out of Part Bfor example, that you might have to pay a late penalty if you want to re-enroll in the program in the future.

Read Also: Does Medicare Cover Dupuytren’s Contracture

Can I Stop Medicare If My New Job Offers Health Insurance

Before deciding whether or not to disenroll from Medicare Part B, first find out whether Medicare is primary or secondary to your employer coverage. That will determine whether dropping Part B could leave you with coverage gaps.

At a large employer. If you work for a company with 20 or more employees, the employers coverage is primary and Medicare is secondary. You can disenroll from Medicare Part B and use your employers coverage instead.

You generally cant drop Part A unless you have to pay a premium for it. For people who have paid Medicare taxes for 40 quarters 10 years of work that dont have to be consecutive Part A is free anyway.

But to avoid a permanent Part B late-enrollment penalty, when you leave, lose or retire from your new job, you must then reenroll in Medicare Part B while youre still on the job or during a special enrollment period that lasts for eight months after your job-based private health insurance stops.

At a small business. The coverage rules are different for smaller companies. For most places with fewer than 20 employees, Medicare becomes your primary coverage at age 65 and the employer plan provides secondary coverage.

This means Medicare settles your medical bills first, and your private group plan pays only for services it covers that Medicare doesnt. If you drop Part B in this situation, you will be left with big coverage gaps.

Medicare Part B Premiums

Each year, the Centers for Medicare & Medicaid Services announces the Medicare Part B premium amount. CalPERS sets the standard Medicare Part B premium reimbursement amount on January 1 based on the amount determined by the CMS. According to the CMS, most Medicare beneficiaries will pay the standard Medicare Part B premium amount.

However, if your Modified Adjusted Gross Income as reported on your IRS tax return is above the set threshold established by the CMS, youll pay the standard Medicare Part B premium amount plus an additional Income-Related Monthly Adjustment Amount . If youre required to pay an IRMAA, youll receive a notice from the Social Security Administration advising you of your Medicare Part B premium cost for the following calendar year, and how the cost is calculated.

You may defer Medicare Part B enrollment because you are still working. Contact the SSA at 772-1213 to defer. This will ensure that you avoid a late enrollment penalty when you decide to retire and enroll in Medicare Part B upon retirement.

If you choose to enroll in Medicare Part B while still actively working, youll remain in a CalPERS Basic health benefits plan and your CalPERS Employer Group Health Plan will be the primary payer, and Medicare becomes the secondary payer.

You May Like: How Much Is Medicare Cost For 2020

Is Medicare Mandatory When Youre First Eligible

If youâre still working when you turn 65, or you become eligible through disability, you may be covered under your employerâs group plan. Or maybe your spouse has an employment-based or union-based group health plan that covers you. You usually donât have to enroll in Medicare right away if you have a group health plan.

Traditional Medicare refers to Medicare Part A, which is hospital insurance, and Part B, which is medical insurance. Part A can be premium-free if youâve worked and paid taxes long enough. If you qualify for premium-free Medicare Part A, thereâs little reason not to take it.

In fact, if you donât pay a premium for Part A, you cannot refuse or âopt outâ of this coverage unless you also give up your Social Security or Railroad Retirement Board benefits. Youâd also have to pay back your previous benefits to the government.

Does Tricare For Life Work Overseas

Medicare provides coverage in the U.S. and U.S. Territories. Medicare doesn’t provide coverage in any other overseas locations.

When using TRICARE For Life in all other overseas locations, whether you live overseas or are traveling overseas, TRICARE is the primary payer and you’re responsible for paying TRICARE’s annual deductible and cost shares. > > View TRICARE For Life Costs.

If you live overseas, you must have Part B to remain eligible for TRICARE even though Medicare doesn’t provide coverage overseas.

Also Check: What Parts Of Medicare Should I Sign Up For

I Have Va Health Care Benefits

VA benefits cover care you receive in a VA facility. Medicare covers care you receive in a non-VA facility. With both VA benefits and Medicare, youll have options for getting the care you need.

Its usually a good idea to . VA health care benefits do not qualify as creditable coverage. You may have to pay a penalty if you delay Part B enrollment, unless you have other creditable coverage such as through an employer.

What Happens To Medicare Advantage Or Part D If I Work

For Medicare Advantage, you also need to have both Part A and Part B, so you must drop that coverage if you stop Part B. After you leave your job, youll have two months to get a Medicare Advantage plan if you want a private plan rather than original Medicare. Otherwise, you can sign up during open enrollment, each year from Oct. 15 to Dec. 7.

For Part D prescription coverage, you can keep coverage as long as you have either Part A or Part B. But you may not need that coverage if your employer offers prescription drug coverage thats considered as good or better than Medicares, called creditable coverage. You wont pay a late-enrollment penalty as long as you sign up for Part D within two months of losing that coverage.

Bottom line: If you end up dropping either the Medicare Advantage all-in-one alternative to original Medicare or the Part D drug coverage that works with traditional Medicare, youll have two months after your job-based insurance ends to reenroll.

Keep in mind

When you return to work, be mindful of the high-income surcharge if you keep Medicare Part B or Part D. If youre single and your modified adjusted gross income is more than $91,000 or $182,000 if married filing jointly, youll have to pay higher premiums.

After you retire or experience certain other life-changing events, you can ask the Social Security Administration, which handles these surcharges, to use your more recent income to reduce or eliminate the surcharge.

You May Like: When Can I Apply For Medicare In California