Disadvantages Of Medicare Advantage Plans

In general, Medicare Advantage Plans do not offer the same level of choice as a Medicare plus Medigap combination. Most plans require you to go to their network of doctors and health providers.

Since Medicare Advantage Plans cant pick their customers , they discourage people who are sick by the way they structure their copays and deductibles. Many enrollees have been hit with unexpected costs and denial of benefits for various types of care deemed not medically necessary.

How To: Enroll In Medicare Part A And Part B

Some people are automatically enrolled in Medicare Part A and Part B. Some people are not.

You’ll be automatically enrolled in Medicare Part A and Part B if:

- You’re receiving Social Security or Railroad Retirement Board benefits when you turn 65 or

- You’re eligible for Medicare because of a disability or medical condition.

You must enroll yourself in Medicare Part A and B if:

- You’re not receiving Social Security benefits when you become eligible for Medicare.

What Are The Medicare Income Limits For 2021

In 2021, the adjustments will kick in for individuals with modified adjusted gross income above $88,000 for married couples who file a joint tax return, that amount is $176,000. For Part D prescription drug coverage, the additional amounts range from $12.30 to $77.10 with the same income thresholds applied.

You May Like: How Does Medicare Work With Employer Insurance

Can Medicare See Your Bank Account

Medicare will usually check your bank accounts, as well as your other assets, when you apply for financial assistance with Medicare costs. However, eligibility requirements and verification methods vary depending on what state you live in. Some states don’t have asset limits for Medicare savings programs.

Is A Medicare Advantage Plan The Best Choice For You

If the advantages of a Medicare Advantage plan outweigh its disadvantages, you should research the best Medicare Advantage plans, including why AARP/UnitedHealthcare is so popular and which company offers the best value on coverage.

On the other hand, if you feel the downsides of Medicare Advantage outweigh its benefits, consider your alternate coverage options by comparing the best Medicare Supplement plans to reduce your health care costs and exploring the best Medicare Part D plans to learn how to get the cheapest prescription drug coverage.

Also Check: What Is The Best Supplemental Insurance To Have With Medicare

Can I Enroll In A Medicare Supplement Plan Later If I Enroll In A Medicare Advantage Plan Now

If you enroll in a Medicare Advantage plan now, you may be able to cancel your Medicare Advantage plan and enroll in a Medicare Supplement plan in the future. To do so, you will have to wait until the Annual Enrollment Period or the Medicare Advantage Open Enrollment Period to make changes.

It is important to know that most beneficiaries will only get a Medicare Supplement Open Enrollment Period once in their lifetime. This is your only opportunity to enroll in a Medigap plan without answering health questions.

If you miss this one-time opportunity to enroll, you will have to answer health questions should you wish to enroll in a Medicare Supplement plan in the future. This means the carrier could deny your application due to pre-existing conditions. Thus, the importance of understanding which coverage is best for you and enrolling in that coverage the first time.

How Do I Change My Medicare Coverage

Your Medicare choices are not set in stone after the first time you enroll. You can make changes to your Medicare coverage during a few special Medicare enrollment periods.

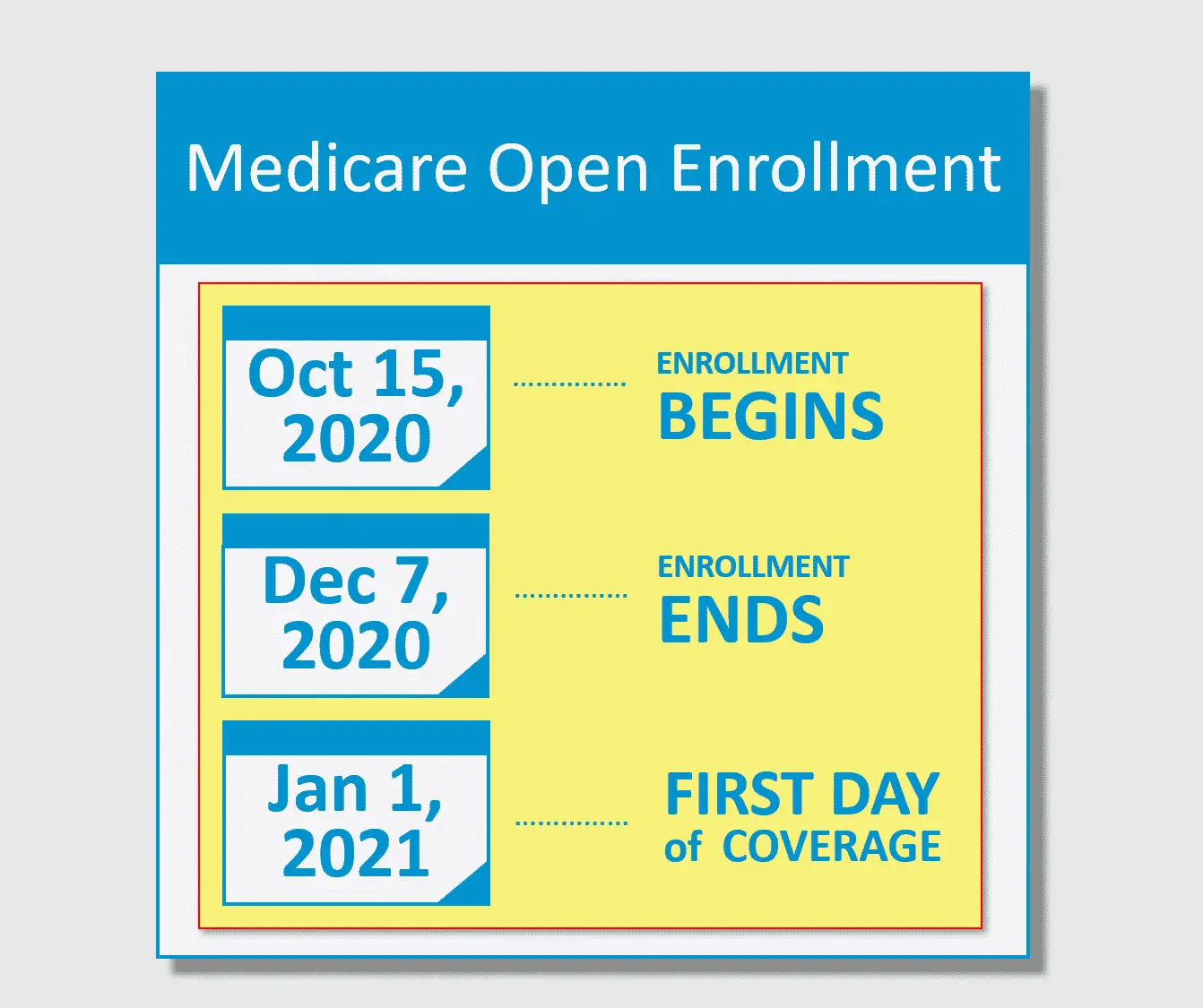

- The Medicare Annual Enrollment Period , October 15 December 7

- The Medicare Advantage Open Enrollment Period, January 1 March 31

- The Medicare Special Enrollment Period for qualifying life events dates vary based on qualifying event

Learn how to make changes to your Medicare coverage during these three time periods:

Read Also: What Age Can I Take Medicare

What Is The Average Monthly Cost Of A Medicare Advantage Plan

The average premium for a Medicare Advantage plan in 2021 was $21.22 per month. For 2022 it will be $19 per month. Although this is the average, some premiums cost $0, and others cost well over $100. For more resources to help guide you through the complex world of medical insurance, visit our Medicare hub.

Lesson Five: Focus On Servicing Your Book Of Business

When the AEP comes to a close in mid-December, many beneficiaries wont be able to make any further changes without special exceptions. Those with MA plans will have a few additional weeks to make their choice during the Medicare Advantage Open Enrollment PeriodJanuary 1 to March 31.

As our agency looks toward the OEP, we anticipate continued persistency and a lower volume of plan switching. The new CMS regulations prohibit the approval of new TV commercials in January, which could affect general awareness of the OEP. Agencies budgeting for TV ads during the OEP should likely position themselves for success with a different lead strategy.

We used to operate with the goal to sign up as many new customers as possible. Now, as we shift to 2023, were putting in the work to qualify our clients to best serve their needs and retain them at a higher level of satisfaction year-round, leading to higher policy persistence.

The information provided here is not investment, tax or financial advice. You should consult with a licensed professional for advice concerning your specific situation.

Forbes Finance Council is an invitation-only organization for executives in successful accounting, financial planning and wealth management firms. Do I qualify?

Read Also: Can Doctors Refuse Medicare Patients

Can I Be Denied A Medicare Supplement Plan For Pre

Medicare Supplement plans are a great way to get affordable insurance for pre-existing medical conditions. But what happens if youre denied coverage because of your health history?

If you are new to Medicare this guide is going to answer some common questions about Medicare supplement plans and their guaranteed issue rights, so that you can enroll in the plan thats best for you.

Cap On How Much You’ll Pay For Covered Services

Unlike traditional Medicare, Medicare Advantage plans have out-of-pocket limits that cannot be more than $7,500 a year for beneficiaries who access care through plan networks. This is especially good for those who have ongoing medical conditions because if you have Parts A and B alone, you won’t have a cap on your medical spending.

Going outside of the network is allowed under many Medicare Advantage preferred provider plans, though medical costs are higher than they are when staying within the plan network. The highest out-of-pocket maximum for health care spending both inside and outside of networks is $11,300 annually.

Read Also: Does Medicare Cover Vitamin D Testing

How Long Do I Have To Submit Medicare Advantage Appeals For Denied Claims

If your claim was denied and you believe it shouldnt have been, you must begin the Medicare Advantage appeals process within 60 days from when the decision was made. According to the Department of Health and Human Services, your insurers required to respond to requests that involve payment disputes within 60 days.

You may be able to hasten this timeline in certain circumstances. For instance, if the wait would jeopardize your health, you or your doctor can request your insurance company to expedite the process. In addition, if youre already receiving services from a hospital, skilled nursing facility, home health care, or a rehab facility, you can request an immediate review before youre discharged. If your plan doesnt respond in time, you can escalate to a Level 2 appeal performed by an independent review organization.

What Does The Future Look Like For Medicare Advantage

Medicare Advantage plans are an integral part of the Medicare program. They provide beneficiaries a multitude of options and offer additional benefits to enrollees. As the popularity of these plans continues to grow and enrollment rises, however, the Medicare program will face several challenges. First, higher costs relative to traditional Medicare will strain federal spending and the solvency of the Hospital Insurance trust fund. Second, increased enrollment could necessitate changes to the payment system for Medicare Advantage plans. Third, questions remain about the quality of Medicare Advantage plans relative to traditional Medicare.

With Medicare Advantage plans predicted to soon become the dominant form of Medicare coverage, it will be important to assess beneficiaries experiences and the long-term sustainability of the program to ensure Medicare Advantage plans provide effective, efficient, and equitable care.

Recommended Reading: How To Reorder Medicare Card

Denial Of Medicare Supplement Policy Renewal

For the most part, Medicare Supplement policies are guaranteed renewal. This means as long as you pay the monthly premium, you cannot be denied coverage once you enroll in a plan, regardless of any health conditions that may arise.

There are very few circumstances when your carrier may drop your coverage after you enroll in a Medicare Supplement plan. If you lie on your application, fail to pay your monthly premium, or your Medicare Supplement plan carrier goes bankrupt, you will lose coverage.

If you fail to pay your premium or lie on the application, you will not have a guaranteed issue right to enroll in another Medicare Supplement plan. Thus, if you apply to another carrier, they have the right to deny you coverage. On the other hand, if you lose coverage due to your plan going bankrupt, you will receive guaranteed issue rights to enroll in another plan regardless of your health.

When Can A Medicare Plan Deny Coverage

Coverage can be denied under a Medicare Advantage plan when:

- Plan rules are not followed, like failing to seek prior approval for a particular treatment if required

- Treatments provided were not deemed to be medically necessary

- An out-of-network provider was used when an in-network alternative was available

- Treatment was received through participation in a clinical trial, depending on plan coverage details and prior approval from an insurance company

The most common reason for the denial of a claim involves the determination of medical necessity. In some cases, a medication or procedure a care provider deems important isnt seen this way by an insurance company. When this occurs, a care provider may need to provide proof of the value of a particular treatment over available alternatives. This can be the case with medications under Medicare Advantage plans that offer prescription drug coverage. Should this occur, it may be necessary to try other medications before resorting to a more costly drug if agreed upon by a provider.

Eldercare Financial Assistance Locator

- Discover all of your options

- Search over 400 Programs

Don’t Miss: Where Do I Sign Up For Medicare Part D

Lessons Learned From Medicare Annual Enrollment Period 2023

Robert W. Bache is founder and chief of sales for Senior Healthcare Direct, an AmeriLife company.

getty

Each year, Medicare makes changes to its health and drug plans that can alter the cost, benefits, coverage and network of providers. When this happens, beneficiaries often have a lot of questions. They want to know if their current plan is still the best one for them.

Medicares Annual Enrollment Period takes place at the same time every year: October 15 to December 7. Beneficiaries have the opportunity to switch their coverage, with changes going into effect the following January 1.

After years of guiding our agency through the AEP, Ive developed a solid understanding of the process. But every year, something surprises me or changes so vastly that it causes us as an industry to take a pause and discuss what weve learned that well carry into the next AEP. Here are just a few lessons learned and some things I know for sure when it comes to the Medicare AEP.

Low Premiums And Predictable Cost

Most Medicare Advantage benefits have an outlined fixed copay for most services. This makes it easy to predict how much a procedure will cost. In addition, to these fixed copayments, many Medicare Advantage health plans have little to no monthly premium.

Now some services will have a 20% coinsurance on most plans. Services such as durable medical equipment covered Part B drugs and chemotherapy will almost always require a 20% coinsurance. These out-of-pocket costs will all count towards the maximum out-of-pocket.

Also Check: When Does Medicare Coverage Begin

In All But Four States Seniors On Medicare Can Be Denied A Medigap Policy Due To Pre

In all but four states, insurance companies can deny private Medigap insurance policies to seniors after their initial enrollment in Medicare because of a pre-existing medical condition, such as diabetes or heart disease, except under limited, qualifying circumstances, a Kaiser Family Foundation analysis finds.

Medigap policies provide supplemental health insurance to help cover the deductibles and coinsurance for Medicare covered services. One in four people in traditional Medicare had a Medigap policy in 2015.

This new analysis of federal law and state regulations shows that only Connecticut, Maine, Massachusetts, and New York require Medigap insurers to sell policies to all Medicare beneficiaries ages 65 and older either continuously during the year or for at least one month per year. In all other states and the District of Columbia, insurers may deny a Medigap policy to seniors, except during their initial open enrollment period when they start on Medicare, or when applicants have other specified qualifying events, such as the loss of retiree health coverage.

Depending on their state, Medicare beneficiaries who miss these windows of opportunity may unwittingly forgo the chance to purchase a Medigap policy later in life if their needs or priorities change, or if they choose to switch to traditional Medicare after several years of being in a Medicare Advantage plan.

Topics

Lesson Two: Federal Regulations Can Change Everything

Just announced at the end of 2022 and taking effect January 1, 2023, insurers cannot air any TV ads for Medicare Advantage plans without first getting approval from federal regulators. These new ad approval guidelines by the Centers for Medicare & Medicaid Services have meant fewer false or misleading third-party TV commercials throughout this years AEP.

As a result, weve seen more carrier-focused commercials and airtime, offsetting the typical deluge of marketing by third-party organizations. This is meant to help eliminate confusion among Medicare beneficiaries, but it also opens the space for more clear communications between our customers and carriers.

Recommended Reading: Does Medicare Part B Cover Doctor Visits

Get Help Finding A Medicare Plan That Fits Your Needs

Whether youd like a Medicare Advantage plan or alternative options such as a Medicare Supplement insurance or even just a Part D plan, we can help. Our licensed agents can help you determine which supplemental plan will fit your needs.

Fill out our online request form or give us a call. We can answer all your supplement insurance questions and make the process easy to understand.

When Medicare Advantage Plans Fall Short

For many seniors, Medicare Advantage plans can work well. A 2021 study in the Journal of the American Medical Association found that Advantage enrollees often receive more preventive care than those in traditional Medicare.

But if you have chronic conditions or significant health needs, you may want to think twice. For one thing, with Original Medicare you can see any provider that accepts Medicare, which is most of them.

But Medicare Advantage plans typically require that you get care from a more limited network of providers, and you may need pre-authorization to see specialists, says Melinda Caughill, a co-founder of 65 Incorporated, a firm that provides Medicare enrollment guidance.

Its a riskier approach to health care, Caughill says, which can also end up being more expensive.

For example, a recent Kaiser study found that about half of all Medicare Advantage enrollees would end up paying more than those in traditional Medicare for a seven-day hospital stay.

You May Like: Why Are Medicare Advantage Plans So Cheap

How To Enroll In Medicare

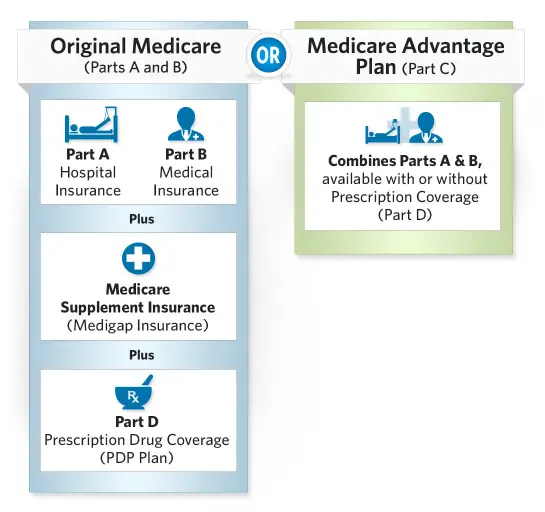

Enrolling in Medicare is easy once you understand how to do so. It’s important to know that how you enroll in Medicare Part A and Part B is different from how you enroll in Medicare Advantage , Part D or Medicare supplement insurance.

See the table below for a quick overview of how to enroll in a Medicare or Medigap plan and read on for how-to steps for both Original Medicare and the three kinds of Medicare and Medigap plans.

Original Medicare Medicare Advantage plan Medicare Prescription Drug plan Medicare Supplement Insurance plan How to Enroll

Enroll in Original Medicare online at the Social Security website or by calling or visiting your local Social Security office.

Enroll directly in the plan e.g., on the plans website or Medicare.gov .

Enroll directly in the plan e.g., on the plans website or Medicare.gov .

Enroll directly in the plan e.g., on the plans website

Original Medicare

How to Enroll

Enroll in Original Medicare online at the Social Security website or by calling or visiting your local Social Security office.

Medicare Advantage plan

How to Enroll

Enroll directly in the plan e.g., on the plans website or Medicare.gov .

Medicare Prescription Drug plan

How to Enroll

Enroll directly in the plan e.g., on the plans website or Medicare.gov .

Medicare Supplement Insurance plan

Enroll directly in the plan e.g., on the plans website

Why Do Medicare Advantage Plans Cost More And How Are They Paid

The government pays Medicare Advantage plans a set rate per person, per year under what is called a risk-based contract.12 That means that each plan agrees to assume the full risk of providing all care for that inclusive amount. This payment arrangement, called capitation, is also intended to provide plans with flexibility to innovate and improve the delivery of care.

But there are layers of complexity built into and on top of that set rate that allow for various adjustments and bonus payments. While those adjustments have proved useful in some ways, they can also be problematic and are the main reason for the extra cost of Medicare Advantage vis-à-vis traditional Medicare.

Benchmarks. Plan benchmarks are the maximum amount the federal government will pay a Medicare Advantage plan. Benchmarks are set in statute as a percentage of traditional Medicare spending in a given county, ranging from 115 percent to 95 percent. For counties with relatively low spending, benchmarks are set higher than average spending for traditional Medicare for counties with relatively high spending, benchmarks are set lower than average traditional Medicare spending . Special Needs Plans and other Medicare Advantage plans are paid in the same manner, with the same benchmarks.

Read Also: What Is Medicare Expansion Mean