How To Cancel A Marketplace Health Plan

Before we talk about how to cancel your Marketplace plan, if you havent already read the How to Transition from the Health Marketplace to Medicare article, we strongly suggest doing that first. It will help answer some important questions such as if you can have both a Marketplace plan and Medicare or if you can delay Medicare, as well as help alleviate any concerns you may have over replacing your plan with Medicare.

If you purchased your current health plan through the Health Marketplace and now you want to cancel it because youre about to enroll in Medicare, here is what you need to know.

How To Disenroll From Your Coverage

To disenroll, you must fill out an online request or print and mail a request. You cannot disenroll by calling.

Disenroll by filling out an online request

To disenroll from your plan, you may send Humana an online disenrollment request.

You can use 1 of these links to complete a disenrollment form online and provide an electronic signature. If you use this method, you do not need to mail or fax Humana your disenrollment request.

If you have additional questions about cancellation or disenrollment, call Humana Customer Care:800-285-7197 Monday Friday, 8 a.m. 8 p.m.7 days a week, 8 a.m. 8 p.m.

Note: If you disenroll from Medicare prescription drug coverage and go without creditable prescription drug coverage for a continuous period of 63 days or more, you may have to pay a Part D late enrollment penalty if you join a Medicare drug plan later. See your Evidence of Coverage for more information.

If you disenroll from Medicare Advantage Plans with Medicare Part B Premium Reduction your Medicare Part B premium benefit will end on the date of disenrollment. It could take several months for the Social Security Administration to complete their processing. Any premium reductions you receive after you disenroll will eventually be deducted from your Social Security.

Can Medicare Supplemental Plans Drop You

Many people in Original Medicare A and B purchase a Supplemental plan to help cover the expenses Medicare doesnt take care of. If you purchase a Supplemental plan, you will be responsible to pay a monthly premium for the coverage. Typically, Supplemental premiums are between $100 and $250 per month. Once again, the only way the Supplemental insurance carrier can drop you is if you fail to pay your monthly premiums. Unlike other Medicare plans well look at later, Supplemental plans are written for life, so no matter your age, how many claims you have, or where you move within the U.S., youll never have to worry about getting dropped by the plan.

Most people set up a bank draft payment for their Part B monthly premiums. This keeps things simple for you and helps ensure you never forget to make the payment. If you set up an automatic bank draft payment plan, just make sure to update your account and routing number if you ever move or switch banks. Because, once again, if you fail to make your monthly payment, your Supplemental coverage will be cancelled after a 30-day grace period.

You May Like: How Much Does A Married Couple Pay For Medicare

What Happens To My Medicare If I Return To Work And Join My Employers Health Plan

If you or your spouse return to work after youve enrolled in Medicare and the employer is offering health insurance, you may be able to opt out of Part B so you dont have to pay premiums for both Medicare and your employers health insurance.

Potentially, you could save at least $2,000 in 2022. And you may be able to save more if you can cancel your Medicare Advantage plan, Part D prescription drug plan or other additional health-related insurance you may be buying.

But not everyone has this option it generally depends on the size of your employer. And when you retire, you will need to reenroll in Part B within a certain time to avoid late-enrollment penalties.

What It Means To Pay Primary/secondary

- The insurance that pays first pays up to the limits of its coverage.

- The one that pays second only pays if there are costs the primary insurer didnt cover.

- The secondary payer may not pay all the remaining costs.

- If your group health plan or retiree coverage is the secondary payer, you may need to enroll in Medicare Part B before theyll pay.

If the insurance company doesnt pay the

promptly , your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer shouldve made.

Also Check: How To Look Up A Medicare Number

Read Also: Can I Sign Up For Medicare Before Age 65

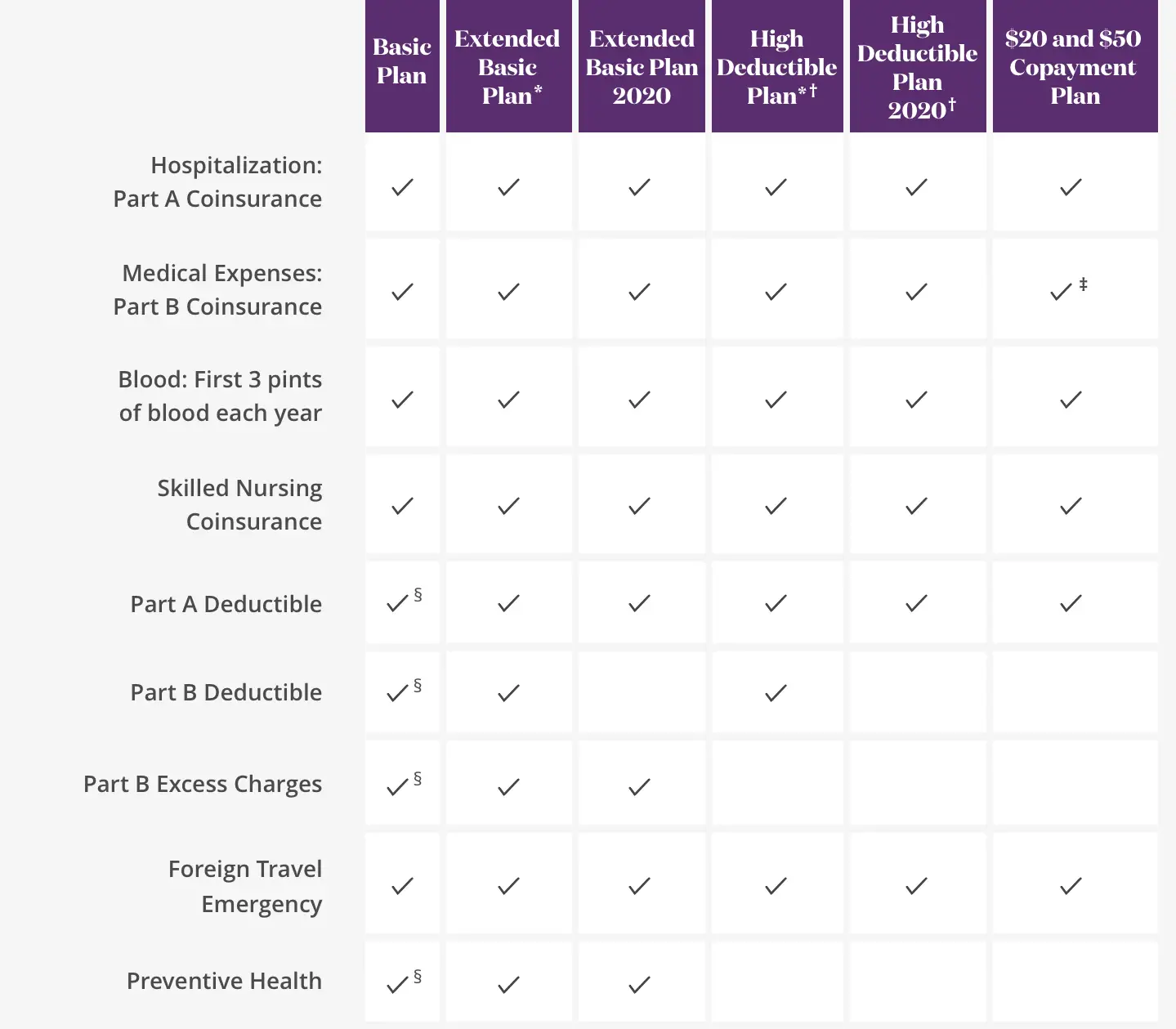

Applying For A Medicare Supplement Insurance Plan

The best time to enroll in a Medicare Supplement plan is during your Medicare Supplement Open Enrollment period because your acceptance is guaranteed. It starts on the first day of the month in which you’re both age 65 or older and enrolled in Medicare Part B. Some states have additional Open Enrollment periods and Guaranteed Issue requirements.

If you apply outside of Open Enrollment or Guaranteed Issue periods, you may be denied coverage or charged more based on your health history. This does not apply to residents of Connecticut and New York where Open Enrollment and Guaranteed Issue is ongoing and Medicare supplement plans are guaranteed available.

Scroll for Important Disclosures

UnitedHealthcare pays royalty fees to AARP for the use of its intellectual property. These fees are used for the general purposes of AARP. AARP and its affiliates are not insurers. AARP does not employ or endorse agents, brokers or producers.

AARP encourages you to consider your needs when selecting products and does not make product recommendations for individuals.

Please note that each insurer has sole financial responsibility for its products.

AARP® Medicare Supplement Insurance Plans

AARP endorses the AARP Medicare Supplement Insurance Plans, insured by UnitedHealthcare.

In some states, plans may be available to persons under age 65 who are eligible for Medicare by reason of disability or End-Stage Renal Disease.

How To Switch From Medicare Advantage To Medicare Supplement

Suppose you decide your Medicare Advantage plans network restrictions and high out-of-pocket costs are not for you. If so, you may be eligible to cancel your Medicare Advantage plan and enroll in a Medicare Supplement plan.

However, there is no way to switch from Medicare Advantage to Medicare Supplement directly. Once you revert from Medicare Advantage to Original Medicare, you become eligible for a Medicare Supplement plan without a lapse in coverage.

When you return to Original Medicare using a Special Enrollment Period or a trial right, you automatically qualify for guaranteed issue rights to enroll. So, you can enroll in a Medicare Supplement plan without underwriting health questions. However, if you return to Original Medicare during a typical enrollment period, you must answer health questions to enroll in a Medicare Supplement plan.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Don’t Miss: What Are The Different Medicare Supplement Plans

What Does Medicare Supplement Insurance Cost

The primary goal of a Medicare Supplement insurance plan is to help cover some of the out-of-pocket costs of Original Medicare . As a general rule, the more comprehensive the coverage, the higher the premium, however, premiums will also vary by insurance company, and premium amounts can change yearly.

Limited Part A And Part B Drug Coverage

Medicare parts A and B offer limited drug coverage under the scope of hospitalization or outpatient medical care. For example, original Medicare covers some antigens, injectable osteoporosis drugs, end-stage renal disease treatment, and drugs used with durable medical equipment such as a nebulizer. Drugs covered by Parts A and B generally include only those administered by a physician in an office or hospital or for specific conditions at home.

You May Like: How To Sign Up For Medicare In Michigan

You May Like: Does Medicare A Have A Deductible

When Can An Insurer Cancel A Medicare Supplement Plan

Many people worry that if something happens, they could lose their insurance. There are some cases when an insurer can cancel a Medicare Supplement plan, such as:

- If you stop paying the monthly premiums

- If your insurer becomes insolvent or goes bankrupt

- If you gave false information on your Medicare Supplement insurance policy application.

If an insurer cancels your policy or drops you because they become insolvent, go bankrupt, or through no fault of your own, you are then covered by guaranteed issue rights. If your insurer cancels your Medigap coverage, then guaranteed issue rights can help you transition to another plan without having to undergo a health screening and paying a premium penalty.

How Do I Report A Death To Life Insurance Or Annuity Companies After Death

Reporting a death to a life insurance or annuity company does require a death certificate. A signature is also needed from each beneficiary.

If you have your life insurance or annuity policy with us at Sams/Hockaday, we will guide you and your family through this process.

Your loved ones will not go through any of this alone, so while you should definitely ensure they know who your agent is, you can rest assured our office will handle it.

Read Also: What Is The Average Cost Of A Medicare Advantage Plan

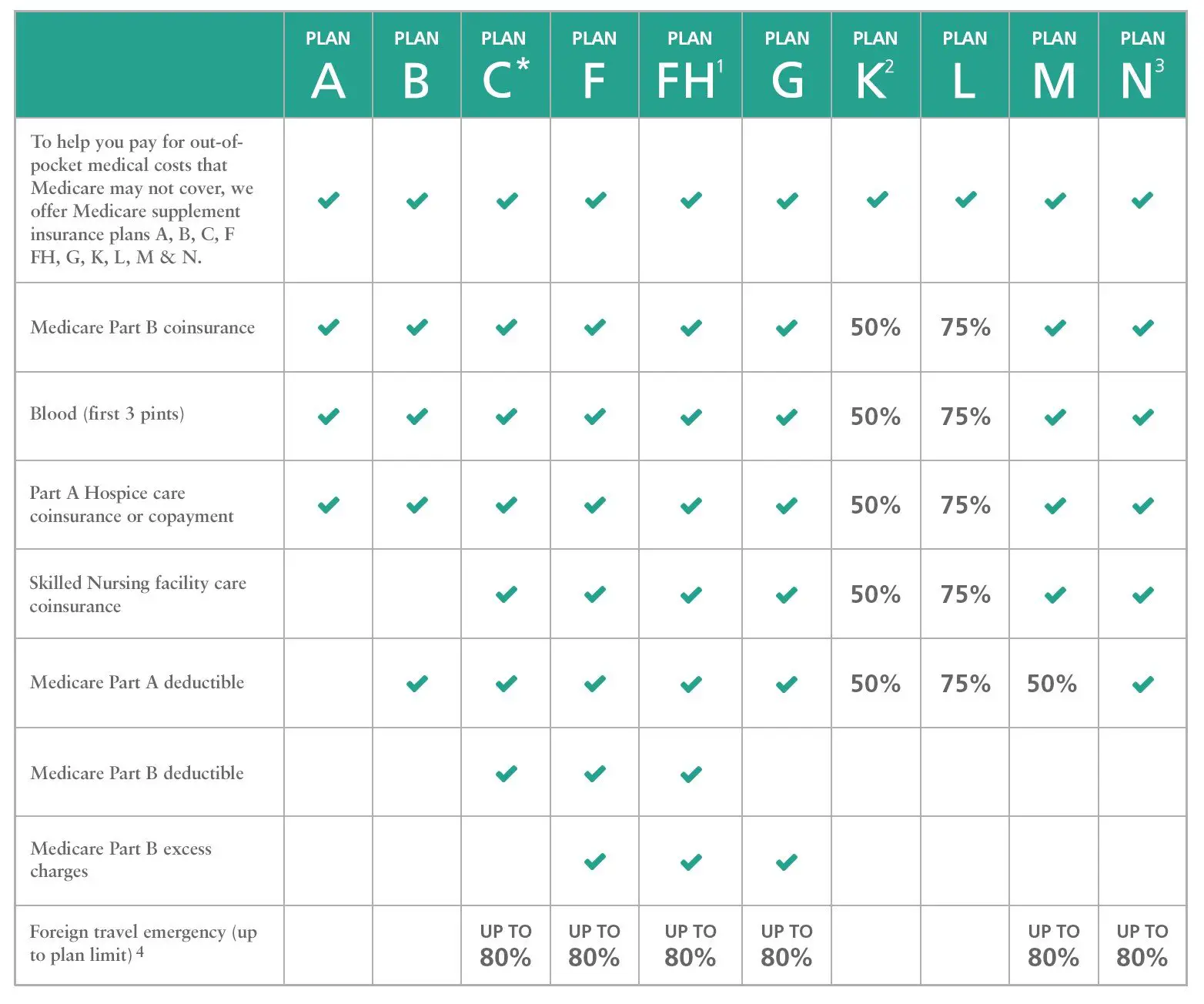

Can You Have A Supplement And An Advantage Plan

While you can’t add a Medicare Supplement plan to a Medicare Advantage plan, the added benefits MA plans provide help make up the difference when it comes to out-of-pocket costs. One great feature is the security of an annual limit on out-of-pocket costs, after which you pay nothing for covered services.

Should I Cancel My Medicare Supplement Insurance If I Move

You do not have to cancel your Medigap plan just because you move. Many insurers provide plans with broad coverage areas, and you may only need to change doctors. In addition, your insurer cannot cancel your coverage because you moved as long as you are paying your premiums. But there are some cases when you may need to change plans.

For example, if you move to or from Minnesota, Wisconsin, or Massachusetts, you will notice that their standardized plans differ from other states. Rather than the lettered Medigap policies, they have their own plans. Also, some insurers only offer coverage in some areas, so to see a doctor, you may have to move to a new insurer. And when you move, you may notice a difference in plan premiums, even if you keep your existing plans. This is because insurers can base their plan pricing on several factors, including location or community.

Read Also: What Is Difference Between Medicare Advantage And Supplement

Inaccuracies On Your Medigap Application

The second instance when an insurance company can drop your Medigap policy is if you provide inaccurate information on your application. Sometimes, in an attempt to get a lower premium, Medicare beneficiaries lie on their applications. If the insurance company finds out that you provided incorrect information during the application, it can cancel your policy.

Before submitting an application, you should review all of the information you provide to ensure its accuracy. If any information is inaccurate, regardless of your intentions, you could lose any guaranteed renewal rights and protections.

Can I Switch Medigap Policies At Any Time

Yes, but insurers may ask questions about your health if you dont qualify for a guaranteed issue right period, when youre assured of the ability to purchase a plan even if you have health problems.

Thats why its important to think about your present and future needs when you first buy a policy. You may want to find a Medigap policy with a company that has lower premiums or better customer service, because you have more coverage than you need, or so you can qualify for additional coverage such as foreign travel emergencies.

Some states let you change Medigap policies at certain times during the year, regardless of your health:

- In California, you have 60 days after your birthday to swap plans.

- In Missouri, you have up to 30 days before and after the anniversary of the date you purchased the policy to switch to the same letter plan with a different insurer.

- In Oregon, you have 30 days after your birthday each year to buy another Medigap plan with equal or lesser benefits.

In Connecticut, Massachusetts and New York, insurers must sell you any Medigap policy at any time regardless of preexisting conditions. In Maine, you can change policies and insurers as long as you choose a plan with the same or lesser benefits and youve never had a gap in coverage of more than 90 days.

You May Like: When Can I Enroll In A Medicare Supplement Plan

Can My Private Medicare Plan Be Taken Away

There are three primary types of private Medicare insurance sold by insurance companies around the U.S.

These types of are not provided by the federal government like Medicare Part A and Part B .

The eligibility rules for private plans can be different than the rules for Original Medicare, so be sure to speak with a representative from your plan carrier if you are concerned about losing your privately-provided Medicare benefits.

Canceling Your Medicare Supplement Insurance Plan And Getting A New One

You may want to cancel your Medicare Supplement plan because you want to switch to a different plan. You can cancel the plan anytime as long as you notify your health insurance company in writing.

However, in most cases, under federal law you donât have the right to switch Medicare Supplement insurance plans unless you have guaranteed-issue rights to buy a plan, either because youâre in the 6-month window of your Medicare Supplement Open Enrollment Period, or for a different reason. The Medicare Supplement Open Enrollment Period begins on the first day of the month in which youâre both age 65 or older and enrolled in Medicare Part B.

During your Medicare Supplement OEP, an insurance company canât reject your application for a plan, or charge you more based on your health history. However, in some cases you might face a waiting period before plan benefits begin. During your Medicare Supplement Open Enrollment Period you may be able to buy a plan, change your mind, cancel that plan, and buy another one. You could begin research about Medicare Supplement insurance plans before your Open Enrollment Period begins so that you are prepared to make a good choice during this time window.

Also Check: How Much Is Aarp Medicare Supplement Insurance

Can I Change Medicare Supplement Plans During Annual Open Enrollment

You can change Medicare supplement plans at any time of year but in most states you will have to pass medical underwriting to do so.

This is a very common misconception because people get confused about the Annual Election Period that Medicare holds each fall. During this time, you can freely change your Medicare Part D drug plan and/or your Medicare Advantage plan.

This period DOES NOT, however, apply to Medicare supplements, also known as Medigap plans.

How Long Do You Have To Buy Back A Medigap Policy

If you drop your Medigap plan because you enrolled in Medicare Advantage, you have special rights to buy back a Medigap policy if youre unhappy with the MA plan: You have 12 months from enrolling in the MA plan to buy back the same Medigap policy if you switch back to Original Medicare. If that policy is no longer available, you can purchase another one.

Also Check: What License Do You Need To Sell Medicare Supplements

Can I Cancel A Medigap Policy At Any Time

En español | Yes, Medigap policies dont have an annual open enrollment period like the time from Oct. 15 to Dec. 7 for a Medicare Part D prescription or Medicare Advantage plan. So you can cancel, buy or switch Medigap policies any time during the year.

But if you change your mind, you may have a difficult time getting Medigap coverage again. Unless you buy at certain times, an insurer may reject you or charge more because of preexisting health conditions.

Medicare supplement insurance, better known as Medigap, is an additional policy that helps pay original Medicare copayments, deductibles and other out-of-pocket costs. Some Medigap policies provide extra coverage, for example, for foreign travel emergencies.

Private insurers sell Medigap policies. Federal and state laws regulate the plans.

Do You Have To Take Medicare When You Turn 65

The answer is no. If you are collecting Social Security retirement benefits or Railroad Retirement Board benefits at least four months before you turn 65, you will be automatically enrolled in Medicare Part A and Part B.

If you choose to delay your Social Security or Railroad Retirement Board retirement benefits, you will not be automatically enrolled in Medicare when you turn 65. In this case, you will have to manually enroll if you want to be covered by Medicare.

Many people who are still working and covered by an employer health insurance policy at age 65 may choose to delay Medicare Part B coverage until they retire and are no longer covered by the employers plan.

As with many questions about Medicare, you may call 1-800-MEDICARE with questions about cancelling Part A or Part B coverage.

You should contact your plan carrier directly if you want to cancel a Medicare Advantage, Part D or Medigap plan.

You May Like: Does Medicare Pay For Mental Health Services

What Happens To Medicare Advantage Or Part D If I Work

For Medicare Advantage, you also need to have both Part A and Part B, so you must drop that coverage if you stop Part B. After you leave your job, youll have two months to get a Medicare Advantage plan if you want a private plan rather than original Medicare. Otherwise, you can sign up during open enrollment, each year from Oct. 15 to Dec. 7.

For Part D prescription coverage, you can keep coverage as long as you have either Part A or Part B. But you may not need that coverage if your employer offers prescription drug coverage thats considered as good or better than Medicares, called creditable coverage. You wont pay a late-enrollment penalty as long as you sign up for Part D within two months of losing that coverage.

Bottom line: If you end up dropping either the Medicare Advantage all-in-one alternative to original Medicare or the Part D drug coverage that works with traditional Medicare, youll have two months after your job-based insurance ends to reenroll.

Keep in mind

When you return to work, be mindful of the high-income surcharge if you keep Medicare Part B or Part D. If youre single and your modified adjusted gross income is more than $91,000 or $182,000 if married filing jointly, youll have to pay higher premiums.

After you retire or experience certain other life-changing events, you can ask the Social Security Administration, which handles these surcharges, to use your more recent income to reduce or eliminate the surcharge.