What Is The Difference Between Medigap And Medicare Advantage

Medigap is a plan that helps cover the gaps in your Original Medicare coverage, while Medicare Advantage facilitates delivery of your Part A and Part B benefits. In general, compared to Medicare Advantage, Medigap plans feature:

- Higher premiums

- Ability to move with you, even if you move out of state

- Ability to see providers of your choice

- No prescription drug coverage

I Have Va Health Care Benefits

VA benefits cover care you receive in a VA facility. Medicare covers care you receive in a non-VA facility. With both VA benefits and Medicare, youll have options for getting the care you need.

Its usually a good idea to . VA health care benefits do not qualify as creditable coverage. You may have to pay a penalty if you delay Part B enrollment, unless you have other creditable coverage such as through an employer.

You Currently Have Tricare Or Champva Coverage

Active duty and retired military members and their families are typically eligible for TRICARE health insurance through the Department of Defense. Those who arent eligible, such as surviving spouses and children, may be eligible for CHAMPVA coverage.

If you have TRICARE or CHAMPVA coverage and are eligible for premium-free Part A, you must also enroll in Part B to keep your current coverage.

If you arent eligible for premium-free Part A, youre not required to sign up for Part A or Part B. If you dont sign up during initial enrollment, though, you will incur a lifetime late enrollment penalty whenever you do sign up.

If you want to defer Medicare coverage, you dont need to inform Medicare. Its simple: Just dont sign up when you become eligible.

You can also sign up for Part A but not Part B during initial enrollment.

Read Also: What Is The Best Medicare Advantage Plan In Washington State

I Have Cobra Coverage

COBRA lets you keep your employer health coverage for a limited time after your employment ends. There are two situations that can happen with COBRA and Medicare, and it depends on which you get first.

Situation 1: If you get COBRA first.

Usually you cant keep COBRA once you become eligible for Medicare. Youll want to sign up for Medicare Part A and Part B when you turn 65, unless you have access to other creditable coverage However, you may be able to keep parts of COBRA that cover services Medicare doesnt, such as dental care.

Your spouse and dependents may be able to continue COBRA coverage after you enroll in Medicare. Talk with your plan benefits administrator about your needs and options.

Situation 2: If you get Medicare first.

In this case, you are allowed to enroll in COBRA as well. Its not required, and COBRA would act as your secondary insurance.

Qualifying For Extra Help With Prescription Drug Costs

Medicare offers a low-income subsidy program to qualified participants in a Medicare Part D prescription drug plan. Under the program , participants may pay a lower deductible and lower copayment amounts for covered prescription drugs. Medicare, not STRS Ohio, determines if participants qualify for the subsidy program.

Medicare works directly with Express Scripts to determine if you qualify for assistance. If you qualify, Express Scripts will send you a letter informing you about the program.

If you receive a letter from Express Scripts, you will be enrolled automatically in the subsidy program offered by Medicare. If you do not receive a letter and believe you may qualify for assistance, you can call Medicare directly for more information or to request an application.

Don’t Miss: How Do I Find Out My Medicare Number

I Am About To Turn 65 My Spouse Is 60 And Still Working We Are Both Covered Under Her Employers Health Plan Do I Have To Do Anything With Regard To Medicare This Year

A person with group health coverage through a current employer may be able to delay enrolling in Part A and Part B until that coverage ends, and wont face penalties for enrolling later, but only if the employer has 20 or more employees. If your wifes employer has at least 20 employees, you may want to enroll in Part A but delay enrollment in Part B until your group coverage through your spouses employer plan ends.

If you are already receiving Social Security benefits, you will be automatically enrolled in Part A and Part B when you turn 65. If you do not want to pay a premium for Part B benefits now because you have comparable coverage under your spouses employer plan, you will need to let Social Security know that you want to delay Medicare Part B enrollment. You can contact Social Security about this beginning three months before you turn 65. Otherwise, Medicare will assume you want to enroll in Part B and the monthly premium will be automatically deducted from your Social Security check.

If the employer has fewer than 20 employees, you should sign up for Part A and Part B when youre first eligible or you will face late enrollment penalties.

If you do delay Part B enrollment because you are covered under your wifes plan, remember to sign up for Part B once her coverage ends. That way, youll have continuous coverage and wont face a late enrollment penalty for Part B.

Not Checking Your Doctors For 2023

If you have a Medicare Advantage plan, you generally must get medical care from doctors within that plans network and a plans network can change at any time. Before you decide to stick with the plan youre in, make sure your preferred medical providers are still in the plans network in 2023.

This may require some legwork on your part, since websites and provider directories arent always up to date.

I was just at a client, and said their doctor wasnt in-network, and it took us calling the provider and looking up a different site on the network side, says Evan Tunis, president of Florida Healthcare Insurance. The best thing I would advise is to call the doctors office and just confirm with them.

More: Its open enrollment and your Medicare coverage needs a checkup

Read Also: What Age Do You Enroll For Medicare

Selecting Your Plan As A Medicare Enrollee

To select a plan, call STRS Ohio toll-free at 8882277877. You may select a new plan up to three months after your 65th birthday. The effective date of coverage under your new plan will be the first of the month following notification to STRS Ohio, if received by the 15th of the month. There will be no interruption in your health care coverage.

Be aware, your plan selection cannot be processed until STRS Ohio receives proof of Medicare enrollment. This applies even if you are selecting a plan offered by your current plan administrator. STRS Ohio must receive proof of Medicare enrollment by the 15th of the month to begin your participation in the plan the first of the following month. Any delay in submitting this proof will delay your enrollment in the plan you select as a Medicare enrollee.

Note: If you change plan administrators, your medical deductible and out-of-pocket maximums will transfer to the new plan administrator only if you move between an Aetna plan and a Medical Mutual plan.

Can You Decline Medicare

You know what they say: 65 is the new 50. Okay, they might not be saying that all the time, but it is applicable to how you might be feeling if youâre facing your 65th birthday.

You might still be working, or you might not have plans to retire anytime soon.

Do you need to enroll in Medicare, or can you decline? Thatâs the question weâre here to answer today. We going to answer it and look at the pros and cons. And if you still have any questions, you should check out the companion article to this one that looks at Medicare requirements.

Read Also: When Can You Get Medicaid And Medicare

When To Enroll In Medicare

Initial Enrollment Period

You have a seven-month initial enrollment period in which to sign up for Medicare. This period begins three months before you turn age 65, includes the month you turn age 65 and ends three months after the month of your birthday.

For coverage to be effective the month you turn age 65, you must sign up during the first three months of the initial enrollment period . If you wait to sign up during the last four months of the period, your effective date of coverage under Medicare will be delayed.

Begins three months before and ends three months after the month you turn age 65

Initial Enrollment Period for Medicare| You will have NO DELAY in coverage if you enroll: | |||

|---|---|---|---|

| Three months before you turn 65 | Two months before you turn 65 | One month before you turn 65 | |

| Coverage begins the month you turn 65 | |||

| You will have a DELAY in coverage if you enroll: | |||

| The month you turn 65 | One month after you turn 65 | Two months after you turn 65 | Three months after you turn 65 |

| Coverage begins one month after the month you enroll | Coverage begins two months after the month you enroll | Coverage begins three months after the month you enroll | Coverage begins three months after the month you enroll |

General Enrollment Period

If you miss the initial enrollment period, you can enroll during a general enrollment period from Jan. 1 through March 31 each year. However, Medicare coverage is not effective until July 1 and a lifetime Medicare late enrollment penalty will apply.

Reasons To Delay Medicare Part B

You may want to delay Medicare Part B to postpone paying the monthly premium that comes with it. Pay attention to timing when youre ready to enroll, though. Part B charges a late enrollment penalty unless you qualify for a Special Enrollment Period. You may qualify if you have through an employer or union.

Speak with your plan benefits administrator before delaying Part B. They can help you find out if you would have creditable coverage and if you can delay or if you need to enroll in Medicare at 65.

There are few reasons you may consider delaying Medicare Part A or Part B for, so learn about your choices and make a plan for Medicare enrollment that works for you.

Read Also: Does Medicare Part C Cover Dentures

Why Would I Opt Out Of Medicare

Part B comes with a premium in most cases. Some people delay enrollment in Medicare Part B to avoid paying the premium â especially if they have other coverage. The same can be true of Part A, for people that must pay a premium for it.

If you delay enrollment in Part B or Part A, make sure you plan it well to avoid problems. For example:

- Group health plans may have different coverage rules if youâre eligible for Medicare coverage. Check with your plan and ask how it would work with and without Medicare.

- You might face a late enrollment penalty if you delay Part B and/or Part A coverage. To avoid a penalty, make sure you enroll in Medicare promptly when your employment ends, or when the group health coverage ends. After the month coverage or employment ends , you might have an 8-month Special Enrollment Period to enroll in Medicare without a penalty. Ask your benefits administrator, or contact Medicare.

Is Prolia Covered Under Medicare Part B Or D

What Part of Medicare Pays for Prolia? For those who meet the criteria prescribed above, Medicare Part B covers Prolia. If you don’t meet the above criteria, your Medicare Part D plan may cover the drug. GoodRx reports that 98% of surveyed Medicare prescription plans cover the drug as of October 2021.

You May Like: What’s The Eligibility For Medicare

When Are The Medicare Enrollment Deadlines

For people who are receiving or eligible to receive Social Security benefits, Social Security will send you instructions for signing up three months before the month you turn 65. People who are receiving Social Security benefits will not be charged for Part A which covers hospital visits and services. Part A also covers hospice and skilled-nursing services as well as some home health care.

Part B is similar to traditional health insurance and comes with a base monthly premium that generally changes each year. Individuals who are considered high-income earners will pay more than the base rate depending on their annual income.

Folks who are living outside the United States or are traveling abroad should contact the closest Embassy or consulate to request enrollment forms.

The actual enrollment period for Original Medicare begins three months before you turn 65 and continues for an additional three months thereafter.

Read Also: Is Kaiser A Medicare Advantage Plan

Is Medicare Part C Mandatory

Signing up for Medicare Part C, better known as Medicare Advantage, is never mandatory.

Medicare Advantage plans serve as an alternative to Original Medicare . These plans are administered by private health insurance companies that contract with the federal government.

Plans must provide the same level of care as Original Medicare but may also bundle other benefits into a single plan, such as prescription drug, dental and vision care.

You May Like: How Do I Choose Medicare Part D Plan

If None Of The Above Situations Apply To You:

- You may face a late enrollment penalty if you do not enroll in Part B when eligible. Your monthly premium may go up 10% for each 12-month period you could have had Part B but didnt. In most cases, youll have to pay this penalty each time you pay your premiums for as long as you have Part B, and it could increase the longer you go without coverage. This is a life-long penalty.

- You may also face a gap in coverage, so if something happened to you and you had to go to the doctor or hospital, you would not have insurance coverage and have to pay 100% of the costs out-of-pocket.

Medicare Coverage For Chronic Care Management

Lindsay MalzoneReviewed by: Rodolfo MarreroHomeFAQsCoverage

Unfortunately, most Americans suffer from some form of chronic illness. Per the Centers for Disease Control and Prevention , 6 out of 10 Americans have at least one chronic condition. And on top of that, 4 out of 10 American adults suffer from two or more chronic conditions.

So what exactly is a chronic condition? Furthermore, does Medicare cover these conditions? Today well dive into how Medicare offers comprehensive coverage for chronic care management. Well look at eligibility factors, how much you can expect to pay out-of-pocket, and much more.

Recommended Reading: Is Belsomra Covered By Medicare

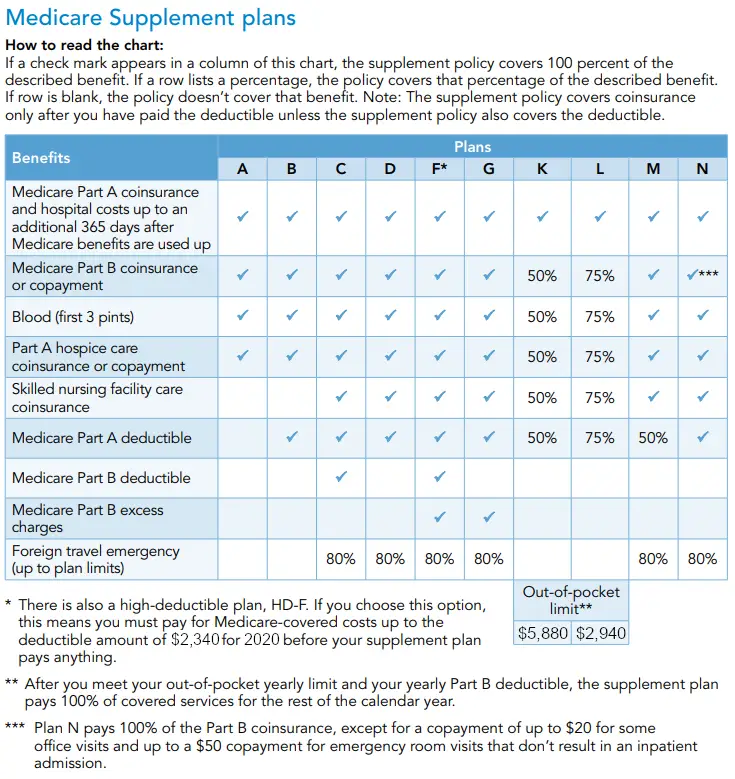

Do Medicare Supplement Policies Cover Chronic Care Management Plans

Original Medicare doesnt only cover Medicares CCM plans, but Medigap policies too. Medicare Supplement plans cant only cover the costs associated with your CCM but anything that Medicare wont typically cover. So, if you have copays for your doctors appointments, your Medigap plan can help pay for those copays. Medigap plans will vary in price depending on your specific policy.

Compare Prescription Drug Plans And Make Sure Your Doctors Are In Your Network

Your prescription drug plan may change whats covered every year.

This article is reprinted by permission from NerdWallet.

Millions of retirees are in the thick of Medicare open enrollment, which runs from Oct. 15 to Dec. 7, but many find the process challenging. Some dont understand the difference between Original Medicare and Medicare Advantage, many are overwhelmed by Medicare advertising, and only 4 in 10 people review their plan options each year, according to a from health care consulting firm Sage Growth Partners.

This leads to Medicare open enrollment misses, including not confirming that your providers are in-network for the next plan year and not comparing your Medicare Part D prescription drug coverage with other available options.

Here are some common Medicare open enrollment mistakes:

Read Also: Is Ibrance Covered By Medicare

What You Need To Know

- Federal spending on entitlements overall including Social Security, Medicaid and Affordable Care Act subsidies is seen growing from $3 trillion next year to $12.5 trillion in 30 years.

- The GOP wants to mitigate these costs by, among other things, raising the eligibility age for Medicare to match the Social Security retirement age, which is 67 for those born after 1960.

- Simply forming a bipartisan commission with no sense of urgency would result in a compromise proposal that is forgotten as soon as it is released.

Republicans hoped that Americans would deliver a clear repudiation of President Joe Bidens economic policies when they went to the polls earlier this month. They came away with something far less decisive.

The GOP has gained control of the House of Representatives, but with the slimmest of slim majorities, and it has no chance of taking the Senate even if the party is victorious in Georgias runoff.

Still, GOP leaders in the House are confident they can leverage their narrow victory into meaningful policy gains. It wont be easy, but they do have one and perhaps more than one path to success.

Returning to thorny issues, theyre likely to push for reforms to two major entitlement programs: Medicare and Social Security. Medicare spending is forecast to top $1 trillion for the first time next year, and rise at a faster pace than gross domestic product for the foreseeable future.

The Latest

Is Medicare Mandatory When Youre First Eligible

If youâre still working when you turn 65, or you become eligible through disability, you may be covered under your employerâs group plan. Or maybe your spouse has an employment-based or union-based group health plan that covers you. You usually donât have to enroll in Medicare right away if you have a group health plan.

Traditional Medicare refers to Medicare Part A, which is hospital insurance, and Part B, which is medical insurance. Part A can be premium-free if youâve worked and paid taxes long enough. If you qualify for premium-free Medicare Part A, thereâs little reason not to take it.

In fact, if you donât pay a premium for Part A, you cannot refuse or âopt outâ of this coverage unless you also give up your Social Security or Railroad Retirement Board benefits. Youâd also have to pay back your previous benefits to the government.

Read Also: What Insurance Companies Offer Medicare Supplement Plans