States With Mandated Medigap Coverage Options For Those Under 65

According to a report by the Kaiser Family Foundation, there are 30 states that require insurers to offer at least one Medigap plan to qualifying Medicare beneficiaries under 65.1 Certain states guarantee coverage options for those with ESRD, for those with a disability, or both.

These state requirements can have a big impact on Medigap applicants under 65. For example, if you live in California and have Medicare coverage due to ESRD, a Medigap insurance company is not legally required to offer you a Medigap plan.

The state only protects applicants under 65 with a qualifying disability.

The following chart details the states that legally require Medigap plans to those under 65, along with the health requirements to qualify.

| States with guaranteed issue requirements for under-65 beneficiaries | |

|---|---|

| Number | |

The 30 states in the chart above have a guaranteed issue requirement, which means that insurance companies must offer at least one plan to qualifying applicants under the age of 65.

If applicants are under 65 and have Medicare Part A and Part B coverage, the insurance company must offer at least one Medigap plan to them in the qualifying states. Insurance companies are only required to offer one Medigap plan, but they are permitted to offer more options.

In addition to a guaranteed issue requirement, most of the 30 states above also have an open enrollment period requirement.

1 https://kaiserfamilyfoundation.files.wordpress.com/2013/04/8412-2.pdf#page=24

Crypto Price Prediction: $100000 Bitcoin Could Come Even Sooner Than You Think With Ethereum Leading The Way

What does Medicare cover?

There are four parts to Medicare. Part A provides coverage while you are admitted to the hospital as an inpatient. Part B includes coverage for medical expenses for things such as a doctors visit, preventative testing, medical equipment and outpatient surgeries and procedures. Part C is known as Medicare Advantage and is another way to get your Medicare benefits through a private insurance company instead of the federal government. Finally, Part D is your prescription drug plan. Original Medicare includes Parts A and Part B only.

What are the benefits?

It may seem intrusive to get enrolled in healthcare without asking for it, but there is a big benefit to it. The benefit to automatic enrollment of Original Medicare is that you do not have to worry about missing your window to gain access. It can also serve as a reminder to review your health insurance and revise the coverage to be more aligned with your specific healthcare needs. Many beneficiaries tackle this process by working with a qualified Medicare insurance agent. They stay on top of all the ins and outs of Medicare so you dont have to.

What are the drawbacks?

How does enrollment work?

There are so many different conditions that come into play when considering enrolling in Medicare. It is important to understand how to get started, whether this happens automatically or not.

Applying For Medicare Supplement Insurance At Age 65

When you turn 65, you will be granted a Medigap Open Enrollment Period during which you can apply for a Medigap plan. This six-month period will begin once you turn 65 and are enrolled in Medicare Part B .

During this period, insurance companies cant use your medical history like your hearing loss as a reason to raise your premiums or deny your coverage completely. They must issue you a plan at the same rate as someone with no significant medical history.

Read Also: Is Enbrel Covered By Medicare

Medicare Advantage Eligibility With A Disability

If you have a disability, you may be eligible for Medicare, including Medicare Advantage. To apply for Medicare with a disability, you must have been unable to work for a year or longer, or have been eligible for Social Security or Railroad Retirement Board benefits for 24 months.

To qualify as a disability, a condition must be severe enough to prevent a person from working, and must be on the Social Security Administration’s list of disabling conditions.

Some examples of potentially eligible disabilities include:

- Chronic respiratory disorders such as cystic fibrosis

- Chronic liver disease

- Hearing loss

Original Medicare For Under 65

You can always stay on Original Medicare only and pick up a prescription drug plan on Medicare Under 65. This allows freedom from networks and referrals, but you have no cap on the maximum you can pay. Your risk can be very high because of the lack of a cap on your spending.

Prescription drug plans will work exactly the same for you as it does for beneficiaries over 65 as well.

Don’t Miss: How Old Do I Have To Be For Medicare

Coverage Choices For Medicare

If you’re older than 65 and not already getting benefits from Social Security, you have to sign up for Medicare Part A and Part B. It doesn’t happen automatically. However, if you already get Social Security benefits, you’ll get Medicare Part A and Part B automatically when you first become eligible .

There are two main ways to get Medicare coverage:

Other Benefits Of Medicare Advantage

Original Medicare doesnt have an out-of-pocket maximum, so this is an important protection. Another key benefit of Medicare Advantage plans is that they often come with prescription drug coverage. This feature can save you money since youd otherwise have to pay full price for prescriptions, or enroll in a standalone Part D drug plan to get help with the cost of your medications.

Besides these benefits, Part C plans frequently provide for extra benefits beyond what is covered by Original Medicare. These extra benefits can include:

- Vision and hearing coverage

- Fitness benefits like free and discounted gym memberships

- Transportation

- Safety alert systems

You may want to consider a Medicare Advantage plan for coverage before your 65th birthday. This can protect you from high out-of-pocket expenses and save you money on medications and other services. You can always enroll in a Medicare Supplement insurance plan down the road, when you turn 65, and you can use your Medigap Open Enrollment Period.

You May Like: Does Medicare Pay For Exercise Classes

Getting Medicare Enrollment Assistance

If you have questions about or need help with Medicare eligibility or enrollment due to disability, you will want to talk with Social Security office. You can also go to your local State Health Insurance Assistance Program office for Medicare counseling.

If you get approved for disability benefits but arent yet eligible for Medicare yet , you can reach out your local state human services agency to see if Medicaid may be an option for you.11

How Much Does Medicare Cost At Age 65

The standard premium for Part B modestly increases year over year. Part A costs also can increase, including the annual deductible and other coinsurance. Known as hospital insurance, Part A doesnt require a monthly premium as long as you have paid Medicare taxes through employment for at least 10 years.

Part B, known as medical insurance, typically pays 80% of the covered cost while you pay the deductible and then 20%.

Read Also: Can You Get Medicare At 60

How Does Medicare Supplement Insurance Work

Medicare Supplement insurance, also known as Medigap coverage, works the same for those who are under 65, with a few exceptions.

In general, Medigap plans cover some or all of the gaps in Original Medicare. These gaps refer to amounts that youre expected to pay with Original Medicare. The gaps include:

- Part A deductible $1,408 for 2020

- Part A coinsurance

- Part B deductible $198 for 2020

- Part B coinsurance 20 percent of the Medicare-approved cost for Part B services like doctors visits

- Part B excess charges up to 15 percent of the Medicare-approved cost for Part B services

- Emergency coverage during international travel

Enrolling In Original Medicare

If youre already receiving Social Security or Railroad Retirement Board benefits and youre a U.S. resident, the federal government automatically enrolls you in both Medicare Part A and Medicare Part B at age 65. Youll receive your Medicare card in the mail about three months before you turn 65, and your coverage will take effect the first of the month you turn 65.

Medicare Part B has a monthly premium, which will be deducted from your Social Security or Railroad Retirement check. The standard Part B premium is $170.10/month for 2022. Thats up from $148.50/month in 2021, and quite a bit higher than initially projected in the Medicare Trustees Report projects. But the Social Security cost-of-living adjustment for 2022 is the largest its been in 30 years, and will cover the increase in Part B premiums . However, the larger-than-expected increase in Part B premiums will eat up a significant portion of the Social Security COLA that many beneficiaries receive.

You can opt out of Part B and avoid the premiums, but its generally only a good idea to do that if youve got health insurance from your current employer or your spouses current employer, and the employer has at least 20 employees.

If youre disabled and receiving Social Security Disability benefits, your Medicare coverage will start automatically in the 25th month that youre receiving disability benefits.

Read Also: Does Medicare Have A Limit

Getting Medicare At Age 65

For people without a qualifying disability, eligibility for Medicare Part A requires each of the following:

- You are at least 65 years old.

- You are a U.S. citizen or permanent legal resident having lived in the U.S. for at least five years.

- You are eligible to receive Social Security benefits or Railroad Retirement Board benefits.

If you have worked and paid Medicare taxes for at least 40 quarters , you will be eligible for premium-free Part A.

If you paid Social Security taxes for fewer than 40 quarters, you can still be eligible for Medicare Part A, but you will have to pay a monthly premium.

You may also become eligible for Medicare because of your spouses health care coverage.

If you are at least 65 years old and married to someone at least 62 years old who has worked and paid Social Security taxes for 40 quarters, you may qualify for Medicare as their dependent, even if you do not qualify for Medicare on your own.

Does Medigap Cover Younger Spouses

Not only does Medigap not cover younger spouses, it also can be difficult and rather expensive to enroll in before 65 with a disability.

If you decide to enroll in Medicare when youre first eligible at 65, Medigap can fill in the gaps of Original Medicare. Some of these gaps are Medicares deductibles, copays, coinsurance, and an additional 365 hospitalization days.

Don’t Miss: How To Sign Up For Medicare In Arkansas

A Disability And A Long Wait Are Required For Early Medicare Enrollment

Lisa Sullivan, MS, is a nutritionist and health and wellness educator with nearly 20 years of experience in the healthcare industry.

Medicare isn’t available to most people until age 65, but if you have a long-term disability or have been diagnosed with certain diseases, Medicare is available at any age.

According to Kaiser Family Foundation data, 14% of all Medicare beneficiaries are under age 65. As of April 2021, 63.3 million Americans were enrolled in Medicare. So roughly 9 million of those beneficiaries are under age 65 and eligible for Medicare because of a disability as opposed to age.

Who Qualifies For Medicare Under 65

To qualify for Medicare under the age of 65, the Social Security Administration has to first determine that you meet the criteria for disability. Disability is generally defined as having an illness or condition that is expected to last at least one year while depriving you of a certain amount of income each month.

Qualifying disabilities can include but are not limited to the following:

- Parkinsons disease

- Permanent kidney failure, also called end-stage renal disease

- Amyotrophic lateral sclerosis

Disabled Medicare beneficiaries under the age of 65 receive the same health insurance benefits as seniors who are enrolled in the program.

It is also important to remember that Medicare provides individual, not group, coverage. Medicare benefits do not extend to family members.

You May Like: How To Pay For Medicare Without Social Security

Medicare Faqs And Information To Consider

Automatic Enrollment:

If you are already receiving Social Security benefits, Railroad Retirement benefits, or Federal Retiree benefits, your enrollment in Medicare is automatic. Your Medicare card should arrive in the mail shortly before your 65th birthday. Check the card when you receive it to verify that you are entitled to both Medicare Parts A and B.

Initial Enrollment Period:

If you are not eligible for Automatic Enrollment, contact the Social Security Administration at 800-772-1213 or enroll online at www.socialsecurity.gov, or visit the nearest Social Security office to enroll in Medicare Part A and Medicare Part B. You have a seven month window in which to enroll in Medicare without incurring a penalty. If youre not automatically enrolled in premium-free Part A, you can sign up for it once your Initial Enrollment Period starts. Your Part A coverage will start six months back from the date you apply for Medicare, but no earlier than the first month you were eligible for Medicare. However, you can only sign up for Part B during the times listed below.

General Enrollment Period:

- General Enrollment Period for Medicare Parts A & B

If you have coverage through a current employer, you are not required to enroll in Medicare Part A and B. Below are some things to keep in mind about each part of Medicare.

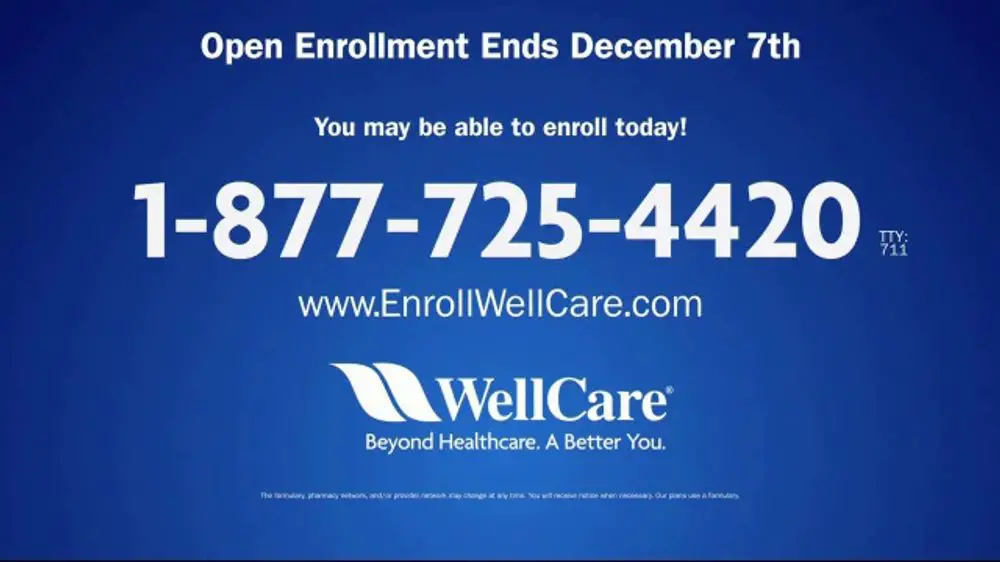

When Is Medicare Open Enrollment

Medicare open enrollment also known as Medicares annual election period runs from October 15 through December 7 each year.

During this annual window, Medicare plan enrollees can reevaluate their coverage whether its Original Medicare with supplemental drug coverage, or Medicare Advantage and make changes or purchase new policies if they want to do so.

During the Medicare open enrollment period, you can:

- Switch from Original Medicare to Medicare Advantage .

- Switch from Medicare Advantage to Original Medicare .

- Switch from one Medicare Advantage plan to another.

- Switch from one Medicare Part D prescription drug plan to another.

- Enroll in a Medicare Part D plan if you didnt enroll when you were first eligible for Medicare. If you havent maintained other , a late-enrollment penalty may apply.

Prior to 2021, patients with end-stage renal disease were unable to enroll in Medicare Advantage plans unless there was a Medicare Special Needs plan available in their area for ESRD patients. But that changed as of 2021, under the terms of the 21st Century Cures Act. People with ESRD gained the option to enroll in Medicare Advantage as of 2021, and CMS expected more than 40,000 to do so. This can be particularly advantageous for beneficiaries with ESRD who are under age 65 and living in states that dont guarantee access to Medigap plans for people under the age of 65.

You May Like: Is The Medicare Helpline Legit

Medicare Sign Up: What You Cant Do

The annual Medicare open enrollment period does not apply to Medigap plans, which are only guaranteed-issue in most states during a beneficiarys initial enrollment period, and during limited special enrollment periods.

If you didnt enroll in Medicare when you were first eligible, you cannot use the fall open enrollment period to sign up. Instead, youll use the Medicare general enrollment period, which runs from January 1 to March 31.

Medicares general enrollment period is for people who didnt sign up for Medicare Part B when they were first eligible, and who dont have access to a Medicare Part B special enrollment period. Its also for people who have to pay a premium for Medicare Part A and didnt enroll in Part A when they were first eligible.

If you enroll during the general enrollment period, your coverage will take effect July 1.

Learn more about Medicares general enrollment period.

Here Are The Main Differences Between Medicare Supplement And Medicare Advantage:

| Plan Features | ||

|---|---|---|

| Medicare Part A Hospital Coverage | Yes | No, but it provides out-of-pocket expense coverage in addition to it1 |

| Medicare Part B Medical Coverage | Yes | No, but it provides out-of-pocket expense coverage in addition to it1 |

| Medicare Part D Prescription Drug Coverage | Usually included | No, but you can buy separate coverage |

| Out-of-pocket expenses covered | No | Yeshow much coverage you have depends on the policy you choose |

| Other coverage included | Yes–most plans include additional coverage. | No, but you can buy separate coverage. |

| Provider network | Yesyour costs are lower when you visit in-network doctors and hospitals. . | Noyou can choose any doctor or hospital youd like that accepts Medicare |

| Free programs and services | Often includes no-cost programs and services not covered by Original Medicare. | Often includes no-cost programs and services2 |

| Offered through | ||

| Part D Prescription Drug coverage, if not included | Original Medicare and Part D Prescription Drug coverage |

Explore Cigna Medicare Supplement Insurance or learn more about Cigna Medicare Advantage plans.

Recommended Reading: How Much Does Humira Cost With Medicare

Who Is Automatically Enrolled For Medicare And Who Needs To Sign Up

Some people will be automatically enrolled in Medicare Part A, which is hospital insurance, and Part B, which is medical insurance, if they meet certain criteria:

- If youre already getting Social Security benefits or are receiving retirement benefits from the Railroad Retirement Board , youll automatically get Part A and Part B on the first day of the month youll turn 65.

- If youve gotten Social Security or RRB disability benefits for 24 months, youll automatically get Part A and Part B.

- If you have ALS , youll get Part A and Part B the month your disability benefits begin.

If youre automatically enrolled, you can expect to get your Medicare card in the mail three months before youll be eligible for benefits. On the other hand, if youre 65 and are not yet receiving Social Security or RRB benefits or if you qualify for Medicare because you have end-stage renal disease, youll need to sign up.

You May Like: Is Inogen One Covered By Medicare