Working After Full Retirement Age

If you choose to work and collect Social Security retirement, your combined income determines if you pay federal income taxes on your Social Security in 2021. Combined income is the total of your nontaxable interest, adjusted gross income and 50 percent of your annual Social Security retirement.

If this total exceeds $25,000 and you are single, or $32,000 and you are married, you pay federal income taxes on part of your Social Security. The Internal Revenue Service taxes 50 percent of Social Security retirement benefits between $25,000 and $34,000 combined income for singles and between $32,000 and $44,000 for married couples filing a joint tax return. The IRS taxes 85 percent of Social Security benefits above $34,000 combined income for singles and above $44,000 for married couples.

References

Recommended Reading: What Is The Advantage Of Medicare Advantage

Enrollment Period For Medigap

The 6-month Medigap open enrollment period begins the month someone turns 65 and enrolls in Part B.

If a person does not enroll during the OEP, they may find they cannot purchase a plan at a later date. If a company does decide to sell them a policy, it may cost more due to any health conditions.

In contrast, if someone buys a Medigap plan during the OEP, the company cannot charge them more than it would charge a person who does not have any health conditions.

If someone has group health insurance through their employer or union, Medigap OEP will start when the individual signs up for Part B.

Got Questions About Medicare Lets Go Over Them Together

Listen, I get it. Medicare can get pretty confusing pretty quickly. But you dont need to have it all figured out on your own. So whether youve been asking yourself, can I work full-time while on Medicare or you still have an entire list of unanswered questions, Im here to help!

If youre new here, my name is Alan McDaniel. Ive been in the insurance industry for over 20 years, and Im passionate about helping people make better insurance decisions. Schedule your free Medicare consultation today, and Ill be happy to answer all of your questions for free!

Also Check: Does Medicare Pay For Assisted Living In Ohio

Working Past 65 Here’s When And Why You Should Enroll In Medicare

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

We publish unbiased product reviews our opinions are our own and are not influenced by payment we receive from our advertising partners. Learn more about how we review products and read our advertiser disclosure for how we make money.

If youre not planning to retire anytime soon but youre about to turn 65, you might be wondering if you should sign up for Medicare. Everyones circumstances are different, but in general, the decision to enroll will depend on the size of your employer and the value youre getting from your workplace health insurance.

Can You Get Medicare If You Are Still Working

- Your current employment status is not a factor in whether or not youre eligible for Medicare at age 65.

- If you initially decline Medicare coverage, you may have to pay a penalty if you decide to enroll at a later date.

You can get Medicare if youre still working and meet the Medicare eligibility requirements.

You become eligible for Medicare once you turn 65 years old if youre a U.S. citizen or have been a permanent resident for the past 5 years. You can also enroll in Medicare even if youre covered by an employer medical plan.

Read on to learn more about what to do if youre eligible for Medicare and are still employed.

Also Check: What Does Cigna Medicare Supplement Cover

Can You Keep Your Health Savings Account With Medicare

A Health Savings Account is used to pay for medical expenses with pretax funds. There are certain requirements you need to meet to be able to contribute to an HSA.

You must be enrolled in a high-deductible health plan and you cant have any other plan. Since Medicare is considered another health plan, you can no longer contribute funds to an HSA once enrolled in Medicare. If your employer was contributing on your behalf, they would also have to cease those additions.

You may receive a tax penalty on funds you contribute to an HSA after you are enrolled in Medicare. However, you dont lose those funds in your HSA account, as you can use them to pay for expenses such as Medicare premiums, copayments, deductibles, and future health care costs.

Michele Dubbert is a licensed independent health insurance agent, working with individuals, families and small businesses. She has been in the Health Insurance industry since 2013. Her passion and specialty prevail in Medicare as she truly enjoys working with this age group.

She takes joy in learning about her clients and their needs. This assists in finding the right plan that fits their lifestyles and most importantly gives them piece of mind. Many of her clients come to her frustrated with the Medicare process, so she helps them from beginning to end.

Medicare Part Bit Depends On The Size Of Your Employer

Medicare Part B covers doctors’ services, outpatient care, medical supplies and preventive services. The primary consideration in deciding if you need Part B is how many employees work at your company.

- If your company has 20 or more employees, your company would remain your primary insurer and you can delay enrolling in Part B without worrying about a late-enrollment penalty or lapse of coverage. When you leave your job, you then have eight months to sign up for Part B under a Special Enrollment Period.

- If your company has fewer than 20 employees, Medicare is considered your primary insurer, whether you’ve enrolled in Medicare or not. Your company plan is the secondary, which means that your employer plan won’t pay for anything that’s assumed to be covered by Medicare. If you don’t sign up for Part B as soon as you’re eligible, you may have to pay a penalty, and there could be a delay in coverage.

Also Check: Does Medicare Supplemental Insurance Cover Pre Existing Conditions

Do I Need To Enroll At 65 If I Work For A Small Company

The laws that prohibit large companies from requiring Medicare-eligible employees to drop the employer plan and sign up for Medicare do not apply to companies with fewer than 20 people. In this situation, the employer decides.

You generally need to sign up for Medicare Parts A and B during your initial enrollment period, which begins three months before and ends the three months after the month you turn 65. If you dont, you could end up with large coverage gaps.

If the employer does require you to enroll in Medicare, which is most common, Medicare automatically becomes your primary coverage at 65 and the employer plan provides secondary coverage. In other words, Medicare settles your medical bills first, and the group plan pays only for services it covers but Medicare doesnt.

So if you fail to sign up for Medicare when required, you essentially will be left with no coverage.

Extremely important: Ask the employer whether you are required to sign up for Medicare when you turn 65 or are eligible to receive Medicare earlier because of a disability. If so, find out exactly how the employer plan will fit in with Medicare. If youre not required to sign up for Medicare, ask the employer to provide the decision in writing.

When Medicare is primary coverage and the employer plan is secondary, you have the right to buy Medigap later with full federal protections. But you must do so within 63 days of the employer coverage ending.

Who Is Eligible For Medicare

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease . Medicare has two parts, Part A and Part B . You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if:

- You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

- You are eligible to receive Social Security or Railroad benefits but you have not yet filed for them.

- You or your spouse had Medicare-covered government employment.

To find out if you are eligible and your expected premium, go the Medicare.gov eligibility tool.

If you did not pay Medicare taxes while you worked, and you are age 65 or older and a citizen or permanent resident of the United States, you may be able to buy Part A. If you are under age 65, you can get Part A without having to pay premiums if:

- You have been entitled to Social Security or Railroad Retirement Board disability benefits for 24 months.

- You are a kidney dialysis or kidney transplant patient.

While most people do not have to pay a premium for Part A, everyone must pay for Part B if they want it. This monthly premium is deducted from your Social Security, Railroad Retirement, or Civil Service Retirement check. If you do not get any of these payments, Medicare sends you a bill for your Part B premium every 3 months.

Don’t Miss: Does Medicare Pay For Shingles Shot 2020

Is Medicare Part B Based On Income

Medicare premiums are based on your modified adjusted gross income, or MAGI. … If your MAGI for 2020 was less than or equal to the higher-income threshold $91,000 for an individual taxpayer, $182,000 for a married couple filing jointly you pay the standard Medicare Part B rate for 2022, which is $170.10 a month.

Employment Plays No Role In Medicare Eligibility As Long As You’re 65 Or Older You Can Sign Up For Medicare

If you are a United States citizen aged 65 or older, you’re eligible for Medicare even if you already have a group health plan through your job. So the answer is yes, you may drop your employer health insurance to go on Medicare .

This page describes how Medicare works if you have health coverage as part of your employment benefits. Please note that the following information also applies if the employer coverage is via your spouse.

Recommended Reading: Does Medicare Pay For Inogen Oxygen Concentrator

Are You Automatically Enrolled In Medicare Part B

Medicare will enroll you in Part B automatically. Your Medicare card will be mailed to you about 3 months before your 65th birthday. If you’re not getting disability benefits and Medicare when you turn 65, you’ll need to call or visit your local Social Security office, or call Social Security at 1-800-772-1213.

Is Medicare Free At Age 65

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

You May Like: How Old Before You Qualify For Medicare

When Should You Apply For Medicare Part A If You Are Still Working

While you are still working, there are 3 different times you are able to sign up for Part A. These instances are listed below:

Unlike Medicare Part B, no penalties are accrued if you do not apply for Medicare Part A right away .

Delaying Enrollment Could Result In A Permanent Penalty

As described above, you cant reject premium-free Medicare Part A without also giving up your Social Security benefits. But since your work history is allowing you access to Medicare Part A without any premiums, few people consider rejecting Part A coverage.

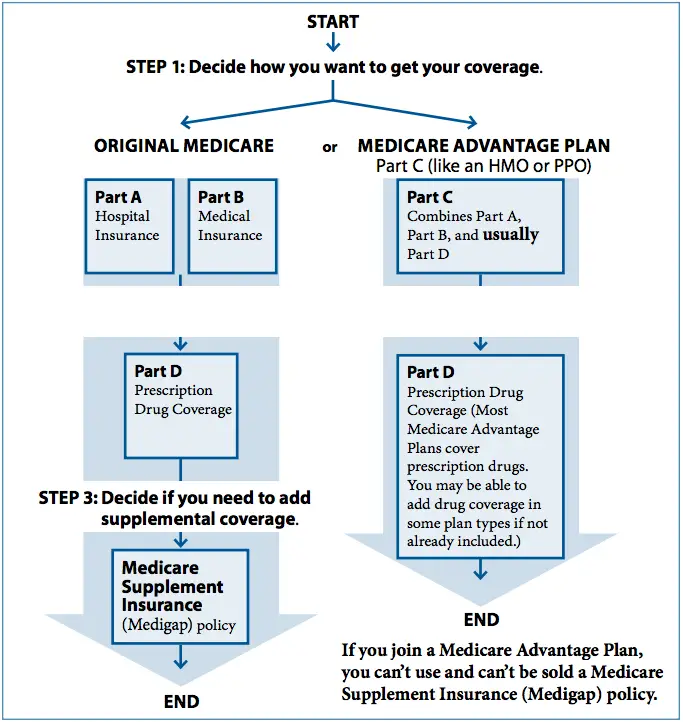

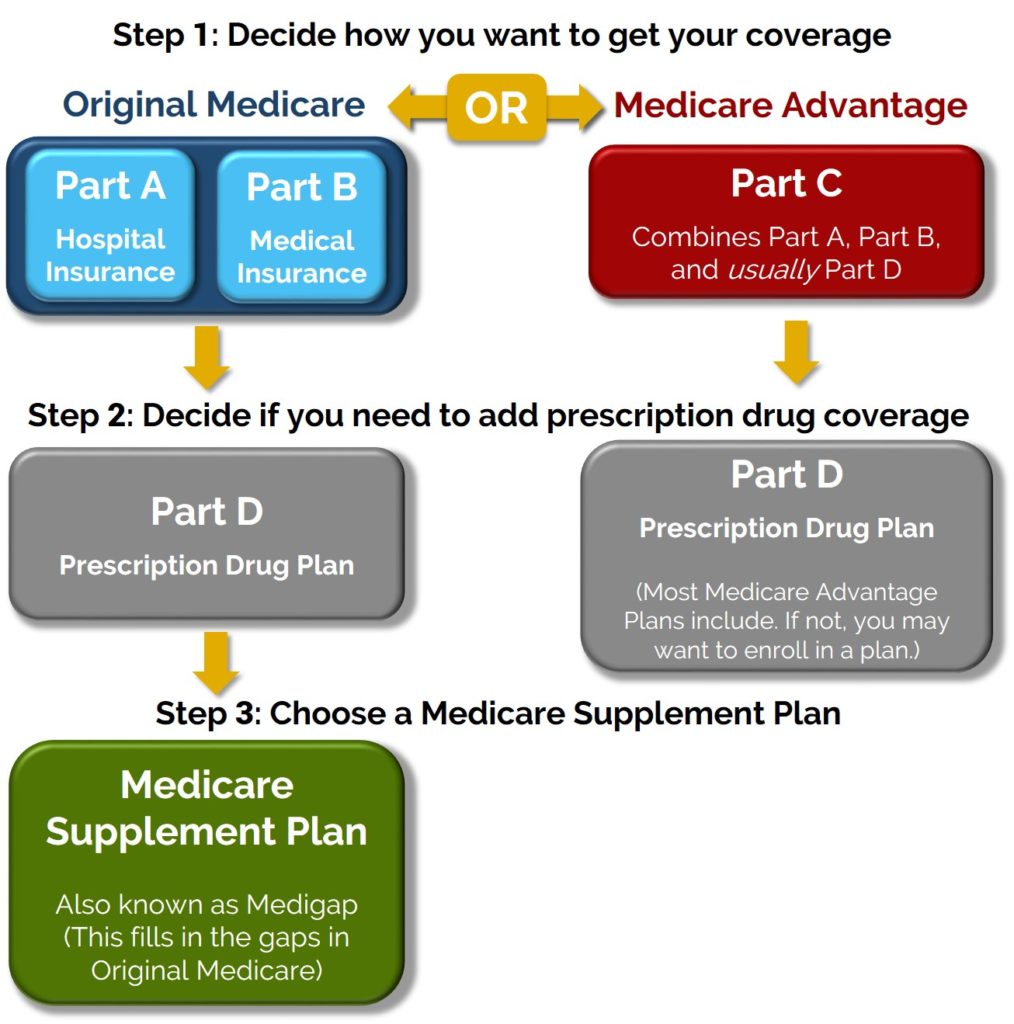

The other parts of Medicare, however, do involve premiums that you have to pay in order to keep the coverage in force. That includes Medicare Part B and Part D , as well as supplemental Medigap plans. Medicare Part C, otherwise known as Medicare Advantage, wraps all of the coverage into one plan and includes premiums for Part B as well as the Medicare Advantage plan itself.

So its understandable that some Medicare-eligible people, who are healthy and not using much in the way of medical services, might not want to enroll in Part D and/or Part B. Similarly, people who are eligible for Part A but with premiums might want to avoid enrolling in order to save money on premiums. But before deciding to postpone enrollment in any part of Medicare, its important to understand the penalties and the enrollment limitations that will apply if you decide to enroll in the future.

There are penalties associated with delaying your Medicare enrollment unless the reason youre delaying is that you are still working and youre covered by the employers health plan. If thats the case, youll be eligible for a special enrollment period to sign up for Medicare when you eventually retire.

Don’t Miss: Does Medicare Cover Pill Pack

Things To Do Before Signing Up For Medicare

Medicare Part C An Alternative To Original Medicare

When you enroll in Medicare, you have the option to choose a Medicare Advantage plan as an alternative to Original Medicare, which includes Medicare A and B. Medicare Advantage is a type of Medicare health plan offered by a private company that provides all Part A and B benefits.

On the plus side, a Medicare Advantage plan also usually provides Part D benefits as well as sometimes providing extras like vision and dental at a lower total cost. On the minus side, you generally have to choose doctors within a particular medical network and get a referral to see a specialist. Another caveat: in some cases, joining a Medicare Advantage plan could cause you to lose your employer plan. Be sure to check with your benefits administrator.

Also Check: Does Medicare Pay For A Registered Dietitian

What Are The Drawbacks Of Getting Medicare While Still Working

While Medicare Part A is free, Medicare Part B which covers doctor visits and outpatient medical supplies requires you to pay a monthly premium . If you keep your existing insurance, you could end up paying premiums for two policies, which could get expensive.

Also, having two insurance policies can be confusing and possibly lead to billing complications. You and your doctor would have to keep track of which plan is primary and which is secondary.

Finally, if you have a high-deductible health plan through your employer, you may no longer be eligible to contribute to a health savings account once you enroll in Medicare.

Can I Work Full Time At 66 And Collect Social Security

When you reach your full retirement age, you can work and earn as much as you want and still get your full Social Security benefit payment. … In addition, as long as you continue to work and receive benefits, we’ll check your record every year to see whether the extra earnings will increase your monthly benefit.

You May Like: What Is The Cost Of Medicare Supplement Plan F

Medicare And Private Insurance

Medicare and Medicaid are government-run health insurance programs. Private insurance means any healthcare plan sold by a private insurance company.

If your private insurance plan is provided by an employer, the above rules regarding primary and secondary payers applies. There is no other type of private health insurance in which Medicare is secondary payer. This includes COBRA, retiree health plans, and coverage via the ACA Marketplace. If you have one of these plans, Medicare is primary payer with your private insurance paying secondary.

Does Medicare Work With Health Savings Accounts

When enrolled in any Part of Medicare, you cannot contribute to a Health Savings Account . Likewise, your employer cannot contribute to your HSA once any Part of your Medicare is active.

So, if your group offers an HSA plan when you have Medicare and employer coverage, you are not eligible for the HSA option. If you make HSA contributions past your Medicare enrollment, you can face profound tax implications.

If your spouse has coverage through your group insurance, they can still contribute if their Medicare is not active, and contributions are made in their name. The good news is that you can use the funds saved in your HSA to pay for any medical expenses while you are on Medicare.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Read Also: What To Do For Medicare Before Turning 65