What Different Types Of Coverage Can You Have With Medicare

If youre still employed but became eligible for Medicare and enrolled during your Initial Enrollment Period, youre allowed to have private health insurance coverage through your employer. You may also still be enrolled on your spouses group plan if theyre still receiving health insurance from their employer and receive Medicare at the same time.

Youre also able to be enrolled in Medicare and COBRA at the same time. COBRA is a plan that allows you, or your spouse, to temporarily keep private health insurance coverage once employment ends. Finally, you can also enroll in TRICARE and Medicare simultaneously. TRICARE is insurance coverage for active military personnel, as well as retired military veterans. It also provides coverage for their dependents. In order to be able to have both TRICARE and Medicare at the same time, you must:

- Be 65 or older and enrolled in Medicare Part B

- Have a disability, end-stage renal disease , or amyotrophic lateral sclerosis , and be enrolled in both Medicare Part A and Part B

- Have Medicare and are a dependent of an active duty service member with TRICARE coverage

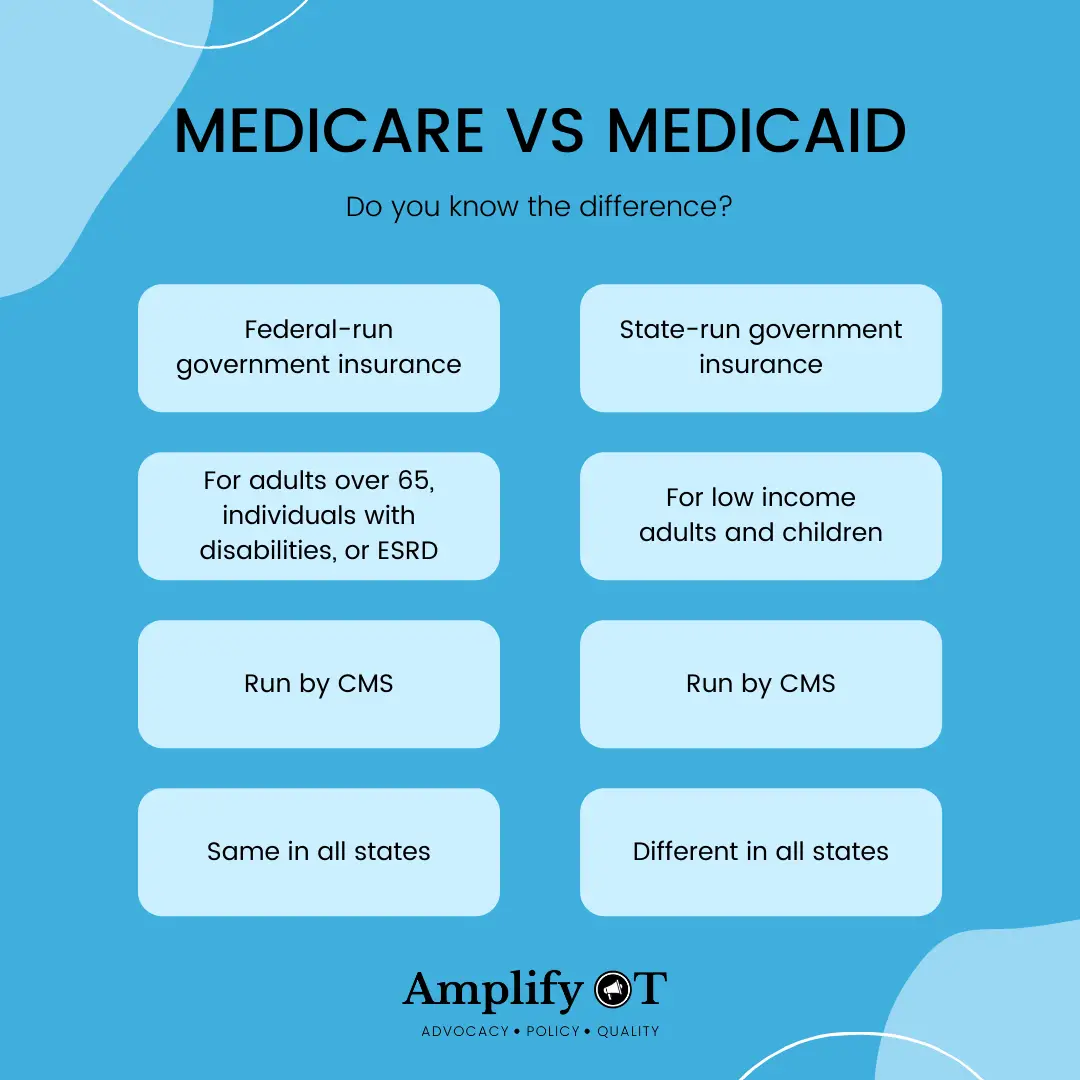

What Is The Difference Between Medicare And Medicaid

If youve ever been confused about the differences between Medicare and Medicaid, you are not alone. Simply put, both Medicare and Medicaid are government-regulated health insurance programs that help to provide healthcare service and treatment to millions of Americans, but each program has slightly different rules of eligibility and provides different coverage to different groups of people.

Medicare Part B: What Does It Cover

Part B of Medicare pays for medically necessary outpatient services. This can vary from diagnostic tests to doctor visits and outpatient surgeries. Medicare Part B will also usually cover durable medical equipment .

The Part B premium is $164.90 in 2023, although this can be higher depending on your income. The Part B deductible is $226 in 2023, and you will pay a 20 percent co-insurance after your deductible has been met.

Recommended Reading: Does Medicare Cover Any Weight Loss Programs

Best National Coverage: Aetna

- Coverage Limit : $1,000 to $4,500

- Providers In Network: 700,000

With plans offered in all 50 states, Aetna is our top choice for national coverage. The insurer features a provider network of over 1.2 million health care professionals across the country.

-

Available in all 50 states

-

Large provider network

-

Not all plans offered in all areas

-

Not all plans come with dental coverage

We chose Aetna as best for national coverage for its operations in all 50 states. Aetna has approximately 12.7 million dental members, and their network includes about 1.2 million health care professionals, with over 700,000 primary care doctors and specialists.

With many of their Medicare Advantage plans, Aetna offers home delivery of most prescription drugs through their mail-order pharmacy: CVS Caremark. Aetna also offers a concierge program with many of its Medicare Advantage plans. An Aetna concierge can help you manage your health care expenses, understand your benefits, locate providers near you, and help plan for treatments.

Founded in 1853, Aetna has a full range of plans with premiums ranging from $0 to nearly $100 each month, depending on your needs and location.

Also Check: Visions Federal Credit Union Vestal

Medicare And Workers Compensation

Workers compensation always pays first when youre using it alongside Medicare. Thats because workers compensation is an agreement that your employer will pay medical costs if youre hurt at work. In return, you agree not to sue them for damages. Since your employer has agreed to pay, Medicare will not pay until the benefit amount of your workers compensation is completely spent.

However, sometimes a workers compensation case needs to be investigated or proven before its approved. In this case, Medicare will act as a temporary primary payer. When your claim is approved, workers compensation will reimburse Medicare. Youll also be reimbursed for any coinsurance or copayments you made.

You May Like: Is Everyone Eligible For Medicare

Also Check: What Is The Penalty For Not Signing Up For Medicare

If You Have Cobra Or Retiree Insurance

The point where COBRA, Medicare, private insurance and retirement intersect can be awfully tricky. Employers of 20 people or more must offer a Consolidated Omnibus Budget Reconciliation Act, or COBRA, extension of their health plans to employees facing certain qualifying events, like getting laid off or retirement. Qualifying for Medicare upon turning 65 is sometimes but not always a qualifying event, as well. But you are responsible for the entire COBRA premium, both what you paid and what your employee paid, prior to your retirement, plus a 2% surcharge by the insurance company for its administrative costs.

Depending on what your options are and what you choose to do, the interplay among private insurance, Medicare and COBRA are integral. For example, an employee retires and waives COBRA in favor of a retiree health plan covering him and his family. But you cant have both that retiree health plan and Medicare at the same time. When he qualifies for Medicare, he loses the retiree plan but must be offered COBRA from the date of his Medicare qualification to at least 18 months forward. Employees should consult with their company benefits administrators for more information.1

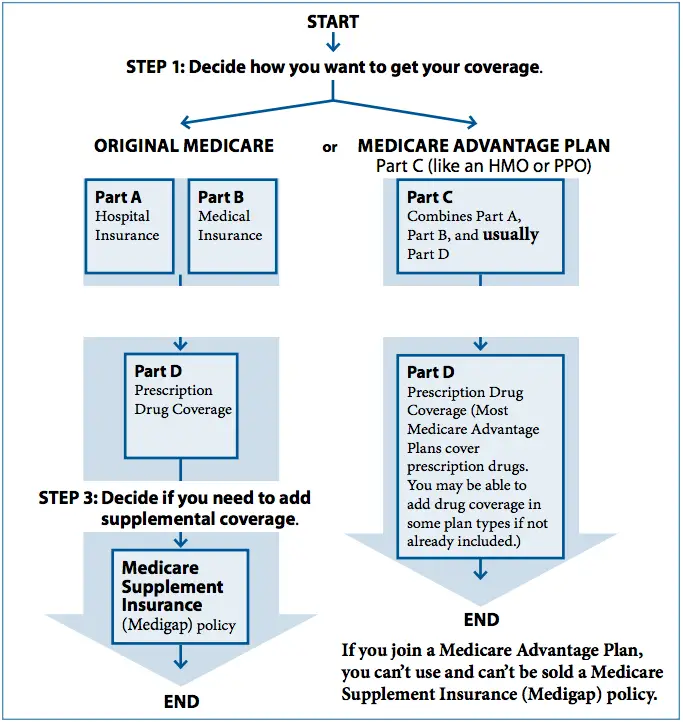

Other Health Insurance: What Are My Options

If you are eligible for Medicare, there are a few options that you have for additional medical insurance. Some of these plans can coexist with Original Medicare, but Part C Medicare Advantage plans cannot. Well run through every option you have, and discuss how it interacts with your Medicare coverage.

You May Like: What Does Medicare Supplement Cover

How Does The Free Covid

In January 2022, President Joe Biden announced the launch of CovidTests.gov, a website that let households order four free rapid antigen COVID-19 tests shipped by USPS. The site added four more free tests in March, and then another eight more in May. The latest round of shipments also includes four COVID tests.

Unlike some complicated government applications, ordering free tests from the Postal Service is simple. It takes less than two minutes to complete a short form asking for your name and mailing address, and the tests ship in about a week or two. Americans without internet access or those who have trouble ordering online can request tests using a toll-free phone number — 800-232-0233.

Can I Use Private Insurance Instead Of Medicare

AgingInPlace.org keeps our resources free by working as an affiliate partner with some companies mentioned on our site.These partnerships or the commission we may earn do not affect our opinions or evaluations of the products we mention.Our reviews are solely based on our research methodology and from input from our AgingInPlace.org Advisory Board.Learn more about our ad policies.

Can I Use Private Insurance Instead Of Medic…

Medicare is a federal health care program designed to provide benefits for those 65 and older or those who are younger in age but have been diagnosed with a qualified medical condition. But what if you want to use private insurance instead?

You May Like: Do I Have Medicare Part A Or B

Create A Secure Online Account

Youll need your Medicare number to create a Medicare account, which is different from the online Social Security account that you might have used to sign up for Medicare. Once done, you can access your health info, pay premiums, view original Medicare claims, print a Medicare card and get program updates and alerts.

Can I Drop My Employer Health Insurance And Go On Medicare

Do I Need Medicare Part B If I Have Other Insurance

Remember, Medicare is a U.S. federal government health insurance program that subsidizes healthcare services.

It depends on the type of insurance an individual has. If the insurance is a COBRA or individual policy, or retiree coverage provided by a union or employer, enrollment in both Part A, hospital insurance, and Part B, medical insurance, is necessary. These types of insurance are secondary to Medicare, paying for any covered care after Medicare has paid its share.

But if the insurance comes through current employment of either the beneficiary or his or her spouse with a large employer , Medicare recommends enrollment in premium-free Part A. Part B enrollment is not necessary. When this coverage ends, Medicare provides special periods to enroll in Part B and obtain other coverage, such as a Part D prescription drug plan, a Medigap policy, or a Medicare Advantage plan.

Do I Need Medicare Part B If I Have Retiree Insurance

It depends on the type of insurance an individual has. If the insurance is a COBRA or individual policy, or retiree coverage provided by a union or employer, enrollment in both Part A, hospital insurance, and Part B, medical insurance, is necessary. These types of insurance are secondary to Medicare, paying for any covered care after Medicare has paid its share.

Do I Need Medicare Part B If I Have Medicaid

Here are a few examples of how Medicaid can work with Medicare.

Privacy

Disclaimer

You May Like: What Does Part A Of Medicare Pay For

If You Can Have Medicare And Private Insurance How Does That Work

If you have private health insurance along with your Medicare coverage, the insurers generally do âcoordination of benefitsâ to decide which insurer pays first.

For example, suppose youâre enrolled in Medicare Part A and Part B, and youâre still covered through an employer, or your spouseâs employer.

- If the employer has 20 or more employees, the group health plan usually pays first.

- If the employer has fewer than 20 employees, Medicare usually pays first.

Important: If youâre eligible for both Medicare and private insurance such as a retiree group plan, check with the group plan to find out how your coverage may change when youâre eligible for Medicare.

What Factors Affect How You Can Build Your Health Coverage

When you have multiple options, there are several factors that will determine the best structure for your health insurance coverage. Those factors include:

-

Whether your spouse has health insurance

-

Whether you like the doctors or hospitals in your private plans network

-

The out-of-pocket costs of both primary and secondary insurance

The total out-of-pocket costs for each policy would include, among others:

-

Out-of-pocket prescription costs, which are dictated by your plans drug formulary

If you get health insurance through an employer that has fewer than 20 workers, youll have to purchase Medicare when you turn 65, and that will be your primary coverage.

Another factor to consider: whether you have creditable drug coverage. Medicare requires everyone 65 and older to have adequate prescription drug coverage, so you may need to purchase a standalone Part D plan if your employer plan does not qualify. Your plan provider can tell you whether or not your prescription drug coverage is creditable.

Its important to tell your doctor or healthcare provider if you have multiple insurers. In cases where you get treatment and your private insurance does not pay for a service that Medicare believes should be covered, Medicare may make a conditional payment on your behalf.

Don’t Miss: How Much Does Medicare Pay For Urgent Care Visit

Open Enrollment For People Age 65 And Older

The open enrollment period for Medicare supplement plans is a six-month period during which you may buy any Medicare supplement plan offered in Texas. During this period, companies must sell you a policy, even if you have health problems. The open enrollment period begins when you enroll in Medicare Part B. You must have both Medicare parts A and B to buy a Medicare supplement policy.

You can use your open enrollment rights more than once during this six-month period. For instance, you may change your mind about a policy you bought, cancel it, and buy any other Medicare supplement policy.

Although a company must sell you a policy during your open enrollment period, it may require a waiting period of up to six months before it starts covering your preexisting conditions.

Preexisting conditions are conditions for which you received treatment or medical advice from a doctor within the previous six months.

Other Ways To Get Medicare Coverage

If you do not qualify on your own or through your spouses work record but are a U.S. citizen or have been a legal resident for at least five years, you can get full Medicare benefits at age 65 or older. You just have to buy into them by:

- Paying premiums for Part A, the hospital insurance. How much you would have to pay for Part A depends on how long youve worked. The longer you work, the more work credits you will earn. Work credits are earned based on your income the amount of income it takes to earn a credit changes each year. In 2022 you earn one work credit for every $1,510 in earnings, up to a maximum of four credits per year. If you have accrued fewer than 30 work credits, you pay the maximum premium $499 in 2022. If you have 30 to 39 credits, you pay less $274 a month in 2022. If you continue working until you gain 40 credits, you will no longer pay these premiums.

- Paying the same monthly premiums for Part B, which covers doctor visits and other outpatient services, as other enrollees pay. In 2022 the amount is $170.10 for individuals with a yearly income of $91,000 or less or those filing a joint tax return with $182,000 in income or less. Rates are higher for people with higher incomes.

- Paying the same monthly premium for Part D prescription drug coverage as others enrolled in the drug plan you choose.

You can enroll in Part B without buying Part A. But if you buy Part A, you also must enroll in Part B.

You can get Part D if youre enrolled in either A or B.

Read Also: How Does Medicare Differ From Medicaid

When Can You Enroll In Medicare And Medigap Plans

You can enroll in Medicare only during certain times. The Initial Enrollment Period is the first time you can enroll and it usually lasts for seven months starting three months before the month you are 65, the month you turn 65, and the three months after the month you reach 65.

If you dont enroll during the Initial Enrollment Period, you may end up paying a late enrollment penalty if you want to have Part B later.

The Medigap open enrollment period begins the month you are 65 and enrolled in Part B and lasts for six months. If you dont buy a Medigap policy during this period, you may not be able to get coverage or it may be more expensive.

Medicaid Is Structured As A Federal

Subject to federal standards, states administer Medicaid programs and have flexibility to determine covered populations, covered services, health care delivery models, and methods for paying physicians and hospitals. States can also obtain Section 1115 waivers to test and implement approaches that differ from what is required by federal statute but that the Secretary of HHS determines advance program objectives. Because of this flexibility, there is significant variation across state Medicaid programs.

The Medicaid entitlement is based on two guarantees: first, all Americans who meet Medicaid eligibility requirements are guaranteed coverage, and second, states are guaranteed federal matching dollars without a cap for qualified services provided to eligible enrollees. The match rate for most Medicaid enrollees is determined by a formula in the law that provides a match of at least 50% and provides a higher federal match rate for poorer states .

Figure 2: The basic foundations of Medicaid are related to the entitlement and the federal-state partnership.

You May Like: How To Check Medicare Payments

How Do You Know If Medicare Is Primary Or Secondary

Medicare and your other insurance plans coordinate their benefits to avoid duplicate payments. If Medicare is your primary payer, it will pay first and your private plan will kick in to cover some or all of the costs not covered by Medicare. If Medicare is secondary, the opposite will occur.

Typically, whether Medicare is primary or secondary to your existing insurance will depend on how you get your other insurance policy. If you work for a large employer , your workplace insurance is your primary policy. The same rule applies if you get insurance through your spouses large employer. Similarly, if youre on active-duty military and get insurance through Tricare, Medicare will be secondary.

However, if you work for a small company or get health insurance from a former employer, Medicare pays first.

In any case, even if both insurers pay a portion of the costs, you may still end up owing money for your treatment if the two insurers dont completely cover your copayment or deductible.

Using Medicare With Other Insurances

You can also have both Medicare and private insurance to help cover your health care expenses.In situations where there are two insurances, one is deemed the primary payer and pays the claims first. The other becomes known as the secondary payer and only applies if there are expenses not covered by the primary policy.

In claims arising from no-fault or liability insurance cases, the no-fault or liability policy is the primary payer and Medicare is the secondary.

Medicare.gov says that the coordination of benefits rules determine which policy is the primary and which is the secondary.

For instance, if you are 65 or older and have insurance through your employer or your spouses employer and that employer has 20 or more employees, the rules dictate that the employers policy is the primary payer and Medicare is the secondary payer. However, if the employer employs fewer than 20 people, Medicare will usually be the primary.

In claims arising from no-fault or liability insurance cases, the no-fault or liability policy is the primary payer and Medicare is the secondary. However, if the primary denies a medical bill or has decided that it is not liable for the service rendered, Medicare will act as a sole insurance policy and pays as such.

Medicare is also secondary if medical expenses occur as a result of on-the-job accidents involving a workers compensation claim as the employers insurance is required to pay first.

Read Also: Does Medicare Cover Vision Care