When Does Medicare Coverage Start

Medicare coverage is dependent on when you have signed up and your sign-up period. Coverage always starts on the first of the month.

If you meet the criteria for Premium-free Part A, your coverage starts the month you turn 65-years old or the month before if your birthday is the first of the month.

Part B and Premium-Part A plans are dependent on sign-up:

You can also sign up for Premium-free Part A after your 65th birthday. Coverage starts 6 months back from sign-up or when you apply for benefits from Social Security or the Railroad Retirement Board.

After your IEP is over, you can only sign up for Part B and Premium-Part A during the other periods of General Enrollment or Special Enrollment.

For Original Medicare, the General Enrollment Period is Jan. 1 March 31, with coverage beginning on July 1. You may have to pay a monthly late enrollment penalty if you do not qualify for Special Situations.

Under Special Situations or the SEP, you can sign up for Part B and Premium-Part A without paying a late enrollment penalty. Your coverage will start next month. Access your situation and

How Do I Sign Up For Medicare Part B If I Already Have Part A

If you are already enrolled in Medicare Part A and you would like to enroll in Part B under the Special Enrollment Period , you can apply online at Apply for Medicare Part B Online during a Special Enrollment Period. You can upload your application and documents that verify your group health plan coverage through your employer.

You can also fax or mail your completed CMS-40B, Application for Enrollment in Medicare Part B and the CMS-L564, Request for Employment Information enrollment forms and evidence of employment to your local Social Security office. If you have questions, please contact Social Security at 1-800-772-1213 .

Note: When completing the forms CMS-40B and CMS-L564:

- State I want Part B coverage to begin in the remarks section of the CMS-40B form or online application.

- If your employer is unable to complete Section B, please complete that portion as best as you can on behalf of your employer without your employer’s signature.

- Also submit one of the following forms of secondary evidence:

- Income tax returns that show health insurance premiums paid.

- W-2s reflecting pre-tax medical contributions.

- Pay stubs that reflect health insurance premium deductions.

- Health insurance cards with a policy effective date.

- Explanations of benefits paid by the GHP or LGHP.

- Statements or receipts that reflect payment of health insurance premiums.

Can I Have Part D Coverage Without Having Parts A Or B

If youre like most people, you probably have a few different insurance policies scattered around your house. But what about your prescription drug coverage? If youre not sure whether or not you have Part D drug coverage, read on to find out if youre eligible and find out what you need to do to get started.

Contents

Also Check: How To Get Into A Nursing Home On Medicare

Who Is Eligible For Medicare Part B

Anyone who is eligible for premium-free Medicare Part A is eligible for Medicare Part B by enrolling and paying a monthly premium. If you are not eligible for premium-free Medicare Part A, you can qualify for Medicare Part B by meeting the following requirements:

- You must be 65 years or older.

- You must be a U.S. citizen, or a permanent resident lawfully residing in the U.S for at least five continuous years.

You may also qualify for automatic Medicare Part B enrollment through disability. If you are under 65 and receiving Social Security or Railroad Retirement Board disability benefits, you will automatically be enrolled in Medicare Part A and Part B after 24 months of disability benefits. You may also be eligible for Medicare Part B enrollment before 65 if you have end-stage renal disease or amyotrophic lateral sclerosis .

Should I Sign Up For Medical Insurance

With our online application, you can sign up for Medicare Part A and Part B. Because you must pay a premium for Part B coverage, you can turn it down.

If youre eligible at age 65, your Initial Enrollment Period begins three months before your 65th birthday, includes the month you turn age 65, and ends three months after that birthday.

Note: Important Upcoming Change Rules for 2023 and later: If you accept the automatic enrollment in Medicare Part B or if you sign up during the first three months of your IEP, your coverage will start the month youre first eligible. Beginning January 1, 2023, if you sign up during the month you turn 65 or during the last three months of your IEP, your coverage starts the first day of the month after you sign up.

The following chart shows when your Medicare Part B becomes effective in 2022:

| In 2022, if you sign up during this month of your IEP | Your Part B Medicare coverage starts |

|---|---|

| One to three months before you reach age 65 | The month you turn age 65. |

| The month you reach age 65 | One month after the month you turn age 65. |

| One month after you reach age 65 | Two months after the month of enrollment. |

| Two or three months after you reach age 65 | Three months after the month of enrollment. |

The following chart shows when your Medicare Part B becomes effective in 2023:

Recommended Reading: When Can You Start Medicare

When Can I Apply

- Initial enrollment period. This is a 7-month window around your 65th birthday when you can sign up for Medicare. It begins 3 months before your birth month, includes the month of your birthday, and extends 3 months after your birthday. During this time, you can enroll for all parts of Medicare without a penalty.

- Open enrollment period . During this time, you can switch from original Medicare to Part C , or from Part C back to original Medicare. You can also switch Part C plans or add, remove, or change a Part D plan.

- General enrollment period . You can enroll in Medicare during this time frame if you didnt enroll during your initial enrollment period.

- Special enrollment period. If you delayed Medicare enrollment for an approved reason, you can later enroll during a special enrollment period. You have 8 months from the end of your coverage or the end of your employment to sign up without penalty.

How Medicare Works With Other Insurance

If you have

and other health insurance , each type of coverage is called a “payer.” When there’s more than one payer, “coordination of benefits” rules decide who pays first. The “primary payer” pays what it owes on your bills first, and then sends the rest to the “secondary payer” to pay. In some rare cases, there may also be a third payer.

Also Check: Will Medicare Pay For Liposuction

What Does Part B Cover And What Will I Pay

Medicare Part B has an annual deductible of $203 in 2021. This deductible is projected to be $217 in 2022.

You must pay all Medicare-approved Part B costs until you meet the deductible before Medicare starts to pay its share. After you meet your deductible, youll generally be responsible for coinsurance of 20% of the Medicare-approved amount for the service. As described below, you can purchase a Medigap plan that will cover some or most of these charges.

In general, Medicare Part B covers two types of services:

- Medical services: Healthcare services that you may need to diagnose and treat a medical condition. These services are often provided on an outpatient basis, but can also be provided during an inpatient stay. Medicare will only pay for services that they define as being medically necessary.

- Preventive services: Healthcare services to prevent illness or help detect an illness in an early stage so it can be managed before getting worse .

You May Like: Is Unitedhealthcare Dual Complete A Medicare Plan

Do I Need To Notify Anyone If Im Delaying Medicare

You don’t need to provide notice that you’d like to delay enrolling unless you’re receiving Social Security or Railroad Retirement Board benefits. If you are receiving either, you’ll be automatically enrolled in Medicare Parts A & B when you turn 65, and you’ll need to let Social Security know you wish to delay Part B. By law though, if you receive Social Security benefits and are eligible for Medicare, you must also have Medicare Part A.

Get Your Medicare When Working Past 65 Guide and Webinar AccessYou’ll get timely emails with important information to help you navigate your Medicare enrollment journey when working past 65. In this email series, you’ll receive a helpful PDF guide, exclusive access to six webinars and learn about Medicare basics, enrollment, plan options and more.

*Required fields

Thank you for signing up! Your Medicare When Working Past 65 guide and webinar access link will arrive in your inbox soon. Enjoy!

You May Like: How Old Before Medicare Starts

Explore Our Plans And Policies

Medicare Advantage Policy Disclaimers

All Cigna products and services are provided exclusively by or through operating subsidiaries of Cigna Corporation. The Cigna name, logos, and other Cigna marks are owned by Cigna Intellectual Property, Inc. All clinical products and services of the LivingWell Health Centers are either provided by or through clinicians contracted with HealthSpring Life & Health Insurance Company, Inc., HealthSpring of Florida, Inc., Bravo Health Mid-Atlantic, Inc., and Bravo Health Pennsylvania, Inc. or employees leased by HS Clinical Services, PC, Bravo Advanced Care Center, PC , Bravo Advanced Care Center, PC and not by Cigna Corporation. The Cigna name, logos, and other Cigna marks are owned by Cigna Intellectual Property, Inc. All pictures are used for illustrative purposes only.

Cigna contracts with Medicare to offer Medicare Advantage HMO and PPO plans and Part D Prescription Drug Plans in select states, and with select State Medicaid programs. Enrollment in Cigna depends on contract renewal.

Medicare Supplement Policy Disclaimers

Medicare Supplement website content not approved for use in: Oregon and Texas.

AN OUTLINE OF COVERAGE IS AVAILABLE UPON REQUEST. We’ll provide an outline of coverage to all persons at the time the application is presented.

American Retirement Life Insurance Company, Cigna National Health Insurance Company and Loyal American Life Insurance Company do not issue policies in New Mexico.

Exclusions and Limitations:

Medicare And Hsa: Confusing

We realize these rules can be confusing and sometimes downright mind-boggling! Thats why the insurance experts at Boomer Benefits are here to guide you. Are trying to determine what to do about your Medicare coverage? Give us a call so we can help you consider all the moving parts. You should also consult your tax professional about your HSA contributions to receive guidance on the financial end of things.

You May Like: Does Medicare Cover Lift Chair Recliners

Understanding What Medicare Part B Offers

First, lets take a look at what Medicare Part B actually covers. Medicare Part B covers medical treatments and services under two classifications: medically necessary services and preventive services. What qualifies something as medically necessary? In general, medically necessary services must be medical treatments that are required to treat a recognized medical condition or illness. Necessary services and items might include the following:

- Diagnostic equipment

- Supplies, such as walkers or wheelchairs

For example, diabetics need regular doctor visits to ensure appropriate blood levels, as well as appropriate diagnostic coverage to ensure accurate readings.

Medicare Part B beneficiaries also gain access to preventive services, like yearly screenings for the flu or certain cancers. In addition, Part B may cover other medical procedures and treatments that fall within the necessary or preventive range. Ambulance services, clinical research, mental health counseling and some prescription drugs for outpatient treatment may all be covered under Medicare Part B.

As of the 2019 plan year, the Centers for Medicare and Medicaid Services has lifted coverage caps on critical services covered under Medicare Part B. These include physical therapy, speech language pathology and occupational therapy.

But original Medicare doesnt cover everything. You may need to obtain supplemental insurance, such as Medigap, if you need coverage for the following:

The Cost Of Medicare Part B

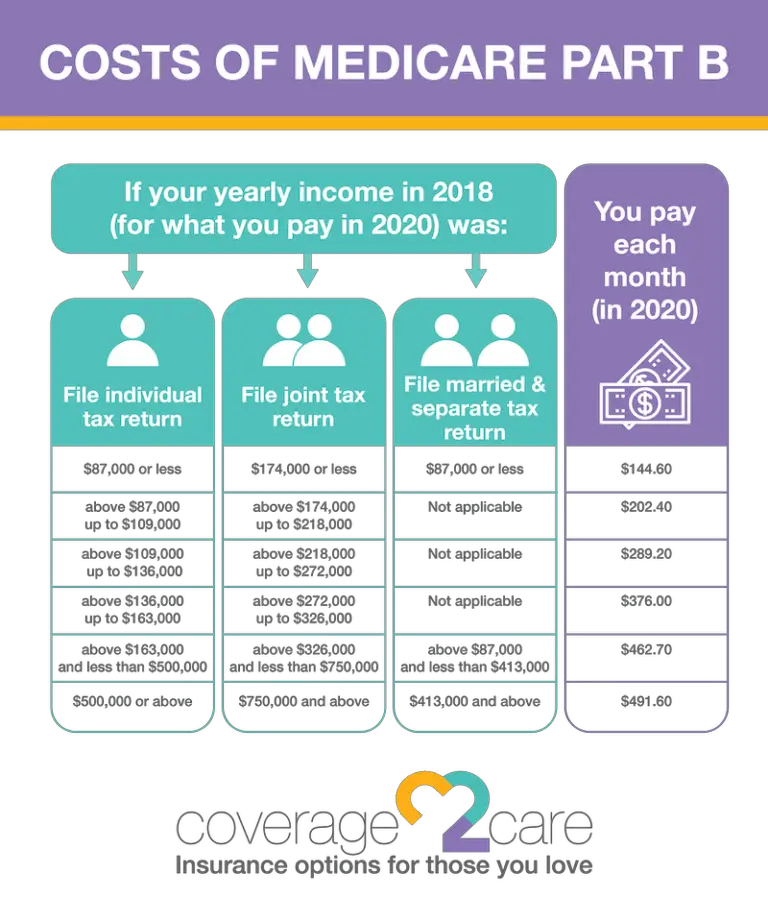

Unlike Medicare Part A, Medicare Part B requires a premium from everyone. The standard premium for Medicare Part B in 2020 is $144.60 a month, which applies to most people, including new enrollees. That premium changes each year, usually increasing. In 2021, the Part B premium is $148.50 a month.

Youll also have an annual deductible of $203 in 2021 .

There are penalty fees for not signing up during your Initial Enrollment Period , but well discuss those in a separate section.

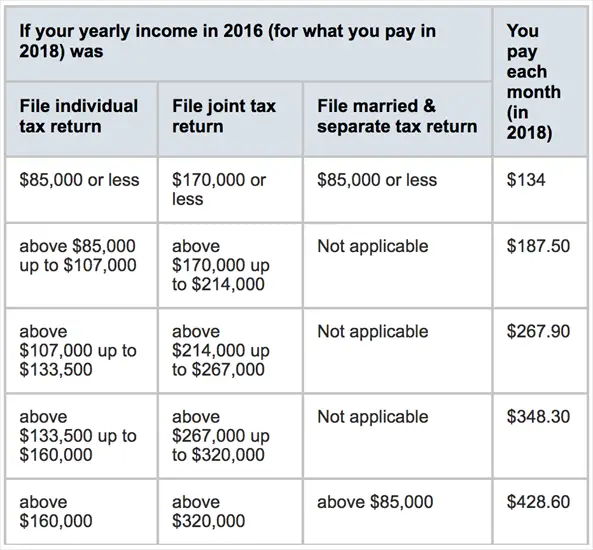

While most people pay the standard amounts for premiums and deductibles, some people will pay more, depending on their income. The more you make, the higher your likelihood will be for paying more than the standard amount. The extra fee per month is called the Income Related Monthly Adjustment Amount . How much more can you expect to pay if you fall outside of the standard range? The Medicare website offers a handy chart on the rates for those with higher incomes, which is updated each year. These are the rates for 2020, based on the income reported on your 2018 tax return:

These amounts reflect individual incomes only. Married couples will pay the same rates, but for different, higher thresholds. For example, a couple that earns over $174,000 per year and files a joint tax return will pay $202.40 per month for Medicare Part B premiums.

Read Also: Does Medicare Pay For Contrave

What Does Medicare Part A And Part B Cover

Original Medicare

You can enroll in Medicare Part A once you turn 65. If you’re already collecting Social Security disability benefits, you’ll be automatically enrolled in Part A.

Part B

Medicare pays 80 percent of approved charges and you pay about 20 percent.

Part B is optional because you have to pay a monthly premium and meet a deductible before Medicare will pay benefits.

Tricare Champva & Va Benefits With Medicare

If you have TRICARE or CHAMPVA coverage, you will need to see if you qualify for premium-free Part A. If you are eligible, you will be required to enroll in both Part A and Part B to keep TRICARE or CHAMPVA coverage. If you are not eligible, enrollment is optional, but you could face late enrollment penalties. Its best to talk with your TRICARE and CHAMPVA benefits administrator to learn more.

VA benefits alone will not qualify you to delay Medicare without penalty, so if you have VA health coverage and are still working past 65, you will need to enroll in Medicare during your Initial Enrollment Period.

Don’t Miss: How Can I Enroll In Medicare Part D

Why Would Someone Only Have Part B Medicare

Asked by: Prof. Steve Jakubowski

Part B helps cover medically necessary services like doctors’ services, outpatient care, and other medical services that Part A doesn’t cover. Part B also covers many preventive services. Part B coverage is your choice. However, you need to have Part B if you want to buy Part A.

How Much Is The Medicare Deductible

In addition to premiums, plan members are also responsible for paying a deductible and coinsurance with Original Medicare. The 2022 deductible for inpatient hospital stays is $1,556 per benefit period. The annual deductible for Part B is $233. After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services.

Recommended Reading: Is Dental Insurance Included In Medicare

How Much Does Medicare Part B Cost

When you enroll in this part of Medicare, you are responsible for its costs such as premium. In 2022, the standard Medicare Part B premium is $170.10 each month.

However, those in a higher income bracket will pay a higher monthly premium.This higher monthly premium is due to the Income Related Monthly Adjustment Amount . IRMAA is calculated by looking at your annual income and using a sliding scale to determine your premium.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

| 2020 annual income: Individual | |

|---|---|

| $587.30 | Plan Premium + $77.90 |

For most beneficiaries, the premium is automatically deducted from their monthly Social Security benefits check. If you do not receive Social Security benefits, you will get a quarterly bill from Medicare.

Medicare offers an online payment option called Easy Pay, which you can access with a MyMedicare account. Additionally, you may pay your quarterly premium by mail instead.

Alongside the premium, your Medicare Part B coverage includes an annual deductible and 20% coinsurance, for which you are responsible for paying out-of-pocket. In 2022, the Medicare Part B deductible is $233.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

If you are a lower-income beneficiary and are dual-eligible for both Medicare and Medicaid, you may qualify for a Medicare Savings Program.

Who Is Eligible For Part A Medicare

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

Recommended Reading: Does Blue Cross Blue Shield Medicare Supplement Cover Silver Sneakers

You Get Bitten By Cobra

The Consolidated Omnibus Reconciliation Act allows most employees and their family members to continue coverage after their employment ends usually for up to 18 months. But having COBRA benefits does not mean you can safely delay signing up for Part B. Individuals who delay enrolling in Part B because they have COBRA coverage will not receive a SEP to enroll in Part B later.

Furthermore, COBRA carriers may recoup what they paid toward your medical bills when they discover you were eligible for Medicare but not enrolled in it. This is because COBRA plans cover only the portion of your health care claims Medicare wouldnt be responsible for paying even if you dont have Medicare.

COBRA insurers may not know youre eligible for Medicare at first. But by the time your COBRA plan ends, the insurer usually becomes aware of your Medicare eligibility and may begin recouping that Medicare should have paid on first. This usually occurs after the Part B SEP has ended, causing you to wait to enroll in Part B during the general enrollment period from January to March of each year.

Enrolling in Part B during the GEP means Medicare coverage wont begin until July of the year you enroll .