Enrolling In Medicare With A Disability

Just like when you become eligible for Medicare at age 65, when you are eligible with disability, you have an Initial Enrollment Period of 7 months.

Your Initial Enrollment Period will begin after you have received either disability benefits from Social Security for 24 months or certain disability benefits from the Rail Road Retirement Board for 24 months.1 In other words, your IEP starts on the 25th month of disability benefits.

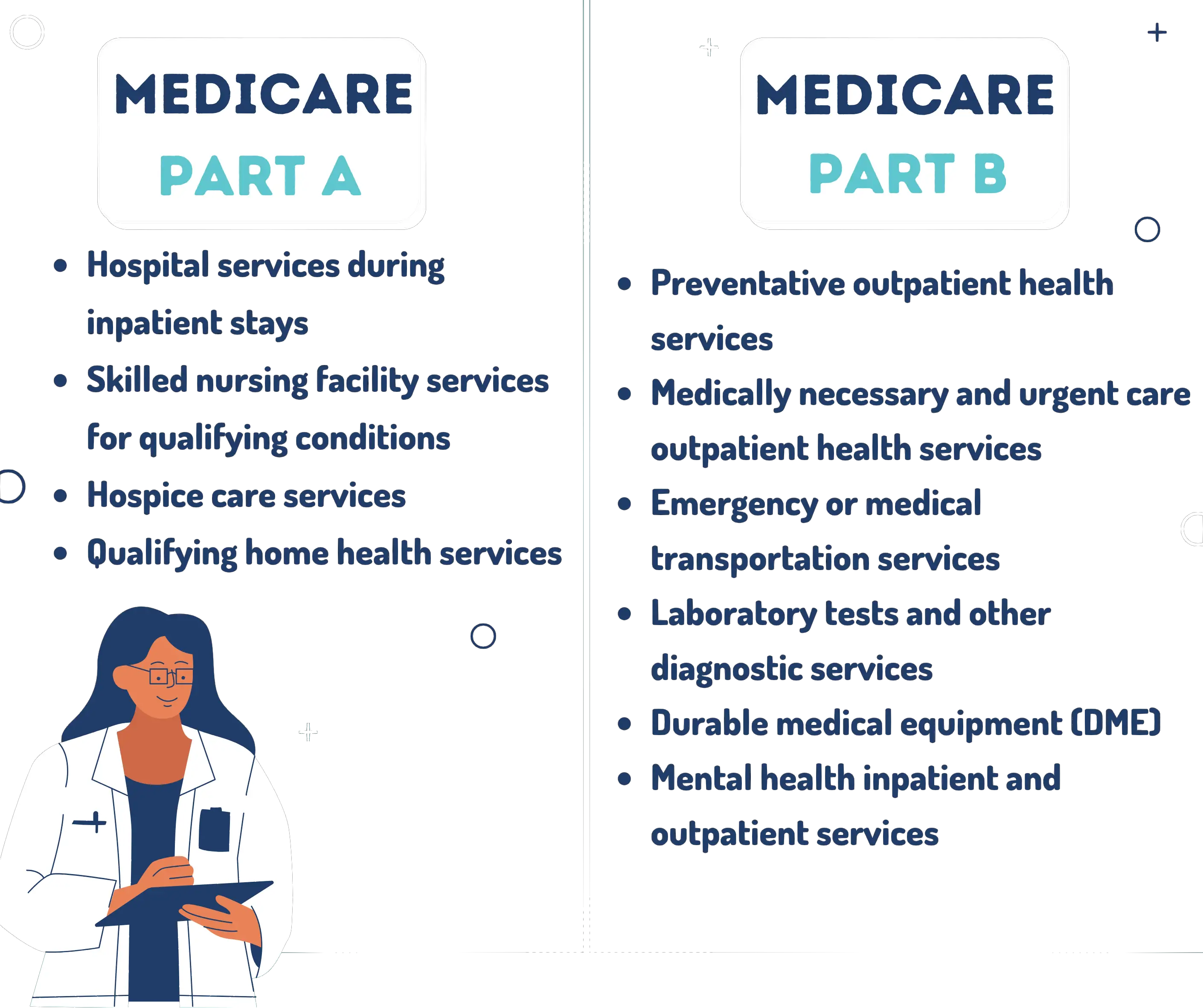

You will be automatically enrolled in Medicare Part A and Part B, but if you decide you want to get a Medicare Advantage or Part D prescription drug plan, you will need to enroll yourself directly with the private plan provider. You will need to enroll during your IEP to avoid late enrollment penalties.

NOTE: If you become eligible for Medicare because of ALS or ESRD, your situation is different. See the below special sections for eligibility and enrollment for ALS and ESRD.

The Information We Collect And How We Collect It

Personally Identifiable Information. The HealthPlanOne.com website collects two kinds of information that relates to you. The first, and most important to you, is information that is personally identifiable to you. This is information like your name, telephone number, email address, home address and social security number. We do not collect personally identifiable information unless you decide to provide us with it. To be clear, you are never required to provide us with Personal Information but not all of the services we offer will be available to you without that information. For example, we will ask for your contact information if you have requested us to send you information about certain plans or services.

Personal Information also includes information on your health. However, we do NOT ask for and do NOT collect Medical Records from you. Those records remain between you and your doctor.

If at any time you would like to review or update the Personal Information we have collected about you, please contact us and we will arrange for you to do so. While you work with us, you remain in control of all of your personal information at all times.

What Are My Insurance Options If I Cannot Get Medicare At Age 62

If you dont qualify for Medicare, you may be able to get health insurance coverage through other options:

- Employer-provided insurance

LeRon Moore has guided Medicare beneficiaries and their families as a Medicare professional since 2007. First as a Medicare provider enrollment specialist and now a Medicare account executive, Moore works directly with Medicare beneficiaries to ensure they understand Medicare and Medicare Advantage Plans.

Moore holds a bachelors degree from Southern New Hampshire University and is A+ Certified with a Medical Records Clerk Certification and Medical Terminology Certification from Midlands Technical College.

Hes passionate about educating, informing, and resolving issues concerning Medicare and Medicare Advantage Plans, and considers it imperative that he does all he can to educate and inform the senior community as much as possible about Medicare.

You May Like: Will Medicare Pay For Drug Rehab

Warren At Hearing: Lowering Medicare Eligibility Age To 55 Could Cover Tens Of Millions Of Americans We Cant Waste This Opportunity To Expand Coverage And Lower Costs

Washington, DC In a Senate Finance Committee hearingtoday, United States Senator Elizabeth Warren made the case forlowering the Medicare eligibility age from 65 to 55 while questioning Ms.Chiquita Brooks-LaSure, President Bidens nominee to serve as the Administratorof the Centers for Medicare and Medicaid Services. Senator Warren believes inlowering the age to 55 would expand coverage for millionsand has the potential to lowerpremiums for the Medicare program.

In responding to Senator Warrens questions about the challenges facingolder Americans who havent hit 65 yet, Ms. Brooks-LaSure responded that beingright below the Medicare eligible age can be an incredible challenge forpeople if they dont have affordable employer sponsored insurance. Ms.Brooks-LaSure also said that we need to continue to work to make surethat we have affordable options available for that population inparticular and agreed to work with President Biden to expand coverage andlower health care costs.

Transcript: Hearing to Consider the Nominations ofAndrea Joan Palm to be Deputy Secretary of Health and Human Services andChiquita Brooks-LaSure to be Administrator of the Centers for Medicare andMedicaid ServicesU.S. Senate Committee on FinanceThursday, April 15, 2021

Senator Warren: Thank you, Mr. Chairman. Andcongratulations to our nominee.

Ms. Brooks-LaSure: Yes. It is a good thing when healthier,younger people join join this pool.

Thank you, Mr. Chairman.

Legal Terms & Conditions

HealthPlanOne.com is a service mark of HealthPlanOne, LLC. All trademarks, service marks, trade names and logos displayed on this site are proprietary or licensed to HealthPlanOne, LLC, except for those of the insurance carriers, agent, brokers, industry organizations, associations, health care institutions, and other service companies, which are service marks or trademarks of their respective entities. The name, trademarks, service marks and logos of HealthPlanOne LLC and any of the insurance companies represented by HealthPlanOne LLC may not be used in any advertising or publicity, or otherwise for any commercial use by other insurance agent or brokers. Any such use is prohibited by federal trademark and copyright law. This site is a copyrighted publication of HealthPlanOne, LLC. No portion of this site or any news or information displayed on this site may be published, broadcast, duplicated, photocopied, faxed, downloaded, uploaded, distributed, transmitted or redistributed in any way for any purpose without HealthPlanOne, LLCs prior express written permission. The content presented on this site is that of HealthPlanOne, LLC and not necessarily that of the participating insurance carriers. However, certain content is presented by insurance carriers, agents, brokers, industry organizations, service providers and educational institutions, and that content is solely that of the respective entity providing the content.

Recommended Reading: How Do I Replace My Medicare Card Online

What Are The Characteristics Of Medicare Beneficiaries Under Age 65 With Disabilities Compared To Beneficiaries Age 65 Or Older

Medicare beneficiaries under age 65 with disabilities differ from beneficiaries age 65 or older in several ways, including their demographic, socioeconomic, and health status profiles.

Income: In 2012, a much larger share of beneficiaries under age 65 with disabilities than older beneficiaries had low annual incomes . Nearly one quarter of younger beneficiaries with disabilities had incomes less than $10,000 per year and two-thirds had incomes less than $20,000 per year, compared to 13% and 39%, respectively, of older beneficiaries.7

Figure 1: Selected Characteristics of Medicare Beneficiaries Under Age 65 Compared to Those Age 65 or Older

Race/ethnicity and gender: A larger share of beneficiaries under age 65 than older beneficiaries are black and Hispanic , and a larger share are male .

Health status: Nearly two-thirds of all younger Medicare beneficiaries had a cognitive or mental impairment in 2012, compared to 29% of older beneficiaries . This includes memory loss that interferes with daily activity, difficulty making decisions, trouble concentrating, and loss of interest within the past year.8 Nearly 6 in 10 reported their health status as fair or poor and almost the same share reported having one or more limitations in their activities of daily living, compared to 20% and 34% of beneficiaries age 65 or older, respectively. But roughly the same share of both younger beneficiaries with disabilities and older beneficiaries report having five or more chronic conditions .

You Automatically Get Medicare When You Turn 65

- Well mail you a welcome package with your Medicare card 3 months before your Medicare coverage starts.

Sign up for Part B if you live in Puerto Rico or outside the U.S.You get Part A automatically. If you want Part B, you need to sign up for it. If you dont sign up for Part B within 3 months of turning 65, you might have to wait to sign up and pay a monthly late enrollment penalty.

Read Also: Do I Have To Have A Medicare Drug Plan

How We Use The Information We Collect

Because we respect your privacy and value our relationship with you, we only use your Personal Information to offer you information about and the opportunity to purchase health care coverage that is right for you or your family. We also use third party partners and affiliates to help us to provide these services so we may share your information with these third parties and affiliates for such purposes. These third parties and affiliates are not authorized by us to use your Personal Information in any other way.

For example, we provide your Personal Information to our parent company, HealthPlanOne, LLC, so that they can help you to find and apply for Medicare and health insurance. We have also contracted with other third parties to provide the same services so as to ensure that your questions are answered and so that more than one opinion may be made available to you.

Since Aggregate Information does not include Personal Information, we reserve the right to use and share this information with others. However, we primarily use this information to customize your experience on our Site, to help us improve the quality of the Site, and to make your use of the Site easier and more valuable to you.

We do not sell, license, transmit or disclose Personal Information that you provide to us except with the following exceptions:

HIPAA Notice of Privacy Practices

Do I Have To Take Part B

You are not required to take Part B, and some people choose to delay. Deciding to opt out of Part B at this time is a personal choice and depends on your unique situation. about whether or not you should take Part B when you qualify for Medicare with a disability. Some people who qualify for Medicare under age 65 due to disability but are covered under an employers plan or a spouses employer plan, may opt to delay.2

Also Check: What Is The Best And Cheapest Medicare Supplement Insurance

Contact Social Security To Sign Up For Medicare

You can either:

Know when to sign up for Part BYou can only sign up for Part B at certain times. If you dont sign up for Part B when you turn 65, you might have to wait to sign up and pay a monthly late enrollment penalty. Find out when you can sign up. How much is the Part B late enrollment penalty?

Reaching Age 62 Can Affect Your Spouse’s Medicare Premiums

Although reaching age 62 does not qualify you for Medicare, it can carry some significance for your spouse if they receive Medicare benefits.

When one spouse in a couple turns 62 years old, the other spouse who is at least 65 years old may now qualify for premium-free Medicare Part A if they havent yet qualified based on their own work history.

- For example, Gerald is 65 years old, but he doesnt qualify for premium-free Part A because he did not work the minimum number of years required for eligibility. He can still receive Medicare Part A, but he will have to pay a monthly premium for it. In 2020, the Medicare Part A premium can be as high as $458 per month.

- Lets say Geralds wife, Jessica, reaches age 62 and has worked for the required number of years to qualify for premium-free Part A once she turns 65. Because Jessica is now 62 years old and has met the working requirement, Gerald may now receive premium-free Part A.

In the above example, Jessica has not become eligible for Medicare by turning 62. Her husband Gerald, however, is now eligible to receive his Medicare Part A benefits without paying a monthly premium any longer.

Also Check: What Is Retirement Age For Medicare

Citizenship And Residency Requirements

In most cases, to be eligible for Medicare, you need to be a U.S. citizen living in the U.S.

You can also qualify for Medicare if you’re a permanent U.S. resident who has been living in the U.S. for five continuous years prior to the month you apply for Medicare.

Even though these two eligibility criteria are specifically for Medicare Part B, they also apply to most other parts of Medicare. That’s because Part B enrollment is required for enrollment in Medicare Part C, Medicare Part D, Medigap and the Medicare Part A paid plans.

However, if you qualify for the free Medicare Part A plan because of your work history, you can be enrolled in Part A plan without being enrolled in Part B.

How Much Does Medicare Cost At Age 65

The standard premium for Part B modestly increases year over year. Part A costs also can increase, including the annual deductible and other coinsurance. Known as hospital insurance, Part A doesnt require a monthly premium as long as you have paid Medicare taxes through employment for at least 10 years.

Part B, known as medical insurance, typically pays 80% of the covered cost while you pay the deductible and then 20%.

Don’t Miss: Should Federal Retirees Enroll In Medicare

Is Medicare Eligibility Based On Income

Medicare eligibility is not based on income. As long as you meet the basic Medicare eligibility requirements, you are entitled to coverage.

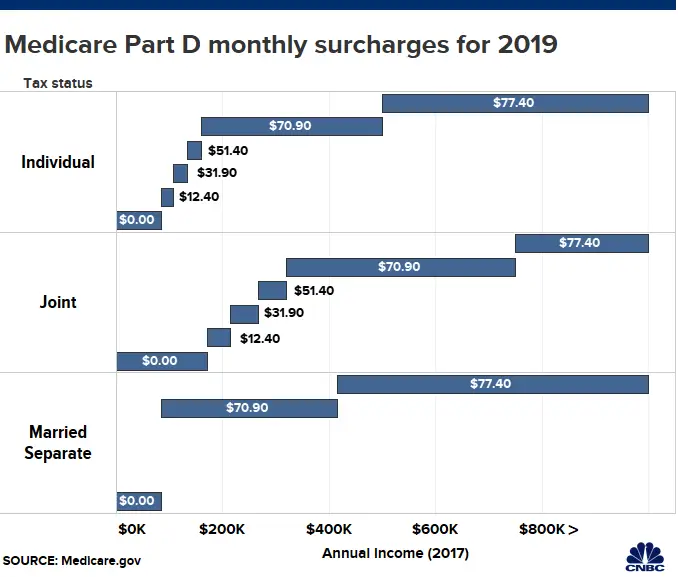

However, your income will affect how much you pay for coverage. If you are a high earner and have an annual income over a specific limit, you will be responsible for additional premiums due to IRMAA.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

If you receive a monthly income below certain thresholds, you may become eligible for programs like low-income subsidies, Medicaid, and Medicare Savings Programs. These programs offer financial assistance to those on Medicare with low incomes to ensure coverage regardless of income.

Coverage During Medicare Waiting Period

We estimate that 24% of new Medicare enrollees were uninsured during the waiting period . About half were covered by their own employers or their spouses employer during the waiting period. Seventeen percent were covered by Medicaid.

Here, too, there were significant differences by race, marital status, education, and income. Similar proportions of Whites and African Americans were uninsured during the waiting period, but the two racial groups drew their coverage from different sources. A third of African Americans were on Medicaid, compared to 10.5% of Whites. The rate of spousal coverage for Whites was three times the rate for African Americans. Married Medicare enrollees were far more likely to have employer coverage in the waiting period than divorced, separated or never married individuals, who were the most often uninsured. More than a third of individuals who were poor at age 55/56 were uninsured, nearly three times the rate for the top income category. The higher rate of Medicaid coverage for the poor did not offset much higher rates of employer insurance at higher incomes. More than half of new Medicare enrollees in the top income category were covered by their own employment-related insurance in the waiting period. The differences by education were similar to, but less extreme than the differences by income.

Read Also: Is Healthfirst Medicaid Or Medicare

Recommended Reading: Does Medicare Cover Dtap Vaccine

B Enrollment May Be Impacted If You Lose Coverage Through Your Spouse

In most cases, individuals who do not enroll in Part B when they first become eligible may have to pay late enrollment penalties. However, if you were covered by a spouses employer or retiree coverage, you may be eligible for a Special Enrollment Period during which to get Part B.

The online blog doesnt take into account every situation, so its important that you ask questions and get answers for your specific situation. You may want to contact the Social Security Administration for more information by calling 1-800-772-1213 , Monday through Friday from 7 a.m. to 7 p.m.

Can I Retire And Collect Social Security At 55

So can you retire at 55 and collect Social Security? The answer, unfortunately, is no. The earliest age to begin drawing Social Security retirement benefits is 62. Once you turn 62, you could claim Social Security retirement benefits but your earnings from consulting work could affect how much you collect.

Read Also: Does Medicare Cover Cataract Removal

Should I Sign Up For Medical Insurance

With our online application, you can sign up for Medicare Part A and Part B. Because you must pay a premium for Part B coverage, you can turn it down.

If youre eligible at age 65, your Initial Enrollment Period begins three months before your 65th birthday, includes the month you turn age 65, and ends three months after that birthday.

Note: Important Upcoming Change Rules for 2023 and later: If you accept the automatic enrollment in Medicare Part B or if you sign up during the first three months of your IEP, your coverage will start the month youre first eligible. Beginning January 1, 2023, if you sign up during the month you turn 65 or during the last three months of your IEP, your coverage starts the first day of the month after you sign up.

The following chart shows when your Medicare Part B becomes effective in 2022:

| In 2022, if you sign up during this month of your IEP | Your Part B Medicare coverage starts |

|---|---|

| One to three months before you reach age 65 | The month you turn age 65. |

| The month you reach age 65 | One month after the month you turn age 65. |

| One month after you reach age 65 | Two months after the month of enrollment. |

| Two or three months after you reach age 65 | Three months after the month of enrollment. |

The following chart shows when your Medicare Part B becomes effective in 2023:

Signing Up For Medicare

If youre collecting Social Security benefits. If you claim Social Security benefits at age 65 or earlier, you will automatically be enrolled in Medicare when you turn 65, in both Part A and Part B. You can disenroll from Part B but not from Part A.

To enroll in Part B after age 65 later , you can fill out an Application for Enrollment in Medicare Part B and bring it or mail it to a Social Security office.

If youre not collecting Social Security benefits. If you are 64 years and nine months or older and you have not started collecting Social Security benefits, you can sign up for both Part A and Part B online at .

How Medicare enrollment affects HSAs. Note that, when youre enrolled in Part A, you are no longer allowed to make pre-tax contributions to your health savings account , though you cancontinue to use the funds already in your HSA account. Since anyone collecting Social Security retirement benefits has to be enrolled in Part A, this means that no one collecting Social Security can contribute to an HSA.

Don’t Miss: How To Enroll In Medicare Part B Special Enrollment