Who Is The Primary Insurer Your Group Plan Or Medicare

When health insurance claims are filed, there is typically a primary insurer and a secondary insurer . Whether or not you should enroll in Part B depends on who is the primary insurer, Medicare or your group plan. How do you know? The number of people employed at your company is the deciding factor.

In companies with less than 20 employees: Medicare automatically becomes the primary insurer, with group insurance second. In this case, you should take Part A and Part B when you are first eligible. Why? If your employer is a secondary insurer, they pay after Medicare pays. By delaying Medicare benefits, you wont have a primary insurer, and what you pay out-of-pocket will be high.

In companies with more than 20 employees: Your employer becomes the primary insurer, with Medicare coverage second. In this case, you can delay enrolling in Part B as your group coverage will pay your medical claims.

Are Medicare Rules Different If I Have Fehb Coverage

Most people who have retiree coverage must enroll in Medicare Part A and Part B when first eligible. If they dont enroll, their retiree plan may pay only a small amount or nothing at all for their care. Medicares rules for you are different, however, if youre a federal retiree. As a federal retiree, if you dont enroll in Medicare, your FEHB plan will act as your primary insurer and wont pay less because you qualify for Medicare.

However, if you choose to delay your enrollment in Part B , you may find that youre subject to a late enrollment penalty if you eventually decide later on that youd like to enroll in Part B. If you continue working past age 65, you can safely delay Part B while youre still enrolled in FEHB coverage as an active employee. But once you transition to retiree coverage, you have an eight-month window during which you can enroll in Part B at any time without a penalty. But after that window ends, your opportunity to enroll in Part B will be limited to the January-March General Enrollment Period, and you would be subject to a late enrollment penalty for Part B if you delay your enrollment for 12 months or longer.

Is Fehb Better Than Medicare Part B

Federal retirees with HMO plans dont need to join Part B. HMOs generally cover most medical services with small copayments at the time of each service.

The cost of seeing doctors outside of your HMO plan network can be financially taxing. For these retirees, joining Part B may be the better option because it covers costs for out-of-network services.

Traveling within the country is common for many, especially during retiring years. Individuals that travel may consider purchasing non-emergency coverage while out of town.

Part B will cover these costs, whereas FEHB generally includes emergency care when traveling outside the U.S. plus dental and vision benefits.

For some, paying the Part B premium is worth the benefits.

Recommended Reading: Who Do I Talk To About Medicare

Helping You Prepare For Whats Next

When it comes to Medicare, theres a lot to consider. To help you make the most informed decision, weve provided some important information you can use to better understand how Medicare works and when youre eligible to enroll.Keep in mind that if youre already a member of FEP and you choose to combine your coverage with Medicare,* youll get additional benefitsplus coverage for services that Medicare does not cover.

Other Health Insurance: What Are My Options

If you are eligible for Medicare, there are a few options that you have for additional medical insurance. Some of these plans can coexist with Original Medicare, but Part C Medicare Advantage plans cannot. Well run through every option you have, and discuss how it interacts with your Medicare coverage.

Recommended Reading: Does Medicare Pay For Visiting Nurses

What Happens When I Retire

It’s important to understand what your options are once you retire. The first step is to find out if you can keep the coverage you have now when you retire, and whether or not it can be combined with Original Medicare coverage. If you have group retiree health coverage, you’ll need to contact the plan’s benefits administrator to learn about how the coverage works with Medicare and what you need to do.

Understanding Original Medicare Eligibility And Enrollment

Original Medicare is available to a wide variety of people. Most often, Medicare enrollees are people who have reached their 65th birthday and already receive Social Security benefits. However, it is also available to certain patients with end-stage renal disease.

Medicare enrollment happens during special periods, known as enrollment periods. The first enrollment period, when someone turns 65, is known as the Initial Enrollment Period. There is also an Open Enrollment Period at the end of each year, and certain life events can trigger a Special Enrollment Period, which lets people change their insurance.

Enrolling late in Medicare can result in late enrollment penalties. These can be severe, especially for Part B. However, there are various reasons that allow you to rightfully delay your coverage, such as having coverage from your employer.

You May Like: Can You Get Medicare Advantage Without Part B

Do I Enroll In Medicare If My Spouse Has Retiree Coverage

Yes. You can delay signing up for Medicare only if you or your spouse has coverage from a current employer. You need to enroll in Medicare no later than eight months after your spouse stops working or you may have to pay a lifetime late-enrollment penalty when you do enroll in Part B.

That is also the case if your spouse continues his or her employers coverage through the Consolidated Omnibus Budget Reconciliation Act of 1985 , a federal law that requires organizations with 20 or more employees to offer health insurance for up to 18 months after workers leave their job. COBRA doesnt count as active employment, so you must enroll in Medicare during your initial enrollment period to avoid late-enrollment penalties.

Is There A Late Enrollment Penalty

If an individual did not sign up for Part B when he or she was first eligible, then the Part B monthly premium may be higher. In particular, the cost of Part B may go up 10 percent for each 12-month period that an individual could have been enrolled in Part B but did not sign up for it. The individual will have to pay this extra monthly premium as long as the individual has Part B, except in special cases. For those individuals who miss the deadline to enroll in Medicare Parts A and B when they are first eligible, Medicare has an open season enrollment for Parts A and B each year between January 1 and March 31 with coverage becoming effective the following July 1. But a late enrollment penalty for Part B will apply equal to 10 percent per year of the first tier Part B monthly premium amount in effect that year . The penalty period is measured from the last month the individual could have enrolled in Medicare and July 1 of the year Medicare Part B becomes effective.

Recommended Reading: What Is Part B Excess Charges In Medicare

What Happens If I Decline Fehb Coverage

If you decline FEHB coverage, you would give up the subsidy the government pays toward it which is the same for active employees and retirees and can be as high as $530 for self-only coverage, and over $1,300 if youre also covering family members. If your family members are covered under FEHB, their coverage would end if you terminate yours.

Medicare Part D If You Have Fehb Coverage

If you have FEHB coverage, you typically don’t have to enroll in a Part D plan. FEHB plans include prescription drug coverage, often with fewer restrictions than Medicare Part D plans. They also limit what you’ll pay each year in covered prescription costs, so you may pay less than with a Part D plan.

FEHB is considered creditable drug coverage, so if you choose not to purchase Part D right now, you won’t have to pay a late enrollment penalty if you decide to enroll in the future.

If you do sign up for a Part D plan, that plan will become the primary insurer.

If you’re eligible for Extra Help, you may want to consider enrolling in a Part D plan because the co-pays are typically lower than your out-of-pocket costs with FEHB plans.

Recommended Reading: Is Medicare Enrollment Required At Age 65

Sometimes Group Insurance Changes When You Become Eligible For Medicare

Even if you know that your employer will be the primary insurer, take a look at your benefits. Sometimes they change when you become eligible for Medicare. Read over your group coverage benefits to see how they work once you or your spouse turn 65. Then decide if its better for you to enroll in Part B now or delay enrollment. Remember, Part B carries a monthly premium that you will be responsible for paying.

Do You Need Both Medicare And Federal Employee Health Benefits

Although most people who are eligible for Medicare and FEHB wont need a Medicare Supplement or Medicare Part D plan, the truth is that FEHB can be expensive. Thus, these beneficiaries often ask if theres a way to coordinate their coverage that will also minimize their out-of-pocket costs. With Medicare, there are a few ways to do this.

Recommended Reading: How Old To Receive Medicare Benefits

Things You Should Know

How to find out whether or not you are eligible for Medicare Part A and Part B benefits if you are retired and under age 65 and your spouse or you are disabled

If you or your spouse is disabled and receiving Social Security disability benefits, contact Social Security about Medicare-eligibility. If eligible, contact the GIC at 617.727.2310 to request a Medicare Plan enrollment form.

If you have been a state employee and have never contributed to Social Security

You may still be eligible for Medicare benefits through your spouse. When you turn age 65, visit Social Securitys website or call Social Security to apply to see if you are eligible.

What happens to your spouse’s coverage if you enroll in a GIC Medicare Supplemental Plan

Your spouse will continue to be covered under in a GIC non-Medicare plan if he/she is under age 65 until he or she becomes eligible for Medicare. See the Benefit Decision Guide for under and over age 65 health insurance products. If your spouse is over age 65, he/she must enroll in the same Medicare supplemental plan that you have joined.

What you need to do at age 65 if your spouse or yourself was not eligible for Medicare Part A for free, but now, you and your spouse have subsequently become eligible for Medicare Part A for free

You or your spouse must notify the GIC in writing when you become eligible for Medicare Part A. The GIC will notify you of your coverage options. Failure to do this may result in loss of GIC coverage.

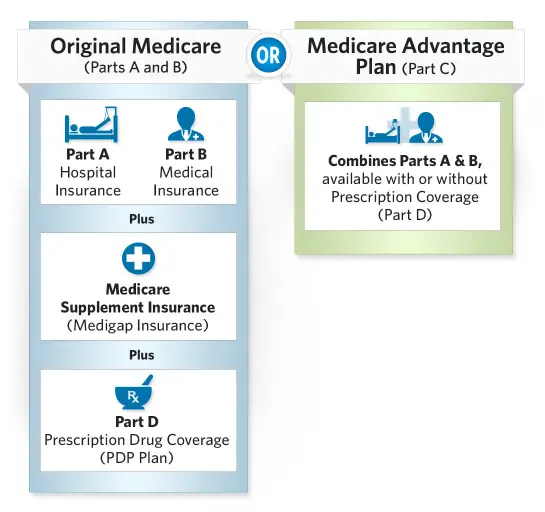

How Does Medicare Work

When enrolling, keep in mind that the Medicare plan known as original, covering Parts A and B, is operated by Medicare. Medicare Advantage policies are conducted by independent insurance providers but cover similar costs as Parts A and B. You dont have to re-enroll in Medicare each year, although you do get an opportunity to change your plan during the yearly open enrollment period.

In many ways, Medicare works like private insurance, and you usually must meet a deductible and pay for your share of services and supplies when you receive them. In addition to medically necessary services, Medicare will also pay for many preventive services, including screenings and shots.

Also, most federal employees keeping FEHB do not need to enroll in Medicare Part D since their prescription drug benefits are covered.

Recommended Reading: Will Medicare Pay For Eye Exams

Get Help Comparing Medicare Plans Where You Live

You may contact your local State Health Insurance Assistance Program for free assistance with your Original Medicare benefits.

If youre considering enrolling in a Medicare Advantage plan or a Medicare prescription drug plan, you can compare plans online for free or over the phone with the help of a licensed insurance agent. Learn about the costs, coverage and benefits of plans that may be available in your area.

Compare Medicare Advantage plans in your area

Or call to speak with a licensed insurance agent. We accept calls 24/7!

1 United States Office of Personnel Management . . Federal Benefits Open Season. Retrieved from https://www.opm.gov/healthcare-insurance/healthcare/reference-materials/2019-open-season.pdf.

About the author

Christian Worstell is a senior Medicare and health insurance writer with MedicareAdvantage.com. He is also a licensed health insurance agent. Christian is well-known in the insurance industry for the thousands of educational articles hes written, helping Americans better understand their health insurance and Medicare coverage.

Christians work as a Medicare expert has appeared in several top-tier and trade news outlets including Forbes, MarketWatch, WebMD and Yahoo! Finance.

Christians passion for his role stems from his desire to make a difference in the senior community. He strongly believes that the more beneficiaries know about their Medicare coverage, the better their overall health and wellness is as a result.

Mail Handlers Insurance And Medicare

The Mail Handlers Benefit Plan has been serving federal and postal employees for over 50 years. Aetna administers the MHBP, whose plan options include Self Only, Self Plus One, and Self and Family similar to FEHB.

Its best to have MHBP and Medicare when you become Medicare-eligible. Medicare will be the primary insurance and MHBP will give you access to things Medicare doesnt cover like additional options for chiropractic care.

Also Check: What Does Medicare Pay For Glasses After Cataract Surgery

Medicare Part B: What Does It Cover

Part B of Medicare pays for medically necessary outpatient services. This can vary from diagnostic tests to doctor visits and outpatient surgeries. Medicare Part B will also usually cover durable medical equipment .

The Part B premium is $164.90 in 2023, although this can be higher depending on your income. The Part B deductible is $226 in 2023, and you will pay a 20 percent co-insurance after your deductible has been met.

Fehb Coverage After Retirement

Its never mandatory to take Medicare yet, there can be consequences to delaying enrollment. When you have FEHB, youre safe from the Medicare Part B late enrollment penalty for as long as you or your spouse is actively working.

When you or your spouse retires, however, things get more complicated. Once you or your spouse stops working you will be granted a Special Enrollment Period. This will allow you 63 days from the time of the event to enroll in Medicare if you have delayed coverage. Otherwise, youll be subject to the late enrollment penalty whenever you enroll.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

As long as you keep FEHB, whether or not youre working, your prescription drug coverage is sufficient, and youll avoid the late enrollment penalty for Medicare Part D.

Also Check: Will Medicare Pay For A Bedside Commode

Original Medicare And Other Insurance: Can You Have Both

If you have Original Medicare, there are some other insurance plans you can have at the same time, and some you cant. You can have Original Medicare alongside a Part D prescription drug plan, but not a Part C Medicare Advantage plan. You can also have a Medigap plan and Original Medicare at the same time.

Original Medicare can coexist alongside a COBRA plan and veterans benefits as well. You can also be enrolled in Medicare while you have insurance from your current employment. However, you cant have Medicare at the same time as a health savings account.

How Does Medicare Work For Federal Employees

Medicare is a program backed by the federal government that supplies health insurance benefits to people over age 65 and people with certain disabilities. While all citizens are entitled to this benefit, some people have additional choices. Federal employees have their own benefit program called the Federal Employees Health Benefits program. This program offers a wide variety of plans for federal workers, their spouses and their children up to age 26.

While the exact costs depend on the plan you choose, most people enrolled in the FEHB pay about 30% of their premium while their employer pays 70%. Many federal workers can carry this plan into retirement, allowing them the option to forego Medicare coverage. However, you can still sign up for Medicare with the FEHB and doing so may be beneficial.

Recommended Reading: Does Medicare Part C Cover Dental And Vision

Do Federal Retirees Need Medicare Part D

Federal retirees needing prescription drug coverage often find themselves asking is FEHB credible coverage? Can I postpone enrolling in Medicare Part D?

The answer: yes! FEHB coverage is comparable to Medicare coverage. Therefore, beneficiaries in the federal program may delay joining a Part D plan likewise, theyre exempt from any Part D late enrollment penalties.

The federal employee plans often include prescription drug benefits, although drug coverage may vary. Like any prescription drug plan, check for specific drugs within the plans formulary.

Part D likely pays primarily for prescriptions even with FEHB. Beneficiaries must continue to keep drug coverage from the FEHB program as its health and medication coverage may not be separate.

Can I Drop My Employer Health Insurance And Go On Medicare

Do I Need Medicare Part B If I Have Other Insurance

Remember, Medicare is a U.S. federal government health insurance program that subsidizes healthcare services.

It depends on the type of insurance an individual has. If the insurance is a COBRA or individual policy, or retiree coverage provided by a union or employer, enrollment in both Part A, hospital insurance, and Part B, medical insurance, is necessary. These types of insurance are secondary to Medicare, paying for any covered care after Medicare has paid its share.

But if the insurance comes through current employment of either the beneficiary or his or her spouse with a large employer , Medicare recommends enrollment in premium-free Part A. Part B enrollment is not necessary. When this coverage ends, Medicare provides special periods to enroll in Part B and obtain other coverage, such as a Part D prescription drug plan, a Medigap policy, or a Medicare Advantage plan.

Do I Need Medicare Part B If I Have Retiree Insurance

It depends on the type of insurance an individual has. If the insurance is a COBRA or individual policy, or retiree coverage provided by a union or employer, enrollment in both Part A, hospital insurance, and Part B, medical insurance, is necessary. These types of insurance are secondary to Medicare, paying for any covered care after Medicare has paid its share.

Do I Need Medicare Part B If I Have Medicaid

Here are a few examples of how Medicaid can work with Medicare.

Privacy

Disclaimer

Also Check: How To Order Another Medicare Card