How Do You Sign Up For Medicare

Before you need to worry about a renewal, you need to apply for Medicare in the first place!

Luckily, this is relatively easy: for Original Medicare , residents of the United States and its territories are automatically enrolled upon becoming eligible, provided theyre receiving Social Security benefits. If youre not receiving Social Security, youll need to sign up manually by contacting the Social Security Administration.

Do I Have To Enroll In Medicare Every Year

The short answer is no, you do not have to enroll in Medicare every year. Once you have signed up for a Medicare plan, you can stick with it for as long as you are happy with the coverage.

If you havenât received a notice that your coverage is changing or some aspect of your plan is ending, it can keep going unattended for as long as you want. The only exception is if you stop paying your premiums.

That said, we recommend you review your Medicare coverage at least once a year to ensure you are receiving the coverage you need at the most competitive pricing. Medical needs change with time, and what you needed a year or more ago might look different than what you need now.

What Is Medicare Open Enrollment

Medicare open enrollment also known as the annual election period or annual coordinated election period refers to an enrollment window that takes place each fall, during which Medicare plan enrollees can reevaluate their existing Medicare coverage whether its Original Medicare with supplemental drug coverage, or Medicare Advantage and make changes if they want to do so.

This guide is all about Medicares annual election period. If youre interested in learning about additional opportunities to enroll or change your Medicare coverage, weve covered those here.

Don’t Miss: How To Get New Medicare Card If Lost

What To Do During Aep To Change To A Medicare Advantage Plan

If you decide to enroll in a new Medicare Advantage or Part D plan during the AEP, you need to enroll in the new plan by December 7th. You can make changes as many times as you want during this period. The only one that will be processed is the last one you enroll with.

Most people work with a licensed professional to select a Medicare Advantage Plan. A professional can ensure that your plan covers the drugs and medical professionals you use. Medicare Advantage Plans can range widely in both formulary and the providers that accept your chosen insurance company and plan.

Do I Have To Renew Medicare Advantage Every Year

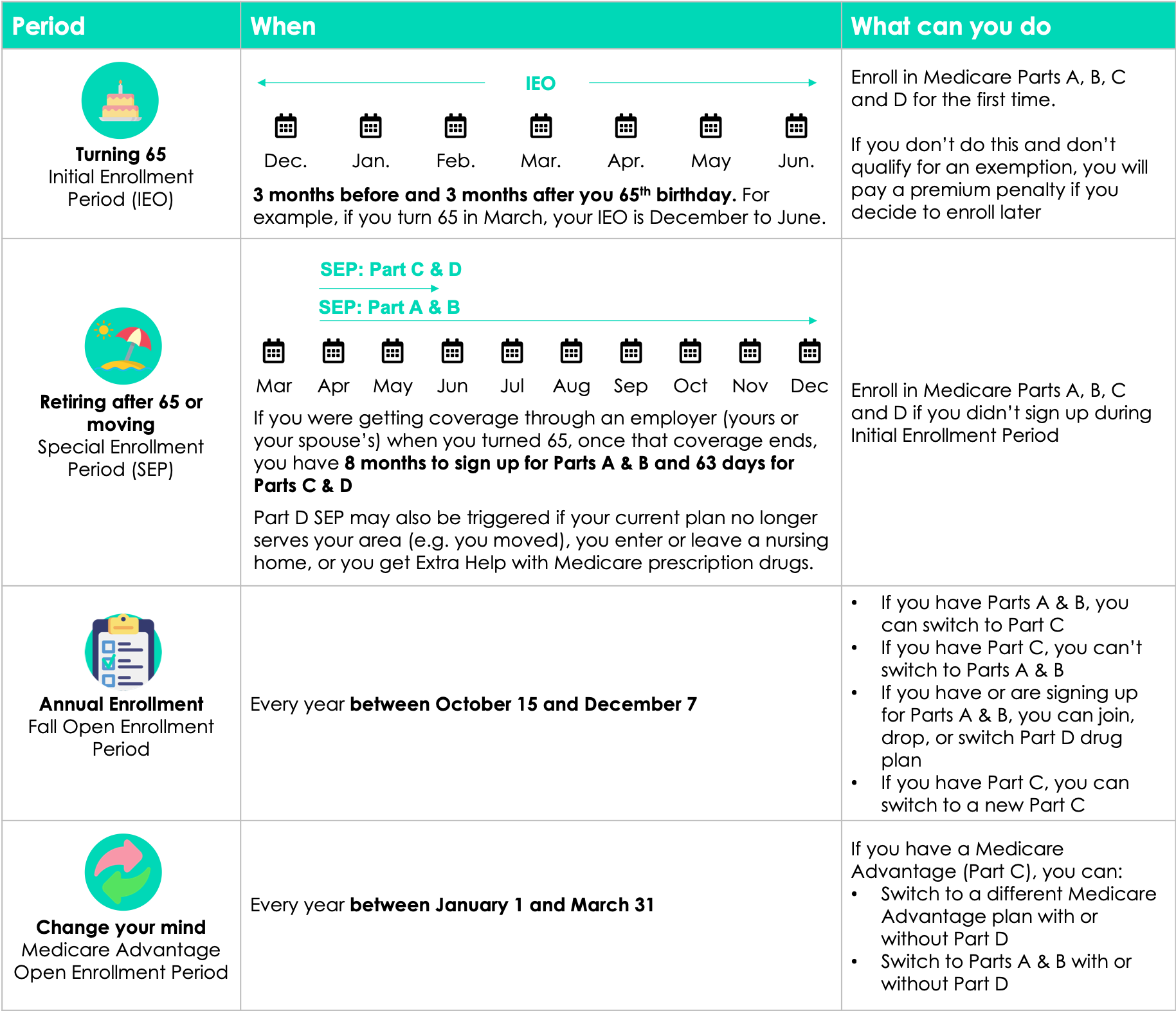

There is a big emphasis on enrollment periods when you’re in the Medicare program. You need to know which ones are important to you, what you can do during each, and which penalties you may incur for missing an enrollment period. Plus, it seems like there are so many to keep track of!

A couple of enrollment periods each year apply to Medicare Advantage plan members. This leads many of our clients to ask, “Do I need to renew my Medicare Advantage plan every year?”

The answer is no. Your Medicare Advantage plan will renew each year automatically unless you cancel the policy or stop paying the monthly premiums. The same is true of Medicare Parts A and B, Part D prescription drug plans, and Medicare supplements.

However, you’re not off the hook quite that easily. You may not be required to renew your Advantage plan each year, but you absolutely should review your coverage options! First, let’s talk about your opportunities to do this each year. Then, we’ll review a few exceptions to the auto-renewal rule.

You May Like: Does Medicare Cover Tooth Extraction

What Happens If I Miss Medicare Open Enrollment

If you miss the opportunity to change your plan during the AEP or MA OEP, youll need to keep your current plan for one more year, until the next open enrollment period.

However, you may still be able to make changes to your Medicare coverage if you qualify for a special enrollment period. An example of this could be if you lose health insurance coverage from your employer or your spouses employer.

If you dont qualify for a Medicare special enrollment period, youll need to wait for the next relevant Medicare open enrollment period to make changes to your Medicare health or prescription drug plan.

Review Opportunity #: The Medicare Advantage Open Enrollment Period

The Medicare Advantage program has another enrollment period called the Medicare Advantage Open Enrollment Period. This one runs from January 1 to March 31 and applies to Medicare beneficiaries already enrolled in a Part C plan.

During OEP, you can make a one-time change to your Part C plan. You can either change to a different Part C plan, or you can switch back to Original Medicare . If you switch back to Original Medicare, you’ll also have the opportunity to enroll in a stand-alone Medicare prescription drug plan.

The OEP is your last chance to make any changes for the year.

Read Also: Are Grab Bars Covered By Medicare

What Happens If My Medicare Advantage Plan Or Medicare Part D Plan Are Not Renewed

If your Medicare Part C or Prescription Drug Plan plans are not renewed , you will have a Special Election Period . During a SEP for a Medicare Advantage non-renewal, you can sign up for a Medicare Supplement plan or change your Medicare coverage to a new Medicare Advantage plan. If your Part D plan non-renews for the next year, you can choose a new Part D plan if you dont do so, you may be without drug coverage for the following year. Besides the SEP granted to people in a non-renewing plan, there are also different SEPs applied to different circumstances. Listed below are a few SEP scenarios and their corresponding time frame:

- You moved and your plan is not offered in your new service area if you notify your plan prior to your move, you can switch the month before the month you move it continues for 2 full months after you move. But, if you tell your plan after you have moved, you will be able to switch plans beginning the month you tell your plan, plus 2 more full months.

- The Medicare contract for your plan is not renewed for the upcoming year December 8 to the end of February.

- Your plan leaves the Medicare program in mid-year your SEP begins the month in which you are notified and continues for two more months.

- Medicare terminates its contractual agreement with your plan you have two months before and one full month following the end of the contract.

Ask: How Much Money Can I Afford To Spend On Health Care

It may seem like a scary question to answer but its an important one. Take some time to look at how much you spent overall on health care costs in the last year. Then, you can look at different plans and how their cost sharing works for each. Compare plan costs by taking a look at your current health needs and try to estimate how much you may spend in the year to come. This will help you get an idea of the financial responsibility each plan may come with and if it will fit your lifestyle and budget.

Also Check: Can I Receive Medicare If I Am Disabled

B Late Enrollment Penalty

If you dont sign up for Part B when youre eligible, you will most likely have to pay a late penalty. This penalty will last for as long as you have Part B.

To calculate the penalty, take your standard monthly premium amount and increase it by 10 percent for each 12-months you could have had Part B but didnt. For example, if you could have had Part B for two years but didnt, youd have to pay a 20 percent penalty. Your monthly premium would be increased by 20 percent for as long as you have Part B.

Do You Have To Renew Your Plan If You’re Keeping Medicare Coverage

No, you dont need to renew Medicare if youre keeping the same plan. Once you settle on a Medicare plan, you do not have to actively renew your plan annually in most situations. However, it can be smart to review your plans annually to ensure you have a plan that meets your needs and budget, especially for Medicare Advantage and Part D plans.

Medicare Advantage and Medicare Part D plans can change annually. Changes may include drug or provider offerings, the premium, or your out-of-pocket limit. You can choose a different plan, or youll be notified to enroll in a new plan if youre no longer in the plans service area.

For Original Medicare , there are no renewal requirements once enrolled. Medigap plans also known as Medicare Supplement plans auto renew annually unless you make a change.

Read Also: Does Medicare Cover Inversion Tables

Will I Need To Renew My Medicare Card Each Year

You will not have to renew your Medicare card each year. However, you will need to replace your card if it is lost, damaged, stolen, or if your details have changed.

Visit your nearest Medicare Service Center with your proof of identity to replace your card, or request a new card by visiting myMedicare.gov.

How Often Do You Have To Enroll In Medicare

In general, once youâre enrolled, you donât need to take action to renew your Medicare coverage every year. This is true whether you are in Original Medicare, a Medicare Advantage plan, or a Medicare prescription drug plan. As long as you continue to pay any necessary premiums, your Medicare coverage should automatically renew every year with a few exceptions as described below.

Don’t Miss: Will Medicare Pay For Drug Rehab

For Insurance Quotes By Phone Tty 711 Mon

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MedicareInsurance.com, DBA of Health Insurance Associates LLC, is privately owned and operated. MedicareInsurance.com is a non-government asset for people on Medicare, providing resources in easy to understand format. The government Medicare site is www.medicare.gov.

This website and its contents are for informational purposes only and should not be a substitute for experienced medical advice. We recommend consulting with your medical provider regarding diagnosis or treatment, including choices about changes to medication, treatments, diets, daily routines, or exercise.

This communications purpose is insurance solicitation. A licensed insurance agent/producer or insurance company will contact you. Medicare Supplement insurance plans are not linked with or sanctioned by the U.S. government or the federal Medicare program.

MULTIPLAN_GHHK5LLEN_2023

Medicare Advantage And Part D:

These plans renew their contract with Medicare each year Medicare must approve the plan design each year. If it is approved by CMS , and you want to keep the plan, you do not have to do anything. But the plan contract with Medicare IS renewed annually. You will receive a notice each year around late September/early October about the plans status for the following calendar year. This also contains information about how the plan is changing for the following year. See below for more information about what happens if/when your plan is not renewed for the following year. What are the differences in Medigap and Medicare Advantage

Also Check: What Are Some Medicare Advantage Plans

Medicare Renewal When Might You Have To Renew Your Medicare Coverage

There are some exceptions where youâll need to take action to continue your coverage. Some situations where your Medicare Advantage or stand-alone Medicare Part D prescription drug plan coverage wonât be automatically renewed include, but arenât limited to:

- Your plan reduces its service area, and you now live outside of its coverage area.

- Your plan doesnât renew its Medicare contract for the upcoming year.

- Your plan leaves the Medicare program in the middle of the year.

- Medicare terminates its contract with your plan.

If your Medicare plan doesnât renew its contract with Medicare for the coming year, your Special Election Period will run from December 8 to the last day of February of the following year. If you have Medicare Advantage and don� ât enroll in a new plan by the date that your current plan ends its contract with Medicare, youâll be automatically returned to Original Medicare.

Keep in mind that your new coverage starts on the first day of the month after you submit your enrollment application, meaning if you apply on February 8, your new Medicare plan wouldnât begin until March 1.

Remember You Have A Set Time To Decide

The Medicare Annual Enrollment Period runs October 15 through December 7. This is the only time each year anyone with Medicare coverage can make changes .

Automatic renewal is a great way to go if you feel confident that the coverage you already have will fit your needs going forward. Its easy and convenient but once open enrollment is over on December 7, your chance to change your Medicare coverage for next year is over, too, unless you move or otherwise qualify for a special exception. You get to choose the Medicare coverage that you think best fits your needs each year during this time. You may choose to let your current coverage renew. Or you may choose something different. The important thing is to choose.

Also Check: How Is Medicare Part B Penalty Calculated

Do You Have To Renew Medicare Advantage

You will be automatically re-enrolled in your Medicare Advantage plan annually unless the company that provides your plan stops offering it. Then youll get a chance to buy a different one during the annual Open Enrollment Period from October 15 to December 7. There is also a Medicare Advantage Open Enrollment Period from January 1 to March 31. During both those periods, youll also be able to switch Medicare Advantage plans even if its just because you dont like the Advantage plan you have, or you are looking for more benefits or lower cost. Once you enroll in a new plan, you will be automatically disenrolled from the old one.4

Dont Be Afraid Of Change Change Can Be Good

It is easy to be complacent about Medicare coverage, especially if your favorite doctors accept it and you arent faced with many big bills. But dont take for granted that there isnt something better. Medicare is a big program with lots of options.

A Medicare insurance broker is an independent agent who represents many insurance companies. A broker will work with you to find the options for you. Working with a broker doesnt cost you any money. Find one you like and trust. Tell them about your medical issues and allow that person to analyze your coverage and maybe help you find something better.

You May Like: Is A Chiropractor Covered By Medicare

Whos Eligible To Make Coverage Changes During Medicare Open Enrollment

If youre currently covered by Original Medicare or Medicare Advantage, then youre eligible to make changes during open enrollment.

However, the annual Medicare open enrollment period does not apply to Medigap plans, which in most states are only guaranteed-issue during a beneficiarys initial enrollment period, and during limited special enrollment periods. So to clarify, you cannot use the annual Medicare open enrollment period to enroll in a new Medigap plan on a guaranteed-issue basis. You can certainly apply for a new Medigap plan during this window just as you can at any time of the year. But if your six-month initial enrollment period for Medigap has ended, the Medigap insurer will use medical underwriting to determine your eligibility and premium.

In addition, if you didnt enroll in Medicare Part B when you were first eligible, you may not use the AEP to sign up. Instead, youll use Medicares general enrollment period, which runs from January 1 to March 31. The general enrollment period is also for people who have to pay a premium for Medicare Part A and didnt enroll in Part A when they were first eligible.

There Are Two Types Of Medicare:

- Original Medicare includes Part A and Part B. For drug coverage, you join a Medicare prescription drug plan . To pay additional costs, which can mount up quickly, most people buy a Medicare Supplement plan .

- Medicare Advantage, otherwise known as Medicare Part C, is an all-in Medicare health plan operated by private companies that contract with Medicare to provide Part A and Part B benefits and usually, but not always, prescription drug coverage.

Which plan you choose affects many things going forward, including how your Medicare works, what it pays for, and how easy or hard it is to switch things around.

One of the best places to learn about Medicare is Medicare.gov, the governments information site. In order to get accurate information, you must create an account. Once youve done that, you can tailor your results. The site doesnt give you help making a decision about what is best for you, but it does offer plenty of personalized details to guide your decision making.

You May Like: Does Medicare Cover In Home Care For Seniors

How To Figure Out What Will Change Next Year

The first step: Carefully read a letter youll receive from your plan in September, called the annual notice of change. Medicare requires all plans to send this notice to enrollees every year informing them of any changes the plan will make for the next year. That includes four areas:

If you dont receive this annual notice of change, ask your plan for the information.

The second step: Pay special attention to whether the medications youre taking now or expect to take in the new year will still be covered and at what cost to you. Dont take this step for granted even if the prescriptions youre taking are generic.

The details of this letter will tell you about changes in the new year to your Part D plans formulary, its list of covered drugs, and whether those drugs are moving to a different tier, which are drugs grouped together based on the price youll pay. Insurers often charge lower copayments for preferred generic and preferred brand-name drugs than they do for medications not on their preferred lists.

Each private insurer that offers Part D plans negotiates with pharmaceutical companies on the prices they will have to pay. The insurers update the medicines in their formulary tiers in the annual notice of change letter.