Unitedhealthcare Dual Complete Plans

Plans are insured through UnitedHealthcare Insurance Company or one of its affiliated companies, a Medicare Advantage organization with a Medicare contract and a contract with the State Medicaid Program. Enrollment in the plan depends on the plans contract renewal with Medicare. This plan is available to anyone who has both Medical Assistance from the State and Medicare. This information is not a complete description of benefits. Call TTY 711, or use your preferred relay service for more information. Limitations, co-payments, and restrictions may apply. Benefits, premiums and/or co-payments/co-insurance may change on January 1 of each year.

Read Also: How To Get Emergency Medicare

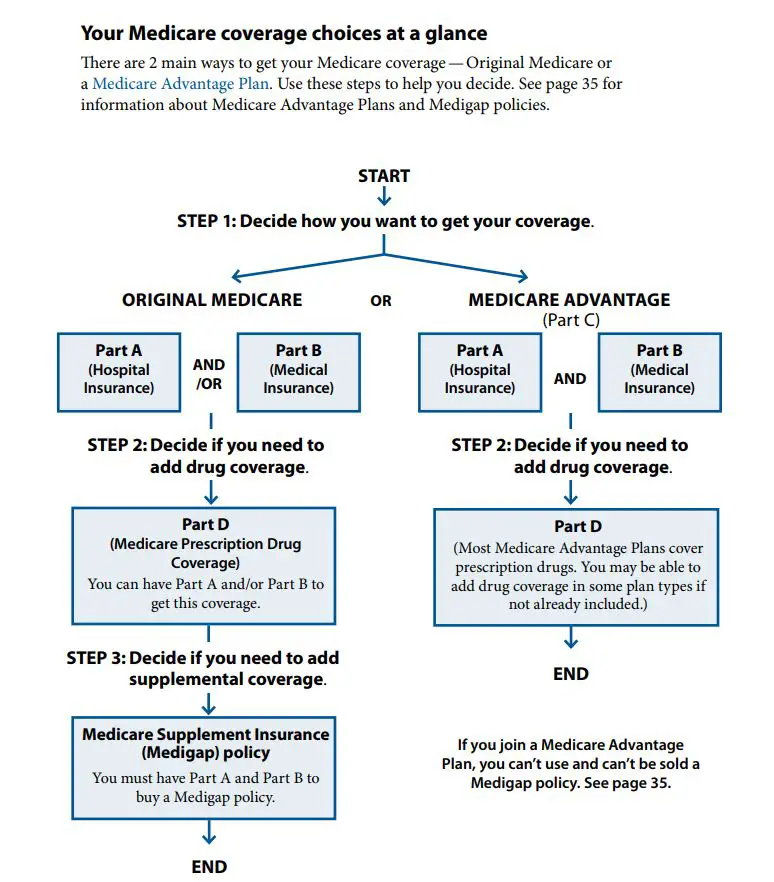

What Is A Ppo

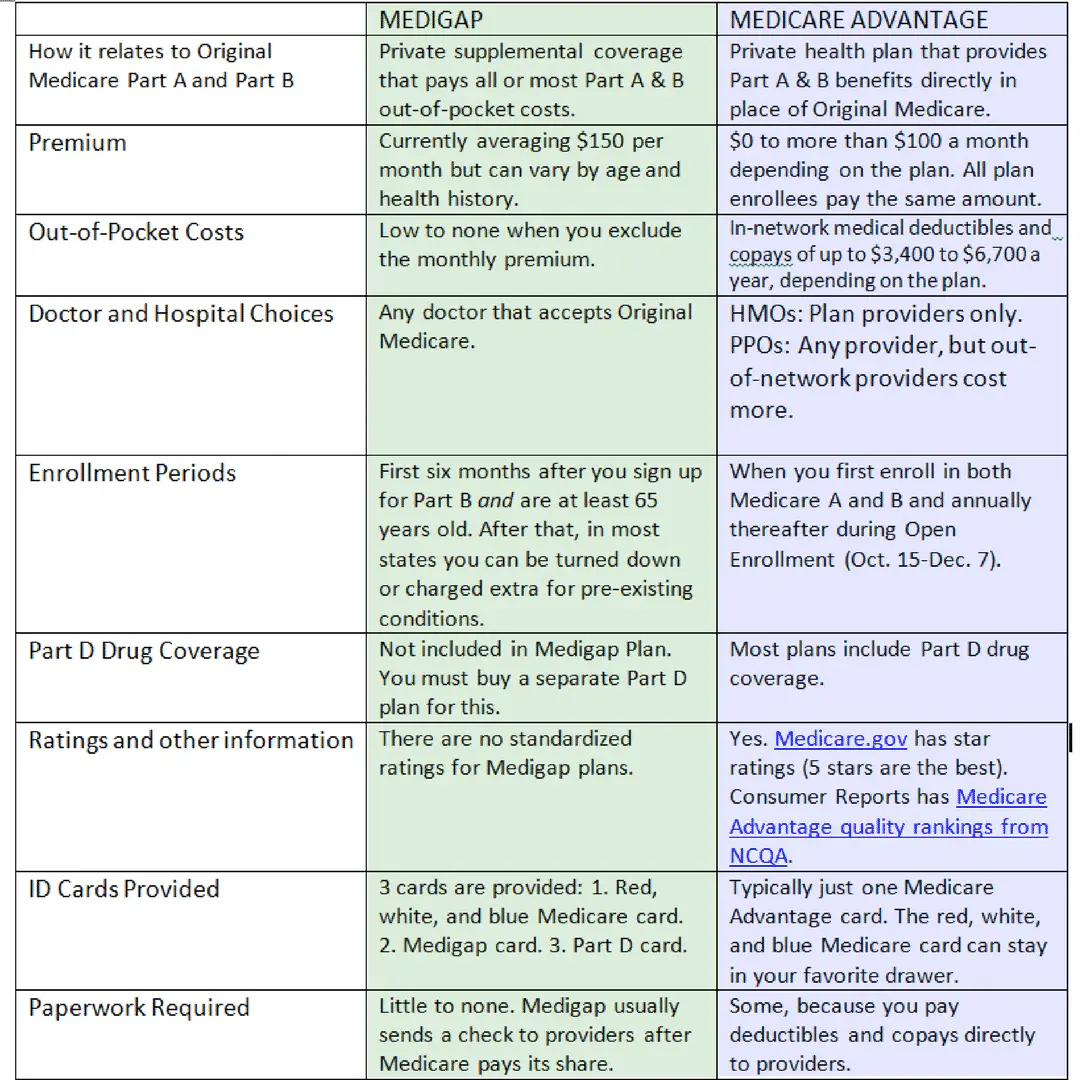

PPO stands for Preferred Provider Organization. Unlike an HMO, you can get your health care services performed by anyone on or off their list. For health care providers not on the plans preferred provider list, you will likely pay more for services. 64% of those enrolled in Medicare Advantage plans are in HMOs and 31% in PPOs.

What Are The Benefits Of Medicare Advantage

Medicare Advantage plans provide all the same benefits provided by Original Medicare, plus coverage for items and services not covered by Original Medicare, including some vision, some dental, hearing and wellness programs like gym memberships.

Some plans even provide transportation to doctor visits and adult day care services, says Amanda Baethke, director of corporate development at Aeroflow Healthcare in North Carolina, referring to newly expanded supplemental benefits. Plans can also tailor their benefit packages to offer benefits to those who are chronically ill.

Cigna, for example, launched free COVID-19 vaccination transportation for its Medicare Advantage customers. Over 500,000 customers in 23 states are eligible for four one-way trips, up to 60 miles each way, to get a vaccine.

Another bonus to consider is that coverage is expanding. According to a new report commissioned by the Better Medicare Alliance, the number of Medicare Advantage plans offering Special Supplemental Benefits for the Chronically Ill rose from 245 plans in 2020 to 845 in 2021. Some of the top new non-medical benefits offered includeNORC at the University of Chicago. Innovative Approaches to Addressing Social Determinants of Health for Medicare Advantage Beneficiaries. Better Medical Alliance. Accessed 9/6/21. :

Recommended Reading: Are Canes Covered By Medicare

Department Of Financial Services

What is Medicare Select?

Medicare Select is a type of Medigap policy that requires insureds to use specific hospitals and in some cases specific doctors in order to be eligible for full benefits. Other than the limitation on hospitals and providers, Medicare Select policies must meet all the requirements that apply to a Medigap policy. Medicare Select policies may have lower premiums because of this requirement.

When you use the Medicare Select network hospitals and providers, Medicare pays its share of approved charges and the insurance company is responsible for all supplemental benefits in the Medicare Select policy. In general, Medicare Select policies are not required to pay any benefits if you do not use a network provider for non-emergency services. However, Medicare will still pay its share of approved charges no matter what provider you use.

The availability of Medicare Select coverage is limited to the geographic areas of the state serviced by the particular policys network of hospitals and doctors.

Key Terms To Remember When Choosing A Medicare Supplement Plan:

Coinsurance The amount a Medicare beneficiary will have to pay for healthcare services, items, and equipment.

Deductibles The amount that a Medicare enrollee will have to pay each coverage period towards expenses before their Medicare coverage starts.

Copayments Set amounts that Medicare beneficiaries pay for medical services and items, such as doctors consultations and blood tests.

Monthly premiums The amount that Medicare enrollees have to pay each month for Medicare coverage for Part and B expenses.

Out-of-pocket expenses These are any costs that Medicare doesnt cover, which a beneficiary must pay.

Before you decide on a plan, make sure that youre getting the right cover for your medical costs and that your provider is offering a deal thats right for your needs.

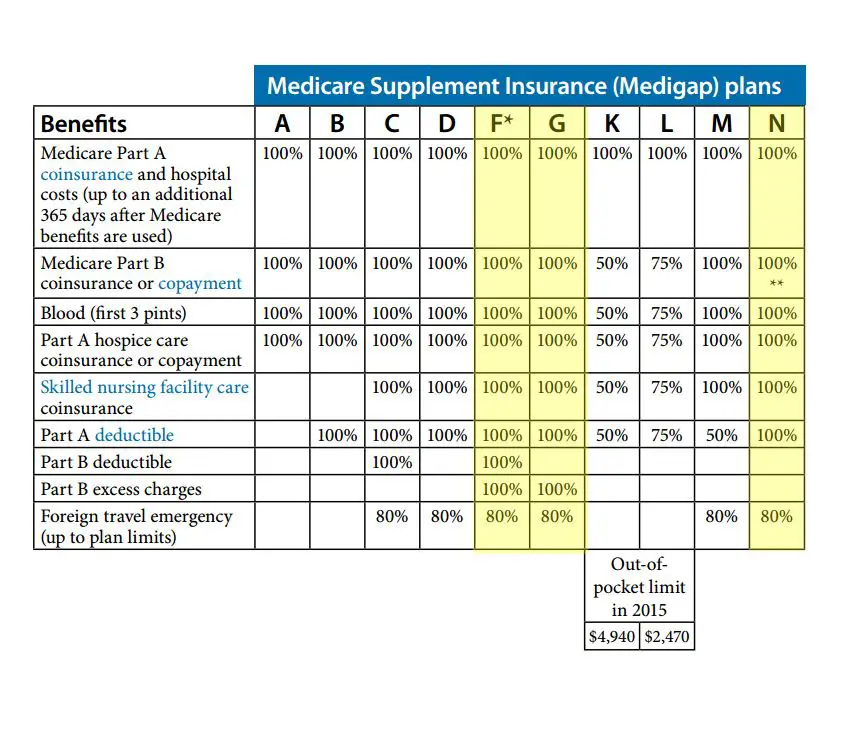

Below is a table summarizing the different benefits that each plan covers. The percentage indicates how much coverage each Medicare Supplement Plan offers.

Also Check: Is Medicare Advantage The Same As Medicare Supplement

When Can I Apply For Medicare Supplement Insurance

Your open enrollment period starts when you turn 65 or when you first sign up for Part B. It lasts for 6 months. This is the best time to sign up, because youll get the best possible rate and cant be denied for a pre-existing condition. After this 6-month window closes, you can still apply but the insurance company may use medical underwriting. There is also the possibility that you could be denied.

How Do I Enroll In Medicare

Automatic Enrollment Period

A person receiving SSDI for the required time period is automatically enrolled in Medicare Part A and Medicare Part B . Beneficiaries should receive a Medicare card in the mail a few months before they become eligible. This will notify beneficiaries of their automatic enrollment in Medicare Part A and Medicare Part B. If you do not receive this card, you should contact the Social Security office as you approach Medicare eligibility. Medicare Part A is usually premium-free for everyone. If you have worked fewer than 40 quarters, the premium is based on the number of quarters worked. For Medicare Part B there is a monthly premium which is usually deducted from your Social Security check. The monthly Part B premium can change annually. A person has the option to turn down Medicare Part B. If you are a beneficiary or your spouse is actively working for an employer that is providing an employer group health plan , you may be able to continue the EGHP coverage if you or your spouses employer has 100 or more employees. In this situation you will be able to delay enrollment in Medicare Part B. If you are going to delay your enrollment in Medicare Part B, you should meet with a Social Security representative or call 1-800-772-1213 or 1-800-325-0778 .

Special Enrollment

For more details and further information, please call SHIIP at 1-855-408-1212 Monday through Friday from 8am to 5pm.

Read Also: How To Determine Medicare Part B Premium

Open Enrollment For Texans With Disabilities

People under age 65 who get Medicare because of disabilities have a six-month open enrollment period beginning the day they enroll in Medicare Part B. This open enrollment right only applies to Medicare supplement Plan A.

Note: People who have Medicare because of disabilities have another open enrollment period during the first six months after turning 65.

What Is Medicare Supplement

Medicare Supplement plans are sold by private insurance companies to help fill the gaps of Original Medicare coverage.

In 2018, 34% of people enrolled in Original Medicare had coverage provided by Medicare Supplement plans to cover some of the costs of approved servicesthats roughly 11 million people, according to a report from the Kaiser Family FoundationKoma W, Cubanski J, Neuman T. A Snapshot of Sources of Coverage Among Medicare Beneficiaries in 2018. Kaiser Family Foundation. Accessed 9/4/2021. .

There are 10 Medigap plans to choose fromall with letter names ranging from A to Nthat provide standardized coverage and help pay for things like deductibles, coinsurance and copays. However, Medigap policies dont cover prescription drugs youll need to purchase a Medicare Part D plan in addition to a Medicare Supplement plan.

Don’t Miss: Does Medicare Pay For Telephone Psychotherapy

What Do Medicare Supplement Plans Cover

Medicare Supplement plans cover all the same services Original Medicare. Once Original Medicare pays its portion, those without a Medigap plan have a deductible, copayments, or coinsurance. However, you are no longer responsible for these out-of-pocket costs with Medicare Supplement plans.

Depending on your Medigap plan, the policy will cover most or all your leftover costs from Original Medicare. Refer to the Medicare Supplement comparison chart above to see what each lettered plan covers and what you will be responsible for paying.

These benefits include:

- No network restrictions you can see any doctor or visit any hospital that accepts Original Medicare

- No requirement for referrals to see a specialist

- Coverage is the same in all states

- 12 Unique plan options available to fit your needs/budget

- Guaranteed renewable plans your carrier cannot drop you for any reason other than not paying your premium

- Medigap plans help reduce your out-of-pocket costs

If you are looking for a plan that prioritizes convenience and ease, a Medicare Supplement plan may be right for you.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

I Have Health Insurance Through My Spouses Employer Can I Still Get Medicare Benefits

If you have other health insurance coverage, usually you are still eligible for Medicare benefits after your 24th month of disability payments. However, Medicare benefits are generally secondary to your other coverage, which means Medicare only pays for covered services after your primary health insurance pays its share.

Dont Miss: Must I Take Medicare At 65

Recommended Reading: Do I Have To Pay For Part B Medicare

Do Any Medicare Supplements Have Networks

Yes, there is one type of Medicare supplement that has network restrictions. These are called Select Plans and they are not very common. Select Plans are usually offered from larger providers like Anthem, United Healthcare and Mutual of Omaha to name a few.

Select Plans will require you to stay in-network for routine care usually administered by your primary care physician. Emergencies will always be covered, however, and are not subject to any network restrictions. The advantage of Select Plans are the lower premiums they offer.

If you find a traditional plan with no network restrictions at the same price as a Select Medicare supplement, the traditional plan might be a smarter purchase. Theres no point in narrowing your options unless it saves you significantly on your premiums.

The final word on the matter: Almost all Medicare supplement plans have no network restrictions.

How Do Medicare Supplement Plans Work With Original Medicare

Once you enroll in Original Medicare, you become eligible for a Medicare Supplement plan. When you have Original Medicare, you do not have 100% coverage for Medicare-covered services. This leaves beneficiaries with out-of-pocket costs that can quickly add up.

To offset these costs, beneficiaries can enroll in Medicare Supplement plans. Once Original Medicare pays its portion of the bill, your plan will pay second. Depending on your plan, you may not pay anything out-of-pocket once you meet your plans deductible.

After factoring in your monthly premium, you will begin saving you money as early as your first doctor appointment of the year.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

You May Like: Does Medicare Pay For Dexcom

Can You Change From A Medicare Advantage Plan To A Medicare Supplement Plan

During the Annual Enrollment Period, which runs from October 15 to December 7 each year, you are free to reconsider your Medicare coverage. If you decide you want to try a Medicare Supplement plan vs. Medicare Advantage plan, you can make that change during this period.4

Considering Medicare Advantage vs. Medicare Supplement? One is not better than the other. They provide different types of coverage. Finding the right fit for you depends on what kind of Medicare coverage youre seeking, as well as your health care needs. Review all details of plans when shopping and be open to considering alternatives when your needs change.

What About Medicare Select Plans

Medicare SELECT plans are a type of Medigap plan that is sold in some states in addition to the traditional Medigap plans. SELECT plans are not very commonly sold or purchased, but in some states, they are an option. What is a SELECT plan and how does it differ from a regular Medigap plan?

SELECT plans provide the same coverage as traditional Medigap plans however, they have a network that you must stay within to receive those benefits. The networks are usually statewide or regionally specific. If you are out of the area/out of network, you may still receive some benefits but those benefits will be much more limited than if you were in network.

Medicare SELECT plans are the only type of Medigap plan that has a network, and they are not commonly sold or purchased in most states.

Also Check: Does Medicare Cover Inogen One G4

Applying For A Medicare Supplement Insurance Plan

The best time to enroll in a Medicare Supplement plan is during your Medicare Supplement Open Enrollment period because your acceptance is guaranteed. It starts on the first day of the month in which you’re both age 65 or older and enrolled in Medicare Part B. Some states have additional Open Enrollment periods and Guaranteed Issue requirements.

If you apply outside of Open Enrollment or Guaranteed Issue periods, you may be denied coverage or charged more based on your health history. This does not apply to residents of Connecticut and New York where Open Enrollment and Guaranteed Issue is ongoing and Medicare supplement plans are guaranteed available.

Scroll for Important Disclosures

UnitedHealthcare pays royalty fees to AARP for the use of its intellectual property. These fees are used for the general purposes of AARP. AARP and its affiliates are not insurers. AARP does not employ or endorse agents, brokers or producers.

AARP encourages you to consider your needs when selecting products and does not make product recommendations for individuals.

Please note that each insurer has sole financial responsibility for its products.

AARP® Medicare Supplement Insurance Plans

AARP endorses the AARP Medicare Supplement Insurance Plans, insured by UnitedHealthcare.

In some states, plans may be available to persons under age 65 who are eligible for Medicare by reason of disability or End-Stage Renal Disease.

When You Need Care

With most Medicare supplement plans, you can go to any doctor or hospital that accepts Medicare. You’ll give them your Medicare card and your Medicare supplement plan ID card.

Original Medicare will pay its share. Your Medicare supplement plan will pay your share of the costs, depending on what the plan covers. It may also coordinate payment with Medicare and your health care providers. That means you won’t have to bother with claim filing or paperwork.

Read Also: What Is A Medicare Advantage Plan Ppo

Your Medicare Supplement Plan Choices

The government decides which Medicare supplement plans health insurance companies can offer. There are 10 different plans: A, B, C, D, F, G, K, L, M and N. Plan F and Plan G also offer a high-deductible option. Each plan pays the same amount for the same services, no matter which health insurance company is selling it. There are two main differences:

- Which plans a company offers. But all companies that sell Medicare supplement plans or Medigap plans have to offer Plan A.

- What the company charges for their Medicare supplement plans.

Can I Receive Care From A Provider That Does Not Accept Medicare

The short answer is yes, you can receive care from a provider, even if they don’t accept Original Medicare.

However, you will likely incur far greater costs than you would if you went to a provider that did accept Medicare. The costs will depend on a few different factors, including which Medicare Supplement plan you have and the extent that the medical provider is willing to work with Medicare.

If you have Medicare Supplement Plan N, you may be subject to Part B excess charges if your doctor does not accept Medicare. In most states, medical providers that do not accept Medicare are allowed to charge 15% more than Medicare-approved rates.

For example, if Medicare said that they would reimburse a doctors visit up to $100, that office could then bill you for another $15, which would be your excess charge.

Excess charges are rare and often very minimal when they do happen. Additionally, they are relatively easy to avoid by checking that your doctor is Medicare-approved before your appointment.

Alternatively, if your medical provider has wholly opted out of Medicare, the excess charge policy does not apply, and you would be responsible for all costs at whatever price the doctorâs office chooses to charge for.

Again, this situation is rare and, most often, avoidable by checking the approved status of your doctor beforehand.

Recommended Reading: What Medicare Plan Covers Dental

How Much Does A Medicare Advantage Plan Cost

Many Medicare Advantage plans have a $0 premium, so be sure to explore your options. Baethke explains it like this: If you enroll in a plan that does charge a premium, you must pay this fee every month in addition to your Medicare Part B premium, which is around $165 .

Medicare Part Bs coinsurance and the deductible is $226, according to Medicare.gov, and once they are met, your copay under Medicare Advantage is typically 20% of the Medicare-approved amount for most services and products, such as durable medical equipment like glucometers, walkers, hospital beds and more.

What gets many people into financial trouble is not following the rules of their plan, such as using an out-of-network provider or facility or getting products or services from a supplier not approved by Medicare.

Sometimes, patients urgently need this medical equipment and arent thinking about reading the fine print, says Baethke. This is why its so important to understand Medicares DME requirements from the beginning.

Nebulizers, for instance, are DME commonly used to treat conditions that cause difficulty breathing, such as asthma and COVID-19. If your doctor recommends one, Medicare requires you to get the machine through a Medicare-approved supplier. Not doing so will mean a denied claim from your Medicare Advantage insurerand a sizable surprise bill.

To learn more about your costs in specific Medicare Advantage plans, contact the plan or visit Medicare.gov/plan-compare.

What Are The Benefits To Medicare Advantage

Medicare Advantage covers more than Medicare , allowing patients more options and flexibility. Patients can customize their Medicare Advantage to cover specific needs like wheelchair ramps, adult day care, and respite care. Additionally, the 2020 CARES Act expanded Medicare’s network to cover more telehealth services.

You May Like: Does Everyone Over 65 Get Medicare