What Are The Medicare Eligibility Rules

You can become eligible for Medicare in one of three ways:

-

You are age 65 or older and meet the citizenship and residency requirements.

-

You have a long-term disability.

-

You have permanent kidney failure or ALS.

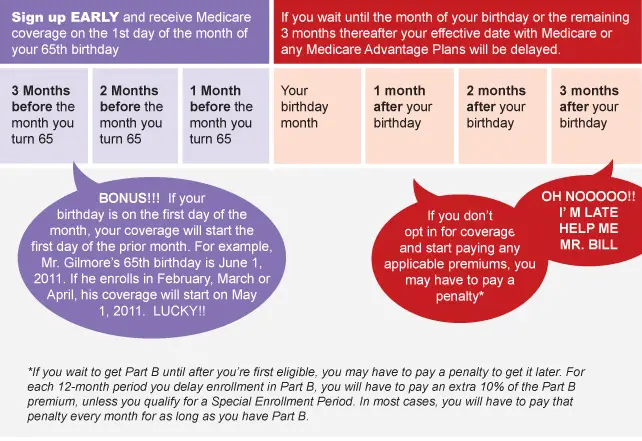

If you become eligible for Medicare by age, you can 3 months before your 65th birthday, during your birth month, and in the following 3 months. But if you wait until after your birthday to enroll, your coverage may be delayed by 1 to 3 months, depending on how long you wait.

You can estimate when youll be eligible for Medicare by using its eligibility calculator.

If youve paid into Medicare for long enough at least 10 years of payroll tax deductions if you are eligible for Medicare by age you can receive Medicare Part A premium-free. Otherwise, you can pay a premium based on how many quarters you have paid taxes.

If youve received Social Security retirement or disability or Railroad Retirement Board benefits for at least 4 months prior to turning 65, you will be automatically enrolled in Part A and Part B. In that case, you dont have to fill out an application for Medicare.

You also can choose whether to delay Part B enrollment. If you want to put off Part B, you can call the Social Security Administration at or send back your Medicare card when it arrives to avoid being charged premiums.

-

You are eligible for Social Security or RRB.

-

Your spouse is eligible for Social Security or RRB.

-

Your or your spouse paid enough Medicare taxes through a government job.

Do I Have To Be Enrolled In Medicare Part B Before I Enroll In A Medicare Advantage Plan

Yes. The Medicare Advantage program provides the means for Medicare beneficiaries to receive Medicare Part A and Part B benefits from a Medicare Advantage plan rather than from the government-administered Medicare program. Medicare Advantage doesnt replace Original Medicare Part A and Part B coverage it simply delivers these benefits through an alternative channel: private insurance companies. Medicare Advantage plans are offered by private insurance companies that contract with Medicare. Medicare Advantage plans must offer at least the same benefits as provided under Medicare Part A and Part B . Many Medicare Advantage plans offer extra benefits not available from Original Medicare. Therefore, to enroll in a Medicare Advantage plan, you must be enrolled in both Medicare Part A and Part B. You must also reside in the plans service area.

The Initial Enrollment Period is the first chance you have to enroll in Original Medicare, Part A and/or Part B. Your Initial Enrollment Period starts three months before you first meet all the eligibility requirements for Medicare and lasts for seven months.

To enroll in a Medicare Advantage plan, however, you have to be entitled to Medicare Part A and enrolled in Medicare Part B. This can occur simultaneously with the Initial Enrollment Period. You are likely to hear this enrollment period referred to as the Initial Coverage Election Period. This is the first time Medicare beneficiaries may enroll in a Medicare Advantage plan.

What Should You Do Once You Get Medicare

Although you can rely on Original Medicare alone, 86% of Medicare enrollees also have some type of additional coverage.2 It can be from an employer, a privately-purchased plan or from a government-run program like Medicaid. Original Medicare pays for a great deal of healthcare, but still leaves you with potentially costly gaps in healthcare coverage. Supplementary plans can cover these gaps including deductibles and copayments at a fraction of the out-of-pocket rate.

MedicareGuide.coms plan selector is designed to intelligently bring you the best Medicare Supplement plans. These plans, also known as Medigap policies, fill the gaps in coverage that you would otherwise be charged by Original Medicare.

Read Also: Do I Have Medicare Or Medicaid

Do I Automatically Get Medicare When I Turn 65

Some people automatically get Medicare at age 65, but those numbers have declined as the Medicare and Social Security ages have continued to drift apart.

Most people who automatically get Medicare at age 65 do so because they have been receiving Social Security benefits for at least four months before turning 65. Traditionally, Medicare premiums are deducted from your Social Security check. For the longest time, you could retire with full Social Security benefits at 65 and start on Medicare at the same time.

You are still automatically enrolled in Medicare Part A and Part B at 65 if youre drawing Social Security, but not as many people draw Social Security that early these days because of changes to the eligibility age for full Social Security benefits.

In 2000, the Social Security Amendments of 1983 began pushing back the standard age for full Social Security benefits. The progressive changes are nearing their conclusion: Beginning in 2022, the standard age for full benefits will be 67 for anyone born after 1960.

Besides the Medicare eligibility age of 65, what remains unchanged is that you can opt to begin drawing partial Social Security benefits as early as age 62. So, if you opt for accepting partial Social Security benefits before age 65, you are automatically enrolled in Medicare.

A smaller group of people also automatically get Medicare at age 65: people who receive Railroad Board benefits for at least four months before 65.

Medicare Supplement Plan Eligibility

Like Medicare Advantage, Medicare supplemental insurance often called Medigap because it fills in the out-of-pocket coverage gaps in Medicare Parts A and B is also purchased from private insurers.

Medigap helps cover copayments, coinsurance and deductibles from Medicare Part A and Part B.

You must meet one of these qualifications to be eligible for Medigap coverage:

- You must be 65 or older.

- You have been diagnosed with Lou Gehrigs disease.

- You have been entitled to Social Security or U.S. Railroad Retirement Board disability payments for at least 24 months.

- You have been diagnosed with end-stage renal disease, requiring regular dialysis or a kidney transplant.

Read Also: Does Medicare Cover In Home Help

Where Do I Apply For Medicare In Texas

You can apply for Medicare in Texas with Social Security, either online or by phone. If you receive benefits from Social Security or the Railroad Retirement Board, you qualify for automatic enrollment.

HealthMarkets can help determine if you qualify for Medicare. The HealthMarkets FitScore can assist you in exploring your options and help you find a Medicare Advantage, Medicare Part D or Medicare Supplement plan that meets your needs. Get your free FitScore® today to start comparing plans.

46891-HM-0612

HealthMarkets FitScore intends to identify plans that fit your needs. You should carefully review official plan materials.

Sign Up: Within 8 Months After Your Family Member Stopped Working

- Your current coverage might not pay for health services if you dont have both Part A and Part B .

- If you have Medicare due to a disability or ALS , youll already have Part A coverage.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty until you turn 65. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

Also Check: How To Get Motorized Wheelchair Through Medicare

How To Set Up Medicare Easy Pay

Enrolling in Medicare Easy Pay and paying Medicare online is easy! All you need to do is fill out this Medicare Easy Pay form and submit it to the following address.

It can take up to 6-8 weeks to process, so make sure you continue to pay your bill until your Medicare Easy Pay becomes active.

Once its active, youll notice that your premium is deducted from your bank account on the 20th of the month. Youll see it on your bank statement as Automated Clearing House .

Mail your Medicare Easy Pay form to:

Medicare Premium Collection CenterSt. Louis, MO 63197-9000

How To Find Plans That Offer The Giveback Benefit

Not all MA plans offer this benefit, so you must find a plan that does in order to take advantage of the opportunity. In 2021, these plans are offered in nearly all states, so you may find one close to you.

If you enroll in a plan that offers a giveback benefit, you’ll find a section in the plan’s summary of benefits or evidence of coverage that outlines the Part B premium buy-down. Here, you’ll see how much of a reduction you’ll get. You can also call us toll-free at 1-855-537-2378 and one of our knowledgeable, licensed agents will answer your questions and explain your options.

Also Check: What Is The Best Medicare Advantage Plan In Arizona

What Are Cases When Medicare Automatically Starts

Medicare will automatically start when you turn 65 if youve received Social Security Benefits or Railroad Retirement Benefits for at least 4 months prior to your 65th birthday.

Youll automatically be enrolled in both Medicare Part A and Part B at 65 if you get benefit checks. According to the Social Security Administration, more than 30% of seniors claim Social Security benefits early.1 For those seniors, Medicare Part A and Part B will automatically start when they reach the age of 65.

When do You Get Your Medicare Card?

You can expect to receive your Medicare card in the mail three months before your birthday. Your Medicare card will come with a complete enrollment package that includes basic information about your coverage. Your card wont be usable until you turn 65, even though youll receive the card before that time.

What Are Your Costs?

Keep in mind that youll still have to pay the usual costs of Medicare, even though youre automatically enrolled. Once your Medicare is active, the cost of your Part B premium will be deducted from your Social Security or RRB benefits.

What If You Already Enrolled in Medicare?

What about Medicare Supplement ?

What If I Switch to Medicare Advantage?

And if you want to switch to Medicare Advantage , youll have a one-time Initial Enrollment Period for Medicare Advantage that begins 3 months before the month you turn 65 and lasts for 7 months.

What I Have Part A?

Requalifying For Medicare At 65

If you become eligible for Medicare before you turn 65 due to disability or one of the above diagnoses, youll requalify again when you reach age 65. When you do, youll have another Initial Enrollment Period and all the benefits of a newly eligible Medicare recipient, such as a Medicare Supplement Enrollment Period.

You May Like: Does Medicare Cover In Home Care For Seniors

Already Enrolled In Medicare

If you have Medicare, you can get information and services online. Find out how to .

If you are enrolled in Medicare Part A and you want to enroll in Part B, please complete form CMS-40B, Application for Enrollment in Medicare Part B . If you are applying for Medicare Part B due to a loss of employment or group health coverage, you will also need to complete form CMS-L564, Request for Employment Information.

You can use one of the following options to submit your enrollment request under the Special Enrollment Period:

Note: When completing the forms CMS-40B and CMS-L564

- State I want Part B coverage to begin in the remarks section of the CMS-40B form or online application.

- If possible, your employer should complete Section B.

- If your employer is unable to complete Section B, please complete that portion as best as you can on behalf of your employer without your employers signature and submit one of the following forms of secondary evidence:

- Income tax form that shows health insurance premiums paid.

- W-2s reflecting pre-tax medical contributions.

- Pay stubs that reflect health insurance premium deductions.

- Health insurance cards with a policy effective date.

- Explanations of benefits paid by the GHP or LGHP.

- Statements or receipts that reflect payment of health insurance premiums.

Some people with limited resources and income may also be able to get .

Who Is Eligible For Medicare Advantage Plans

Youll automatically qualify for Medicare Advantage once you qualify for Part A and Part B coverage. Advantage plans are sold by private companies and are designed to cover some of the out-of-pocket costs Original Medicare does not cover.

4 Medicare Advantage Eligibility Requirements

While regular Medicare Advantage does not cover ESRD, you may qualify for a Medicare Special Needs Plan . SNPs are special types of Advantage plans specifically designed for a particular condition or financial situation.

You can keep your Medicare Advantage plan if you purchased it before developing ESRD. You can also buy an Advantage plan after being medically determined to no longer have ESRD usually from a successful kidney transplant.

Don’t Leave Your Health to Chance

You May Like: How To Apply For Medicare By Phone

Eligibility Requirements For Non

Medicare, like most federal programs created to give benefits and opportunities to eligible recipients, is a program for American citizens. One of the requirements to be eligible to receive and enjoy Medicare coverage is to have United States citizenship or to be a permanent resident of the United States. However, there is one circumstance in which you may be able to qualify for Medicare even if you are not a U.S. citizen or permanent resident.

Who Is Eligible For Medicare

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease . Medicare has two parts, Part A and Part B . You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if:

- You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

- You are eligible to receive Social Security or Railroad benefits but you have not yet filed for them.

- You or your spouse had Medicare-covered government employment.

To find out if you are eligible and your expected premium, go the Medicare.gov eligibility tool.

If you did not pay Medicare taxes while you worked, and you are age 65 or older and a citizen or permanent resident of the United States, you may be able to buy Part A. If you are under age 65, you can get Part A without having to pay premiums if:

- You have been entitled to Social Security or Railroad Retirement Board disability benefits for 24 months.

- You are a kidney dialysis or kidney transplant patient.

While most people do not have to pay a premium for Part A, everyone must pay for Part B if they want it. This monthly premium is deducted from your Social Security, Railroad Retirement, or Civil Service Retirement check. If you do not get any of these payments, Medicare sends you a bill for your Part B premium every 3 months.

Recommended Reading: What Does Medicare Part A

What Is Medicare Easy Pay

Medicare Easy Pay automatically deducts your Medicare premium from a designated checking or savings account. Youll still get a Medicare Premium Bill in the mail, but it will say, This is not a bill. It will serve as a statement letting you know that your premium has automatically been deducted from your bank account.

If you prefer to not have your Medicare premiums automatically deducted, there are a few other ways you can pay:

- You can sign onto MyMedicare.gov and pay your premiums online with your credit card or debit card.

- If you receive Social Security benefits, you can have your Medicare premiums deducted from your benefits.

- If you prefer to pay by check or credit card, you can return your Medicare bill with a check or credit card number by mail.

Using Medicare Easy Pay will save you time and prevent you from accidentally forgetting to pay your premiums.

How To Opt Out Of Medicare Part B

So, if you dont want to be enrolled, you may be able to opt out. Follow the instructions in your Welcome to Medicare packet, which Medicare sends you during the three months before youre eligible, in most cases.

Were always happy to answer your questions. Call one of our eHealth licensed insurance agents at 1-888-296-0117 . Representatives are available from 8 AM to 8 PM Monday through Friday, and from 10 AM to 7 PM Saturdays, Eastern time.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealths Medicare related content is compliant with CMS regulations, you can rest assured youre getting accurate information so you can make the right decisions for your coverage. Read more to learn about our Compliance Program.

Find Plans in your area instantly!

You May Like: Does Medicare Cover Whooping Cough Vaccine

Primary And Secondary Payers

Your Medicare and private insurance benefits are coordinated, which means they work together. Typically, a primary payer will pay insurance claims first and a secondary payer will only kick in for costs not covered by the primary payer. The secondary payer may not pay all of the remaining uncovered costs, and you may be responsible for any additional balance.

In many instances, if you are age 65 and covered by either a retiree plan or a plan with fewer than 20 employees, then Medicare is your primary payer and private insurance is your secondary. If this is your situation, you should enroll in Part A and B, along with D if your private insurance plan doesnt have creditable prescription drug coverage.

If youre covered by a plan with 20 or more employees, Medicare is often the secondary payer. Medicare may pay costs that your employers plan doesnt.