What Are Medicare Savings Programs

Medicare Savings Programs can pay Medicare Part A and Medicare Part B premiums, deductibles, copays, and coinsurance for enrollees with limited income and limited assets. There are four different types of MSPs, and they provide varying benefits. Two of the MSPs only help to pay Medicare Part B premiums , and one MSP helps disabled working individuals pay their Part A premiums.

Cdc Shingles Vaccine Recommendations

The Centers for Disease Control and Prevention recommends Shingrix vaccination for anyone 50 years and older, even if you have already had shingles, if you had another type of shingles vaccine, and if you dont know whether or not youve had chickenpox in the past.

You should not get the vaccine if you are allergic to any of the components, are pregnant or breastfeeding, currently have shingles, or you have lab tests that definitively show that you do not have antibodies against the varicella-zoster virus. In that case, you may be better off getting the varicella vaccine instead.

Care For Your Glasses

The caps on the number of glasses Medicaid will pay for vary by state. For instance, if youre an adult in Mississippi, you get one pair every five years. Children can get two per year unless a doctor says theres a need for more. Connecticut has no limits for those under 21, but adults can get just one pair every two years. States set their own rules for acceptable replacement reasons. Some possible reasons include broken, lost or damaged glasses, a change in vision and an allergic reaction to the current pair.

Recommended Reading: Does Medicaid Cover Auto Accidents In Michigan

You May Like: Does Medicare Medicaid Cover Dentures

How Does Ohio Regulate Long

Medicare beneficiaries increasingly rely on long-term services and supports or long-term care which is mostly not covered by Medicare. In fact, 20 percent of Medicare beneficiaries who lived at home received some assistance with LTSS in 2015. Medicaid fills this gap in Medicare coverage for long-term care, but its complex eligibility rules can make qualifying for benefits difficult. Whats more eligibility rules vary significantly from state to state.

Medicaid nursing home coverage

In past decades, most Americans received long-term care services in nursing homes. Medicaid covers these services for an unlimited number of enrollees in each state who meet income and resource limits.

Income limits: The income limit is $2,349 a month if single and $4,698 a month if married .

When only one spouse needs nursing home care, the income limit for single applicants is used and usually only the applying spouses income is counted. Non-applying spouses are allowed to keep a portion of their Medicaid spouses income.

This income limit doesnt mean nursing home enrollees can keep all of their income up to the limit. Nursing home enrollees have to pay nearly all their income toward their care, other than a small personal needs allowance and money to pay for health insurance premiums .

Assets limits: The asset limit is $2,000 if single and $3,000 if married . If only one spouse has Medicaid, federal rules allow the other spouse to keep up to $128,640.

Estate recovery in Ohio

In What Cases Are Recliners Not Covered By Medicare

The recliners are not covered under Medicare in the following cases:

- If you are hospitalized or are staying at a nursing home

- In case you have already claimed Medicare for another motorized device such as a scooter or wheelchair

- If there is a spring device mechanism in the recliner to help you lift out

Read Also: How To Calculate Medicare Tax

Does Medicaid Cover Mobility Scooters

Medicaid does cover mobility scooters on a case-by-case basis. Some aspects of the coverage are different under Medicaid, compared to Medicare. One fact is that Medicaid is administered by the individual states. Therefore, there may be some variation in the process of receiving coverage.

A 2017 letter to state Medicaid directors explained that medical supplies, equipment and appliances are a mandatory benefit and that the act does not specify a list of medical equipment and appliances that are allowable in the Medicaid program. The individual states, under Medicaid rules, states are prohibited from having absolute exclusions of coverage on medical equipment, supplies, or appliances.

There is still a comprehensive application process to determine whether a patient qualifies for Medicaid coverage for a mobility scooter. The physician, supplier and provider follow the procedures required for coverage in the specific state.

What Will Medicaid Cover

- Medicaid covers both routine and comprehensive eye exams which can include a variety of testing such as visual field test, pupil dilation, color blindness, glaucoma, and many others.

- Medicaid covers glaucoma screenings for people at higher risk for glaucoma.

- Medicaid covers eyeglasses that includes the frames, lenses, fittings, repairs and replacements of glasses.

- Medicaid covers bifocal and trifocals, or for two pair of single vision glasses if bifocals dont work. Over-sized lenses, no-line, progressive multi-focal and transitions are not a covered Medicaid benefit. However, if you want to buy these, you can pay for the additional costs.

- Medicaid only covers contact lenses if they are considered medically necessary and if there is no other alternative treatment. If they arent medically necessary, but you want them, you can pay for them separately.

- Medicaid Covers safety frames.

- People that select frames and lenses that arent covered must pay the difference in cost.

- Medicaid also covers prosthetic eyes.

Read Also: Pregnancy Medicaid Florida Phone Number

Read Also: Will Medicare Pay For Liposuction

Manual For State Payment Of Medicare Premiums

On September 8, 2020, the Centers for Medicare & Medicaid Services released an updated version of the Manual for State Payment of Medicare Premiums . The manual updates information and instructions to states on federal policy, operations, and systems concerning the payment of Medicare Parts A and B premiums for individuals dually eligible for Medicare and Medicaid. The update to the manual is part of CMS Better Care for Dually Eligible Individuals Strategic Initiative aimed at improving quality, reducing costs, and improving customer experiences.

The prior version of this manual had not been fully updated since the 1990s. The updated manual clarifies various provisions of statute, regulation, and operations that have evolved over time. We redesigned the manual content to make it easier for states to discern federal requirements and find information, compliant with federal accessibility standards and fully available online for the first time.

The manual is part of the CMS Manual System, specifically Pub. 100-24. It is divided into the following sections:

How To Get A Free Mobility Scooter Through Medicaid

Many states use the Medicare payment rates when they cover mobility scooters. Many Medicaid recipients do not pay any costs for their medical coverage. Medicaid recipients cannot, however, just select a scooter that they want and hand over their Medicaid card for coverage. The provider, supplier, and physician must all accept Medicaid and be properly enrolled in the state program.

Are you a senior that receives Medicaid QMB? You may be able to get your scooter without cost if you do, since you do not pay deductibles, co-pays or other costs. Make sure that you give the physician, supplier and provider your Medicare card and your Medicaid QMB card.

You may qualify for this program if you are on Medicare and are income-eligible. The program, called Medicare Qualified Beneficiary, is administered through Medicaid. Many people that receive Medicare also receive Medicaid QMB benefits, which cover premiums, deductibles, and co-pays.

Contact Medicare to learn more about the program and you may be able to receive extra coverage, meaning that Medicaid pays for the costs of your scooter that is not covered by Medicare. The program does not cover benefits such as dental, vision, and hearing aid costs.

You May Like: Is There A Copay With Medicare Part D

Medicare Vision Coverage And Medicare Advantage Plans

Medicare Advantage plans are an alternative to the government-run Medicare program and provide another way to get your Original Medicare, Part A and Part B, benefits. Offered through private insurance companies that are contracted with Medicare, these plans are required to cover at least the same level of benefits as Medicare Part A and Part B .

However, one benefit of Medicare Advantage plans is that they may offer coverage that goes beyond Original Medicare, including routine vision or dental, hearing, and prescription drugs. Benefits vary by plan, but Medicare Advantage plans may cover routine eye exams, eyeglasses, contacts, and fittings for frames and contact lenses this coverage would be in addition to all of the preventive or diagnostic vision services and treatment covered under Original Medicare. Since each Medicare Advantage plan may offer different coverage, always check with the individual plan to see if vision benefits are included and what your costs may be. You still need to continue paying your Medicare Part B premium if you sign up for a Medicare Advantage plan, in addition to any premium the plan may charge.

New To Medicare?

Becoming eligible for Medicare can be daunting. But dont worry, were here to help you understand Medicare in 15 minutes or less.

Does Medicare Cover Lung Cancer

Medicare covers many services for lung cancer, but costs can still add up. A 2018 study in Cancer Medicine looked at the amount people on Medicare spent for lung cancer at different stages.

During the screening and diagnostic phase, the average spent was $861. Chemotherapy and radiation costs averaged $4,242 to $8,287 per month over the first six months of care. The average cost of surgery, if pursued, was $30,096. This analysis, again, did not include the cost of more expensive immunotherapies.

Recommended Reading: Can You Use Medicare In Any State

Does Medicare Cover Vision And Glasses

Original Medicare does not cover routine vision exams or glasses, but Part B helps cover certain vision-related services if you have eye disease or injury. Medicare Advantage plans, an alternative to Original Medicare, provide the same coverage as Part B, plus more. Most MA plans offer some coverage for routine eye exams and corrective lenses.

Part B vision care coverage is limited to medically necessary treatment for your eye problems. Some of the eye conditions covered by Part B may be a common and normal part of aging and are considered to be Medicare-covered services. MA plans include all Medicare-covered services plus some non-covered Medicare services, such as routine eye exams and financial allowances for corrective lenses.

What Is Considered Medically Necessary Contact Lenses

Contact lenses are defined as medically necessary when the patient has an eye disease or prescription that has to be managed with contacts because glasses cant provide sufficient correction. Most contact lenses worn by individuals are classified as an elective vision correction option by insurance companies.

Recommended Reading: Does Medicaid Cover Gastric Balloon

Recommended Reading: How Do You Qualify For Medicare In Texas

How Much Does Medicare Cost For A Married Couple

Medicare has no family plans, meaning that you and your spouse must enroll for Medicare benefits separately. This also means husbands, wives, spouses and partners pay separate Medicare premiums.

You may need to enroll at different times, depending on your age and health. While Medicare considers you individually as beneficiaries, your marital status can influence some of your Medicare costs.

How Will I Know How Much My Medicare Part B Premium Will Be

The Social Security Administration or the Railroad Retirement Board, if that applies to you will tell you how much your Part B premium will be. Heres a table that may help you to know what to expect, particularly if your income is above a certain level.

If your income falls into one of four higher-income categories based on your 2019 tax return, in most cases youll pay more than the standard Medicare Part B premium. The amounts listed below reflect the Income Related Monthly Adjustment Amount, or IRMAA. To determine your Part B premium, the Social Security administration looks to your income tax returns from two years ago .

Here is a chart of Medicare Part B premiums for 2021, including IRMAA amounts, if applicable. Please note that your actual premium may be different depending on your individual circumstances.

| Your reported tax income in 2019 | Your 2021 Part B premium |

Don’t Miss: What Are The Four Different Parts Of Medicare

Which Lenses Are Covered By Medicaid

If you need a new pair of glasses, you must find out the types of lenses covered by Medicaid. Medicaid will pay for regular single-vision lenses, meant to correct near and distance vision.

If you need bifocals or trifocals, no need to worry, Medicaid will also pay for them. Bifocals and trifocals are expensive, so Medicaid only covers one pair per year.

For single-vision glasses, Medicaid will cover two pairs per year because they are relatively cheap.

Some of the lenses not covered by Medicaid include:

If youd like to get any of the above lenses, you can still use your Medicaid coverage. However, you will incur out-of-pocket costs because these are specialty lenses.

Read Also: Medicaid South Dakota Income Guidelines

Retiree Health Plan Part B Reimbursement Options

If you’re retired and have Medicare and retiree group health plan coverage from a former employer, Medicare typically pays first for your medical bills and your retiree plan would pay the remaining amount.

Some of these retiree plans offer a Part B reimbursement to eligible enrollees. Each retiree plan has different eligibility requirements, so check with your plan to understand your options. However, for most plans you must be a retired employee or already enrolled in the health plan and be enrolled in Medicare Part B.

You may be reimbursed the full premium amount, or it may only be a partial amount. In most cases, you must complete a Part B reimbursement program application and include a copy of your Medicare card or Part B premium information.

You May Like: How To Change From Medicare Advantage To Original Medicare

Help Paying Your Medicare Costs

To let you know you automatically quality for Extra Help, Medicare will mail you a purple letter that you should keep for your records. You don’t need to apply for Extra Help if you get this letter.

- If you aren’t already in a Medicare drug plan, you must join one to use this Extra Help.

- If you’re not enrolled in a Medicare drug plan, Medicare may enroll you in one so that you’ll be able to use the Extra Help. If Medicare enrolls you in a plan, you’ll get a yellow or green letter letting you know when your coverage begins, and you’ll have a Special Enrollment Period to change plans.

- Different plans cover different drugs. Check to see if the plan you’re enrolled in covers the drugs you use and if you can go to the pharmacies you want.

- If you have Medicaid and live in certain institutions or get home and community based services, you pay nothing for your prescription drugs.

Drug costs in 2021 for people who qualify for Extra Help will be no more than $3.70 for each generic drug and $9.20 for each brand-name drug. Look on the Extra Help letters you get, or contact your plan to find out your exact costs.

NOTE: When you apply for Extra Help, you can also start your application process for the Medicare Savings Programs. These state programs provide help with other Medicare costs. Social Security will send information to your state unless you tell them not to on the Extra Help application.

There are 4 kinds of Medicare Savings Programs:

Paying For The Doctor When You Have Original Medicare

For Medicare-covered services, you must first pay the Medicare Part B annual deductible, which is $166 in 2016. After you have met your deductible, you pay a Part B coinsurance for Medicare-covered services. For doctors visits you generally pay 20 percent of the Medicare-approved amount for care you receive. This is also called a 20 percent coinsurance.

However, you may have to pay more depending on what type of doctor you see and whether your doctor takes Medicare assignment. A doctor who takes Medicare assignment agrees to accept the Medicare-approved amount as full payment. In general, there are three categories of Original Medicare doctors:

- If you see a participating doctor, you are only responsible for paying a 20 percent coinsurance for Medicare-covered services. Most doctors who treat patients with Medicare are participating doctors.

Be sure to always ask your doctor if he/she accepts Medicare before you get care.

Don’t Miss: How Many Parts Does Medicare Have

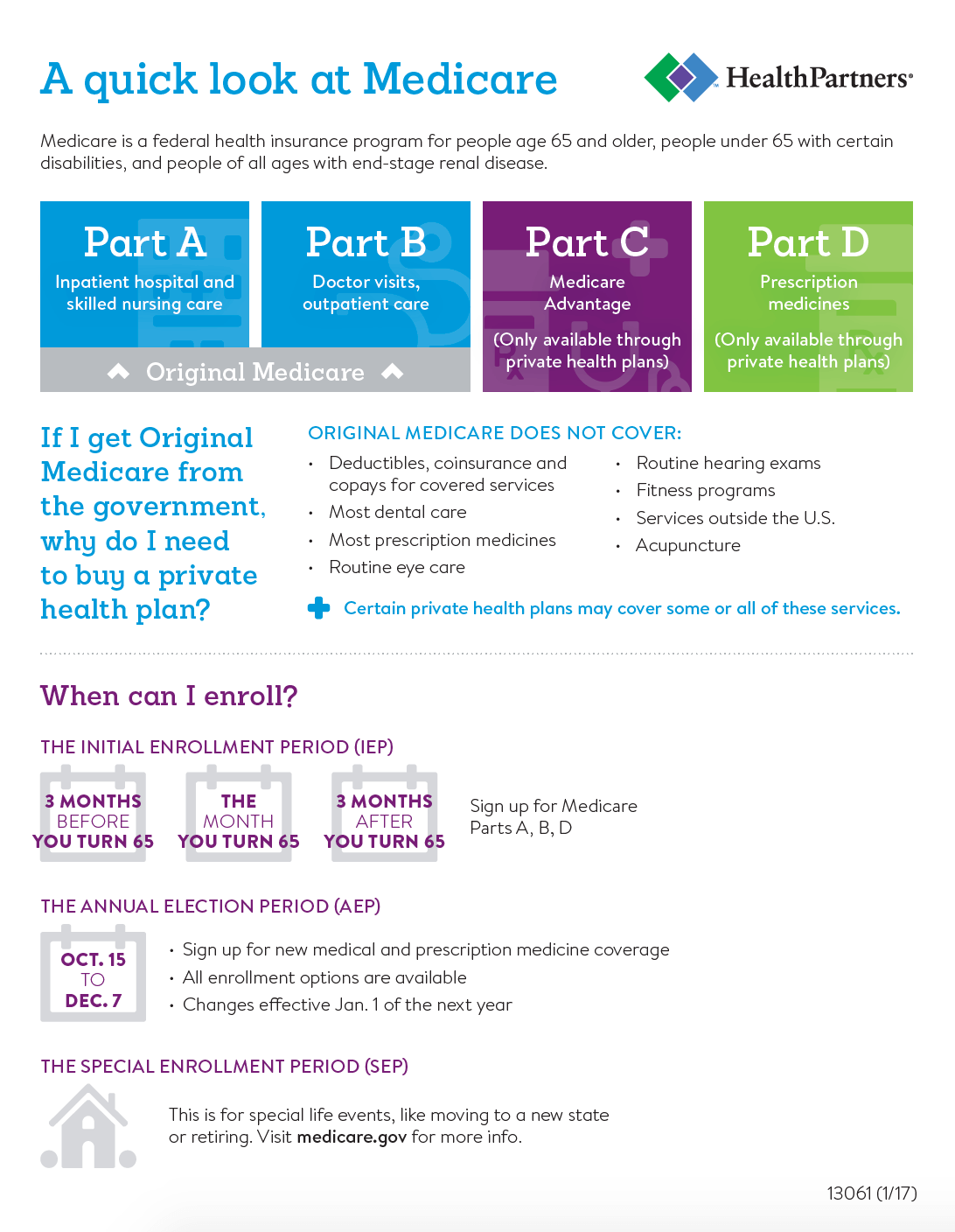

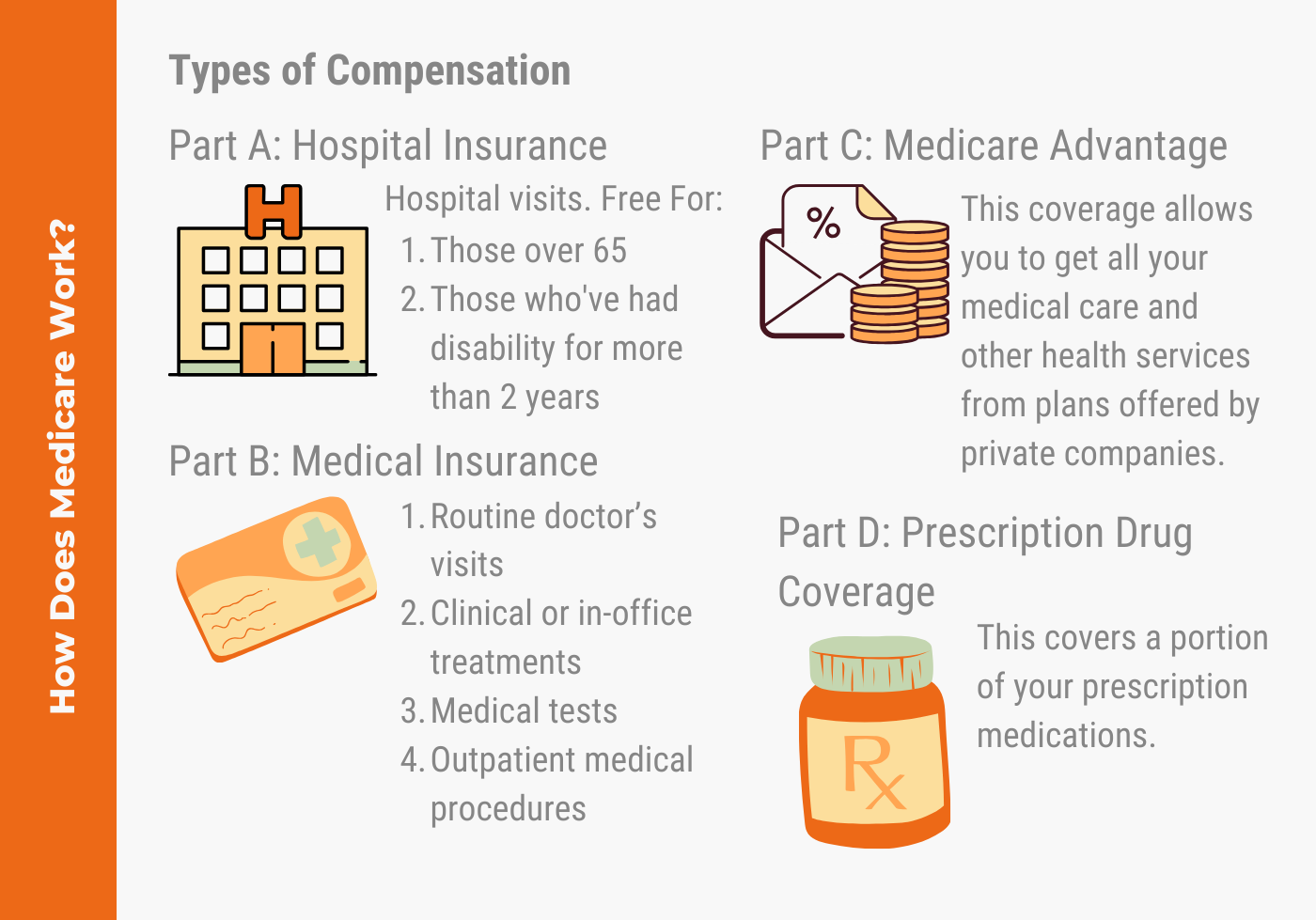

Understanding Medicare And Medicaid

Medicare is health and hospitalization insurance for people age 65 and older and those under 65 with certain disabilities or end-stage renal disease. Some portions of Medicare are free and others cost money, with premiums typically deducted from your Social Security benefit checks.

Even if you have private insurance you should apply for Medicare. If you wait until after your 65th birthday to apply, you may end up paying a late penalty or higher premiums. For most people, the initial enrollment period is the seven-month period that begins three months before the month in which they turn 65. If you miss that window, you may enroll between January 1 and March 31 each year, although your coverage won’t begin until July 1.

There are four types of Medicare coverage available.