Can You Pass Along Benefits Upon Death

Some traditional insurance products offer the ability to continue benefits for family members listed on the policy following the policy holders death. Medicare insurance does not provide an option for this. Because each plan applies only to the individual to whom the plan was issued, benefits cant be passed on to others upon death or for any other reason.

Do Husband And Wife Pay Separate Medicare Premiums

You and your spouse pay separate premiums for Medicare benefits under Medicare Part B, and Medicare Part D if you sign up for it. If one or both of you choose to enroll in a Medicare Advantage plan, you will continue to pay separately the Medicare Part B premium and possibly a separate plan premium.

Medicare Part B And Spouses

Medicare Part A is hospital insurance, while Medicare Part B refers to medical insurance. Part A is free for those with the qualifying number of Social Security credits. However, Part B requires a monthly premium.

If one spouse turns 65 years of age and the other still has health insurance coverage through their employer, the individual without Medicare may decide to wait for Medicare Part B enrollment. There is no late enrollment penalty for spouses if they enroll during a SEP.

They can enroll in Part B while still using an employer-sponsored health plan. They also may enroll during the 8-month period that begins the month after the original health plan or employment ends.

Medicare base the special enrollment criteria on whichever event comes first, the end of health plan coverage or employment.

You May Like: How To Get Replacement Medicare Id Card

Does Medicare Work With Health Savings Accounts

When enrolled in any Medicare parts, you CANNOT contribute to a Health Savings Account . Your employer also cant contribute to your HSA once your Medicare is active. If you continue to add to your HSA, you could face tax penalties.

If your spouse has coverage on your group insurance, they can still contribute as long as their Medicare is not active. The good news is, you can use the funds in your HSA to pay for any medical expenses.

Read Also: How Much Does Humira Cost With Medicare

When Can A Spouse Claim Spousal Benefits

You can claim spousal benefits as early as age 62, but you won’t receive as much as if you wait until your own full retirement age. For example, if your full retirement age is 67 and you choose to claim spousal benefits at 62, you’d receive a benefit that’s equal to 32.5% of your spouse’s full benefit amount.

Also Check: What Is The Annual Deductible For Medicare

Can My Spouse Get Medicare At Age 62

Summary:

When you get Medicare at age 65, that doesnât include Medicare for your spouse. In this way, Medicare is not like employer group coverage. Your Medicare insurance doesnât cover your spouse â no matter whether your spouse is 62, 65, or any age.

But in some cases, a younger spouse can help you get Medicare Part A with no monthly premium.

Can You Share Medical Devices Or Prescriptions With Others

Although you cant share coverage, some Medicare recipients feel inclined to seek out care and share their medical devices and prescriptions with others. Doing this may be a criminal offense, and it may also result in serious fines and penalties if you are caught. As such, you should never share items obtained through Medicare coverage with others. Beyond the potential for criminal and civil penalties, you could be jeopardizing someone elses health by providing prescribed medications and devices to someone who has not obtained a prescription.

Don’t Miss: Does Medicare Part A Or B Cover Prescriptions

Medicare When Your Non

Youll need to make some decisions about Medicare when you become eligible, whether or not you continue working past age 65.

Either way, your spouse will need health insurance until he or she is also eligible for Medicare. Here are some of the options:

- Your spouse may continue coverage through your employer plan if you keep working and keep the employer coverage.

- Your employer may offer COBRA coverage for your spouse if you retire.

- Your spouse may choose to buy individual health insurance until he or she turns 65.

Your employer benefits manager can help you and your spouse understand your choices.

Determine If Medicare Or Group Insurance Is The Primary Insurer

The size of your employer often decides whether or not you can delay enrollment in Part B without paying a penalty. In companies with fewer than 20 employees, Medicare automatically becomes the primary insurer, with group insurance secondary. If you learn that your current insurance will become secondary to Medicare, then you should take Part A and Part B when you are first eligible. The reason for this is because secondary insurance only pays after the primary insurer pays, and pays very little. If you choose to delay Medicare, you will not have a primary insurer, and your out-of-pocket costs will be high.

On the other hand, if your employer has more than 20 employees and you learn that your group health insurance will remain the primary insurer with Medicare coverage second, then you may not need to enroll in Part B immediately as your current coverage will cover your needs.

Also Check: Do Medicare Advantage Plans Cover Annual Physicals

Can A Person Who Never Worked Get Medicare

Medicare Coverage for People Who Never Worked You can still get Part A without any work history to do so, you’ll have to pay a monthly premium like any other form of insurance. … Medicare Part B, which covers outpatient care, comes with a monthly premium that is not affected by your work history.

When Do Medicare Benefits Combine

If you turn 65 and get Medicare at the same time as your spouse, then you will both have your own Medicare plans. There will be no need to think of one of you as on the others plan as is common with private insurance each person is independently a Medicare beneficiary.

However, there are certain aspects of Medicare that can be combined between spouses when one fills some criteria that the other doesnt.

Read Also: Does Medicare Pay For Skilled Nursing

My Husband And I Are Retired He Just Turned 65 And Is Now Covered By Medicare But I Am 62 And I Dont Have Health Insurance As The Spouse Of A Medicare Beneficiary Can I Enroll In Medicare During The Medicare Open Enrollment Period

No. Although your husband now qualifies for Medicare, you will not qualify for Medicare until you turn age 65. If you do not have health insurance now, you can consider signing up for health insurance coverage through a Marketplace plan. If your household income is at least 100% of the federal poverty level , you may qualify for premium tax credits to reduce your cost of a Marketplace policy. If your household income is at or below 138% of poverty , you might be eligible for Medicaid if you live in a state that has expanded its Medicaid program.

Is Medicare Free At Age 65

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

Recommended Reading: What Is Medicare And Medicaid Insurance

Medicare If You’re Married

You and your spouse’s Medicare coverage might not start at the same time. Medicare is an individual plan . However, you may be eligible for Medicare based on your spouses work history — even if you are not eligible on your own. You and your spouse’s Medicare coverage might not start at the same time. Since you each must enroll in Medicare separately, one of you may be able to sign up before the other one, depending on your age.

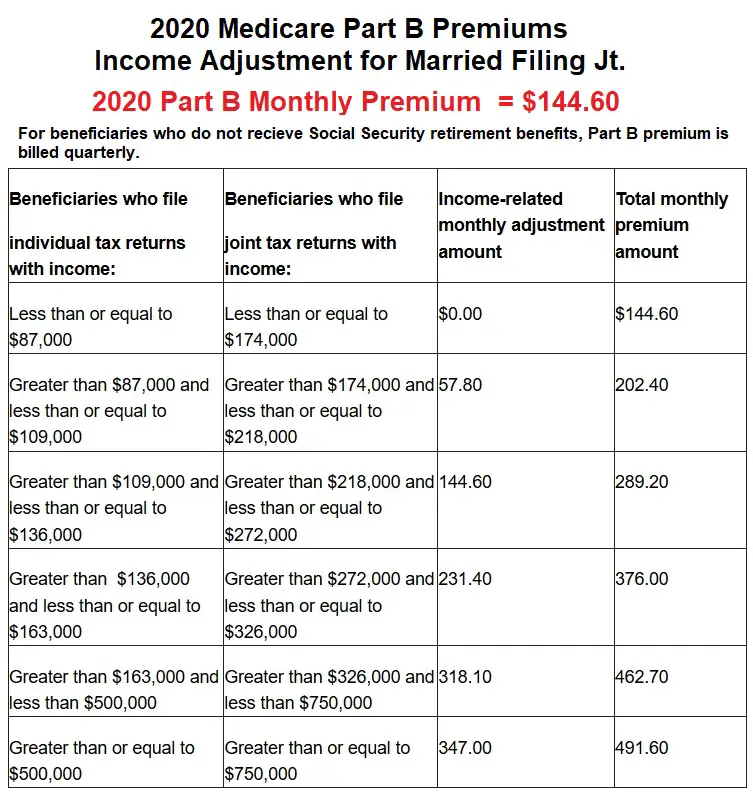

Your premiums may change because of your total income. There are no family plans or special rates for couples in Medicare. You will each pay the same premium amount that individuals pay. Here’s what to know about costs:

How Can My Spouse Obtain Coverage

Because Medicare benefits cant be shared between spouses, each individual in a marriage will need to obtain their own plan. If your spouse has met all of the eligibility requirements for Medicare, they will need to reach out to Medicare online or at a local office to enroll. Additionally, your spouse can work with an insurance broker to discuss their individual needs to find a plan that works.

To get more of your Medicare questions answered, subscribe to our free monthly newsletter

Medicare Benefits Solutions is a non-government website. This is a solicitation for insurance. By submitting information on this site, I am providing my written consent for Medicare Benefits Solutions, herein after referred to as Medicare Benefits, which is a brand operated by HealthCompare Insurance Services Inc., its sales agents, or affiliates to contact me at the phone number or email address listed to provide me with quotes or information about Medicare Advantage, Medicare Supplement, and Medicare Part D plans. I further consent to such calls or texts sent via autodialer, automated technology, prerecorded message and/or artificial voice. I understand my consent is not a condition of purchase and that I can revoke my consent at any time via medicarebenefits.com/about-us/contact-us. Additional charges may apply to SMS, call, or Internet usage depending on your data providers.

Also Check: How Much Does Part C Medicare Cost

Why Does Medicare Not Cover My Spouse

Medicare does not cover your spouse as the federal government budgets and pays for Medicare expenses on an individual basis. In addition, coverage such as premium-free Part A, is provided based on individual contribution income taxes over the years.

For example, if you are receiving Medicare coverage from a Medicare Advantage plan, the government pays the private health insurance company a fixed amount per month for care delivered to you. This payment amount only covers care delivered to you and does not include payments for your spouse .

When Can Children Qualify For Medicare Coverage

Children may qualify for Medicare coverage if they have a disability as determined by the Social Security Administration .

Children with disabilities can qualify for Medicare coverage when they have been getting Social Security Disability Insurance for at least two years. The SSDI program pays benefits to adults who have a disability that began before they turned 22 years old. Social Security considers this SSDI benefit a childs benefit because it is paid on a parents Social Security earnings record.

For a disabled adult dependent to become entitled to SSDI, a parent must be receiving Social Security retirement or disability benefits or have died and had worked to earn enough quarters of coverage to qualify for Social Security benefits.

A disabled adult dependent can get Medicare immediately if they are diagnosed with ESRD or amyotrophic lateral sclerosis .

Children with ESRD may be eligible for Medicare if the following conditions are met:

- You or your spouse have earned at least six credits within the last three years by working and paying Social Security taxes or are eligible for Social Security or Railroad Retirement Board benefits.

- Your child has a kidney transplant or needs regular dialysis because their kidneys no longer work.

Contact Social Security to see if your disabled child meets eligibility requirements and to apply for Medicare.

Read Also: What Is Medicare Plan F

Medicare For Divorced Spouse

The Social Security Administration requires you to meet specific criteria to qualify for Medicare benefits from a divorce. Qualifying for Medicare is different than Social Security benefits. You can be eligible for your spouse/ex-spouse Social Security benefits at age 62, and you wont qualify for Medicare until age 65. Of course, you may be eligible for Medicare sooner if you have End-Stage Renal Disease or disability for at least two years.

If youre 62 and your spouse or ex-spouse is 65, you CANNOT use their Medicare benefits for eligibility. You must wait until the age of 65 to qualify unless youre eligible through disability.

If the following situations apply, you may qualify for Medicare after divorce:

- Your ex-spouse is at least 62 years old and eligible for Social Security.

- You must be currently unmarried.

- Youre at least 65 years old.

- You were married for 10+ years.

Medicare Part A benefits are free when you, a current or former spouse, have at least 40 calendar quarters of work or ten years of work history paying into Social Security.

Does Medicare Cover Spouses

Asked by: Orval Breitenberg V

Anyone who meets Medicare eligibility requirements can get Medicare, including spouses. … Medicare is individual insurance, so spouses cannot be on the same Medicare plan together. Now, if your spouse is eligible for Medicare, then he or she can get their own Medicare plan.

Recommended Reading: Do I Have To Get Part B Medicare

Will My Spouse And Dependent Children Also Receive Medicare Benefits

Medicare is individual insurance, but there are other coverage options for your spouse and dependent children.

Unlike other types of health insurance, you cannot get coverage for your spouse and dependent children when you have Medicare. However, there are other coverage options, including employer-sponsored group and government-subsidized health insurance and insurance that you can purchase through the Health Insurance Marketplace in your state. Children with disabilities can get Medicare if they meet eligibility requirements.

What Is The Medicare Part B Premium For 2021

Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

Read Also: Can You Receive Medicare Without Receiving Social Security Benefits

How Medicare Works If Your Age 62 Spouse Is Still Working And Youre On Medicare

Traditional Medicare includes Part A and Part B . To qualify for Medicare, your spouse must be age 65 or older. If your spouse is age 62 , he or she could only qualify for Medicare by disability.

Hereâs an example of when a younger spouse whoâs not yet on Medicare might help you save money.

- Suppose you reach age 65 and become eligible for Medicare, but you havenât worked long enough to qualify for premium-free Medicare Part A.

- And suppose your younger spouse has worked at least 10 years while paying Medicare taxes. When your spouse turns 62, youâll qualify for premium-free Part A. Your spouse wonât qualify for Medicare until they turn 65, but their work record will help you save money by getting Part A with no monthly premium.

When Can My Spouse Collect Half Of My Social Security

You can claim spousal benefits as early as age 62, but you won’t receive as much as if you wait until your own full retirement age. For example, if your full retirement age is 67 and you choose to claim spousal benefits at 62, you’d receive a benefit that’s equal to 32.5% of your spouse’s full benefit amount.

Read Also: Can I Get Glasses With Medicare

Does Medicare Cover My Spouse

Medicare is a federal health insurance program that provides coverage to people 65 years of age and over, as well as those with certain disabilities. In most instances, Medicare is not designed specifically to cover spouses. That being said, some spouses will qualify for Medicare based on the work record of their spouse or former spouse.

If your spouse is 65 years of age or older, they may be eligible for their own Medicare plan, even if they have never worked outside the home. If they have a qualified disability, the same applies, regardless of age.

If a spouse has not worked outside the home and is divorced, they may be eligible for Medicare dependent on the work record of their former partner, provided they were married for at least ten years. This type of coverage only applies to unmarried divorced people. The benefits offered in this situation are different than the benefits offered through traditional Medicare.

Do I Have To Sign Up For Medicare If I’m 65 Or Older And Still Working

If you’re age 65 or older, eligible for Medicare, and have insurance through your current job or your spouses current job, you need to make some important Medicare enrollment decisions.

If you don’t enroll on time, you may have to pay a penalty. Before you make any changes, it’s good to understand how your current coverage works with Medicare about four to five months before you become eligible for Medicare.

Ask your benefits manager or human resource department how your employer health insurance works with Medicare, and confirm this information with the Social Security Administration and Medicare .

When you retire or if you lose your employer coverage, you will get a Special Enrollment Period to sign up for Medicare. Be sure to review the rules carefully, so you don’t miss deadlines.

Note: If you have a Health Savings Account, you and your employer should stop contributing to it 6 months before you sign up for Medicare Part A to avoid an IRS tax penalty. As well, before you enroll in Medicare while still working, check with your employer to see if their employer group health plan coverage for prescription drugs is creditable coverage. If it is not creditable, you could face paying Medicare Part D penalties later on.

You May Like: Does Medicare Pay For Sleep Study