How To Determine What Kind Of Care You Need

It is important to talk to your family, your doctor, your healthcare provider, or a social worker to help decide what type of long-term care you may need.

If you are in a hospital, nursing home, or working with a home health agency , you should speak to the following to help better understand your options:

- A discharge planner

- A social worker

- An organization in a âNo Wrong Door System,â such as Aging and Disability Resource Center or Area Agency on Aging .

- Contact your local Indian health care provider for more information if you are an American Indian or Alaska Native

Does Medicare Provide Long Term Coverage

Youve probably thought about long-term care and nursing homes at some point in your life, but you likely put them in the back of your mind. We get it its not something most people look forward to.

But even if you or a loved one have many years before possibly moving into a nursing home or assisted living facility, its important to start thinking about how you might pay for it. Medicare, unfortunately, doesnt cover most long-term care.

Lets dive into the different types of long-term care and what your coverage may look like.

Recommended Reading: What Is Medicare Plan N Coverage

Am I Eligible For A Skilled Nursing Facility

To qualify for coverage to stay at an SNF, you must first have a qualifying hospital stay: your stay must last at least 3 consecutive days and be classified as inpatient.

In addition, your doctor must document that you need daily inpatient care or supervision that can only be given at an SNF. Youll typically need to enter the SNF within 30 days of leaving the hospital.

Don’t Miss: Which Medicare Supplement Plan Covers The Most

Life Insurance Policies For Long

Some life insurance policies can help pay for long-term care. Some policies offer a combination product that includes both life insurance and long-term care insurance.

Policies with an “accelerated death benefit” provide tax-free cash advances while you are still alive. The advance is subtracted from the amount your beneficiaries will receive when you die.

You can get an accelerated death benefit if you live permanently in a nursing home, need long-term care for an extended time, are terminally ill, or have a life-threatening diagnosis such as AIDS. Check your life insurance policy to see exactly what it covers.

You may be able to raise cash by selling your life insurance policy for its current value. This option, known as a “life settlement,” is usually available only to women age 74 and older and men age 70 and older. The proceeds are taxable and can be used for any reason, including paying for long-term care.

A similar arrangement, called a “viatical settlement,” allows a terminally ill person to sell their life insurance policy to an insurance company for a percentage of the death benefit on the policy. This option is typically used by people who are expected to live two years or less. A viatical settlement provides immediate cash and is tax-free, but it can be hard to get. Companies decline more than half of the people who apply.

What Are The Requirements For Medicare Nursing Home Coverage

Before Medicare covers skilled nursing home costs, you must have a qualifying hospital stay of at least three inpatient days prior to your nursing home admission. You must have inpatient status for at least three days time spent in the emergency department or observation unit doesnt count toward the three-day requirement.

If you refuse nursing care or medical therapies recommended by your doctor while you are in a skilled nursing facility, you may lose your Medicare nursing home coverage.

Also Check: How To Compare Medicare Supplement Plans

Theres A 70% Chance Youll Need Some Type Of Long

Americans have plenty of reasons to dread buying traditional long-term care insurance. The policies are expensive, with rising annual premiums and so many different elements that shopping for one is overwhelming. âIt can be a complex and oftentimes frustrating experience,â says Tom Beauregard, founder of HCG Secure in Goshen, Conn., which sells long-term care insurance with a focus on aging at home.

The market and the policies have also evolved over the years. In fact, anyone whose idea of long-term care insurance was shaped by the policies their parents or grandparents had may be in for a rude awakening. âTheyâre like Rolls Royce policies compared with what we have today,â says Brian Gordon, president of Murray A. Gordon and Associates, a long-term care insurance broker in Bannockburn, Ill. âBut they didnât cover home health care, so thatâs the give and take.â

Read Also: What Age Can You Get Medicare Health Insurance

Medicare Part A Covers Services Received In Long

Medicare Part A provides hospital insurance and covers care received in a long-term care hospital . You may qualify for this type of care if you meet the following two requirements:

- You have more than one serious health condition

- You may improve with care and time, eventually being able to return home

You generally must meet your Part A deductible for each benefit period during which you are admitted for an inpatient stay at an LTCH. The 2022 Medicare Part A deductible is $1,556 per benefit period.

After you meet the Part A deductible, you are responsible for Part A coinsurance payments of $389 per day for days 61-90 of your inpatient stay in each benefit period, and $778 per day for days 91 and beyond in each benefit period until you exhaust your 60 lifetime reserve days.

When your 60 lifetime reserve days are used up, you are responsible for all costs.

Also Check: How To Choose A Medicare Supplement Plan

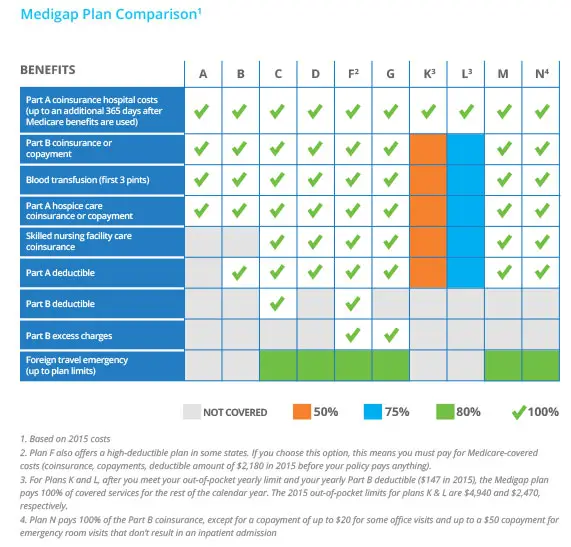

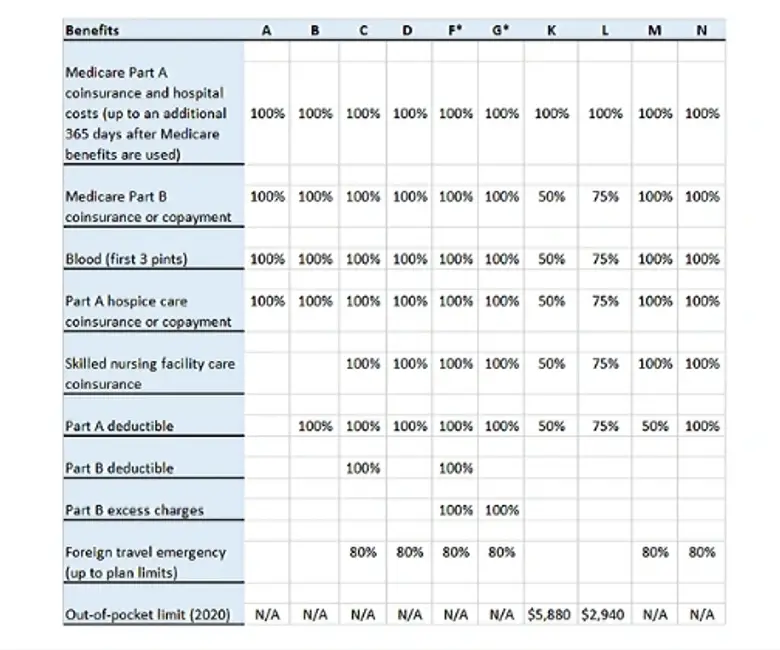

Do Any Medigap Plans Cover Assisted Living

Medicare Supplement insurance does not provide coverage for assisted living care. It only covers short-term care in facilities like nursing homes or short-term at-home care.

Medigap can cover certain expenses you might incur while living in an assisted living facility. For instance, if you need durable medical equipment, such as a CPAP machine for respiratory assistance, those costs will be covered at least in part by Medicare Supplement insurance.

Your Medicare Supplement insurance will also cover any other healthcare costs covered by your individual plan, such as the first three pints of blood every year or visits from your physician.

However, Medicare wont cover the costs associated with living in the facility. Assisted living care usually involves costs related to food, board, and other services.

Are Telehealth Services Covered By Insurance

Telehealth is a service that uses video calling and other technologies to help you see your doctor or other health care provider from home instead of at a doctors office or medical facility. Many insurance providers including Medicare, Medicaid, and many private insurers have started to cover telehealth services. However, coverage can vary by location and insurance plan. Check with your insurance company or health care provider’s billing department for the latest information about coverage for telehealth services.

Learn more about telehealth services and how to prepare.

You May Like: How To Fight Medicare Denial

When Is A Good Time To Buy Long

Many people ask the question, When should I buy long-term care insurance?

My joking answer is to have it in force the day before you need it.

If you knew exactly when you would need long-term care, it would be an easy decision, but the problem is nobody knows when they will need it. Some need it at age 30. Others at age 70. Some people never need it.

Typically, people recommend exploring long-term care insurance in your late 50s or early 60s. Generally, many people dont have any significant health events that would disqualify them from coverage and policies are not too costly however, you never know when something may happen that may disqualify you.

Source:

Some people in their 40s get long-term care insurance because they are afraid they wont qualify later. Waiting is a risk. There is still a 16% denial rate for people 49 or younger.

Each day that passes means you could be diagnosed with cognitive impairment, Huntingtons disease, multiple sclerosis, Parkinsons or another illness that disqualifies you from getting long-term care insurance.

I know someone who discussed memory issues once with their doctor, and that note disqualified them from coverage.

You need to decide for yourself whether the risk of waiting to buy long-term care insurance is worth it.

How To Purchase

It is best to purchase a policy within 6 months of enrollment in Medicare. During this time, insurers are required to accept applicants regardless of pre-existing conditions.

Medigap plans are sold directly by private companies. to find Medicare Supplemental Insurance in your area.

Each state has a State Health Insurance and Assistance Program called SHIPs, which are staffed by volunteers that help seniors with their Medicare related questions. Find SHIPs in your state.

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

Also Check: Does Medicare Pay For Prostate Cancer Treatment

Can I Get Long

Yes, long-term careinsurance exists, and can help you cover these costs. Long-term care servicesare typically less expensive when you buy them at a younger age, and while yourehealthier. The older you are, the more costly they can become, so its wise toconsider purchasing a policy at a younger age. Details of long-term careinsurance can vary, so its important that you review your options carefully.

If Medicare Won’t Pay For Long

Long-term care can be tremendously expensive, and unfortunately, your options for covering it are limited.

One option is to rely on your own savings or a loan, like a reverse mortgage.Another is to buy long-term care insurance, which is sold by many insurance companies and typically covers things that Medicare wont, such as extended home care, assisted living and nursing home care. The earlier you buy a policy, the more affordable it’s likely to be. The premium becomes more expensive the older you are. You may also be able to trade in your life insurance policy for long-term care insurance. People who have worked for the government or were in the military may qualify for discounted insurance.

Recommended Reading: Where To Compare Medicare Part D Plans

Dropping Your Entire Medigap Policy

You may want a completely different Medigap policy . Or, you might decide to switch to a Medicare Advantage Plan that offers prescription drug coverage.

If you decide to drop your entire Medigap policy, you need to be careful about the timing. When you join a new Medicare drug plan, you pay a late enrollment penalty if one of these applies:

- You drop your entire Medigap policy and the drug coverage wasn’t creditable prescription drug coverage

- You go 63 days or more in a row before your new Medicare drug coverage begins

How Do I Choose The Best Medicare Advantage Plan

Factors to consider when choosing a Medicare Advantage plan

Don’t Miss: Does Medicare Pay For Life Line Screening

Whats The Difference Between Nursing Home Care Long

Its important to understand the different types or nursing care Medicare may cover, as well as the ones it doesnt, so you arent unexpectedly stuck paying your nursing home costs.

Nursing home care can be either skilled or custodial. Skilled nursing home care covered by Medicare is short-term and expected to help improve your condition. If you have hip replacement, for example, your doctor may recommend a couple of weeks in a skilled nursing facility for physical therapy to help you learn to walk with your new hip and recover your mobility more quickly.

Long-term care, on the other hand, is generally custodial carehelp with things such as eating, bathing, toileting, and dressing. As the name suggests, it may last a period of weeks, months, or years. It is usually not covered by Medicare.

Home care nursing is generally home health care provided by a credentialed medical professional. It can be short-term while you recover from an illness or injury, or long-term if you have a serious chronic condition or have chosen hospice care. Medicare may cover home care nursing under certain situations.

Does Medicare Pay For Home Care Nursing

If you meet the requirements for home health care, Medicare generally covers part-time, intermittent home care nursing and other medical therapies, such as physical and occupational therapy. If the home care nursing follows a qualifying hospital stay, Part A may cover 100% of allowable charges.

If there was no qualifying inpatient hospital stay, Part B may still cover some home care nursing services.

Medicare typically doesnt pay for more than eight hours a day of home care nursing, and it typically doesnt cover services seven days a week. Medicare only covers home care nursing for a short period of time.

If you qualify for hospice care and choose hospice benefits under Part A, Medicare pays for part-time home care nursing for as long as you receive hospice care.

Also Check: How To Find A Dentist That Accepts Medicare

Paying For Long Term Care Expenses Medicare Medicaid And Medicare Supplement Insurance Benefits

There are some common misconceptions concerning who is responsible for long term care expenses. Oftentimes consumers erroneously believe that government run Medicare and private supplemental insurance will pay the costs associated with extended care. Unfortunately, this is not the case.

Medicare, when combined with some supplemental Medigap policies, will only cover a maximum of 100 days of prescribed skilled care in an extended care facility. After 100 days has passed, there are no additional benefits from either of these two insurance programs.

Department Of Veterans Affairs

The U.S. Department of Veterans Affairs provides coverage for long-term care at a facility or at home for some veterans. If your family member or relative is eligible for veterans benefits, check with the VA or get in touch with the VA medical center nearest you. There could be a waiting list for VA nursing homes.

To learn more about VA healthcare benefits, call 877-222-8387, or visit theVeterans Health Administration website or the Veterans Affairs Caregiver Support page. You can also find more information in Geriatrics and Extended Care: Paying for Long-Term Care.

You May Like: Does Medicare Pay For Pedicures

Does Medicare Or Medicaid Cover Long

Many people assume Medicare will pay for long-term care, but in most cases, it wont.

Youll need to pay for long-term care through the following:

- Personal resources

- Long-term care insurance

Medicaid is a joint federal and state program that can help with medical costs, including long-term care however, you have to spend down nearly all of your assets before you can apply and get coverage.

Each state has different rules regarding Medicaid and how much you can spend down, gifting rules, and more.

In many states, you cant have more than $2,000 in countable assets. You may be able to keep your house , a car, and prepaid funeral expenses, but its very limited.

Where Can I Get Long

You may be able to get long-term care at home or at a long-term care facility.

Note that the costs listed below are national medians as reported by Genworth Financial in 2020. They could vary by state.

- You may be able to continue living at home with the help of a home health aide. Median monthly cost per Genworth Financial: $4,576.

- Adult day care centers provide a safe environment to be social and engage in activities during the day while family caregivers are otherwise occupied. Median monthly cost per Genworth Financial: $1,603.

Residential care includes:

- Retirement housing that may offer social activities and transportation

- Assisted living that offers meals, supportive services and health care. Median monthly cost per Genworth Financial: $4,300

- Nursing homes which can provide 24-hour care and medical treatment. Median monthly cost per Genworth Financial: $7,756 for a semi-private room, and $8,821 for a private room.

- Memory care units for Alzheimers and dementia patients which may be locked. This might be more expensive than a semi-private room.

- Continuing care retirement communities were residents can progress through levels of care as the need arises.

Read Also: Does Medicare Cover Wheelchair Repairs

Out Of Pocket Expenses

Medicare will provide a strong health insurance underpinning, but there are some out-of-pocket expenses that you have to cover on your own.

There is a $148.50 monthly deductible for Part B, which is the portion of the program pays for treatments that are administered by doctors and other health care professionals. The deductible for this coverage is $203, and you have to pay 20 percent of the costs out of your own pocket.

Part A covers hospitalization, and you do not have to pay a monthly premium for this coverage, but there is a $1484 deductible this year. A coinsurance payment is required for stays that exceed 60 days in duration.

The prescription drug coverage can be purchased from a variety of providers. There are different coinsurance, premium, and deductible arrangements depending on the specific plan that you decide to use.

These expenses can be manageable if you plan ahead for retirement effectively, but there is one looming expense that is not easily handled. Medicare does not cover a stay in a nursing home, and it does not pay for in-home care that is provided by a paid caregiver.

Updated By Bethany K. Laurence, Attorney

In response to both these movements, many new home health care agencies have sprung up. Youre increasingly likely to find such an agency in your local area. Most are able to provide care for patients who no longer need high-level care in a hospital but who still require part-time nursing or rehabilitative therapy.