How Will Your Coverage Costs Be Divided Among The Insurance Plans

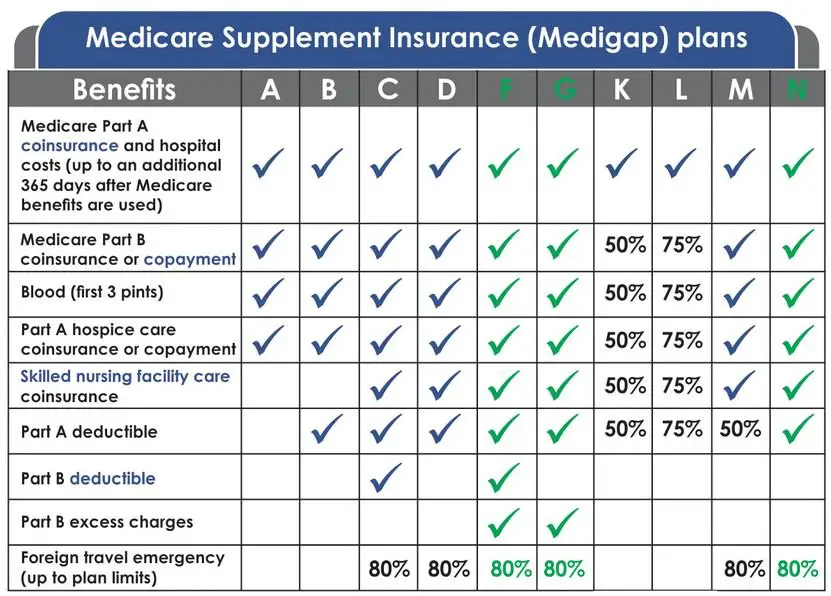

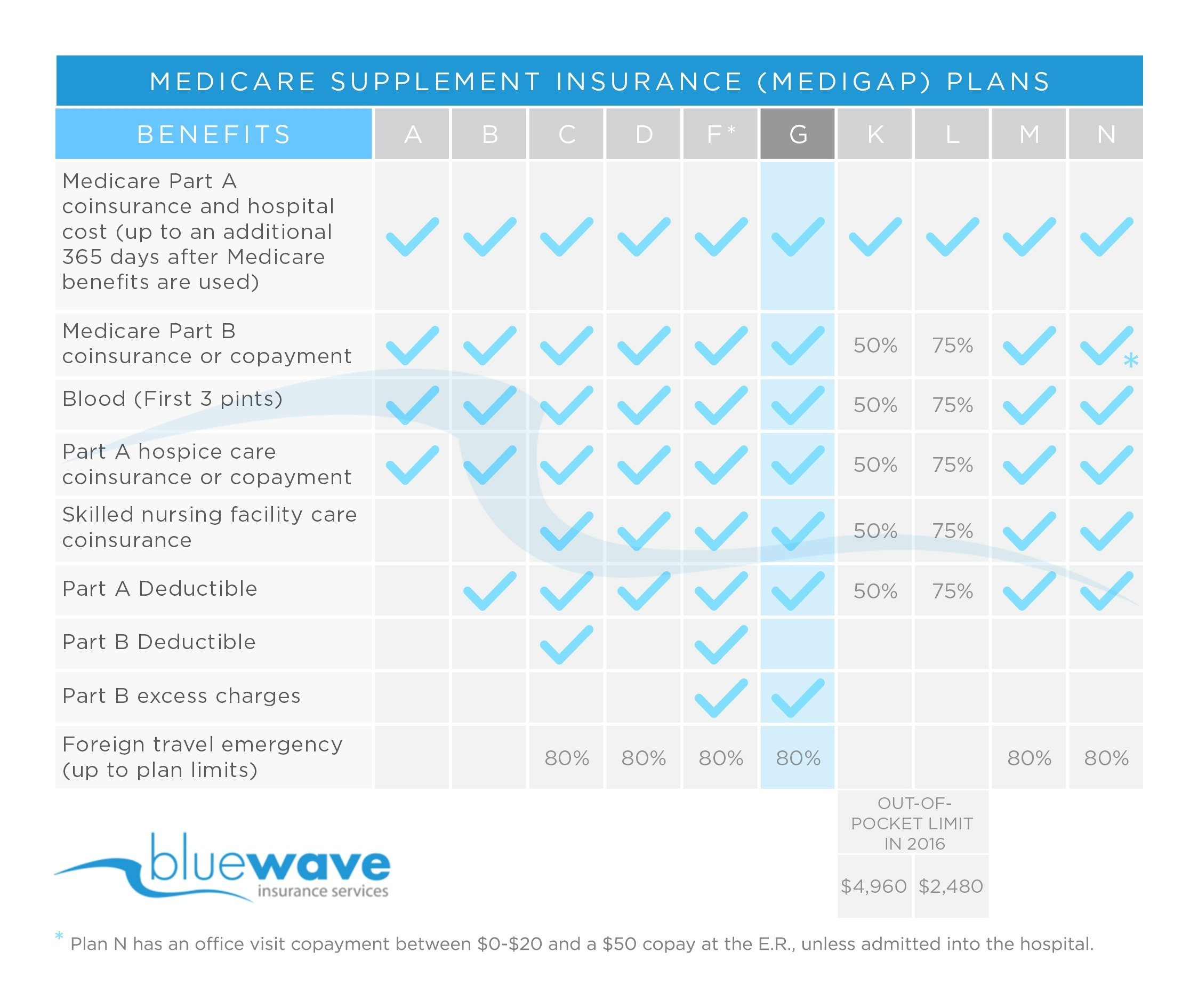

When you have Medicare and other health insurance, such as a Medicare Supplement insurance plan, each type of coverage is called a payer. The primary payer will pay what it owes on your health-care bills first and then send the balance to the secondary payer. Coordination of benefit rules decide who pays first. The secondary payer might not pay all of the uncovered costs and some could be your responsibility. For example, if you have a foreign travel emergency, the five Medicare Supplement insurance plans that cover this only cover it up to 80% up to plan limits. You will then be responsible for paying 20% of the covered costs of your care while traveling, as well as any costs your Medicare Supplement insurance plans doesnt cover.

Generally, people who use health-care services frequently might save money by purchasing a Medicare Supplement insurance plan. However, if you infrequently need medical benefits, you could pay more for the Medicare Supplement insurance plan premium than you save.

The product and service descriptions, if any, provided on these eHealth Insurance Web pages are not intended to constitute offers to sell or solicitations in connection with any product or service. All products are not available in all areas and are subject to applicable laws, rules, and regulations.

New To Medicare?

Becoming eligible for Medicare can be daunting. But dont worry, were here to help you understand Medicare in 15 minutes or less.

Note: If You Live In Massachusetts Minnesota Or Wisconsin Medigap Policies Are Standardized In A Different Way

MEDIGAP DEDUCTIBLE AMOUNT FOR HIGH DEDUCTIBLE POLICY OPTIONS The 2019 deductible amount for Medigap high deductible plans F & J is $2,300.00. The high deductible amount for Medigap plans F and J is updated each year and is based on the August CPI-U figures released by the Bureau of Labor Statistics. The full text of the announcement is available on the CMS website at: . This figure represents the out-of-pocket expense, excluding premiums that a beneficiary must incur before the policy begins paying any benefits. Under the high deductible option, policies pay 100% of covered out-of-pocket expenses once the deductible has been satisfied in a year. Note, the high deductible option for benefit packages F or J was added by Section 4032 of the Balanced Budget Act of 1997, Sec. 1882 of the Social Security Act, 42 U.S.C. 1395ss.

How Can I Purchase A Medicare Supplement Plan

To purchase a Medicare Supplement plan, you must be enrolled in Original Medicare. The best time to enroll is during your Medigap Open Enrollment Period. This six-month period begins when you enroll in Medicare Part B.

During this period, insurance companies cannot subject you to medical underwriting. This is a process that can be used to raise your premiums or deny you coverage. Outside of this period, you are not guaranteed the ability to enroll in a Medicare Supplement plan. Each plan of the same type must cover the same standard set of benefits. However, your costs can vary from carrier to carrier.

MORE ADVICE Discover more tips for comfortably aging in place

- Plan L

- Plan N

*Plan C and Plan F are available only to applicants who were first eligible for Medicare prior to 2020.

As mentioned before, each plan offers a different set of benefits. Youll want to review each of these options to find the plan that works best for you.

You May Like: Does Kaiser Medicare Cover Dental

What Are The Costs Of Medicare Supplement Plan F

Because Plan F generally offers the broadest coverage of the 10 Medigap plans, it is usually the most expensive plan. This might not always be the case, however, and its recommended that you shop around to consider all the options in your area. Please remember that though Medigap Plan F benefits are broad, they dont cover all of Original Medicares costs. Youll still need to pay your Medicare Part B premiums each month, and if you havent worked enough years to qualify for premium-free Medicare Part A, you may also have to pay a premium for that coverage.

Plan F costs will vary depending on your county and chosen insurance company. Costs for the standard Medicare Supplement Plan F may include:

- Monthly premiums

- Annual deductibles

- Copayments

- Coinsurance payments

Medicare Part D Premiums And Costs

Medicare Part D plans are sold by private insurance companies as an optional addition to Original Medicare. These plans provide their members with coverage for the prescription drugs they need to survive. Each Part D plan has a uniqueformulary, which is the list of drugs it covers.

It is important to ensure that the drugs you are currently taking or expect to take in the future are included in your plans formulary. Otherwise, you could end up paying for those drugs entirely out of pocket.

Read Also: How To Pay Ny State Taxes

Recommended Reading: Does Emory Hospital Accept Medicare

Aarp Medicare Supplement Plan C

One of the most exhaustive Medicare Supplement options, Plan C covers most out-of-pocket expenses. However, Plan C is being phased out. Those who became eligible for Medicare after January 1, 2020, will not be able to purchase this plan.

Plan C includes all of the benefits offered under Plan A. For those who are eligible, AARPs Plan C also covers:

- Coinsurance for care provided in a skilled nursing facility

- Your Medicare Part A deductible

- 100% of approved foreign travel emergency costs

What Do These Policies Cover

Heres a link to the benefits each type of supplemental insurance provides. As you can see, most of them only cover Medicare deductibles and co-insurance nothing more. Unless otherwise stated in the policy, it will not cover any service not approved by Medicare. These policies also will not pay any healthcare provider a penny more than the amount Medicare approves for a service. That means that a health care provider who sees a patient who has a supplemental plan gets paid the exact same amount as he would from a patient who only has Medicare.

When you buy insurance, any insurance, its purpose is to cover you for unexpected costs you could never cover yourself. You buy homeowners insurance to cover damage done by a fire or a storm or water damage done by a broken pipe. No one buys a homeowners policy that covers utilities or routine maintenance. Most people who own a house are used to paying for the cost of painting it. Homeowners expect to pay for the cost of replacing their roof every 20 years as well, even though the cost of a new roof on most houses would actually exceed the cost a Medicare patient would pay for the treatment for most cancers.

We also dont use our car insurance to fill our gas tank, change the oil or pay for a transmission overhaul. Again, the cost of overhauling your cars transmission is probably more than what you would pay for a major surgery if you have Medicare.

You May Like: Why Am I Paying For Medicare

What About Cancer Chemotherapy How Much Will That Cost You

The cost of cancer chemotherapy is probably one of the most expensive treatments a Medicare recipient could face. This is, in part, because medical oncologists are paid more if they give more expensive chemotherapy agents. Oncologists in the US get an average 6% commission on the price of any medications they administer in their office. This commission creates a major conflict of interest for these doctors that has dramatically increased cancer chemotherapy costs in recent years.

Still, Medicare Part B covers IV therapy, including cancer chemotherapy, when administered either in a nursing home or an infusion center. If you receive chemotherapy during a hospitalization, then the cost of your chemotherapy is covered by your Part A deductible.

How much will the chemotherapy cost you? As with everything else in health care, the cost of cancer chemotherapy varies dramatically depending on the treatment. Most of the basic chemotherapeutic drugs have been around for decades so they arent very expensive. Heres a statement showing Medicares approved fee for a basic chemotherapy infusion:

Figure 4: Chemotherapy bill

This patient received IV carboplatin and gemcitabine and fosaprepitant for nausea. For this, medicare was billed over $7,700. It doesnt show how much Medicare approved for this treatment but, her 20% portion of the approved fee was $269.97. That means that Medicare approved a total of $1350 for this treatment or about 17% of what was billed.

Medicare Supplement Deductibles By Plan

There are 10 standardized Medicare Supplement plans available in most states, and two of those plans offer a high-deductible option. Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,490 in 2022. Plan members must meet this deductible before the plan begins to cover any of Medicare out-of-pocket expenses.

Medicare Supplement Insurance plans are sold by private insurance companies. These plans help pay for Original Medicare deductibles and other out-of-pocket Medicare expenses like copayments and coinsurance.

Six types of Medigap plans provide full coverage of the Medicare Part A deductible, and another three plans provide partial coverage of the Part A deductible.

Two plans, Plan F and Plan C, provide full coverage of the Medicare Part B deductible, although these plans are only available to beneficiaries who became eligible for Medicare before Jan. 1, 2020. If you were eligible for Medicare before 2020, you may still be able to apply for Plan F or Plan C if theyre available where you live. If you already have either plan, you can keep your plan as long as you continue to pay your plan premiums.

Recommended Reading: Who Pays For Medicare Part B Premiums

Benefits Of Aarp Medicare Plans

There are many features and perks of AARP plans.

- Coverage is offered nationwide.

- You can use any doctor who accepts Medicare. This includes your current doctor.

- You don’t have to be referred to other doctors you may need to see.

- Your policy cant be canceled or your premium increased because of health problems.

- A supplement plan can be joined with Medicare Part D to help lower your prescription drug costs.

Medicare Supplement Insurance May Help Cover Deductibles

You can buy private Medicare Supplement insurance to cover Medicares out-of-pocket expenses, including the hospital deductible.

However, if you’re in a Medicare Advantage Plan, you can only purchase a Medicare Supplement plan if your Medicare Advantage plan coverage is ending.

Explore Medicare

This material is provided for informational use only and should not be construed as medical advice or used in place of consulting a licensed medical professional. You should consult your doctor to determine what is right for you.

Humana is a Medicare Advantage HMO, PPO and PFFS organization and a stand-alone prescription drug plan with a Medicare contract. Humana is also a Coordinated Care plan with a Medicare contract and a contract with the state Medicaid program. Enrollment in any Humana plan depends on contract renewal.

Some links on this page may take you to Humana non-Medicare product or service pages or to a different website.

Y0040_GNHKHNSEN

Also Check: Does Medicare Offer Gym Memberships

General Features Of Medicare Supplement Insurance Plans

Medicare Supplement insurance plans work with Original Medicare to help with out-of-pocket costs not covered by Parts A and B. The following are also true about Medicare Supplement insurance plans:

- Predictable costs help you stay ahead of unexpected out-of-pocket expenses.

- No network restrictions mean you can see any doctor who accepts Medicare patients.

- You don’t need a referral to see a specialist.

- Coverage goes with you anywhere you travel in the U.S.

- There is a range of plans available to fit your health needs and budget goals.

- Purchasing a Medigap plan and a Medicare Part D prescription drug plan could give you more complete coverage.

- Guaranteed coverage for life means your plan can’t be canceled.

As long as you pay your premiums when due and you do not make any material misrepresentation when you apply for this plan.

For PA residents only: As long as you pay your premiums when due. You do not misstate one or more material facts when you apply for this plan. UnitedHealthcare has 2 years to act on misstatements. The 2 year limit does not apply to fraud.

Rates are subject to change. Any change will apply to all members of the same class insured under your plan who reside in your state. can provide peace of mind by helping with some of these costs.

Can You Switch Yes But Theres A Catch

Its logical to consider enjoying the cost savings of a Medicare Advantage plan while youre relatively healthy, and then switching back to regular Medicare if you develop a condition you want to be treated at an out-of-town facility. In fact, switching between the two forms of Medicare is an option for everyone during the open enrollment period. This Annual Election Period runs from October 15 to December 7 each year.

Heres the catch. If you switch back to regular Medicare , you may not be able to sign up for a Medigap insurance policy. When you first sign up for Medicare Part A and Part B, Medigap insurance companies are generally obligated to sell you a policy, regardless of your medical condition. But in subsequent years they may have the right to charge you extra due to your age and preexisting conditions, or not to sell you a policy at all if you have serious medical problems.

Some states have enacted laws to address this. In New York and Connecticut, for example, Medigap insurance plans are guaranteed-issue year-round, while California, Massachusetts, Maine, Missouri, and Oregon have all set aside annual periods in which switching is allowed. If you live in a state that doesn’t have this protection, planning to switch between the systems depending on your health condition is a risky business.

Read Also: How Can I Find Out If I Have Medicare

What Does Medicare Plan F Cover

Those who have Medicare Plan F wont pay out-of-pocket costs for Medicare parts A and B. Policyholders would only pay the premiums, which start at $0 for Part A and $135.50 for Part B. Additionally, individuals would not have to pay the deductible, which is $1,364 for Part A and $185 for Part B.

Supplemental Medicare Plan F will cover:

- Medicare Part A coinsurance and hospital costs

- Medicare Part A deductible

- Hearing aids and routine hearing tests

- Cosmetic surgery

- Prescription drugs

The most important to note of these coverage gaps are prescriptions drugs and we would recommend purchasing Medicare Part D if you need this coverage. Medicare Plan F does provide coverage for injectable or infusion drugs given in a clinical setting but does not pay for other prescription drugs. The ideal coverage package would include Medicare parts A and B, along with the Part D prescription drug plan and a supplemental Medigap policy such as Plan F.

Unfortunately, none of the Medicare and Medigap policies cover dental care. If you are looking for dental coverage, then you would need to purchase a stand-alone dental insurance policy.

You May Like: How Do I Do My Taxes

Signing Up For Medigap Insurance

To be eligible for a Medigap policy, you must be at least 65 years old and enrolled in Medicare Part B. The best time to enroll in a Medigap policy is during your six-month Medigap open enrollment period.

- Failing to enroll in a Medigap plan during this time may result in higher monthly premiums or refusal of coverage.

- If you enroll in a Medigap insurance policy during your open enrollment period, insurance companies cannot use medical underwriting to determine the cost of your plan, regardless of your current health or health history.

- You cannot be enrolled in Medicare Advantage and a Medigap plan. If you enroll in a Medigap plan while you are enrolled in Medicare Part C, you will lose your Medicare Part C coverage and be automatically enrolled in Original Medicare.

Have questions about what Medigap covers? Ready to start comparing quotes in your area? Connect with a licensed insurance agent to speak with someone who can help. Based in the United States, our agents are trained to help you find the right plan for your needs.

Recommended Reading: Does Medicare Pay For Soclean

Talk To A Tax Attorney

Need a lawyer? Start here.

Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

Medicare Supplement Plan N Cost

Lets talk a little bit more about the differences between the two plans, and more specifically what other charges you could incur on Medicare Plan N.

Again, if youre somebody who doesnt go to the doctor very oftenand I have clients who never got to the doctor who loves Plan N because they pay lower premiums all year long.

So they absolutely love it. They know if something happens to them, theyve got outstanding coverage, but their out-of-pocket expenses are going to be minimal, even on a Plan N.

So they love Plan N because they dont go to the doctor very often, but they know they are protected very, very well, God forbid something major happens.

Don’t Miss: How To Register For Social Security And Medicare