An Overview Of The Medicare Part D Prescription Drug Benefit

Medicare Part D is a voluntary outpatient prescription drug benefit for people with Medicare provided through private plans that contract with the federal government. Beneficiaries can choose to enroll in either a stand-alone prescription drug plan to supplement traditional Medicare or a Medicare Advantage plan, mainly HMOs and PPOs, that provides all Medicare-covered benefits, including prescription drugs . In 2022, 49 million of the 65 million people covered by Medicare are enrolled in Part D plans. This fact sheet provides an overview of the Medicare Part D program, plan availability, enrollment, and spending and financing, based on data from the Centers for Medicare & Medicaid Services , the Congressional Budget Office , and other sources. It also provides an overview of upcoming changes to the Part D benefit based on provisions in the Inflation Reduction Act.

Income Limits For Medicare Savings Programs

There are four kinds of Medicare Savings Programs , each with its own income and resource qualifications. As with the Extra Help program, income and resources are assessed separately and you must meet both requirements to qualify for a savings program.

| Program |

|---|

Limits are slightly higher in Alaska and Hawaii. If you have income from working, you may qualify for benefits even if your income is higher than the limits listed.

MSPs are federally funded programs administered by individual state Medicaid agencies. These programs help people with limited income and resources pay Medicare costs that include premiums, deductibles, copayments and coinsurance.

You can apply for an MSP through your states Medicaid office. To find the contact information, select your state here and choose Other insurance programs from the menu on the left.

Costs For Original Medicare Beneficiaries

These costs apply for those who chose the Original path with or without a Medicare supplement plan .

Hospitalization:

- Part A will have a $1,600 deductible for inpatient hospitalizations in 2023. This is not an annual deductible rather it applies to hospital stays in a 60-day benefit period.

- Getting caught in the revolving hospital door could result in additional copayments. If a person is admitted to the hospital repeatedly copayments come into play: $400 per day for days 61 to 90 and $800 per day for days 91 to 150.

Skilled nursing facility stay: Part A covers the first 20 days of an SNF stay. In 2023, the beneficiary will pay $200 a day for days 21 to 100.

Part B deductible: Beneficiaries are responsible for the first $226 of outpatient services next year. Two physician visits or one MRI generally will meet this deductible.

Also Check: Does Medicare Cover Eye Lift Surgery

How Do I Know If I Will Reach The Medicare Donut Hole

Your Part D company sends out a statement, or explanation of benefits , each month. This statement tells you exactly how much you have already spent on covered medications and how many dollars are left before you reach the coverage gap. Likewise, after you reach the gap, your insurance company will continue to send you notices that track your gap spending. They will calculate how many dollars are left before you reach catastrophic coverage.

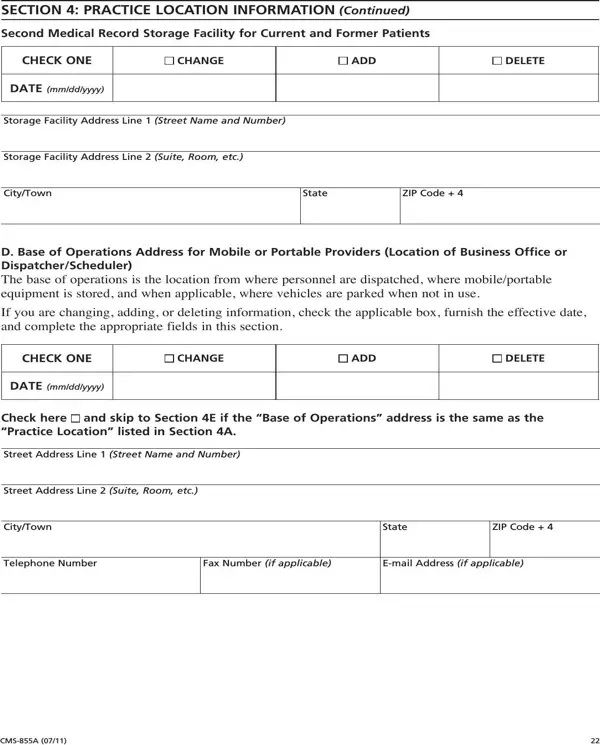

How To Apply For A Msp7

If you answer yes to the following questions, call your State Medicare Program to check if you qualify.

Note: If your income or resources are higher than the amounts listed, you may still apply to check if you qualify.

Also Check: Do You Pay For Medicare After 65

Recommended Reading: What Age Is For Medicare

Who Pays The High

If your adjusted gross income is more than $91,000 if youre single or $182,000 if youre married and filing jointly, you may have to pay a high-income surcharge, which adds $12.40 to $77.90 to your monthly Part D premiums in 2022.

The high-income surcharge is paid to Medicare. These premiums can be deducted automatically from your Social Security benefits, or Medicare can send you a bill. Another option is to sign up for Easy Pay and have the premiums automatically paid from your checking or savings account.

Even if youre satisfied with your coverage, its a good idea to go to Medicare.gov to compare the plans available in your area. Plans can change their coverage, costs and provider networks every year.

Images: Medicare.gov

Kimberly Lankford is a contributing writer who covers personal finance and Medicare. She previously wrote for Kiplinger’s Personal Finance Magazine, and her articles have also appeared in U.S. News & World Report, The Washington Post and the Boston Globe. She received the personal finance Best in Business award from the Society of American Business Editors and Writers.

Medicare Prescription Drug Plan Availability In 2023

In 2023, 801 PDPs will be offered across the 34 PDP regions nationwide , a 5% increase from 2022 .

Beneficiaries in each state will have a choice of multiple stand-alone PDPs, ranging from 19 PDPs in New York to 28 PDPs in Arizona . In addition, beneficiaries will be able to choose from among multiple MA-PDs available at the local level.

In 2023, under a provision in the Inflation Reduction Act, Part D enrollees will pay no more than $35 per month for covered insulin products in all Part D plans. This new requirement builds on a current Innovation Center model in which only participating enhanced Part D plans cover insulin products at a monthly copayment of $35 in the deductible, initial coverage, and coverage gap phases of the Part D benefit. In 2023, a total of 2,881 Part D plans will participate in this model, including 324 PDPs and 2,557 MA-PDs. While this model will continue in 2023, beneficiaries will not need to enroll in one of the model-participating plans to benefit from the $35 monthly copay cap for insulin. Under the new Inflation Reduction Act requirement, all Part D plans do not have to cover all insulin products at the $35 monthly copayment amount, only those insulin products that are covered on a plans formulary.

You May Like: Which Is Better Traditional Medicare Or Medicare Advantage

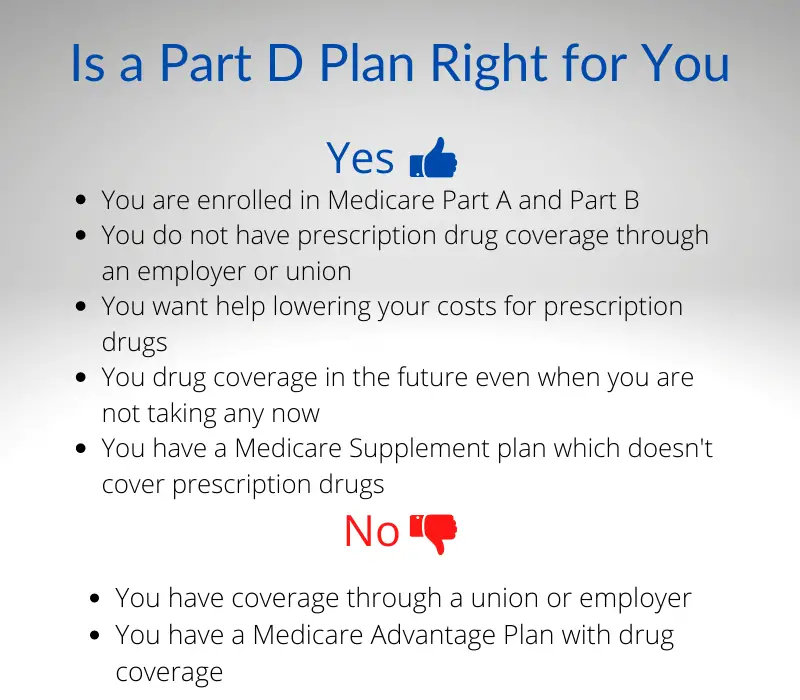

What Is Medicare Part D

Medicare Part D provides beneficiaries with coverage for the cost of prescription drugs. For many, prescription medications are essential in maintaining a healthy lifestyle. Medicare Part D is provided by private insurance companies and regulated by Medicare. To receive the most comprehensive Medicare Part D coverage, it is important to review all the plan options and make a decision based on your needs as an individual.

The cost of medications can put a strain on finances. To alleviate this, Medicare Part D prescription drug plans help reduce the price of these drugs for beneficiaries.

Medicare Part D Explained: Prescription Drug Coverage

In most cases, Medicare Part A and Part B doesnt cover outpatient prescription drugs. Instead, these pharmaceuticals are covered by optional Medicare Part D plans.

Medicare Part D is prescription drug coverage you can purchase through private insurance companies once you qualify for Medicare, explains Amanda Reese, Medicare department manager at Hafetz and Associates in Linwood, New Jersey.

Read Also: Will Medicare Pay For A Patient Lift

Do Medicare Premiums Change Yearly Based On Income

Yes, your Medicare Part B premium will change based on your MAGI.

You can expect to pay more for your Medicare Part B premiums if your MAGI is over a certain amount of money. For 2022, the threshold for these income-related monthly adjustments will kick in for those individuals with a MAGI of $88,000 and for married couples filing jointly with a MAGI of $176,000.

To find coverage for the things that Medicare does not cover, start shopping with eHealth.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealthâs Medicare related content is compliant with CMS regulations, you can rest assured youâre getting accurate information so you can make the right decisions for your coverage.Read more to learn about our Compliance Program.

Recommended Reading: Does Medicare Cover A Nebulizer

How Do You Qualify For $144 Back From Medicare

How do I qualify for the giveback?

Can a consumer who qualifies for low income subsidy receive financial assistance for Medicare Part D?

Eligible beneficiaries who have limited income may qualify for a government program that helps pay for Medicare Part D prescription drug costs. Medicare beneficiaries receiving the low-income subsidy get assistance in paying for their Part D monthly premium, annual deductible, coinsurance, and copayments.

What are the income limits to get extra help with Medicare?

What is the income limit? To qualify for Extra Help, your annual income must be limited to $19,320 for an individual or $26,130 for a married couple living together. Even if your annual income is higher, you may still be able to get some help.

What is the income limit to qualify for extra help with Medicare?

$19,320What is the income limit? To qualify for Extra Help, your annual income must be limited to $19,320 for an individual or $26,130 for a married couple living together. Even if your annual income is higher, you may still be able to get some help.

You May Like: Do You Have To Buy Medicare Part B

How Do You Qualify For Medicare Part D

In general, to qualify for Medicare Part D, you must first sign up for either Medicare Part A or Part B.

In order to qualify for Medicare, a person must either:

- Be age 65, and a U.S. citizen or permanent legal resident of at least 5 years

- Have a disability, and receive disability benefits for 2 years

- Receive diagnosis with ALS, or end-stage kidney disease

In most cases, people through Social Securitys website, phone, or mail options. Otherwise, railroad workers apply through the Railroad Retirement Board .

Many people get Part A hospital insurance at no cost. Otherwise, those who didnt work and pay taxes, or cant claim any taxed work history of a spouse or parent, must pay a full or partial premium.

Most people have to pay a premium for Part B, regardless of work history.

D Plan Premiums And Benefits In 2023

Premiums

The 2023 Part D base beneficiary premium which is based on bids submitted by both PDPs and MA-PDs and is not weighted by enrollment is $32.74, a modest decrease from 2022. But actual premiums paid by Part D enrollees vary considerably. For 2023, PDP monthly premiums range from a low of $1.60 for a PDP in the Oregon/Washington region to a high of $201.10 for a PDP in South Carolina . Even within a state, PDP premiums can vary for example, in Florida, monthly premiums range from $8.40 to $170.10. In addition to the monthly premium, Part D enrollees with higher incomes pay an income-related premium surcharge, ranging from $12.20 to $76.40 per month in 2023 .

Benefits

The Part D defined standard benefit has several phases, including a deductible, an initial coverage phase, a coverage gap phase, and catastrophic coverage, although it currently does not have a hard cap on out-of-pocket spending. Between 2022 and 2023, the parameters of the standard benefit are rising, which means Part D enrollees will face higher out-of-pocket costs for the deductible and in the initial coverage phase, as they have in prior years, and will have to pay more out-of-pocket before qualifying for catastrophic coverage .

- The standard deductible is increasing from $480 in 2022 to $505 in 2023

- The initial coverage limit is increasing from $4,430 to $4,660, and

- The out-of-pocket spending threshold is increasing from $7,050 to $7,400 .

Don’t Miss: How Does Medicare Plan G Work

Whats The Process For Applying To Medicare

No matter what type of Medicare coverage you want, enrolling in Medicare starts by completing the Social Security Administrations application.

This first step is sometimes called applying for Original Medicare or, more specifically, applying for Medicare Part A and Medicare Part B . The process is quick, and the application will only take about 10 to 30 minutes, according to the Social Security Administration.

You can complete your Medicare application online, by phone or in person. You cannot complete your initial Medicare application by mail. The agency recommends applying online, when possible. This will allow you to set up your accounts so you can review your application status and eventually manage your Medicare benefits.

Apply online

Visit the Social Security Administration portal to start a new Medicare application

Apply by phone

Apply in person

Make an appointment or visit your local Social Security office to start a Medicare application

Enrollment in Medicare usually isnt automatic. Most people will apply for Medicare at age 65 and then apply for full Social Security benefits a year or two later.

The next step is to choose your coverage by visiting Medicare.gov or working with an independent insurance broker.

Because Medicares government plans only provide basic benefits, most enrollees also get coverage through a private insurance company.

Find Cheap Medicare Plans in Your Area

Ways you can sign up

How To Apply For Medicare Part D

Our comprehensive guide helps you find the best Part D drug plan for you

Although Medicare is not without its faults, one thing is clear: Medicare Part D has been a successful program. With nearly 70% of all beneficiaries enrolled in Part D, this optional add-on to Original Medicare is a popular way to lower drug costs.1

But before diving into the deep end of Part D plans, youll want to perform due diligence to get the best plan for your needs. In this guide, well walk you through how to research and then successfully sign up for a Part D plan.

Read Also: What Is Medicare Part B Id

Medicare Part D Enrollment

The Medicare Part D enrollment period takes place each year form April 1 to June 30. If you enrolled in coverage for Medicare parts A or B and want to add Part D, you can enroll during this period the first time. After this, to change Part D plans, you must wait for open enrollment to come around again.

How To Apply Online For Just Medicare

Are you within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet? You can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later. It takes less than 10 minutes, and there are no forms to sign and usually no documentation is required.

To find out what documents and information you need to apply, go to the .

You May Like: Why Are Medicare Advantage Plans So Cheap

Choose The Right Prescription Drug Plan For You

Here are some tips for finding a plan that meets your budget, needs and preferences.16

- Check the prices. The monthly premium is an important consideration but look too at cost-sharing, such as deductibles, coinsurance and copays. A low premium may cost you more in the long run.

- If you prefer one-stop shopping and are willing to choose a plan that limits you to a network of providers, you may have lower premium costs with a Medicare Advantage plan with prescription drug coverage.

- If you take no or very few medications, you may want to opt for a low-premium plan. It will still cover most of the drugs that people on Medicare need.

- If you are taking specific long-term medications, check their availability and costs in various plans. If the drugs you take are generics, look for plans that charge you little or nothing for these.

- If you expect large medication expenses, it may pay to look for a plan that extends additional coverage if you reach high spending levels.

- When selecting a plan, check to see if they have a convenient preferred pharmacy, where you can often get added savings on prescription drugs.

How Does Medicare Part D Work

While there are many Part D plans available depending on a persons geographic location, each plan follows the same set of stages listed below, as outlined by the federal government.

Stage 1: Deductible

During this period, you pay the full cost of your medications until you meet your plans deductible. Some plans will offer coverage for certain medications during this stage, says Reese.

Stage 2: Initial Coverage

Once you hit your deductible, the initial coverage stage kicks in. During this stage, you pay your copayment and coinsurance rates, and your plan covers the remaining expenses.

Stage 3: Coverage Gap

If the total amount you and your plan pay for prescription drugs reaches a certain number during the year, you enter the coverage gap. Also known as the donut hole, the coverage gap occurs when theres a temporary limit on what your plan will cover for drugs, requiring you to pay up to 25% of the retail cost of your medications.

Stage 4: Catastrophic

If you reach the catastrophic stage with your medication expenses, Part D will cover most of your prescription drug costs for the rest of the year. You only pay 5% of the cost or $3.95 for generic drugs and 5% of the cost or $9.85 for brand name drugs.

Recommended Reading: How Is Bernie Paying For Medicare For All

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.