Documents Needed If You Sign Up In Person

- An original or certified copy of your birth certificate or other proof of birth

- Proof of United States citizenship or legal residency if not born in the U.S.

- Your Social Security card if you are already receiving benefits

- A copy of your most recent W-2 form and/or self-employment tax return

- U.S. military discharge papers if you served before 1968

- Health insurance information

How Do I Enroll In Medicare

Administration at 1-800-772-1213 to enroll in Medicare or to ask questions about whether you are eligible. You can also visit their web site at www.socialsecurity.gov.

The Medicare.gov Web site also has a tool to help you determine if you are eligibile for Medicare and when you can enroll. It is called the Medicare Eligibility Tool.

Medicare Initial Enrollment Period

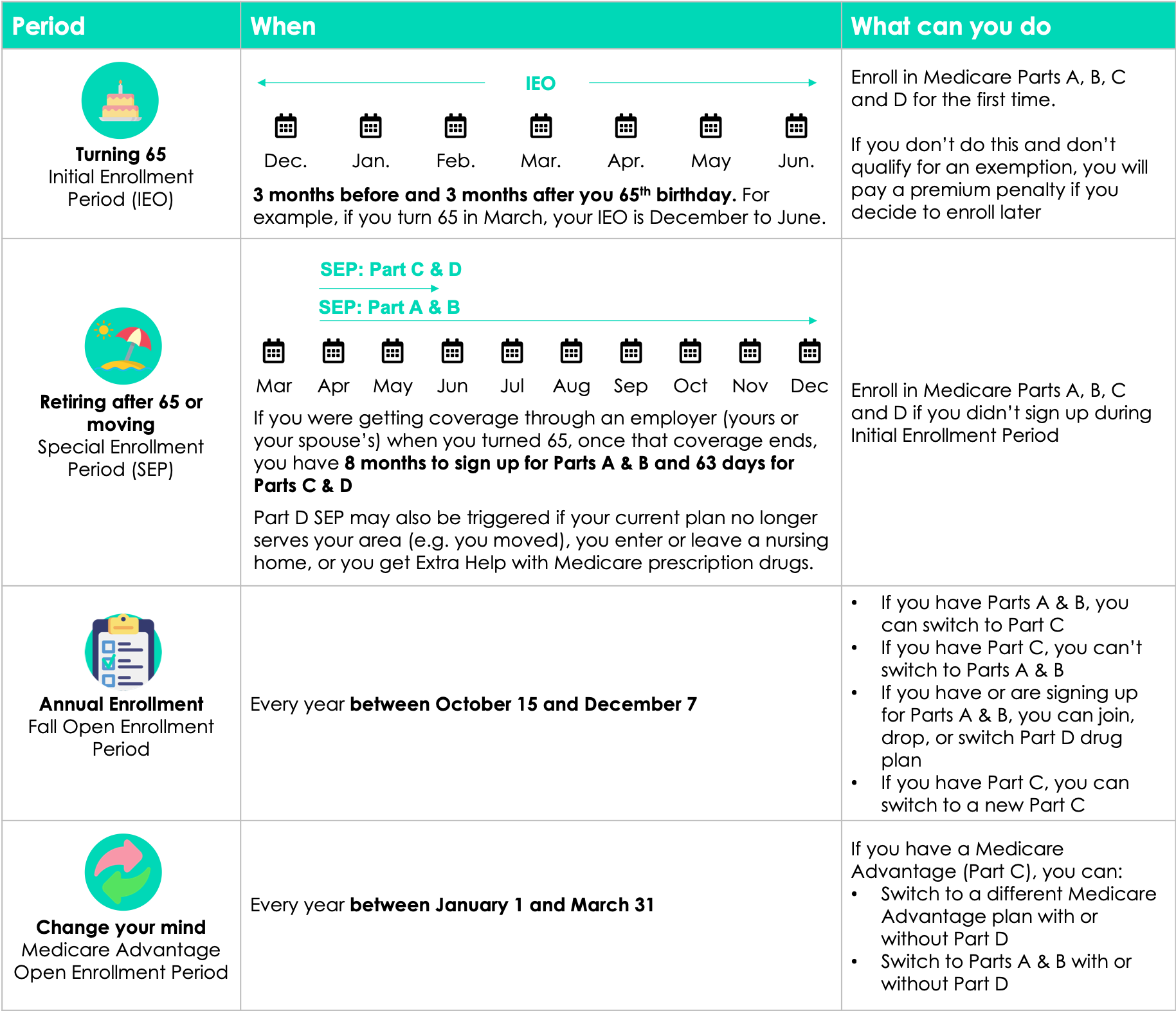

Your first chance to enroll in Medicare is around age 65 when you have a seven-month window to apply. This is your Medicare Initial Enrollment Period. You can file for Original Medicare Parts A and B, or sign up for a private Medicare plan at any time during the three months before, the month of, and the three months after your 65th birthday.

Need coverage the month you turn 65? You should sign up in the three-month window before your birthday.

Take a deeper dive in our related article about all-things Medicare Initial Enrollment Period.

Also Check: Does Medicare Pay For A Portable Oxygen Concentrator

When Is The Medicare Part D Annual Election Period

If you did not enroll in prescription drug coverage during IEP, you can sign up for prescription drug coverage during the Annual Election Period that runs every year from October 15 to December 7.

During AEP, you can:

- Sign up for a Medicare prescription drug plan.

- Drop a Medicare prescription drug plan.

- Join a Medicare Advantage plan that includes prescription drug coverage.

- Switch from a Medicare Advantage plan that doesnât include prescription drug coverage to a Medicare Advantage plan that does .

Outside of the Part D Initial Enrollment Period and the Annual Election Period, usually the only time you can make changes to prescription drug coverage without a qualifying Special Election Period is during the Medicare Advantage Open Enrollment Period but only if you are dropping Medicare Advantage coverage and switching back to Original Medicare. The Medicare Advantage Open Enrollment Period runs from January 1 to March 31.

Medicare Part A and Part B do not include prescription drug coverage, and if you switch back to Original Medicare during the Medicare Advantage Open Enrollment Period, you will have until March 31 to join a stand-alone Medicare prescription drug plan.

How To Sign Up For Medicare Advantage: When Can I Enroll

Medicare Advantage, also known as Medicare Part C, is another way to receive Original Medicare benefits and is offered through private insurance companies that have contracts with Medicare. At minimum, all Medicare Advantage plans must offer the same Medicare Part A and Part B benefits as Original Medicare. Some Medicare Advantage plans also include additional benefits, such as prescription drug coverage. You must have Original Medicare, Part A and B, to enroll in a Medicare Advantage plan through a private insurer.

You can enroll in a Medicare Advantage plan during two enrollment periods, the Initial Coverage Election Period and Annual Election Period.

Also Check: What Mental Health Services Does Medicare Cover

You Automatically Get Medicare

- You should already have Part A and Part B , because you have ALS and youre already getting disability benefits.

- We mailed you a welcome package with your Medicare card.

Sign up for Part B if you live in Puerto Rico or outside the U.S.

- Well mail you a welcome package with your Medicare card 3 months before your Medicare coverage starts.

Sign up for Part B if you live in Puerto Rico or outside the U.S.You get Part A automatically. If you want Part B, you need to sign up for it. If you dont sign up for Part B within 3 months after your Part A starts, you might have to wait to sign up and pay a monthly late enrollment penalty.

- Well mail you a welcome package with your Medicare card 3 months before your Medicare coverage starts.

Sign up for Part B if you live in Puerto Rico or outside the U.S.You get Part A automatically. If you want Part B, you need to sign up for it. If you dont sign up for Part B within 3 months of turning 65, you might have to wait to sign up and pay a monthly late enrollment penalty.

Should I Sign Up During My Initial Enrollment Period

For most people, the answer is yes. They need to sign up for Medicare during their seven-month initial enrollment period , which starts three months before the month you turn age 65 and ends three months after your birthday month. If your 65th birthday is in June, your IEP begins March 1 and ends Sept. 30.

If your birthday falls on the first day of a month, the whole initial enrollment period moves forward one month. For example, if your birthday is June 1, your IEP begins Feb. 1 and ends Aug. 31.

If you or your spouse is still working and you have health insurance coverage from that active employer, you may be able to wait. But otherwise, you need to sign up for Medicare during your IEP to avoid late enrollment penalties and delayed coverage.

The phrase active employer is key. If you have other insurance that isnt from your own or your spouses current employer, you will still need to sign up for Medicare during your initial enrollment period. You need to sign up during your IEP in all of these circumstances: If you have

- COBRA health coverage that extends the insurance you or your spouse received from an employer while working

- Health insurance that you bought yourself and no employer provided it

- No health insurance

- Retiree benefits from your own or a spouses former employer

- Veterans benefits from the Department of Veterans Affairs health system but no insurance from a current employer

Don’t Miss: How To Fill Out Medicare Part B Application

Can You Delay Signing Up For Medicare Part B

You may pay a penalty later on if you dont sign up for Medicare when you are first eligible when you turn 65. You can delay signing up for Medicare Part B without penalty, however, if you have health insurance through an employer with more than 20 employees. If you have health insurance from an employer with fewer than 20 employees, you need to sign up for Medicare when you are first eligible because the employer has no legal obligation to offer health insurance to an employee or spouse who is eligible for Medicare.11 Check here to see whether or not you need to sign up for Part B as soon as youre eligible.

Recommended Reading: What Is The Deadline For Changing Medicare Plans

Signing Up For Medicare Supplement Or Medicare Advantage Plans

As long as you have Medicare Part A and Part B, you can sign up for a Medicare Supplement plan at any time. However, the best time to enroll is during your Medicare Supplement Open Enrollment Period.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

You can enroll in any Medigap plan for which youre eligible, with no health underwriting questions during this time. Thus, you wont face denial due to pre-existing conditions.

If you choose to enroll in a Medicare Advantage plan, it is best to do so during your initial enrollment period. This is the same timeframe as applies to Medicare Part A and Part B enrollment.

You can enroll in any Medicare Advantage plan available in your service area during this window. If you miss this enrollment period, you must wait until the Annual Enrollment Period to enroll in a plan.

Keep in mind, when enrolling in a plan, it is important to note that you are not able to enroll in a Medicare Advantage plan and a Medigap plan at the same time. So, before you enroll, it is essential to compare all options available.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

You May Like: Is Medicare Accepted In Puerto Rico

How To Sign Up For Medicare Supplement Insurance Plans: When Can I Enroll

Medicare Supplement insurance plans are voluntary, additional coverage that helps fills the gaps in coverage for Original Medicare. The best time to enroll in a Medicare Supplement insurance plan is during your individual Medigap Open Enrollment Period, which is the six-month period that begins on the first day of the month you turn 65 and have Medicare Part B. If you decide to delay your enrollment in Medicare Part B for certain reasons such as having health coverage based on current employment, your Medigap Open Enrollment Period will not begin until you sign up for Part B.

During your Medigap Open Enrollment Period, you have a âguaranteed-issue rightâ to buy any Medigap plan sold in your state. This means that insurance companies cannot reject your application for a Medicare Supplement insurance plan based on pre-existing health conditions or disabilities. They also cannot charge you a higher premium based on your health status. Outside of this open enrollment period, you may not be able to join any Medigap plan you want, and insurers can require you to undergo medical underwriting. You may have to pay more if you have health problems or disabilities.

What You Need To Know About Medicare Parts A B C And D

We recommend the best products through an independent review process, and advertisers do not influence our picks. We may receive compensation if you visit partners we recommend. Read our advertiser disclosure for more info.

There are four parts of Medicare: Part A, Part B, Part C, and Part D. In general, the four Medicare parts cover different services, so its essential that you understand the options so you can pick your Medicare coverage carefully.

Recommended Reading: Does Medicare Pay For Oral Surgery

Also Check: What Medicare Plans Cover Silver Sneakers

How Do I Sign Up For Part A Hospital Insurance

Youll be enrolled automatically in Part A when you apply for Social Security or Railroad Retirement Board benefits, or when you turn 65, if youve been getting those benefits for at least four months.

If you havent applied for Social Security but want Medicare, youll have to sign up through Social Security. You can do this online at www.ssa.gov/benefits/medicare or by calling 1-800-772-1213.

If you or your spouse worked for a railroad, youll need to call the Railroad Retirement Board at 1-877-772-5772 to sign up for Medicare.

Other Parts Of Medicare That Cover Hospitalization Costs

Although Part A is generally known as hospital insurance, other parts of Medicare may also cover some of the costs of a hospital stay.

These may include:

- Part B. Generally, Medicare Part B doesnt cover costs for inpatient care, but it may cover services that occur before or after inpatient care. Part B covers doctors appointments, emergency room visits, urgent care visits, lab work, X-rays, and many other outpatient services.

- Part C .Medicare Advantage plans are sold by private insurance companies and include the services covered under parts A and B. They may also cover prescription drugs, dental care, or vision care.

- Medicare supplement insurance . These plans help you pay for out-of-pocket healthcare costs and fees from Part A and Part B, such as copays, coinsurance, and deductibles. Medigap plans are sold by private insurance companies, so coverage and costs vary by plan, provider, and location.

From year to year, there may be slight variations in coverage and costs for Medicare Part A. For 2022, the main changes are related to costs, including the deductible and coinsurance amounts.

Read Also: What Is The Best Medicare Advantage Plan In Ohio

How Do I Sign Up For Medicare Part B If I Already Have Part A

If you are already enrolled in Medicare Part A and you would like to enroll in Part B under the Special Enrollment Period , you can apply online at Apply for Medicare Part B Online during a Special Enrollment Period. You can upload your application and documents that verify your group health plan coverage through your employer.

You can also fax or mail your completed CMS-40B, Application for Enrollment in Medicare Part B and the CMS-L564, Request for Employment Information enrollment forms and evidence of employment to your local Social Security office. If you have questions, please contact Social Security at 1-800-772-1213 .

Note: When completing the forms CMS-40B and CMS-L564:

- State I want Part B coverage to begin in the remarks section of the CMS-40B form or online application.

- If your employer is unable to complete Section B, please complete that portion as best as you can on behalf of your employer without your employer’s signature.

- Also submit one of the following forms of secondary evidence:

- Income tax returns that show health insurance premiums paid.

- W-2s reflecting pre-tax medical contributions.

- Pay stubs that reflect health insurance premium deductions.

- Health insurance cards with a policy effective date.

- Explanations of benefits paid by the GHP or LGHP.

- Statements or receipts that reflect payment of health insurance premiums.

Reasons To Delay Medicare

If youre thinking about deferring Medicare, discuss the pros and cons with your current insurer, union representative, or employer. Its important to know how or if your current plan will work with Medicare, so you can choose the most comprehensive overage possible.

Some of the common reasons you may want to consider deferring Medicare include:

- You have a plan through an employer that you want to keep.

Recommended Reading: How Much Does Medicare Part B Cost For A Couple

Read Also: Is Part B Medicare Required

Enrollment Period For Medicare Part A

Youre eligible to enroll in Medicare Part A during your Initial Enrollment Period , which is the seven-month period around your 65th birthday. Your IEP begins three months before the month of your 65th birthday, includes your birth month, and lasts up to three months after your birthday month.

When you apply for Social Security benefits, youre automatically enrolled in Medicare Part A.

Also Check: Should I Sign Up For Medicare While Still Employed

The Parts Of Medicare

Social Security enrolls you in Original Medicare .

- Medicare Part A helps pay for inpatient care in a hospital or limited time at a skilled nursing facility . Part A also pays for some home health care and hospice care.

- Medicare Part B helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Other parts of Medicare are run by private insurance companies that follow rules set by Medicare.

- Supplemental policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses.

- Medicare Advantage Plan includes all benefits and services covered under Part A and Part B prescription drugs and additional benefits such as vision, hearing, and dental bundled together in one plan.

- Medicare Part D helps cover the cost of prescription drugs.

Most people age 65 or older are eligible for free Medicare hospital insurance if they have worked and paid Medicare taxes long enough. You can sign up for Medicare medical insurance by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium. To learn more, read .

Read Also: Can You Get A Medicare Advantage Plan Under 65

It’s Going To Cost You

Medicare is not free.

“This comes as a surprise to so many beneficiaries who have paid taxes throughout their working lifetimes and assumed this would mean Medicare would be ‘paid up’ by the time they turn 65,” said Danielle Roberts, co-founder of insurance firm Boomer Benefits.

“Those taxes will mean no premiums for Part A, but Parts B and D have premiums that beneficiaries pay monthly throughout their retirement years,” Roberts said.

Spouses without their own work history may qualify for premium-free Part A as well.

Part A also has a deductible of $1,566, which applies to the first 60 days of inpatient hospital care in a benefit period. For the 61st through 90th days, beneficiaries pay $389 per day, and then $778 per day for 60 “lifetime reserve” days.

Meanwhile, Part B’s standard monthly premium is $170.10 this year. However, some beneficiaries pay more through income-adjusted surcharges.

“Many of my high-income earners are shocked at how much Medicare premiums will cost them in retirement,” said Elizabeth Gavino, founder of Lewin & Gavino and an independent broker and general agent for Medicare plans.

The government uses your tax return from two years earlier to determine whether you’ll pay extra. To request a reduction in that income-related amount due to a life-changing event such as retirement, the Social Security Administration has a form you can fill out.

How To Apply For Medicare Through The Rrb

If you worked for the railroad, call the Railroad Retirement Board at 877-772-5772 or submit an online service request through the RRB website.

The best time to apply is during the Medicare Initial Enrollment Period. Or, you can sign up during the Medicare General Enrollment Period.

Note: If you are still working, you can still sign up for RRB Medicare coverage when you turn 65. No need to retire.

If you, or a family member, are already receiving a railroad retirement annuity, you will automatically be enrolled in Medicare Part A and B. Coverage begins when you turn 65.

Recommended Reading: When Do I Apply For Medicare Part B

When Is My Initial Enrollment Period For Medicare Part D:

You can enroll in a stand-alone Medicare prescription drug plan during your Initial Enrollment Period for Part D. You are eligible for prescription drug coverage if:

- You live in a service area covered by the health plan, and

- You have Medicare Part A AND/OR Medicare Part B.

Generally, your Initial Enrollment Period for Part D will occur at the same time as your Initial Enrollment Period for Medicare Part B .

Once you are eligible for Medicare Part D, you must either enroll in a Medicare prescription drug plan, Medicare Advantage Prescription Drug plan, or have creditable prescription drug coverage. Some people may choose to delay Medicare Part D enrollment if they already have creditable prescription drug coverage through an employer group plan.

However, if you do not sign up for prescription drug coverage when you are first eligible for Part D, you may have to pay a late-enrollment penalty for signing up later if you go without creditable prescription drug coverage for 63 or more consecutive days.

Also Check: Do You Have To Pay A Premium For Medicare