How Does Medicare Part B Work

Before getting into the weeds of Medicare Part B premiums, lets do a quick review of Medicare Part B and its role in federal retirement health insurance.

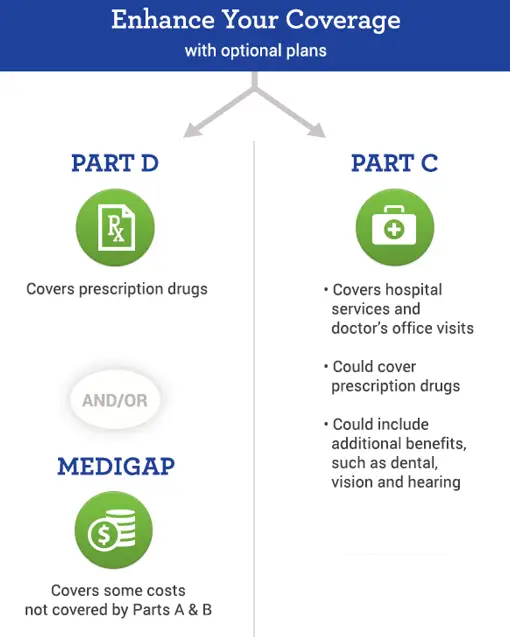

Once you turn 65, you become eligible to enroll in Medicare, with its maddening mix of different programs, including Part A, Part B, Part C and Part D. Some of these programs charge you premiums, and some dont.

First the good news: Most Medicare enrollees arent required to pay a premium for Medicare Part A, which covers costs for inpatient hospital care, home nursing care and hospice care. That said, there are typically deductibles and copays for some Medicare Part A expenses.

Medicare Part B covers doctor appointments, outpatient tests and exams as well as medical equipment. Unless your income is very low, youll be charged a monthly premium for Medicare Part B, regardless of whether you are enrolled in Original Medicare or Medicare Advantage, the two options for receiving your Medicare benefits.

If you opt for Original Medicare, the government will cover 80% of your Part B expenses after you meet your deductible. You can purchase a separate supplemental Medigap policy from a private insurer to cover the additional 20% youre on the hook for.

Medicare And Employer Coverage: Who Pays First

If your employer has fewer than 20 employees, Medicare becomes primary. Thus, your employer coverage pays second when you have both Medicare and coverage through an employer with fewer than 20 employees.

If your employer has more than 20 employees, Medicare will pay secondary to your group coverage. With small group insurance, we highly recommend enrolling in both Medicare Part A and Part B as soon as you are eligible. If you do not enroll in Medicare once you are eligible, your small employer coverage can refuse to pay your claims. In this case, having Medicare and employer coverage is essential. Thus, we recommend enrolling in Medicare Part B to avoid any gaps in coverage.

Additionally, if you do not enroll in Medicare Part B, you will need to pay the late penalty because your group insurance will not be for Medicare.

The Cost Of Medicare Part B

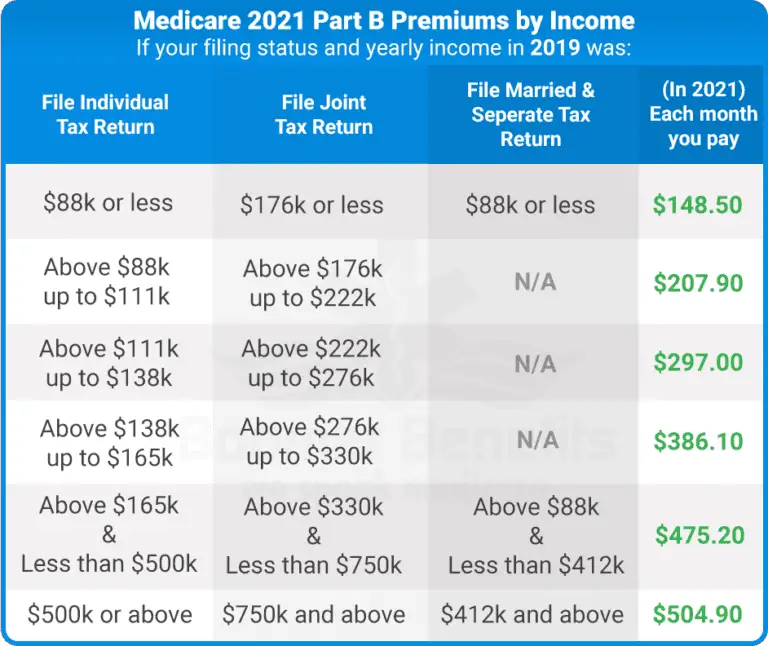

Unlike Medicare Part A, Medicare Part B requires a premium from everyone. The standard premium for Medicare Part B in 2022 is $170.10 a month, which applies to most people, including new enrollees. That premium changes each year, usually increasing. In 2023, the Part B premium drops to $164.90 a month.

Youll also have an annual deductible of $226 in 2023 as well as a 20 percent coinsurance rate for covered services under Part B.

New for 2023: People who had successful kidney transplants may be able to enroll in new, limited Part B coverage. This applies to people who were only eligible for Medicare because of end-stage renal disease and who would otherwise lose Medicare coverage because its been 36 months since a successful kidney transplant. In this case, these enrollees can enroll in a limited Part B plan that only covers immunosuppressive drugs. The monthly premium for this limited benefit is $97.10 a month in 2023.

If this applies to you, talk to Medicare directly about enrollment. Youll still need to meet the Part B deductible and Part B cost sharing amounts in addition to paying the premium for this limited coverage.

There are penalty fees for not signing up during your Initial Enrollment Period , but well discuss those in a separate section.

The above IRMAA rates are for 2023. You can learn more about IRMAA charges and how they might affect you personally by talking to Medicare directly.

Read Also: How Much Does Medicare Cost Annually

Medicare Part B Enrollment And Penalties

Medicare Part B is optional, but in some ways, it can feel mandatory, because there are penalties associated with delayed enrollment. As discussed later, you dont have to enroll in Part B, particularly if youre still working when you reach age 65.

However, if you dont qualify for a Special Enrollment Period , then you may incur penalty charges. These penalty charges are indefinite for as long as you keep Medicare Part B. When should you enroll in Medicare Part B? If youre not automatically enrolled because of the aforementioned conditions, then here are your enrollment options:

- You have a seven-month initial period to enroll in Medicare Part B. The seven months include the three months prior to your 65th birthday, the month containing your 65th birthday and the three months that follow your birthday month. If you turn 65 on March 8, then you have from December 1 to June 30 to enroll in Medicare Part B.

- If you delay enrollment, then you have to wait until the next general enrollment period begins. For Medicare Part B, you have from January 1 through March 31 to enroll. Coverage doesnt begin until July.

What happens if you miss your initial enrollment window? If you delay Medicare Part B enrollment, then youll have to wait to enroll when the general enrollment period starts. In this example, your birthday is March 8. Because you missed your initial window, youll have to wait until January of the following year to enroll.

What Is The Difference Between Medicare Part A And Medicare Part B

Medicare Part A and Medicare Part B are the two parts of Medicare that make up Original Medicare coverage. For most, Original Medicare is your primary healthcare coverage once you reach age 65 or receive disability income.

Medicare Part A handles inpatient services and benefits, whereas Medicare Part B covers outpatient, doctor, and medical supply benefits.

The two coverages work hand in hand but are not the same in terms of cost and benefits. Often, you will not need to pay a premium for Medicare Part A. However, you will need to pay a monthly premium for Medicare Part B. Regarding out-of-pocket costs, both parts of Medicare require you to pay deductibles, coinsurance, and copayments. However, those costs look very different between the two parts.

Don’t Miss: Does Medicare Cover Smoking Patches

You Want To Keep Contributing To An Hsa

You may also want to defer signing up for original Medicare if you currently have a health savings account . Once youre enrolled in original Medicare, youre no longer able to contribute funds to an HSA.

The money you put in an HSA increases on a tax-free basis and can be used to pay for many healthcare expenses.

HSAs are available to people with high-deductible health insurance plans. If your current health insurance meets Medicares requirements for creditable coverage, you wont incur a penalty if you defer for this reason.

How Do You Enroll In Medicare

Most people enroll in Medicare through the Social Security Administration. The fastest, easiest way to do it is by completing the online application at SSA.gov. It’s available 24 hours a day, 7 days a week, and takes less than 10 minutes to complete.

The online application allows you to sign up for both Medicare Part B and Medicare Part A. , please see the section How to Apply for Medicare Part B When You Already Have Part A below.)

If you prefer, you may also call Social Security at 1-800-772-1213 . Representatives are available Monday through Friday from 7 AM until 7 PM.

In-person Medicare enrollment has been suspended since March of 2020, which is when local Social Security offices closed due to the COVID-19 pandemic. Once offices reopen, you may find your local SSA office by clicking here.

When applying for Medicare through Social Security, you need the following information:

- Date and place of birth

- Medicaid number

- Current health insurance information, including employment start and end dates and the start and end dates of your current coverage

Social Security provides this checklist to help you prepare for your Medicare and retirement applications.

The Railroad Retirement Board manages Medicare enrollment for anyone who worked for a railroad. Call the RRB toll-free at 1-877-772-5772 Monday through Friday from 9 AM until 3:30 PM.

Finally, if you have questions about your Medicare coverage or eligibility, call 1-800-MEDICARE or TTY 1-877-486-2048.

Recommended Reading: Can You File For Medicare Online

What Prescription Drugs Are Covered By Medicare Part B

Medicare Part B only covers certain medications for some health conditions, while Part D offers a wider range of prescription coverage. Part B drugs are often administered by a health care provider , or through medical equipment at home. Examples of drugs covered under Medicare Part B include:

- Injections for osteoporosis

- End-stage renal disease medications

- Flu, pneumonia, and Hepatitis B shots

Medicare Part D may cover medications that arent covered under Part B, and vice versa. When you choose a Medicare plan, make sure it will cover your current medications.

The Medicare Part B Premium

Most seniors pay a standard monthly premium for Medicare Part B. In 2022, that standard premium is $170.10 per month. It can be higher depending on your income.

However, that cost might be lower for many people who are receiving Social Security benefits. Part B premiums can be automatically deducted from your Social Security benefit payment. If your Part B premiums are deducted from your Social Security benefit payments, the premium amount may be lower.

Also Check: How To Get An Electric Scooter Through Medicare

Should I Sign Up For Medical Insurance

With our online application, you can sign up for Medicare Part A and Part B. Because you must pay a premium for Part B coverage, you can turn it down.

If youre eligible at age 65, your Initial Enrollment Period begins three months before your 65th birthday, includes the month you turn age 65, and ends three months after that birthday.

Note: Important Upcoming Change Rules for 2023 and later: If you accept the automatic enrollment in Medicare Part B or if you sign up during the first three months of your IEP, your coverage will start the month youre first eligible. Beginning January 1, 2023, if you sign up during the month you turn 65 or during the last three months of your IEP, your coverage starts the first day of the month after you sign up.

The following chart shows when your Medicare Part B becomes effective in 2022:

| In 2022, if you sign up during this month of your IEP | Your Part B Medicare coverage starts |

|---|---|

| One to three months before you reach age 65 | The month you turn age 65. |

| The month you reach age 65 | One month after the month you turn age 65. |

| One month after you reach age 65 | Two months after the month of enrollment. |

| Two or three months after you reach age 65 | Three months after the month of enrollment. |

The following chart shows when your Medicare Part B becomes effective in 2023:

How To Avoid The Medicare Part B Late Penalty

Medicare Part B pays 80 percent of outpatient health care costs and 100 percent for many preventive services. But it pays to think carefully about when to sign up. Heres why.

- Part B comes with a monthly premium. You could save money if you delay enrollment.

- Part B charges a late penalty. In some cases, you could pay more if you sign up after your eligibility date.

In order to avoid the Part B late penalty, you need to first figure out when you have to enroll. Lets look at some situations that can help you answer whether you need Part B at age 65 or if you can delay enrolling.

Don’t Miss: What Is The Difference Between Medicare Part B And D

What Is The Late Enrollment Penalty For Medicare Part B

Medicare Part B enrollment is complicated, and the wrong decision can leave you without health coverage for months and lead to lifetime premium penalties. Part B premiums increase 10 percent for every 12-months you were eligible for Part B but not enrolled. People who delay Part B because they were covered through their own or a spouses current job are exempt from this penalty, and can generally enroll in Part B without any delays.

However, people who delay Part B enrollment and didnt have current job-based health coverage can find themselves out of luck. They dont qualify for the Part B Special Enrollment Period and cant enroll in Part B until the next General Enrollment Period , which runs from January to March of each year, with Part B coverage beginning that July. The GEP for the current year may have passed by the time you discover you need Part B, potentially your Part B coverage effective date by an entire year.

Also Check: Where Can I Get Medicare Information

Unemployed Applicants Should Use State Or Federal Marketplace

An unemployed person can apply for health insurance on the federal or state exchanges. They may find affordable low-premium options based on family income. Should they not find an affordable option, they may qualify for an exemption, Medicaid, or the CHIP.

Many states offer assistance to low-income families to help them qualify for affordable health insurance including payment assistance. If income is below the minimum needed for Obamacare, then applicants can seek coverage under the applicable state Medicaid program or CHIP for minors.

Also Check: How Can I Get Medicaid In Florida

You May Like: Does Medicare Cover Nursing Home Care For Dementia

When Do You Use This Application

Use this form:

- If youre in your Initial Enrollment Period and live in Puerto Rico. You must sign up for Part B using this form.

- If youre in your IEP and refused Part B or did not sign up when you applied for Medicare, but now want Part B.

- If you want to sign up for Part B during the General Enrollment Period from January 1 March 31 each year.

- If you refused Part B during your IEP because you had group health plan coverage through your or your spouses current employment. You may sign up during your 8-month Special Enrollment Period .

- If you have Medicare due to disability and refused Part B during your IEP because you had group health plan coverage through your, your spouse or family memberscurrent employment.

- You may sign up during your 8-month SEP.

NOTE: Your IEP lasts for 7 months. It begins 3 months before your 65th birthday and ends 3 months after you reach 65 .

Do I Need To Notify Anyone If Im Delaying Medicare

You donât need to provide notice that youâd like to delay enrolling unless youâre receiving Social Security or Railroad Retirement Board benefits. If you are receiving either, youâll be automatically enrolled in Medicare Parts A & B when you turn 65, and youâll need to let Social Security know you wish to delay Part B. By law though, if you receive Social Security benefits and are eligible for Medicare, you must also have Medicare Part A.

Read Also: Is Mutual Of Omaha A Good Company For Medicare Supplement

Recommended Reading: Do I Have To Join Medicare At Age 65

Already Enrolled In Medicare

If you have Medicare, you can get information and services online. Find out how to .

If you are enrolled in Medicare Part A and you want to sign up for Part B, please complete form CMS-40B, Application for Enrollment in Medicare Part B . If you are applying for Medicare Part B due to a loss of employment or group health coverage, you will also need to complete form CMS-L564, Request for Employment Information.

You can use one of the following options to submit your enrollment request under the Special Enrollment Period:

Note: When completing the forms CMS-40B and CMS-L564:

- State I want Part B coverage to begin in the remarks section of the CMS-40B form or online application.

- If possible, your employer should complete Section B.

- If your employer is unable to complete Section B, please complete that portion as best as you can on their behalf and submit one of the following forms of secondary evidence:

- Income tax form that shows health insurance premiums paid.

- W-2s reflecting pre-tax medical contributions.

- Pay stubs that reflect health insurance premium deductions.

- Health insurance cards with a policy effective date.

- Explanations of benefits paid by the GHP or LGHP.

- Statements or receipts that reflect payment of health insurance premiums.

Some people with limited resources and income may also be able to get .

How Does Medicare Work

If youve been following this blog for a while now, then youre practically an expert in Medicare. Weve gone over the basics of Medicare. Weve talked about the various Parts of Medicare plans. Weve even talked about whether or not you should change your current Medicare plan!

So whether youre a Medicare expert or one of our wonderful new-comers, heres a brief breakdown of Medicare for you:

Medicare is a national health insurance program in the U.S. To qualify for Medicares health insurance coverage, you must be 65 or older. Some younger folk can also qualify for Medicare if they have been diagnosed with certain disabilities or an End-Stage-Renal Disease. Medicare plans are broken down into various Parts, each with their own requirements and coverage options. For more information on the various Medicare Parts, check out this post.

Read Also: What Is My Medicare Number Provider

Can You Stop And Restart Medicare Part B

But to avoid a permanent Part B late-enrollment penalty, when you leave, lose or retire from your new job, you must then reenroll in Medicare Part B while you’re still on the job or during a special enrollment period that lasts for eight months after your job-based private health insurance stops. At a small business.