Ways To Apply For Disability Benefits:

- If you or your spouse worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772.

Once your disability benefits start, well mail you a welcome package with your Medicare card.

Sign up for Part B if you live in Puerto Rico or outside the U.S.You get Part A automatically. If you want Part B, you need to sign up for it. If you dont sign up for Part B within 3 months after your Part A starts, you might have to wait to sign up for Part B and pay a monthly late enrollment penalty.

Medicare Eligibility If You Move Out Of The United States

Generally, Medicare doesnt cover health care services outside the 50 states of the U.S. and the following U.S. territories:

- District of Columbia

- Northern Mariana Island

If you move outside the U.S. and hope to maintain Medicare coverage in case you return, not much will change with your Medicare Part A insurance. This benefit is free for most people. So, if you return to the U.S. later, Part A coverage will be available to you.

The situation is trickier with Medicare Part B coverage. You must continue to pay for this coverage to keep it active. If youre living overseas, that means spending money for coverage you wont use.

However, if you opt not to pay for Part B while overseas and then move back to the United States, you will be subject to penalties for delaying coverage. In addition, if you decide to re-enroll for Part B after dropping it, you only will be able to do so between the months of January and March, with benefits kicking in the following July. Again, penalties may apply.

If you move back to the U.S. after living abroad and you enroll in a Part D drug plan within two months, Medicare coverage begins on the first day of the month after you enroll. You wont be liable for late penalties. However, if you miss the deadline, you will have to wait until the Annual Enrollment Period October 15 to December 7 to sign up, and you will owe permanent late penalties.

If I Retire At Age 62 Will I Be Eligible For Medicare At That Time

Medicare is federal health insurance for people 65 or older, some younger people with disabilities, and people with end-stage kidney disease. Most commonly, you are eligible for Medicare when you turn 65, but there are other health insurance options if you are younger and do not have coverage through you or your spouses employer.

What you should know

| 1. The typical age requirement for Medicare is 65, unless you qualify because you have a disability. | 2. If you retire before 65, you may be eligible for Social Security benefits starting at age 62, but you are not eligible for Medicare. |

| 3. You have options for health insurance if you are too young for Medicare. You may obtain it through your employer, or you can purchase from private-sector insurance companies through the health insurance exchange. You may be eligible for Medicaid, which is based on income. | 4. If you retire before you are 65, you may be eligible for employer-provided group health insurance under the Consolidated Omnibus Budget Reconciliation Act . |

Medicare was established in 1965 in order to provide health coverage for seniors who would otherwise not be covered by employer-sponsored health insurance plans. If you retire at the age of 62, you may be eligible for retirement benefits through social security, but early retirement will not make you eligible for Medicare.

Read Also: What Is Trumps Plan For Medicare

Read Also: Do Any Medicare Supplement Plans Cover Dental And Vision

Medicare Eligibility: Age 65 And Other Ways To Qualify

Find Cheap Medicare Plans in Your Area

You become eligible for Medicare at age 65, or beforehand through a disability or medical condition.

In addition, there are other eligibility restrictions based on citizenship, type of Medicare plan, where you live and your work history.

Remember that income does not affect your eligibility for Medicare. But those who have a low income can be dual-enrolled in both Medicare and Medicaid, which can further reduce your medical expenses.

| Medicare eligibility by age | Medicare eligibility by health condition | |

|---|---|---|

| Main eligibility requirement | ||

| Work history requirements | None for enrollment, but there are requirements to determine if you’re eligible for free Medicare Part A | None for those with a disability who automatically get free Medicare Part A, but those with ESRD have a work requirement |

| Location restrictions | No restriction for Parts A and B, but for other Medcare parts, you’re only eligible for the plans offered in your area | No restriction for Parts A and B, but for other Medcare parts, you’re only eligible for the plans offered in your area |

If you qualify for Medicare by age, your initial enrollment period starts three months before your birthday month and ends three months after your birthday month.

If you don’t qualify for Medicare and still need health insurance, you may be eligible for:

- A health insurance marketplace plan: Plans available to all with discounts based on income

- Medicaid/ CHIP: Health insurance for those with low incomes

When Is Medicare Annual Enrollment

Medicares general enrollment period runs from October 15 to December 7 each year. During this time, you can join, change or drop a plan, but only one change can be made. Enrolling by December 7 ensures that you will have coverage on Jan. 1 of the following year.

The Medicare Advantage open enrollment period dates are different January 1 through March 31. At this time, you can enroll in a Medicare Advantage plan, switch to a different plan, or switch back to Original Medicare. Again, only one change is allowed during this time.

Medicare.gov. Costs. Accessed August 2022.

Disclaimer:

MULTI-PLAN_ QS-INWhosEligiblearticle_M

Don’t Miss: Is It Medicaid Or Medicare

Contact Social Security To Sign Up For Medicare

You can either:

Know when to sign up for Part BYou can only sign up for Part B at certain times. If you dont sign up for Part B when you turn 65, you might have to wait to sign up and pay a monthly late enrollment penalty. Find out when you can sign up. How much is the Part B late enrollment penalty?

You Automatically Get Medicare

- You should already have Part A and Part B , because you have ALS and youre already getting disability benefits.

- We mailed you a welcome package with your Medicare card.

Sign up for Part B if you live in Puerto Rico or outside the U.S.

- Well mail you a welcome package with your Medicare card 3 months before your Medicare coverage starts.

Sign up for Part B if you live in Puerto Rico or outside the U.S.You get Part A automatically. If you want Part B, you need to sign up for it. If you dont sign up for Part B within 3 months after your Part A starts, you might have to wait to sign up and pay a monthly late enrollment penalty.

- Well mail you a welcome package with your Medicare card 3 months before your Medicare coverage starts.

Sign up for Part B if you live in Puerto Rico or outside the U.S.You get Part A automatically. If you want Part B, you need to sign up for it. If you dont sign up for Part B within 3 months of turning 65, you might have to wait to sign up and pay a monthly late enrollment penalty.

Don’t Miss: How Much Does Ss Take Out For Medicare

Getting Help With Medicare Costs

You might be able to get help paying for your Medicare coverage if your income and resources are below a specified limit. You could qualify for Medicaid, a government program for low-income individuals.

If your income is too high to qualify for Medicaid, try a Medicare Savings Program , which generally has higher limits for income. As a bonus, if you qualify for an MSP, you automatically qualify for Extra Help, which subsidizes your Part D costs.

Contact your states Medicaid office for more information.

How Much Does Medicare Cost On Disability

If you qualify for SSDI, you’ll typically qualify for premium-free Medicare Part A based on your work record. Part B requires a monthly premium , automatically deducted from your Social Security check. You can technically opt out of Part B if you dont want to pay the premiums. Just know that without Part B, youll forego extensive medical coverage. Its usually not a good idea to opt out of Part B unless you have other health insurancelike from an employer.

You May Like: Can Doctors Refuse Medicare Patients

Other Ways To Get Medicare Coverage

If you do not qualify on your own or through your spouses work record but are a U.S. citizen or have been a legal resident for at least five years, you can get full Medicare benefits at age 65 or older. You just have to buy into them by:

- Paying premiums for Part A, the hospital insurance. How much you would have to pay for Part A depends on how long youve worked. The longer you work, the more work credits you will earn. Work credits are earned based on your income the amount of income it takes to earn a credit changes each year. In 2022 you earn one work credit for every $1,510 in earnings, up to a maximum of four credits per year. If you have accrued fewer than 30 work credits, you pay the maximum premium $499 in 2022. If you have 30 to 39 credits, you pay less $274 a month in 2022. If you continue working until you gain 40 credits, you will no longer pay these premiums.

- Paying the same monthly premiums for Part B, which covers doctor visits and other outpatient services, as other enrollees pay. In 2022 the amount is $170.10 for individuals with a yearly income of $91,000 or less or those filing a joint tax return with $182,000 in income or less. Rates are higher for people with higher incomes.

- Paying the same monthly premium for Part D prescription drug coverage as others enrolled in the drug plan you choose.

You can enroll in Part B without buying Part A. But if you buy Part A, you also must enroll in Part B.

You can get Part D if youre enrolled in either A or B.

Medicare Advantage Plan Eligibility For 2023

Heres what you need to know about eligibility for Parts C and D:

| If you | |

| Qualify for Medicare because youre turning 65 | Sign up for Medicare Advantage or Part D during your 7-month initial enrollment period |

| Qualify for Medicare because of a disability but arent 65 | Sign up for Medicare Advantage or Part D during the 7-month period that starts 3 months before your 25th month of disability payments, includes that 25th month, and ends 3 months after the 25th month of disability payments |

| Qualify for Medicare because of a disability and youre 65 | Sign up for Medicare Advantage or Part D during the 7-month period that starts 3 months before the month you turn 65, includes your birthday month, and ends 3 months after your birthday month |

| Dont have Medicare Part A, and you enrolled in Part B during general enrollment | Sign up for Medicare Part D only, from April 1 to June 30 |

| Have Medicare Part A, and you enrolled in Part B during general enrollment | Sign up for Medicare Advantage only, from April 1 to June 30 |

You can also switch to Medicare Advantage or join a Part D drug plan during the Medicare annual open enrollment period, which runs from October 15 through December 7 each year. And if you already have an Advantage plan, you can use the Medicare Advantage Open Enrollment Period to make a one-time change to your coverage.

- A Part D drug plan

- A Medicare Advantage plan with drug coverage

- Another Medicare health plan that covers prescription drugs

- A plan from an employer or union

Recommended Reading: Will Medicare Pay For Inogen

How Long Do Medicare Benefits Last For People With Disabilities

As long as youre receiving Social Security disability benefits, your Medicare coverage will continue. In some cases, your Medicare coverage can extend beyond your disability payments.

For example, if you return to work and become ineligible for SSDI, you could stay on Medicare for another eight and a half years93 monthsas long as your disability persists. However, you have to opt in to your employers health plan if they offer one.

In this case, your employer’s health plan would become the primary payer, and Medicare would pay secondary . Unfortunately, if your employer offers only an HSA plan, you wont be able to use Medicare since HSAs and Medicare dont mix.

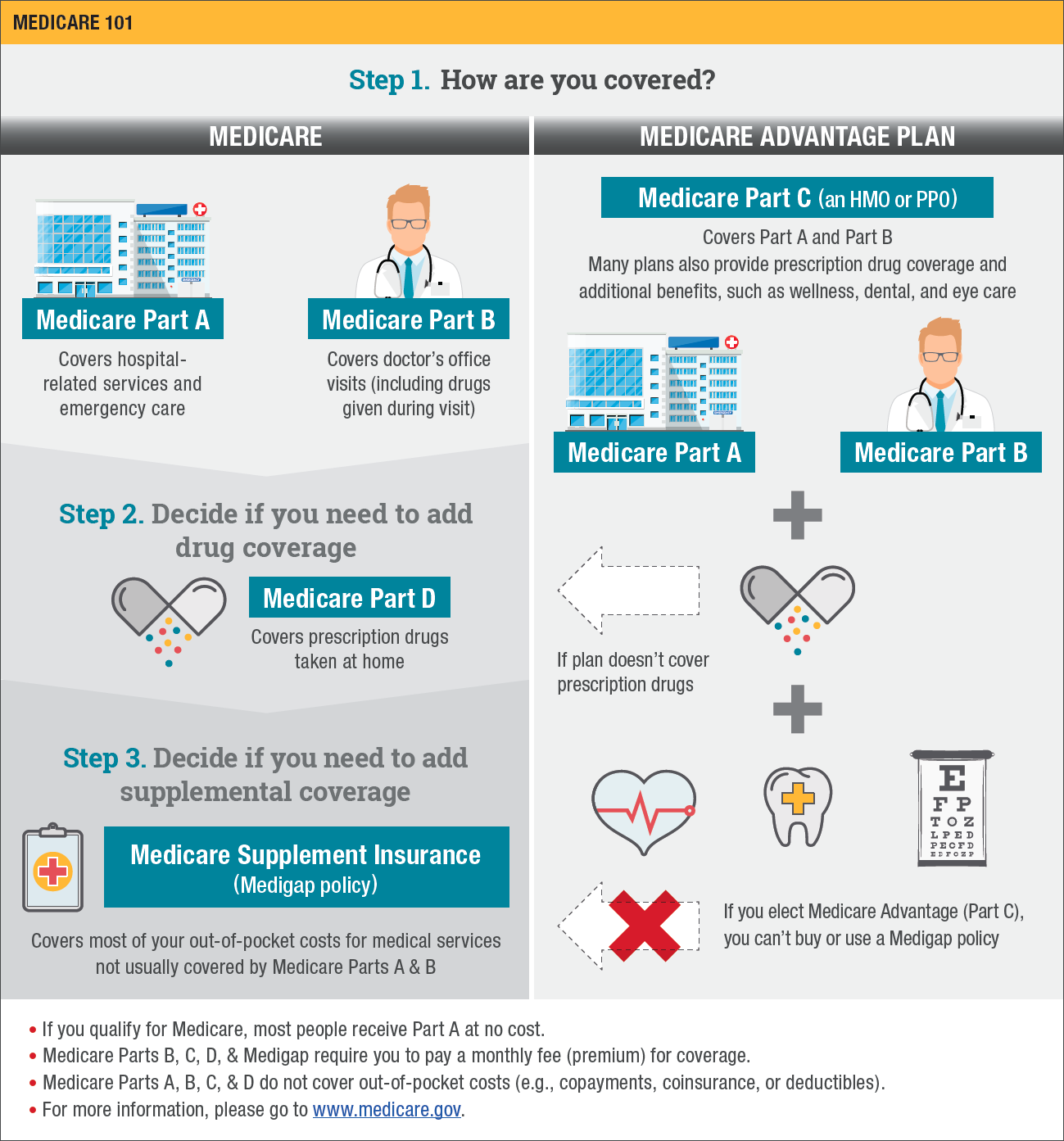

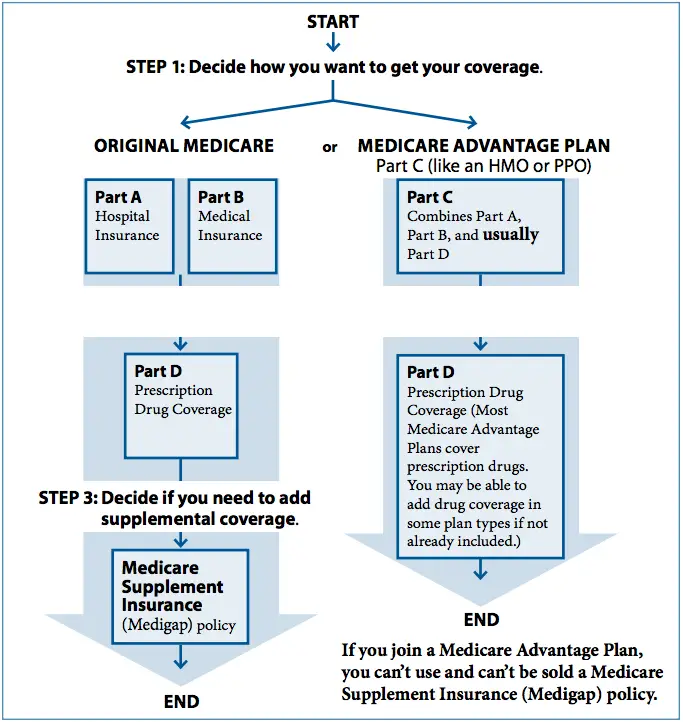

How Do You Become Eligible For Medicare Part C

You also qualify for Medicare Part C upon turning 65. What is Medicare Part C? This type of health coverage is known as Medicare Advantage and private insurance companies offer this insurance. It is an alternative way to receive Medicare coverage.

To be eligible for Part C, you must be enrolled in Medicare Part A and Part B and you must live in the same area that a Part C plan covers.

Part C coverage plans often cover prescription drugs and many have vision, dental and fitness benefits, in addition to other perks not found in Original Medicare. When choosing a Medicare Advantage plan, make sure to read the fine print from each health insurance company to find the plan that works for you.

Read Also: Does Medicare Cover Counseling For Depression

Penalties For Applying Outside The Enrollment Window

A person may have to pay penalties for Medicare Part A if they enroll outside the open enrollment window.

Medicare adds 10% to the premium for double the number of years for which a person did not sign up for Medicare Part A while eligible.

For example, if a person waits 3 years after reaching the age of 65 to apply for Medicare Part A, their premium increase will last for 6 years.

It is best to apply during the initial open enrollment window, as this makes Medicare plans more cost effective.

Medicaid Eligibility And Costs

The federal and state partnership results in different Medicaid programs for each state. Through the Affordable Care Act , signed into law in 2010, President Barack Obama attempted to expand healthcare coverage to more Americans. As a result, all legal residents and citizens of the United States with incomes 138% below the poverty line qualify for coverage in Medicaid participating states.

While the ACA has worked to expand both federal funding and eligibility for Medicaid, the U.S. Supreme Court ruled that states are not required to participate in the expansion to continue receiving already established levels of Medicaid funding. As a result, many states have chosen not to expand funding levels and eligibility requirements.

Those covered by Medicaid pay nothing for covered services. Unlike Medicare, which is available to nearly every American of 65 years and over, Medicaid has strict eligibility requirements that vary by state.

However, because the program is designed to help the poor, many states have stringent requirements, including income restrictions. For a state-by-state breakdown of eligibility requirements, visit Medicaid.gov.

When Medicaid recipients reach age 65, they remain eligible for Medicaid and also become eligible for Medicare. At that time, Medicaid coverage may change based on the recipient’s income. Higher-income individuals may find that Medicaid pays their Medicare Part B premiums. Lower-income individuals may continue to receive full benefits.

You May Like: Does Kaiser Offer Medicare Advantage Plan

How Do You Become Eligible For Medicare Part D

As with the other types of Medicare coverage, most people are eligible for Part D coverage when they turn 65 or if you have a qualifying condition.

What is Medicare Part D? Private insurance companies offer this Medicare prescription drug coverage, which is paired with Original Medicare. That means you must enroll in Medicare Part A and Part B to be eligible for this coverage. People with Medicare Advantage arent eligible for Part D coverage.

Spouse Eligibility For Part A

A person who is 65 or older may qualify for Medicare Part A benefits if their spouse has paid Medicare taxes for 40 quarters of employment. This would entitle them to a premium-free Part A plan.

If a person is younger than their spouse and has not yet reached 65 years of age, they cannot qualify for Medicare earlier based on their spouses eligibility, unless they have a qualifying disability.

For example, if a person is 62 and their spouse is 65, they cannot obtain Part A benefits until reaching 65 themselves.

Read Also: Do I Need Pip If I Have Medicare

Sign Up: Within 8 Months After Your Family Member Stopped Working

- Your current coverage might not pay for health services if you dont have both Part A and Part B .

- If you have Medicare due to a disability or ALS , youll already have Part A coverage.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty until you turn 65. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

Medicare Part C Eligibility

Medicare Part C, also called Medicare Advantage, is an insurance option for people who are eligible for Medicare. These plans are offered through private insurance companies.

You dont need to buy a Medicare Part C plan. Its an alternative to original Medicare that offers additional items and services. Some of these include prescription drugs, dental, vision, and many others.

To be eligible for a Medicare Part C plan:

- You must be enrolled in original Medicare .

- You must live in the service area of a Medicare Advantage insurance provider thats offering the coverage/price you want and thats accepting new users during your enrollment period.

To enroll in original Medicare , in general, you must qualify by:

Also Check: Can I Find My Medicare Number Online