How Much Does Medicare Cost

Original Medicare

Original Medicare is divided into Part A and Part B .

- Part A helps pay for inpatient hospital care, some skilled nursing care, home health care and hospice care.

- Part B helps pay for doctor services, outpatient hospital care, durable medical equipment, home health care not covered by Part A, and other services. Medicare was never intended to pay 100% of medical bills. Its purpose is to help pay a portion of medical expenses. Medicare beneficiaries also pay a portion of their medical expenses, which includes deductibles, copayments, and services not covered by Medicare. The amounts of deductibles and copayments change at the beginning of each year.

Part A – Monthly Premium

If you are eligible, Part A is free because you or your spouse paid Medicare taxes while you were working. You earn Social Security “credits” as you work and pay taxes. For each year that you work, you earn 4 credits.

| $471 | $499 |

You are 65 or older, and you receive or are eligible to receive full benefits fr om Social Security or the Railroad Retirement Board

You are under 65, and you have received Social Security disability benefits for 24 months You are under 65, and you have received Railroad Retirement disability benefits and you meet Social Security disability requirements You or your spouse had Medicare-covered government employment You are under 65 and have End-Stage Renal Disease

Can You Add Medicare Part C At Any Time

No, you cannot add Medicare Part C at any time. If you qualify for a Medicare Advantage plan and are ready to enroll, its important to understand Medicares enrollment periods. While you may be automatically enrolled in Medicare when you become qualified, you must actively enroll in a Medicare Advantage plan.

You can enroll during specific times of the year, including:

Medicare Eligibility At 65 And Older

You can apply for Medicare the year you turn 65, but you generally must meet three eligibility requirements to qualify for full Medicare benefits at this age.

The chief requirement is that you must be a U.S. citizen or permanent legal resident who has lived in the U.S. for at least five years.

In addition, you must meet one of the following other requirements:

- You or your spouse must have worked long enough to also be eligible for Social Security benefits or for railroad retirement benefits. This usually means you have worked for at least 10 years. You must be eligible for these Social Security benefits even if you are not yet receiving them.

- You or your spouse is either a government employee or retiree who did not pay into Social Security but did pay Medicare payroll taxes while working.

If you pay Medicare payroll taxes for 10 full years, you wont have to pay premiums for Medicare Part A, which covers hospital care.

You dont need the work credits to qualify for Medicare Part B, which covers doctor visits or outpatient services, and Medicare Part D, which covers prescription drugs. Everyone pays premiums for both regardless of work history.

If you are still working at 65, you dont have to sign up for Medicare but there are benefits to signing up while still employed. Similarly, if you have never worked, you can still get Medicare. It may be more expensive depending on your spouses work history.

You May Like: What Are Medicare Part Abcd

Are You Required To Join Medicare At 65 What You Need To Know

Americans qualify for Medicare at age 65, but whether or not you must enroll depends on your work situation.

Peter Butler

Writer

Peter is a writer and editor for the CNET How-To team. He has been covering technology, software, finance, sports and video games since working for @Home Network and Excite in the 1990s. Peter managed reviews and listings for Download.com during the 2000s, and is passionate about software and no-nonsense advice for creators, consumers and investors.

Coverage.com, LLC is a licensed insurance producer . Coverage.com services are only available in states where it is licensed. Coverage.com may not offer insurance coverage in all states or scenarios. All insurance products are governed by the terms in the applicable insurance policy, and all related decisions and policy obligations are the sole responsibility of the underwriting insurer. The information on this site does not modify any insurance policy terms in any way.

CNET editors independently choose every product and service we cover. Though we can’t review every available financial company or offer, we strive to make comprehensive, rigorous comparisons in order to highlight the best of them. For many of these products and services, we earn a commission. The compensation we receive may impact how products and links appear on our site.

Medicare Part B Premiums For 2023

- Publish date: Nov 10, 2022 12:00 PM EST

Medicare recently announced what the premiums will be for Medicare Part B in 2023. For the first time in a while, premiums will drop in 2023 instead of increasing, which is good news for many consumers, according to MOAA.

Jae Oh, author of Maximize Your Medicare, discusses what has caused this decrease in premiums. Earlier this year we spoke about the fact that as a result of an Alzheimer’s medication, which is covered by Part B, and the fact that the price was actually lower than anticipated, that Part B premiums would be lower going into 2023, he said. Instead of being adjusted down mid-year, we now have the news that part B premiums for most people are going to be down to $164.90. The Part B deductible will be higher at $226 a year.

Follow us on and !

Along with this decrease in Part B premiums is an increase in Social Security Cost of Living Adjustment – also known as COLA – for 2023. People have estimated this increase to be about 8-9%, but Oh said that we will know for certain after the next CPI reading. Nevertheless, 2023 will be a very unusual but exciting time for Medicare consumers.

Read Also: When To Apply For Medicare When Turning 65

How Did Medicare And Medicaid Help People

CHANGING LIVES: Medicare and Medicaid provide Americans with access to the quality and affordable health care they need to live happy, healthy and productive lives. Medicaid provides comprehensive coverage to more than 70 million eligible children, pregnant women, low- income adults and people living with disabilities.

Understanding Medicare Advantage Coverage

Medicare Advantage plans use many styles of managed care to deliver services and savings to subscribers. Medicare Advantage plans have some High Deductible Health Plans that can work with Medicare Savings Accounts. The accounts receive funds that consumers can use to pay out-of-pocket expenses. The below-listed descriptions show the basic elements.

HMO is the health maintenance organization. It uses a primary care physician to deliver care, and refer the patient to other network resources. The HMO does not use outside resources.

PPO is the preferred provider organization. These Medicare Advantage plans do not require referrals or a primary care doctor. They permit the use of outside resources but cover them at a lower rate of cost sharing than for network resources.

EPO is the exclusive provider organization. This type of Medicare Advantage plan offers low prices and a simple network. The members must use network resources except for emergency care.

HMOPOS is the Point of sale option for health maintenance organization. This type of Medicare Advantage plan uses a primary care physician. The doctor can make referrals to outside resources, and the insurance will cover with a lower rate of cost sharing than if using network resources.

FFFS is the fixed-fee-for-services type of Medicare Advantage plan. This type of managed care offers a wide network and freedom of choice for the consumer. The FFFS can standalone or connect to another network for regional or national coverage.

You May Like: Is Xarelto Covered By Medicare Part D

Learn More About Medicare

Join our email series to receive your free Medicare guide and the latest information about Medicare and Medicare Advantage.

- Visit the Check Your Enrollment page on Medicare.gov, the official website for Medicare.

- Fill out the requested information, including your zip code, Medicare number, name, date of birth and your effective date for Medicare Part A coverage or Part B coverage.

If you just recently enrolled, it may not be immediately reflected online. You may contact the plan provider directly to confirm your enrollment or check online again at a later date to see if your enrollment status has been updated.

If you are enrolled in Medicare Part A and/or Part B, your Medicare card should detail what Medicare coverage you have, as seen below.

Do You Need Medicare Part B

The short answer is yes, especially if youll need the covered services mentioned above. However, if you have health insurance through a current job or are on your spouses active plan, you can delay your Medicare Part B enrollment without penalty. Once the spouse with employer coverage stops working whether its you or your partner you have eight months to sign up for Part B. Also, you need to be enrolled in Medicare Part B if you want to sign up for a Medicare Advantage plan.

Also Check: Does Medicare Cover Mammograms After Age 70

What Is Medicare Part A Hospital Insurance

Medicare Part A covers the following services:

- Inpatient hospital care: This is care received after you are formally admitted into a hospital by a physician. You are covered for up to 90 days each benefit period in a general hospital, plus 60 lifetime reserve days. Medicare also covers up to 190 lifetime days in a Medicare-certified psychiatric hospital.

- Skilled nursing facility care: Medicare covers room, board, and a range of services provided in a SNF, including administration of medications, tube feedings, and wound care. You are covered for up to 100 days each benefit period if you qualify for coverage. To qualify, you must have spent at least three consecutive days as a hospital inpatient within 30 days of admission to the SNF, and need skilled nursing or therapy services.

- Home health care: Medicare covers services in your home if you are homebound and need skilled care. You are covered for up to 100 days of daily care or an unlimited amount of intermittent care. To qualify for Part A coverage, you must have spent at least three consecutive days as a hospital inpatient within 14 days of receiving home health care.

- Hospice care: This is care you may elect to receive if a provider determines you are terminally ill. You are covered for as long as your provider certifies you need care.

Keep in mind that Medicare does not usually pay the full cost of your care, and you will likely be responsible for some portion of the cost-sharing for Medicare-covered services.

How Does A Medicare Advantage Plan Cover My Drugs

To find out about each plans coverage for your medications, type your zip code into the Plan Finder. Then under Plan Type, click the circle next to Medicare Advantage Plan and scroll down to hit the Apply button. If your zip code spans more than one county, youll have to click the circle next to yours.

Then hit the Start button. After answering a question or two, make sure you choose Yes to see your drug costs when comparing plans. Then you can either add your drugs and dosages or use the information from your online Medicare account. You can also select nearby pharmacies you use.

Youll get a list of plans in your area, which shows the Monthly premium and Yearly drug & premium cost specifically for your medications. A plan with little or no premium may end up being more expensive if it charges large copayments for your medications.

You can click on the drop-down menu at the top of the page to sort the plans by Lowest drug + premium cost and other criteria. Click on the Plan Details button for each plan to get more information about copayments and monthly costs for the drugs on your list. You’ll also see when youll enter and leave the coverage gap, based on the costs of your drugs.

You May Like: Are Dental Implants Covered By Medicare

When To Sign Up For Medicare

If you are already taking Social Security benefits, you will be automatically enrolled in Parts A and B. You can choose to turn down Part B, since it has a monthly cost if you keep it, the cost will be deducted from Social Security if you already claimed benefits.

For those who have not started Social Security, you will have to sign yourself up for Parts A and B. The seven-month initial enrollment period begins three months before the month you turn 65 and ends three months after your birthday month. To ensure coverage starts by the time you turn 65, sign up in the first three months.

If you are still working and have health insurance through your employer , you may be able to delay signing up for Medicare. But you will need to follow the rules and must sign up for Medicare within eight months of losing your employers coverage to avoid significant penalties when you do eventually enroll.

How Do I Know If I Have Medicare

Since Medicare is a national program, all Medicare insurance cards look the same. Heres an example:

People with Medicare Advantage will have two insurance cards: One for traditional Medicare, and one for their Medicare Advantage plan. Medicare Advantage cards will look different from each other, depending on the plan.

Recommended Reading: How To Pay For Medicare Without Social Security

Medicaid Vs Medicare: You Can Have Both

Posted: January 17, 2020

Medicaid and Medicare. Its hard to think of two words that cause as much confusion.

- Whats the difference between these two government health insurance programs?

- What exactly are Medicaid and Medicare?

- Whos eligible to get Medicaid or to get Medicare?

- And how can some people get both?

Read on to find out the answers to these questions and more.

You May Like: Midwives In Houston That Accept Medicaid

Medicare Supplement Medigap Insurance

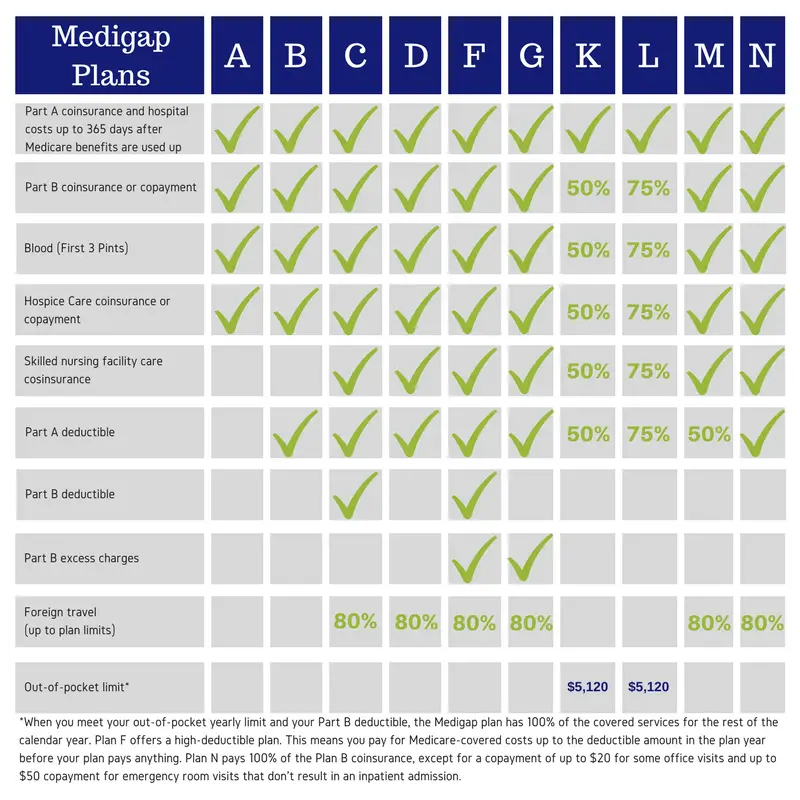

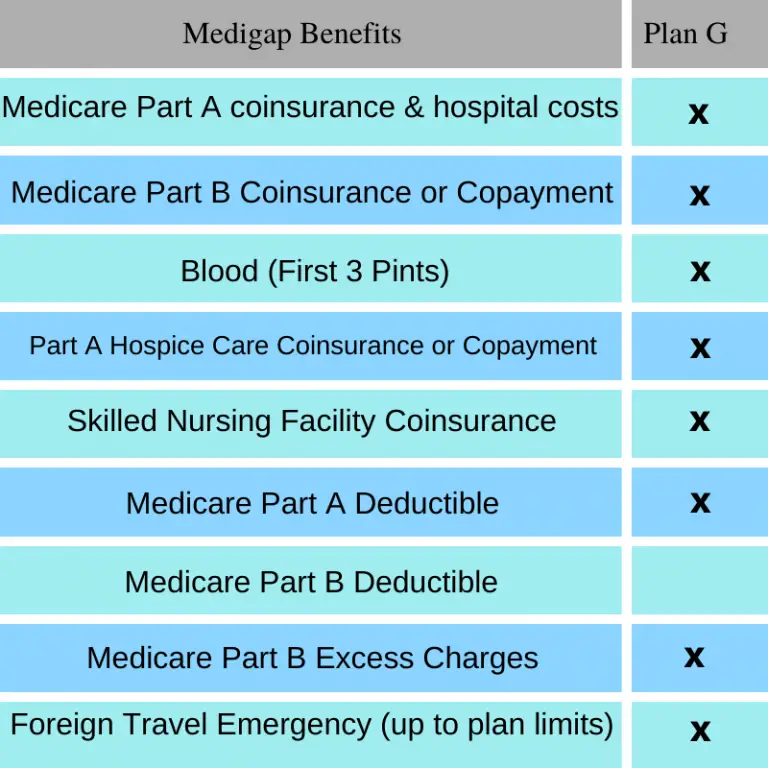

Medicare Supplement insurance is health insurance sold by private insurance companies to cover some of the “gaps” in expenses not covered by Medicare.

For policies sold before June 01, 2010, there are fourteen standardized plans A through L. For policies sold on or after June 01, 2010, there are 11 standardized plans A through N. Each standardized Medigap policy must provide the same basic core benefits such as covering the cost of some Medicare copayments and deductibles. Some of the standardized Medigap policies also provide additional benefits such as skilled nursing facility coinsurance and foreign travel emergency care. However, in order to be eligible for Medigap coverage, you must be enrolled in both Part A and Part B of Medicare.

As of June 1, 2010, changes to Medigap resulted in modifications to the previously standardized plans offered by insurers. Medigap plans H, I, and J, which contained prescription drug benefits prior to the Medicare Modernization Act, were eliminated. Plan E was also eliminated as it is identical to an already available plan. Two new plan options were added and are now available to beneficiaries, which have higher cost-sharing responsibility and lower estimated premiums:

- Plan M includes 50 percent coverage of the Medicare Part A deductible and does not cover the Part B deductible

- Plan N does not cover the Part B deductible and adds a new co-payment structure of $20 for each physician visit and $50 for each emergency room visit

Don’t Miss: What Age Do You File For Medicare

What Are The 2023 Income Adjustments For Medicare Part D

If you receive Medicare Part D for prescription drug coverage — which received a massive boost this year from the passage of the Inflation Reduction Act — and earn more than a certain amount, you’ll need to pay extra monthly. The adjustment amounts for each income tier haven’t changed much at all from 2022, but the income brackets themselves all rose about 6%.

What Are My Costs

- Original Medicare

-

- For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance.

- You pay a premium for Part B. If you choose to join a Medicare drug plan, youll pay a separate premium for your Medicare drug coverage .

- There’s no yearly limit on what you pay out of pocket, unless you have supplemental coveragelike Medicare Supplement Insurance .

- Medicare Advantage

-

- Out-of-pocket costs varyplans may have different out-of-pocket costs for certain services.

- You pay the monthly Part B premium and may also have to pay the plan’s premium. Plans may have a $0 premium or may help pay all or part of your Part B premium. Most plans include Medicare drug coverage .

- Plans have a yearly limit on what you pay out of pocket for services Medicare Part A and Part B covers. Once you reach your plans limit, youll pay nothing for services Part A and Part B covers for the rest of the year.

You May Like: When Are You Eligible For Medicare Part B