Employer Or Military Retiree Coverage

If you or your spouse has an Employer Group Health Plan as retiree health coverage from an employer or the military , you may not need additional insurance. Review the EGHPs costs and benefits and contact your employer benefits representative or SHIIP to learn how your coverage works with Medicare.

What Is A Zero Premium Medicare Advantage Plan

Medicare Advantage plans are offered to you through a private insurance company. These plans replace traditional Medicare coverage: Part A being hospital insurance, Part B is medical insurance, and Part D, which provides prescription drug coverage.

Depending on the plan you choose, a Medicare Advantage plan may also cover extra services like hearing, vision, dental, and other wellness programs that traditional Medicare does not.

To keep costs low, the federal government contracts with private insurance companies to provide your plan. Through this contract, the government pays a flat fee to the insurance company. The insurance company then creates agreements with a network of hospitals or providers, which keeps your costs lower as long as you stay in network.

Most health plans have a maximum amount that a person has to pay out of pocket. Once that amount is met, the health plan will cover 100 percent of the cost for the healthcare services for the rest of the year.

Medicare Prescription Drug Coverage

Medicare Prescription Drug Plans are sold by private insurance companies approved by Medicare. All people new to Medicare have a seven-month window to enroll in a PDP three months before, the month of and three months after their Medicare becomes effective. The month you enroll affects the PDPs effective date. All people with Medicare are eligible to enroll in a PDP however, unless you are new to Medicare or are entitled to a Special Enrollment Period, you must enroll or change plans during the Open Enrollment Period for Medicare Advantage and Medicare Part D, Oct. 15 through Dec. 7. There is a monthly premium for these plans. If you have limited income and assets/resources, assistance is available to help pay premiums, deductibles and co-payments. You may be entitled to Extra Help through the Social Security Administration. To apply for this benefit contact SHIIP at 1-855-408-1212 or the Social Security Administration at 800-772-1213 or www.socialsecurity.gov.

Also Check: Do Medicare Advantage Plans Cover Chemotherapy

How To Apply Online For Just Medicare

Are you within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet? You can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later. It takes less than 10 minutes, and there are no forms to sign and usually no documentation is required.

To find out what documents and information you need to apply, go to the .

Medicare For Individuals Who Are Divorced Or Widowed

Many individuals who are divorced or widowed are concerned that the loss of their spouse will somehow affect their ability to qualify for Original Medicare .

Rest assured your marital status does not affect your ability to qualify for Medicare. You are eligible for Medicare if:

- You are a U.S citizen or legal resident for at least 5 consecutive years and

- Age 65 or older or

- Younger than 65 with a qualifying disability or

- Any age if you have end-stage renal disease or amyotrophic lateral sclerosis .

Recommended Reading: Which One Is Better Medicare Or Medicaid

Who Is Eligible For Part A

In order to receive premium-free Part A, you must of course be eligible for Part A generally. The eligibility for Part A is simple: if you are 65 or older, have been receiving disability benefits for 25 months or longer, and have ESRD or ALS , then you are eligible to receive Medicare Part A insurance.

Structure Your Income To Avoid A Premium Surcharge

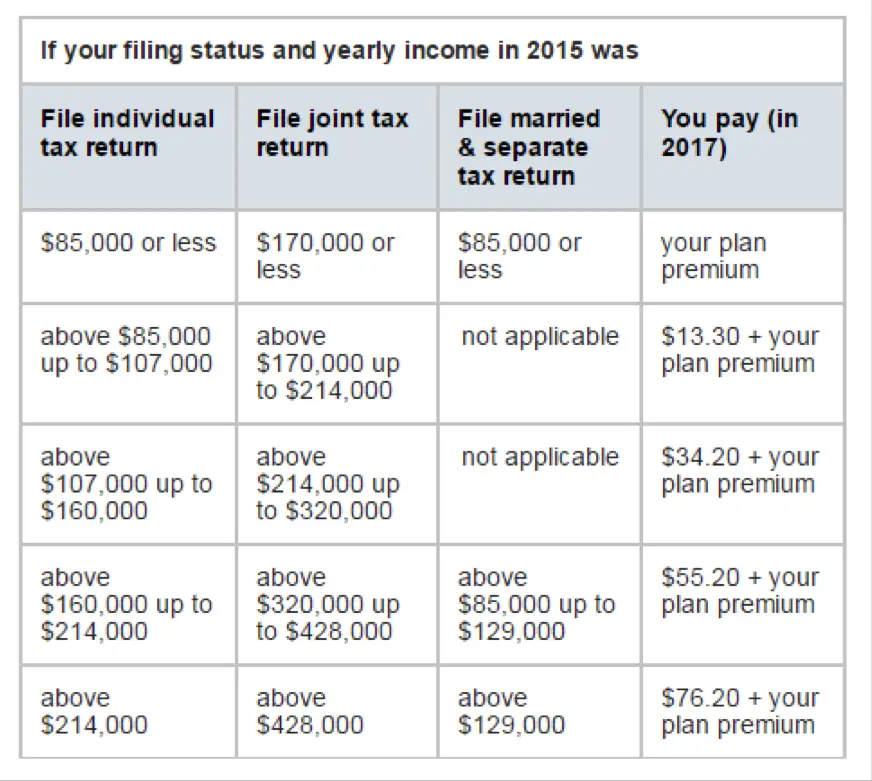

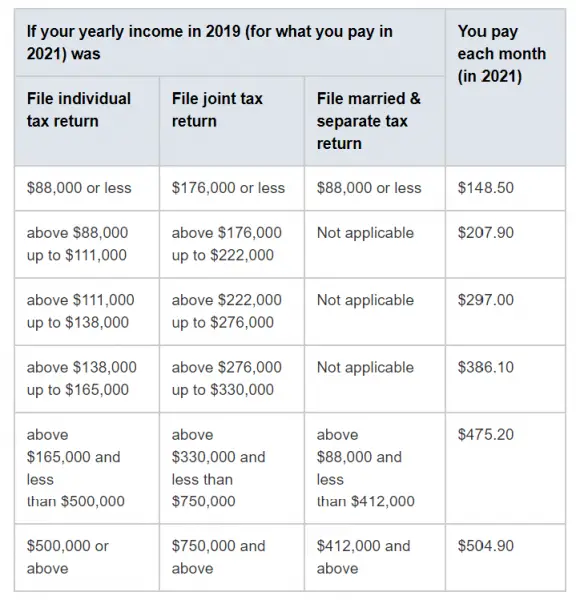

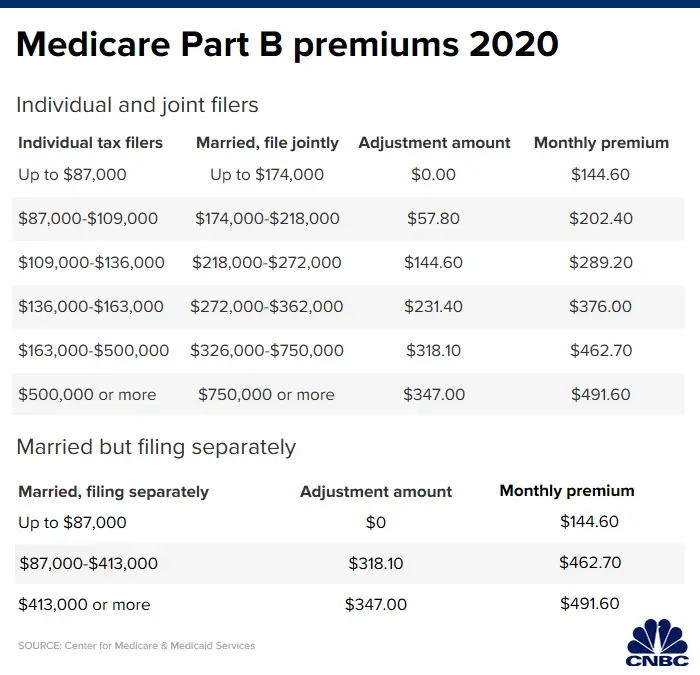

The standard premium for Medicare Part B is $170.10 per month in 2022, and dropping to $164.90/month in 2023. But that assumes youre not a higher earner. Those with higher income levels are subject to higher premium costs. For 2022 heres what youll pay for Part B if your income falls into the level that triggers a surcharge:

| 2022 Medicare Part B premium costs by income level | ||

|---|---|---|

| Income level: individual tax filer | Income level: joint tax filer | Total monthly premium |

| $750,000 and above | $560.50 |

If youre able to defer income strategically to future tax years so that you can report a lower total on your tax return, you might save yourself a higher premium charge for at least a year, since those surcharges are based on previous tax returns. For example, your 2022 tax return will determine whether you pay a surcharge in 2024 .

You May Like: Are Spouses Eligible For Medicare

Who Is Eligible For Medicare Benefits

Any U.S. citizen age 65 or over is eligible for Medicare benefits. Permanent U.S. residents who have lived in the country for at least five consecutive years may also be eligible to enroll.

Individuals on Social Security disability automatically receive Medicare benefits after their 24th disability payment.

If you have end-stage renal disease or amyotrophic lateral sclerosis , you donât have to wait to be on disability for two years before you can enroll in Medicare. Medicare benefits generally kick in on the first day of the 4th month of dialysis treatments for those with ESRD. Lou Gehrigâs disease sufferers qualify for coverage the month they begin receiving disability payments.

Paying For A Prescription Drug Plan

If you qualify for theQMB, SLMB or QI Medicare Savings Programs, then you also automatically qualify for a program called Extra Help designed to help with paying for your prescription drugs. Prescription drug coverage is provided through Medicare Part D, which is why Extra Help is also known as the Part D Low-Income Subsidy. Part D coverage generally comes with a premium, a deductible and a copayment or coinsurance. Learn more about Medicare Part D here.

But you dont have to be in a Medicare Savings Program to receive help paying for your prescriptions under Extra Help. If your annual income as an individual is up to $1,698 per month or $2,288 as a couple in 2022, you may be eligible. Asset limits in 2022 are up to $15,510 for an individual or $30,950 for a couple.

Depending on which Medicare Part D plan you choose, the program can reduce or eliminate your plans premium and deductible, and also lower the cost you pay for the prescription drugs covered under your plan.

Read Also: What Is Taken Out Of Social Security For Medicare

Does Medicare Cover The Costs Of Diabetic Supplies

Yes, Medicare does cover certain supplies if you have diabetes. Part B covered supplies include blood sugar self-testing equipment and supplies, insulin pumps, and therapeutic shoes or inserts. To get Medicare drug coverage, you must join a Medicare prescription drug plan. These plans typically cover insulin, anti-diabetic drugs, and certain diabetes supplies such as syringes and needles. The Medicare Coverage of Diabetes Supplies and Services booklet provides a comprehensive look what diabetes related services are covered.

How Does Social Security Fit In

When you read about Medicare enrollment, you will often see Social Security mentioned. The reason for this is that your Social Security benefits can work in tandem with your Part A and Part B coverage.

Basically, if you already receive Social Security or Railroad Retirement Board benefits, then youll be able to enroll automatically and have your monthly premiums if you have any, taken out of your benefits check automatically.

You May Like: Does Medicare Cover Aba Therapy

How Can I Get Assistance Paying My Health Care Costs

If you have a limited income, you may be able to get assistance with your health care costs through certain programs:

- Medicaid: If you have a low monthly income and minimal assets, you may be eligible for coverage through Medicaid to pay Medicare costs, like copays and deductibles, and for health care not covered by Medicare, such as dental care and transportation to medical appointments.

- Medicare Savings Programs : If you do not qualify for Medicaid but still have problems paying for health care, you may qualify for an MSP, a government-run program that helps cover Medicare costs. There are three types of MSP, and all of them pay the monthly Medicare Part B premium. The Qualified Medicare Beneficiary program covers deductibles and coinsurances as well.

- Extra Help: Also known as the Part D Low-Income Subsidy , this is a federal program that helps pay for some to most of the costs of Medicare Part D prescription drug coverage. You may be eligible for Extra Help if you meet the income and asset limits. Also, in many cases, enrollment in an MSP automatically leads to enrollment in Extra Help.

- State Pharmaceutical Assistance Programs: SPAPs are offered in some states to help eligible individuals pay for prescriptions. Most SPAPs have income guidelines. Many also require you to enroll in a Medicare Part D plan and to apply for Extra Help.

Contact Your Local State Health Insurance Assistance Program

Based on the information you provided, you do not appear to be eligible for Medicare cost-saving programs.

Each state offers a State Health Insurance Assistance Program , partly funded by the federal government, to give you free counseling and assistance. A SHIP counselor may be available by phone or in person.

Visit www.shiptacenter.org to find your local SHIP office.

You May Like: Where Can I Go To Apply For Medicare

How Do I Sign Up For Part A

In most cases, youll be automatically enrolled in Medicare Part A. Youre automatically enrolled in original Medicare which is made up of parts A and B starting on the first day of the month you turn 65 years old.

If youre under age 65 and receiving Social Security or RRB disability benefits, youll automatically be enrolled in Medicare Part A when youve been receiving the disability benefits for 24 months.

If youre not automatically enrolled, you can through the Social Security Administration.

How Can A Medicare Advantage Plan Have A $0 Monthly Premium

Private insurance companies are able to offer zero-premium Medicare Advantage plans, in part, because:

- To help manage costs, Medicare Advantage plans usually enter into contracts with a network of doctors and hospitals.

- That means you may have to pay more money if you see a doctor outside the plans network

Recommended Reading: Does Medicare Cover In Home Help

How Can Shiip Help

Get answers to your Medicare questions.

We offer free, objective information about Medicare, Medicare Advantage plans, Medicare claims, Medicare supplement insurance, Medicare Prescription Drug Plans, fraud and abuse prevention and long-term care insurance. Trained SHIIP volunteer counselors are available for one-on-one counseling in every county in the state.

As Long As You Or Your Spouse Paid The Medicare Tax For At Least 10 Years You Qualify For Premium

When it comes to Original Medicare , most people end up paying relatively little in monthly premiums. One of the main reasons for this is that Medicare Part A health insurance is offered to most beneficiaries with no premiums at all.

The way that this works can be a bit complex, and most people never have to deal with it: they automatically receive medical insurance and never pay a premium. However, understanding who qualifies for this premium-free version of Part A, as well as what exactly it entails, is essential if youre going to be enrolling in Medicare soon.

Well run through the full set of details regarding how premium-free Part A works, including some misconceptions about what you will pay as well as exactly what you need to know to find out if you qualify.

Read Also: Will Medicare Pay For A Medical Alert Necklace

% California Working Disabled Program

The 250% California Working Disabled program helps Californians who are working, disabled and have income too high to qualify for free Medi-Cal. Californians who qualify may be able to receive Medi-Cal by paying a small monthly premium based on their income. Premiums range from $20 to $250 per month for an individual or from $30 to $375 for a couple.

To qualify, you must:

Also learn about how AB 1269 made the California Working Disabled program event better. This bill was signed into law in 2009 and became effective August 2011.

All these CWD rules are explained in more detail in the Medi-Cal section of the Disability Benefits 101 website.

How Do I Enroll In A Medicare Supplement Plan

Medicare Supplement Insurance plans are one health insurance option for people with Original Medicare. There are standardized Medicare supplement insurance plans available that are designed to fill the gaps left by Original Medicare . These are sold by private insurance companies as individual insurance policies and are regulated by the Department of Insurance. After age 65 and for the first six months of eligibility for Medicare Part B, beneficiaries have an Open Enrollment Period and are guaranteed the ability to buy any of these plans from any company that sells them. Companies cannot deny coverage or charge more for current or past health problems. If you fail to apply for a Medicare supplement within your Open Enrollment Period, you may lose the right to purchase a Medicare supplement policy without regard to your health. Information about the Medicare supplement plans sold in North Carolina is available from SHIIP by calling us toll-free at 1-855-408-1212.

Use our free tool to find estimated premium rates.

Read Also: Does Medicare Cover A 3d Mammogram

What Is Part A

Medicare Part A is often referred to as your hospital insurance. However, its more accurately described as inpatient insurance: it covers the health care you receive while you are an inpatient. This includes things like hospice care, skilled nursing facility care, and home care in some instances.

Part A is part of Original Medicare, which means that you may be enrolled in it automatically when you become eligible at age 65.

When Do I Use My Medicare Cards

Everyone who enrolls in Medicare receives a red, white, and blue Medicare card. This card lists your name and the dates that your Original Medicare hospital insurance and medical insurance began. It will also show your Medicare number, which serves as an identification number in the Medicare system.

If you have Original Medicare, make sure you always bring this card with you when you visit doctors and hospitals so that they can submit bills to Medicare for payment. If you have a supplemental insurance plan, like a Medicare Supplement Plan, retiree, or union plan, make sure to show that plans card to your doctor or hospital, too, so that they can bill the plan for your out-of-pocket costs.

Note: Medicare has finished mailing new Medicare cards to all beneficiaries. You can still use your old card to get your care covered until January 1, 2020. However, if you have not received your new card, you should call 1-800-MEDICARE and speak to a representative.

If you are enrolled in a Part D plan , you will use the Part D plans card at the pharmacy.

Remember: Do not give your Medicare or Social Security numbers or personal data to strangers. Medicare will never ask for this information over the phone. If you believe you have been the target of Medicare marketing or billing fraud, contact your local Senior Medicare Patrol.

Read Also: What Do You Need To Sign Up For Medicare

Sign Up For Part B On Time

Your initial window to enroll in Medicare begins three months before the month of your 65th birthday, and ends three months after that month. If you dont sign up during that seven-month period, you can enroll during Medicares General Enrollment Period each year.

But for each 12-month period you go without Medicare coverage despite being eligible, youll be hit with a penalty that raises your Part B premium cost by 10%. Worse yet, that penalty will remain in effect for the rest of your life. The takeaway? If you want to save money, dont be late.

Is Medicare Advantage Really Free Monthly Plan Premium Explained

You may be surprised to learn that some Medicare Advantage plans have a monthly plan premium of $0. Thats rightzero dollars per month. And that usually includes coverage for services that arent covered under Original Medicare.

For most of us, costs and coverage are the 2 main factors when it comes time to choose a Medicare Advantage plan. Learn more about the $0 monthly premium Medicare Advantage plans, including how they work and how to enroll.

Recommended Reading: How Many Medicare Plans Are There

Can I Get No

Medicare includes Part A, Part B, Part C, and Part D. There are several programs that may help a person to get reduced or premium-free Medicare parts B, C, and D.

For example, a person with certain income and assets conditions may get some parts of Medicare premium-free through the Medicare savings programs , which are run by state governments.

Other programs include Extra Help and Medigap.