More Medical Plans Through Your Employer

Medical plans are insured and/or administered by Cigna Health and Life Insurance Company or Connecticut General Life Insurance Company. Plans contain exclusions and limitations and may not be available in all areas. For costs and details of coverage, see your plan documents. Policy forms: OK – HP-APP-1 et al., OR – HP-POL38 02-13, TN – HP-POL43/HC-CER1V1 et al. .

- I want to…

Disclaimer Individual and family medical and dental insurance plans are insured by Cigna Health and Life Insurance Company , Cigna HealthCare of Arizona, Inc., Cigna HealthCare of Georgia, Inc., Cigna HealthCare of Illinois, Inc., and Cigna HealthCare of North Carolina, Inc. Group health insurance and health benefit plans are insured or administered by CHLIC, Connecticut General Life Insurance Company , or their affiliates . Group Universal Life insurance plans are insured by CGLIC. Life , accident, critical illness, hospital indemnity, and disability plans are insured or administered by Life Insurance Company of North America, except in NY, where insured plans are offered by Cigna Life Insurance Company of New York . All insurance policies and group benefit plans contain exclusions and limitations. For availability, costs and complete details of coverage, contact a licensed agent or Cigna sales representative. This website is not intended for residents of New Mexico.

What Is Covered By An Indemnity Health Insurance Plan

Your indemnity policy booklet or your employee benefit booklet will spell out the terms and conditions of what is covered and what is not covered. Read your policy or benefit booklet before you need health care services and ask your health insurance agent, insurance company or employer to explain anything that is unclear.

A Hospital Indemnity Plan Gives You Protection

You have two main choices for a Hospital Indemnity plan. One will pay you a lump sum if youre confined in a hospital . The number of days youre in the hospital doesnt change the total amount youll be paid. The other choice will pay you a set amount for each day that youre confined in the hospital . Both will pay you for either an observation or inpatient stay.

Youll want to decide which type of Hospital Indemnity plan and coverage amount makes the most sense for your personal situation. A major factor is the amount of out-of-pocket expense you would be responsible for your current insurance coverage if you were hospitalized.

Recommended Reading: Can Medicare Take Your House

Plans Do Not Restrict Access Based On Geographic Location

As explained in our definition of the indemnity health plan above, in an indemnity plan, you have the freedom to choose your doctor, specialist, or hospital with few, if any limitations.

In some cases, HMO and PPO’s may limit your options for a doctor, specialist, or hospital by geographic restriction, or area in which the provider is located. This gives a significant advantage to the freedom offered by an indemnity plan for many people.

Notice Of Coverage Options Available Through The Exchanges

Section 18B of the Fair Labor Standards Act , as added by section 1512 of the Affordable Care Act, generally provides that, in accordance with regulations promulgated by the Secretary of Labor, an applicable employer must provide each employee at the time of hiring , a written notice:

Q1: When do employers have to comply with the new notice requirements in section 18B of the FLSA?

You May Like: What Age Do You Register For Medicare

A Huge Market Opportunity

Letâs take a look at some statistics. According to the Kaiser Family Foundationâs A Dozen Facts About Medicare Advantage in 2020:

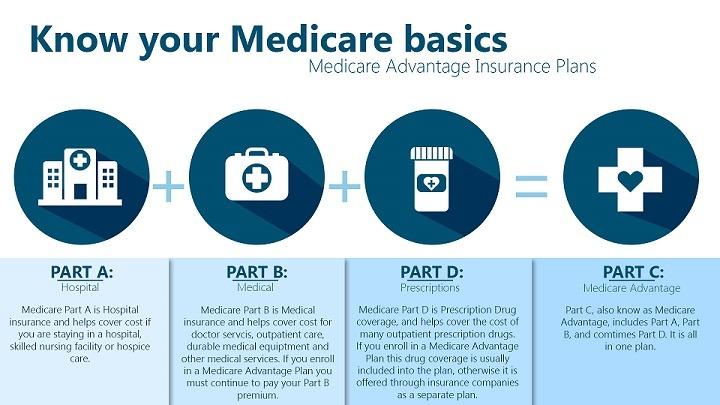

- 36% of Medicare beneficiaries are in MA plans as of 2020.

- 89% of MA beneficiaries are enrolled in Medicare Advantage Prescription Drug plans.

- Of those 89% of MAPD beneficiaries, a whopping 60% dont pay a premium for their plan.

- Those in MA plans in 2020 have average out-of-pocket limit of $4,925 dollars for in-network services and an average out-of-pocket limit of $8,828 dollars for out-of-network services .

Right now, there are a lot of beneficiaries out there who could benefit from hospital indemnity plans. With the Congressional Budget Office projecting that MA enrollment will grow to 51 percent by 2030, you should expect to keep meeting people who make excellent prospects for this product.

Right now, there are a lot of beneficiaries who could benefit from hospital indemnity plans.

If You Choose A Cigna Indemnity Plan Its Important To Know How It Works2

- You choose any licensed dentist for routine, preventive, diagnostic and emergency dental care.

- You dont have to choose a primary care dentist or get specialist referrals.

- Your plan benefit summary highlights the dental procedures covered by your plan.2

- When you meet your annual deductible and satisfy any waiting periods, you pay a coinsurance , and the plan pays the rest .

Read Also: How Much Medicare Is Taken Out Of Social Security Check

Compliance Of Health Reimbursement Arrangements With Public Health Service Act Section 2711

Q2: May an HRA used to purchase coverage on the individual market be considered integrated with that individual market coverage and therefore satisfy the requirements of PHS Act section 2711?

No. The Departments intend to issue guidance providing that for purposes of PHS Act section 2711, an employer-sponsored HRA cannot be integrated with individual market coverage or with an employer plan that provides coverage through individual policies and therefore will violate PHS Act section 2711.

Q3: If an employee is offered coverage that satisfies PHS Act section 2711 but does not enroll in that coverage, may an HRA provided to that employee be considered integrated with the coverage and therefore satisfy the requirements of PHS Act section 2711?

No. The Departments intend to issue guidance under PHS Act section 2711 providing that an employer-sponsored HRA may be treated as integrated with other coverage only if the employee receiving the HRA is actually enrolled in that coverage. Any HRA that credits additional amounts to an individual when the individual is not enrolled in primary coverage meeting the requirements of PHS Act section 2711 provided by the employer will fail to comply with PHS Act section 2711.

Q4: How will amounts that are credited or made available under HRAs under terms that were in effect prior to January 1, 2014, be treated?

What Is Hospital Indemnity Insurance

Hospital Indemnity insurance can reduce hospital costs, even for those with Medicare. When choosing your plan, you can select a per-day cash amount and benefit periods.

Plans with more benefits will cost more than those with fewer benefits. But, your options have some customizable options. You can use the cash benefit to cover things like medical copayments or deductibles. Also, if you need to use the benefit to pay rent or utilities, you can.

The benefit periods are the maximum amount of days spent in the hospital that your policy will cover. Hospital Indemnity policies tend to include a variety of services.

Benefits can include one of four services:

- Before your hospital stay

- During an outpatient hospitalization

Don’t Miss: Does Medicare Pay For Bunion Surgery

Affordable Care Act Implementation Faqs

Set out below are additional Frequently Asked Questions regarding implementation of various provisions of the Affordable Care Act. These FAQs have been prepared by the Departments of Labor, Health and Human Services , and the Treasury . Like previously issued FAQs, these FAQs answer questions from stakeholders to help people understand the new law and benefit from it, as intended.

What It Means To Pay Primary/secondary

- The insurance that pays first pays up to the limits of its coverage.

- The one that pays second only pays if there are costs the primary insurer didn’t cover.

- The secondary payer may not pay all the uncovered costs.

- If your group health plan or retiree health coverage is the secondary payer, you may need to enroll in Medicare Part B before your insurance will pay.

If the insurance company doesn’t pay the

promptly , your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should’ve made.

Also Check: How Do I Apply For Medicare In Missouri

My Clients Needs Come First

Steve has been very instrumental in helping me navigate the available Medicare options, so I was able to choose the Medicare Advantage Plan that was best for me. He has always maintained a professional demeanor. He is very pleasant and personable to interact with. He has taken an interest in me as a person and is always available to answer any questions I may have. I look forward to many years of having Steve be my Medicare Health Insurance representative.Teresa S.

I found Steve thru a friend for help with my Medicare plan enrollment. He was very knowledgeable and professional in getting me enrolled in the correct Medicare plan and would highly recommend him to anyone.Jerry C.

I am happy with Steves complete communication and understanding of each and everything that I needed in reference to my Medicare health insurance. Thank you very much and I am happy in my retirement.Timothy S.

Steve gave me personal attention and guidance to help me get started with Medicare. He explained my options clearly, and patiently answered all of my questions. I would highly recommend working with Steve.

John A.

How Much Money Is Included In A Cash Benefit

The amount of money you receive in a cash benefit will vary depending on your plan and the medical service is covered. Benefits can be as low as $50 for lower-end services and as much as $2,000 for things like surgery. These amounts will be predetermined in your plan.

Some average cash benefits you may receive with fixed indemnity health insurance include:

- $50: X-rays, preventative care

- $800 per day: daily hospital confinement or

- $2000: surgery.

You May Like: How Do I Know If I Have Part D Medicare

Hospital Indemnity Insurance Helps Protect You From Costs Medicare Insurance Does Not Cover

Its becoming more common that Medicare beneficiaries are entering hospitals as observation patients, which isnt covered by Part A of Original Medicare. In fact, in the span of 8 years, the number has doubled to nearly 1.9 million beneficiaries. That means you cant count this time in observation towards the three-day inpatient hospital stay needed for Medicare to cover your skilled nursing facility stay.

A Hospital Indemnity insurance plan can provide help to offset costs not covered by your insurance plan if you are hospitalized. These costs can include deductibles, copays, and other unexpected or additional expenses. Benefits are paid directly to you, or a medical provider that you designate, and are paid in addition to any other health care coverage.

Some of the advantages of Aetnas Hospital Indemnity plans are:

- Daily hospital coverage up to $300 per day for up to 20 days per period of care with a lifetime maximum of 365 days

- Daily Nursing/Assisted Living facility care up to $300/day maximum

- A lump sum amount if you are confined in a hospital

- Observation stays are included

- This isnt a one-time payout. A new benefit period begins each time youve been released from the hospital and 60 days has elapsed. The policy pays every new benefit period.

- Policies are guaranteed renewable for life as long as premiums are paid on time.

Whats Covered Under Fixed Indemnity Health Insurance

This varies with each plan. Each fixed indemnity plan covers certain medical services, and may cover some of the following:

- First Day Hospital Coverage: You receive a fixed cash benefit for the first day of a confined stay in a hospital

- Daily Hospital Coverage: You receive a fixed cash benefit for each day in the hospital up to a certain number of days. . For example, if you end up in a hospital for 6 days, it may cover days 2 to 6

- Intensive Care Unit Coverage: You receive a fixed cash benefit for each day in the ICU depending on the number of days

- Surgery: You receive a fixed cash benefit for any surgical operation

- ER visit: You receive a fixed cash benefit for any trip to an emergency room

- Ambulance: You receive a fixed cash benefit for any ride in an ambulance, including both ground and air ambulances or

- X-rays: You receive a fixed cash benefit for a diagnostic x-ray or other laboratory imaging.

Read Also: Does Medicare Pay For Revitive

How Does A Hospital Indemnity Plan Work With Medicare A Case Study

Josh Hurley

Meet Grace â a 65-year-old woman with a Medicare Advantage plan. Though her plan is great, it leaves her with a copay of $250 per day for the first five days of an inpatient hospital stay. Should you recommend that she buy a hospital indemnity plan?

Listen to this article:

Hospital indemnity insurance often provides beneficiaries with predetermined benefit amount upon a qualifying health event . This benefit can help the policyholder pay for deductibles, copays, lodging, and more. You can continue reading about the basics of hospital indemnity insurance here. Now, letâs take a look at if this extra coverage would make sense for someone on Medicare, like Grace.

Why Do I Need It

4 Things to Know

After being confined in the hospital for days, some people are surprised to discover their stay was categorized as hospital observation. GTLs Advantage Plus covers hospital observation.

GTLs Advantage Plus plan is guaranteed issue for ages 64 1/2 to 65 1/2 and a simple yes/no application for other ages.

Coverage is guaranteed renewable for life as long as your premiums are paid on time.

The policy gives you access to the Ask Mayo Clinic online symptom assessment tool you can use 24/7 as a trustworthy medical resource.

Don’t Miss: What Does Medicare Part B Include

Hospital Indemnity Insurance For Medicare Advantage

Medicare Advantage plans may impose additional out-of-pocket costs if you have an accident, long-term illness or other hospital stay. You may face large copays for your first few days in the hospital. Your deductibles, copayments and coinsurance can add up quickly.

Your maximum out-of-pocket expenses can be $3,000 to $10,000 for a hospital stay.

Hospital indemnity insurance pays you a fixed amount for each day youre hospitalized to help offset your MOOP.

But hospital indemnity is not for everyone on Medicare Advantage. You should look closely at your Medicare Advantage plan and compare it to the indemnity plan you are considering to see if it fits your needs.

What to Consider Before Buying a Hospital Indemnity Plan

Types Of Hospital Indemnity Insurance Coverage

Different hospital indemnity insurance plans offer benefits beyond inpatient hospitalization. These options may cost more, but they can cover out-of-pocket costs for specific situations your Original Medicare or Medicare Advantage may not.

Its important to consider what options you want and whether or not your other plans cover what you believe you will need in the future.

Be sure to ask for the options you think you will need and compare supplemental insurance if you are considering an indemnity plan.

Options for Hospital Indemnity Insurance Coverage

- Emergency Care Before Hospitalization

- Some indemnity plans cover visits to urgent care or emergency rooms and ambulance transport that end up as inpatient hospitalization. Coverage is usually a lump-sum cash payment for each service.

- Family Assistance During Hospitalization

- Options may include daily payment for transport and lodging for family members to be near you when you are hospitalized.

- Treatment After Hospitalization

- If you need additional treatment after youre discharged from the hospital, this option can help cover out-of-pocket costs for physical therapy or other therapy. It can also cover your stay in a skilled nursing facility.

- Outpatient Hospitalization

- Medicare and Medicare Advantage plans consider observation care as outpatient hospitalization and pay different amounts than for inpatient hospitalization. An indemnity plan can help cover the gap in what you have to pay.

Recommended Reading: Where To Send Medicare Payments

How Does A Fixed Indemnity Plan Work

A fixed indemnity insurance product like Health ProtectorGuard, underwritten by Golden Rule Insurance Company, works differently than other insurance you might have had in the past that helped pay for health-related costs.F10 Fixed indemnity insurance pays a set benefit per specified medical expense, as opposed to a share of the total covered costs after a deductible, which is an approach you might be used to.

So how does that actually work? A look at a couple common scenarios might help you understand the benefits of this type of fixed indemnity plan.

Heres An Illustration Of How Guardian Hospital Indemnity Insurance Works

Carol goes to the ER for severe abdominal pain and nausea. She has a CT scan that reveals she has gallstones. She is admitted and has emergency surgery to remove her gallbladder. She stays for one night and is released the next day.

While Carol has medical insurance, she still needs to pay $3,815 of out-of-pocket expenses due to her deductible , coinsurance, and other expenses not covered by her plan. Since she has Guardian Hospital Indemnity insurance, her out-of-pocket cost is reduced by 85% to $565.*

| Out-of-Pocket Cost Summary | |

|---|---|

| Cost Savings | 85% |

*For illustrative purposes only. Covered benefits and benefit amounts may vary by employer-sponsored plan. See your plan for specific coverage amounts and details.

You May Like: What Does Medicare Cost Me