It Looks Like The Ssa Used 3 Year Old Information To Calculate My Irmaa Even Though I Have A More Recent Tax Return On File What Can I Do

It appears that this is a common occurrence. In fact, it’s common enough for the SSA procedure manual to have its own section that outlines what to do:

To summarize, this is the process by which the SSA office should verify the taxpayer’s more recent return, and use that information to re-run the IRMAA calculation. For example, a client recently asked about her 2021 IRMAA, which was calculated using 2018 tax return information, even though she and her husband had filed a 2019 tax return.

This shouldnot require an SSA-44, because this is not considered a life-changing event. This is a completely different procedural matter that requires a different process to resolve it.

Update: Recently, a client had this conversation with the SSA on this very matter. It appears that something in the SSA’s system is automatically generating a lot of these notices, which the SSA is trying to get fixed. Two different SSA employees told her that in the interim, the best way to resolve this is to

- Contact the SSA office to inform them of this

- Resubmit the SSA-44 form. If possible, put the form to the attention to the person/department you discussed this with

Your mileage may vary. Will update this post as warranted.

In What Situations Can I Appeal

There are two situations when you can appeal an IRMAA.

The first situation involves the tax information used to determine the IRMAA. Some examples include:

- The data used by the SSA to determine the IRMAA is incorrect.

- The SSA used older or out-of-date data to determine the IRMAA.

- You filed an amended tax return during the year the SSA is using to determine the IRMAA.

The second situation involves life changing events that significantly impact your income. There are seven qualifying events:

- signed statement from your employer indicating reduction or stoppage of work

- letter or statement indicating a loss or reduction of a pension

- statement from an insurance adjuster indicating loss of an income-generating property

How We Make Money

We sell different types of products and services to both investment professionals and individual investors. These products and services are usually sold through license agreements or subscriptions. Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management. We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters.

Read Also: When Does Medicare Part D Start

What Can I Do If I Dont Want To Pay Irmaa

The Social Security Administration can make a determination if you must pay IRMAA at any time after you apply for Medicare benefits. If you receive a notice from the SSA that you owe IRMAA, and you disagree with the finding, you can file an appeal with the Social Security Administration using information the SSA sends with your initial determination notice. You can also file this form if you experience a life-changing event that has significantly impacted your income for the year.

Do you need Medicare coverage for prescription drugs? Just enter your zip code to begin looking for Medicare Part D plans in your area.

New To Medicare?

Becoming eligible for Medicare can be daunting. But dont worry, were here to help you understand Medicare in 15 minutes or less.

How To Appeal An Irmaa

If you disagree with an IRMAA notice youve received, you can appeal it for several reasons. One reason is the tax information used by the SSA to decide the IRMAA may have been incorrect or outdated. Another reason is you experienced a life changing event such as a loss of income, death of a spouse, marriage or divorce.8

You have 60 days from receiving a notice to file an appeal. To get started, contact the SSA at 800-772-1213 .9

Read Also: How Much Is Premium For Medicare

How Much Will Irmaa Cost You

IRMAA is unique in that it is one of the few taxes that has no phase in with respect to income levels. If you are one dollar above the income threshold, you will pay significantly more for your Medicare.

For example, in 2021, if a married couple on Medicare had income of $176,000, each person will pay $148.50 per month for Medicare Part B. If they have income of $176,001, they will each pay $207.70 per month. That 1 dollar in extra income can cost a married retired couple about nearly $120 per month, or $1,425 per year in extra taxes.

In total there are 6 different brackets for Medicare premiums And so, knowing where those income thresholds are, is a very important place to start.

How To Limit The Impact Of Medicares Irmaa Surcharge

There are a few things retirees can do to limit the impact of IRMAA and keep yourself out of those higher brackets.

First, you can withdrawal money from Roth or taxable brokerage accounts during the year instead of IRAs. This will help reduce income that counts towards the IRMAA limit.

If you dont have investments in a Roth account, you can consider doing Roth conversions which may not help you avoid IRMAA surcharges this year, but can help prevent it in future years.

Also, you can be flexible with your spending, and spread out large withdrawals over multiple years.

For example, if you intend to buy a car in January, maybe you can withdrawal half of the money in December of the year prior, and the remaining half in January to spread the income between 2 different tax years.

Don’t Miss: What Age Can You Get Medicare Health Insurance

Medicare Modernization Act Introduces Income

The Medicare Modernization Act of 2003, which introduced Medicare Part D prescription drug coverage for the first time, also made a shift to how Medicare Parts B and D are funded, by requiring high-income Medicare enrollees to pay a higher-than-25% portion of their Medicare premiums, beginning in 2007.

Specifically, the rules require that Medicare enrollees whose Income exceeds $85,000 must pay 35% of the total Part B premium , rising as high as paying 80% of the total Medicare Part B premium cost once income exceeds $214,000 of Modified AGI .

Similarly, beginning in 2011 under the Affordable Care Act, higher-income individuals are now also required to pay a surcharge on their Medicare Part D prescription drug coverage. Unlike the Part B surcharge which adjusts enrollee premiums to cover a target percentage of total cost the Part D income-related surcharge is simply a flat dollar amount, starting at $13.30/month and rising as high as $76.20/month for those in the highest income tier.

Notably, these income-related monthly adjustment amount surcharges are applied based on Modified Adjusted Gross Income . And each of the four surcharge tiers are cliff thresholds meaning even $1 of income past the threshold results in the entire surcharge amount being applied.

How We Use Your Personal Data

How we use your information depends on the product and service that you use and your relationship with us. We may use it to:

- Verify your identity, personalize the content you receive, or create and administer your account.

- Provide specific products and services to you, such as portfolio management or data aggregation.

- Develop and improve features of our offerings.

To learn more about how we handle and protect your data, visit our privacy center.

Don’t Miss: Is Xolair Covered By Medicare Part B

How Much Does Irmaa 2021 Cost

How Much does IRMAA 2021 Cost?

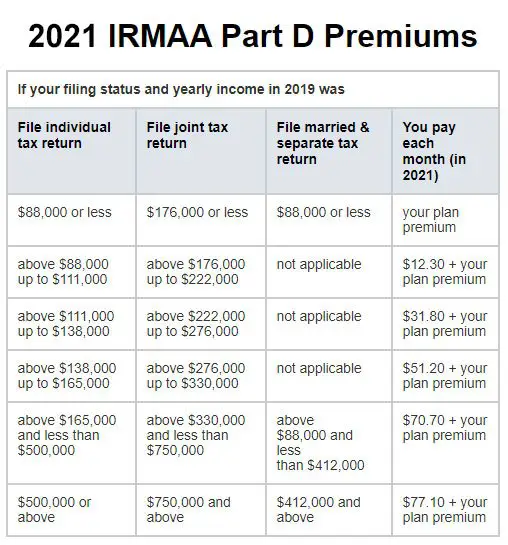

See above the 5 tiers of IRMAA, as well as the cost ranges for Individual, Joint, and Married Filing Separately.

For 2021, the base tier is less than 88k or 176k depending on your filing status. All individuals pay a surcharge of $148.50 for Part B, which is a 3.7% increase from the year previous.

Next, see tier one which starts $1 above the base tier. That $1 over the cliff could cost you an additional $860 in surcharges that year!

If you are in tier 5, you pay an additional $5202 a year. That wont break the bank if you have an income over 750k a year, but you get absolutely nothing for the gift of paying more. Just Medicare parts B and D.

And part D is separate. How much does part D cost? Add $12.30 for tier 1 up to $77.10 for tier 5 per month per person to your plan premium.

IRMAA Part B and Part D add together to give the total surcharge, or tax.

How Much You Pay In Surcharges

These monthly surcharges are on top of your normal original Medicare premiums for Part B and Part D coverage. In many cases, you could end up paying several hundred dollars more a month than what you had planned.

Here are how the monthly charges break down in 2020:

· If youre single and make between $87,000 and $109,000 or married and make between $174,001 and $218,000 jointly, youll pay an extra $57.80 for Part B and $12.20 for Part D.

· If youre single and make more than $109,000 up to $136,000 or married and make over $218,000 up to $272,000 jointly, youll pay an extra $144.60 for Part B and $31.50 for Part D.

· If youre single and make more than $136,000 up to $163,000 or married and make over $272,000 up to $326,000 jointly, youll pay an extra $231.40 for Part B and $50.70 for Part D.

· If youre single and make more than $163,000 and less than $500,000 or married and make over $326,000 and less than $750,000 jointly, youll pay an extra $318.10 for Part B and $70.00 for Part D.

· If youre single and make $500,000 or more or married and make $750,000 or more jointly, youll pay an extra $347.00 for Part B and $76.40 for Part D.

If youre married and lived with your spouse at some time during the taxable year, but filed a separate tax return, the additional monthly charges break down as follows:

· Individuals who make more than $87,000 and less than $413,000 will pay an extra $318.10 for Part B and $70.00 for Part D.

Don’t Miss: Does Medicare Cover International Medical Emergencies

Income Brackets For Part B And Part D Irmaa

For 2021, the income brackets for Part B and Part D are the same. Heres a chart explaining how income affects the Part B premium and Part D IRMAA.4

Part D IRMAA must be paid directly to Medicarenot your plan or employer. Its your responsibility to pay it even if your employer or a third party pays your Part D plan premiums. Youll get a bill each month from Medicare for your Part D IRMAA and can pay it the same way you pay your Part B premiums.7

Requesting A Reconsideration Or Appealing Irmaa Surcharges For A Life

While many higher-income individuals will find themselves perpetually subject to IRMAA, based on ongoing income that exceeds the MAGI thresholds, others may find that IRMAA impacts them only periodically, in occasional years where the first IRMAA tiers are reached.

Accordingly, its important to recognize that even if a household has been subject to IRMAA in the past, he/she will not automatically be subject to the IRMAA surcharges in the future. Instead, the determination is made based on his/her income each year. With the caveat that, due to the nature of the prior-prior year income calculation, that a household could have a reduction in income in the current year, and still be subject to IRMAA due to higher income in prior years.

For instance, a married couple that had higher income in 2016 and 2017, due to a series of substantial Roth conversions in retirement that put their household income over $170,000, would be subject to IRMAA surcharges on their Medicare Part B and Part D premiums in 2018 . Even though, in 2018, their income might be well below the specified threshold . Still, because the 2018 premiums and surcharges in 2018 were calculated based on their 2016 income, IRMAA will apply. Notably, the couple will benefit from their lower income in 2018 which makes them not subject to IRMAA anymore but the lower Medicare Part B and Part D premiums, without IRMAA surcharges, wont apply until 2020 .

Recommended Reading: Does Medicare Part C Cover Dentures

What If Im Unfairly Charged Irmaa

This is a real situation people find themselves in. Remember, the income upon which your Medicare premiums are based is taken from your tax return from two years prior. This can result in a situation where individuals are currently receiving a smaller income but are paying Medicare premiums as though they were making a large income. This situation often presents itself during the transition from working to retirement. If you find that you are incorrectly subject to IRMAA, you can submit a request for reconsideration of your IRMAA to the Social Security office. The Request process involves filling out and submitting an SSA-44 Form which can be found by clicking on this link.

Avoiding Large Irmaa Surcharges Is Another Issue Retirees Need To Consider

Why is my Medicare premium so high next year?!

- Print icon

- Resize icon

I turned age 64 over the Labor Day weekend. One of my goals for my 65th orbit of the sun is to really dig into Medicare.

Luckily, I have a few friends and relatives who have blazed the trail before me. Ive also studied Medicare as part of some financial planning courses I took a few years ago. Still, one topic Ive never researched in detail is Medicares income-related monthly adjustment amount, otherwise known as IRMAA.

Traditional Medicare is made up of Part A , Part B and Part D . Parts B and D have monthly premiums. For 2021, the Part B standard monthly premium is $148.50. Part B also has a $203 deductible. After you meet your deductible, Medicare typically covers 80% of your Part B costs. Meanwhile, the Part D standard monthly premium varies based on the plan you choose.

IRMAA is an amount you may pay in addition to your standard Part B and Part D premiumsif your income is above a certain level. The Social Security Administration has a series of income brackets that determine what that amount is. Most people will pay just the standard premium amount. But if your modified adjusted gross income is above the specified threshold, you may owe IRMAA.

Don’t Miss: How To Change Medicare Direct Deposit

How To Avoid Irmaa 2021

IRMAA stands for Income-Related Monthly Adjustment Amount. What a mouthful-She is a modest penalty for a high-income retiree to swallow. What you do now affects your 2023 IRMAA Brackets!

Two aspects make IRMAAs particularly unpalatable: She is an income cliff penalty. One dollar over the limit could cost you 3.4 times more for the same Medicare services. And secondly, you need to do tax planning TWO YEARS in advance. Without even actually knowing where exactly the cliff is going to be!

Medicare Premiums And Surcharges Examples

Below are three examples of how Medicare premiums and surcharges are computed. Understanding the calculations will help clients appreciate and understand the strategies to lessen the impact.

Example 1

B is single. He usually reports MAGI of about $75,000 per year. He is enrolled in a Medicare Part D plan. In 2017, when his other income included in MAGI is $77,500, he is considering withdrawing an additional $32,500 from his traditional IRA to purchase a car for cash, for a total MAGI of $110,000. How much more will B need to pay in 2019 for Medicare premiums?

If he makes the withdrawal, B will need to pay total Medicare costs of $3,633.60 in 2019, or $2,007.60 in excess of the base premium cost, if his MAGI is increased by the $32,500 . The excess premium will be incurred only for 2019, provided his MAGI in 2018 dropped back below $85,000. The excess premiums represent an increase in household expenses as a percentage of his 2017 income of 1.83% or 2.59% of his normal income level. In this case, B may want to try to keep his income below the $85,000 surcharge threshold by financing his purchase or leasing the car. He could withdraw enough from his IRA to service the debt and still stay below the threshold.

Example 2 concerns a couple who have not signed up for a Part D plan however, they must still pay Part D surcharges, since a former employer has enrolled them and is paying the basic cost as a fringe benefit.

Effect on premiums of an additional IRA withdrawal

Example 2

Also Check: Does Social Security Automatically Sign You Up For Medicare

How Does Medicare Calculate My Premium

Medicare is a federal program that mandates standardization of services nationwide, so many people may assume the premiums would be the same for everyone. In reality, there are variations in the premiums people pay, if they pay any at all.

Medicare qualifications

The formula for determining a persons qualification for Social Security and Medicare is the same. It is based on income earned and taxes paid for the duration of working life. The annual W-2 Form that U.S. employees receive includes not only year-to-date earnings but also taxes paid toward Social Security and Medicare. Forty credits are required to be eligible for benefits. The requirements may be modified for young people claiming disability or survivor benefits. Four is the maximum number of credits a person can earn per year, so it takes at least 10 years or 40 quarters of employment to be eligible for Medicare. The Social Security statement available to registered users on ssa.gov reveals if you have earned enough credits to qualify for Medicare when you reach age of 65.

Medicare Part A premium

Part A and Medicare Part B premiums are calculated differently. For Part A, most Medicare recipients are not charged any premium at all.

Seniors at age 65 are eligible for premium-free Part A if they meet the following criteria:

People under age 65 may receive Part A with no liability for premiums under the following circumstances:

Medicare Part B premium

Related articles: