Medicare Part D: Prescription Drugs

Prescription drug coverage, known as Part D, is also administered by private insurance companies. Part D is optional and is normally included in any Medicare Advantage plan. Depending on your plan, you may have to meet a yearly deductible before your plan begins covering your eligible drug costs. Some Part D plans have a co-pay.

Medicare prescription drug plans have a coverage gapa temporary limit on what the drug plan will cover. The coverage gap is often called the “doughnut hole,” and this gap kicks in after you and your plan have spent a certain amount in combined costs. For example, in 2022 the donut hole occurs once you and your insurer combined have spent $4,430 on prescriptions.

Once you have paid $7,050 in out-of-pocket costs for covered drugs, you have reached the level of “catastrophic coverage,” for 2022 in out-of-pocket costs for covered drugs. This means you are out of the prescription drug “donut hole” and your prescription drug coverage begins paying for most of your drug expenses again.

Many states have insurance options that will close the coverage gap, but these may require paying an additional premium.

Do I Need Medicare Part B If I Have Employer Health Insurance

Summary: You are not required to have Medicare Part B coverage if you have employer coverage. You can drop Medicare Part B coverage and re-enroll in it when you need it. … You also may choose to defer enrollment in Medicare Part B coverage if you are employed at age 65 or older and eligible for Medicare.

Why Is There No Part B Medicare

A person does not have to sign up for Medicare Part B when they turn age 65, providing they have creditable insurance coverage. … When a person stops working, and their employer’s insurance no longer covers them, they can usually qualify for a Special Enrollment Period where they can sign up for Medicare Part B.

Recommended Reading: Do I Need A Primary Care Physician With Medicare

Managing For Success And Savings

The Affordable Care Act has revised the fee for services approach to Medicare and particularly the Original Medicare. The law has moved Medicare to a value-based approach that has turned in some solid signs of improvement in payments, costs, and performance.

The system detects and discourages waste, inaccuracy, and overcharges by providers. Fee for service medicine emphasized the volume of patients seen and the number of services performed.

This approach put pressure on providers to see patients too frequently and perform tests, procedures, and activities with only marginal benefits. The value basis goes to results and efficiency.

What Is The Fastest Way To Apply For Medicare Part B

Asked by: Susie Lind

Apply online This is the easiest and fastest way to sign up and get any financial help you may need. You’ll need to create your secure my Social Security account to sign up for Medicare or apply for Social Security benefits online. Call 1-800-772-1213. TTY users can call 1-800-325-0778.

Read Also: Does Medicare Cover Capsule Endoscopy

What Are Medicare Costs In 2021

Medicare costs include premiums, copays, and coinsurance, all of which are adjusted each year. Increases in 2021 involve Part A deductibles, and coinsurance, along with Part B premiums and the deductible.

According to the 2020 Medicare Trustees Report, it is difficult to predict future Medicare costs because of the uncertainty of changes and advances in technology and medicine.

Each Medicare part has different costs, which help fund Medicare services.

C: Medicare Advantage Plans

With the passage of the Balanced Budget Act of 1997, Medicare beneficiaries were formally given the option to receive their Original Medicare benefits through capitated health insurance Part C health plans, instead of through the Original fee for service Medicare payment system. Many had previously had that option via a series of demonstration projects that dated back to the early 1970s. These Part C plans were initially known in 1997 as “Medicare+Choice”. As of the Medicare Modernization Act of 2003, most “Medicare+Choice” plans were re-branded as “Medicare Advantage” plans . Other plan types, such as 1876 Cost plans, are also available in limited areas of the country. Cost plans are not Medicare Advantage plans and are not capitated. Instead, beneficiaries keep their Original Medicare benefits while their sponsor administers their Part A and Part B benefits. The sponsor of a Part C plan could be an integrated health delivery system or spin-out, a union, a religious organization, an insurance company or other type of organization.

The intention of both the 1997 and 2003 law was that the differences between fee for service and capitated fee beneficiaries would reach parity over time and that has mostly been achieved, given that it can never literally be achieved without a major reform of Medicare because the Part C capitated fee in one year is based on the fee for service spending the previous year.

Don’t Miss: Will Medicare Pay For A New Mattress

Income Related Monthly Adjustment Amount

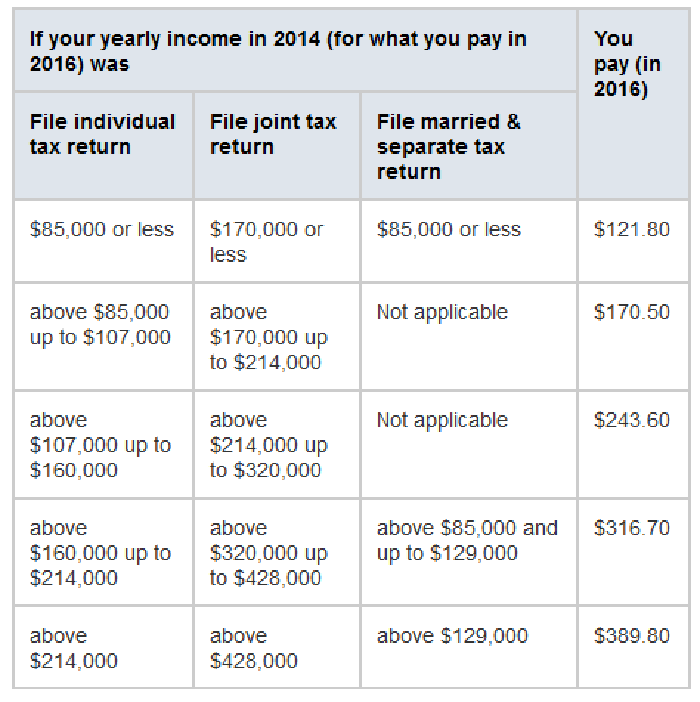

The standard Part B premium amount in 2020 is $144.60.

Most people pay the standard Part B premium amount.

If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, youll pay the standard premium amount and an Income Related Monthly Adjustment Amount .

IRMAA is an extra charge added to your premium.

What Is Retroactive Reimbursement Of Medicare Premium

If you filled any covered prescriptions since < Retroactive Effective Date> , Medicare’s Limited Income Newly Eligible Transition Program will pay you back for what you spent out of pocket for these prescriptions, minus any copayments that apply (up to $3.70 for a generic drug and up to $9.20 for a brand-name drug …

Don’t Miss: What Does Medicare Part B

Will Social Security Get A $200 Raise In 2021

In order for a 5.9% increase to result in an extra $200 per month in benefits, you would have needed to have received at least $3,389 per month in 2021. … This figure changes from year to year to adjust for inflation and is the the amount on which the SSA calculates the maximum Social Security benefit.

What Is The Longer

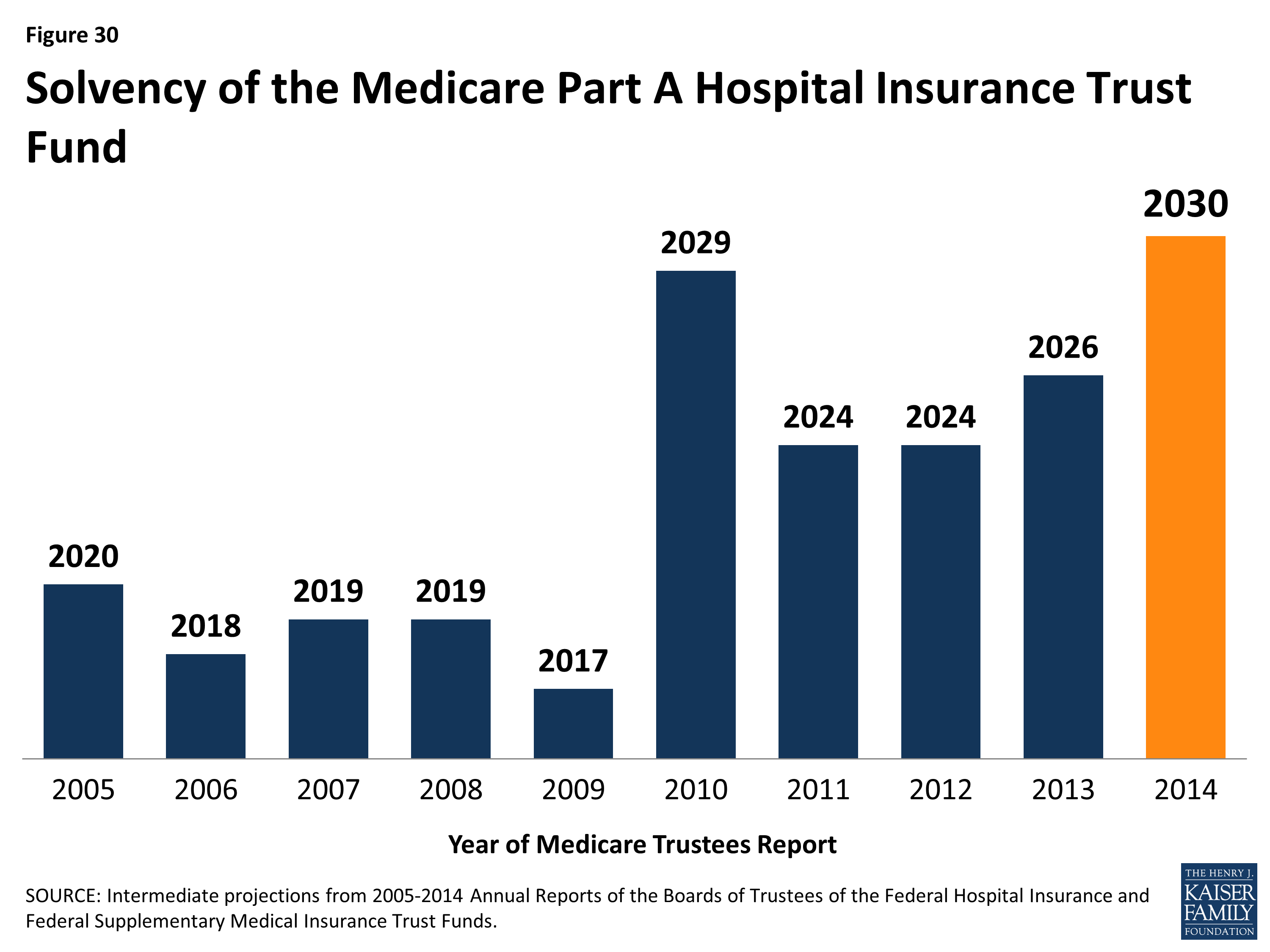

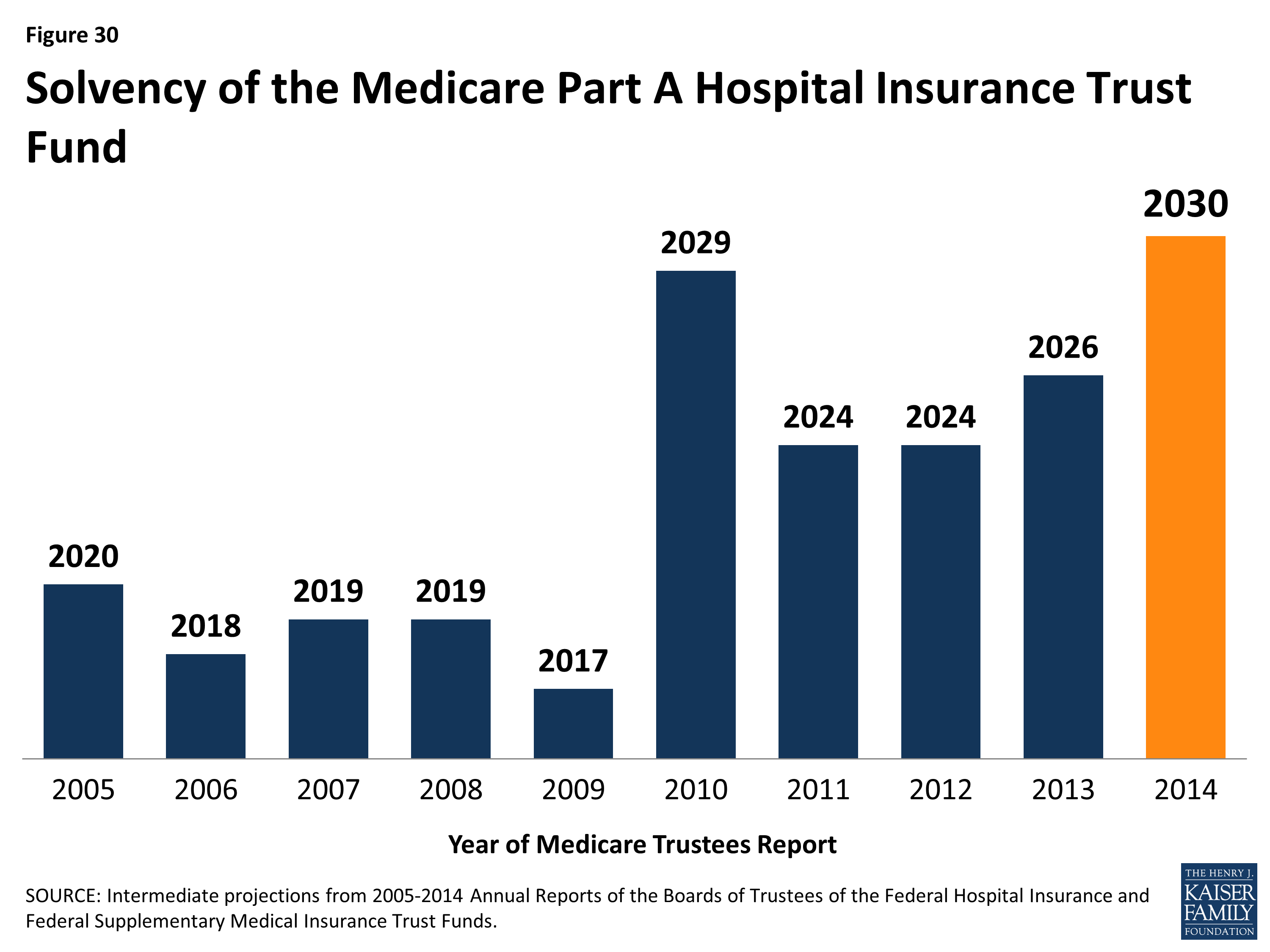

Over the longer term, the Medicare program overall faces financial pressures associated with higher health care costs and an aging population. It remains to be seen how the recent volatility in the economy, higher inflation, and the longer-term health effects of the COVID-19 pandemic will affect spending and revenue projections for the HI trust fund. To sustain Medicare for the long run, policymakers may consider adopting broader changes to the program that could include both reductions in payments to providers and plans or reductions in benefits, and additional revenues, such as payroll tax increases or new sources of tax revenue. Evaluating such changes would likely involve careful deliberation about the effects on federal expenditures, the Medicare programs finances, and beneficiaries, health care providers, and taxpayers.

Topics

Also Check: Does Medicare Pay For A Caregiver In The Home

How Do I Decline Medicare Part A

If you want to disenroll from Medicare Part A, you can fill out CMS form 1763 and mail it to your local Social Security Administration Office. Remember, disenrolling from Part A would require you to pay back all the money you may have received from Social Security, as well as any Medicare benefits paid.

Proposals For Reforming Medicare

As legislators continue to seek new ways to control the cost of Medicare, a number of new proposals to reform Medicare have been introduced in recent years.

Premium support

Since the mid-1990s, there have been a number of proposals to change Medicare from a publicly run social insurance program with a defined benefit, for which there is no limit to the government’s expenses, into a publicly run health plan program that offers “premium support” for enrollees. The basic concept behind the proposals is that the government would make a defined contribution, that is a premium support, to the health plan of a Medicare enrollee’s choice. Sponsors would compete to provide Medicare benefits and this competition would set the level of fixed contribution. Additionally, enrollees would be able to purchase greater coverage by paying more in addition to the fixed government contribution. Conversely, enrollees could choose lower cost coverage and keep the difference between their coverage costs and the fixed government contribution. The goal of premium Medicare plans is for greater cost-effectiveness if such a proposal worked as planned, the financial incentive would be greatest for Medicare plans that offer the best care at the lowest cost.

Currently, public Part C Medicare health plans avoid this issue with an indexed risk formula that provides lower per capita payments to sponsors for relatively healthy plan members and higher per capita payments for less healthy members.

- Senate

Recommended Reading: Does Aetna Medicare Advantage Cover Dental

How Large Is The Projected Shortfall

To address the shortfall between Part A spending and revenues over the next decade, based on the Medicare trustees projections, a total of $247.4 billion in spending reductions or additional revenues, or some combination of both, would be needed to cover the total deficit between 2028 and 2031 . This $247.4 billion deficit represents the cumulative difference between Part A spending and revenues over these years, after taking into account the assets in the trust fund between 2021 and 2028 that can be used to pay for Part A spending until the assets are depleted. Over a longer 75-year timeframe, the Medicare Trustees estimate that it would take either an increase of 0.70% of taxable payroll or a 15% reduction in benefits to bring the HI trust fund into balance.

Speak With A Licensed Agent Today

To learn more about your Medicare options Part A, B, C or D and to learn more about the benefits that might be available in Medicare Advantage plans in your area, call today to speak with a licensed insurance agent.

Or call 1-800-557-6059TTY Users: 711 to speak with a licensed insurance agent. We accept calls 24/7!

About the author

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options.

His work has been featured in outlets such as Vox, MSN, and The Washington Post, and he is a frequent contributor to health care and finance blogs.

Christian is a graduate of Shippensburg University with a bachelors degree in journalism. He currently lives in Raleigh, NC.

Where you’ve seen coverage of Christian’s research and reports:

1 10-minute claim is based solely on the time to complete the e-application if you have your Medicare card and other pertinent information available when you apply. The time to shop for plans, compare rates, and estimate drug costs is not factored into the claim. Application time could be longer. Actual time to enroll will depend on the consumer and their plan comparison needs.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Read Also: Are You Required To Get Medicare At 65

Medicare And The Affordable Care Act

The Affordable Care Act reduced the disparity in drug costs by closing the Donut Hole between the authorizations for prescription benefits.

The ACA reduced some payments to beneficiaries while increasing services in the qualified health plan requirements. Original Medicare meets the standards for Obamacare coverage due to the addition of the below-described essential benefits, prevention services, and wellness reforms.

- Added prevention and wellness benefits at no costs to users

- Reduced the Donut Hole and help it disappear in future years

- Management improvement, costs reduction, and better patient outcomes

- Strengthened the Trust Fund for Hospital Insurance

Cma Statement On Medicare Financing

Statement for the Record from the Center for Medicare AdvocacyThe Hospital Insurance Trust Fund and the Future of Medicare FinancingSenate Finance CommitteeSubcommittee on Fiscal Responsibility and Economic GrowthHearing Date: February 2, 2022

The Center for Medicare Advocacy is pleased to provide a statement for the record for the above-referenced hearing. The Center, founded in 1986, is a national, non-partisan education and advocacy organization that works to ensure fair access to Medicare and to quality health care. At the Center, we educate older people and people with disabilities to help secure fair access to necessary health care services. We draw upon our direct experience with thousands of individuals to educate policy makers about how their decisions affect the lives of real people. Additionally, we provide legal representation to ensure that people receive the health care benefits to which they are legally entitled, and to the quality health care they need.

Overview

The annual release of the Medicare Trustees report, which projects the fiscal health of the Medicare program, focusing on the Part A Trust Fund, often serves as an impetus for calling for Medicare changes and cuts. The latest report, released in August 2021, projects that the Part A Trust Fund will be depleted by 2026 unchanged from the previous projection, despite the impact of the COVID-19 pandemic.

Center for Medicare Advocacy Report: Ensuring Medicares Financial Health

Read Also: Does Medicare Pay For Hospitalization

What Are The Two Treasury Accounts Used To Pay For Medicare

The federal government relies on two trust funds to finance Medicare services provided through Medicare Part A and Medicare Parts B and D, respectively.

One trust fund, known as the Hospital Insurance Trust Fund, supplies money for Part A services. The other trust fund, known as the Supplemental Insurance Trust Fund, provides money for Parts B and D.In other words, Part A draws funding from the HI Trust Fund, while Medicare Parts B and D derive funding from the SMI Trust Fund.

The HI Trust Fund is funded through the following sources that finance Part A:

- Payroll taxes from employers and employees

- Part A premiums from people who dont qualify for premium-free Part A

- Income from taxes from Social Security benefits

- Interest from trust fund investments

The SMI Trust Fund is funded through sources that provide money for Parts B and D:

- Funds authorized by Congress

- Interest accrued from trust fund investments

Signing Up For Original Medicare

Some people qualify for automatic enrollment, and others have to enroll.

- If youre already receiving Social Security or railroad retirement benefits youll be enrolled in Part A and Part B automatically on your 65th birthday. If youre under 65, its the 25th month you receive disability benefits.

- ALS patients are automatically enrolled in Medicare coverage when their Social Security disability benefits begin, regardless of age. If you have end-stage renal disease , you must manually enroll.

If youre eligible for Medicare but dont qualify for automatic enrollment, you can apply online, over the phone or in person at your local Social Security office.

If you worked for a railroad, youll need to contact the Railroad Retirement Board for information on enrollment.

Read Also: How To Pick The Best Medicare Plan

How Is Medicare Advantage Funded

Medicare pays private insurers administering Medicare Advantage plans a fixed amount every month for each beneficiary enrolled in their plans.

These funds are taken from Medicare Parts A and B treasury accounts to cover the costs of providing Medicare Parts A and B services under the policies. This usually amounts to more than $1,000 a month distributed to the insurance companies for each beneficiary enrolled in an Advantage plan.

In total, Medicare spends more than $348 billion on Medicare Part C funding each year. The program also pays plans an additional amount for providing drug coverage. In 2021, these funds covered more than 26 million beneficiaries enrolled in Medicare Advantage, which is 42% of the entire Medicare population.

The method for determining the costs of each beneficiary is based on a bidding process as well as a risk adjustment assessment that gauges the health of each beneficiary to better ascertain expenses.

Medicare Advantage plans submit bids that estimate the costs to insure each beneficiary, costs that are then compared to a benchmark rate that Medicare uses to determine health care costs in each county of the country.

After the bidding process is complete, Medicare uses risk adjustments to gauge the health status of each beneficiary, and to thus modify the monthly fee to better reflect the cost of providing care to each beneficiary.

The Trust Fund For Medicare Part A Did Not Significantly Change From Last Year Though Its Financial Position Still Remains Precarious

The trust fund for Medicare Part A will be able to pay full benefits until 2026 before reserves will be depleted.

Thats the same year as predicted in 2020, according to a summary of the trustees 2021 report, which was released on Tuesday. If the reserves run out for the Hospital Insurance Trust Fund, then the programs income should be able to cover 91% of scheduled benefits. Medicare Part A covers hospital care for enrollees.

Reserves for the Hospital Insurance Trust Fund fell by $60 billion, to $134 billion, at the end of 2020. This drop was related to the expansion of the Medicare Accelerated and Advance Payments Program because of COVID-19. This program is meant to provide funding to Part A providers and Part B suppliers when there are disruptions to submitting and processing claims. These payments should be repaid this year and 2022.

The financial status of the Trust Fund has not appreciably changed and the Trustees project that it will be able to pay full benefits until 2026, unchanged from last years Medicare report, according to the summary. Trust income is projected to be lower than last years estimates due to lower payroll tax revenues while Trust expenditures are also expected to be lower because of smaller projected provider payment updates and improvements in the projection methodology.

Overall, there were 62.6 million Medicare beneficiaries in 2020.

Read Also: Does Medicare Cover Ambulance Fees