A Few Words On Medigap

Medigap is Medicare supplemental insurance that can ameliorate some of the costs that aren’t covered by Medicare Parts A and B. This insurance is provided by private companies, and typically requires that a beneficiary already have Medicare Parts A and B to enroll. Premiums are generally paid monthly, and it’s best to enroll as close as possible to enrollment in Parts A and B.

Is Medicare Part A Free

Typically, most people dont pay for Part A if they have paid Medicare taxes for a certain amount of time while working. However, if you dont qualify for premium-free Part A, it can be purchased for a monthly premium. This amount may vary each year and is based on how long you or your spouse worked and paid Medicare taxes.

Who Is Eligible For Medicare Part A

Typically, you must be age 65 to enroll in Medicare. To receive Medicare Part A free of charge, you must meet the following criteria:

- Youve worked and paid Medicare taxes at least 40 quarters or roughly 10 years. If your spouse worked, but you did not, you can still qualify.

- You receive Social Security or Railroad Retirement Board benefits.

- You or your spouse are or were Medicare-covered government employees.

Other people may also qualify for Medicare Part A based on their health, such as if they have:

- a disability

- end stage renal disease

The federal government automatically enrolls some people in Medicare Part A. Youre automatically enrolled in Part A if you meet the criteria listed above.

If you none of those sound like you, then youll need to apply for Medicare Part A.

Recommended Reading: Is Healthfirst Medicaid Or Medicare

C: Medicare Advantage Plans

| Learn how and when to remove this template message) |

With the passage of the Balanced Budget Act of 1997, Medicare beneficiaries were formally given the option to receive their Original Medicare benefits through capitated health insurance Part C health plans, instead of through the Original fee for service Medicare payment system. Many had previously had that option via a series of demonstration projects that dated back to the early 1970s. These Part C plans were initially known in 1997 as “Medicare+Choice”. As of the Medicare Modernization Act of 2003, most “Medicare+Choice” plans were re-branded as “Medicare Advantage” plans . Other plan types, such as 1876 Cost plans, are also available in limited areas of the country. Cost plans are not Medicare Advantage plans and are not capitated. Instead, beneficiaries keep their Original Medicare benefits while their sponsor administers their Part A and Part B benefits. The sponsor of a Part C plan could be an integrated health delivery system or spin-out, a union, a religious organization, an insurance company or other type of organization.

The intention of both the 1997 and 2003 law was that the differences between fee for service and capitated fee beneficiaries would reach parity over time and that has mostly been achieved, given that it can never literally be achieved without a major reform of Medicare because the Part C capitated fee in one year is based on the fee for service spending the previous year.

Medicare Prescription Drug Coverage

Medicare Prescription Drug Coverage helps cover your prescription drug costs.

Prescription Drug Plans can be purchased as stand-alone plans from private insurers in addition to Original Medicare or Medicare Advantage plans that dont offer drug coverage.

Many Medicare Advantage plans also include Part D coverage.

If you’re looking for Medicare prescription drug coverage, you can consider enrolling in a Medicare Advantage plan that includes drug coverage, or you can consider enrolling in a Medicare Part D plan.

You can compare Part D plans available where you live and enroll in a Medicare prescription drug plan online in as little as 10 minutes when you visit MyRxPlans.com.1

Recommended Reading: How To Get Dental And Vision Coverage With Medicare

Enrollment Period For Medicare Part D

Like Medicare Part C, you are eligible to enroll in Medicare Part D during the seven-month period around your 65th birthdaybeginning three months before the month of your 65th birthday, including the month of your birthday, and up to three months after the end of your birthday month. You must enroll directly through an insurance company.

Reimbursement For Part A Services

For institutional care, such as hospital and nursing home care, Medicare uses prospective payment systems. In a prospective payment system, the health care institution receives a set amount of money for each episode of care provided to a patient, regardless of the actual amount of care. The actual allotment of funds is based on a list of diagnosis-related groups . The actual amount depends on the primary diagnosis that is actually made at the hospital. There are some issues surrounding Medicare’s use of DRGs because if the patient uses less care, the hospital gets to keep the remainder. This, in theory, should balance the costs for the hospital. However, if the patient uses more care, then the hospital has to cover its own losses. This results in the issue of “upcoding”, when a physician makes a more severe diagnosis to hedge against accidental costs.

You May Like: Does Medicare Cover Dna Testing

Why Do I Need Medicare Part B

Medicare Part B is crucial for attending to your health needs. The benefits of Medicare Part B include medically necessary and preventive services. As we age, we are at a higher risk of acquiring chronic health conditions, so preventative services help catch illnesses before it is too late.

Medicare Part B covers your annual physical exams, laboratory tests at doctors appointments, mental healthcare, and more. Some of the costs you incur at the hospital might also fall under Part B.

Get A Free Quote

Find the most affordable Medicare Plan in your area

If you delay enrollment into Medicare Part B, you may need to pay a monthly late enrollment penalty. This penalty is not based on your actual premium amount but rather, on the standard Medicare Part B premium. It is important not to wait to apply for Medicare Part B because the Part B late enrollment penalty lasts a lifetime.

The Parts Of Medicare Explained

There are four main parts of Medicare insurance: Part A, Part B, Part C, and Part D. Medicare Part A and Medicare Part B together make up Original Medicare. Medicare Part C, also known as Medicare Advantage, and Medicare Part D programs that let you get Medicare plans through private insurance companies that contract with Medicare. There is also Medicare Supplement insurance , which is sold by private companies.

Don’t Miss: How To Avoid Medicare Part D Penalty

Why Do I Need Medicare Part C

It is not necessary to enroll in Medicare Part C. Although it is one of the four parts of Medicare, it exists as one of many options for additional coverage. Medicare Part C covers what Medicare Part A and Part B cover, plus additional benefits.

Get A Free Quote

Find the most affordable Medicare Plan in your area

Many beneficiaries find the relatively low premiums and all-inclusive nature of these Medicare Part C plans attractive. After thoroughly researching their options, some beneficiaries may find additional benefits from choosing to go with a Medicare Part C plan. Especially those under 65 who are eligible for Medicare due to a disability.

For some, Medicare Part C is not ideal, however. If you are someone who likes to keep out-of-pocket healthcare costs low, you may consider another route of coverage.

Medicare Supplement plans can be an alternative option for additional coverage. Researching into Medicare Advantage plans vs Medicare Supplement plans will help you decide whether Medicare Part C or Medicare Supplement plan is your best choice.

Original Medicare: Parts Coverage And Exclusions

The federal government designed Medicare to provide affordable healthcare to people in the United States, including people aged 65 years or older as well as younger people with certain health conditions.

According to the Centers for Medicare and Medicaid Services, there were more than 60 million enrollees in the Medicare program in 2019.

Medicare has various parts and options for healthcare coverage. Original Medicare combines Part A and Part B . After an individual pays the deductible, Medicare pays a share of healthcare costs.

This article looks at the details of original Medicare, eligibility, enrollment options, and costs.

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan:

- Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments.

- Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

- Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

Federally funded Medicare has four parts covering various healthcare services. In general, the program is for older people in the U.S., although younger people with disabilities or some medical conditions may also be eligible for Medicare.

The program consists of:

Don’t Miss: Does Medicare Cover Fall Alert Systems

What Are The Different Parts Of Medicare

En español | Since Congress created the Medicare program in 1965, its benefits have expanded along with the number of its beneficiaries. The program now covers 57 million older Americans, plus 9 million disabled people. There are now four main parts to Medicare:

- Part A helps pay for the cost of inpatient stays in hospitals and short-term skilled nursing facilities, home health services and hospice care.

- Part B helps pay for doctors services , outpatient care , diagnostic tests, preventive care and some medical equipment and supplies.

- Part C, or Medicare Advantage, is an alternative coverage option to original Medicare that allows you to choose to receive all of your Medicare health care benefits through one plan. These plans must cover all Part A and Part B services, and most include Part D drug coverage. Some plans also provide extra benefits that original Medicare doesnt offer.

- Part D helps cover the cost of outpatient FDA-approved prescription drugs.

What Is Medicare Part B Medical Insurance

Medicare Part B provides outpatient/medical coverage. The list below provides a summary of Part B-covered services and coverage rules:

This list includes commonly covered services and items, but it is not a complete list. Keep in mind that Medicare does not usually pay the full cost of your care, and you will likely be responsible for some portion of the cost-sharing for Medicare-covered services.

The 2022 Part-B premium is $170.10 per month

Recommended Reading: Does Medicare Cover Private Home Care

Making An Informed Decision

If youre new to Medicare, you may want to determine which type of Medicare insurance plan will fit your health-care and financial needs. If youre still employed or have coverage such as veterans benefits, check with your plan administrator to see how this insurance works with Medicare. Its also important to decide if you need prescription drug coverage. Once your Medicare benefits kick in, dont forget to schedule your complimentary Welcome to Medicare physical exam with a doctor, and be sure to ask about any preventive services he or she might recommend.

As you can see, there are various Medicare insurance options available. To get help finding a plan or comparing plans in your area, you can enter your zip code where indicated on this page or feel free to contact one of eHealths licensed insurance agents at the phone number shown below.

Statistical data from the Centers for Medicare & Medicaid Services, On its 50th anniversary, more than 55 million Americans covered by Medicare as of July 28, 2015 and 2016 MA Part D Landscape State-by-State Fact Sheet as of September 21, 2015.

Why Do I Need Medicare Part A

If you have not needed hospital or inpatient coverage in the past, you might wonder why you need Medicare Part A. Without proper coverage, hospital stays can be costly. The cost of services and amenities quickly adds up without coverage.

Get A Free Quote

Find the most affordable Medicare Plan in your area

Predicting the future is not possible, so knowing when you will need inpatient coverage is not feasible. If you enroll in Medicare Part A coverage and need hospital and inpatient services in the future, Medicare Part A will provide coverage. Under Medicare Part A, your hospital meals, some hospital rooms, lab tests, x-rays, and more are covered. Additionally, because Medicare Part A coverage does not have a premium for most, it only makes sense to enroll. You have paid into the coverage your entire working life, so it is important to utilize benefits once you qualify.

Recommended Reading: Is Aarp Medicare Part D

Medicare Part B: Doctors And Tests

Medicare Part B covers a long list of medical services including doctor’s visits, medical equipment, outpatient care, outpatient procedures, purchase of blood, mammograms, cardiac rehabilitation, and cancer treatment.

You’re not required to enroll in Part B if you have “” from another source, such as an employer or spouse’s employer. If you don’t enroll and you don’t have creditable coverage from another source, you may have to pay a penalty if you enroll later.

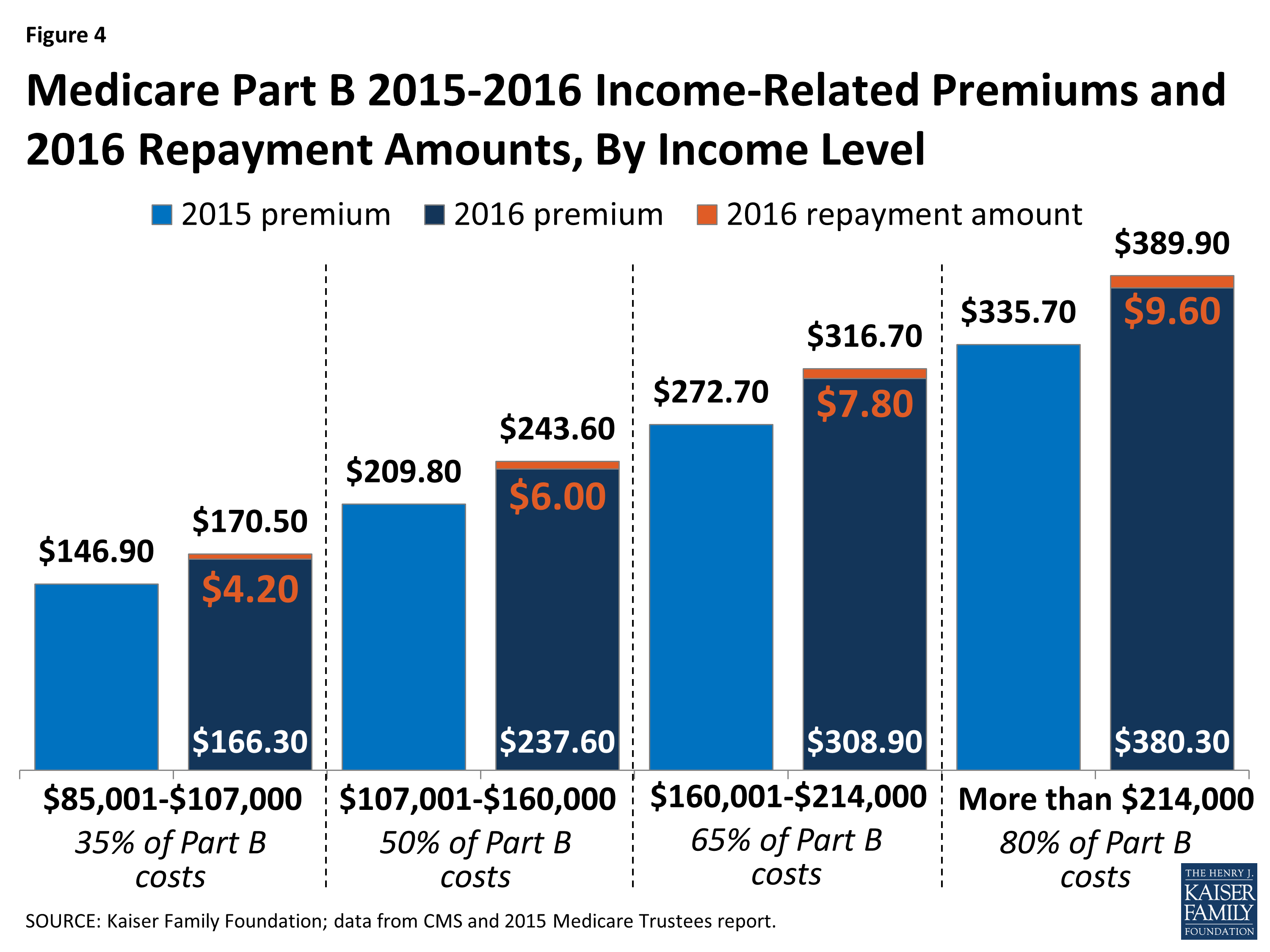

You pay a monthly premium for Part B. In 2022, the standard cost is $170.10, up from $148.50 in 2021. If you’re on Social Security, this may be deducted from your monthly payment.

The annual deductible for Part B is $233 in 2022. Once you meet the deductible, you pay 20% of the Medicare-approved cost of the service, provided your healthcare provider accepts Medicare assignment. But beware: There is no cap on your 20% out-of-pocket expense.

For example, if your medical bills for a certain year were $100,000, you could be responsible for up to $20,000 of those charges, plus the charges incurred under Part A and D umbrellas. There is no lifetime maximum.

Kathryn B. Hauer, MBA, CFP®, EA, a financial advisor with Wilson David Investment Advisors in Aiken, S.C., and author of Financial Advice for Blue Collar America, explains:

On the other hand, you pay nothing for most preventive services, such as diabetes screenings and flu shots, if you receive those services from a provider who accepts Medicare assignment.

What Is Medicare And Who Can Get It

Medicare is a government health insurance program administered by the Centers for Medicare & Medicaid Services . According to a CMS report, over 55 million people were Medicare beneficiaries as of 2015, including over 39 million enrolled in Medicare Part D .

Can you answer yes to at least one of the following statements?

- I am 65 years of age or older.

- I am under 65, but I receive disability benefits from the Social Security Administration or the Railroad Retirement Board .

- I have amyotrophic lateral sclerosis .

- I have end-stage renal disease , which is permanent kidney failure that requires a transplant or dialysis.

If so, then you are likely to be eligible for Medicare benefits. You must be at least 65 years old and an American citizen or permanent legal resident of at least five consecutive years. You may also qualify at any age through disability or by having end-stage renal disease or amyotrophic lateral sclerosis.

Read Also: Is Blood Pressure Monitor Covered By Medicare

Medicare Part A & Part B Premiums

The majority of consumers do not pay a monthly Part A premium.

If you or your spouse paid Medicare taxes while working for a set period of time, you normally dont have to pay a monthly premium for Part A. This is referred to as premium-free Part A on occasion.

What is covered by Medicare Part A in details

Hospitalizations and inpatient treatment, such as:

A room that is semi-private

Meals at the hospital

Nursing services provided by professionals

Specialized treatment, such as critical care, is available.

During an inpatient stay, drugs, medical supplies, and medical equipment are used.

As an inpatient, lab tests, X-rays, and medical equipment are used.

Services in the operating room and the recovery room

Services in the operating room and the recovery room

In a hospital or skilled care facility, certain blood transfusions are required.

After an approved hospital stay, inpatient or outpatient rehabilitation options are available.

Part-time, expert care for those who are unable to leave their homes

What is not covered by Medicare Part B

Exams, glasses, or contact lenses are all options.

Hearing exams or hearing aids are both options.

Exams, cleanings, X-rays, and other dental procedures are all part of basic dental care.

Acupuncture

The majority of prescribed medications

Long-term assistance

Cosmetic surgery is a procedure that is used to improve

Foot care that is done on a regular basis

What is Medicare Part C? Medicare Advantage Plans.

Insurance Plan

Medicare Part B Coverage And Costs

Medicare Part B can be categorized as medical insurance. It may cover items such as clinical research, ambulance services, durable medical equipment , mental health, and limited outpatient prescription drugs. Part B costs are dependent on a couple different factors.

Your base premium is a monthly payment that is determined by your income. After you pay your deductible for the year, you will typically pay 20% of the Medicare-approved amount for:

- Doctor services

Recommended Reading: What Is The Penalty For Not Enrolling In Medicare

What Are Medigap Plans

Medigap plans, also called Medicare supplement insurance, helps cover costs not paid for by Medicare. Medigaps are provided by private companies and help pay for things like copayments, coinsurance, and deductibles. This is especially helpful to cover lengthy hospitalizations and skilled nursing rehab stays. Medigaps also may offer limited additional services not covered by Original Medicare.

If you choose Original Medicare, you should consider a Medigap policy, says Melanie Musson, an insurance expert and finance writer for clearsurance.com. You may be responsible for a portion of your hospital bill if you have a lengthy hospitalization or rehabilitation stay at an inpatient nursing facility. Since inpatient hospital bills can be astronomically high, you could run through your savings very quickly.

Medigaps also cover a range of outpatient costs that Original Medicare does not cover.

When you first enroll in Medicare, you cant be denied coverage or forced to pay higher rates for Medigap policies, says Musson, however, this depends on the state where you live. Six months after enrolling, though, you may be denied coverage depending on circumstances. So when you first enroll in Original Medicare, you should consider purchasing a Medigap policy, even if you think your health is excellent and you dont need one.