Do You Need Extra Help Paying Medicare Premiums

If you never worked and are not eligible for premium-free Medicare, health care can become a considerable expense for you in retirement. There are some options available if you need help paying your Medicare premiums.

You may want to look into Medicaid, an assistance program designed to help cover your health care if you cant afford other forms of insurance. You typically can only qualify for Medicaid if you have a very low level of income.

Another option could be to take advantage of a Medicare Savings Program, where your state can help you pay some of your Medicare costs like your deductible or coinsurance. According to the Medicare website, there are four different programs with their own qualifications, but you typically need to show that you have low income or lack of resources.

You also could qualify for Supplemental Security Income benefits to help lighten your financial burden. SSI benefits are available if you have limited income and are 65 and older, blind or have a disability.

An option that could help specifically with drug prices is Extra Help. This program can pay your prescription drug costs, and you should be eligible for it if you qualify for Medicaid, a Medicare Savings Program or SSI benefits.

Other Ways To Get Medicare Coverage At Age 65

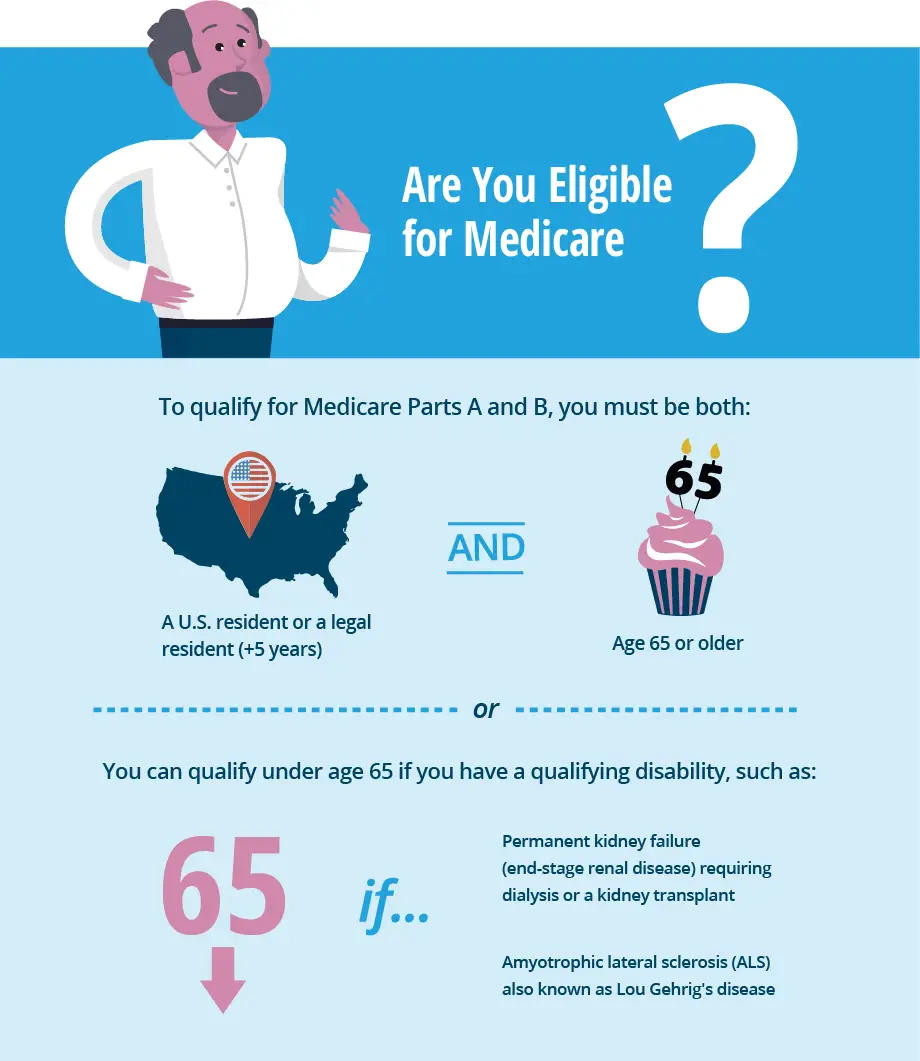

If you dont qualify for premium-free Medicare Part A coverage, you may be eligible to buy coverage. However, you must still be a U.S. citizen or a permanent resident for at least five years to qualify.

Other Medicare Eligibility Options

- You can pay premiums for Medicare Part A hospital insurance. Premium costs vary based on how long you have worked and paid into Medicare.

- You can pay monthly premiums for Medicare Part B medical services insurance. Youll pay the same premiums as anyone else enrolled in Part B.

- You can pay monthly premiums for Medicare Part D prescription drug coverage. Your premium will be the standard rate and would depend upon the plan you choose.

You will not be able to purchase a Medicare Advantage plan or Medigap supplemental insurance unless you are enrolled in Original Medicare Medicare Parts A and B.

I Applied For Medicare When Will My Medicare Coverage Begin

The effective date of Medicare based on ESRD is dependent upon the type of treatment you choose:

- For hemodialysis patients Medicare is effective the 4th month of treatmentFor example, if hemodialysis is begunin May, Medicare becomes effective August 1.

- For home dialysis patients Medicare is effective the first month of treatment.

- For transplant recipients Medicare is effective

- the month you’re admitted to the hospital for a kidney transplant or for health care needed prior to a transplant if the transplant takes place that same month or within the following two months.

- Two months prior to transplant if the transplant is delayed more than two months after you are admitted to the hospital in anticipation of transplantor related health services

You May Like: What Is Medicare Id Number

Do You Need 40 Quarters To Qualify For Medicare

You do not need to have earned 40 quarters to qualify for Medicare coverage. Medicare eligibility is based primarily on your age .

The number of quarters you paid Medicare taxes will affect your Medicare costs, however. Your Medicare Part A premium is partly based on the number of quarters for which you worked and paid Medicare taxes.

As mentioned above, you qualify for premium-free Medicare Part A if you paid Medicare taxes for 40 quarters. If you paid Medicare taxes for less than 40 quarters, you will typically have to pay a premium for your Part A coverage.

The full breakdown for 2022 Medicare Part A premiums is as follows:

|

If you paid Medicare taxes for… |

…your 2020 Medicare Part A premium will be: |

|

At least 40 quarters |

|

|

$499 per month |

Most Medicare beneficiaries do not pay a premium for their Part A benefits.

You would need to pay Medicare taxes for at least 7.5 years to qualify for the $274 premium in 2022. Anything less than 7.5 years would require you to pay a $499-per-month premium in 2020.

The number of quarters counted do not have to be consecutive in order to count towards your qualified total.

What Happens If You Enroll In Part D Late

If you dont enroll in Part D when youre first eligible and you didnt have other drug coverage for 63 consecutive days, Medicare may charge a penalty when you enroll, adding it to your monthly premium. Part D premiums vary by plan.

If youre concerned about drug coverage costs, Medicare has a program called Extra Help for people with limited incomes. There is no Part D penalty if you get Extra Help.13

Read Also: Does Medicare Pay For Entresto

Find A $0 Premium Medicare Advantage Plan Today

For California residents, CA-Do Not Sell My Personal Info, .

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

The purpose of this communication is the solicitation of insurance. Callers will be directed to a licensed insurance agent with TZ Insurance Solutions LLC, TruBridge, Inc. and/or a third-party partner who can provide more information about Medicare Advantage Plans offered by one or several Medicare-contracted carrier. TZ Insurance Solutions LLC, TruBridge, Inc., and the licensed sales agents that may call you are not connected with or endorsed by the U.S. Government or the federal Medicare program.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Medicare has neither reviewed nor endorsed this information.

At What Age Do I Qualify For Social Security

You can begin collecting Social Security retirement benefits as early as age 62. Doing so, however, is often not advisable, since it means lowering your monthly benefits potentially for life.

To collect the full monthly benefit your earnings record entitles you to, you must wait until full retirement age to sign up for Social Security. Depending on your year of birth, that age will fall out somewhere between 66 and 67. For each month you file for Social Security ahead of full retirement age, youll face a reduction in your monthly benefits that will likely remain in effect indefinitely, unless you manage to go through the motions of withdrawing your application soon after filing it.

Read Also: How To Get New Medicare Card Without Social Security Number

Is It Possible To Be Eligible For Medicare And Medicaid

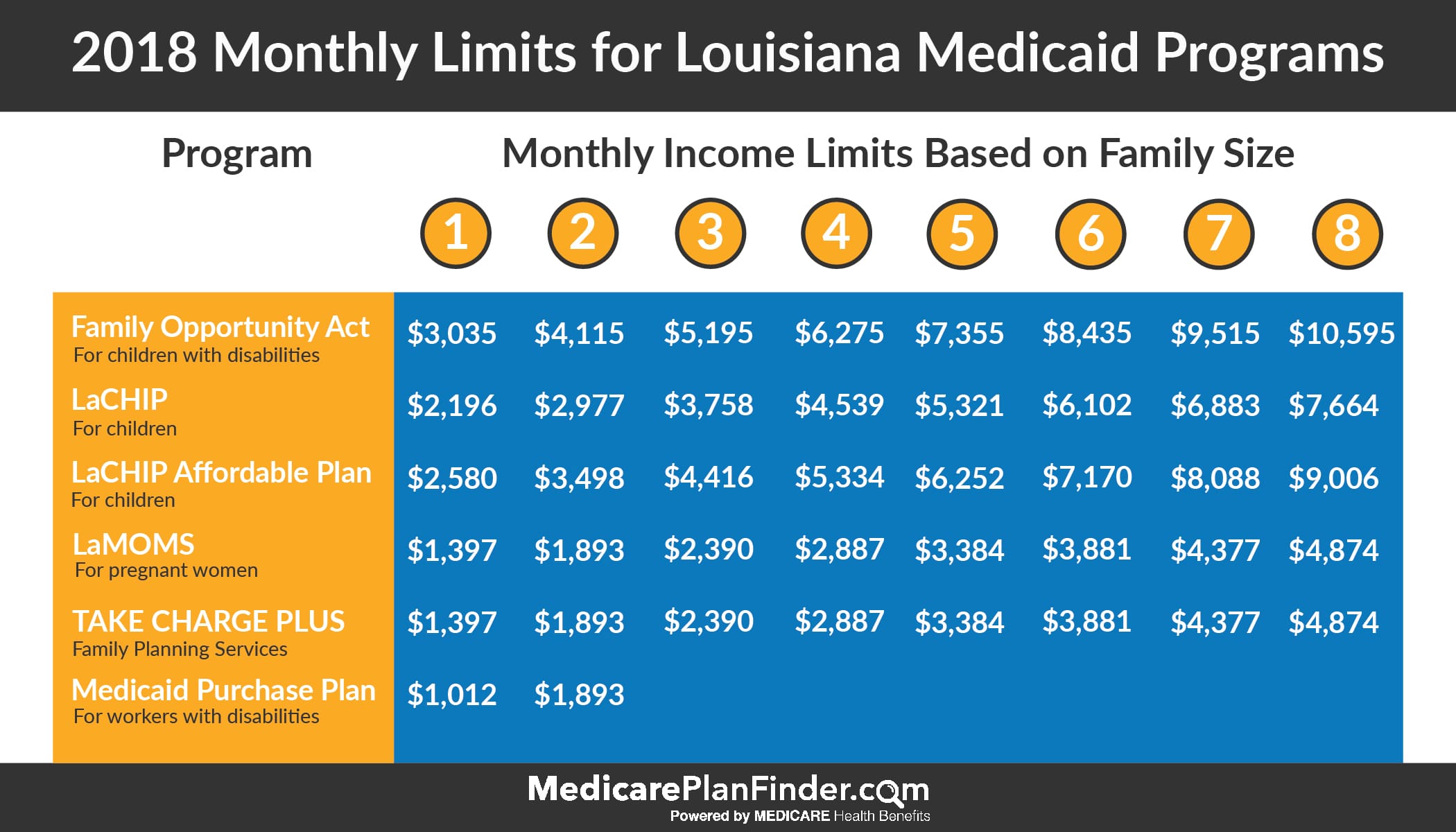

Yes. Medicaid is a joint federal-state health insurance program that states run to help those with limited income and resources pay medical bills. Enrollment in both Medicare and Medicaid is called having dual eligibility. Coverage varies by state.

Individuals with full Medicaid can get help paying for services that Medicare doesnt cover or only partially covers, such as nursing home care and long-term supports and services. In most cases, Medicaid will pay your Medicare Part B premium and may help with deductibles and other costs. This may be through a Medicare Savings Program, a state-based program that can help you pay for out-of-pocket Medicare expenses. Contact your state Medicaid program or ask your SHIP counselor if you qualify.

With Medicare and full Medicaid, youll automatically qualify for Extra Help, financial assistance for Medicare Part D drug coverage costs.

Most dually eligible beneficiaries qualify for full Medicaid benefits, according to the Kaiser Family Foundation. You may be eligible for Medicaid if you have a limited income and:

-

Are 65 or older

-

Have a child under the age of 19

-

Are pregnant

-

Are caring for a child

What Are Employment Quarters For Social Security

The Social Security Administration calls employment quarters by several names, such as quarter of coverage and Social Security credits or simply credits.

How credits for Social Security retirement benefits have been calculated has changed over the years. Today, Social Security credits are based on your total income during the year, and the year is divided into four employment quarters.

The dollar amount needed to earn credits may go up slightly each year, according to the Social Security Administration, as average earnings increase. For more information on the current earnings needed to earn Social Security or Medicare work credit, visit the Social Security website.

There are special rules for certain types of jobs, such as domestic work, farm work, and work for a church or similar organization that does not collect Social Security and Medicare taxes. Employment of this sort may count towards your employment quarters for retirement and Medicare benefits, but you should contact the Social Security Administration to confirm. Conversely, some people may not qualify for Social Security retirement credits, such as federal employees hired before 1984, railroad employees with more than 10 years of service, and employees of some state and local governments. Other factors may be used to determine their eligibility for premium-free Medicare Part A.

Also Check: Does Medicare A Have A Deductible

What Is A Quarter Of Coverage

To calculate a persons eligibility for premium-free Medicare Part A insurance, Medicare counts the number of employment quarters the individual worked.

A quarter of coverage is a 3-month calendar quarter in which a person worked in a job and paid Medicare taxes. Every quarter of coverage earned counts as one credit toward qualifying for free Medicare Part A.

During a quarter of coverage, an employee pays Federal Insurance Contributions Act taxes, which combine withheld taxes for Medicare and Social Security.

On a paycheck, Medicare withholding tax appears as Fed Med/EE. Each year has four quarters. Roughly, 40 quarters equals 10 years of work.

The 40-quarters rule only applies to premium-free Medicare Part A. Other parts of Medicare, including Medicare Part B, involve a monthly premium regardless of how long a person has worked in their lifetime.

How Many Work Credits Do I Need To Qualify For Ssdi

Generally speaking, to be insured for SSDI benefits you must have earned at least 20 work credits during the past 40 quarters prior to the onset of your disability. The date in which your SSDI coverage expires is referred to as your date last insured.

So, if you earned 4 work credits in each year from 2008 to 2013 and stopped working in 2013, you would be insured for the next five years, and your date last insured would be in 2018. In order to receive SSDI benefits, you would need to establish that you became disabled prior to 2018.

You May Like: Do I Need An Appointment To Sign Up For Medicare

Number Of Credits Needed For Disability Benefits

To be eligible for disability benefits, you must meet a recent work test and a duration work test.

The number of credits necessary to meet the recent work test depends on your age. The rules are as follows:

- Before age 24 – You may qualify if you have 6 credits earned in the 3-year period ending when your disability starts.

- Age 24 to 31 In general, you may qualify if you have credit for working half the time between age 21 and the time you become disabled. As a general example, if you become disabled at age 27, you would need 3 years of work out of the past 6 years .

- Age 31 or older – In general, you must have at least 20 credits in the 10-year period immediately before you become disabled.

The following table shows how many years of work credits you need to meet the duration of work test based on your age when your disability began. For the duration of work test, your work does not have to fall within a certain period. The table only provides an estimate of how many work credits you need. It does not cover all situations. If you are statutorily blind, you must only meet the duration of work test. When statutory blindness is involved, there is not a recent work test requirement.

NOTE: This table is an estimate only and does not cover all situations

| If you become disabled… |

|---|

| 9.5 years |

When Do You Have To Pay For Medicare

If you dont qualify for premium-free Part A coverage, youll need to pay a monthly premium. Youll also have to pay a premium if you sign up for Part B, which is optional.

If you receive Social Security benefits, youll have these premiums automatically deducted from your checks. Medicare will bill you directly if you arent collecting Social Security.

If you sign up for Parts C and D, youll also need to pay premiums for those plans. If you receive Social Security benefits, you can request that the premiums be deducted from your checks, but this wont happen automatically. If you dont receive benefits, youll get a bill from Medicare for Part D and from the insurer for Part C.

Recommended Reading: How Do I Find A Medicare Advocate

Reaching Age 62 Can Affect Your Spouse’s Medicare Premiums

Although reaching age 62 does not qualify you for Medicare, it can carry some significance for your spouse if they receive Medicare benefits.

When one spouse in a couple turns 62 years old, the other spouse who is at least 65 years old may now qualify for premium-free Medicare Part A if they havent yet qualified based on their own work history.

- For example, Gerald is 65 years old, but he doesnt qualify for premium-free Part A because he did not work the minimum number of years required for eligibility. He can still receive Medicare Part A, but he will have to pay a monthly premium for it. In 2020, the Medicare Part A premium can be as high as $458 per month.

- Lets say Geralds wife, Jessica, reaches age 62 and has worked for the required number of years to qualify for premium-free Part A once she turns 65. Because Jessica is now 62 years old and has met the working requirement, Gerald may now receive premium-free Part A.

In the above example, Jessica has not become eligible for Medicare by turning 62. Her husband Gerald, however, is now eligible to receive his Medicare Part A benefits without paying a monthly premium any longer.

Make Your Decisions Independently

Collecting Social Security is by no means a prerequisite to getting Medicare. In fact, its often advisable to sign up for Medicare as soon as youre eligible but wait on Social Security to avoid a reduction in benefits, or boost them as much as possible.

The only downside to signing up for Medicare alone is having to make your premium payments directly, as opposed to having them deducted from your Social Security benefits, but its a small price to pay for the upside of a higher lifetime income stream.

Maurie Backman has been writing professionally for well over a decade, and her coverage area runs the gamut from healthcare to personal finance to career advice. Much of her writing these days revolves around retirement and its various components and challenges, including healthcare, Medicare, Social Security, and money management.

Also Check: How Do You Get Dental Insurance On Medicare

How Many Employment Quarters Do You Need To Have Worked To Get Premium

For the Social Security Administration, the number of employment quarters that qualify you for retirement and premium-free Medicare Part A depends on your date of birth. If you were born in 1929 or later, you need 40 credits . If you were born in 1928, you need 39 credits, and the amount decreases as the date goes further back those born in 1927 need 38 credits, etc.

If you were a railroad employee and you qualify for the minimum railroad retirement annuity noted above, youre likely to qualify for premium-free Medicare Part A. That length of service should provide equivalent employment quarters and Medicare taxes.

Are Medicare Premiums Tax

Some of your Medicare premiums are tax-deductible. Medicare Part B and Part D are optional coverage, and you can deduct these premiums as medical expenses on your taxes. Medicare Part A can only be deducted as medical expenses if you voluntarily enrolled in Part A and dont qualify for Social Security benefits.

Also Check: When Will Medicare Cover Hearing Aids

Healthmarkets Can Answer Your Medicare Eligibility Questions

If you are eligible for Medicare and are ready to shop for a plan, HealthMarkets can help. We make it easy to compare plans, get free Medicare quotes, and enroll. Answer a few short questions and to see what kind of Medicare plan might work best for your lifestyle, and which plans make the best fit. Get started now.

46253-HM-0920

When You Choose To Start Taking Social Security Benefits

The yearand even the month within that yearthat you choose to begin taking Social Security benefits affects how much you receive each month. You can start claiming Social Security benefits early as age 62, the current early retirement age. But you wont get your full PIA. Itll be reduced based on how many months you have until your full retirement age. This reduction can really add up, topping in at as high as 30% for particularly early claimers.

You can avoid these surcharges on your PIA, of course, simply by waiting to start payments until your full retirement age. This is generally between ages 66 and 67, depending on when you were born.

You can even add onto your base amount by delaying when you start benefits. After you reach full retirement age, you can boost your benefits by up to 8% of your PIA annually simply by not claiming Social Security. These benefit increases are known as delayed retirement credits, and you can accrue them up to age 70.

An important note: These benefit rate changes are performed to provide roughly the same cumulative benefit over a lifetime, assuming a roughly average lifespan. In other words, if you start Social Security earlier, youll probably claim it for longer someone with the same lifespan who delayed payments would claim them for less time. To provide them the same total benefit, earlier payments must be smaller and later benefits have to be larger to catch up.

Also Check: What Nursing Homes Take Medicare