Delaying Enrollment In Medicare When You’re Eligible For It Could Result In A Penalty That Will Remain In Effect For The Rest Of Your Life

Your initial window to enroll in Medicare begins three months before the month of your 65th birthday, and ends three months after that month.

While Medicare Part A which covers hospital care is free for most enrollees, Part B which covers doctor visits, diagnostics, and preventive care charges participants a premium. Those premiums are a burden for many seniors, but heres how you can pay less for them.

When Can I Enroll In Medicare Part B

If you are receiving retirement benefits before age 65 or qualify for Medicare through disability, generally youâre automatically enrolled in Medicare Part A and Part B as soon as you become eligible.

If you do not enroll during your initial enrollment period and do not qualify for a special enrollment period, you can also sign up during the annual General Enrollment Period, which runs from January 1 to March 31, with coverage starting July 1. You may have to pay a late enrollment penalty for not signing up when you were first eligible.

If youâre not automatically enrolled, you can apply for Medicare through Social Security, either in person at a local Social Security office, through the Social Security website, or by calling 1-800-772-1213 from 8AM to 7PM, Monday through Friday, all U.S. time zones.

Keep in mind that once you are both 65 years or older and have Medicare Part B, your six-month Medigap Open Enrollment Period begins. This is the best time to purchase a Medicare Supplement insurance plan because during open enrollment, you have a âguaranteed-issue rightâ to buy any Medigap plan without medical underwriting or paying a higher premium due to a pre-existing condition**. Once you are enrolled in Medicare Part B, be careful not to miss this one-time initial guaranteed-issue enrollment period for Medigap.

How Medicare Premiums Are Calculated

If you’re currently on Medicare, you probably know that your monthly premium is subject to change each year. But exactly how your premium changes isnt based on the factors you might think, like your health, annual income, or chosen Medicare plan.

Instead, your Medicare Part B premiums will likely increase due to rising healthcare costs.

Understanding how your Medicare premiums are determined can help you better plan your healthcare finances, which is especially important for seniors on a fixed income.

Lets take a closer look at what Medicare is, how monthly payments are calculated, and the current rates you can expect.

Recommended Reading: What Is Traditional Medicare Coverage

Medicare Advantage Msa: A Special Type Of $0 Premium Plan

Another type of Medicare Advantage plan thats available is the Medical Savings Account plan. This plan is different because its designed to not include Medicare Advantage premiums at all. This $0 premium is not because the insurance company is passing on savings to plan members. As with all Medicare Advantage plans, you still pay your Part B premiums when you enroll in a MSA plan.

The trade off with not having a monthly premium is that MSA plans have a high deductible. The deductible is the amount of Medicare-covered services you must pay for out-of-pocket before the plan starts paying for covered services. The money that goes into your MSA can be used to pay your deductible and other healthcare costs.

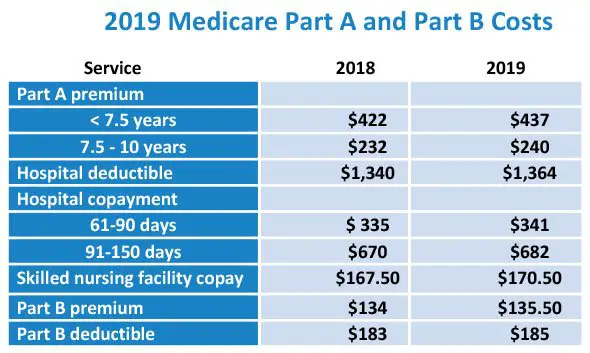

Medicare Part A Costs Are Not Affected By Your Income Level

Your income level has no bearing on the amount you will pay for Medicare Part A . Part A premiums are based on how long you worked and paid Medicare taxes.

Medicare Part A premium costs in 2022 are as follows:

2022 Medicare Part A Premium Cost|

Number of quarters you paid Medicare taxes |

2022 Medicare Part A monthly premium |

|---|---|

|

40 or more |

|

|

$499 |

Most Part A beneficiaries qualify for premium-free Part A coverage.

Two of the Medicare Savings Programs that may help pay Part A premium costs for qualified individuals include:

- Qualified Medicare Beneficiary Program

- Qualified Disabled and Working Individuals Program

Medicare Advantage and Medigap costs by income level

Medicare Part C plans and Medicare Supplement Insurance plans are sold by private insurance companies. The cost of plans can vary from one provider to the next.

Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

Don’t Miss: What Is Part D For Medicare

What Is Part D Coinsurance

There are four payment stages or Part D policyholders.

- Your annual deductible: For 2022, it can be up to $480 per year. You pay this entirely out of pocket.

- Initial coverage, where youll pay your share of copay or coinsurance until the total amount spent on drugs reaches $4,430.

- The coverage gap , where you pay 25% of all costs until youve paid $7,050 out of pocket.

- Catastrophic coverage: For the rest of the year, youll owe 5% coinsurance or $3.95 for generic drugs and $9.85 for brand drugs, whichever is greater.

Medicare Part B Costs

Medicare Part B helps cover your medical bills. Lab tests, doctor visits, and wheelchairs are examples of some services and items that Medicare Part B would help pay for.

Medicare Part B does have a monthly premium, which is $170.10 per month.â¯This monthly premium tends to go up a little bit each year. Also,â¯if you have a high income, your premium will be higher.

This means itâs important to make sure you really need Medicare Part B, because if you donât, youâre paying for insurance you arenât using.

We always recommend individuals who are working past the age of 65 to contact us to make sure their current insurance setup is appropriate.

Medicare Part B does have a deductible, but itâs much cheaper than youâre probably used to seeing â itâs only $233 per year. After you meet that deductible, you typically pay 20% of the Medicare-approved amount for any services, tests, or items you need.

Also Check: What Insurance Companies Offer Medicare Supplement Plans

How Much Does Medicare Usually Cost

Most enrollees will get Medicare Part A for free. This will provide coverage for hospitalization, skilled nursing and hospice.

But the other parts of Medicare are not always free. This year, most people will pay $170.10 per month for Medicare Part B, which covers medical care such as doctor’s appointments, lab tests and diagnostics. And there are additional Medicare parts that can be added on top of this to cover prescription drugs, reduce your portion of medical costs, or provide extra benefits. That’s why your total Medicare costs will depend on the combination of Medicare plans you choose and the cost for each type of coverage.

The cheapest option is often to pay for Medicare Part B and enroll in a $0 Medicare Advantage bundle that includes prescription drug benefits and extras like dental coverage. A costlier approach, which can provide a better limit for your medical expenses, is to pay for Part B, Medigap and Part D.

| Type of Medicare coverage | |

|---|---|

| Medigap | $163 |

When enrolling in Medicare, everyone will sign up for Medicare Parts A and B, the two components that are administered by the federal government. The monthly fee for Part B is determined each fall by the Centers for Medicare & Medicaid Services .

These variations in cost are why it’s important to compare plan options when you initially sign up for Medicare and to review your choices annually. This will help you get the best deal based on your available plan options and current medical needs.

Medicare Part C Costs

If you choose to get Medicare Part C, which is also calledâ¯Medicare Advantage , you are replacing Medicare Parts A and B. Often times, MA plans also include a drug benefit, so you also replace Part D.

However,â¯you still must pay the $170.10 monthly premium for Medicare Part B.

MA premiums vary, depending on which type of plan you choose, which area youâre in, and other similar factors.â¯In general, MA premiums are quite low, and sometimes theyâre even $0.â

While the monthly premium is very low or even $0, there are some things to consider before opting in to an MA plan.â¯You can read about the pros and cons of Medicare Advantage here.

You May Like: Does Medicare Part B Cover Inpatient Hospital Services

How Are Payroll Deductions Reported

When reporting employee tax withholdings and filing the required employer tax payments to the federal government, you typically use the following forms:

These documents can be submitted via paper or e-file. Individual states have their own guidelines for reporting payroll deductions, so its important to check with your local authorities.

Unearned Income Medicare Contribution Tax

There is also an additional tax on unearned income, such as investment income, for those with AGIs higher than the thresholds mentioned above. It is known as the unearned income Medicare contribution tax or the net investment income tax . Taxpayers in this category owe an additional 3.8% Medicare tax on all taxable interest, dividends, capital gains, annuities, royalties, and rental properties that are paid outside of individual retirement accounts or employer-sponsored retirement plans. It also applies to passive income from taxable business activity and to income earned by day traders.

This tax is applied to the lower of the taxpayers net investment income or modified AGIexceeding the listed thresholds. This tax is also levied on income from estates and trusts with income exceeding the AGI threshold limits prescribed for estates and trusts. Deductions that can reduce the amount of taxable net investment income include early withdrawal penalties, investment interest and expenses, and the amount of state tax paid on this income.

When the NIIT legislation was enacted in 2010, the IRS noted in the preamble to its list of regulations that this was a surtax on Medicare. The Joint Committee on Taxation specifically stated: “No provision is made for the transfer of the tax imposed by this provision from the General Fund of the United States Treasury to any Trust Fund.” This means that the funds collected under this tax are left in the federal government’s general fund.

Recommended Reading: Where Do You Sign Up For Medicare

Medicare Part B Medical/doctor Visits

Most people pay $170.10 each month. Some who are at a higher-income level pay more.

The deductible is $233 per year. After your deductible is met, you typically pay 20 percent of the cost of the services.

You can expect to pay:

- $0 for Medicare-approved laboratory services

- $0 for home healthcare services

- 20 percent of the Medicare-approved amount for durable medical equipment, such as a walker, wheelchair, or hospital bed

- 20 percent for outpatient mental health services

- 20 percent for outpatient hospital services

Late enrollment fees can be equal to 10 percent of your premium amount. The fees are payable for twice the number of years you were not enrolled.

Theres no out-of-pocket maximum for the amount you pay.

Returning To Work With Medicare Disability Enrollment

You are allowed to keep your Medicare coverage for as long as a medical professional deems you medically disabled.

If you under age 65 and return to work, you wont have to pay a premium for Part A for the next 8.5 years.

If youre still younger than age 65 once that 8.5-year time period as passed, youll begin paying the Part A premium. In 2021, the standard Part A premium is $259.

Your Medicare costswill depend on your specific circumstances. Its important to know that unlikestandard insurance plans, each Medicare part has its own costs and rules.

Also Check: How To Qualify For Medicare Part B

Can You Change How You Pay For Medicare

If you have Social Security benefits, your Part B premiums will be automatically deducted from them. If you dont qualify for Social Security benefits, youll get a bill from Medicare that youll need to pay via:

- Your online Medicare account

- Medicare Easy Pay, a tool that lets you automatically transfer monthly payments

- Online bill pay through your bank account

- Check, money order, or credit card payment

If you are having trouble paying your bill, you can contact someone at Medicare for help.

Medicare Advantage and Part D premiums arent automatically deducted from your Social Security benefits, so youll typically receive a bill and pay the insurer directly. If youd prefer to have your premiums for these plans deducted from your benefits check, you can contact your insurer to request this change.

Medicare Part A Hospitalization

For most people, Part A will be provided to you at no charge. If you need to buy Part A, youll pay up to $499 each month.

A deductible amount of $1,556 must be paid for by the insurance policyholder for each benefit period.

Copayments are based on the number of days of hospitalization.

Late enrollment fees can be equal to 10 percent of your premium amount. The fees are payable for twice the number of years you were not enrolled.

Theres no out-of-pocket maximum for the amount you pay.

Read Also: Do Most Doctors Accept Medicare

How Medicare Is Funded

Medicare is funded by two trust funds that can only be used for the program. The hospital insurance trust fund is funded by payroll taxes paid by employees, employers, and the self-employed. These funds are used to pay for Medicare Part A benefits.

Medicare’s supplementary medical insurance trust fund is funded by Congress, premiums from people enrolled in Medicare, and other avenues, such as investment income from the trust fund. These funds pay for Medicare Part B benefits, Medicare Part D benefits, and program administration expenses. The standard monthly premium set by the CMS for 2022 for Medicare Part B is $170.10 , although that number increases for higher-income earners. Premiums for Medicare Part D, which covers prescription drugs, will average $33 per month in 2022, up from $31.47 in 2021.

Benefit payments made by Medicare cover the following services:

- Home healthcare

The CARES Act expands Medicare’s ability to cover treatment and services for those affected by COVID-19 including:

- Providing more flexibility for Medicare to cover tele-health services

Tips On How To Pay Medicare Premiums

- Make sure to pay both your Part B and Part C premiums on time so you wont lose coverage. Automatic deductions are the best way to avoid missing a payment.

- Make sure both Medicare and your Part C provider have your current mailing address for bill delivery .

- Dont miss more than three months of Medicare Part B payments. Premiums are due the 25th of every month and coverage will end in the fourth month if past due payments are not made.

- Contact your Medicare Part C provider if you think you will miss a payment. Private insurance companies have their own rules on plan cancellation for nonpayment.

You May Like: Do I Have To Sign Up For Medicare At 65

Medicare Part B And Coinsurance/copayments

You usually pay a 20% coinsurance amount for covered services. If your doctor or health care provider accepts assignment for a covered service, you would pay the Part B deductible along with 20% of the Medicare-approved amount for services rendered. Accepting assignment means that your doctor will not charge you more than the Medicare-approved amount for the covered service. You would still be responsible for cost-sharing.

Whats The Current Medicare Tax Rate

In 2021, the Medicare tax rate is 1.45%. This is the amount youll see come out of your paycheck, and its matched with an additional 1.45% contribution from your employer for a total of 2.9% contributed on your behalf.

| 2021 Medicare tax rate |

|---|

| Your employer pays | 1.45% |

For those who are self-employed, the full 2.9% must be paid by the individual, rather than splitting the tax with an employer. This tax toward Medicare is included in the self-employment tax that is paid quarterly through estimated tax payments.

The self-employment tax amount is based on net earnings calculated using IRS form Schedule SE. Even though the tax rate is higher for the self-employed, its being paid on a smaller portion of income because the taxable income is 92.38% of net profit.

For high-income self-employed earners, the Additional Medicare Tax of 0.9% also applies for any income above the annual threshold.

| 2021 Medicare tax for self-employed | |

|---|---|

| Rate you pay on 92% of net earnings | 2.9% |

You May Like: Do You Have To Have Medicare At 65

You Need To Be Enrolled In A Medicare Advantage Plan To Receive The Benefit

According to the official U.S. government website for Medicare, some Medicare Advantage plans cover part or all of your Medicare Part B monthly premium. In order to enroll in a Medicare Advantage plan, you’ll need to be enrolled in or eligible for both Medicare Part A and B.

To receive the Medicare give back benefit, you’ll need to enroll in a plan that offers to pay your Part B monthly premium.

How Do I Make My Medicare Payments

If youre on federal retirement benefits, your Medicare Part B premiums get deducted from your Social Security checks. You can elect to get your Medicare Part D premiums deducted from your benefit checks, too. Contact your insurer.

If youre not on federal retirement benefits, youll get a Medicare Premium Bill for any parts of Medicare that youre paying for each month. You can pay this bill via your banks online service or by mailing back a credit card, debit card, check or money order payment.

However, Medicare Easy Pay is probably the simplest way to pay your Medicare Premium Bill. It automatically deducts your payment from a linked bank account around the 20th of each month. Deductibles and copays are generally paid directly to health care providers at the time of service.

Read Also: How Do Zero Premium Medicare Plans Work