What Is Part A Coinsurance

Medicare refers to the payments that you make when you see a doctor, stay in a skilled nursing facility, or have an extended hospital stay as coinsurance, although theyre fixed amounts rather than a percentage of costs. For the 61st to 90th day of inpatient hospital treatment with Medicare, you must pay coinsurance of $389 per day. The next 60 days are part of your lifetime reserve benefit, and youll owe $778 per day, up to 60 days over your lifetime.3

Youll also have to pay coinsurance for skilled nursing care for days 21 through 100 at a rate of $194.50 per day.4

The Final Costs Of Medicare Advantage

There are many different factors to consider and types of coverage to choose from, which makes it tricky to determine exactly what your Medicare Advantage costs will be. The best way to keep costs down is to stay within your network of providers.

Research has shown that over the last five years, Medicare Advantage premiums have been slowly dropping. 42% of Medicare beneficiaries are enrolled in Medicare Advantage plans, more than doubling enrollments over the past decade . With enrollments increasing, premiums go down. Thanks to these lowered premiums, more and more Americans are accessing the comprehensive health care coverage they benefit from the most.

Medicare Advantage in 2021: Premiums, Cost Sharing, out-of-Pocket Limits and Supplemental Benefits. KFF, 29 July 2021, .

Medicare Advantage in 2021: Enrollment Update and Key Trends. KFF, 24 June 2021, .

How Much Does Part D Cost

Medicare Part D provides coverage for prescription drugs. It can offer a degree of cost protection.

Premium amounts vary by plan and by where you live. In 2022, the average Part D monthly premium is $33.37. The annual deductible is no more than $480. As with Part B, you may need to pay an extra monthly charge if you make more than a certain amount. Its called the Part D IRMAA. You may also have to pay a copayment or coinsurance when you pick up your prescribed medicines. The more costly the prescription, the more youll pay.

Ensuring you have consistent drug coverage is key. If you go 63 or more days in a row with no Medicare drug coverage or other creditable prescription coverage, you may have to pay a penalty if you sign up for Part D later.

Also Check: What Is The Difference Between Medicare Supplemental And Advantage Plans

What Is Part D Coinsurance

There are four payment stages or Part D policyholders.

- Your annual deductible: For 2022, it can be up to $480 per year. You pay this entirely out of pocket.

- Initial coverage, where youll pay your share of copay or coinsurance until the total amount spent on drugs reaches $4,430.

- The coverage gap , where you pay 25% of all costs until youve paid $7,050 out of pocket.

- Catastrophic coverage: For the rest of the year, youll owe 5% coinsurance or $3.95 for generic drugs and $9.85 for brand drugs, whichever is greater.

What Is The Part A Late Payment Penalty

If you have to pay Medicare Part A premiums but dont enroll at age 65, your monthly premiums may cost 10% more. And you may be required to pay those higher premiums for twice the number of years you didnt sign up.5

A Word of Advice

While calculating the costs of Medicare can feel overwhelming, figuring out the cost of each part can help you devise a good estimate of your total Medicare costs.

Read Also: Which Is Primary Medicare Or Private Insurance

Foreign Travel Emergency Costs

Original Medicare does not typically cover healthcare services received outside of the U.S. and its territories. This means that you are generally responsible for 100 percent of your health care costs while traveling abroad.

Listed below are three exceptions to this rule.

- Youre in the United States when you have a medical emergency and a foreign hospital is closer than the nearest U.S. hospital.

- You live in the United States and a foreign hospital is closer to your home than the nearest U.S. hospital that can treat you for your medical condition.

- Youre traveling through Canada without reasonable delay by the most direct route between Alaska and another state when a medical emergency occurs and the Canadian hospital is closer than the nearest U.S. hospital.

If you have a Medigap plan that helps cover foreign travel emergency costs, however, you could get help covering some of the costs that Original Medicare would not otherwise typically pay.

How Much Does Medicare Part C Cost In 2022

The premium for Medicare Part C â also called Medicare Advantage â depends on your plan and the insurer, since these health plans are provided by private insurance companies.

Deductibles, copays and coinsurance for Medicare Part C vary by plan. However, there is a limit to how much you can spend on out-of-pocket expenses. After that limit, your Medicare Part C plan will pick up all the remaining cost of covered health care services. The out-of-pocket limit for Medicare Advantage canât exceed $7,550 a year for in-network services. That means you could save more money if you have a lower out-of-pocket expenses limit. The limit is $11,300 for out-of-network services.

The average out-of-pocket limit for Medicare Advantage enrollees was $5,059 in 2019, according to the Kaiser Family Foundation.

Learn more about Medicare Part C.

Recommended Reading: Does Aetna Medicare Cover Home Health Care

Premium Additions For Higher Incomes

Medicare Part D charges higher premiums for people with higher reported income. This means youll pay any premium that is mandated by your selected plan in addition to a flat fee based on your reported income.

Like Part B, the income used to determine your extra premium payment is based on the income you reported on your IRS tax return from two years prior. The table below breaks down what a 2022 Medicare Part D enrollee would have pay for a premium.1

| Annual 2020 Income |

| Plan premium + $77.90 |

A Coinsurance For Skilled Nursing Facility Care

Medicare Part A covers skilled nursing care provided in a skilled nursing facility under certain circumstances. The 2022 Part A coinsurance amounts are as follows:

- Days 1-20: $0 coinsurance per benefit period

- Days 21-100: $194.50 coinsurance per day of each benefit period

- Days 101 and beyond: You are responsible for all costs

Also Check: What Does Medicare Supplement Plan N Cover

Cost Of Medicare Part B

- Standard cost in 2022: $170.10 per month

- Annual deductible in 2022: $233

For most people, the cost of Medicare Part B for 2022 is $170.10 per month. This rate is adjusted based on income, and those earning more than $91,000 will pay higher premiums.

For high-earners, the cost of Medicare Part B is based on your adjusted gross income from your previous year’s taxes. Only about 7% of enrollees will pay these higher rates, and below you can find an exact breakdown of the different income thresholds for Medicare Part B premiums. If you file joint taxes, then you can double these income levels to figure out what your monthly Part B premium would be. These figures are updated annually by the Social Security Administration .

| Individual income | |

|---|---|

| $500,001 or more | $578.30 |

Those with low incomes can get help paying for Medicare Part B through several government programs including Medicaid, Supplemental Security Income and the Medicare Savings Program.

Besides the monthly premium, enrollees in Medicare Part B are also responsible for paying the deductible.

For 2022, the Part B deductible is $233, which means you would need to pay $233 before coinsurance benefits would kick in.

If you have Medicare Supplement Plan C or Plan F, the supplemental policy will pay for this Part B deductible. If you have a Medicare Advantage plan, the Part B deductible doesn’t apply because the plan will set its own deductible.

Medicare Part A Costs And Coverage

Medicare Part A is hospital insurance. It covers inpatient hospital stays, skilled nursing facility care and hospice care. Long-term care is not covered under Part A.

If you receive Social Security for at least four months before your 65th birthday, you will be automatically enrolled in Part A and Part B. If you dont receive Social Security before turning 65, youll need to sign up with Social Security to receive coverage.

What Medicare Part A Covers

- Inpatient care

- Home health care

- Skilled nursing facility care

Part A charges no monthly premium to anyone who paid Medicare taxes through their employer for at least ten years. Those who havent worked that long have to pay premiums for Part A coverage. Most beneficiaries do not have to pay the premium.

2022 Medicare Part A Out-of-Pocket Costs and Increases

| Income Level for Individual Taxpayer | Income Level for Joint Tax Filers | Monthly Medicare Part B Premium |

|---|---|---|

| $91,000 or less |

Recommended Reading: Does Medicare Cover Continuous Glucose Monitoring Systems

Find A $0 Premium Medicare Advantage Plan Today

1 MedicareAdvantage.com’s The Best States for Medicare report.

2 10-minute claim is based solely on the time to complete the e-application if you have your Medicare card and other pertinent information available when you apply. The time to shop for plans, compare rates, and estimate drug costs is not factored into the claim. Application time could be longer. Actual time to enroll will depend on the consumer and their plan comparison needs.

3 TZ Insurance Solutions LLC internal sales data, 2019. This data is based on the Medicare Supplement Insurance policies TZ Insurance Solutions LLC has sold. It is not a comprehensive national average of all available Medicare Supplement Insurance plan premiums.

About the author

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options.

His work has been featured in outlets such as Vox, MSN, and The Washington Post, and he is a frequent contributor to health care and finance blogs.

Christian is a graduate of Shippensburg University with a bachelors degree in journalism. He currently lives in Raleigh, NC.

Where you’ve seen coverage of Christian’s research and reports:

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Medicare Advantage Plans Costs And Coverage

Medicare Advantage plans, is an all-in-one alternative to Original Medicare. These plans are administered by private insurance companies approved by the federal government.

Medicare Advantage bundled plans include Part A and Part B and usually have Part D drug coverage. Plans may also include other extra benefits such as vision and dental.

What Medicare Advantage Covers

- All the services covered by Original Medicare.

- Vision, hearing and dental are usually included.

- Emergency and urgent medical care is always covered.

- Most plans offer some form of prescription drug coverage.

Since Medicare Advantage plans are provided through private insurers, there are no fixed premiums, deductibles or coinsurance. Instead, they vary from plan to plan. You first must have Original Medicare before you can buy a Medicare Advantage plan.

The companies that administer the plans decide what to charge for premiums, deductibles and coinsurance once a year. Medicare does not have a hand in determining the costs. Changes take effect on Jan. 1 of the following year.

Cost-Determining Factors of Medicare Advantage PlansDon’t Leave Your Health to Chance

Also Check: Can You Receive Medicare Without Social Security

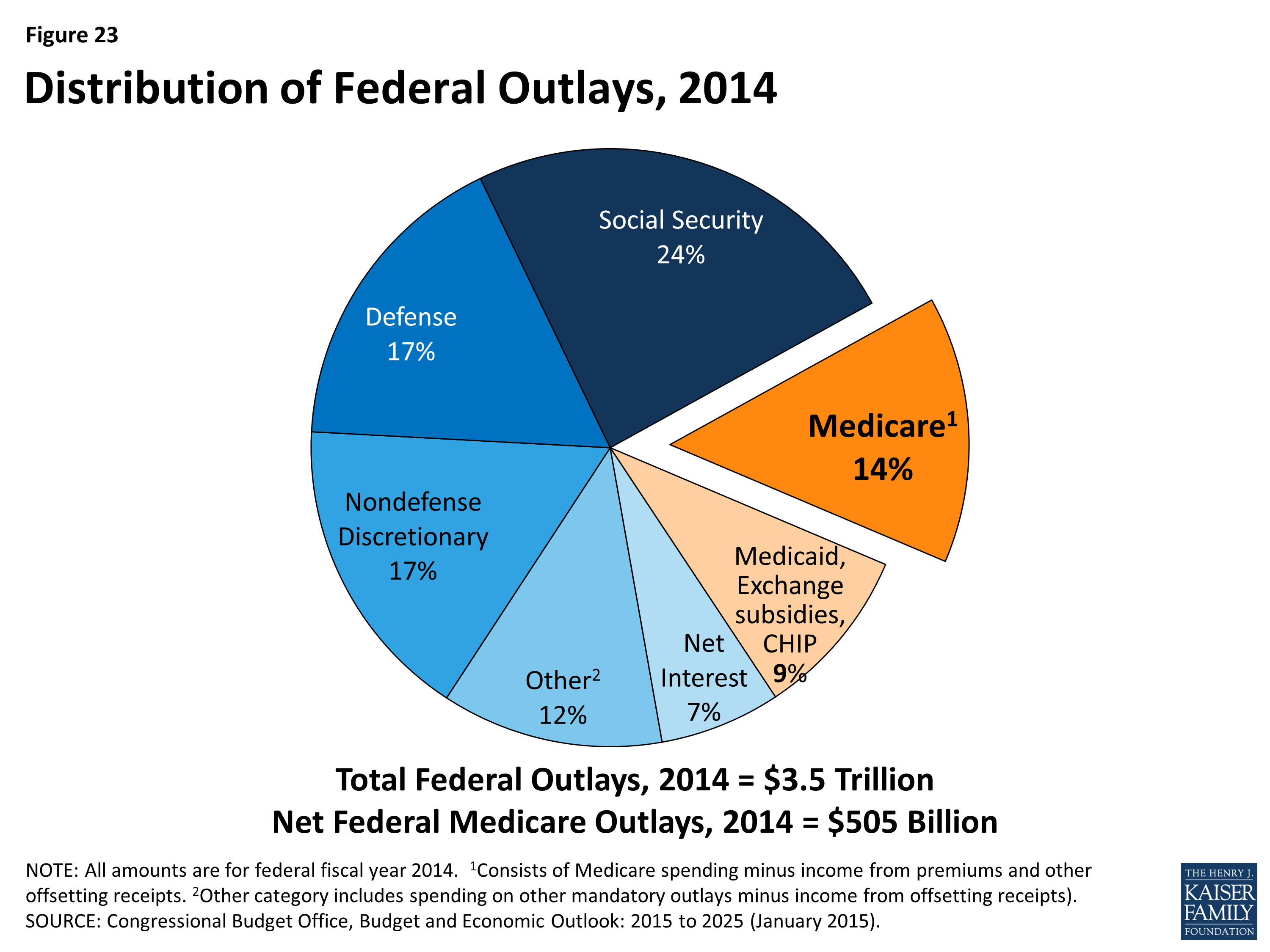

Medicare And Medicaid Costs

Medicare is administered by the Centers for Medicare & Medicaid Services , a component of the Department of Health and Human Services. CMS works alongside the Department of Labor and the U.S. Treasury to enact insurance reform. The Social Security Administration determines eligibility and coverage levels.

Medicaid, on the other hand, is administered at the state level. Although all states participate in the program, they aren’t required to do so. The Affordable Care Act increased the cost to taxpayersparticularly those in the top tax bracketsby extending medical coverage to more Americans.

According to the most recent data available from the CMS, national healthcare expenditure grew 4.6% to $3.8 trillion in 2019. That’s $11,582 per person. This figure accounted for 17.7% of gross domestic product that year. If we look at each program individually, Medicare spending grew 6.7% to $799.4 billion in 2019, which is 21% of total NHE, while Medicaid spending grew 2.9% to $613.5 billion in 2019, which is 16% of total NHE.

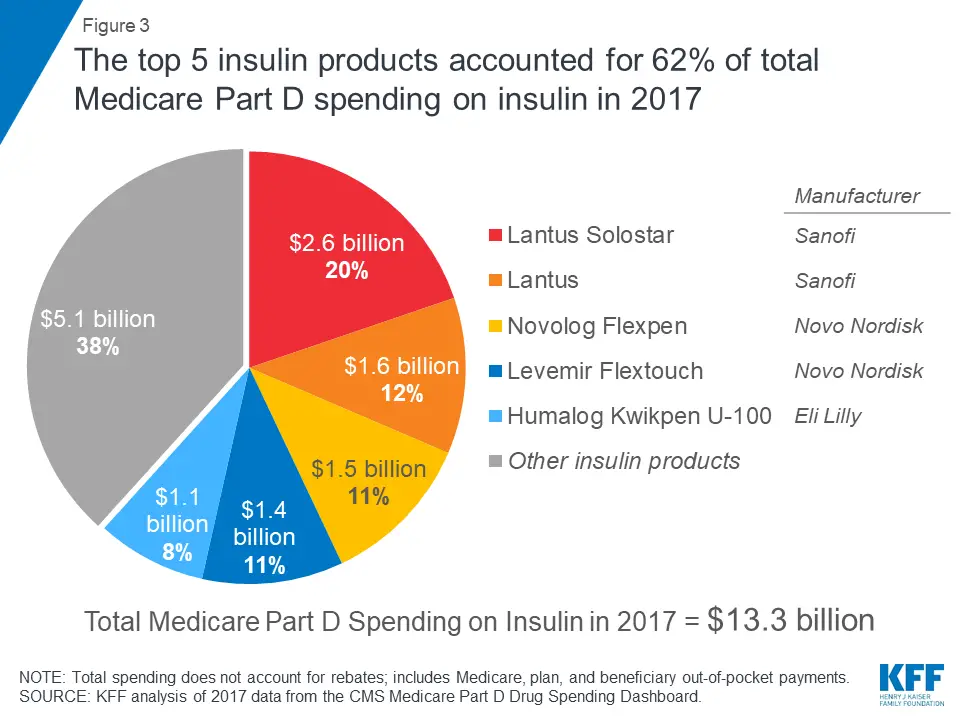

How Much Does Medicare Part D Cost In 2022

Medicare Part D is prescription drug coverage. It is provided by Medicare-approved private insurers.

Premium costs vary by plan, state and income, but the average basic monthly premium for a Medicare Part D plan in 2020 was about $43, according to data from the CMS compiled by Policygenius. High-income Medicare beneficiaries are subject to an income-related monthly adjustment amount , meaning if you make more, youâll pay more. For 2022 plans, the additional costs will be based on your 2020 income.

Getting Medicare Part D requires enrolling in Original Medicare, so youâll pay any of those premiums, too.

The deductibles vary, but no Medicare Part D plan can have a deductible higher than $480 in 2022, up from $445 in 2021.

Copays and coinsurance vary by plan and tier and whether youâve hit the Medicare Part D coverage gap, or âdonut hole.â After the insurer has covered a certain amount on prescriptions, they will temporarily limit how much your plan will help pay for prescriptions.

Learn more about Medicare Part D plans and the âdonut holeâ here.

Recommended Reading: What Age Can I Apply For Medicare

How Much Does Medicare Advantage Cost Per Month

In 2022, the average monthly premium for Medicare Advantage plans is $62.66 per month.1

Depending on your location, $0 premium plans may be available in your area.

Medicare Part C, also known as Medicare Advantage, is sold by private insurance companies. Medicare Advantage offer the same benefits that are covered by Original Medicare, and most Medicare Advantage plans include additional benefits that Original Medicare doesnt cover.

Because Medicare Advantage plans are sold by private insurance companies, plan costs can vary based on location, carrier, benefits offered and more.

Find out the average cost of Medicare Advantage plans in your state.

Medicare Part B Coverage & Enrollment

When it comes to Medicare, Part B is a big part of what comes to mind when older Americans think about their medical coverage. Medicare Part B covers the medical services you need and, along with Part A , provides the foundation of Original Medicare.

But Part B coverage isnt exclusive to Original Medicare youll receive at least the same benefits with Medicare Advantage . It replaces Original Medicare , but offers the same Part A and B benefits or coverage as Original Medicare. Along with receiving Part A and B benefits, Medicare Part C often bundles additional services like dental, hearing, vision and prescription drug coverage.

You May Like: How Do I Know What Medicare Coverage I Have

How To Appeal A Part B Premium Income Adjustment

You may request an appeal if you disagree with a decision regarding your income-related monthly adjustment amount. Complete a Request for Reconsideration or contact your local Social Security office to file an appeal.

You may be able to skip the formal appeal and simply provide documentation if your income changed due to any of the following:

- You married, divorced or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property due to a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination or reorganization of an employers pension plan.

- You or your spouse received a settlement from an employer or former employer because of the employers closure, bankruptcy or reorganization.

These methods apply to the Part B premium. Contact the IRS if you disagree with your adjusted gross income amount, which is provided to Medicare by the IRS.

How Medicare Is Funded

Medicare is funded by two trust funds that can only be used for the program. The hospital insurance trust fund is funded by payroll taxes paid by employees, employers, and the self-employed. These funds are used to pay for Medicare Part A benefits.

Medicare’s supplementary medical insurance trust fund is funded by Congress, premiums from people enrolled in Medicare, and other avenues, such as investment income from the trust fund. These funds pay for Medicare Part B benefits, Medicare Part D benefits, and program administration expenses. The standard monthly premium set by the CMS for 2022 for Medicare Part B is $170.10 , although that number increases for higher-income earners. Premiums for Medicare Part D, which covers prescription drugs, will average $33 per month in 2022, up from $31.47 in 2021.

Benefit payments made by Medicare cover the following services:

- Home healthcare

- Physician payments

- Hospital inpatient services

- Medicare Advantage Plans, also known as Part C Plans, which are offered by Medicare-approved private companies

- Other services

The CARES Act expands Medicare’s ability to cover treatment and services for those affected by COVID-19 including:

- Providing more flexibility for Medicare to cover tele-health services

Also Check: Is Root Canal Covered By Medicare

So How Are The Medicare Premiums You Pay For Calculated

These additional Medicare premiums are all calculated through something called IRMAA, which stands for Income-Related Monthly Adjustment Amount. It is an additional amount that you may have to pay along with your Medicare premium if your modified adjusted gross income is higher than a certain threshold.

Your MAGI is calculated by taking your adjusted gross income plus any of the following that apply to you: untaxed foreign income, non-taxable Social Security benefits, tax-exempt interest, and income from within the US territories that was not already included in AGI. For most people, your MAGI will be the same as your AGI but read this report by the Congressional Research Service here for further details.

In 2022, the IRMAA surcharges only apply if your MAGI is more than $91,000 for an individual or more than $182,000 for a couple. Most people have income below these levels, so the majority of enrollees will pay the standard premium, $170.10 per month.