Cost Of Medicare Supplement

For 2022, a Medicare Supplement plan costs an average of $163 per month. However, costs will depend on two factors: the policy you choose and the pricing structure in your state.

Firstly, different plan letters have different prices since each policy provides a different level of coverage. For example, Medigap Plan G, a more comprehensive plan, costs more than Plan K, a cheaper plan with less coverage. Below are the average monthly premiums of each Medigap plan for 2022. Notice that a range is given since costs can vary.

| Medigap plan |

|---|

| $102-$302 |

Monthly premium for a 65-year-old female nonsmoker

Secondly, Medigap prices will differ based on state regulations and whether the plan can set rates based on age or health status. There are three different ways in which Medigap policies can be priced:

- Community-rated

- Issue-age-rated

- Attained-age-rated

The simplest rating system is community-rated, which means the same monthly premium is charged to everyone who has the same Medigap policy. This means your premium will not be based on your age but could go up because of inflation.

Issue-age-rated has a premium structure in which your monthly premium is based on the age you are when you buy the Medicare Supplement plan. In this case, premiums will be lower for people who buy at a younger age. For example, if you bought a Medigap policy at age 65, your premium could be $200, but if you bought the same plan at 80, that policy might cost $300.

How Can I Lower Retirement Health Care Costs

As daunting as these expenses seem, there are some things you can do to mitigate their effect and lessen the risk that they will derail your retirement.

For example, following doctors orders and making small changes can reduce your overall costs.

According to the HealthView report, if a 45-year-old man with high blood pressure does as instructed by his doctor, he can lower his annual health care costs and extend his life.

By taking medication as prescribed and maintaining a healthy level of physical activity, this individual could save an average of more than $3,600 in annual pre-retirement out-of-pocket healthcare costs, the report states. He can also expect to increase his actuarial longevity by more than two years.

Retirement planning is also important when it comes to health care costs. Make sure you include these costs in your budget and consider how you will cover them.

One option is to dedicate the income from an annuity solely to out-of-pocket health care expenses.

If you have the option of using a health savings account , consider maximizing your contributions for use in retirement.

Weigh In: What Do You Think Of Proposals To Lower Medicares Age Requirement To 62 Or Less

So now Id like to hear from you. Do you think lowering the initial age of Medicare eligibility is a good idea? Would you be more apt to support Medicare at 62 so it would line up with Social Securitys eligibility age? Id like to hear your thoughts in the comments below.

Dont leave without downloading my Social Security cheat sheet. Its completely free and packed with information that Ive distilled from thousands of government website pages.

Also, if you havent already, you should join the other 330,000 subscribers on my YouTube channel. If youre subscribed with notifications turned on, youll know as soon as I release a new video. See you there!

Read Also: Do You Have To Work To Get Medicare

Do I Automatically Get Medicare When I Turn 65

Some people automatically get Medicare at age 65, but those numbers have declined as the Medicare and Social Security ages have continued to drift apart.

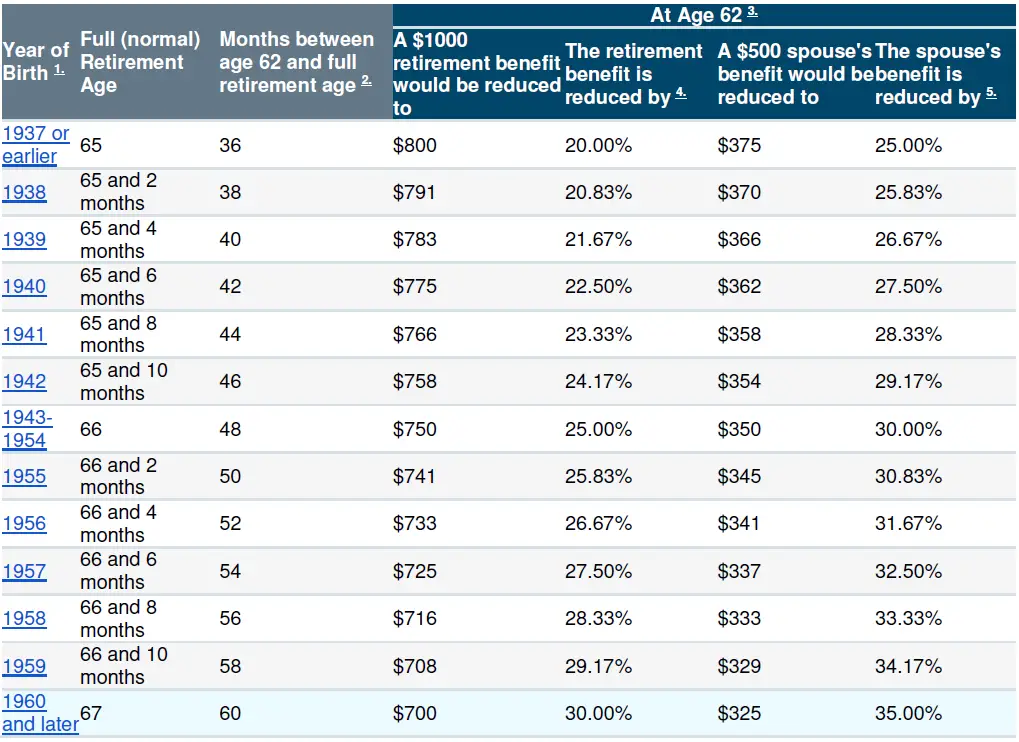

Most people who automatically get Medicare at age 65 do so because they have been receiving Social Security benefits for at least four months before turning 65. Traditionally, Medicare premiums are deducted from your Social Security check. For the longest time, you could retire with full Social Security benefits at 65 and start on Medicare at the same time.

You are still automatically enrolled in Medicare Part A and Part B at 65 if youre drawing Social Security, but not as many people draw Social Security that early these days because of changes to the eligibility age for full Social Security benefits.

In 2000, the Social Security Amendments of 1983 began pushing back the standard age for full Social Security benefits. The progressive changes are nearing their conclusion: Beginning in 2022, the standard age for full benefits will be 67 for anyone born after 1960.

Besides the Medicare eligibility age of 65, what remains unchanged is that you can opt to begin drawing partial Social Security benefits as early as age 62. So, if you opt for accepting partial Social Security benefits before age 65, you are automatically enrolled in Medicare.

A smaller group of people also automatically get Medicare at age 65: people who receive Railroad Board benefits for at least four months before 65.

I Am About To Turn 65 And Go On Medicare And My Income Is $120000 I Know That People With Higher Incomes Are Required To Pay Higher Premiums For Medicare Part B And Part D How Will These Higher Premiums Affect Me

Medicare beneficiaries with incomes above $88,000 for individuals and $176,000 for married couples are required to pay higher premiums. The amount you pay depends on your modified adjusted gross income from your most recent federal tax return. To determine your 2021 income-related premium, Social Security will use information from your tax return filed in 2020 for tax year 2019. If your income has gone down since you filed your tax return, you should contact Social Security and provide documentation regarding this change. At your current income level, in 2021, you would pay just over $4,300 in annual Medicare premiums combined for Part B and Part D .

Recommended Reading: Does Medicare Pay For Glucometer

How Does Age Affect Medicare Supplement Insurance Premiums

There are three different age-related pricing models that Medicare Supplement Insurance companies use to determine their Medigap plan rates in 2021-2022.

Each type of cost model can affect the average price of a given Medigap plan.

-

Community-rated Medigap plansWith community-rated Medigap plans, every member of the plan pays the same rate, regardless of age.

For example, an 82-year-old who enrolls in a community-rated Plan G will pay the same Medigap premiums as a 68-year-old beneficiary who has the same Plan G in the same market.

-

Issue-age-rated Medigap plansWith issue-age-rated Medigap plans, premiums are based on your age at the time you enrolled in the plan.

You will typically pay less for an issue-age-rated plan if you enroll in the plan when you’re younger. Your premiums also won’t increase based on your age.

-

Attained-age-rate Medigap plansAttained-age-rated Medigap plans set their premiums based on your current age. As you age, your Medigap plan premiums will gradually increase each year.

Medigap premiums can increase over time due to inflation and other factors, regardless of the pricing model your insurance company uses.

Should I Sign Up For Medical Insurance

With our online application, you can sign up for Medicare Part A and Part B . Because you must pay a premium for Part B coverage, you can turn it down.

If youre eligible at age 65, your initial enrollment period begins three months before your 65th birthday, includes the month you turn age 65, and ends three months after that birthday.

If you choose not to enroll in Medicare Part B and then decide to do so later, your coverage could be delayed and you may have to pay a higher monthly premium for as long as you have Part B. Your monthly premium will go up 10 percent for each 12-month period you were eligible for Part B, but didnt sign up for it, unless you qualify for a .

If you dont enroll in Medicare Part B during your initial enrollment period, you have another chance each year to sign up during a general enrollment period from January 1 through March 31. Your coverage begins on July 1 of the year you enroll. Read our publication for more information.

Also Check: How To Find A Medicare Number For A Patient

Recommended Reading: Does Medicare Cover Kidney Transplant

Compare Health Insurance Plans For Retirees

If youre looking for health insurance coverage as a retiree, its good to take advantage of any government programs you qualify for and shop around to ensure that you have the coverage you need. For example, even if you qualify for Medicare, you may need to purchase supplemental plans for services that are not covered, like dental work.

When evaluating different plans, there are a few different factors that you should consider. You should make sure that the insurance company has in-network providers in your area and they offer a plan that meets your specific health needs. You should also compare policy premiums and deductibles, waiting periods, and customer satisfaction.

How Many Months Before You Turn 65 Do You Apply For Medicare

Generally, you’re first eligible starting 3 months before you turn 65 and ending 3 months after the month you turn 65. If you don’t sign up for Part B when you’re first eligible, you might have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B.

You May Like: Can I View My Medicare Eob Online

How To Get Health Insurance Before Youre Eligible For Medicare

Although you can retire at age 62 and still receive social security benefits, if you retire before the age of 65, you will need to find health insurance to cover your medical costs until youre eligible for Medicare. The price of health insurance can come as a shock to workers who are used to having their employers contribute to their plan premiums.

If possible, its good to research these costs and options before you retire so you can plan according to the market and your needs.

B Late Enrollment Penalty

If you dont Part B when youre first eligible, you may be required to pay a late enrollment penalty.

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

For example, if you waited three years after your Initial Enrollment Period to sign up for Medicare Part B, your late enrollment penalty could be 30 percent of the Part B premium.

You will continue to owe this penalty for as long as you remain enrolled in Medicare Part B.

As mentioned above, the 2022 standard premium for Part B is $170.10 per month. If you owe the standard Medicare Part B premium but sign up for Part B a year after you were initially eligible, the late enrollment fee can add another $17.01 per month to your Part B premium.

You May Like: What Age Can You Get Medicare Health Insurance

How Social Security Helps Pay For Medicare

In addition to automatically enrolling you in Medicare, if you are receiving Social Security or Railroad Retirement Board benefits, your Medicare Part B premium will be automatically deducted from your monthly benefit payment.

If you are not receiving Social Security or Railroad Retirement Board benefits yet, you will get a bill called a Notice of Medicare Premium Payment Due . Bills can be paid for by check or money order, a credit or debit card, or through online bill pay services.

In conclusion, as youre starting to think about Medicare and retirement, do some research and make sure you understand how your Social Security benefits can or will play a role.

1

Spouses And Social Security

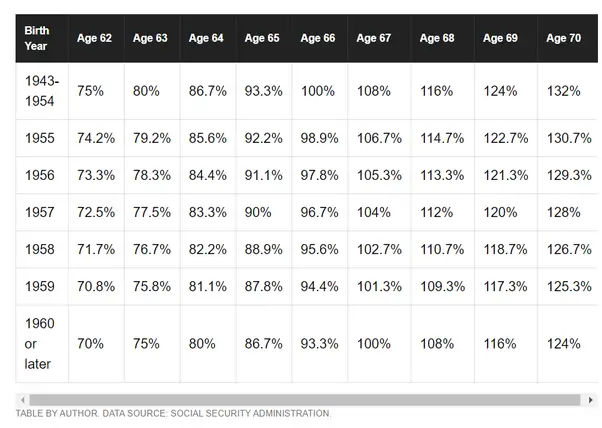

You can claim Social Security benefits based on your spouse’s work record. If claiming spousal benefits provides more, claiming before your FRA on a spouse’s record means you’ll lose even more than claiming on your own recordthe benefit reduction for a spouse is up to 35% while the reduction for claiming your own benefit is up to 30%. For instance, if you’re the spouse of Colleen in the above example and you are the same age, you’d be eligible for only $650 a month at age 6235% less than the $1000 a month you would get at your FRA of 67.

Not married? Read Viewpoints on Fidelity.com: Social Security tips for singles

Your decision to take benefits early could outlive you. If you were to die before your spouse, they would be eligible to receive your monthly amount as a survivor benefitif it’s higher than their own amount. But if you take your benefits early, say at age 62 versus waiting until age 70, your spouse’s survivor Social Security benefit could be up to 30% less for the remainder of their lifetime.

You May Like: What Does Original Medicare Not Cover

How Much Is Needed For Health Care Costs In Retirement

According to the Fidelity Retiree Health Care Cost Estimate, an average retired couple age 65 in 2021 may need approximately $300,000 saved to cover health care expenses in retirement.

Of course, the amount youll need will depend on when and where you retire, how healthy you are, and how long you live. The amount you need will also depend on which accounts you use to pay for health caree.g., 401, HSA, IRA, or taxable accounts your tax rates in retirement and potentially even your gross income.2

Tip: If you’re still working and your employer offers an HSA-eligible health plan, consider enrolling and contributing to a health savings account . An HSA can help you save tax-efficiently for health care costs in retirement. You can save pretax dollars , which have the potential to grow and be withdrawn tax-free for federal and state tax purposes if used for qualified medical expenses.3

Read Viewpoints on Fidelity.com: 5 ways HSAs can fortify your retirement

Find A $0 Premium Medicare Advantage Plan Today

For California residents, CA-Do Not Sell My Personal Info, .

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

The purpose of this communication is the solicitation of insurance. Callers will be directed to a licensed insurance agent with TZ Insurance Solutions LLC, TruBridge, Inc. and/or a third-party partner who can provide more information about Medicare Advantage Plans offered by one or several Medicare-contracted carrier. TZ Insurance Solutions LLC, TruBridge, Inc., and the licensed sales agents that may call you are not connected with or endorsed by the U.S. Government or the federal Medicare program.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Medicare has neither reviewed nor endorsed this information.

Also Check: Does Medicare Cover Toenail Clipping

When Should I Sign Up For Medicare

Generally, we advise people to file for Medicare benefits 3 months before age 65. Remember, Medicare benefits can begin no earlier than age 65. If you are already receiving Social Security, you will automatically be enrolled in Medicare Parts A and B without an additional application. However, because you must pay a premium for Part B coverage, you have the option of turning it down. You will receive a Medicare card about two months before age 65. If you would like to file for Medicare only, you can apply by calling 1-800-772-1213. Our representatives there can make an appointment for you at any convenient Social Security office and advise you what to bring with you. When you apply for Medicare, we often also take an application for monthly benefits. You can apply for retirement benefits online.

If you didnt sign up when you were first eligible for Medicare, you can sign up during the General Enrollment Period between January 1 and March 31 each year, unless you are eligible for a Special Enrollment Period.

How Much Does Medicare Part D Cost In 2022

Medicare Part D is prescription drug coverage. It is provided by Medicare-approved private insurers.

Premium costs vary by plan, state and income, but the average basic monthly premium for a Medicare Part D plan in 2020 was about $43, according to data from the CMS compiled by Policygenius. High-income Medicare beneficiaries are subject to an income-related monthly adjustment amount , meaning if you make more, youâll pay more. For 2022 plans, the additional costs will be based on your 2020 income.

Getting Medicare Part D requires enrolling in Original Medicare, so youâll pay any of those premiums, too.

The deductibles vary, but no Medicare Part D plan can have a deductible higher than $480 in 2022, up from $445 in 2021.

Copays and coinsurance vary by plan and tier and whether youâve hit the Medicare Part D coverage gap, or âdonut hole.â After the insurer has covered a certain amount on prescriptions, they will temporarily limit how much your plan will help pay for prescriptions.

Learn more about Medicare Part D plans and the âdonut holeâ here.

Read Also: Does Medicare Pay For Mental Health Services

How Do I Pay For Long

Medicare and other health insurance plans dont generally cover long-term care. This means most retirees who dont have long-term care insurance have few options.

According to a report by the Henry J. Kaiser Family Foundation, Medicaid covers 62 percent of nursing home residents care. But Medicaid coverage for long-term care varies by state, and the programs strict income limits leave retirees no choice but to deplete their savings before applying for assistance.

Married people who anticipate a spouse needing long-term care should investigate the benefits of a Medicaid-compliant annuity, which can preserve an income for the healthy spouse.

Alternatively, some people opt for private long-term care insurance, but the cost of these policies can be prohibitive. According to a 2016 study in the journal Inquiry, only 7.4 million people owned long-term care insurance policies in 2015, and, the authors claimed, ownership had become dominated by the highest earners and the wealthy.

Annuities Offer Help for Long-Term Care

There are many types of annuities from which to choose, but not all will fit your needs. Jamie Hopkins, a financial professor and contributor to Forbes, recommends using deferred annuities, a qualified longevity annuity contract , 1035 exchanges and hybrid long-term care annuity products to finance expenses.

Hybrids and Other Options

Its also possible to get short-term care insurance, which can cover up to 360 days in a care facility.