Does Medicare Cover The Freestyle Libre

- Get the facts about Medicare coverage for the FreeStyle Libre. Learn about the cost of the continuous glucose monitor and when it is covered for diabetes treatment.

The U.S. Centers for Disease Control and Prevention estimates that one out of every 10 adults in the United States suffers from diabetes and that approximately 90% to 95% have type 2 diabetes. If you’re one of the more than 34 million Americans living with the disease, blood sugar monitoring is likely a part of your daily routine. Although essential to managing diabetes, traditional blood glucose monitors come with hassles and pain of frequent finger sticks. The FreeStyle Libre simplifies monitoring and is often covered by Medicare.

Medicare Part B Eligibility And Enrollment

Medicare Part B is available to U.S. citizens and legal residents who fall under one of the following criteria:

- Over the age of 65

- Under the age of 65 with a disability

- Have end-stage renal disease

- Have Lou Gehrig’s disease

If you contributed to Social Security while working and are getting benefits for at least four months prior to turning 65, you will be enrolled in Medicare Part A automatically. You’ll also be enrolled in Part B, but you can choose to decline it since you must pay a separate monthly fee for Part B insurance.

If you do not receive benefits from Social Security, then you’ll need to manually enroll in Medicare Part B. Enrollment begins three months before your 65th birthday and ends three months after the month you turn 65, for a total of seven months.

During this initial enrollment period, you can sign up for any part of Original Medicare. When you enroll before the month you turn 65, coverage begins on the first day of your birth month. If you sign up the month you turn 65 or in the final three months of your enrollment period, your Medicare policy will be effective on the first day of the following month.

If you delay enrolling in Medicare, you may have to wait for a general enrollment period to apply, which runs from Jan. 1 to March 31 each year. Your coverage would start on July 1 following the GEP.

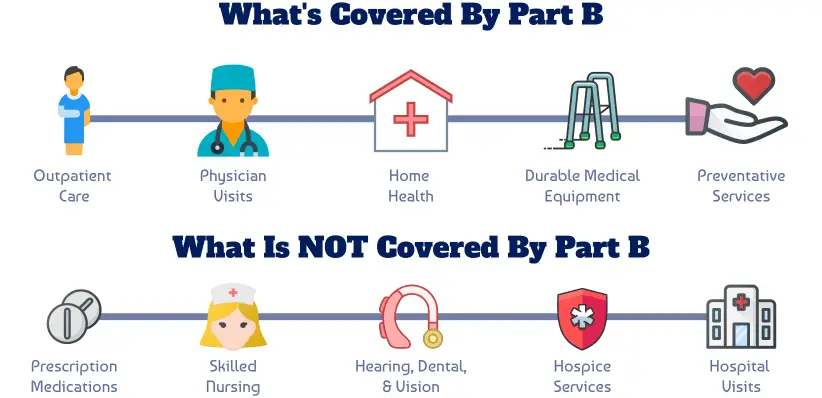

Common Services That Medicare Does And Doesnt Cover

Heres general info about what Medicare does or doesnt cover for common health care needs. Visit medicare.gov/coverage for more detail. Also, check a Medicare health plans Summary of Benefits to learn whats covered.

Medicare has some coverage for acupuncture and it is limited to treatment of chronic low back pain. Some Medicare Advantage plans have benefits that help pay for acupuncture services beyond Medicare such as treatment of chronic pain in other parts of the body, headaches and nausea.

Assisted living is housing where people get help with daily activities like personal care or housekeeping. Medicare doesnt cover costs to live in an assisted living facility or a nursing home.

Medicare Part A may cover care in a skilled nursing facility if it is medically necessary. This is usually short term for recovery from an illness or injury.

The federal Medicaid program can help pay costs for nursing homes or services to help with daily living activities.

Medicare Part B covers outpatient surgery to correct cataracts. It also pays for corrective lenses if an intraocular lens was implanted. Coverage is one pair of standard frame eyeglasses or contact lenses as needed after the surgery.

Medicare Part B covers a chiropractors manual alignment of the spine when one or more bones are out of position. Medicare doesnt cover other chiropractic tests or services like X-rays, massage therapy or acupuncture.

Read Also: What Is Medicare Part G

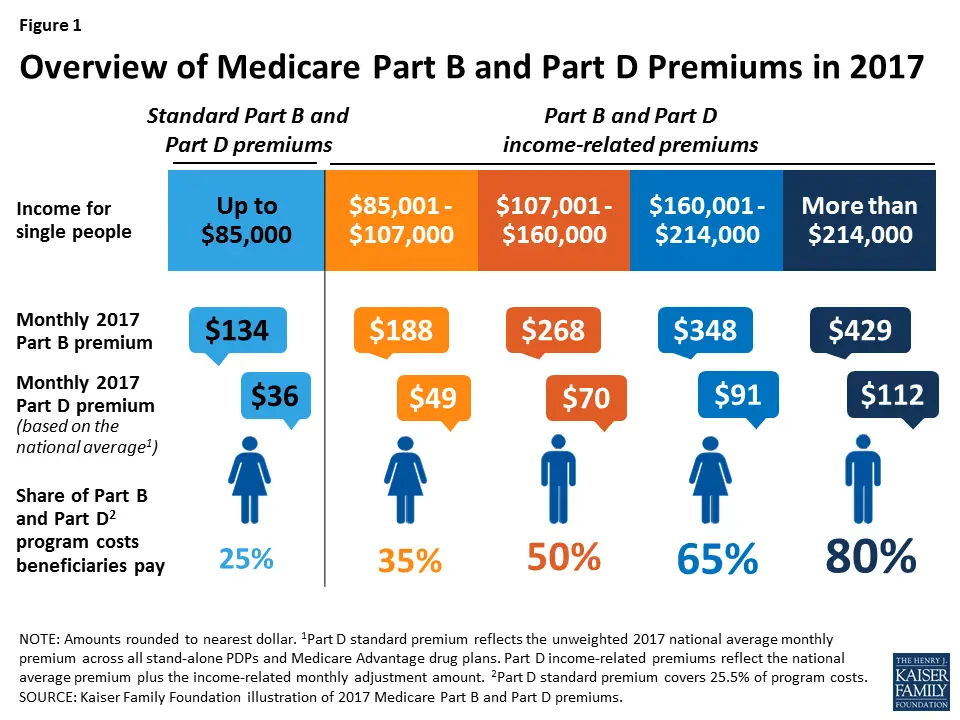

How Much Does Medicare Part B Cost In 2022

The standard Medicare Part B premium in 2022 is $170.10 per month, but you could pay more. Your monthly premium is determined by the modified adjusted gross income reported on your IRS tax return from two years ago, based on your filing status.

2022 Medicare Part B premiums are based your income from the 2020 tax year.

What Is Medicare Part D

Medicare prescription drug coverage is insurance run by an insurance company or other private company approved by Medicare. There are two ways to get Medicare prescription drug coverage: Medicare Prescription Drug Plans. These plans add drug coverage to Original Medicare, some Medicare Cost Plans, some Medicare Private Fee-for-Service Plans, and Medicare Medical Savings Account Plans.

Medicare Advantage Plans are other Medicare health plans that offer Medicare prescription drug coverage. You get all of your Part A and Part B coverage, and prescription drug coverage , through these plans. Medicare Advantage Plans with prescription drug coverage are sometimes called “MA-PDs.”

If you decide not to join a Medicare drug plan when youre first eligible, and you dont have other credible prescription drug coverage, you will likely pay a late enrollment penalty.

How Much Does Medicare Prescription Drug Coverage Cost?Each plan can vary in cost and drugs covered. The Medicare Drug Plan Finder can help you find and compare plans in your area.

Many people qualify to get Extra Help paying their Medicare prescription drug costs but dont know it. Most who qualify and join a Medicare drug plan will get 95% of their costs covered. Dont miss out on a chance to save. Extra Help and other programs may help make your health care and prescription drug costs more affordable.

You May Like: Does Medicare Cover Laser Therapy

Medicare Supplement Plan G: Coverage And Benefits

Now lets get into the benefits of Plan G! Its one of the most popular plans, with good reason. Medicare Plan G will pay for all of the out-of-pocket expenses we mentioned earlier, with the exception of the Part B deductible.

To review, Plan G covers:

- Part A deductible

- Part A coinsurance and hospital costs

- It also offers an additional 365 days after Medicare benefits are exhausted

- First 3 pints of blood

- Hospice care coinsurance or copayment

- Part B coinsurance or copayment

- Part B excess charges

- Emergency services during foreign travel

Is Ivig Covered By Medicare Part B

Medicare Part BcoveragePart Bcovercovered by Medicare

. Correspondingly, is IVIG covered by Medicare?

Currently, Medicare pays for IVIG medications for beneficiaries who have primary immune deficiency who wish to receive the drug at home.

Additionally, does Medicare pay for infusion therapy? Although Medicare covers infusion therapy in hospitals, skilled nursing facilities , hospital outpatient departments , and physician offices, it does not ade- quately cover infusion therapy furnished in patients’ homes.

Consequently, how much does an IVIG treatment cost?

The total cost of IVIG therapy ranges from $5000 to $10,000, depending on the patient’s weight and number of infusions per course. Additional costs may include a hospital stay if home infusion is not covered.

What insurance covers IVIG?

Coverage of IVIG Treatment for AIBDs by the Top 10 Private US Insurers by Market Sharea

| Rank |

|---|

Also Check: How To Pick A Medicare Plan

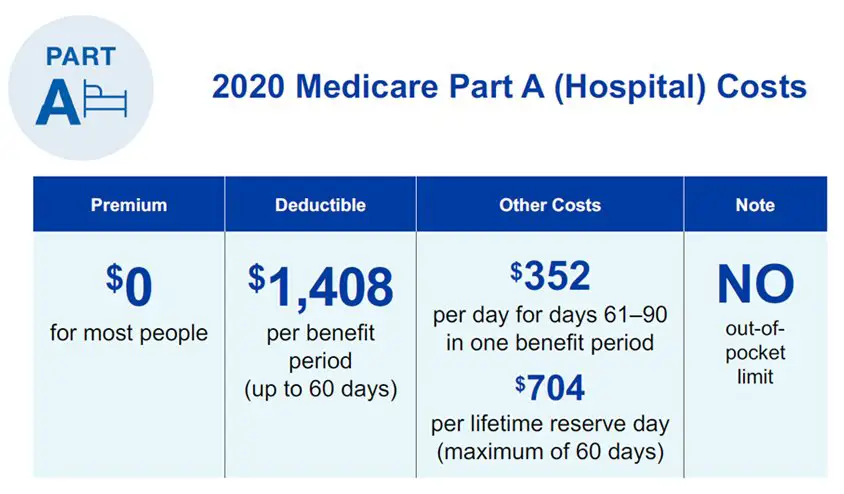

Medicare Part A: Hospital Coverage

Medicare Part A is also called hospital coverage because it primarily covers costs like inpatient hospital care, nursing facility care, and hospice care. Part A can also cover some home health care costs, though these are mostly covered by Part B.

Premiums

Most people have no monthly premium for Part A due to paying Medicare taxes for a long enough time . If you dont qualify for premium-free Part A can buy the coverage instead. The premium costs as of 2021 are either $259 or $471, depending on how long someone worked and paid Medicare taxes.

Deductibles

Medicare Part A has a deductible of $1484 per benefit period, defined as the time between when you are first admitted to the hospital and the time that you have not received services for 60 consecutive days.

Copays and Coinsurance

There is no coinsurance required for the first 60 days of a stay in a hospital or skilled nursing facility, but there are coinsurance amounts that kick in after the initial sixty days have passed.

How Do You Sign Up For Medicare Part B

Signing up for Medicare Part B depends on your situation. In some cases, enrollment is automatic, and in others you must apply. If youre already receiving benefits from Social Security or the Railroad Retirement Board for at least four months before you turn 65, youll be automatically enrolled. If thats not the case, you can apply online at ssa.gov/medicare.6

That said, while most people should enroll in Medicare Part A, some people may choose to delay signing up for Part B. This typically depends on the kind of health coverage you have. For instance, if youre working and you still have health coverage through a job, or you have coverage through your spouse whos still working, you may be able to delay coverage without paying a late enrollment penalty.7 There are a lot of nuances find out about those and other situations here.

If you have Lou Gehrigs disease , end-stage renal disease , or youre under 65 and you are receiving Social Security Disability Insurance benefits, find out about enrollment here.

Recommended Reading: Are Medical Alert Systems Covered By Medicare

When Can You Enroll In Medicare Part B

You can sign up for Medicare Part B during the 7-month period that begins 3 months before your 65th birthday and 3 three months after that birthday.

If you have ALS, you may enroll in Medicare as soon as your Social Security disability insurance goes into effect.

If you have ESRD, you can enroll for Medicare starting on the first day of your fourth month of dialysis. If you do home dialysis, you dont have to wait 4 months and can apply immediately.

You may also apply immediately for Medicare if youre hospitalized for a kidney transplant.

When Can I Enroll In Plan A And Plan B

Your first chance to sign up for Original Medicare is during your Initial Enrollment Period The Initial Enrollment Period is the seven-month period around your 65th birthday when most people are eligible for the first time to enroll in Medicare.. To figure out your IEP, follow the seven-month rule your enrollment window includes the three full calendar months before the month you turn 65. It remains open during your birth month, and the three months after. For example: If your birthday is in June, your seven-month window will open Mar. 1 and close Sept. 30.

3 months before your 65th birthday: May, April, Mar.Your birth month: 3 months after you turn 65: July, Aug., Sept.

If you missed your IEP, there are other enrollment periods available. You may be eligible for a Special Enrollment Period due to a Qualifying Life Event Qualifying Life Events are life changes that allow you to enroll in a new health insurance plan during a Special Enrollment Period. These include having or adopting a child, losing other coverage, marriage, a change of income and moving.. There is also a designated time to change your Medicare plan. Learn all about Medicares different enrollment periodsand how GoHealth can help you.

Read Also: Can You Get Medicare If You Retire At 62

Medicare Part B Covers Bone Mass Measurements

Part B will cover bone mass measurements once every 24 months if you have an increased risk of osteoporosis.

If your X-rays show that you have possible osteoporosis, vertebral fractures or osteopenia, Medicare Part B will cover your bone mass measurements in full, as long as your doctor accepts Medicare assignment.

Medicare Advantage Part C

What it helps cover:

- Medicare Advantage plans are required by law to provideat minimumthe same coverage, benefits and rights provided by Original Medicare Part A and Part B, with the exception of hospice care.

- Many Medicare Advantage plans also choose to offer prescription drug coverage, as well as coverage for routine dental, vision and hearing benefits, to compete for your business.

What it costs:

- Medicare Advantage plans are offered by private insurance companies contracted by the federal government, so they vary in cost, coverage, deductibles and copays.

- Many Medicare Advantage plans offer affordable or $0 dollar premiums plus a variety of coverages and benefits not offered by Original Medicare .

You May Like: How To File Medicare Claims For Providers

Can You Ever Get Both Part A And Part B Coverage At The Same Time

When youre an inpatient in a hospital, its possible to get Part A and Part B coverage at the same time. For example, while Part A generally covers medically necessary surgery and certain hospital costs, Part B may cover doctor visits while youre an inpatient.

Did you know that theres another way to get your Part A and Part B coverage? A Medicare Advantage plan delivers these benefits, and often more. Most Medicare Advantage plans include prescription drug coverage. Learn more about Medicare Advantage plans. You must pay your Medicare Part B premium when you have a Medicare Advantage plan, as well as any premium the plan might charge.

This information is not a complete description of benefits. Contact the plan for more information. Limitations, copayments, and restrictions may apply. Benefits, premiums and/or copayments/co-insurance may change on January 1 of each year.

Also Check: Is Medicare Advantage A Good Choice

Cdc Shingles Vaccine Recommendations

The Centers for Disease Control and Prevention recommends Shingrix vaccination for anyone 50 years and older, even if you have already had shingles, if you had another type of shingles vaccine, and if you dont know whether or not youve had chickenpox in the past.

You should not get the vaccine if you are allergic to any of the components, are pregnant or breastfeeding, currently have shingles, or you have lab tests that definitively show that you do not have antibodies against the varicella-zoster virus. In that case, you may be better off getting the varicella vaccine instead.

Also Check: What Age Can You Get Medicare Health Insurance

How To Sign Up For Medicare Part B

Beneficiaries collecting Social Security benefits when they age into Medicare at 65 will automatically be enrolled. Youll receive your Medicare card the month before your birthday. If youre not collecting Social Security benefits, youll need to enroll yourself. You can apply online, over the phone, or in-person.

All beneficiaries will have an Initial Enrollment Period for both Part A & Part B. This period begins three months before the month you turn 65th birthday and ends three months after. If you dont enroll during your Initial Enrollment Period and dont have , you could be subject to a penalty.

You wont pay the penalty if you meet certain conditions that allow you to sign up for Part B during a Special Enrollment Period. An example would be if you continued working past 65 and had creditable coverage through an employer group health insurance.

Medicare Part B Premium

If you have Part B, youll need to pay a monthly premium. The standard monthly premium for 2022 is $170.10.

However, the amount of this premium can increase based on your income. People with a higher income typically pay whats known as an income-related monthly adjustment amount . For 2022, your income amount is calculated from your 2020 tax return.

The following individuals can enroll in original Medicare :

- people age 65 and older

- individuals with a qualifying disability

Eligibility for Part B depends on whether or not youre eligible for premium-free Part A. Most people get premium-free Part A because theyve paid Medicare taxes while working.

Read Also: Does Medicare Cover Disposable Briefs

Who Is Eligible For Part B

As soon as you become eligible for Medicare, you can signup for Medicare Part B. Typically, eligibility is determined by age for those 65 or older, or individuals who have other qualifying conditions. Enrollment in Part B is optional but many people choose to apply for Part B when they first become eligible.

Premium Surcharge Is Based On 2020 Tax Return You Can Appeal It If Your Income Has Changed

The government determines whether you have to pay an income-related premium surcharge based on your income tax return from two years ago, since that is the most recent tax return they have on file at the start of the plan year. 2020 tax returns were filed in 2021, so those were the most current returns available when income-related premium adjustments are determined for 2022.

But if a life-change event has subsequently reduced your income, theres an appeals process you can use. In the appeal, you can request that the income-related premium adjustment be changed or eliminated without having to wait for it to reflect on a future tax return.

Recommended Reading: Do You Have To Resign Up For Medicare Every Year

Medicare Coverage For Shingles Vaccine

Shingrix is not the first shingles vaccine, but it is the only one currently on the market in the United States.Instead of using a live virus,the vaccine uses a protein from the virus to trigger an immune response. It is administered in two doses two to six months apart.

This shingles vaccine has been shown to decrease the risk for shingles by 97% for people between 50 and 69 years old and by 91% for people 70 and older. It reduces complications as well. The risk for post-herpetic neuralgia goes down by 91% and 89%, respectively, in those age groups.

Because the vaccine works well, it is important to know if and when Medicare covers it.

How Does One Pay For Assisted Living

Unfortunately, Medicare does not cover these costs. People typically pay for assisted living through savings or with money from retirement accounts. Purchasing long-term care insurance can be a good way to help pay for these facilities. However, you must plan early and purchase this insurance before the need for care arises. Most people purchase a policy like this while in their 40s or 50s.

Also Check: How Much Medicare Is Taken Out Of Social Security Check

You May Like: How To Get Prior Authorization For Medicare