How Much Does Medicare Drug Coverage Cost

Your costs will vary depending on the drugs you use, the plan you choose, and whether you qualify for extra help paying your Medicare Part D costs. Exact coverage and costs are different for each plan, but all Medicare drug plans must provide at least a standard level of coverage set by Medicare. Call the plan you’re interested in to find out more about plan costs.

Payments you make in a Medicare drug plan include the following:

Making Sense Of The Medicare Part D Drug Plan Deductible

Medicare Part B Drug Plan Deductibles Can Be Complicated

getty

Medicare Part D prescription drug coverage can cause confusion, and much of that starts with the deductible, which is the first of the Part D drug coverage payment stages. Confusing yes, but the inherent hazards of the deductible, those with financial implications, can be avoided with some factual information.

Lets start with some typical questions.

If my plan has a deductible, why are my drugs free?

Why do I keep paying toward the deductible every month and never seem to meet it?

How come what I pay for drugs can change during the year?

Drug plan deductible facts

How the deductible works

In each of these examples, the plan has the standard deductible, $445.

- Daniel takes a Tier 3 insulin with a full cost of $1,038. He will meet the deductible in the first month.

- Dorothys one medication, a Tier 4 muscle relaxant with a full cost of $2.26, is subject to the deductible. She will pay that amount, $2.26, every month and wont meet the plans deductible this year.

- Dons regimen of seven drugs includes two of Tier 3 in the mix. The full cost for those two is $70.96. He will meet the deductible in July.

- Dianas drug list includes seven medications, all Tier 1. This tier is not subject to the deductible. Plus, her plan does not charge a copayment for Tier 1 medications.

Going forward

Medicare Part C = Medicare Advantage Plans

- Once you have Parts A and B, you can enroll in a Medicare Advantage plan

- When Medicare Advantage plans include Part D prescription drug coverage, theyre called MAPD plans

- MAPD plans are usually the lowest cost way to get Parts A, B and D together

- Youll continue to pay your Part B premium to the federal government

- Usually, youll pay an additional monthly premium to your private insurance company, too

- Medicare Advantage plans may also include extras like dental and vision coverage

- You wont be denied due to a pre-existing condition

You May Like: Is Pneumococcal Vaccine Covered By Medicare

What Does Medicare Part D Cost

Like Medicare Advantage plans, Part D stand-alone plans will also vary in costs based on the plan you choose. Each plan negotiates prices with drug manufactures and pharmacies. Your copays and coinsurance rates are based on these prices and on guidelines set by Medicare. You can find explanations of specific drug costs in each Part D plans Summary of Benefits or Evidence of Coverage materials.

Your total prescription drug costs will also be impacted by the number of prescriptions you take, how often you take them, if you get them from an in-network or out-of-network pharmacy, and what Part D coverage stage you are in. Your costs may also be less if you qualify for the Extra Help program.

First, lets look at what kinds of costs you could pay for Part D, then dive into the different coverage stages and how they work.

Read Also: Does Medicare Vary By State

Getting Out Of The Donut Hole

In 2021, you have to ride out $2,620 in prescription spending to get out of the coverage gap. Your share of the costs for drugs can change significantly during this time.

Once youre in this donut hole, you have to pay up to 25 percent of the cost of any name brand drug your plan covers.

On the plus side, 95 percent of the cost of the drug meaning a good portion of what your insurer pays counts as your out-of-pocket costs toward getting out of this coverage gap.

Also Check: Does Medicare Cover Dexcom G6 Cgm

Medication Therapy Management Programs For Complex Health Needs

Plans with Medicare drug coverage must offer free Medication Therapy Management services if you meet certain requirements or are in a program to help members use their opioids safely. This program helps you and your doctor make sure that your medications are working to improve your health.

Through the MTM youâll get:

- A comprehensive review of your medications and the reasons why you take them.

- A written summary of your medication review with your doctor or pharmacist.

- An action plan to help you make the best use of your medications

A pharmacist or other health professional will talk with you about:

- Whether your medications have side effects

- If there might be interactions between the drugs youâre taking

- Whether your costs can be lowered

- How to safely dispose of unused medications

Its a good idea to schedule your medication review before your yearly wellness visit, so you can talk to your doctor about your action plan and medication list. Bring your action plan and medication list with you to your visit or anytime you talk with your doctors, pharmacists, and other health care providers. Also, take your medication list with you if you go to the hospital or emergency room.

If you take many medications for more than one chronic health condition, contact your drug plan to see if youâre eligible for a Medication Therapy Management program.

Employer/union Coverage And Part D Irmaa

| Note |

|---|

|

You pay your Part D IRMAA directly to Medicare, not to your plan or employer. Youre required to pay the Part D IRMAA, even if your employer or a third party pays for your Part D plan premiums. If you dont pay the Part D IRMAA and get disenrolled, you may also lose your retirement coverage and you may not be able to get it back. |

Read Also: How Do I Apply For Medicare In Arizona

How Much Will Your Part D Late

Your late-enrollment penalty is calculated when you join a Medicare drug plan.

To estimate your penalty amount, multiply 1% of the national base beneficiary premium for the current year by the number of full months you were eligible to join a Medicare drug plan but didn’t. Round this to the nearest ten cents. This penalty amount is added each month to your Medicare drug plan’s premium for as long as you have a plan.

For example, if you waited 24 months to join a plan, you would multiply $0.31 times 24 for a total penalty, after rounding, of $7.44. This amount would be permanently added to the monthly premium of the plan you chose. The national base beneficiary premium may increase each year, so the penalty amount may also increase each year.

Medicare Part D Costs: Out

Once in the donut hole, you will need to reach your out-of-pocket threshold to move into the next phase of your drug plan catastrophic coverage. In 2023, the Medicare Part D out-of-pocket threshold is $7,400.

Once you spend this amount on prescription drugs, you will only be responsible for a small copayment up to 5% of the total cost of your medications.

Example: Due to the high-cost drugs she is prescribed, Susan met her $505 deductible in March, her initial coverage limit of $4,660 in August, and now, she is out of the donut hole as her total drug costs equal $7,400 by November. She is now responsible for up to 5% of the retail cost of her drugs through the end of the year.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

In 2024, catastrophic coverage will be eliminated. Thus, once you move out of the donut hole, you will not be responsible for any medication costs for the rest of the year.

Don’t Miss: How To Switch Medicare Advantage Plans

Medicare Part D Cost: Medicare Part D Coverage Phases

There are four coverage phases for Medicare Part D. These include:

*In 2025, the coverage gap coverage phase will be eliminated due to the Inflation Reduction Act of 2022.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

**In 2024, the catastrophic coverage phase will be eliminated due to the Inflation Reduction Act of 2022.

Each of the four coverage phases has a different dollar amount you must meet to move on to the next phase in your Medicare Part D plan. During each phase, your plan will have a pre-determined amount you must pay for each drug. This amount varies by phase, policy, and carrier.

To depict all four Medicare Part D drug plan phases, we will follow Susan through her Medicare Part D journey. This year, Susan enrolled in a Medicare Part D plan with a $505 deductible. She takes high-tier drugs with high out-of-pocket copayments. Below, we will review Susans costs throughout each Medicare Part D drug phase.

Help Covering Medicare Part D Costs

If you have limited income and resources, a program called Extra Help may be able to help you with Medicare Part D prescription drug costs, including premiums, coinsurance and your deductible.

The U.S. Social Security Administration estimates that Extra Help is worth about $5,000 per year to those who receive it.

You can find out if you qualify and apply for Extra Help with Medicare Part D prescription drug costs at the Social Security website.

To qualify for the Extra Help program, you must be receiving Medicare, live in one of the 50 U.S. states or the District of Columbia and have limited resources and income.

Don’t Miss: Is Oral Surgery Covered By Medicare

Cost Of Medicare Part D In 2023 And How It Works

Find Cheap Medicare Plans in Your Area

Medicare Part D, or Medicare drug coverage, is a type of prescription drug policy that can help you pay for a variety of medications. You can purchase a stand-alone Part D policy and pair it with Medicare Parts A and B.

The average monthly cost of a Medicare Part D plan is $49.

Costs depend on the Part D plan you select, but rates can be higher if you decide to wait and join a Part D plan after your initial enrollment period ends, which is usually about three months after you turn 65.

D Spending And Financing

Part D Spending

The Congressional Budget Office estimates that spending on Part D benefits will total $119 billion in 2023, representing 14% of net Medicare outlays . Part D spending depends on several factors, including the total number of Part D enrollees, their health status and drug use, the number of high-cost enrollees , the number of enrollees receiving the Low-Income Subsidy, and plans ability to negotiate discounts with drug companies and preferred pricing arrangements with pharmacies, and manage use .

Part D Financing

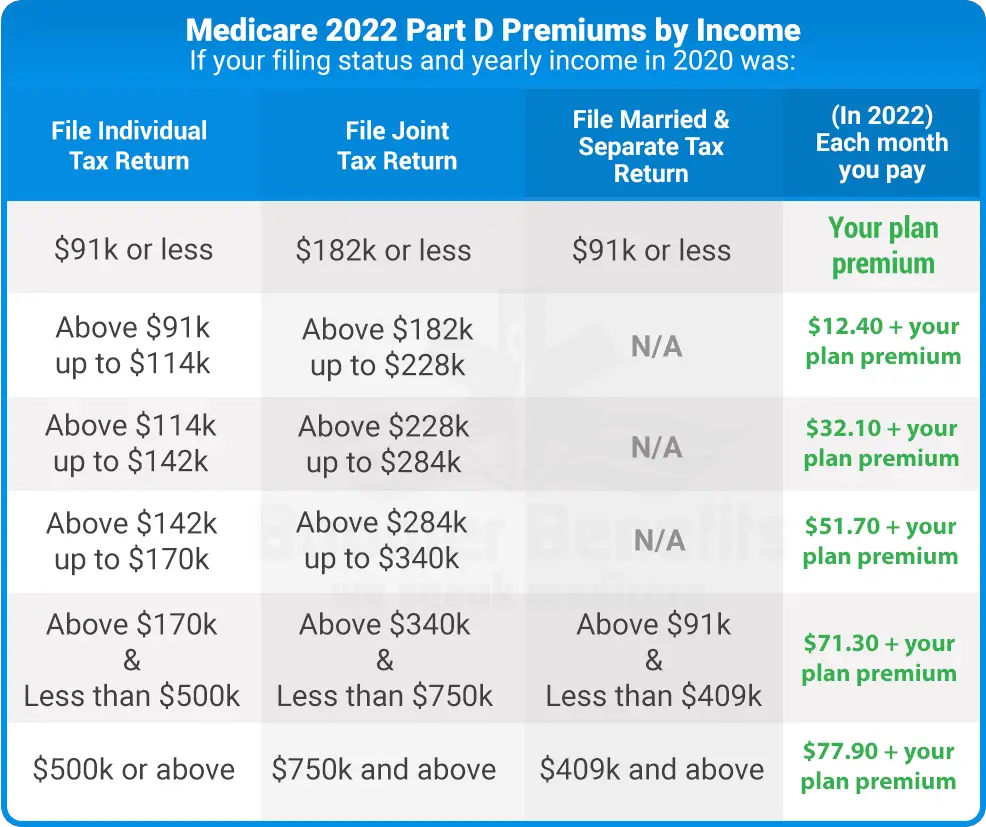

Financing for Part D comes from general revenues , beneficiary premiums , and state contributions . The monthly premium paid by enrollees is set to cover 25.5% of the cost of standard drug coverage. Medicare subsidizes the remaining 74.5%, based on bids submitted by plans for their expected benefit payments. Higher-income Part D enrollees pay a larger share of standard Part D costs, ranging from 35% to 85%, depending on income.

Payments to Plans

Also Check: Do You Get Medicare At 65

Costs You Could Pay With Medicare Part D

With stand-alone Part D plans, you will pay a monthly premium and may also pay an annual deductible, copays and coinsurance.

Some plans charge deductibles, some do not, but Medicare sets a maximum deductible amount each year. In 2022, the annual deductible limit for Part D is $480. In 2023, the annual deductible limit for Part D is $505.

Copays are generally required each time you fill a prescription for a covered drug. Amounts can vary based on the plans formulary tiers as well as what pharmacy you use if the plan has network pharmacies.

Some plans may also set coinsurance rates for certain drugs or tiers. In this case the plan charges a percentage of the cost each time you fill a prescription.

How To Enroll In Medicare Part D

Typically, if you qualify for Medicare, you qualify for Part D prescription drug coverage. But its important to keep in mind that you may enroll in Part D coverage only in a few specific periods:

- Your Medicare Initial Enrollment Period : You can enroll in a Part D plan in the 3 months you turn 65, the month of your 65th birthday or 3 months after.

- The Medicare Annual Enrollment Period : This runs from Oct. 15 to Dec. 7 every year. During the AEP, you may make changes to your Medicare Part C and Part D coverage. They will take effect on Jan. 1 of the following year.

- The Medicare Advantage Open Enrollment Period : This lasts from Jan. 1 to March 31 each year. You may add, drop or change your Part D coverage during this time.

- Special Enrollment Period : You may be able to enroll in a new Part D plan if youre eligible for an SEP. You may qualify for an SEP under certain circumstances, such as if you make changes to a job-based drug coverage plan, or if you have or lose Extra Help.

Recommended Reading: What Is The Most Expensive Medicare Supplement Plan

What Are Medicare Special Needs Plans

If you are eligible for both Medicare and Medicaid, you may also be eligible to join a Dual-eligible Special Needs Plan . This is a certain type of Medicare Advantage plan that offers all of the same coverage as Medicare Part A and Part B along with additional benefits that are tailored to the needs of someone with limited income and resources.

All Medicare Advantage Special Needs Plans must include coverage for prescription drugs.

Learn more about Medicare Special Needs Plans and D-SNPs, and find out if there are any plans available where you live. You can compare Medicare plans online, including what drugs they cover and what pharmacies are part of the plan network. You can also call to speak with a licensed insurance agent to learn more.

How Well Does Shingrix Work

Two doses of Shingrix provide strong protection against shingles and postherpetic neuralgia , the most common complication of shingles.

- In adults 50 to 69 years old with healthy immune systems, Shingrix was 97% effective in preventing shingles in adults 70 years and older, Shingrix was 91% effective.

- In adults 50 years and older, Shingrix was 91% effective in preventing PHN in adults 70 years and older, Shingrix was 89% effective.

- In adults with weakened immune systems, Shingrix was between 68% and 91% effective in preventing shingles, depending on their underlying immunocompromising condition.

In people 70 years and older who had healthy immune systems, Shingrix immunity remained high throughout 7 years following vaccination.

You May Like: Does Shingles Nerve Pain Ever Go Away

Don’t Miss: How Can I Sign Up For Medicare Part B

What Parts Of Medicare Cover The Shingles Vaccine

Original Medicare Part A and Part B doesnt cover the shingles vaccine. However, there are other Medicare plans that may cover at least part of the costs. These include:

- Medicare Part C. Medicare Advantage is a plan you can buy through a private insurance company. It may offer additional benefits not covered by original Medicare, including some preventive services. Many Medicare Advantage plans include prescription drug coverage, which would cover the shingles vaccine.

- Medicare Part D. This is the prescription drug coverage portion of Medicare and typically covers commercially available vaccines. Medicare requires Part D plans to cover the shingles shot, but the amount it covers can be very different from plan to plan.

Making Sure Youre covered

There are a few steps you can take to make sure your shingles vaccine is covered if you have Medicare Advantage with drug coverage or Medicare Part D:

- If your doctor cant bill your plan directly, ask your doctor to coordinate with an in-network pharmacy. The pharmacy might be able to give you the vaccine and bill your plan directly.

- File your vaccine bill for reimbursement with your plan if you cant do either of the options above.

If you have to file for reimbursement, youll have to pay the full price of the shot when you get it. Your plan should reimburse you, but the amount covered will vary based on your plan and if the pharmacy was in your network.

Read Also: How Many Shingles Vaccines Are There

Eliquis Coverage Through Medicare Advantage

Medicare Advantage is a way to get your Medicare benefits through private insurance companies. Although these plans primarily cover Part A and Part B services, many of them also include at least some prescription drug costs.

When you buy a Medicare Advantage plan, you should make sure that Eliquis will be covered for you. 99% of Medicare Advantage plans will cover Eliquis, so this is an option you should consider if it is a prescription you will need. You will most likely be able to find a plan that works for you.

Also Check: Does Medicare Cover Lift Chair Recliners

What To Do If Your Drug Isnt Covered

If you have trouble getting the medication that you want covered, you may be able to appeal. You and your doctor can submit a formal request for an exception to a drug coverage rule. For example, you could send a request to get coverage for a drug thats not in your formulary. You could also send a request to waive a step therapy requirement to use a lower-tier drug.

Recommended Reading: How Much Is Medicare Copay For A Doctorâs Visit