What Changes Are Coming To Social Security In 2022

If you are already receiving Social Security benefits, you will receive a 5.9% COLA increase to your monthly Social Security benefit. This nice increase will be somewhat offset by the increase in Part B premiums. To earn the maximum of four credits in 2022, you need to earn $6,040 or $1,510 per quarter.

What Taxes Are Taken Out Of Social Security

Some people who get Social Security must pay federal income taxes on their benefits. However, no one pays taxes on more than 85% percent of their Social Security benefits. You must pay taxes on your benefits if you file a federal tax return as an individual and your combined income exceeds $25,000.

When Are You Eligible For Social Security And Medicare

People are eligible for Medicare when they turn 65. Youll sign up for coverage at that time.

Social Security becomes available when you turn 62, but its usually not wise to get Social Security benefits at 62. Instead, you should wait until your retirement age, so you can receive full Social Security benefits.

Federal law dictates your retirement age based on when you were born. The retirement age was once 65. However, in the 1980s, Congress passed a law raising the retirement age for those born in 1938 and later.

For instance, people born 1960 or dont reach retirement age status until 67. At that time, they can begin to collect full Social Security benefits.

People born between 1943 and 1954 reach retirement age status at 66. Those who were born in other years should check their specific retirement age.

On the flip side, people who delay receiving Social Security until after they reach retirement age status receive larger monthly checks. You can delay Social Security checks until age 70. You can technically delay payments even beyond 70, but you wont get higher checks once you begin receiving benefits. Waiting until age 70 is when you receive the highest Social Security checks.

Also Check: What Is Medicare In Simple Terms

People Enrolled In Both Social Security And Medicare Have Their Premiums Automatically Deducted From Their Monthly Check

If you receive Medicare health insurance benefits and Social Security retirement benefits at the same time, you can have your Medicare premiums automatically deducted from your Social Security check each month. This can save a lot of time and energy, as you wont have to worry about paying your premiums manually. This option is available for every part of Medicare, including private plans like Medicare Advantage and Medicare Part D.

This article explains everything you need to know to understand how much will be deducted from your Social Security benefits.

Is Social Security Based On The Last 5 Years Of Work

Social Security benefits are based on your lifetime earnings. Your actual earnings are adjusted or indexed to account for changes in average wages since the year the earnings were received. Then Social Security calculates your average indexed monthly earnings during the 35 years in which you earned the most.

You May Like: Will Medicare Pay For A Toilet Seat Riser

What Debts Are Forgiven At Death

What Types of Debt Can Be Discharged Upon Death?

- Secured Debt. If the deceased died with a mortgage on her home, whoever winds up with the house is responsible for the debt. …

- Unsecured Debt. Any unsecured debt, such as a credit card, has to be paid only if there are enough assets in the estate. …

- Student Loans. …

Does Inheritance Affect Social Security

Social Security is not a means-tested program, which means that your eligibility for Social Security is not affected by any receipt of assets or income that you receive from an inheritance. Therefore, if you are receiving Social Security, receipt of inheritance will not have an effect on your Social Security payments.

Also Check: Are Cancer Drugs Covered By Medicare

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual’s Medicare wages that exceed a threshold amount based on the taxpayer’s filing status. Employers are responsible for withholding the 0.9% Additional Medicare Tax on an individual’s wages paid in excess of $200,000 in a calendar year, without regard to filing status. An employer is required to begin withholding Additional Medicare Tax in the pay period in which it pays wages in excess of $200,000 to an employee and continue to withhold it each pay period until the end of the calendar year. There’s no employer match for Additional Medicare Tax. For more information, see the Instructions for Form 8959 and Questions and Answers for the Additional Medicare Tax.

The Interaction Between Medicare Premiums And Social Security Colas

Social Security and Medicare assist in providing financial security to most elderly and disabled individuals in the United States. Certain interactions between Social Security and Medicare may have important financial implications for individuals who are enrolled in both programs.

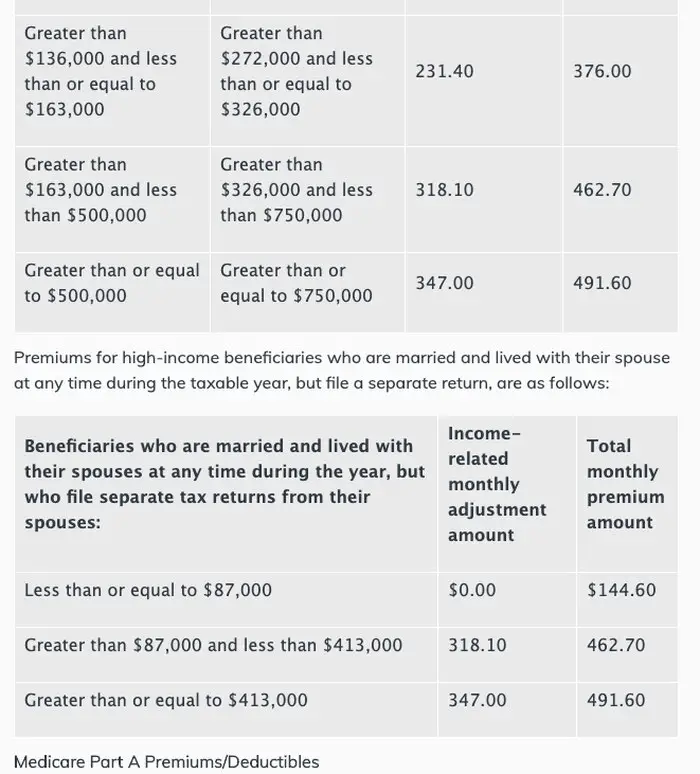

Social Security provides monthly cash benefits to retired or disabled workers and their family members. The Social Security benefits that are paid to retired workers are based on workersâ past earnings. Medicare is a federal insurance program that pays for covered health care services for most individuals aged 65 and older. Medicare Part B and Part D are voluntary, premium-based programs for Medicare beneficiaries providing coverage for physician services and prescription medications . Standard Medicare Part B and Part D premiums are set at a rate each year to cover approximately 25% of per capita program costs. High-income beneficiaries may pay higher than standard premiums. Individuals who are enrolled in both Social Security and Medicare must have their Medicare Part B premiums automatically deducted from their monthly Social Security benefit and may choose to have their Medicare Part D premiums automatically deducted from their monthly Social Security benefit.

Read Also: What Does Cigna Medicare Supplement Cover

Also Check: Which Medicare Insurance Is Best

How Can I Live On Social Security Alone

7 Tips to Live Well on Social Security Alone

Will The Republicans Really Cut Social Security

Republicans, the New York Times says, have embraced plans to reduce federal spending on Social Security and Medicare, including cutting benefits for some retirees and raising the retirement age for both safety net programs.

A common talking point for Democrats during the midterm elections is that if Republicans gain control of Congress, they will make changes to Social Security that make the program less secure. President Biden has said so himself.

These programs these programs are do something so basic yet so important. Almost half of all seniors in the United States lived in poverty before Social Security, Biden said this week. Let me say that again: 50 percent almost 50 percent of all the seniors in America lived in poverty before before this law was passed. Almost half the seniors half of them lived in poverty, even those who spent a lifetime working. Not enough to put food on the table.

Those are more than government programs. Theyre a promise a promise we made as a country to work hard and contribute, and when it comes time to retire, were going to be there for you. Were going to be there for the basic needs.

Earlier this week, the White House deleted a tweet that claimed credit for an announced COLA increase in Social Security benefits next year. That increase was the result of a formula based on inflation, and not the result of any White House action.

The argument, per the piece, is that cuts are necessary to reign in spending.

Read Also: Is Victoza Covered By Medicare

Does Social Security Count As Income

Since 1935, the U.S. Social Security Administration has provided benefits to retired or disabled individuals and their family members. … While Social Security benefits are not counted as part of gross income, they are included in combined income, which the IRS uses to determine if benefits are taxable.

B Premium Can Be Limited By Social Security Cola But That Hasnt Been An Issue For Most Beneficiaries Since 2019

In 2022, most enrollees will pay $171.10/month for their Part B coverage, which is the standard amount. Most enrollees were also paying the standard amount in 2021 , in 2020 , and in 2019 . Some enrollees pay more than the standard premium, if theyre subject to a high-income surcharge .

But thats in contrast with 2017 and 2018, when most enrollees paid a premium that was lower than the standard premium. The standard premium in 2018 was actually $134/month, but the cost of living adjustment for Social Security wasnt quite large enough to cover all of the increase from 2017s premium for most enrollees. Thats why most people paid about $130/month.

The standard Part B premium increased by about $9/month in 2020. But the 1.6% Social Security COLA for 2020 increased the average beneficiarys Social Security benefit . Since the COLA for most beneficiaries exceeded the premium increase for Part B, most Part B enrollees paid the standard premium in 2020. And for 2021, the 1.3% COLA was adequate to cover the increase to the new standard premium for virtually all enrollees. The COLA for 2022 was the largest it had been in 30 years, and more than adequate to cover even the substantial increase in Part B premiums.

Also Check: Are Medicare Supplement Plans Worth It

Working In Retirement: How Does It Affect Social Security And Medicare

Are you retired but considering going back to work?

Whether you’re in it for the extra income, or merely getting paid for something you enjoy doing anyway, it’s important to understand how bringing home a paycheck in retirement could affect your Social Security benefits and medical insurance coverage.

Here are a few things to consider before punching that timecard.

What Are The Medicare Part B Premiums For Each Income Group

| File individual tax return |

Source: Medicare.gov

In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.

This means that the average beneficiary will see never see ten percent of their total income, before accounting for the other health care costs they may have to pay throughout the year.

Deductible increases

In addition to premiums, the CMM also announced an increase to the Part B deductible.

The deductable refers to the amount a member is expected to pay before their coverage kicks in.

The deductible will increase from $203 to $230 in 2022. After the deductible has been reached, members will be required to pay twenty percent of the costs for various services including, most doctor services, outpatient therapy, and medical equipment.

What is causing the increase in costs?

The CMM provided a series of reasons as to why the price is increasing.

The first is that each year based on the continuous increase in the costs of providing health care. Each year, the premium increases a small amount to reflect this market-wide trend. However, from 2020 to 2021, the price only increased two percent, whereas from 2021 to 2022 it will be more than fifteen percent.

Read Also: What Is The Average Medicare Supplement Premium

Why Did I Get An Extra Payment From Social Security This Month

The extra payment compensates those Social Security beneficiaries who were affected by the error for any shortfall they experienced between January 2000 and July 2001, when the payments will be made. Who was affected by the mistake? The mistake affected people who were eligible for Social Security before January 2000.

When To Sign Up For Social Security And Medicare

People are eligible for Medicare when they turn 65. Youll sign up for coverage at that time. Social Security becomes available when you turn 62, but its usually not wise to get Social Security benefits at 62. Instead, you should wait until your retirement age, so you can receive full Social Security benefits.

Also Check: How To Find Out If I Have Medicare

Read Also: What Is Medicare Part A For

Cms Announces 2022 Medicare Part B Premiums

Today, the Centers for Medicare & Medicaid Services released the 2022 Medicare Parts A and B premiums, deductibles, and coinsurance amounts, and the 2022 Part D income-related monthly adjustment amounts. Most people with Medicare will see a 5.9 percent cost-of-living adjustment in their 2022 Social Security benefitsthe largest COLA in 30 years. This significant COLA increase will more than cover the increase in the Medicare Part B monthly premium.

Most people with Medicare will see a significant net increase in Social Security benefits. For example, a retired worker who currently receives $1,565 per month from Social Security can expect to receive a net increase of $70.40 more per month after the Medicare Part B premium is deducted.

CMS is committed to ensuring high quality care and affordable coverage for those who rely on Medicare today, while protecting Medicares sustainability for future generations,” said CMS Administrator Chiquita Brooks-LaSure. The increase in the Part B premium for 2022 is continued evidence that rising drug costs threaten the affordability and sustainability of the Medicare program. The Biden-Harris Administration is working to make drug prices more affordable and equitable for all Americans, and to advance drug pricing reform through competition, innovation, and transparency.

What Is The Medicare Part B Premium For 2021

Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

Don’t Miss: Does Medicare Cover Office Visits

Assessing The Cost Of Premiums

There are several different parts of Medicare. Most people do not have to pay premiums on Medicare part A, which covers services such as inpatient care, hospice care, nursing facilities, and some home healthcare costs because they paid Medicare taxes throughout their careers.

Image source: Getty Images.

Medicare part B premiums tend to be the costliest. Part B covers outpatient care, medical equipment, preventative services like vaccines, and some home health services. In 2022, the Medicare part B premium amount most people paid shot up nearly 15% from $148.50 to $170.10 per month. The increase was mainly due to Medicare covering a new Alzheimer’s drug called Aduhelm.

But this year, Medicare decided to provide more limited coverage for Aduhelm, which will actually lead to a roughly 3% drop in standard Medicare part B premiums in 2023, from $170.10 to $164.90 per month. In fact, experts consider 2023 to essentially be a once-in-a-lifetime event because Social Security benefits are rising so much and Medicare part B premiums are falling.

Another positive for Medicare part B in 2023 is that deductibles are expected to decline from $233 this year to $226 next year.

Offer From The Motley Fool

The $16,728 Social Security bonus most retirees completely overlook: If you’re like most Americans, you’re a few years behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $16,728 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

The Motley Fool has a disclosure policy.

The Motley Fool is a USA TODAY content partner offering financial news, analysis and commentary designed to help people take control of their financial lives. Its content is produced independently of USA TODAY.

Recommended Reading: Are Physicals Covered By Medicare

Which Forms Of Medicare Take Money Out Of My Social Security Check

Typically, only Medicare Part B. Part A does not usually have premiums. If you wish to add a Part D drug plan, there may be extra payments that would require money that could come from your Social Security benefits.

If you wish to add other parts or adjust payments taken from your Social Security check, you can log into your Social Security account and make those changes.

Read More: Medicare and Social Security: How They Work Together

How Much Does Medicare Cost Per Month

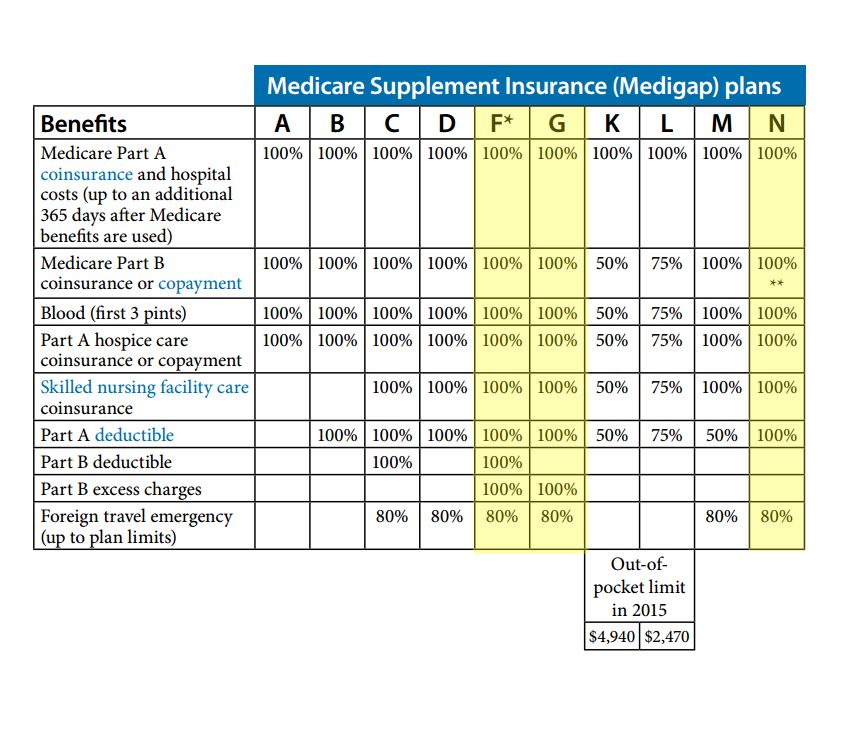

The amount that you will pay for Medicare each month will vary based upon your income and the kind of supplemental coverage you choose.

An example would be the base Part B premium of $170.10/month plus a Medigap Plan G monthly premium of $125/month plus a Part D premium of $27/month your total would be $322.10/month in premiums.

With this example you can be sure your additional out-of-pocket spending would be minimal as Plan G would pick up the majority of your out-of-pocket costs.

There are many different Medicare plan options to choose from so that you can have a monthly premium within your budget.

Don’t Miss: Can I Sign Up For Medicare Advantage At Any Time

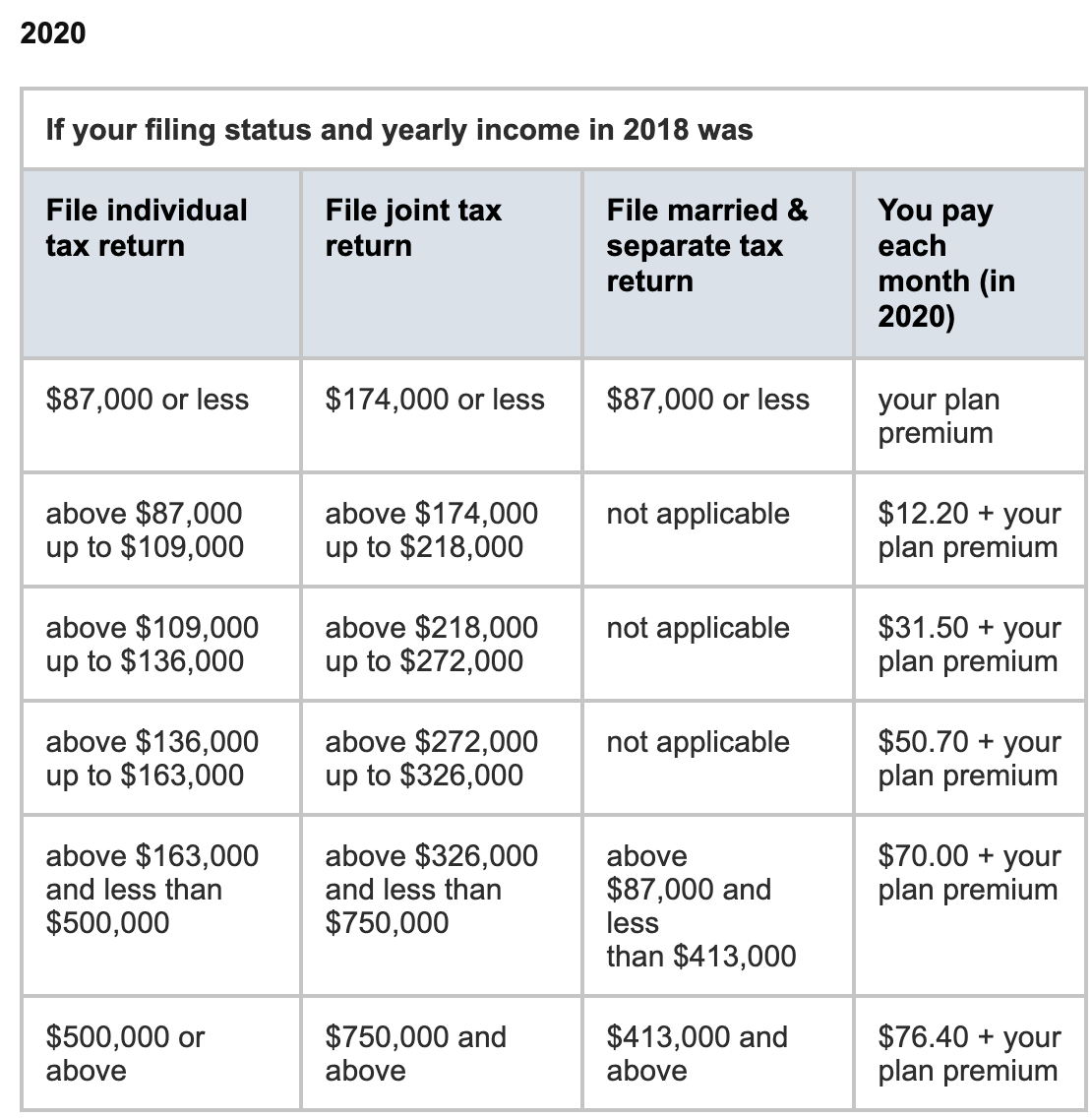

Is Medicare Part B Based On Income

Medicare premiums are based on your modified adjusted gross income, or MAGI. … If your MAGI for 2020 was less than or equal to the higher-income threshold $91,000 for an individual taxpayer, $182,000 for a married couple filing jointly you pay the standard Medicare Part B rate for 2022, which is $170.10 a month.

Medicare Advantage Premiums And Social Security Benefits

Medicare Advantage, also known as Medicare Part C, is a type of insurance provided by private insurance companies that contract with Medicare. Private insurance companies manage the plans but have to work within guidelines provided by the federal government. They are only available to people who are eligible for Original Medicare.

Medicare Advantage premiums vary in price just like other private insurance plans. This means that there is no way to say how much you will pay without getting a quote.

To have your Medicare Advantage monthly premium deducted from your Social Security benefit, you have to contact the Social Security Administration. Otherwise, you will have to pay the premium directly to your insurance company.

You May Like: What Is The Monthly Premium For Medicare Plan G