Are There Different Types Of Insulin

The type of insulin you use can affect your bodys reaction, because not all types of insulin are the same. There are human insulins, called traditional insulins, and another type is analog insulin. Analog insulin is human insulin but it usually undergoes a genetic alteration that affects the properties of the insulin.

What does that mean?

The alteration of the insulin can impact things like how long the drug works in your body, how fast the insulin begins to take effect in your body, and how well it works in your bloodstream.

The different types of insulin also have an impact on how you receive the insulin and how much you pay for the insulin. In some cases, you may receive one type of insulin in a vial and other types may be administered with an insulin pen. With traditional insulins, you have many options for generic versions, which can cost a fraction of brand-name insulins.

How insulin reacts within your body is also an important consideration. Here are four types:

- rapid-acting insulin

- long-acting insulin

Insulin Cap For Medicare Patients Signals Hope For Others

WASHINGTON Years before he came to the Senate, Raphael Warnock spent time bedside with Georgia residents suffering from the long-term effects of diabetes, a condition made worse by limited access to life-saving drugs like insulin.

Ive seen the human face of this up close as a pastor. Ive been there and witnessed what happens when diabetes goes on untreated, Warnock said in an interview with The Associated Press. Ive been there with families when they received the news that a loved one will have to receive an amputation.

That work as a pastor helped the freshman senator push Congress to take its first step in limiting the high cost of insulin for millions of Americans.

The passage of the expansive climate change and health care bill this month delivered key Democratic priorities to voters months before the midterm elections, including provisions to lower health care costs.

As a result, by 2026, Medicare will gain the power to start negotiating costs for pharmaceuticals and its beneficiaries out-of-pocket prescription costs will be limited to $2,000 starting in 2025.

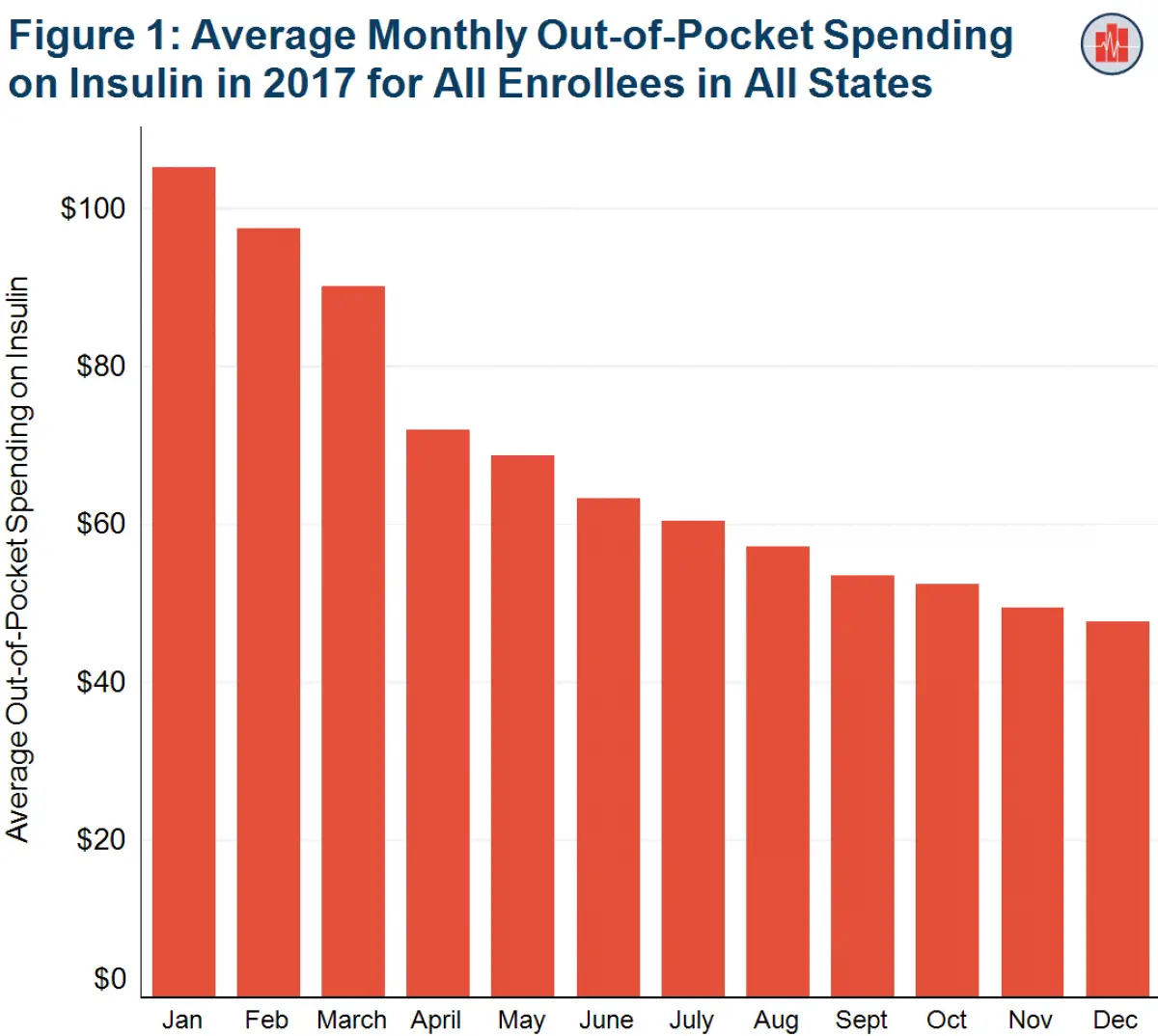

But the most immediate relief will take effect in January when the cost of insulin for patients on Medicare will be capped at $35 a month.

Mayor: Boston is succeeding in reducing youth homelessness

In Warnocks state, the annual average is higher, coming in at $591 for more than 50,000 Georgia residents whose lives are dependent on the drug.

The Parts Of Medicare

Part A and Part B

If you are automatically enrolled in Part A and Part B, you will get your red, white, and blue Medicare card in the mail three months before your 65th birthday. Otherwise, you will want to check with your local Social Security office to enroll by visiting www.ssa.gov or by calling 1-800-772-1213.

Part A is your hospital insurance plan.

It covers inpatient care, hospital stays, skilled nursing care, hospice care, and some home care. Most people do not have to pay a premium for Part A.

Part B is your medical insurance plan.

It will pay a portion of doctor visits, some diabetic medical supplies, and some preventive services. You will pay a premium for Part B based on your income.

Note: Many patients add a supplemental policy such as Medigap to help lower Part A and Part B costs. Medigap cannot be used for Part D coverage or in Medicare Advantage plans.

For prescription drug coverage you have two options:

Part C is your Medicare Advantage plan.

Part D is your stand-alone prescription drug plan.

Regardless of how you choose to obtain prescription drug coverage, be mindful that your providers and treatments are covered before selecting a plan.

Don’t Miss: Why Sign Up For Medicare At 65

What Is The Cost Of Insulin With Insurance

The American Diabetes Association Insulin Access and Affordability Working Group report found that nearly half of Americans have employer-sponsored health insurance. About 20% are insured through Medicaid, and 14% are insured through Medicare. Approximately 7% of Americans purchase health insurance on their own. About 9% of Americans remain uninsured.

Diabetes is considered a pre-existing condition, which is a condition you have prior to applying for health insurance. According to research, about 1.9 million people with diabetes who didn’t have insurance gained coverage after the Affordable Care Act went into effect in 2010.

Still, having insurance doesn’t mean insulin is affordable. Insured patients will often pay a copay or a percentage, rather than the list price, for their insulin. Redmond says that cost could range from $30 to $50.

In cases of high-deductible health plans, patients have to pay the list price for their insulin until their deductible is met. This could mean thousands of dollars out of pocket. Many patients just have a problem paying that much, says Redmond.

Cms Expands Diabetes Medicare Coverage To Include Cgms That Integrate With Medtronic Insulin Pumps

Medtronic plc , a global leader in healthcare technology, today announced that the U.S. Centers for Medicare & Medicaid Services will expand Medicare coverage for all types of

DUBLIN, Dec. 22, 2021 /PRNewswire/ Medtronic plc , a global leader in healthcare technology, today announced that the U.S. Centers for Medicare & Medicaid Services will expand Medicare coverage for all types of continuous glucose monitors , including adjunctive and non-adjunctive CGMs. This includes CGMs that integrate with Medtronic insulin pumps. The proposed rule was finalized on December 21, 2021 and will be effective starting 60 days after official publication.

We commend CMS for taking action to help more people with diabetes and empowering them to choose the therapies that best meet their diabetes management needs, said Jeff Farkas, vice president of health economics, reimbursement, and government affairs for the Diabetes business at Medtronic. This is a very important benefit expansion for our customers who have experienced significant clinical and quality of life benefits from their integrated Medtronic insulin pump systems and are now able to receive coverage for all components of their system on Medicare.

Any forward-looking statements are subject to risks and uncertainties such as those described in Medtronics periodic reports on file with the Securities and Exchange Commission. Actual results may differ materially from anticipated results.

|

Contacts: |

You May Like: Does Medicare Cover Adult Daycare

What Are Insulin Pens

Insulin pens are medical devices used to inject insulin. There are other products that do this as well, such as insulin pumps. In most cases, insulin devices and insulin medication will be covered separately. As a result, some plans may cover insulin, but not insulin pens. This article will describe the coverage options for both insulin and insulin pens under every part of Medicare.

What Is The Insulin Savings Model

As of 2021, there is a new program that applies to both Medicare Advantage plans and Part D plans known as the insulin savings model. This model allows you to compare plans that cover insulin at a cheaper cost more easily.

Participating plans will cover a 30-day supply of insulin for no more than $35. There will be other factors you need to look into to determine whether these plans are a good fit for you, so it is still a good idea to compare quotes and examine the formulary in more detail.

Medicare.gov provides a tool that allows you to compare plans and see which ones provide this type of coverage.

Also Check: Can You Cancel A Medicare Supplement Plans At Any Time

Free Trials Or Samples

Many insulin manufacturers offer free trials or free supplies of their medications. You can search for these programs online by typing in your prescription medications name and the word coupon or trial.

These programs are intended to help you find which medicine works best for you, but they may also help lower your costs over time.

Sometimes doctors offices also have free samples they can provide to get you started on a new medication, help you switch to a new medication, or if you cant get immediate access to your insulin.

How Much Insulin Coverage Does Part B Provide

Medicare Part B covers outpatient care. This includes most procedures, tests, and check-ups that you may undergo in a doctors office. Like Part A, Part B does not cover insulin, with the exception of insulin pumps, which are discussed below.

Part B covers durable medical equipment, also known as DME. It includes equipment like wheelchairs and other mobility aids, as well oxygen tanks. Medicare only covers durable medical equipment that is considered medically necessary for your condition. DME can be purchased or rented.

Part B covers some equipment used by people with diabetes as DME. This includes blood sugar monitors, continuous glucose monitors, therapeutic shoes, lancet devices, blood glucose test strips, and insulin pumps. However, insulin pens are not covered.

Insulin pumps can be covered as DME, in which case the insulin is covered as well. This is the only scenario in which Medicare Part B will provide coverage for insulin.

If you receive DME under Part B, make sure to only go through a Medicare-approved DME supplier. Otherwise, you’ll likely be responsible for 100% of the cost. You may also need to receive prior authorization for durable medical equipment.

Recommended Reading: Are Motorized Wheelchairs Covered By Medicare

How Has The Government Impacted Insulin Prices

On July 24, 2020 former President Donald Trump signed an executive order that included language aimed at lowering insulin and other drug prices for Americans. This order became effective on January 22, 2021.

As with any legal order, the devil’s in the detail, Robin Feldman, Arthur J. Goldberg Distinguished Professor of Law at UC Hastings College of Law San Francisco, tells Verywell. She also noted that we are, “…going to need some systemic changes to try to address the problems that are driving drug prices higher in general, and insulin prices higher specifically.

On June 16, 2021, under the Biden administration, the Department of Health and Human Services published in the Federal Register their plan to rescind this 2020 rule. They cited various reasons for doing so:

- It created high administrative costs for impacted health centers.

- Impacted health centers had difficulty maintaining new rules to determine patient eligibility for receiving medications at lower prices.

- The new rules led to a decrease in staff available to help with critical and emergency services.

- Covid-19 added additional stress to these impacted health centers.

On March 1, 2022 in the State of the Union Address, President Biden discussed capping insulin prices at $35 a month. He also mentioned lowering the prices of prescription medication.

Does Medicare Part A Cover Insulin Pens

Medicare Part A is often referred to as hospital insurance because it covers inpatient care. Although usually associated with hospital care, Part A also pays for skilled nursing facility care, hospice care, and home health care in limited cases.

Medicare Part A does not cover insulin pens. However, if you receive insulin while you are an inpatient in a hospital, it will be covered by Part A. There may be some exceptions to this rule, so it is best to discuss insulin coverage with your inpatient healthcare provider.

Also Check: Will Medicaid Pay My Medicare Premium

When Does Medicare Part D Cover Insulin

Medicare Part D prescription drug plans may cover injectable insulin not used with an insulin infusion pump and inhaled insulin.4 Part D plans that participate in the Part D Senior Savings Model, which Humana calls the , may also offer coverage choices that include multiple types of insulin at a maximum copayment of $35 for a 30-day supply.5

Some diabetic supplies that Medicare Part D may help cover include:6

- Insulin pens with or without included insulin

- Inhaled insulin devices with or without included insulin

The Medicare Part D Donut Hole

When Medicare Part D was implemented in 2006, it had a built-in coverage gap where drug plans did not pay toward medications. The gap was nicknamed the donut hole because plans offered coverage all around it.

The Affordable Care Act provided discounts from 2012 through 2019. In 2020 forward, drug plan members will pay 25% of the cost for any prescribed medication from the time they meet the Initial Deductible until they reach the out-of-pocket spending limit that leads to Catastrophic Coverage.

In summary, Medicare Part D prescription drug plans have four phases:7

The donut hole magnifies the importance of controlling your insulin costs. The added cost forces people to seek alternatives or cut back on dosages. But with the 2020 price discounts of 75% on purchases while in the donut hole, it is less likely you will find your particular insulin cheaper outside the Part D system.

Don’t Miss: Is Xolair Covered By Medicare Part B

What If I Cannot Afford My Insulin

Medicares Extra Help program pays for some out-of-pocket costs for prescription drugs. Social Security estimates this amounts to about $4,900 per year.9 It covers the monthly premiums, annual deductibles, and copays of the Part D plan in which you are enrolled. You must have limited resources and income and live in the 50 states or the District of Columbia. Contact Medicare for more information.10

A comprehensive publication is available from the Centers for Medicare & Medicaid Services entitled Medicare Coverage of Diabetes Supplies, Services, & Preventive Programs.11

How Can You Cope

Some insulin users still might be tempted to tackle the Medicare Plan Finder themselves. The experts say: Dont.

Figuring out the best Part D or Medicare Advantage plan for an insulin user requires going through the Medicare Plan Finder several times and comparing a number of details within multiple plans. Keeping track of the numbers can require creating a spreadsheet. People who try to use the Plan Finder themselves could end up very confused, says Greiner.

AARP Membership $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

You May Like: How To Switch Back To Traditional Medicare

How Medicare Part B Covers Diabetes

Medicare Part B covers the fasting blood glucose test, which is a diabetes screening. Medicare covers two diabetes screenings each year for beneficiaries who are at high risk for diabetes. High risk factors for diabetes include: high blood pressure, history of abnormal cholesterol and triglyceride levels, obesity, or a history of high blood sugar. If diabetes runs in your family, you may also need regular diabetes testing. Your doctor may also recommend services that Medicare doesnt cover.

You generally pay nothing for these diabetes tests if your doctor accepts the amount approved by Medicare for the diabetes screening. However, you may have to pay 20% of the amount approved by Medicare for the doctors visit.

If your doctor diagnoses you with diabetes, Medicare covers the supplies you need to control your diabetes, including blood sugar testing monitors, blood sugar test strips, lancet devices and lancets, and blood sugar control solutions.

Medicare Part B may cover an external insulin pump and insulin as durable medical equipment. You pay 20% of the amount approved by Medicare, after the yearly Medicare Part B deductible.

Medicare may also cover medical nutrition therapy for diabetes, if referred by a doctor. You pay 20% of the amount approved by Medicare after the yearly Medicare deductible for services related to diabetes.

Hanie Redmond Pharmd Cde Bc

Without a doubt, insulin is lifesaving, and just a day or so without it will require hospitalization and could lead to death for those patients.

If someone has type 1 diabetes or if someone has had damage to their pancreas, these are instances where their body doesnt produce any insulin, Stephanie Redmond, PharmD, CDE, BC-ADM, founder of Diabetes Doctor, tells Verywell. Without a doubt, insulin is lifesaving, and just a day or so without it will require hospitalization and could lead to death for those patients.

Recommended Reading: Will Medicare Pay For Lasik Eye Surgery

Medicare Part D Costs

Medicare Part D costs consist of premiums, deductibles, and copays. Most people on Part D pay an average premium, which will be $33 per month in 2022, unless you are considered high income. Part D premiums may be higher for people with high incomes. Part D deductibles cannot exceed $480 in 2022. Some Part D plans do not have a deductible at all. Some people may qualify for Extra Help, which may reduce or eliminate these costs.

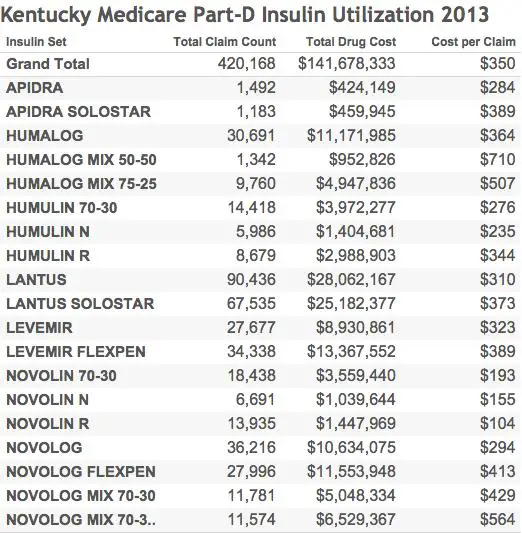

D Formulary Coverage And Tier Placement Of Insulin

Formulary Coverage and Tier Placement of Insulin Therapies

Formulary coverage and tier placement are key factors determining how much Medicare Part D enrollees without low-income subsidies pay out of pocket for their prescriptions, including insulin. In 2019, most insulin products were covered by at least 50% of all Part D plans, including both stand-alone prescription drug plans and Medicare Advantage drug plans . Although coverage of insulin products was not universal, as for drugs in the so-called protected classes, it exceeds the minimum requirement that plans cover at least two chemically distinct drugs in each class.

Even when insulin products are covered by Part D plans, there is variation in tier placement and cost-sharing requirements when enrollees are in the initial coverage phase. A large number of plans placed insulin products on Tier 3, the preferred drug tier, with a $47 copayment per prescription during the initial coverage phase more plans used this combination of tier placement and cost-sharing requirement for coverage of insulin than any other combination in 2019 .

Variation in Out-of-Pocket Spending for Insulin Products by Tier Placement and Cost-Sharing Requirements

Because some insulin products are considerably more expensive than others, differences in tier placement and cost-sharing requirements can translate to wide variation in out-of-pocket spending for any given insulin therapy and from one insulin therapy to another .

Also Check: What Is Oep For Medicare