Medicare Advantage Special Needs Plans May Have Lower Costs

A Medicare Special Needs Plan is a type of Medicare Advantage plan that is designed specifically for someone with a particular disease or financial circumstance.

Many Medicare SNPs cover most of the qualified health care costs for beneficiaries. All SNPs must include prescription drug coverage.

Some Medicare SNPs are designed for people who are dual-eligible, meaning they are eligible for both Medicare and Medicaid. These plans are commonly called Dual-Eligible Special Needs Plans .

Medicare Advantage Special Needs Plans can also cater more specifically to the needs of people with specific medical conditions, such as:

- Dependence issues with alcohol or other substances

- Autoimmune disorders

- Chronic lung disorders

- Strokes

Some SNPs can also be available to people who live in a long-term care facility such as a nursing home.

Is There A Deductible With Medicare

Yes, both Medicare Part A and Medicare Part B each come with a deductible.

Medicare Advantage and Medicare Prescription Drug Plans may also include deductibles as well, although the costs associated with these plans are not standardized like they are in Original Medicare . Some Part D plans include $0 deductibles before the plan’s drug coverage kicks in.

Medicare defines a deductible as:

The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay.

In other words, a deductible is the amount that you must first pay out of your own pocket for health care before your Medicare insurance coverage kicks in.

If You Disagree With Our Decision

If you disagree with the decision we made about your income-related monthly adjustment amounts, you have the right to appeal. The fastest and easiest way to file an appeal of your decision is online. You can file online and provide documents electronically to support your appeal. You can file an appeal online even if you live outside of the United States.

You may also request an appeal in writing by completing a Request for Reconsideration , or you may contact your local Social Security office to file your appeal. You can use the appeal form online, or request a copy through our toll-free number at 1-800-772-1213 . You dont need to file an appeal if youre requesting a new decision because you experienced one of the events listed and, it made your income go down, or if youve shown us the information we used is wrong.

If you disagree with the MAGI amount we received from the IRS, you must correct the information with the IRS. If we determine you must pay a higher amount for Medicare prescription drug coverage, and you dont have this coverage, you must call the Centers for Medicare & Medicaid Services at 1-800-MEDICARE to make a correction. Social Security receives the information about your prescription drug coverage from CMS.

You May Like: Does Medicare Cover Home Health Care Costs

Did The Medicare Part B Deductible Increase For 2021

Q: Did the Medicare Part B deductible increase for 2021?

A: Yes. The Part B deductible increased by $5 for 2021, to $203.

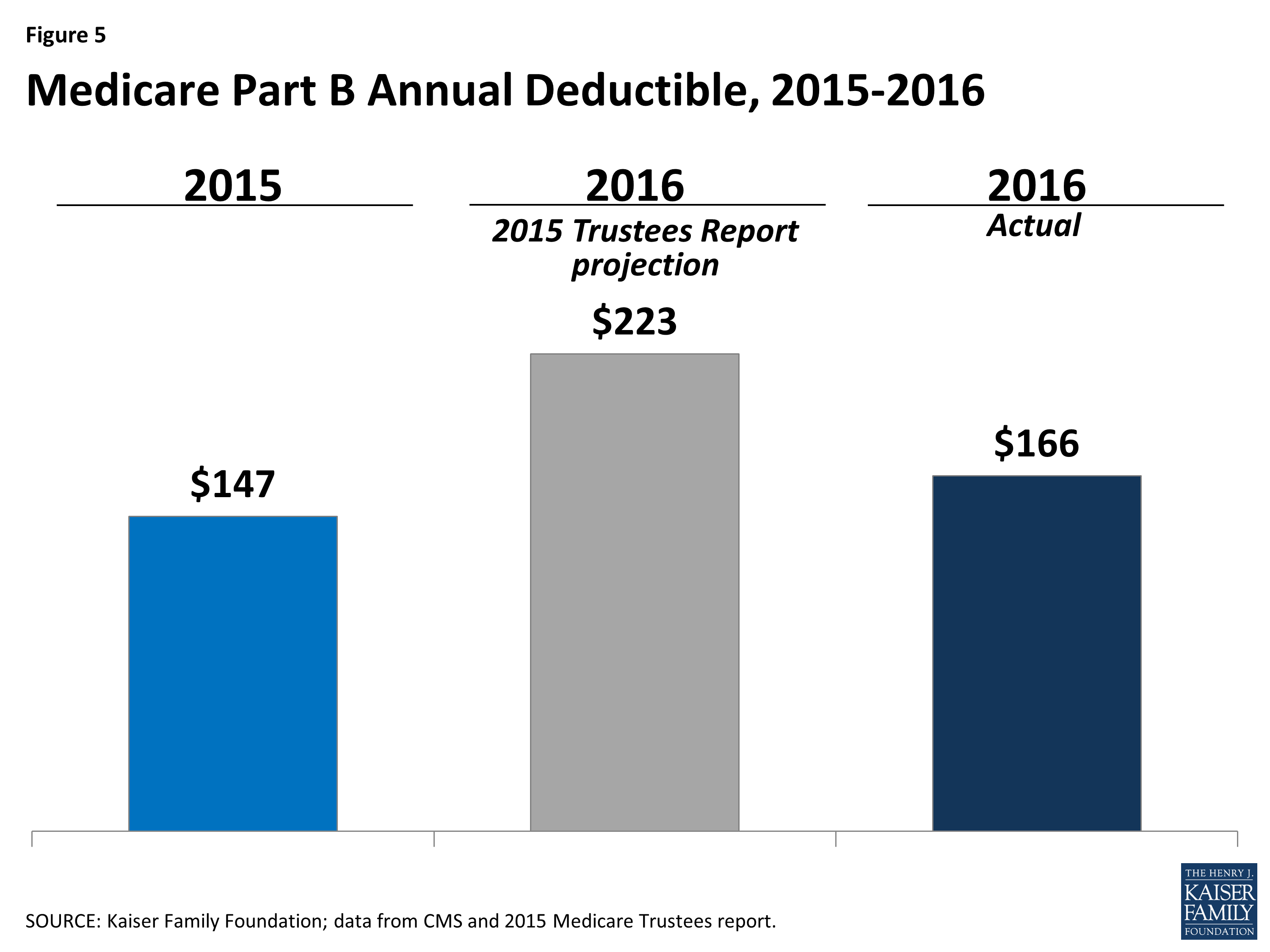

The deductible for Part B was steady at $147 from 2013 to 2015 . It then increased to $166 in 2016 far less than the $223 it would have been without the budget that Congress passed in November 2015, which included a loan for Medicare.

The Part B deductible increased again for 2017, to $183, and remained unchanged for 2018. For 2019, it increased slightly, to $185. And for 2020, it increased by another $13, to $198. The $5 increase in 2021 pushed it over $200 for the first time, with the 2021 Part B deductible reaching $203.

Medicare Supplement Deductibles By Plan

There are 10 standardized Medicare Supplement plans available in most states, and two of those plans offer a high-deductible option. Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,490 in 2022. Plan members must meet this deductible before the plan begins to cover any of Medicare out-of-pocket expenses.

Medicare Supplement Insurance plans are sold by private insurance companies. These plans help pay for Original Medicare deductibles and other out-of-pocket Medicare expenses like copayments and coinsurance.

Six types of Medigap plans provide full coverage of the Medicare Part A deductible, and another three plans provide partial coverage of the Part A deductible.

Two plans, Plan F and Plan C, provide full coverage of the Medicare Part B deductible, although these plans are only available to beneficiaries who became eligible for Medicare before Jan. 1, 2020. If you were eligible for Medicare before 2020, you may still be able to apply for Plan F or Plan C if theyre available where you live. If you already have either plan, you can keep your plan as long as you continue to pay your plan premiums.

Don’t Miss: Does Medicare Pay For Chair Lifts For Seniors

Cost Of Medicare Supplement

For 2022, a Medicare Supplement plan costs an average of $163 per month. However, costs will depend on two factors: the policy you choose and the pricing structure in your state.

Firstly, different plan letters have different prices since each policy provides a different level of coverage. For example, Medigap Plan G, a more comprehensive plan, costs more than Plan K, a cheaper plan with less coverage. Below are the average monthly premiums of each Medigap plan for 2022. Notice that a range is given since costs can vary.

| Medigap plan |

|---|

| $102-$302 |

Monthly premium for a 65-year-old female nonsmoker

Secondly, Medigap prices will differ based on state regulations and whether the plan can set rates based on age or health status. There are three different ways in which Medigap policies can be priced:

- Community-rated

- Issue-age-rated

- Attained-age-rated

The simplest rating system is community-rated, which means the same monthly premium is charged to everyone who has the same Medigap policy. This means your premium will not be based on your age but could go up because of inflation.

Issue-age-rated has a premium structure in which your monthly premium is based on the age you are when you buy the Medicare Supplement plan. In this case, premiums will be lower for people who buy at a younger age. For example, if you bought a Medigap policy at age 65, your premium could be $200, but if you bought the same plan at 80, that policy might cost $300.

Medicare Advantage Plans Have An Out

When you enroll in a Medicare Advantage plan, you can ask about your specific policys out-of-pocket spending limit.

Original Medicare does not include an out-of-pocket spending limit. While its not common, you could potentially be responsible for thousands of dollars in out-of-pocket costs if you only have Original Medicare coverage and require extensive medical care throughout the year.

You May Like: When Are You Required To Sign Up For Medicare

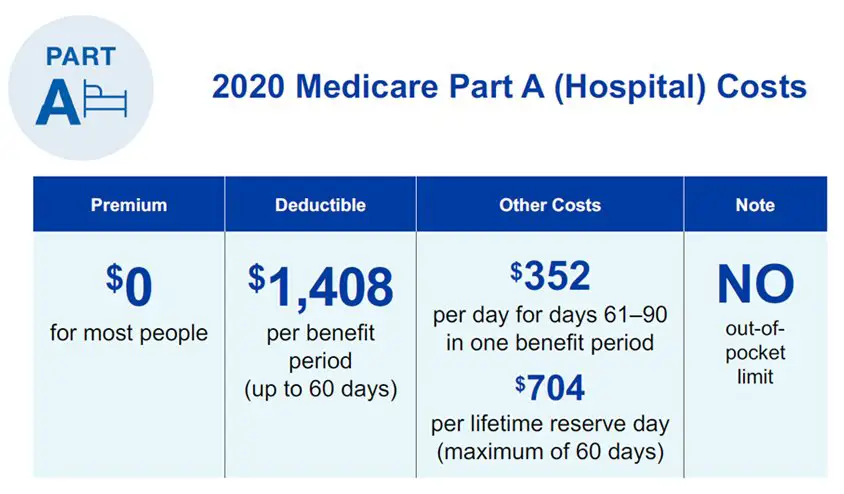

What Is The Medicare Part A Deductible For 2022

The Medicare Part A deductible for 2022 is $1,556 per benefit period.

Unlike the deductible for Part B that operates on an annual basis, the Part A deductible starts and stops with each benefit period.

A benefit period begins the day you are admitted for inpatient care at a hospital or skilled nursing facility, and it ends when you have gone 60 consecutive days without inpatient treatment.

For example, if you are admitted for inpatient hospital care on June 1 and are discharged on June 10, you would still be in the same benefit period if you were admitted again for inpatient care on June 30. You wouldn’t have to meet your Part A deductible again if you already met that deductible during your first hospital stay.

If, however, you were discharged on June 10 and were readmitted to the hospital in October of the same year, you would be in a new benefit period. You would need to meet the Part A deductible again before your Medicare Part A coverage would kick in again.

Find Cheap Medicare Plans In Your Area

For all Medicare plans, costs will vary depending on what plans you decide to purchase, the company you purchase your plan from, your income and sometimes your age. For this reason, you should carefully balance your coverage needs and the costs of the plans when choosing the right mix of Medicare policies.

You May Like: What Date Does Medicare Coverage Start

B Deductibles In Previous Years

The Part B deductible has generally increased over time, although there have been some years when it stayed the same or even decreased. The increase for 2022 is the largest year-over-year dollar increase in the programs history. Heres an historical summary of Part deductibles over the last several years :

- 2005: $110

Does Everyone Have To Pay The Part B Deductible

Some Medicare enrollees arent directly responsible for the Part B deductible:

- Medigap plans C and F cover the deductible .

- Enrollees who have Medicaid or retiree health benefits from an employer generally dont have to pay the Part B deductible, as the other coverage picks up the tab.

- Some Medicare Advantage plans have no deductibles and low copays benefits into one plan for the enrollee, with cost-sharing that can differ greatly from the standard Original Medicare cost-sharing).

But according to a Kaiser Family Foundation analysis, about 19% of Original Medicare beneficiaries only have Medicare Parts A and B. They dont have Medigap coverage, retiree health benefits from a former employer, or Medicaid. These enrollees have to pay the full Part B deductible if and when they need services that are covered under Medicare Part B. For 2021, that deductible is $203.

After the enrollee pays the deductible, Medicare Part B generally covers 80% of the Medicare-approved amount for covered services, and the enrollee pays the other 20%. But again, supplemental coverage can pay some or all of this 20% cost, leaving the enrollee with far lower out-of-pocket costs than they would have under Part B by itself.

Also Check: Do Doctors Have To Accept Medicare Advantage Plans

Enrolling In Medicare Part B

Some people are automatically enrolled in Part A and Part B. These people include:

- those who are going to turn 65 and are already receiving Social Security or RRB retirement benefits

- people who have a disability and have been receiving disability benefits from Social Security or the RRB for 24 months

Some people will have to sign up with the SSA to enroll in parts A and B. These people include those not already collecting Social Security or RRB retirement benefits at age 65 or those with ESRD or ALS.

For people who are automatically enrolled, Part B coverage is voluntary. That means that you can choose not to have it. Some people may wish to delay enrollment in Part B because they already have health coverage. Whether or not you choose to delay enrolling in Part B can depend on the specific health insurance plan that you have.

Monthly Medicare Premiums For 2021

The standard Part B premium for 2021 is $148.50. If youre single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

| Modified Adjusted Gross Income | Part B monthly premium amount | Prescription drug coverage monthly premium amount |

|---|---|---|

| Individuals with a MAGI of less than or equal to $88,000 Married couples with a MAGI of $176,000 or less | 2021 standard premium = $148.50 |

| Your plan premium + $77.10 |

Also Check: Is Medicare Issuing New Plastic Cards

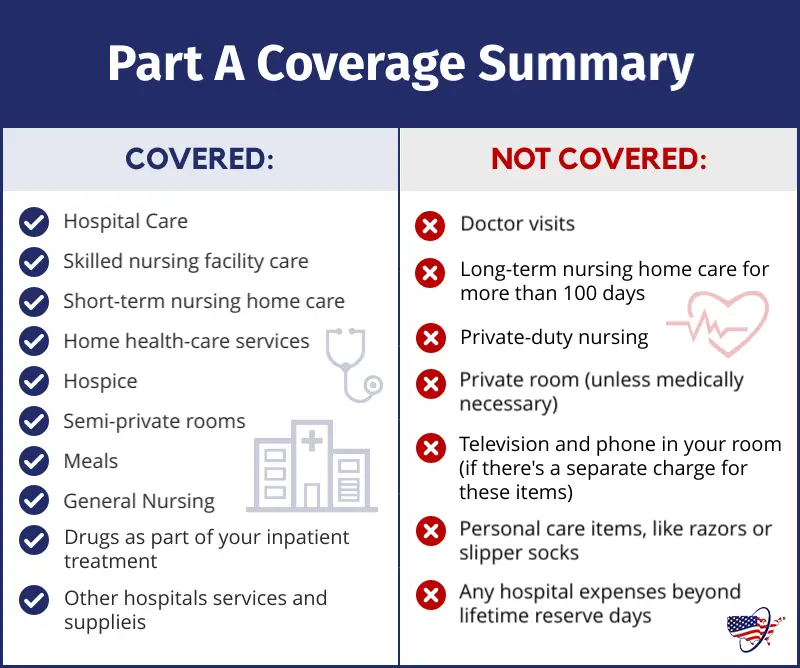

Does Medicare Cover Physical And Occupational Therapy

Physical and occupational therapy are both covered by Medicare Part B, if you qualify. Similarly, Part B includes outpatient therapies such as speech-language therapy and other such services. The coverage for outpatient treatment is 80 percent of the Medicare-approved cost, once you have met the yearly deductible requirement. In 2019, the Part B deductible is $185 per calendar year. People who get Part B are required to pay a monthly premium of 135.50.

How Long Does Medicare Pay For Rehab

A skilled nursing facility is covered by Medicare Part A for up to 100 days, with certain coinsurance charges. After the 100th day of an inpatient SNF stay, you are liable for the whole bill. After youve met your Part A deductible, Medicare Part A will also pay 90 days of inpatient hospital rehab, with some coinsurance fees thrown in for good measure. You will begin to use up your lifetime reserve days on day 91, when you reach the end of the year. Following a surgery, injury, stroke, or other medical incident, you may be required to undertake rehabilitation in a hospital setting.

Medicare Part A covers inpatient hospital care, which may include both the initial treatment and any further rehabilitation you get while still hospitalized as an inpatient.

When you have been out of the hospital for 60 consecutive days, your benefit period comes to an end, and your Part A deductible will be reset the next time you are hospitalized to the hospital. It is possible that your rehabilitation will take place in a skilled care facility . You will normally be covered in full for the first 20 days of each benefit period if you are admitted to a skilled nursing facility .

You May Like: Is Aarp Medicare Part D

What Is The Difference Between Skilled Nursing And Rehab

In a skilled nursing facility youll receive one or more therapies for an average of one to two hours per day. The therapies are not considered intensive. In an acute inpatient rehab hospital youll receive a minimum of three hours per day, five days a week, of intensive physical, occupational, and speech therapy.

What Basic Benefits Do Medicare Supplement Insurance Plans Have

Certain Medicare Supplement insurance plans may help pay deductible and coinsurance costs for Medicare Part A and Part B. The Part A inpatient deductible is $1,484 in 2021 for each benefit period. Part A coinsurance for hospital stays ranges from $0 per day for the first 60 days, to $371 per day , to $742 per day in 2021. The Part B yearly deductible is $203 in 2021. Medicare Supplement insurance plans may help pay these costs. See below for changes in store for some Medicare Supplement insurance.

All the standardized Medicare Supplement insurance plans available in most states may pay 100% of Medicare Part A coinsurance and hospital costs up to an additional 365 days after Original Medicare benefits are exhausted. These standardized Medicare Supplement insurance plans also pay some portion of Medicare Part B coinsurance or copayment . Other Medicare Supplement insurance plan basic benefits may include :

- First three pints of blood needed for a medical procedure

- Skilled nursing facility coinsurance

- Medicare Part A hospice care coinsurance or copayment

Some, but not all, Medicare Supplement insurance plans may pay for the Part A deductible, the Part B deductible, Part B excess charges, and foreign travel emergencies .

Read Also: When Do I Have To Enroll In Medicare

A Brief History Of The Medicare Part B Deductible

Way back in 1966 when Medicare first showed up on the radar, the Medicare Part B deductible came in at $50. It hung out around there for seven years or so before it saw an increase to $60 in 1973. Then, it stayed at $60 for another 9 years until 1982 when it got another bump to $75. It hung out there until 1991 when it got a $25 bounce up to $100.

From there, nobody touched the Medicare Part B deductible for 14 years. It held at $100 from 1991 until 2004. Take that inflation.

After that, we started seeing this number move around pretty regularly. I summarized those amounts below in a nice easy to understand table. It looks like it was held flat during the recession years at $135. Things crept up from there but were reset in 2012 back down to $140 which is the only year we ever saw a reduction. Max predicts we are set to break $200 in 2021, and Ill wager $200 on that if there are any takers out there.

I suppose we shouldnt complain too much. According to this random inflation calculator from the internet, $50 in 1966 would be worth about $406 in 2020. So we have it easy compared to our 1966 counterparts.

Summary Of Medicare Benefits And Cost

The chart below is a comprehensive list of Medicare Part A and B costs, including premiums, deductibles and coinsurance. Medicare supplemental insurance, known as Medigap, can help cover some of the gaps in coverage and pay for part or all of Medicares coinsurance and deductibles, depending on the policy. Some Medicare Advantage plans may also help cover these costs. See Medigap: Medicare Supplemental Insurance and Medicare Advantage for more information.

Read Also: Does Medicare Cover Parkinson’s Disease

What Is The Maximum Out

Original Medicare does not have an out-of-pocket limit. You’ll keep paying co-pays and co-insurance regardless of how many services you receive or how much you spend in a plan year. However, Medicare Advantage plans are required by law to have an out-of-pocket maximum. A study by the Kaiser Family Foundation found that the average out-of-pocket limit for Medicare Advantage recipients in 2021 was $5,091 for in-network services and $9,208 for combined in-network and out-of-network services.

What Is The Medicare Part B Deductible For 2022

The Medicare Part B deductible is $233 per year in 2022.

Medicare Part B provides coverage for outpatient care such as doctors appointments, outpatient surgeries, procedures performed in outpatient facilities, rehabilitation care, preventive medicine, durable medical equipment and more.

Here’s an example of how the Medicare Part B deductible might work in 2022:

- You go to the doctor in January, and the allowed charge is $160. You would be responsible for paying that amount and would have $73 remaining before meeting your annual Part B deductible.

- In March, you go to the doctor again, and the allowed charge is $150. You would be responsible for paying the first $73, which would meet your deductible. There is still $77 remaining on the bill, for which you would be responsible for the Part B copayment or coinsurance, which is typically 20% of the allowed amount .

For the remainder of the year, you would be responsible for the copay on allowed charges billed to your Medicare Part B coverage.

The copay for most services under Medicare Part B is 20%. So, imagine you had $2,000 in covered medical charges in 2022 that were subject to Part B copay costs. You would be responsible for:

- The $233 deductible

- 20% of the remaining $1,767, which is $353.40

That’s a total out-of-pocket responsibility of $586.40

Some Medicare Supplement Insurance plans cover the Part B deductible or the Part A deductible.

Also Check: Does Medicare Part D Cover Dental