Does Medicare Part G Plan Cover Acupuncture Services

Medicare Supplement Plans do not pay for health services directly. Instead, they cover the left-over costs for Medicare-approved services that Part A or Part B did not pay in full. Original Medicare does cover acupuncture for chronic low back pain. If you meet the specific criteria for acupuncture services, Part G will cover the remaining costs. Medicare does not cover acupuncture for other indications.

Is Medicare Supplement Plan G Available To Those Under 65

There are no federal mandates requiring Medicare Supplement plans to be available to those on Medicare under 65 due to disability. Yet, some states require insurance companies offering Medigap plans to provide at least one option to those under 65. Sometimes, these carriers allow you to enroll in Medicare Supplement Plan G.

The most common plan option available to those under 65 is Medicare Supplement Plan A. Medigap Plan A offers only the most basic benefits. However, some carriers understand the importance of widespread plan availability and will allow those on disability to enroll in Medicare Supplement Plan G.

However, when enrolling in a Medicare Supplement plan under age 65, it is important to know that your premium may be double or even triple that of someone over 65. Carriers increase the price to account for high medical costs due to your disability status.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

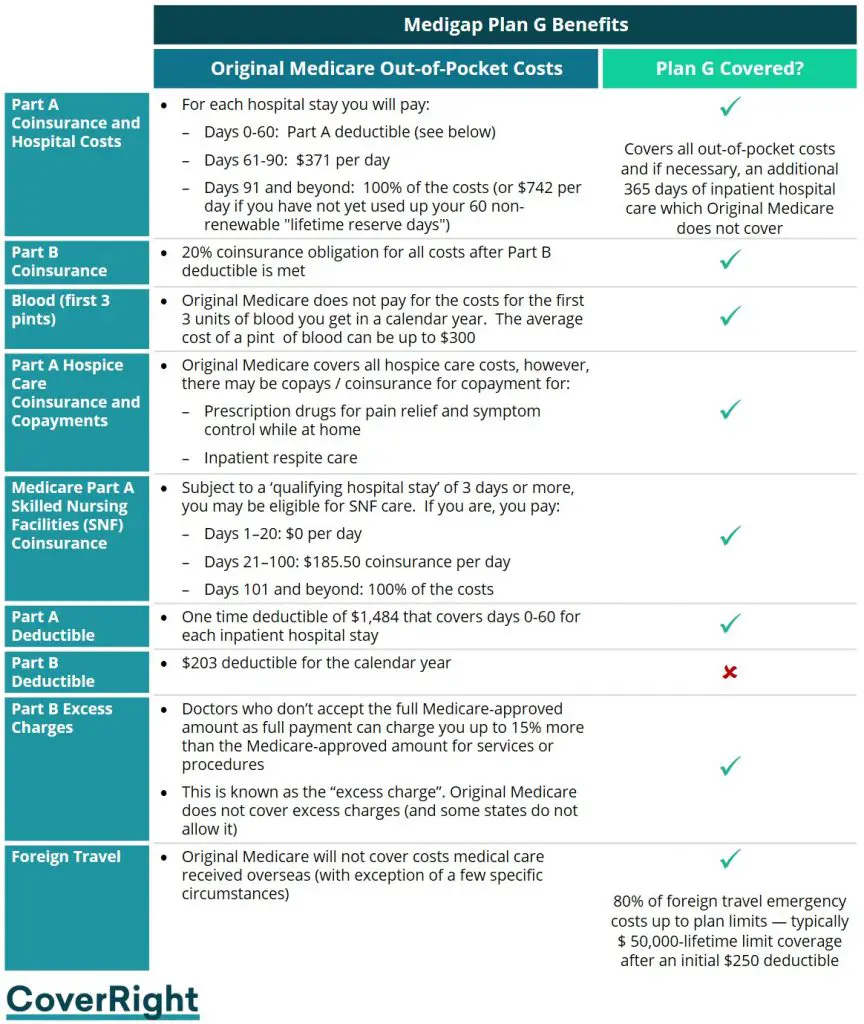

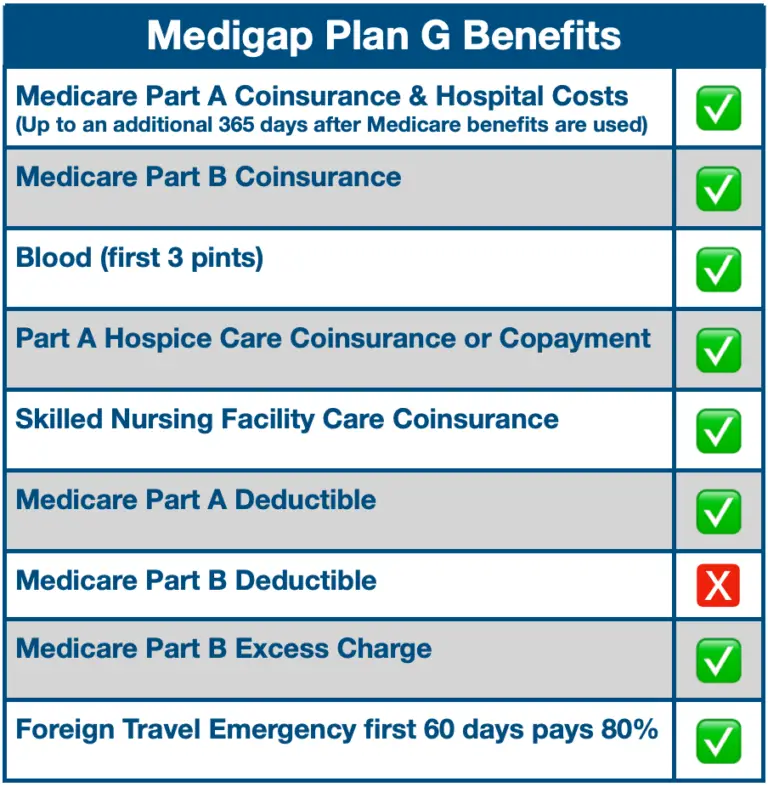

What Benefits Does Medicare Supplement Plan G Cover

Medicare Supplement Plan G is almost identical to Plan F, except for the Part B deductible. If you select Plan G, youll need to pay your Part B deductible , yourself. After you pay your deductible, you have no other out-of-pocket costs, just like the Plan F. Even though it has similar coverage, Medigap Plan Gs monthly premiums are typically much less expensive than those for Plan F. In some cases, the difference in premiums between the two plans may be so large that you could save money by choosing Plan G, even after the Part B deductible.

Ultimately, Plan G has the same benefits as the Plan F, except for coverage for the Part B deductible . Once you pay the Part B deductible, the coverage is the same for both plans.

You May Like: Do All Medicare Plans Have A Deductible

Best Discounts: Blue Cross Blue Shield

Blue Cross Blue Shield

-

Few states offer High-Deductible plan

-

Rates increase based on age

Blue Cross Blue Shield companies offer a number of discount programs for Medicare Supplement Plan G. Blue of California, for example, offers a New to Medicare discount for your first year , discounts for using automatic bank payments , discounts for enrolling in a dental plan at the same time , and a 7% discount if you and someone else in your household sign up for BCBS Medigap plans.

If you are looking for a company with Medicare experience, know that BCBS, founded in 1929, was the first company to manage Medicare claims in 1966. Altogether, BCBS offers Medicare Supplement Plan G in 44 states, excluding Alabama, Hawaii, Massachusetts, Minnesota, Utah, and Wisconsin. High-Deductible Plan G is available in 16 states, including Alaska, Arkansas, Illinois, Iowa, Maryland, Michigan, Montana, New Mexico, North Carolina, Oklahoma, South Carolina, South Dakota, Texas, Virginia, Washington, and Wyoming.

Although AARP by UnitedHealthcare offers a higher New to Medicare discount in its first year, BCBS offers the most discount savings over time. Check with your states plan for details about BCBS discount programs.

How Much Does Medicare Plan G Cost

Medicare Plan G costs between $120 and $364 per month in 2022 for a 65-year-old. You’ll see a range of prices for Medicare supplement policies because each insurance company uses a different pricing method for plans. Furthermore, your exact price for Plan G will also be determined by your location, health, age and gender. For this reason, it is vital to compare rates among different Medicare providers so you can get your best Medicare rate possible.

Recommended Reading: What Is Blue Cross Blue Shield Medicare Advantage

Most Popular Medicare Supplement Plans

Lindsay MalzoneReviewed by: Rodolfo MarreroHomeFAQsMedigap

The Medicare Supplement insurance plan letters with the highest percentage of enrollments nationwide are Plan F, Plan G, and Plan N. But, the best insurance policy for you is going to have a fair price with adequate coverage. Since Original Medicare has deductibles and coinsurances, its beneficial to have a supplemental policy. Below well discuss the most popular Medigap plans and explain how to choose the best option for you.

How To Sign Up For Medigap Plans

Signing up for a Medigap plan is easy. Medicare supplements may be bought through an agent or from the carrier directly, says Corujo. Since theres no annual open enrollment period, you may join at any time.

To buy a Medigap policy, its best to enroll during your Medigap Open Enrollment period, which lasts six months. This period begins the first month you have Medicare Part B and are 65 or older. You can buy any Medigap policy sold in your state during this time, even if you have health problems.

Follow the steps below to purchase your Medigap plan:

- Enroll in Medicare Part A and Part B. This step is required to purchase a Medigap plan. Remember: Medicare and Medigap plans dont cover prescription drugs, so you may also want to consider enrolling in a Medicare Advantage plan or a plan that offers drug coverage. If you choose a Medicare Advantage plan, you cannot then enroll in a Medigap plan. If youre already enrolled in a Medicare Advantage plan, consider whether a Medigap plan would benefit you if so, drop your Medicare Advantage plan before buying a Medigap plan.

- Find which insurance companies in your state are licensed to sell Medigap plans by visiting Medicare.gov.

- Compare costs between companies. Costs will vary depending on the company, state and other factors, but the coverage they offer will be the same.

- Select a Medigap plan that works best for you and purchase your policy.

Don’t Miss: Can I Get Braces With Medicare

How Can I Get Medicare Supplement Plan G Prices

Unfortunately, most insurance companies no longer openly publish their rates online without requiring you to meet with an agent or enter your personal information first. So, although some companies put their Medicare Supplement Plan G prices online, the information will be slanted towards that one company and will not be a full picture of what is available to you.

There are two options for obtaining the prices for a Medicare Supplement Plan G. One, you can contact your state department of insurance to get a list of all the companies offering supplement plans in your state usually around 30-35 companies. From there, you can contact each insurance companys call center and set an appointment to have an agent from each company come to your home so you can meet with them and obtain the rates for their plans. Sounds enjoyable, right?!?!

The much-simpler, more consumer-friendly alternative is to contact a trusted, verified independent Medicare insurance broker. Whether that broker is 65Medicare.org or someone else, using an independent broker gives you the opportunity to compare multiple options in a centralized, unbiased place. The broker works with you based on your needs and is incentivized to put you in a plan that you are happy with and that fits your needs, not one that helps their employers bottom line.

How To Choose The Best Medigap Plan

When choosing a Medigap plan, there are several things to consider, including a budget, healthcare needs, and enrollment eligibility. Unlike Medicare Advantage plans, Medigap plans allow you to enroll in coverage anytime.

However, youll undergo underwriting outside the Medigap Open Enrollment Period or Special Enrollment Period. Beneficiaries that go through underwriting can be denied a policy or charged a higher premium based on health history.

You May Like: Where Can I Go To Sign Up For Medicare

Compare Medicare Supplement Insurance Plans

View or print this helpful chart showing all of our Medicare Supplement insurance plans side by side.

The purpose of this communication is the solicitation of insurance. Contact will be made by an insurance agent/producer or insurance company.

Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and in some states to those under age 65 eligible for Medicare due to disability or End Stage Renal disease.

Medicare Supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program.

Coverage may be limited to Medicare-eligible expenses. Benefits vary by insurance plan and the premium will vary with the amount of benefits selected. Depending on the insurance plan chosen, you may be responsible for deductibles and coinsurance before benefits are payable. These policies have exclusions and limitations please call your agent/producer or Humana for complete details of coverage and costs.

GNHL7EUEN

Does It Matter Which Company I Select

Medicare Supplement plans are completely standardized, so the benefits will be the same from company to company. All Medicare Supplement plans, including Plan G, are standardized in the following ways:

- Benefits You dont have to worry about which company offers the best or most benefits. The benefits of a Plan G will be the same regardless of the company you select.

- Doctors Network Medicare Supplement insurance companies dont have their own doctors networks. Their plans are only supplements to your primary Medicare Parts A & B coverage. Your network is the nationwide Medicare network, so, you dont have to worry about whether one company has a better doctors network than another.

- Claims-Paying Process The Medicare Supplement claims process is highly automated. It is easy for you to use the coverage, and most people never see any paperwork. Once Medicare approves your claim, they will pay their portion and notify your provider of what they owe. The company must then pay the amount due per Medicares instructions. Due to the automation and standardization in this area, every company is equal in its claims-paying history.

To make it simple, Medicare is your primary coverage. The plans that each Medicare Supplement insurance carrier offers are identical from company to company, because they are standardized by the government.

Recommended Reading: Are Podiatrists Covered By Medicare

How Is Medsup Plan G Different From Other Medsup Plans

Medicare Supplement Plan G and Plan F are very similar. The main difference between them is Plan F covers your Medicare Part B deductible while Plan G doesnt.

Some of the other Medicare Supplement plans available today are only slightly different from F and G while a few are quite different. For example:

- MedSup Plan C is like Plan F but doesnt pay your Medicare Part B excess charges.

- Plan N, on the other hand, doesnt pay your Part B deductible or excess charges.

Other MedSup plans pay just a portion of costs, like your Part A deductible or your Part B copay or coinsurance fees. Some come with yearly out-of-pocket limits, too.

Why Consider Plan G

Plan G is the top-of-the-line Medigap option if youre newly eligible for Medicare. Depending on where you live in the country, it can range from $99 per month to $476 per month for the plan premium, which is $1,188 to $5,712 per year. For the premium, which is higher than for other Medigap policies, youll get more comprehensive coverage.

Plan G covers nearly all out-of-pocket costs for services and treatment once you pay the Medicare Part B $233 deductible. This means you pay no copays or coinsurance.

If you dont need that level of coverage, though, you might want a plan with less coverage.

Don’t Miss: What Is The Cost Of Medicare Supplement Plan F

Alternatives To Medicare Supplement Plan G

With Plan F on its way out, Plan G is likely to become the most popular Medigap plan over the next few years. This is due to its availability and comprehensive coverage. In general, as plans increase in popularity, their price will go down as they are offered by more insurance carriers.

Although Plan G offers great coverage, that doesnt mean its right for everyone. There are a few plans that you may be able to find at a better deal, or that simply suit your needs more directly.

How To Shop And Compare Medicare Supplement Plan G

When you sign up for Medicare, or during Open Enrollment, you must first decide if you want to be on Original Medicare or Medicare Advantage. Original Medicare has a nationwide network of providers but has fixed benefits. Medicare Advantage plans are based on a local network of providers but can offer additional benefits. If you sign up for Original Medicare, you are eligible for a Medicare Supplement Plan.

Recommended Reading: When You Retire Is Medicare Free

What Does Medicare Part B Cover

Part B services covered at 80% include outpatient care in an emergency room or hospital, and diagnostic tests such as X-rays. For many preventive services, the coinsurance and the deductible do not apply such as standard flu shots, mammograms, bone density tests, glaucoma tests, and many cancer screenings. Some preventive services have criteria you need to meet before getting the preventive service without the coinsurance and/or deductible. If you dont meet the criteria, the service will be covered under Part B but with the coinsurance and deductible.

Part B also covers doctors visits, ambulances, mental healthcare, outpatient surgeries, home health care, durable medical equipment such as blood sugar monitors and test strips, lancet devices, walkers, and wheelchairs. Home health care is also covered under Medicare Part A if certain conditions are met.

How Do I Decide Between Medicare Supplement Plan F And Plan G

Our clients often ask us for help comparing Medicare Plan F vs. Plan G. We understand it can be a tough decision to make. Well help you compare the plans so that you can feel confident in your choice. First, lets take a look at what benefits the two plans cover.

| Medigap Plan Benefits | ||

|---|---|---|

| Part A coinsurance & hospital costs | Yes | |

| Part B coinsurance or copayment | Yes | |

| Part A hospice care coinsurance | Yes | |

| Skilled nursing facility care coinsurance | Yes | |

| Part B deductible | Yes | |

| Foreign travel emergency | Yes | Yes |

Read Also: Is Balloon Sinuplasty Covered By Medicare

Are Medsup Plans Sold In Massachusetts Minnesota And Wisconsin Different

Insurance companies dont sell MedSup Plan G policies in Massachusetts, Minnesota or Wisconsin. If you live in one of these states, youll have to choose a different kind of Medicare Supplement plan.

These states only offer a few MedSup plans, so you won’t have to do much homework before you settle on one of them.

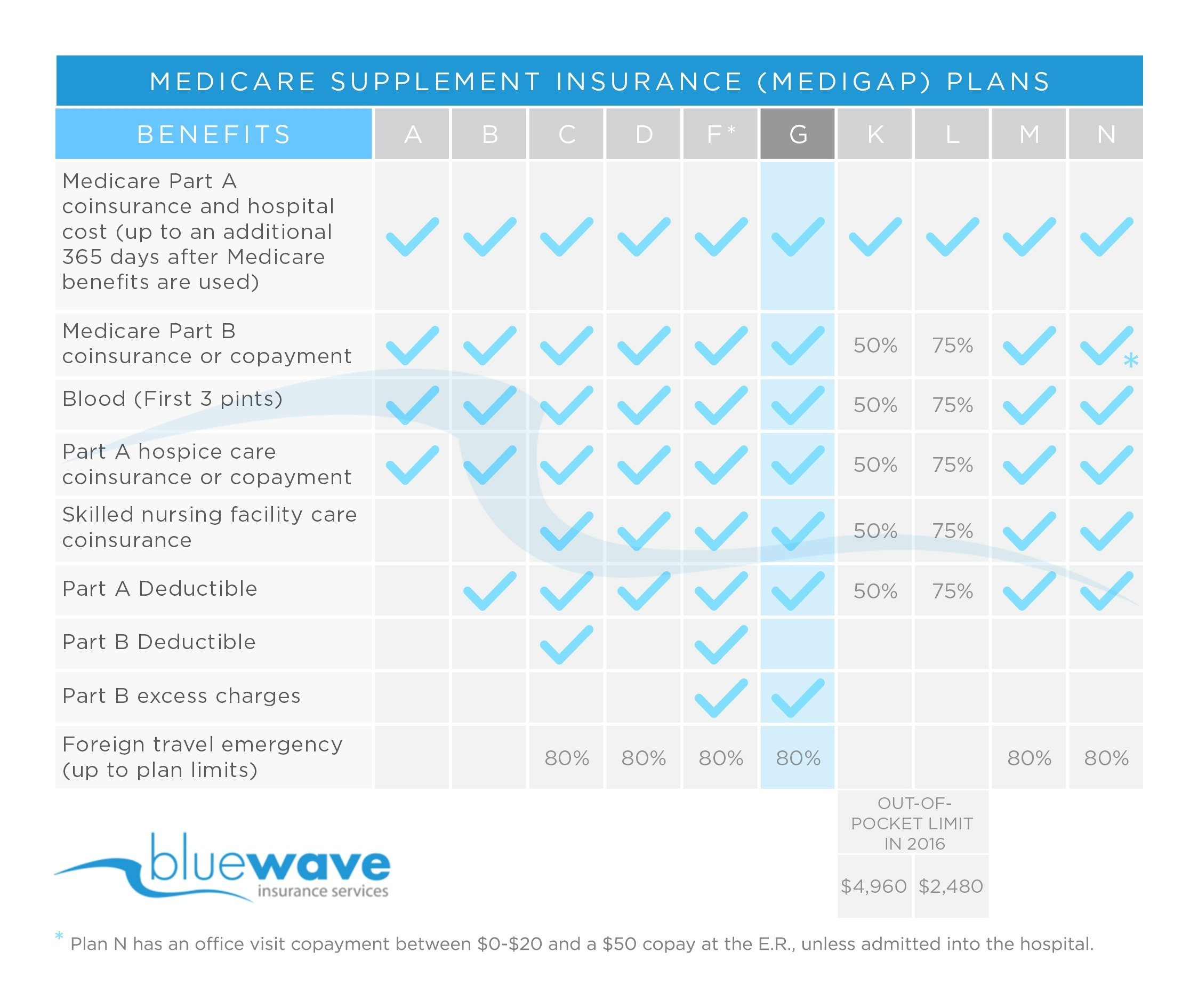

Medicare Supplement Plans Comparison Chart

There are 10 standardized Medigap plans with letter names A through N. Plans with the same letter must offer the same basic benefit regardless of the insurance company providing the plan. For example, all Medigap Plan A policies provide the same benefit, but health insurance company premiums vary based on the way they choose to set ratescommunity-rated, entry age-rated or attained-age-rated.

Don’t Miss: What Is The Number For Medicare

Where Can I Buy Medicare Supplement Plan G

You can buy MedSup Plan G and every other MedSup plan from any insurance company that’s licensed in your state to sell Medicare Supplement coverage.

Remember, all Plan G policies must provide the same benefits or coverages. Just like all Plan F policies must provide the same benefits or coverages.

Insurers can and do charge different amounts for the MedSup Plan G policies they sell, though. Dont enroll in the first one you come across while shopping around. Compare the various costs associated with the plans sold in your area before you make your final decision.

Am I Eligible For Medigap Plan G

If youre in your Medigap Open Enrollment Period, then you are eligible for Medigap Plan G. Outside of that, the Insurance company could charge more or deny the policy.

In most cases, when you go through underwriting there is no issue with getting you approved.

For those with health issues or concerns about underwriting approval, its best to work with an insurance agent because they can help identify the company most likely to approve your application.

If you qualify for a Special Enrollment Period, you may be entitled to Guaranteed Issue rights, meaning you get to avoid underwriting.

Read Also: How To Check Medicare Premium Payments

High Deductible Plans: Understanding High Deductible Plan G

Plan F and Plan G are also unique in that they come in whats known as a high deductible version. These plans will have lower premiums but will have an additional deductible you have to pay in order for your coverage to begin.

This deductible can be as high as $2,490 in 2022. The way that this works is that you have to pay your out-of-pocket costs for Medicare up to that amount, and then your plan will start paying. If you have high deductible Plan F, this can be a combination of copayments, coinsurance, and deductibles for Part A and Part B.

The 2022 Average Cost Of Medigap Plan F And Plan G By Age

by Christian Worstell | Published February 03, 2022 | Reviewed by John Krahnert

Age is one factor that Medicare Supplement Insurance companies can use when determining the premiums for plans. Your Medigap premium is how much you pay per month to be a member of the plan.

Medicare Supplement Insurance premiums tend to increase with age. As you compare Medigap quotes, it may be helpful to consider how your age could affect your Medigap premium costs over time.

In this guide, we break down the average monthly premiums of Medigap Plan G and Plan F by age, from age 65 to age 85.

Don’t Miss: Is Any Dental Covered By Medicare