How Much Is Deducted From Social Security For Medicare Part A

For most people, Medicare Part A hospital insurance is premium-free. This doesnt mean it is actually free, because you still have to pay your deductible, co-insurance, and other out-of-pocket costs. However, you will have no monthly premium fees if you qualify.

You are eligible to receive premium-free Part A coverage at age 65 if:

- You or your spouse paid Medicare taxes for ten years or longer

- You already receive Social Security retirement benefits or Railroad Retirement Board benefits

- You are eligible for these benefits but havent yet received them

- You or your spouse had Medicare-covered employment through the government

You can also get premium-free Part A if you are under 65. This will happen if you have received Social Security or Railroad Retirement Board disability benefits for over 24 months, or if you have end-stage renal disease and meet certain other qualifications.

Part A is paid for through income taxes that you pay for while you work. This is why the amount of years that you paid this tax is used to determine how much you pay in premiums.

Social Security Annual Cost

Social Security beneficiaries’ monthly benefit amount is adjusted annually to maintain purchasing power over time. In October each year, the Social Security Administration announces the cost-of-living adjustment payable in January of the following year.19 The Social Security COLA is a reflection of inflation measured by the Consumer Price Index-Urban Wage Earners and Clerical Workers ,20 calculated by the Bureau of Labor Statistics. The CPI-W, representing 29% of the population, is an estimate of the average change in prices of the goods and services purchased by households whose income is earned primarily from a clerical or wage occupation. The CPI-W gathers prices on thousands of items and services across the United States, including food, beverages, clothing, transportation, medical care, education, housing, recreation, and energy.21 An average CPI-W is calculated from these prices each quarter. The Social Security COLA equals the percentage increase in the average CPI-W from the third quarter of the base year to the third quarter of the current year. If the CPI-W indicates deflation, the Social Security COLA will equal 0.0% and Social Security benefits will not decrease.

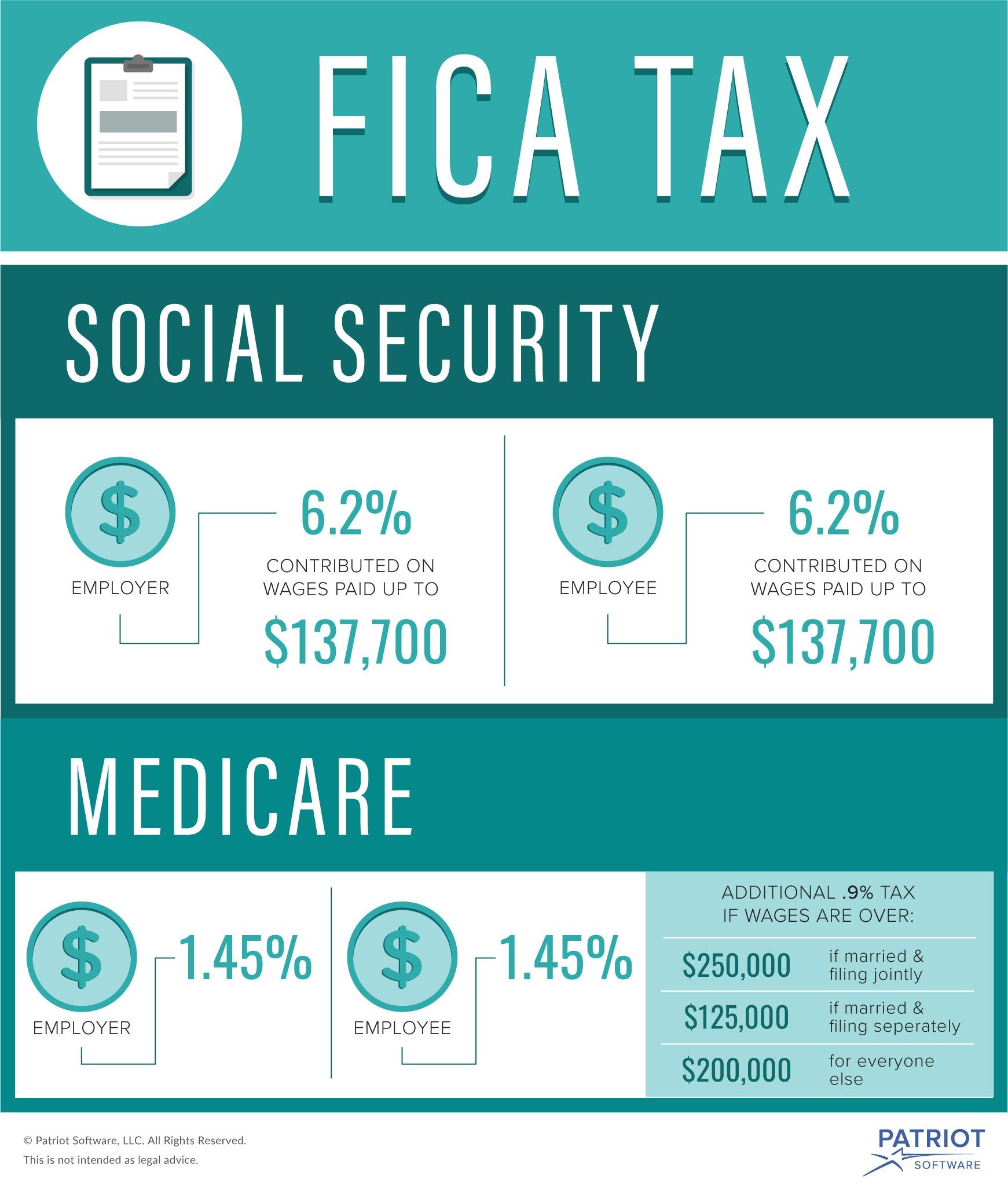

Social Security And Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, , Employers Tax Guide for more information or Publication 51, , Agricultural Employers Tax Guide for agricultural employers. Refer to Notice 2020-65 and Notice 2021-11 for information allowing employers to defer withholding and payment of the employees share of Social Security taxes of certain employees.

Dont Miss: Should Federal Retirees Enroll In Medicare

Recommended Reading: Will Medicare Pay For Diapers

What If I Withheld Too Much

If you deducted too much tax from an employees pay, either for Social Security or for Medicare tax, you may have several things to fix:

- Refund the employee. You will need to pay the employee back for the excess deduction amount. You can give this amount back to the employee in a paycheck or as a separate check. Be sure you dont deduct Social Security from this check!

- File a Corrected 941. If the mistake was included in Form 941 report, you will need to file a correction form to receive a refund.

- Change the employees payroll record. Deduct the over-payment of Social Security taxes from the employees payroll tax record. The W-2 Form for an employee who earns more than $106,800 should show the total amount of pay earned for the year and the total Social Security wages as $106,800. Medicare wages will be the same as the total amount of pay.

You May Like: What Are Medicare Part Abcd

How Much Is Taken Out For Part D Drug Plans

Medicare Part D plans help pay for prescription drug costs. This coverage is not included with Original Medicare . However, some Medicare Advantage plans also provide drug coverage. If you join a Medicare Advantage Prescription Drug plan , you cannot also join a standalone Part D plan.

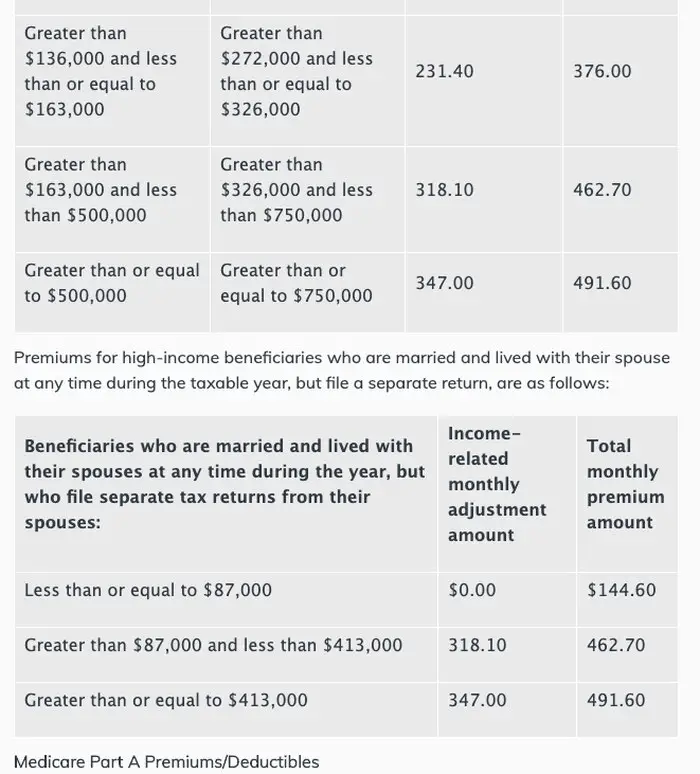

As with Medicare Advantage plans, Part D plans are sold by private insurance companies. This means that their costs will vary, just like Part C plans. However, you may also owe the Income-Related Monthly Adjustment Amount for your Part D plan. The IRMAA table above includes the Part D surcharge at each income bracket.

This amount, as well as your premium itself, can be deducted from your Social Security benefit. Contact the Social Security Administration to set this up.

You May Like: Does Medicare Cover Any Medical Alert Systems

Exemption From Social Security Or Medicare Taxes

Under certain circumstances, New York City employees may be exempt from Social Security and/or Medicare taxes. If you fall into one of the following categories, you may be exempt from Social Security or Medicare taxes:

- Not a pension member and contribute at least 7.5% or more to a single defined contribution plan, such as the Deferred Compensation 401 or 457 plans, or a 403 Tax Deferred Annuity . Get more information about Social Security & Medicare Tax Exemptions for Non-Members of Pension Plans.

- City pension plan member in 1957 electing not to have Social Security

- Half time CUNY student working at CUNY

- Non-resident student or teacher admitted to the US under certain visas

- Foster Grandparent working for the Department of Aging

- Election Inspector/Worker earning less than $2,000 from the Board of Elections in 2021

- Beneficiary of a deceased employee receiving payment after the calendar year of the employees death

- Temporary emergency relief employee.

Learn more about Social Security & Medicare Tax Exemptions for Other NYC Employees.

The Social Security Protection Act of 2004 requires newly hired public employees to sign a Statement Concerning Your Employment in a Job Not Covered by Social Security. Form SSA-1495 explains the potential effects of two provisions in the Social Security law on workers whose earnings are not covered under Social Security.

Are My Medicare Premiums Tax Deductible

Medicare premiums are tax deductible. However, you can deduct premiums only once your out-of-pocket medical expenses reach a certain limit.

The IRS has set that limit at 7.5 percent of your adjusted gross income . Your AGI is the money you make after taxes are taken out of each paycheck.

The IRS allows you to deduct any out-of-pocket healthcare expenses, including premiums, that are more than 7.5 percent of your AGI.

So, if you have an AGI of $50,000, you could deduct healthcare expenses after youve paid $3,750 in medical expenses. Depending on your premiums and other healthcare spending, you might not reach this number.

If your spending is less than 7.5 percent of your AGI, you cant deduct any healthcare expenses, including premiums. However, if your healthcare spending is more than 7.5 percent of your income, you can deduct it.

Keep careful track of your out-of-pocket medical expenses throughout the year so you can make the proper deductions at tax time.

You can pay your Medicare bills online or by mail if they arent automatically deducted. You wont pay an added fee for parts A, B, or D, based on your payment method.

There are several ways to pay:

Don’t Miss: When Can You Join Medicare

Is Medicare Free At Age 65

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

Why Did I Get An Extra Payment From Social Security This Month

The extra payment compensates those Social Security beneficiaries who were affected by the error for any shortfall they experienced between January 2000 and July 2001, when the payments will be made. Who was affected by the mistake? The mistake affected people who were eligible for Social Security before January 2000.

You May Like: Does Medicare Cover Urgent Care Centers

Do You Have To Pay Medicare And Social Security

All income earners are required to pay Medicare and Social Security taxes. Avoiding these taxes is impossible, especially as an income earner. All employees and self-employed taxpayers are required to pay Social Security and Medicare taxes. However, you are exempted from paying Social Security taxes in some situations.

People are eligible for Medicare when they turn 65. Youll sign up for coverage at that time. Social Security becomes available when you turn 62, but its usually not wise to get Social Security benefits at 62. Instead, you should wait until your retirement age, so you can receive full Social Security benefits.

You May Like: Does Medicare Cover Any Dental Surgery

Can You Get Medicare If Youve Never Worked

Even if youve never worked, you will still be eligible for Medicare. The only requirements are to be a United States citizen or legal resident of at least five years and qualify due to disability or age. However, you must pay the full Medicare Part A premium if you do not pay taxes for enough quarters.

However, your spouses work history counts toward your credit for premium-free Medicare Part A. If your spouse meets the requirements, you may be eligible for a reduced or zero Medicare Part A premium.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Don’t Miss: How Does Medicare Part D Deductible Work

How Much Does Medicare Cost

Part A is free to most Americans. Its free as long as you paid taxes for at least 40 quarters ofMedicare taxes. Those who paid taxes fewer than 40 quarters have to pay $499 monthly for Part A.

Part B costs $170.10 monthly for most Americans. People who file individual taxes and make more than $91,000 and those who file joint taxes and make more than $182,000 pay more each month. For instance, those who file individual tax returns with family income of $500,000 or more pay $578.30 for Part B.

Meanwhile, Medicare Advantage has different premiums depending on the plan.but there are plans with zero premiums. Zero-premium plans often have higher deductibles. On the flip side, Medicare Advantage plans with higher premiums often have lower deductibles.

Part D prescription drug plans also have varied premiums . Your income plays a role in Part D premiums. People who file individual tax returns with family income of more than $91,000 have to pay higher premiums.

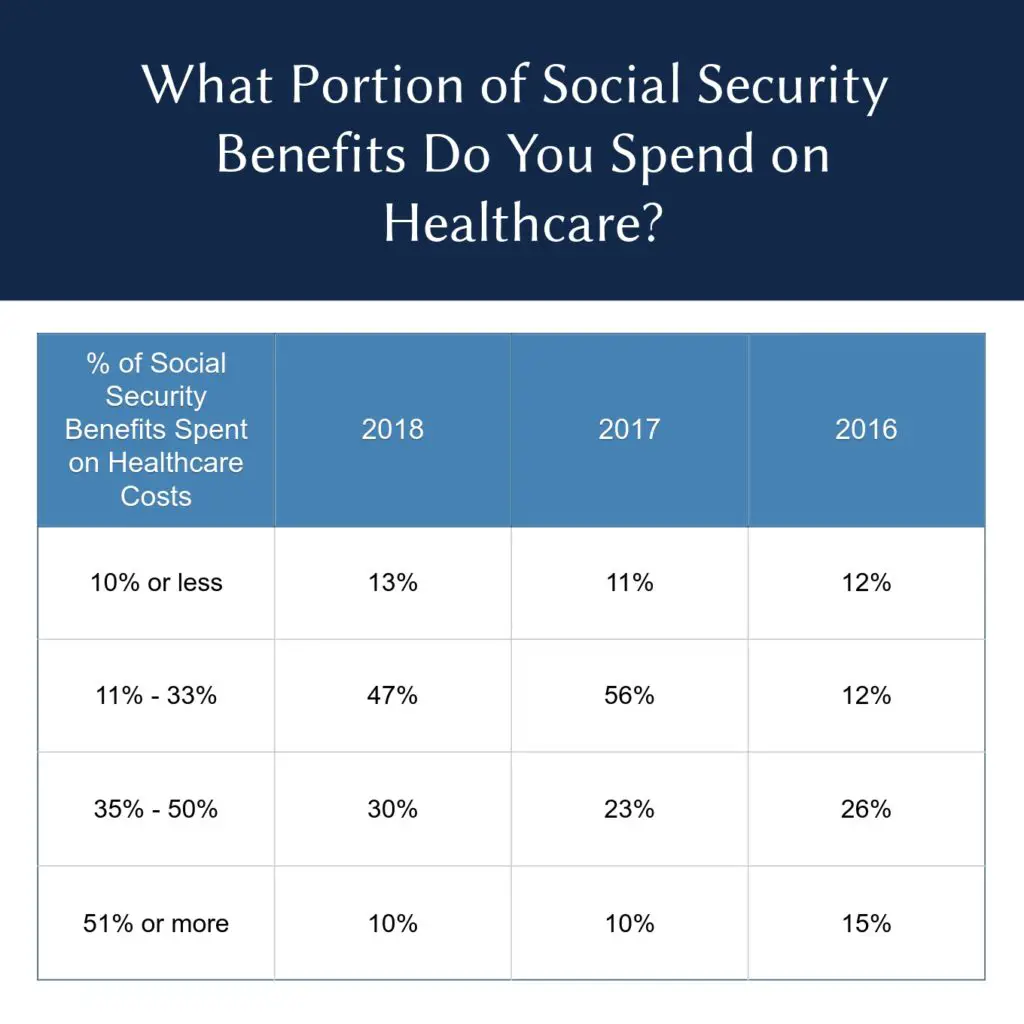

No matter the type of Medicare, people on Social Security can let the federal government take the money directly from your Social Security checks. Having the money removed directly from your check means you wont have to remember to pay for coverage.

Groups Not Covered By The Hold

Several groups are not covered by the hold-harmless provision. The following groups may receive reduced Social Security benefit payments due to Medicare premium increases that are greater than the Social Security COLA:

- New enrollees to either Medicare or Social Security 63

- Medicare Part B enrollees who do not receive Social Security benefits

- High-income individuals who pay income-related Medicare Part B premiums

- Low-income beneficiaries who are in a Medicare Savings Program .

Medicare Part B enrollees who do not receive Social Security may include individuals who spent their careers in employment that was not covered by Social Security, including certain federal, state, and local government workers. This includes civilian federal employees who were hired before 1984 and are receiving Civil Service Retirement System benefits. Although CSRS benefits are increased annually by the same COLA applied to Social Security benefits, the benefits are not Social Security benefits and thus its beneficiaries are not protected under the hold-harmless provision.64

You May Like: Can You Have A Health Savings Account With Medicare

Do I Need To Notify Social Security When I Turn 65

If I want Medicare at age 65, when should I contact Social Security? If you want your Medicare coverage to begin when you turn age 65, you should contact Social Security during the 3 months before your 65th birthday. If you wait until your 65th birthday or later, your Part B coverage will be delayed.

Do I Have To Pay For Medicare

You’ll usually pay 20% of the cost for each Medicare-covered service or item after you’ve paid your deductible. If you have limited income and resources, you may be able to get help from your state to pay your premiums and other costs, like deductibles, coinsurance, and copays. Learn more about help with costs.

Read Also: Does Medicare Pay For Radiation Treatments

How To Get Medicare Part D Deducted From Social Security

Your Medicare Part D premium is not automatically deducted from Social Security.

To get this withhold set up, contact your Part D drug plan and ask to get your monthly premium deducted from your monthly Social Security or Railroad Retirement Board payment. Do not contact Social Security or the RRB as they cannot help you get this set up.

Your plan will ask for the information they need to get these deductions set up. There is nothing additional that you need to do.

Or, you may have the option to select automatic deductions of your monthly premium when you enroll in your new Part D plan.

You May Like: Can You Get Medicare At Age 60

Can I Get Social Security If I Never Worked

Social Security benefits can have an enormous impact on your retirement. Fortunately, you may be eligible for Social Security even if you haven’t worked long enough to qualify for your own benefits. By taking advantage of any of these types of benefits, you can boost your retirement income with little to no effort.

Read Also: How To Calculate Medicare Tax

Can You Opt Out Of Medicare Tax

While regular taxpayers may not opt out, there are certain religious groups which may qualify and be exempt from paying Social Security taxes. The qualifications for this are:

- Waive rights to all Social Security benefits including hospital care

- Be a member of a recognized religious sect that opposes accepting benefits under a private plan that makes payments in the event of death or disability and makes payments for medical costs

- Member of a religious sect that makes a reasonable provision of food, shelter, medical care for its dependents since December 31, 1950

- Never received or entitled to payable Social Security benefits

Those members who would like to apply for Social Security exemptions can do so with a FORM 4029 and file the request with the Social Security Administration. From there, the IRS will notify you if you have qualified.

How Much Should You Have Saved

Many financial advisors suggest that you should plan on living off about 80% of your current income after you retire. Thus, if you currently earn $60,000 per year, youll need a big enough retirement account to fund an annual salary of about $48,000 per year for the rest of your retirement. But others recommend saving enough to fund 100% of your current income, figuring that certain expenses like travel and healthcare will actually increase. If you have the means, its always best to over-prepare financially, meaning you should shoot for that 100% figure if youre able.

Imagine you want to draw $60,000 per year from your savings starting at age 55. If your money is uninvested and just sitting in cash, you should plan on saving at least $2.1 million, as that will fund your withdrawals through age 90, according to online retirement calculators. But if you invest your money at a 5% annual return increasing annual withdrawals by 3% to account for inflation youll only need to save about $1.5 million.

Bear in mind that the earlier you retire, the greater the variability there will be in your planning. Investment returns can vary considerably from year to year, and the longer you have to fund your retirement, the more likely that youll encounter an unexpected expense. Retiring at 55 also brings other complicating factors, such as the taxes and penalties that you may face withdrawing from retirement accounts.

See: Take These 7 Key Steps Today to Retire a Millionaire

Recommended Reading: How To Get Medicare Id Number

The Medicare Part A And B Premiums For 2022 Have Been Announced How Much Will Social Security Beneficiaries See Subtracted From Their Monthly Checks

On 12 November, the Center for Medicare and Medicaid released the 2022 premium prices and deductibles for Medicare Parts A and B.

Across the board, those on Medicare will pay more for their care. The price of the premium for Medicare Part B, which most members are required to pay, will increase fifteen percent from $148.50 to $171. This increase is almost triple the Social Security Cost-of-living adjustment those on social security will see reflected in their benefits next year.

#Medicare Part A & Part B premiums, deductibles & coinsurance amounts for 2022 were released today. For 2022, the standard monthly premium for Part B will be $170.10 & the annual deductible will be $233. Learn more:

Medicare.gov

Medicare Part D Premiums

Each year, the Medicare Part D base premium is set at 25.5% of the expected per capita costs for standard prescription drug coverage.49 Beneficiary premiums are based on average bids submitted by participating drug plans for basic benefits each year and are adjusted to reflect the difference between the standardized bid amount of the plan the beneficiary enrolls in and the nationwide average bid. The actual cost of coverage and premiums, however, varies by plan. Medicare Part D enrollees may pay premiums to their plans directly or may have premiums automatically deducted from their Social Security benefits.50

In 2018, the Medicare Part D base premium is $35.02.51 However, as noted, actual premiums vary by plan and the average Medicare Part D premium, weighted for enrollment, is $41.00.52

Don’t Miss: Can I Have Humana And Medicare