Medicare Part D Premiums

Medicare Part D prescription drug coverage is optional. Some Medicare Advantage plans also incorporate prescription drug coverage. Monthly premiums vary from plan to plan.

Most people only pay their monthly premium for Medicare Part D coverage. But people with higher incomes also have to pay an additional fee based on their income reported to the Internal Revenue Service. For 2022, that would most likely be based on 2020 income.

2022 Medicare Part D Premiums

| Filed an Individual Tax Return | Filed a Joint Tax Return | Your Monthly Premium in 2022 |

|---|---|---|

| $91,000 or less |

The extra amount you pay is not part of your plan premium and you do not pay it to your Medicare Part D insurer.

In most cases, the extra amount will be held out of your Social Security check. If it isnt withheld, youll get a bill from either the Social Security Administration or the Railroad Retirement Board.

You also have to pay the extra fee if you are in a Medicare Advantage plan that includes prescription drug coverage.

If you dont pay the extra fee, you can lose your Medicare Part D coverage.

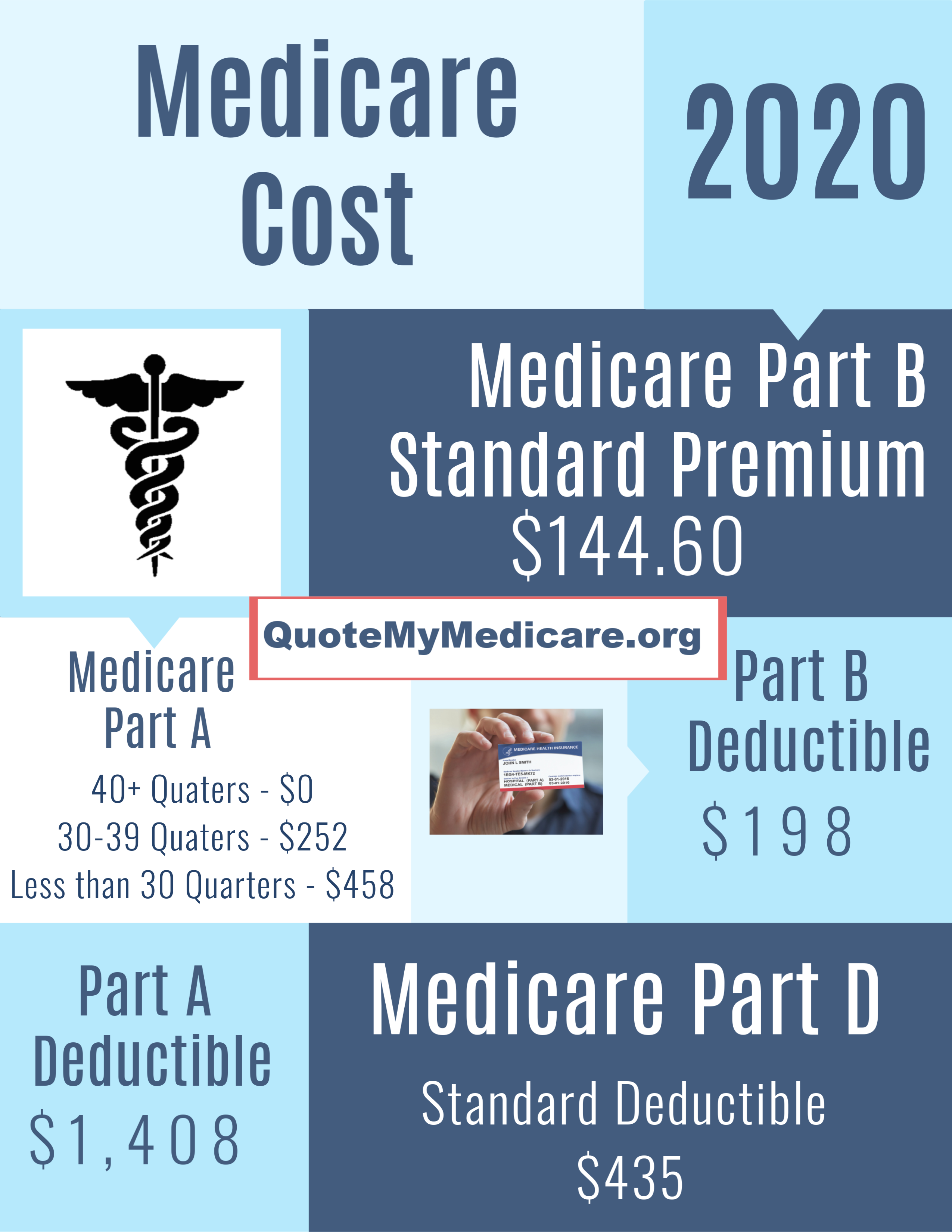

Medicare Part A Premium

Medicare Part A premiums are based on the number of quarters an individual has paid Medicare taxes prior to enrolling in Medicare. Medicare taxes are part of the withholding taxes collected from every paycheck you receive.

If you havent worked a total of 40 quarters , here is how much the Part A premium will cost in 2022:

| Total quarters you paid Medicare taxes | 2022 Part A monthly premium |

|---|---|

| 40 or more | |

| < 30 | $499 |

When you enroll in Part A, youll receive a Medicare card in the mail. If you have Part A coverage, your Medicare card will say HOSPITAL and have a date when your coverage is effective. You can use this card to receive any services that are covered by Part A.

Medicare Costs Terms Explained

Whether youre new to Medicare or could use a refresher, here are some common Medicare terms explained:

Coinsurance is a percentage of your medical and drug costs you may be required to pay as your share of costs for medical services or supplies .

Copayment is a specific dollar amount you may be required to pay as your share of the cost for medical services or supplies .

Deductible is the amount you pay for medical services or prescription drugs in a plan year before your plan begins to pay for benefits.

Premium is the amount you are required to pay each month to Medicare or your private insurer for your healthcare coverage.

To learn more, check out our list of

Don’t Miss: How Medicare Works With Other Coverage

Enrolling In Medicare Part B

Some people are automatically enrolled in Part A and Part B. These people include:

- those who are going to turn 65 and are already receiving Social Security or RRB retirement benefits

- people who have a disability and have been receiving disability benefits from Social Security or the RRB for 24 months

Some people will have to sign up with the SSA to enroll in parts A and B. These people include those not already collecting Social Security or RRB retirement benefits at age 65 or those with ESRD or ALS.

For people who are automatically enrolled, Part B coverage is voluntary. That means that you can choose not to have it. Some people may wish to delay enrollment in Part B because they already have health coverage. Whether or not you choose to delay enrolling in Part B can depend on the specific health insurance plan that you have.

How To Potentially Reduce Your Deductibles With Medicare Supplement Plans

You can buy private to cover , including the hospital deductible.

However, if youre enrolled in a Medicare Advantage Plan, you can only purchase a if your Medicare Advantage plan coverage is ending. Medicare Supplement plans cannot be purchased while you are currently enrolled and planning to remain on a Medicare Advantage plan.

Read Also: Does Medicare Cover New Patient Visit

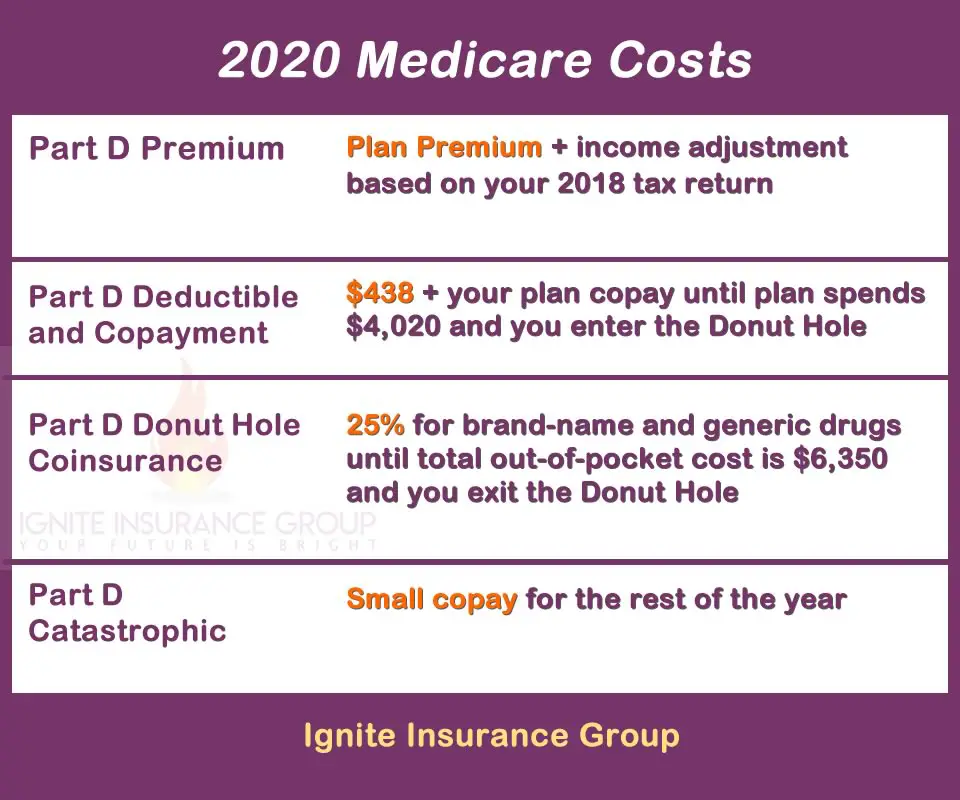

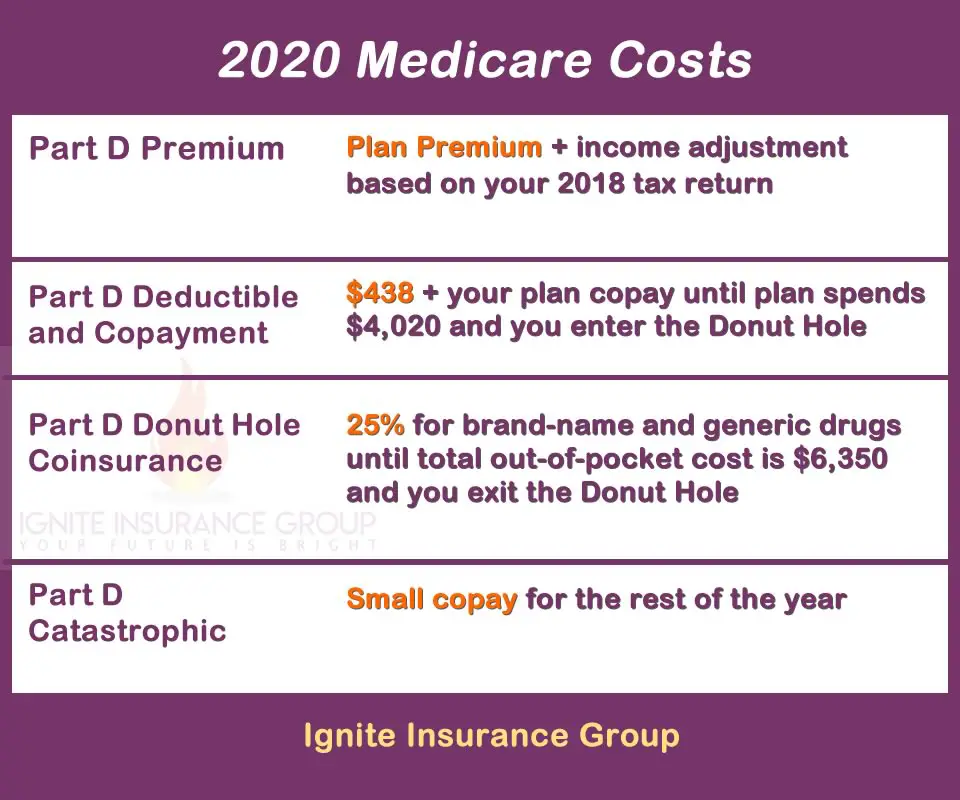

Why Are Changes Coming To Medicare In 2020

Whether Medicare hasbeen your health care plan for many years, or you expect to be eligible forMedicare on or after January 1, 2020, the changes coming to Medicare Supplementplans and the Donut Hole may affect you. Legislation established these changesin 2015 to try and reduce unnecessary costs to Medicare and eliminate the gapin Medicare Part D prescription drug coverage.

To try to reduce costs to Medicare, people entering the program on or after January 1, 2020, will not be allowed to pick up Medicare Supplement plans that cover the Medicare Part B deductible. Medicare Part B covers your outpatient services, like your annual wellness exam at your doctors office. Lawmakers believe that making people responsible for paying a small deductible will encourage them to only visit the doctor when necessary, thereby saving Medicare money.

The gap in Medicare PartD drug plans is often referred to as the Donut Hole. The Donut Hole varies insize depending on the plan, but the high out-of-pocket costs negatively affectenrollees that entered it.

If You Disagree With Our Decision

If you disagree with the decision we made about your income-related monthly adjustment amounts, you have the right to appeal. The fastest and easiest way to file an appeal of your decision is online. You can file online and provide documents electronically to support your appeal. You can file an appeal online even if you live outside of the United States.

You may also request an appeal in writing by completing a Request for Reconsideration , or contact your local Social Security office. You can use the appeal form online, or request a copy through our toll-free number at 1-800-772-1213 . You dont need to file an appeal if youre requesting a new decision because you experienced one of the events listed and, it made your income go down, or if youve shown us the information we used is wrong.

If you disagree with the MAGI amount we received from the IRS, you must correct the information with the IRS. If we determine you must pay a higher amount for Medicare prescription drug coverage, and you dont have this coverage, you must call the Centers for Medicare & Medicaid Services to make a correction at 1-800-MEDICARE . We receive the information about your prescription drug coverage from CMS.

Also Check: When Is Open Enrollment For Medicare Supplement Plans

B Deductibles In Previous Years

The Part B deductible has generally increased over time, although there have been some years when it stayed the same or even decreased. The increase for 2022 was the largest year-over-year dollar increase in the programs history. But the decrease for 2023 was the first time the deductible has declined in over a decade. Heres an historical summary of Part deductibles over the last several years :

To 2016 Medicare Part B Premiums

Medicare Part B premiums went up in 2013 from the previous year, but then they stayed the same until the projected 2016 increase. The 2013 to 2015 premiums started at $104.90 per month and increased for single or married individuals who filed separately with MAGIs over $85,000 and married taxpayers who filed jointly with MAGIs over $170,000.

In 2016, the premium rate of $104.90 from the previous three years applied to about 70% of beneficiaries due to COLA. The other 30% paid a Medicare Part B premium that was not based on COLA. The premium was $121.80 in 2016, which was a 16% increase from the $104.90 paid in 2015.

You May Like: How Much Does Medicare Pay Doctors For Visit

B Late Enrollment Penalty

If you dont Part B when youre first eligible, you may be required to pay a late enrollment penalty.

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

For example, if you waited three years after your Initial Enrollment Period to sign up for Medicare Part B, your late enrollment penalty could be 30 percent of the Part B premium.

You will continue to owe this penalty for as long as you remain enrolled in Medicare Part B.

As mentioned above, the 2023 standard premium for Part B is $164.90 per month. If you owe the standard Medicare Part B premium but sign up for Part B a year after you were initially eligible, the late enrollment fee can add another $16.49 per month to your Part B premium.

Do Any Medicare Supplement Plans Cover Hearing Aids

Medicare Supplement Insurance plans, also called Medigap, do not provide coverage for hearing aids. In fact, these plans dont provide coverage for any health care services or items at all.

Instead, Medigap plans provide coverage for out-of-pocket costs associated with Original Medicare, such as Part A and Part B deductibles, coinsurance and copayments.

Learn more about Medicare Supplement Insurance plans.

You May Like: Does Medicare Cover Alcohol Rehab

Recommended Reading: Are Grab Bars Covered By Medicare

Medicare Part C Premiums

As well as paying the Part B deductible, a person with Medicare Part C will pay a monthly premium. Some premiums are $0. The monthly premium varies based on the type of plan and the coverage offered.

For 2020, the average monthly premium cost for all Medicare Advantage plan types was $25, according to the Kaiser Family Foundation .

Different Medicare Advantage plan types are available. They vary by deductible, coinsurance, and out-of-pocket limits.

A person should look over their last year of healthcare costs to work out the cost effectiveness of a Medicare Part C plan. They should also consider how much they could afford to pay if they were to suddenly need significant medical care.

For targeted cost estimates based on a persons local services, they can visit the Medicare Part C search engine on Medicare.gov.

For more resources to help guide you through the complex world of medical insurance, visit our Medicare hub.

To 2019 Medicare Part B Premiums

Medicare Part B premiums for tax year 2019 started at $135.50 and increased to up to $460.50, depending on your income. The rate of $135.50 was for single or married individuals who filed separately with MAGIs of $85,000 or less, and for married taxpayers who filed jointly with MAGIs of $170,000 or less.

The monthly premium for Medicare Part B was $134 for tax years 2017 and 2018. This rate was for single or married individuals who filed separately with MAGIs of $85,000 or less and for married taxpayers who filed jointly with MAGIs of $170,000 or less. The 2017 premium rate was an increase of 10% over the 2016 rate that was not based on the Social Security Administration’s cost-of-living adjustments .

Medicare has a “hold harmless” provision for seniors. This provision prevents Medicare from raising the premiums more than the cost of living increases. While this keeps seniors from paying more than they should, you’ll have to pay the increased premiums if your COLA is higher than the increase.

Recommended Reading: How Long Does Medicare Open Enrollment Last

Medicare Advantage Plan :

- Monthly premiums vary based on which plan you join. The amount can change each year.

- You must keep paying your Part B premium to stay in your plan.

- Deductibles, coinsurance, and copayments vary based on which plan you join.

- Plans also have a yearly limit on what you pay out-of-pocket. Once you pay the plans limit, the plan pays 100% for covered health services for the rest of the year.

Medicare Premiums Deductibles Co

The following information was adapted from the chart 2020 Medicare Costs at a Glance on the Medicare.gov website:

Part A: premium:

Most people dont pay a monthly premium for Part A , because they paid Medicare taxes while working. If you buy Part A, youll pay up to $499 each month in 2022.

Part A: hospital inpatient deductible and co-insurance

You pay:

- $1,556 deductible for each benefit period

- Days 1-60: $0 co-insurance for each benefit period

- Days 61-90: $389 co-insurance per day of each benefit period

- Days 91 and beyond: $778 co-insurance per each lifetime reserve day after day 90 for each benefit period

- Beyond lifetime reserve days: all costs

Part B: premium

You pay:

The standard Part B premium amount is $170.10 .

Part B: deductible and co-insurance

You pay:

$233 for the deductible. After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services , outpatient therapy, and durable medical equipment .

Part C: premium

Medicare Part C is better known as Medicare Advantage. The Part C monthly premium varies by plan. Compare costs for specific Part C plans.

Part D: premium

The Part D monthly premium varies by plan . Compare costs for specific Part D plans.

You May Like: Are Chemotherapy Drugs Covered By Medicare

What Is The Deductible For Original Medicare

In 2023, the Medicare Part A deductible is $1,600 per benefit period and the Part B annual deductible is $226 . The Centers for Medicare & Medicaid Services releases new premiums, deductibles and coinsurance amounts for Part A, Part B and the Medicare Part D income-related monthly adjustment amounts every fall.

Monthly Medicare Premiums For 2022

The standard Part B premium for 2022 is $170.10. If youre single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

| Modified Adjusted Gross Income | Part B monthly premium amount | Prescription drug coverage monthly premium amount |

|---|---|---|

| Individuals with a MAGI of less than or equal to $91,000 Married couples with a MAGI of $182,000 or less | 2022 standard premium = $170.10 |

| Your plan premium + $77.90 |

Don’t Miss: What Is A Medicare Card

How Much Does Original Medicare Part A Cost

What it helps cover:

- Home healthcare

What it costs:

Most people generally don’t pay a monthly premium for because they paid Medicare taxes while they were working. However, there are costs you may have to cover.

Other Part A costs for 2022 and 2023:

- An annual deductible of $1,600 in 2023 for in-patient hospital stays .

- $400 per day coinsurance payment in 2023 for in-patient hospital stays for days 61 to 90 .

- After day 91 there is a $800 daily coinsurance payment in 2023 for each lifetime reserve day used .

- After the maximum 60 lifetime reserve days are exhausted, there is no more coverage under Part A for inpatient hospital stays.

What Is The High

In 2020 Medicare Supplement Plan G High-Deductible is being introduced. If you select this plan, Medicare will cover its portion, and you will pay your out-of-pocket costs until you have paid the deductible amount. In 2020, the high deductible amount is $2,340. Once you have reached $2,340, your Medicare Supplement plan will pay the remainder of the costs for your Medicare-approved treatment. Because of the potential for high out-of-pocket costs, premiums for this plan are typically much less expensive than for Plan G. Plan G High-Deductible may be a good choice for you if:

- You rarely need medical treatment

- You are able to pay theout-of-pocket deductible

- You prefer theopportunity to save money over not worrying about medical bills

Recommended Reading: What Is Plan C Medicare Supplement

Which Medicare Supplement Plan Offers The Most Coverage To People Who Become Eligible On Or After January 1 2020

While none of the plans available to you will cover the Part B deductible, youll still be able to apply for one of the most popular plans. Medicare Supplement Plan G is very similar to the full coverage Plan F, with the exception that you pay the $198 Part B deductible. After you pay the deductible, you wont have any out-of-pocket costs for your Medicare-approved services.

Healthcare Costs A Little More Each Year Find Out The Details Here

Americans 65 and older rely on Medicare for the healthcare coverage they need. But even though most people are entitled to Medicare benefits, they don’t come without cost. In fact, if you don’t plan for healthcare expenses under Medicare, you’ll get a nasty shock when you approach retirement.

In particular, the various parts of Medicare coverage impose a wide variety of different costs for participants to pay. Whether you face deductibles, co-payments, premiums, or other expenses, being on Medicare requires some financial planning in order to make sure you can cover your costs. The following sections take a look at Medicare and what you’ll have to pay for it in 2020.

Image source: Getty Images.

You May Like: Does Medicare A Or B Cover Prescriptions

Medicare Part B Premium

If you have Part B, youll need to pay a monthly premium. The standard monthly premium for 2022 is $170.10.

However, the amount of this premium can increase based on your income. People with a higher income typically pay whats known as an income-related monthly adjustment amount . For 2022, your income amount is calculated from your 2020 tax return.

The following individuals can enroll in original Medicare :

- people age 65 and older

- individuals with a qualifying disability

Eligibility for Part B depends on whether or not youre eligible for premium-free Part A. Most people get premium-free Part A because theyve paid Medicare taxes while working.

What Is The Medicare Part B Late Enrollment Penalty

If you dont sign up for Part B when youre first eligible, you may be required to pay a late enrollment penalty when you do choose to enroll. Additionally, youll need to wait until the general enrollment period .

With the late enrollment penalty, your monthly premium may go up 10 percent of the standard premium for each 12-month period that you were eligible but didnt enroll. Youll continue to pay this penalty for as long as youre enrolled in Part B.

For example, lets say that you waited 2 years to enroll in Part B. In this case, youd pay your monthly premium plus 20 percent of the standard premium.

You May Like: Is Smart Vest Covered By Medicare