How Your Assets Impact Eligibility

Besides income, your assets will be counted toward meeting eligibility requirements. Countable assets include checking and savings account balances, CDs, stocks, and bonds.

In most states, you can retain up to $2,000 as an individual and $3,000 for a married couple outside of your countable assets. However, these amounts may vary depending on the state in which you live.

Your home, your car, personal belongings, or your savings for funeral expenses remain outside of countable assets. If you can prove other assets are not accessible , they too are exempt. A house must be a principal residence and does not count as long as the nursing home resident or their spouse lives there or intends to return there.

Upon becoming eligible for Medicaid, all of the applicant’s income must be used to pay for the nursing home where the applicant resides. However, you may be allowed to keep a monthly “allowance” and a deduction for medical needs, such as private health insurance. The amount of the allowance varies depending on your living arrangements, type of nursing facility, and state rules. If you are married, an allowance may be made for the spouse still living in the home.

Medicare Advantage May Offer More Comprehensive Coverage

Private insurance companies run Medicare Advantage. Those companies are regulated by Medicare and must provide the same basic level of coverage as Original Medicare. However, they also offer additional coverage known as supplemental health care benefits.

These benefits can be used to cover the cost of health care or medical equipment that could reduce the risk of injury, reduce the impact of lost mobility or injury or help a person maintain their health and independence.

Medicare Advantage covers many services that are excluded from original Medicare. Individual insurers are permitted to exercise discretion when deciding what services to offer under supplemental benefits, so Medicare Advantage customers should contact their insurers to discuss their options before deciding on a care plan.

How Does Medicare Advantage Help With Nursing Home Care

Original Medicare doesnt cover most nursing home stays, but a Medicare Advantage plan may.

Medicare Advantage, also called Part C, is offered by private insurers. More than one-third of Medicare beneficiaries have a Medicare Advantage plan rather than Original Medicare.

The federal government allows more leeway for Medicare Advantage to offer supplemental benefits, such as home and custodial care.

The Medicare Advantage insurer needs a contract with a facility to cover nursing home stays. Check with the plans network before signing up.

If a loved one is headed to a nursing home, check with his or her Medicare Advantage insurer to see which nursing homes are covered in the plan. Once you have a list of local nursing homes in the plan, you can research each one to find a facility thats high quality and fits your loved ones needs.

Recommended Reading: Do I Need Health Insurance With Medicare

What Is Medicare Home Health Care

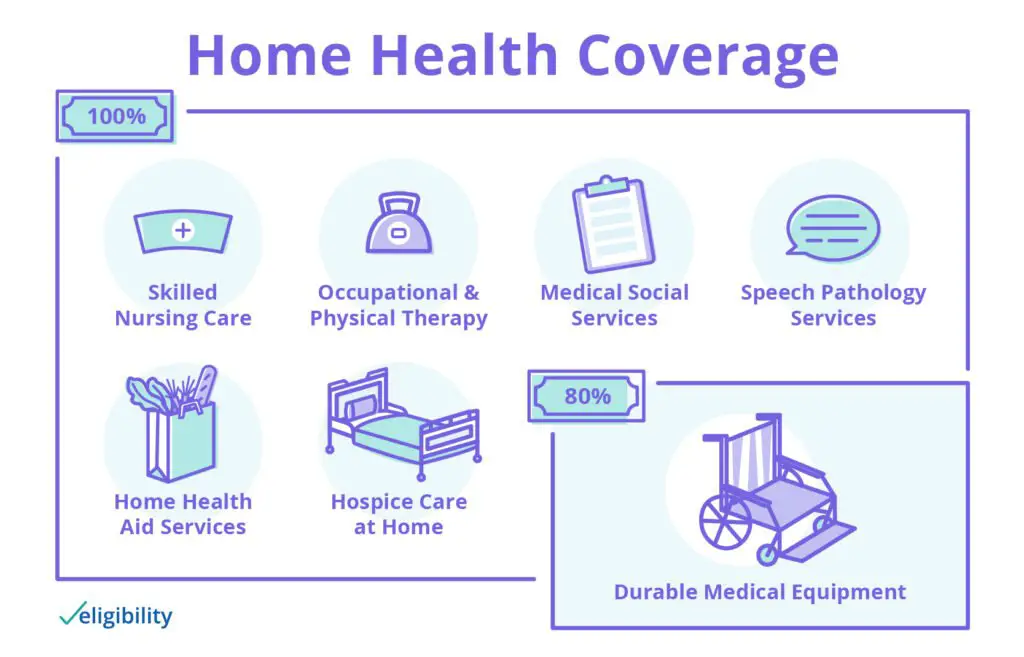

Home health care is a broad range of healthcare services given in your home for injuries and illnesses that are more convenient and less expensive than the services you get in a hospital and other health facilities. Examples of home health care services paid for by Medicare include caregiver education and wound care comprising surgical wounds or pressure sores, injections, monitoring serious illnesses and unstable health statuses, and administering nutritional therapy.

How Much Does Medicare Pay For Nursing Home Care

Original Medicare doesnt often cover nursing home care unless its medically necessary.

However, it covers 100 days of SNF care as long as you meet requirements. You have to enter an SNF or nursing home providing medically necessary care within 30 days of hospital discharge. That hospitalization must last at least three years.

Medicare only pays for medical treatment. It doesnt reimburse for custodial care.

Medicare fully covers the cost of room and board, meals, skilled nursing, rehab services and medical supplies for the first 20 days in an SNF. After that, the patient must pay $176 per day until day 100. After the 100th day, the patient must pay all costs.

Recommended Reading: Does Medicare Cover Mental Health Visits

Medicare’s Limited Nursing Home Coverage

Many people believe that Medicare covers nursing home stays. In fact Medicare’s coverage of nursing home care is quite limited. Medicare covers up to 100 days of “skilled nursing care” per illness, but there are a number of requirements that must be met before the nursing home stay will be covered. The result of these requirements is that Medicare recipients are often discharged from a nursing home before they are ready.

Local Elder Law Attorneys in Your City

City, State

In order for a nursing home stay to be covered by Medicare, you have to meet the following requirements:

Note that if you need skilled nursing care to maintain your status , then the care should be provided and is covered by Medicare. In addition, patients often receive an array of treatments that don’t need to be carried out by a skilled nurse but which may, in combination, require skilled supervision. For example, the potential for adverse interactions among multiple treatments may require that a skilled nurse monitor the patient’s care and status. In such cases, Medicare should continue to provide coverage.

You cannot rely on Medicare to pay for your long-term care. Contact your attorney to create a long-term care plan. To find a qualified elder law attorney, .

For more information on Medicare, .

Related Articles

Nursing Homes Vs Assisted Living Facilities

Many people talk about nursing homes and assisted living facilities as if theyre the same thing. But Medicare treats them very differently when it comes to coverage.

Medicare doesn’t cover help with daily living activities if it’s the only care you need. Most nursing home and assisted living care is custodial care. However, Medicare Part A may cover care in a licensed nursing facility for a limited time if you need skilled nursing care.

A common and popular alternative to a nursing home is an assisted living facility. Theyre a great option for people who no longer canor care tolive on their own, but they can be expensiveand Medicare doesnt cover them.

Don’t Miss: Does Medicare Pay For Entyvio

What Kind Of Nursing Home Care Does Medicare Cover

The term nursing home can refer to different types of places, including rest homes, nursing homes, board-and-care homes, assisted-living facilities, congregate living homes, and sheltered care homes. All of these provide whats called custodial care, which is long-term residence and non-medical assistance with the activities of daily living such as bathing, eating, walking, and dressing for people who dont have acute medical conditions but who are no longer able to care for themselves completely. This type of custodial long-term care is not covered by Medicare.

At the other end of the nursing home spectrum is high-level inpatient medical care, referred to as skilled nursing or rehabilitation care. Under certain circumstances, Medicare Part A covers this skilled care for a limited time while a patient is recovering from a serious illness, condition or injury. For Medicare to cover this care, it must be provided in the skilled nursing facility wing of a hospital, in a stand-alone skilled nursing or rehabilitation facility, or in the skilled nursing or rehabilitation unit within a multilevel facility.

Veterans Assistance For Nursing Homes

There are two options specifically for veterans and surviving spouses. The first is the Aid and Attendance Benefit, also referred to as the Improved Pension. This is a program the provides financial assistance to war-time veterans that require the aid of another person in order to perform his or her activities of daily living. The Aid and Attendance program is intended to help those with limited financial means . A veterans income and financial assets are both considered during the application process. Veterans can use the Benefit towards the cost of nursing home care or assisted living. Read about how the Aid and Attendance Benefit calculates income or the programs eligibility requirements.

The second option for veterans and their spouses which is not limited to those who served during war-time, are state VA nursing homes. Care in a VA nursing home is offered as an alternative to the Aid and Attendance benefit one cannot concurrently receive both benefits. The state VA nursing homes, unfortunately, do not have a unified eligibility or application process. However, a rule of thumb is the veteran or their spouse must be designated at least 70% disabled. Each state has its own nursing homes and each nursing home has its own eligibility requirements. There are a limited number of spaces available within each home and not all of them are designated for long term care. Waiting lists for admission to a VA nursing home are very common. Find VA nursing homes.

Recommended Reading: How To Get Medicare To Pay For Hearing Aids

What Do Va Long

For extended care services, veterans may be subject to a co-payment of up to $97 per day. The amount of the co-payment depends on the veterans VA health system priority group and individual financial circumstances, and also on the type of care or service provided. The amount of co-payment for extended care services is based on income, and for some services, co-pay amounts are based on the assets held by both the veteran and the veterans spouse.

For extended care services expected to last 180 days or less, the VA looks only at the income of the veteran and spouse, taking into account the veterans expenses. For extended care services expected to last 181 days or longer , the VA looks at the income and the assets of the veteran and spouse. Details of these financial calculations are available from the VAs publication VA Copays and Charges.

Some Can Afford To Pay Out Of Savings

People who have accumulated significant wealth may be able to pay out of pocket $100,000 or more annually for nursing home care for five years or more. But thats not most of us.

Planning to pay for nursing home care means confronting complex, unpredictable and potentially enormous costs, not to mention your own mortality. With all these challenges, you owe it to yourself to speak with a professional about how long-term custodial care figures into your overall financial plan. The sooner you get started, the better.

Read Also: What Is Medicare Ffs Program

Medicare May Pay If You Are Qualified What Do I Mean By Qualified

- First you must be qualified to receive Medicare benefits, meaning you must be age 65, blind or disabled. If you are reading this, over age 65 and are currently on Medicare, you have jumped this hurdle already.

- The second qualifying hurdle is that you must have had a 3 day qualifying stay in a hospital. Heres another loaded sentence: To qualify for Medicaid, the hospital must admit you as a patient during your stay. We will discuss why further below.

Future Medicaid Claims Against Your Estate

If you are over 55 and receive long-term care through Medicaid, or if you are permanently institutionalized before you turn 55, your state’s Medicaid program will have a claim against your estate after your death for the amount that the state spent on your care while you were receiving Medicaid. This is called Medicaid estate recovery. However, the state will not try to recover from your estate until after your spouse dies and only if you have not left any minor or disabled children. Some states, including California, can also recover the cost of Medicaid services other than long-term care servicesâas long as they were incurred after you turned 55.

Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

Also Check: When Do You Receive Medicare Card

Cost Of Nursing Homes Vs In

The cost of nursing home care and in-home care will vary depending upon a number of factors: location, amount of care needed, and the level of care that is required. The average cost of care has a vast range between each state, with higher costs being in regions where the cost of living is higher. One might think that home care is always the least expensive option, but depending on the aforementioned factorsparticularly concerning those with special needs or 24 hour care this may not be the case. However, here are summaries of the national averages of common care levels to give you an idea of what to expect.

Using Life Insurance To Pay For Long

If you have a life insurance policy with living benefits, you may be able to take out your death benefit early and use it to help pay for nursing home expenses, supposing you qualify according to your policys provisions. If you have a permanent policy, you may also be able to borrow from the cash value to help pay for expenses.

Keep in mind, any money borrowed from a life insurance policy will likely be subtracted from your beneficiarys inheritance.

Don’t Miss: Does Medicare Cover Oral Surgery Biopsy

Nursing Home Average Costs

On average, a nursing home costs $225 daily for a semi-private room and $253 for a private room. Monthly charges range from $6,844 to $7,698 for semi-private and private rooms respectively. Annual costs range from $82,128 to $92,376 for full time nursing home care. Additional costs may be incurred if dementia, memory care or other special services are required.

Medicare Doesnt Cover Most Long

Nonmedical custodial care in a nursing home like help with eating and bathing is not covered by Medicare. However, Medicare may pay for short-term skilled care in a nursing home if it’s deemed medically necessary because of an injury or illness.

»MORE:What is Medicare, and what does it cover?

But Medicare Part A does cover professional medical care provided in a skilled nursing facility , a time-limited benefit available when medically necessary for recovery and rehabilitation after a hospital stay. There are substantial limits to this Medicare coverage, chiefly a 20% copay for days 21 through 100, and no coverage beyond 100 days.

For people who are medically and financially able to age in place, Medicare does fully cover many home health care services, such as occasional skilled nursing. Medicare also covers 80% of some other costs, from physical therapy to durable medical equipment, such as wheelchairs.

Medicare Advantage also generally does not cover long-term custodial care, but plans may include supplemental coverage to assist with some home health care costs. If you have Medicare Advantage, check your plan for details on coverage.

Don’t Miss: How To Find Out If I Have Medicare

Does Medicare Cover Nursing Homes

Yes, Medicare does cover nursing home costs, but only for short, approved visits. Medicare Part A covers some specific, short-term services within a skilled nursing facility if deemed medically necessary. For example, it covers skilled treatment for an injury or illness in a nursing home.

Original Medicare only pays for nursing home care up to 100 days maximum . Some Medicare Advantage Plans also offer partial coverage, but only if the nursing home contracts with that plan.

Medicare does not cover long-term nursing home care, also known as custodial care. This includes the routine, sometimes unskilled services like help with bathing, dressing, or bathroom use. Medicare does cover a limited number of services within nursing homes for patients who meet specific criteria.

What Is Covered by Medicare

- Medical and nursing care up to 100 days in a skilled facility

- Prescription medication covered under Medicare Part A

- Room and meals

What’s not Covered by Medicare

- Long-term, custodial care

- Enrolled in Medicare Part A .

- Available days in your benefit period.

- Qualifying hospital stay: three or more days hospitalized as an inpatient .

- Enter a Medicare-approved facility within 30 days of qualifying hospital stay.

- A doctor determines you need daily skilled care.

- The skilled nursing facility is Medicare-approved.

- Hospital-related medical condition treated during a qualifying stay.

Medicare Prescription Drug Coverage And Nursing Home Care

When in a skilled nursing facility that is Medicare approved, prescription drug coverage is typically provided via Medicare Part A, according to the CMS.

Yet, prescription drug costs incurred while living in a nursing home or similar institution are also sometimes covered via Medicare Part D or a Medicare Advantage plan, if you have either of these.

MORE ADVICE

MORE ADVICE Discover more tips for comfortably aging in place

A 2017 survey revealed that almost one-third of seniors have no emergency savings and 70 percent have less than six months of savings

Also Check: Does Medicare Supplemental Insurance Cover Pre Existing Conditions

S Of Medicare You Should Know

Generally, Medicare comes in three parts A, B, and D. Part A, typically referred to as Hospital Insurance, exclusively covers inpatient hospital bills like admissions, care in skilled nursing facilities, hospice care, and home health care services. Part B or the Medical Insurance covers specific medical practitioners services, medical supplies, preventive treatments, and outpatient care. Part D or the prescription drug coverage covers the costs of prescribed drugs, including vaccines and other drug recommendations.

Long Term Care Benefits

Medicare is the primary medical care insurance for a large number of seniors. Many are shocked to discover that Original Medicare , also called Traditional Medicare, does not cover costs for most types of long term care, including Alzheimers and dementia care. When it does pay, it is only in a very limited capacity. While Traditional Medicare is not a long term care solution, there are benefits for seniors with recoverable conditions on a short term basis. Also, as mentioned previously, some Medicare Advantage Plans now offer some home and community based long term care benefits under specific circumstances.

Skilled Nursing FacilitiesMedicare will pay for 100% of the cost of care up to 20 days at a skilled nursing facility and approximately 80% of the cost up to 80 more days. The care must be for recovery following an inpatient hospital stay.

Assisted Living CommunitiesMedicare does not cover any cost of assisted living. It will pay for most medical costs incurred while the senior is in assisted living, but will pay nothing toward custodial care or the room and board cost of assisted living. Some Medicare Advantage plans may pay for personal care assistance for persons residing in assisted living or memory care, but will not contribute towards the cost of room and board.

Adult Day CareOriginal Medicare does not pay for adult day care services, but some Medicare Advantage plans may cover the cost.

Don’t Miss: How Old To Be Covered By Medicare