How Often Can You Change Your Medicare Supplement Plan

You can change your Medigap plan as often as you want. However, it doesnt make sense to change plans frequently. Usually, people change plans when they want a lower rate, but you dont need a reason to change plans.

When changing plans, youll have a 30-day free look period that starts when you get the new Medigap policy. But, youll have to pay premiums on both for that initial month.

If you choose to discontinue the new policy, the new Medigap insurance company will reimburse you. However, if you choose to go with the new policy, at least you were adequately covered during your transition from plan to plan.

Of course, choosing a top-rated Medigap carrier can make for a smooth transition.

What Is The Difference Between An Advantage Plan And A Supplemental Plan

Medicare Supplement insurance plans work with Original Medicare, Part A and Part B, and may help pay for certain costs that Original Medicare doesn’t cover. … In contrast, Medicare Advantage plans are an alternative to Original Medicare. If you enroll in a Medicare Advantage plan, you’re still in the Medicare program.

How To Change Your Medicare Advantage Plan

If you have a Medicare Advantage plan you can change to Original Medicare Medicare Part A and Part B or to another Medicare Advantage plan during an appropriate Medicare enrollment period.

You can change to another Medicare Advantage plan by simply joining the new plan youve chosen. Your old coverage will end automatically when the new plans coverage takes effect.

If you want to change to Original Medicare, you have to contact your Medicare Advantage plan administrator and let them know you are switching. You then have to call 1-800-MEDICARE and enroll in Original Medicare.

Recommended Reading: Is Medicare Complete The Same As Medicare Advantage

Can I Change Medicare Advantage Plans Anytime

Updated: January 15, 2022Expert reviewed by: Kelly Blackwell, Certified Senior Advisor®Medicare Advantage Plans, also called Medicare Part C, are an alternative to Original Medicare. They provide the same coverage as Medicare Part A and Part B, and sometimes offer additional benefits not included in Original Medicare, like drug, dental and vision coverage.

Kelly Blackwell

Kelly Blackwell is a Certified Senior Advisor ®. She has been a healthcare professional for over 30 years, with experience working as a bedside nurse and as a Clinical Manager. She has a passion for educating, assisting and advising seniors throughout the healthcare process.

Changing Part D Plans Outside Of Open Enrollment

You may qualify for a special enrollment period to change your Part D plan in certain situations at other times during the year:

If you receive financial assistance from the Part D Extra Help program, you can change Part D plans as often as once each calendar quarter during the first three quarters of the year. Extra Help helps people with low incomes and assets pay Part D premiums and copayments.

If you move into, live in or leave a nursing home or long-term care facility, you generally can join or switch Part D plans. And after you move out, you can take two additional months to decide if you want a different plan.

If you move outside your current drug plans service area, you usually have up to two months to switch to a new Part D or Medicare Advantage plan.

If your current Part D plan terminates its contract with Medicare, you have up to two months before and one month after the plans Medicare contract ends to go to another plan.

If a five-star Part D or Medicare Advantage plan covers your area, you can switch into that plan once any time of the year, except for the first week in December. You can use this special enrollment period for plans that have earned an overall five-star rating from the Centers for Medicare & Medicaid Services once a year. Coverage begins the first day of the month after the plan receives your enrollment request.

Keep in mind

Don’t Miss: What Is The Annual Deductible For Medicare Part A

What Date Can I Change My Medicare Plan

Medicare beneficiaries with Part C insurance or a Part D plan may have to wait for the Annual Enrollment Period to change insurance. However, if Original Medicare is the only insurance, you must sign up for Medigap anytime.

Since Medicare Supplement Insurance doesnt include Prescription Drug Coverage, youll need to buy a separate Part D plan.

What Is A Welcome To Medicare Exam Vs An Annual Physical

As a Medicare Advantage member, you are entitled to receive a one-time Welcome to Medicare exam within the first 12 months of enrollment in Medicare Part B. The Welcome to Medicare exam offers an opportunity for your doctor to review your medical and personal history, conduct several simple measurements and screenings related to your well-being, and outline a plan for future preventive services.

One annual routine physical exam is covered at no cost to you. This includes baseline measurements such as blood pressure, height and weight, review of risk factors, and certain diagnostic tests that include complete blood count and urinalysis. Use of your primary care physician on record is highly encouraged.

If you have been enrolled in Medicare Part B for more than 12 months, you will want to schedule this as an Annual Wellness Visit. Its important to schedule the correct visit so it can be covered correctly.

Read Also: How To Find A Medicare Doctor

Can I Leave Medigap To Join A Medicare Advantage Plan

When choosing to supplement your Original Medicare coverage, you must decide between Medigap and Medicare Advantage you cannot have both. If you decide to join an MA plan, you must first cancel your Medigap policy. You may do this during any of the enrollment periods listed above or if you qualify for one of the Special Enrollment Periods.

If you decide to return to Original Medicare AND this is the first time youve had a Medicare Advantage plan, you qualify for trial rights. This allows you to return to your original Medigap policy without undergoing medical underwriting. If you do not change back within the first 12 months or if this wasnt your first time enrolling in an MA plan, you may be denied Medigap coverage based on underwriting.

Beneficiary And Plan Rights And Responsibilities Upon Disenrollment

Within ten calendar days of receiving a members request to disenroll, CarePlus will acknowledge the request in writing and include the effective date of disenrollment with the plan. Beginning on the effective date of the members disenrollment, CarePlus will not cover any health care the individual receives. In addition, beginning on the effective date of the members disenrollment, the individual can see a healthcare provider through Original Medicare, unless the individual has enrolled in another Medicare Advantage plan. If the members doctor needs to send claims to Medicare, the member may want to let the doctor know that he/she just disenrolled from CarePlus and that it may take a few weeks for Medicare to update their records.

For additional information, please call CarePlus Member Services at 1-800-794-5907, . From October 1 – March 31, we are open 7 days a week, 8 a.m. to 8 p.m. From April 1 – September 30, we are open Monday – Friday, 8 a.m. to 8 p.m. You may always leave a voicemail after hours, Saturdays, Sundays, and holidays and we will return your call within one business day.

Don’t Miss: How To Request A Replacement Medicare Card

If You Have Other Coverage

Talk to your employer, union, or other benefits administrator about their rules before you join a Medicare Advantage Plan. In some cases, joining a Medicare Advantage Plan might cause you to lose employer or union coverage. If you lose coverage for yourself, you may also lose coverage for your spouse and dependents.

In other cases, you may still be able to use your employer or union coverage along with the Medicare Advantage plan you join. Remember, if you drop your employer or union coverage, you may not be able to get it back.

Medicare Supplement Open Enrollment Period

If youre looking to supplement your Original Medicare coverage to help with additional costs, the best time to buy a Medicare Supplement plan is during the six-month enrollment period that starts the first day of the month you turn 65 as long as you have signed up for Medicare Part B.

If you dont sign up for a Medicare Supplement plan during this Open Enrollment Period, you may not be able to buy a Medicare Supplement plan. Unless you have a guaranteed issue right, you may be required to answer medical questions.

You May Like: What Age Do You Apply For Medicare Benefits

Changing Medicare Advantage Plans: Compare Plans Before You Switch

If you want to change Medicare Advantage plans, you may want to make sure youre choosing the right plan for your needs and not missing out on a plan that might be better for you. For an instant side-by-side look at Medicare Advantage plans in your area, start by entering your zip code in the box on this page.

From the list of plans displayed, you can enter your medications to see if theyre covered, look at specific plan costs, and more. Follow the links below to request an email with customized information, or to set up a phone call with me.

New To Medicare?

Becoming eligible for Medicare can be daunting. But dont worry, were here to help you understand Medicare in 15 minutes or less.

How To Change Medigap Policies

Medicare Supplemental insurance commonly called Medigap is a policy sold by private insurers that covers some of your out-of-pocket expenses if you have Original Medicare.

Typically, you are not allowed to change Medigap policies except in two circumstances:

If either of these situations applies, you may be able to change Medigap policies. You dont have to wait a certain length of time before making your switch.

When You Can Switch Medigap Policies

- You have an older Medigap policy thats no longer offered, and you want a newer one.

- You have a Medigap policy for less than six months and have a pre-existing condition.

- You move out of state you can keep your current Medigap policy, but you may have to pay more for a new one if you switch.

- You have a Medicare SELECT policy and move out of its coverage area you can buy a new policy from your current insurer or use your guaranteed issue right to buy certain standardized Medigap policy from any insurance company.

- You join a Medicare Advantage plan

To switch Medigap policies, call the new insurance company, apply for the policy and obtain approval.

Once you have the new Medigap coverage in place, you have a 30-day free look period to decide whether to keep it. You should not cancel your old policy until youve decided to keep the new policy.

You May Like: Does Medicare Cover Scooters For Seniors

Switching Between Original Medicare And Medicare Advantage

People can switch from original Medicare to Medicare Advantage or vice versa. Both Medicare and Medicare Advantage plan providers can arrange for someone to switch plans. Both processes involve speaking to a Medicare Advantage plan provider.

Individuals can switch between original Medicare and Medicare Advantage at any time during the first 3 months of their enrollment. After this time, they must wait for specific enrollment periods to make changes.

People with Medicare Advantage can switch to original Medicare by calling either Medicare at 1-800-MEDICARE or their Medicare Advantage plan provider.

Can You Change My Medicare Advantage Plan After Open Enrollment

Once the open enrollment ends, in general you will not be able to make changes until the next enrollment period, says Joe Boden, vice president and partner at EP Wealth Advisors in Seattle. However, there are a few exceptions when you can make a change or disenroll from your plan outside of the enrollment periods.

Certain events may make you eligible for a Special Enrollment Period . For instance, if this is the first time youve ever enrolled in a Medicare Advantage Plan and you dropped a Medigap policy to enroll, you have a 12 month trial period after enrolling in the MA Plan in which you can drop your MA Plan and go back to Original Medicare.

Another exception is if your Advantage plan drops your healthcare provider, Boden says. Also, if you move and your plan does not have coverage in your new location, you can change plans. Even if your new address is within your current plans coverage area, you can switch to a different plan if your move made you eligible for new options that werent available at your old address. You have from one month before your move until 2 months after your move to switch plans.

Also Check: Do You Have To Enroll In Medicare

Enrollment Periods For Medicare Supplements

Just like Medicare has special enrollment periods throughout the year, Medicare Supplements have a special window where you need to purchase a plan.There is really only one Enrollment period for Medicare Supplements. It is referred to as the Initial Enrollment Period. This window is from 3 months prior to your 65th birthday and 3 months after.

During this period you can enroll in a Medicare Supplement without being subject to medical underwriting and policies are guaranteed issues

Dont Miss: Does Medicare Cover While Traveling Abroad

If I Have Medicare How Can I Enroll In Medicare Advantage

There are several time frames during which you can enroll in or switch to Medicare Advantage:

- During your Initial Enrollment Period: If you are newly eligible for Medicare because of your age or disability status, you can enroll in a Medicare Advantage plan.

- During the Open Enrollment Period: During Medicare Open Enrollment, which extends from October 15 to December 7 each year, you can change Medicare plans, including switching to Medicare Advantage. You can also change or add a Part D prescription drug plan.

- During the Medicare Advantage Open Enrollment Period: From January 1 to March 31, if you already have a Medicare Advantage plan, you can switch to a different Advantage plan or return to Original Medicare.

Each Medicare Advantage plan offers different benefits, so itâs important to review the plans available in your area.

Consider your medical needs, which services you have used most frequently over the past several years, and whether those needs might change. Then weigh the benefits of various types of Medicare Advantage plans.

A Special Needs Plan might be a great option if you have a chronic illness and the right plan is available in your region, while HMO plans can be an affordable option if you like the doctors included in the planâs network.

The official U.S. government website for Medicare can help you compare different plans and apply for the Medicare Advantage coverage thatâs right for you.

Also Check: Is Private Insurance Better Than Medicare

Changing Part D Plans During Open Enrollment

You can sign up for a Medicare Part D plan or switch from one Part D plan to another during each years open enrollment period.

You also can sign up for a Medicare Advantage plan or switch to a different Medicare Advantage plan with or without drug coverage during that time. Coverage in your new plan begins Jan. 1.

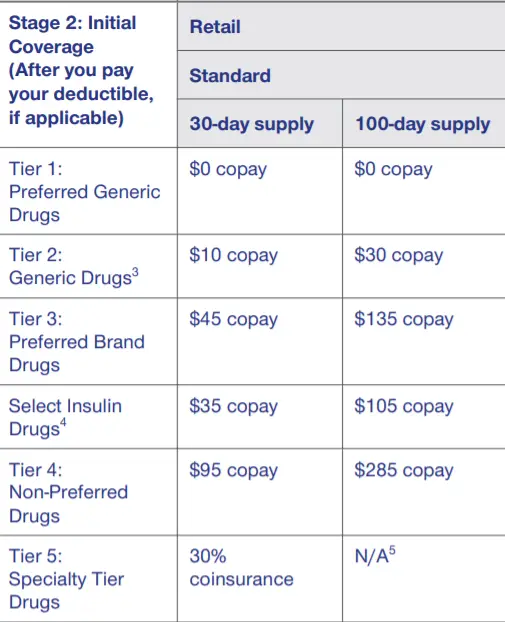

Even if youve been happy with your Part D plan, comparing your options during open enrollment every year is a good idea. Medicare prescription drug plans can change coverage and costs from year to year. Type your zip code, drugs and dosages into the Medicare Plan Finder to find the total cost for every plan available in your area, including premiums and copayments for your specific medications.

If you have prescription drug coverage through a Medicare Advantage plan, you have an extra opportunity to switch to another Medicare Advantage plan or change from Medicare Advantage to original Medicare and join a Part D plan during Medicare Advantage open enrollment each year. You can make one change during that period.

Be aware: If you decide to leave a Medicare Advantage plan for original Medicare, you may not have a guaranteed right to buy a Medigap policy to help cover original Medicares out-of-pocket costs if more than six months have passed since you signed up for Medicare Part B. Check with your State Health Insurance Assistance Program to find out whether an insurer could reject you or charge you more for preexisting conditions.

Can You Cancel A Medicare Advantage Plan At Any Time

You can drop out of the plan and return to original Medicare, with the right to buy Medigap supplemental insurance, at any time during those first 12 months if you joined the plan straight away when you enrolled in Medicare at age 65, or if you dropped a Medigap policy to join the Advantage plan and this is the first …

Also Check: When Does Medicare Start Age

Can I Change Medicare Part D Prescription Drug Plans At Any Time

En español | No, you cant switch Medicare Part D plans any time you might need to, but you do you have options if you want to choose a different plan.

You can get prescription drug coverage either by enrolling in a stand-alone Medicare Part D plan or from a Medicare Advantage plan that combines medical and drug coverage. Private insurance companies that Medicare regulates offer both types of plans.

Every year, you have the chance to change Part D plans or your Medicare Advantage plan if youre among the more than 2 in 5 Medicare beneficiaries in those plans during Medicares annual open enrollment period, and soon after you have an additional opportunity to quit a Medicare Advantage plan to return to original Medicare and a Part D plan. Plus, you may qualify for more chances to change plans outside those windows.