Timely Application And Proofs

If you have Medicare, we need your application and proofs more than one month prior to your retirement effective date. If your last day of work is in June and you want your insurance coverage to start July 1, your retirement effective date, we need your required proofs before June 1. If we get the request and proofs after the first of the month, one month prior to your retirement, but before the end of the month, you will not be enrolled until a month later.

For example, if you submit your application and proofs on June 1, for a retirement effective date of July 1, your actual insurance effective date will be Aug. 1.

Finding The Right Plan For You

Whenshopping for health insurance its important to consider your currenthealthcare needs and any needs you anticipate in the future. Its alsoimportant to consider your budget and what you can afford.

Need help figuring out what coverage is right for you? eHealth is here to help. eHeath is the first and largest online health insurance brokerage, so you can be sure that you will find the best plan for you and your needs with us.

Our online tools are here to not only help save you money but help you keep your doctors when making the switch. eHealths comparison tool allows you to easily compare a large range of health insurance options, so that you can find a plan that fits your budget and coverage needs.

Start shopping for individual and family health insurance now!

And when you turn 65 and are ready for Medicare, let eHealth help you with that transition as well.

Tell Ors Your Medicare Number And Effective Dates For Parts A And B

If your new 11-digit Medicare card arrives after you apply to retire, tell ORS your Medicare number as soon as you receive your card.

You can submit your Medicare enrollment information one of the following ways:

When ORS receives the Medicare number and effective dates for parts A and B, we will send it to your insurance provider and adjust your insurance rate. ORS will change your enrollment to the Medicare plan offered by the carrier you chose on your retirement application.

Also Check: What Does Part B Cover Under Medicare

How Do You Receive Your Medicare Benefits When You Meet Medicare Eligibility Requirements At Age 65

If you meet Medicare eligibility requirements and you have received Social Security benefits for at least four months prior to turning age 65, you will typically get Medicare Part A and Part B automatically the first day of the month you turn age 65.

If youre not enrolled in Original Medicare automatically, you may need to file an application with the Social Security Administration. You can enroll in Medicare Part A and Part B during the period that begins three months before your 65th birthday month, includes your birthday month and ends three months after your birthday month.

Note: You have a choice if you want to keep or refuse enrollment in Medicare Part B. If you refuse it, you dont lose your Medicare Part B eligibility. However, you may have to wait for a valid enrollment period before you can enroll. You may also have to pay a late enrollment penalty for as long as you have Medicare Part B coverage.

What Else Do I Need To Know

- Medicare can help cover your costs for health care, like hospital visits and doctors services.

- Most people dont pay a premium for Part A, but you do pay a monthly premium for Part B.

- If you cant afford the monthly premium, there are programs to help lower your costs. Get details about cost saving programs.

Read Also: How Often Does Medicare Pay For A1c Blood Test

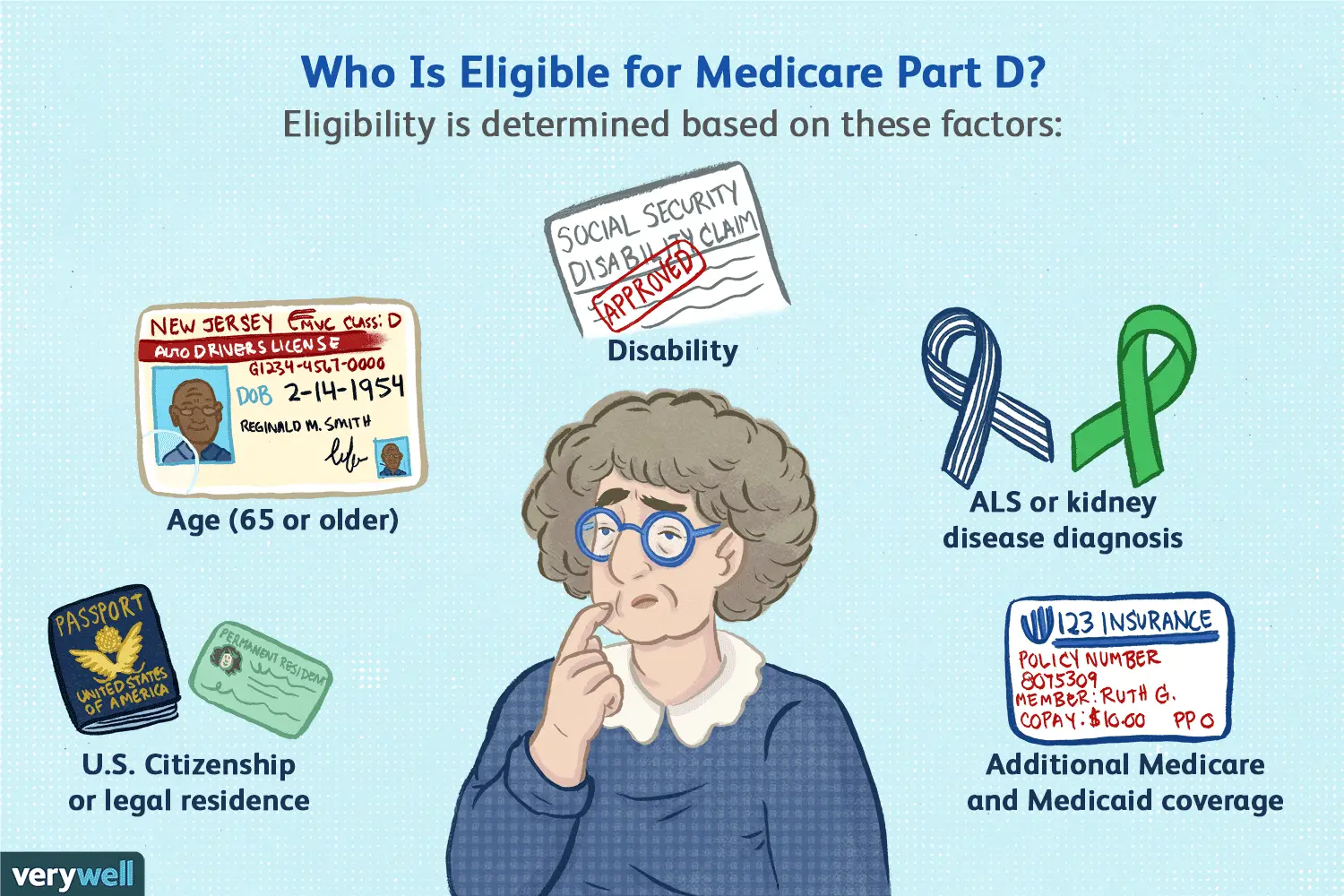

Younger Than Age : Who Is Eligible For Medicare

As long as you meet the citizenship/legal residence requirements described above, you may be eligible for Medicare when you are younger than age 65 if one of the following circumstances applies to you:

- You have been receiving Social Security disability benefits for at least 24 months in a row

- You have Lou Gehrigs disease

- You have permanent kidney failure requiring regular dialysis or a kidney transplant. This condition is called end-stage renal disease .

Read more details about enrollment in Medicare when youre under 65.

Your Spouses Health Plan

If your spouse is still working and has access to a health insurance plan that offers spousal coverage, youll be able to enroll in that plan when your own coverage terminates. Your loss of coverage will trigger a special enrollment period for your spouses plan, just as it does for a marketplace plan.

Even if both you and your spouse were covered under your plan, youll both be able to transition to your spouses employers planassuming coverage is availablewhen your existing plan terminates.

Note that if youre eligible to enroll in your spouses plan, youre likely not eligible for a premium subsidy for a marketplace plan. As long as your spouses coverage is considered affordable for just the employee, the cost to add a spouse is not taken into consideration.

Although the American Rescue Plan made marketplace premium subsidies larger and more widely available, it did not fix this family glitch.

Read Also: What Does Regular Medicare Cover

Taking Medicare But Not Social Security

It is possible to enroll in Medicare coverage but delay taking your Social Security retirement benefits. For many workers, this strategy is the most financially advantageous.

For most older people, it is a good idea to enroll in all parts of Medicare coverage they plan to use as soon as they are eligible at age 65. If you delay enrolling, Medicare Part D may become more expensive. If you delay signing up for Part B, you may also experience a gap in your coverage or have to pay a late enrollment penalty.

However, if you can afford to, it is often a smart financial decision to delay receiving Social Security benefits until at least your full retirement age in order to increase the benefit you receive. This may mean that there are several years during which you are enrolled and covered by Medicare but not yet receiving your monthly Social Security benefit.

Employer Or Military Retiree Coverage

If you or your spouse has an Employer Group Health Plan as retiree health coverage from an employer or the military , you may not need additional insurance. Review the EGHPs costs and benefits and contact your employer benefits representative or SHIIP to learn how your coverage works with Medicare.

Don’t Miss: What Age Is For Medicare

How Can I Be Eligible For Medicare Part C

The Medicare Advantage program is a type of insurance that many people choose to receive their benefits through. If you are enrolled in both Part A and B, then its possible for you to enroll in the plan as well! Some plans have networks smaller than Original Medicare but may include coverage during prescription time periods too.

Many people are under the misconception that if they enroll in a Medicare Advantage plan, they can drop their Part B and escape paying Part B premiums. This is not true.

Its important to know you need both Parts A and B before you even qualify for a variety of plans like Medigap or one through MA providers. You must have your parts throughout any time spent enrolled with an MA provider no matter whatso dont cancel either!

Who Is Eligible For Medicare Under Age 65

You are eligible for Medicare Part D, but it is not required. You must be enrolled in either Parts A and B to get protection against future catastrophic medication costs. If you do enroll, then your copays on medications currently will also go down.

- Individuals who receive Social Security disability income benefits for 24 months are automatically enrolled in Medicare on the 25th month and get coverage that will last until they qualify for Medigap insurance or other health care plans.

- People with Lou Gehrigs disease can enroll in Medicare at any time as long as their monthly social security benefit is subject to tax withholding, which would require a diagnosis of Lou Gehrigs Disease from an approved medical source like Mayo Clinic rather than just self-diagnosis without proper validation

- The start date of your kidney dialysis treatment also determines when youre eligible for medicare this means if you have had three treatments so far then it may be worth checking into how soon before December 22nd your next

Also Check: Does Medicare Pay For Entyvio

Eligibility For Medicare Part C

Medicare Part C is another name for the Medicare Advantage program which is issued by private insurance companies instead of Original Medicare. You can get them from an agent, broker, or the company directly. Usually, these plans have smaller networks than Medicare, but some of them include built-in Part D coverage.

To be eligible for Part C, you must first be enrolled in both Medicare Parts A and B. You must also live in the plans service area.

Many people think that if they enroll in a Medicare Advantage plan, they can drop their Part B and escape paying Part B premiums. This is NOT the case. You must have both A and B to even be eligible to enroll in either a Medicare Advantage plan or Medigap plan. You must continue to be enrolled in Parts A and B during the entire time that you are enrolled in a Medicare Advantage plan.

Preparing As The Eligibility Age Nears

If a person already receives benefits from the Social Security Administration, the Administration will automatically enroll them in Medicare parts A and B.

The person will receive a âWelcome to Medicareâ packet 3 months before their 65th birthday, with instructions on how to sign up.

A person does not have to be retired to receive Medicare. If a person is not currently receiving Social Security benefits, they can apply for Medicare benefits as early as 3 months before their 65th birthday.

For example, if a person turns 65 years of age in April, they can apply for Medicare benefits in January of the same year.

Applying for Medicare benefits as early as possible may help the Social Security office process the paperwork in time for the personâs 65th birthday.

People who apply too late may face a premium 10% higher than that of those who apply on time. This premium would apply for double the time a person has been eligible but did not apply.

A person can apply for Medicare during their birth month or up to 3 months after their birth month without having to pay penalties for Medicare coverage.

However, their benefits will not begin until the Centers for Medicare and Medicaid Services process their request.

Also Check: Does Medicare Cover International Medical Emergencies

Your First Chance To Sign Up

Generally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65.

Avoid the penaltyIf you miss your 7-month Initial Enrollment Period, you may have to wait to sign up and pay a monthly late enrollment penalty for as long as you have Part B coverage. The penalty goes up the longer you wait. You may also have to pay a penalty if you have to pay a Part A premium, also called Premium-Part A.

What You Need To Know

If eligible, you must have Medicare parts A and B to enroll in retiree insurance and prescription drug programs. To allow for processing, we recommend you enroll in Medicare three months before you turn 65 or otherwise become eligible. For most people, Medicare begins at age 65 or after 24 months of Social Security disability.

If you, your spouse, or your dependents don’t enroll in Medicare Part B when first eligible, the insurance for that person will be canceled. If you request reenrollment, coverage will begin on the first day of the sixth month after ORS receives all required forms and proofs.

If you become disenrolled from Medicare for any reason, you will be disenrolled from the retiree insurance plan. You may be billed for the services Medicare would have covered back to the date of disenrollment.

Recommended Reading: What Is The Best Medicare Supplement Insurance Plan

At What Age Can You Get Medicare

At What Age Can You Get Medicare? In the news, you might hear a lot about Medicare eligibility age could be lowered to 62, or even 60. Currently, Medicare eligibility begins at age 65 for most people. However, you can get Medicare before the age of 65 in certain situations.

Keep reading to know more about how you can qualify for Medicare at different ages.

Read More:Getting Medicare Under the Age of 65

When Can I Apply For Medicare

You can apply for Medicare during the Initial Enrollment Period . IEP is the seven months surrounding your 65th birthday. It includes the three months before you turn 65, the month you turn 65, and the three months after. If you have current employer insurance, you can also register while you are working and for up to eight months after you stop working or lose your coverage. This is a window of time called the Special Registration Period for Part B , if you do not register during these times, you can register during the General Registration Period , which runs from January 1 through March 31 of each year. Your coverage will start on the 1st of July of the year in which you register. You may face a late registration penalty if you qualify for Part B prior to enrolling during the GEP. If you receive Social Security Disability Insurance for 24 months, you are automatically registered with Medicare the 25th month that you receive SSDI.

Recommended Reading: How To Check Medicare Status Online

What Is The Medicare Eligible Age

You may decide to retire at 62 because you can start collecting Social Security at that age and you feel ready to move on to a new stage in life. According to the Social Security Administration, you may start receiving retirement benefits as early as age 62. Your employer health benefits will likely end when you retire and you may wonder about your Medicare eligibility age.

Medicare is the government health care program for people age 65 and older and people younger than 65 with certain disabilities. Your Medicare eligible age is not correlated to when you retire and retiring early will not make you eligible for Medicare. Generally the only ways to be eligible for Medicare before age 65 is to:

- Have end-stage renal disease

- Have ALS

- Have a disability and have been receiving Social Security disability benefits for at least 24 months

If you retire at 62 and do not have a disability, you will generally have to wait three years for Medicare coverage. You can look on eHealth for an affordable individual or family health insurance plan as you wait to reach your Medicare eligible age.

There are certain advantages to waiting to retire beyond age 62 besides reaching the Medicare eligible age. If you retire early, your benefits are reduced a fraction of a percent for each month before your full retirement age, according to the Social Security Administration. The amount your benefit will be reduced depends on your year of birth.

Enrolling When Youre Indigenous

If youre Indigenous and have common identity documents, mail or email them with your Medicare enrolment form to Medicare Enrolment Services.

If you dont have standard identity documents, you can use a referee instead. You and your referee need to fill in the Aboriginal and Torres Strait Islander Medicare enrolment and amendment form. The form says who can be a referee.

You can take your form to your local agent, access point or service centre.

Call the Indigenous access line if you need help with the form.

Also Check: What Is The Cost Of Part D Medicare For 2020

How Medicare Affects Your Coverage

Medicare is the federal health insurance program for people who are 65 or older, or otherwise receiving Social Security disability benefits.

Medicare is divided into four different parts, which cover specific services. You will only need to focus on these three if you enroll in a state-sponsored retiree insurance plan:

- Part A

- Part D

Finding Health Insurance Before Medicare Kicks In

May 13, 2013 / 7:34 AM / MoneyWatch

Finding affordable medical insurance is a critical part of retirement planning, particularly if you want to retire before age 65, the eligibility age for Medicare. By getting the right kind of insurance, you help protect yourself against the threat of high, uninsured medical costs, which can blow up the careful plans you’ve made for your retirement. You’ll also want to factor the cost of your premiums into your

Welcome to Week 13 of my series,

To adequately cover the subject, I’ve written five posts on the topic. This first one will cover your options before age 65 my next four posts will discuss the complex situation you have after you become eligible for Medicare.

Here are four conventional possibilities for getting medical coverage between the time you retire and age 65:

–You might be eligible for retiree medical insurance through your employer or your spouse’s employer. Not many employers offer this type of insurance, but it’s worth your time to find out. If your employer offers it, look at the eligibility requirements to make sure you qualify and to see how much you’d pay for premiums. It’s entirely possible you

You May Like: Is Obamacare Medicaid Or Medicare