Review Your Medicare Choices Each Year

Whether you enroll in original Medicare or a Medicare Advantage plan, you generally do not need to renew coverage every year. That being said, plans are sometimes discontinued or their benefits and costs may change to the point that the plan no longer meets your needs. Its not unusual for pharmacy and provider networks to change, for costs to increase, or the list of covered prescription drugs to vary. Thats why its a good idea to review your plan each year and compare it against your current health care needs.

Your health insurer is required to send you an Annual Notice of Change by September 30 each year. The notice outlines any changes in coverage and costs expected to begin the following January. If you decide to change your health care plan after reviewing those updates, you can do so during Medicares open enrollment period. The period runs from October 15 to December 7. During this time, you can switch from original Medicare to Medicare Advantage or vice versa. You can switch from one Medicare Advantage plan to another or from one Medicare Part D plan to another. You can also enroll in Medicare Part D if you have not done so already, although late enrollment penalties may apply.

If you find that the new health care plan is not meeting your needs, you can reverse some plan decisions January 1 to March 31 of the following year. Guidance for the renewal process is offered through the U.S. governments phone line at 1-800-MEDICARE or through your local SHIP.

Medicare For People Turning 65

Most people know that when they turn 65 they can start receiving Medicare. In general, you are eligible at 65 if you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if you:

- Receive retirement benefits from Social Security or the Railroad Retirement Board

- Are eligible to receive Social Security or Railroad benefits but you have not yet filed

- Had Medicare-covered government employment

If you qualify for Medicare this way, your Initial Enrollment Period will begin three months before the month you turn 65.

If you did not pay Medicare taxes while you worked, and you are age 65 or older and a citizen or permanent resident of the United States, you may still be able to buy Part A.

Can You Get Social Security And Not Sign Up For Medicare

Yes, many people receive Social Security without signing up for Medicare.

Most people arent eligible for Medicare until they turn 65. As you can start collecting Social Security retirement benefits at 62, individuals may have Social Security without Medicare for several years.

Most people enroll in Part B once they turn 65, but you may decide to delay enrolling in Part B if you or your spouse has health insurance through an employer. Be sure to learn more about how Medicare enrollment works in your specific case, though. If you delay enrollment in Medicare Part B when youre first eligible and you dont have other creditable coverage, you could face late enrollment penalties for the rest of the time that you have Part B once you sign up.

As most people dont pay a premium for Part A, theres no reason to cancel the coverage, even if you dont think you need it. You are free to decline other Medicare plans, such as Parts B and D, though again you should make sure you wont cause yourself to go without coverage or have to pay late enrollment penalties in the future.

You May Like: What’s The Cost Of Medicare Part B

Effects On The Budget

Implementing either of the two alternatives would reduce federal budget deficits between 2023 and 2028, according to estimates by the Congressional Budget Office and the staff of the Joint Committee on Taxation . The net reduction in deficits would result from the combined effect of changes to outlays and revenues, both of which would decrease over that period. The reduction in outlays would stem from decreases in spending for Medicare and Social Security . The reduction in revenues would largely stem from increases in federal subsidies for insurance purchased through the marketplaces, a portion of which is provided in the form of reductions in recipients tax payments.

CBO and JCT estimate that under the first alternative, deficits would decrease by $15 billion between 2023 and 2028 that reduction comprises an $18 billion decrease in outlays and a $3 billion decrease in revenues. The agencies estimate that under the second alternative, deficits would decline by an additional $7 billion over the same period because the decrease in outlays and the partially offsetting decrease in revenues would be $8 billion and $1 billion greater, respectively. The estimated reduction in deficits between 2023 and 2028 would be greater under the second alternative because of a larger reduction in Medicare enrollment over that period.

Read Also: Does Medicare Cover Eye Care

Medicare Eligibility For Part D

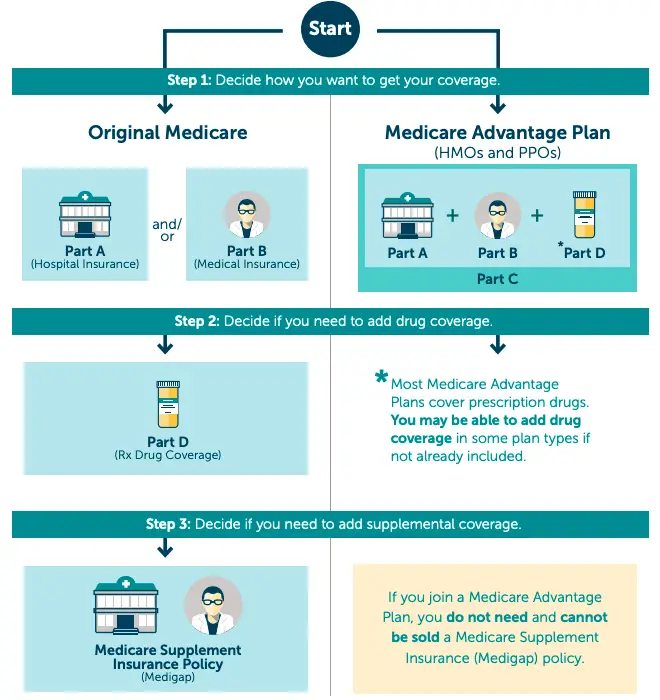

To be eligible for Medicare Part D you must be enrolled in Medicare Part A and/or Part B. You should not purchase a separate Part D drug plan if you are enrolled in Medicare Part C plan that includes drug coverage. Medicare Part D plans are run by private insurance companies, so premium prices and covered drugs will vary by plan.

You should enroll in a Medicare Part D plan when you are first eligible for Medicare, or risk paying a late enrollment penalty. You can avoid paying a late penalty in most cases if you have existing drug coverage.

Don’t Miss: Will Medicare Pay For A Toilet Seat Riser

What Are Medicare Parts C And D And How Many People Are Enrolled

Around a third of Medicare members are enrolled in an Advantage Plan. Since its inception, the number of members who purchase Part C plans has increased.

A survey conducted by the Center for Health Care Strategies found that costs were the highest barrier for low-income seniors in accessing dental coverage. To solve this problem, Progressive Democrats have included pushing to expand Medicare to cover dental, vision, and hearing needs. To appeal to voters, Senator Bernie Sanders took to social media saying: Keeping your teeth in your mouth as you grow old should not be a luxury.

Keeping teeth in your mouth as you grow old should not be a luxury in this country.

Bernie Sanders

With only around thirty percent of seniors having access to dental insurance, many seniors suffer from dental diseases that leave many toothless in their old age. The Centers for Disease Control and Prevention published data that shows that nearly a fifth of those over sixty-five have lost all of their teeth.Twice as many Black beneficiaries have lost all their teeth compared to the national average.

Read Also: Is Entyvio Covered By Medicare Part B

How Much Does Medicare Cost At Age 65

The standard premium for Part B modestly increases year over year. Part A costs also can increase, including the annual deductible and other coinsurance. Known as hospital insurance, Part A doesnt require a monthly premium as long as you have paid Medicare taxes through employment for at least 10 years.

Part B, known as medical insurance, typically pays 80% of the covered cost while you pay the deductible and then 20%.

You May Like: When Is Medicare Supplement Open Enrollment

How Old Do You Have To Be To Get Medicare Part C Or Medicare Supplement

To get Medicare Part C or Medicare Supplement plans, you must be enrolled in Original Medicare. This means, you must be at least 65 years old or meet the Medicare criteria for enrolling under age 65. If you do not meet these criteria, you can get Medicare at age 65.

Medicare Part C and Medicare Supplement plans both act as a supplemental coverage to Original Medicare. However, you cannot have both plans. You are only able to enroll in Medigap OR Part C. If you enroll in Medicare Part C, the plan becomes your primary coverage over Original Medicare. If you enroll in a Medicare Supplement plan, it will pay secondary to Original Medicare. Because they require you to have Original Medicare, you cannot enroll in a plan without Medicare Part A and Part B.

What Are My Insurance Options If I Cannot Get Medicare At Age 62

If you dont qualify for Medicare, you may be able to get health insurance coverage through other options:

- Employer-provided insurance

LeRon Moore has guided Medicare beneficiaries and their families as a Medicare professional since 2007. First as a Medicare provider enrollment specialist and now a Medicare account executive, Moore works directly with Medicare beneficiaries to ensure they understand Medicare and Medicare Advantage Plans.

Moore holds a bachelors degree from Southern New Hampshire University and is A+ Certified with a Medical Records Clerk Certification and Medical Terminology Certification from Midlands Technical College.

Hes passionate about educating, informing, and resolving issues concerning Medicare and Medicare Advantage Plans, and considers it imperative that he does all he can to educate and inform the senior community as much as possible about Medicare.

Don’t Miss: Does Medicare Help Pay For Nursing Home Care

How Do You Qualify For Medicare Early If You Have A Disability

If you have a disability, you may be eligible for Medicare if youâre younger than 65 and:

- You have been collecting Social Security disability benefits for at least 24 months. In this case, youâll likely be automatically signed up for Medicare coverage starting in month 25.

- You have end-stage renal disease . You wonât be automatically signed up for Medicare, though. Youâll still need to contact Social Security or visit their website to enroll.

- You have amyotrophic lateral sclerosis , also known as Lou Gehrigâs disease. If you have ALS, youâll be automatically signed up for Medicare the same month your Social Security disability benefits start.

Other Medicare Eligibility Requirements

There are a few other Medicare eligibility criteria in addition to the age requirement.

- You must be a U.S. citizen or a legal permanent resident who has lived in the United States for at least 5 years.

- You or your spouse mustve paid into Social Security for what amounts to 10 years or more , OR you mustve paid Medicare tax while you or your spouse was an employee of the federal government.

Don’t Miss: Does Medicare Cover Wheelchairs And Walkers

Can I Get Medicare Early If I Retire Early

If you retire earlier than age 65, you will not be eligible for Medicare. Although Medicare is often thought of as insurance for retired people, the Medicare age requirement is still 65. Some people continue to work past age 65 and have insurance coverage through their employer. Many people retire before they turn 65 and must purchase health insurance or are covered on their spouses insurance plan. Although you may be eligible for social security retirement benefits if you retire early, it does not change your age requirement for Medicare health insurance coverage.

How To Get Medicare Part A And Part B Coverage

- If you receive Social Security or RRB benefits for 24 months, you will automatically be enrolled in Medicare Parts A and B at the beginning of the 25th month.

- If you have ALS, you will automatically be enrolled in Medicare Parts A and B as soon as you receive the first month of disability benefits.

- If you have ESRD, you must apply for Medicare benefits. Medicare eligibility depends on a variety of factors, including whether or not you are receiving dialysis, have had a kidney transplant, and/or have paid Medicare taxes sufficiently.

Also Check: How Much Is Premium For Medicare

When Should I Sign Up For Medicare

Generally, we advise people to file for Medicare benefits 3 months before age 65. Remember, Medicare benefits can begin no earlier than age 65. If you are already receiving Social Security, you will automatically be enrolled in Medicare Parts A and B without an additional application. However, because you must pay a premium for Part B coverage, you have the option of turning it down. You will receive a Medicare card about two months before age 65. If you would like to file for Medicare only, you can apply by calling 1-800-772-1213. Our representatives there can make an appointment for you at any convenient Social Security office and advise you what to bring with you. When you apply for Medicare, we often also take an application for monthly benefits. You can apply for retirement benefits online.

If you didnt sign up when you were first eligible for Medicare, you can sign up during the General Enrollment Period between January 1 and March 31 each year, unless you are eligible for a Special Enrollment Period.

Can I Get Medicare At Age 62

Retirement and Medicare typically go hand in hand. So, if you retire at age 62 are you eligible to enroll in Medicare? Unfortunately, you would not be eligible for Medicare if you retire at age 62. You can typically get Medicare at age 65.

If you retire before age 65, you may be eligible for Social Security benefits at age 62, but that will not allow you to enroll in Medicare coverage. You will need to wait until your Initial Enrollment Period begins three months before your 65th birthday to begin the Medicare enrollment process.

Also Check: Does Medicare Cover Eating Disorder Treatment

Preparing As The Eligibility Age Nears

If a person already receives benefits from the Social Security Administration, the Administration will automatically enroll them in Medicare parts A and B.

The person will receive a âWelcome to Medicareâ packet 3 months before their 65th birthday, with instructions on how to sign up.

A person does not have to be retired to receive Medicare. If a person is not currently receiving Social Security benefits, they can apply for Medicare benefits as early as 3 months before their 65th birthday.

For example, if a person turns 65 years of age in April, they can apply for Medicare benefits in January of the same year.

Applying for Medicare benefits as early as possible may help the Social Security office process the paperwork in time for the personâs 65th birthday.

People who apply too late may face a premium 10% higher than that of those who apply on time. This premium would apply for double the time a person has been eligible but did not apply.

A person can apply for Medicare during their birth month or up to 3 months after their birth month without having to pay penalties for Medicare coverage.

However, their benefits will not begin until the Centers for Medicare and Medicaid Services process their request.

Also Check: Will Medicare Pay For A New Mattress

Do I Automatically Get Medicare When I Turn 65

Some people automatically get Medicare at age 65, but those numbers have declined as the Medicare and Social Security ages have continued to drift apart.

Most people who automatically get Medicare at age 65 do so because they have been receiving Social Security benefits for at least four months before turning 65. Traditionally, Medicare premiums are deducted from your Social Security check. For the longest time, you could retire with full Social Security benefits at 65 and start on Medicare at the same time.

You are still automatically enrolled in Medicare Part A and Part B at 65 if youre drawing Social Security, but not as many people draw Social Security that early these days because of changes to the eligibility age for full Social Security benefits.

In 2000, the Social Security Amendments of 1983 began pushing back the standard age for full Social Security benefits. The progressive changes are nearing their conclusion: Beginning in 2022, the standard age for full benefits will be 67 for anyone born after 1960.

Besides the Medicare eligibility age of 65, what remains unchanged is that you can opt to begin drawing partial Social Security benefits as early as age 62. So, if you opt for accepting partial Social Security benefits before age 65, you are automatically enrolled in Medicare.

A smaller group of people also automatically get Medicare at age 65: people who receive Railroad Board benefits for at least four months before 65.

Don’t Miss: Are Doctors Required To Accept Medicare

Ssa Benefits And Medicare

So lets go back to how your full retirement age and Medicare may interact. The biggest thing is that in the past, at age 65, you both got your SSA benefits and became Medicare eligible. This meant you could use your SSA benefits to help pay for Medicare. However, with the full retirement age being at least a year or more past 65, you need to think carefully about when you take your SSA benefits if you want to use them for Medicare costs.

When Can I Apply For Medicare

You may apply for Medicare 3 months before your 65th birthday. This marks the beginning of your Initial Enrollment Period. Your IEP:

- Starts 3 months before the month you turn 65

- Includes the month of your 65th birthday

- Ends 3 months after your birth month

For example, if you turn 65 on July 25, your IEP begins on April 1 and ends on October 31.

The exception to this timeframe is if your birthday falls on the first of the month. In that case, all dates move forward one month. So, if your birthday is July 1, your Initial Enrollment Period begins on March 1 and ends on September 30.

Also Check: Does Medicare Pay For Ambulance Charges

Also Check: When Do I Apply For Medicare Part B

But It Doesnt Have Universal Support

Most Americans support expanding Medicare coverage a 2019 Kaiser Family Foundation poll indicates that 77% of respondents support the idea of introducing a Medicare buy-in for people as young as 50.

But the idea faces detractors in Congress.

And not just from Republicans more conservative members of the Democratic party are likely to push back on any changes to the state-sponsored health system.

In response to Bidens comparatively modest proposed changes, hospital communities argued that expanded health care could encourage more people to retire younger, which would negatively impact the workforce. Theyre also concerned it would reduce the amount health care providers receive in reimbursements.

Also Check: Which Of The Following Is True Regarding Medicare Supplement Policies