Medicare Advantage Vs Medicare

Medicare Advantage Plans may have provider networks that limit your choices. If you go outside the network, your care may not be covered. With Original Medicare, you generally can use any doctor or medical facility that accepts Medicare assignment.

In exchange for less freedom, though, you often pay less. You would still be required to pay a monthly premium for Part B, but the additional cost for a Medicare Advantage Plan may be less than for a Medigap plan. Sometimes the Medicare Advantage Plan may have a $0 premium.

Medicare Advantage Plans may also have a maximum out-of-pocket limit for covered care. That caps the amount youll be expected to pay in addition to your premiums. Original Medicare and most Medigap plans dont have out-of-pocket maximums.

Medigap Plan Changes In 2020

Medigap plans come in a variety of configurations. In most states, the 10 standardized Medigap plans that are available are designated with letters . These are not to be confused with Medicare Parts A through D.

Two popular Medigap plans, C and F, offer full coverage of Part B outpatient deductibles. Because of a change to federal law, neither of these plans is now available to new Medicare beneficiaries who first became eligible for Medicare after January 1, 2020.

If you already had Plan C or Plan F before Jan. 1, 2020, you can keep your plan. If you were eligible for Medicare before that date, you can still buy either plan if they are available where you live.

Likewise, Medigap is not compatible with a Medicare Advantage plan, and enrolling in a gap plan could result in automatic disenrollment from your Part C coverage.

Guaranteed Issue Rights For Medigap

Because Medigap plans are designed for seniors enrolled in Original Medicare, they are subject to heavy regulation meant to protect beneficiaries from unexpected difficulties. One rule all Medigap providers have to follow concerns guaranteed issuance of a policy.

All 50 states require Medigap providers to accept qualified applicants without regard to pre-existing conditions during times when they have a guaranteed issue right. No applicant can be refused coverage because of a negative health history or current health condition if they apply when they have guaranteed issue rights.

Guaranteed issue rights can be granted for a number of reasons, such as losing Medigap coverage through no fault of your own, moving to a new area that isnt serviced by your plan and during your Medigap Open Enrollment Period.

If you apply for a Medicare Supplement plan during a time when you dont have a guaranteed issue right, a Medicare Supplement Insurance company can ask you to undergo medical underwriting as part of the application process. They can charge you more for your plan or deny you coverage altogether based on your health.

Also Check: Does Medicare Supplemental Insurance Cover Pre Existing Conditions

Medicare Part D Prescription Drug Plan Enrollment

When youre eligible to enroll in Original Medicare, you also become eligible to enroll in a Medicare Part D prescription drug plan.

If you want Medicare prescription drug coverage, you typically have two options:

- Enroll in a Medicare Advantage plan that includes prescription drug coverage

- Enroll in a Medicare Part D standalone prescription drug plan

Or call 1-800-557-6059TTY Users: 711 to speak with a licensed insurance agent.

You can also enroll in a prescription drug plan online in as little as 10 minutes when you visit MyRxPlans.com.1

Can I Apply For Medicare Supplements Online

Once youve enrolled in Medicare, you can sign up for Medicare supplement plans online. The best time to enroll in Medigap is during your initial OEP that begins the month youre 65 and enrolled in Medicare Part B. This is when youll generally get the best prices and most policy choices. Your OEP cannot be changed or repeated.

Applications for Medigap outside of your OEP may be denied. Some states may instead allow you to buy Medicare SELECT, another type of Medigap policy.

You can find a Medigap policy that provides coverage near you through Medicare.govs search portal.

You May Like: Does Medicare Cover Full Body Scans

Enrolling In A Medicare Advantage Plan During A Special Enrollment Period

If you missed the other enrollment periods, you generally have to wait for the next Annual Election Period. However, there are certain special circumstances that could qualify you for a Special Enrollment Period, such as:

- You moved out of your current Medicare Advantage plans service area.

- You are eligible for Medicaid.

- You qualify for the Extra Help program, which assists with the cost of your prescription medications.

- You are receiving care in an institution, such as a long-term care hospital or skilled nursing facility.

- You want to switch to a Medicare Advantage plan with a 5-star overall quality rating.

Medicare Part D Coverage

Medicare Part D is the prescription drug benefit that went into effect in 2006. This benefit pays much of the costs for several classes of prescriptions that beneficiaries can pick up at the pharmacy.

Drugs covered by Part D are those controlled by prescription, which are not administered in the hospital or at an outpatient medical office.

Coverage costs and limitations can be complicated, as can the list of covered medications. Speaking with a plan representative can help seniors plan for continuing coverage of needed prescriptions during transitional times.

You May Like: How To Sign Up For Aetna Medicare Advantage

How To Apply For A Medicare Advantage Plan

Prepare and compare to find the best Advantage plan for you.

Medicare Advantage is private insurance’s counterpart to Original Medicare. It’s a great alternative for receiving your Medicare coverage. Rather than purchasing individual components through Original Medicare, Medicare Advantage bundles benefits from Part A and Part B and can even include drug coverage, vision, dental, hearing, and fitness benefits.

If youre ready to join a Medicare Advantage plan, you can easily enroll in one of two ways.

Cost Of A Medicare Advantage Plan

Medicare Advantage policyholders pay their standard Part B premium and they pay their private insurance for the additional coverage. The additional coverage costs between $0 $300 per month. The greater the benefits, the greater the costs, so one should assume that Medicare Advantage plans that cover the additional non-medical benefits discussed in this article will cost several hundred dollars per month. The costs will vary based on state, and private insurers may change the cost once per year.

Recommended Reading: Do You Have To Resign Up For Medicare Every Year

What Are The Medicare Advantage Rules

There is a reason people ask why Medicare Advantage plans are bad? The thing is, you HAVE to use the network of doctors they allow. So, if youre visiting family in Florida, a doctors visit could be 100% your responsibility. Or, if you have a specialist that isnt in the network, if you see that doctor, the cost is all on you.

On top of following the doctor network, you may need a referral every time you want to see a specialist. With Medigap, a referral is a thing of the past.

While there are many reasons to say Medigap is more comprehensive than Advantage, some coverage is always better than no coverage.

Good News About Qualifying For Medicare Advantage

You might qualify for Medicare before age 65 if you have end-stage renal disease . But if you have ESRD, it used to be that you wouldnt qualify for most Medicare Advantage plans. End-stage renal disease is permanent kidney failure that requires you to get dialysis regularly, or have a kidney transplant.

Starting January 1, 2021, youll still be eligible for a Medicare Advantage plan even if you have ESRD.

How can you know if you live within a Medicare Advantage plans service area?

Heres one way you can find out, and its easy. Just enter your ZIP code in the box on this page and click the button. eHealths plan finder will display a list of Medicare Advantage plans in your area. Not only that you can enter your medications and even your doctor to see what plans might cover your medications, and might have your doctor in the plans network.

Of course you are always welcome to contact a licensed eHealth insurance agent.

A plans formulary may change at any time. When required by law, you will receive notice from your plan of changes to the formulary.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealths Medicare related content is compliant with CMS regulations, you can rest assured youre getting accurate information so you can make the right decisions for your coverage. Read more to learn about our Compliance Program.

Don’t Miss: What Information Do I Need To Sign Up For Medicare

Medicare Part D Eligibility

Seniors can enroll in a Part D plan at the same time they enroll in their other Original Medicare benefits, during the initial 7-month window bracketing their 65th birthday.

The Social Security Administration strongly advises seniors approaching eligibility to sign up for a Part D plan as early in that window as possible, as there is a 3-month delay that comes with transferring benefits onto a Part D plan.

For seniors who need daily medication, any delay can create a dangerous gap in coverage. If a lapse in coverage is unavoidable, seniors signing up for Part D are encouraged to speak to their doctor or pharmacist and arrange for an extra supply of prescription medications to be issued to ensure a constant supply during the delay.

In addition to the initial sign-up period, beneficiaries may be able to enroll in a Part D plan during the Fall Open Enrollment .

AEP begins on October 15 of each year and ends on December 7. Changes can be made at any time during this window, including first-ever enrollment in a Part D plan or switching from one Part D plan to another. Any changes made to Part D coverage during this window take effect on the following January 1.

Prescription components attached to a Medicare Advantage plan have the same open, annual and special enrollment periods as the rest of the Part C plan they are connected with.

Always speak with a plan representative prior to making changes to a Part C coverage plan, especially when adding a Part D optional plan.

How To Sign Up For Medicare Part D

Like Medicare Advantage plans, Medicare Part D plans are sold by private insurance companies, so it may be helpful to contact a licensed insurance agent who can help you shop for plans in your area.

You can compare Part D plans available where you live and enroll in a Medicare prescription drug plan online.

Compare Medicare prescription drug plans in your area

Or call 1-800-557-6059TTY Users: 711 to speak with a licensed insurance agent. We accept calls 24/7!

Also Check: Who Is Eligible For Medicare In Georgia

Can I Apply For Medicare Advantage Plans Online

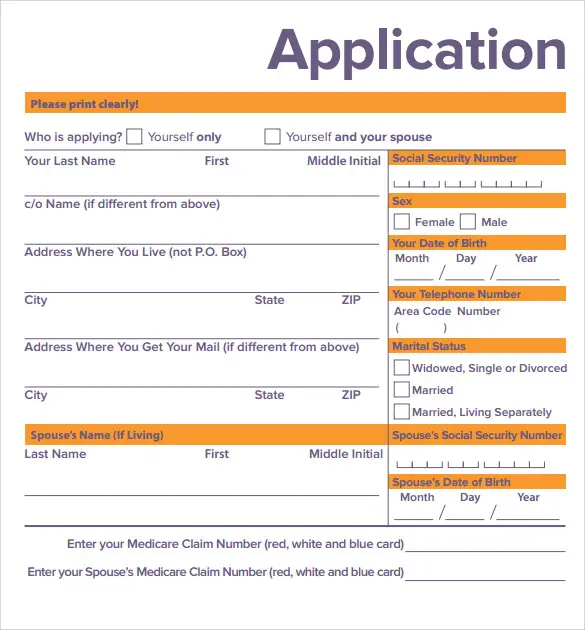

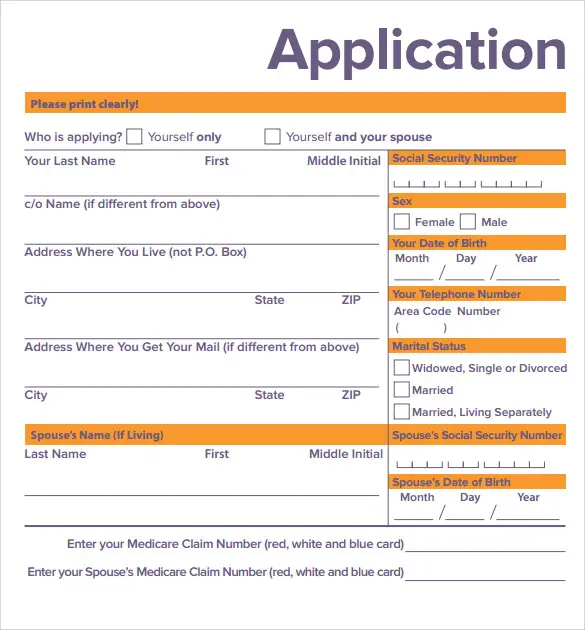

You can apply for some Medicare Advantage Plans online. All plans must provide the option to apply with a paper application, but not all offer online application services. Youll need to visit the plans website to determine if they allow you to join online and obtain the proper enrollment forms. Youll need to provide your Medicare number and the date your Part A and/or Part B coverage began, both of which can be found on your Medicare card.

You can use Medicares Plan Finder to get more information about Medicare Advantage Plans and find their respective contact information.

If You Have Other Coverage

Talk to your employer, union, or other benefits administrator about their rules before you join a Medicare Advantage Plan. In some cases, joining a Medicare Advantage Plan might cause you to lose employer or union coverage. If you lose coverage for yourself, you may also lose coverage for your spouse and dependents.

In other cases, you may still be able to use your employer or union coverage along with the Medicare Advantage plan you join. Remember, if you drop your employer or union coverage, you may not be able to get it back.

You May Like: Are Motorized Wheelchairs Covered By Medicare

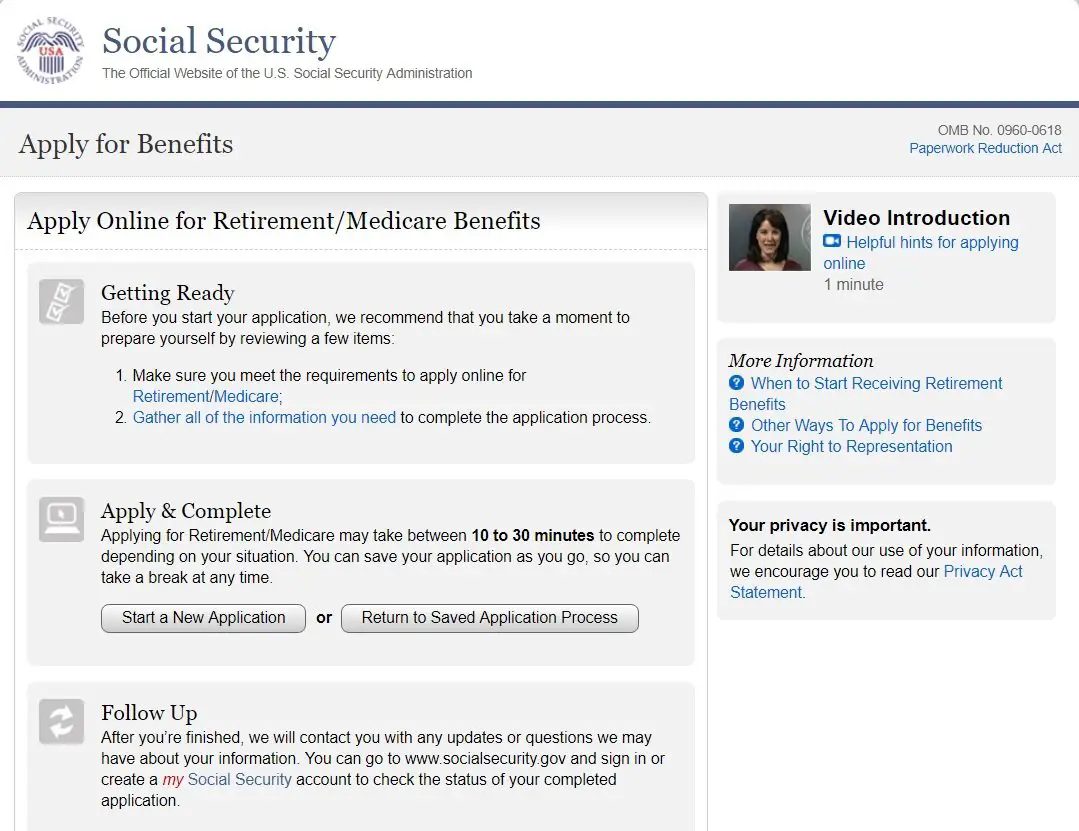

Complete The Online Medicare Application

The SSA provides a checklist for online Medicare applications that specifies the information youll need to create a Social Security account and complete the Medicare online application.

Note you must be within 90 days of your 65th birthday for this to be applicable, Norce says. If you had a Special Enrollment Period , for example working past 65 with employer insurance, you can apply online via Medicares secure online application specifically for this situation.

In order to complete an online application under the SEP for loss of employer coverage, youll either need a completed CMS-L564 form from your employer or to provide additional information, such as pay stubs showing your insurance premium payments, a copy of your current year ID or a tax return indicating your insurance payments, Norce says. You will need to convert these documents to a PDF or such, as you will be required to upload as verification of your Special Enrollment Period during the online application process, adds Norce.

How To Apply For Medicare

If youre receiving benefits from the SSA or the Railroad Retirement Board , you dont have to apply for Medicare. Youll automatically be signed up for Medicare parts A and B as you near your 65th birthday.

Your Medicare card and enrollment information will be mailed to you 3 to 4 months before your birthday. But if youd like to enroll in Part D or want to switch to Medicare Advantage , you can do this during your initial enrollment period. Well explain more about that later.

If youre not automatically enrolled, youll need to apply for original Medicare and any additional coverage you want. Your enrollment period will depend on several factors, including your employment status and the types of coverage you want.

Don’t Miss: Are Medicare Advantage Premiums Deducted From Social Security

Benefits Of The New Medicare Advantage Plans For Alzheimers

Under the changes, Medicare Advantage becomes more about practical improvements to the lives of Alzheimers sufferers. The Centers for Medicaid and Medicare Services says Medicare Advantage will cover Special Supplemental Benefits For Chronically Ill enrollees if the item or service has a reasonable expectation of improving or maintaining the health or overall function of the enrollee as it relates to their chronic disease. This can be interpreted broadly, but it is meant specifically for sufferers of long-term illnesses like Alzheimers and other dementias. For years, home health care and caregivers have only been available outside Medicare, but the new Advantage is changing to reflect these needs. Hot meals, rides to doctor appointments, and around-the-house safety improvements should also be covered and can keep people living in their homes longer instead of being placed in nursing homes.

Home Modifications

Non-Medical Home Care

Something essential for a person with Alzheimers, but not necessarily medical, is companionship. This can be someone around simply for supervision, recreation, and conversation. It can also be more personal help, like a professional who bathes, dresses, and helps with using the bathroom or eating or exercising. And it can also be a homemaker, who handles chores like tidying up and preparing meals. These services will now be an option under Medicare Advantage.

Adult Day Care

Memory Care / Assisted Living

What Is The Medicare Advantage Plan Initial Coverage Election Period:

Most beneficiaries are first eligible to enroll in a Medicare Advantage plan during the Initial Coverage Election Period. Unless you delay Medicare Part B enrollment, this enrollment period takes place at the same time as your Initial Enrollment Period , starting three months before you have both Medicare Part A and Medicare Part B and ending on whichever of the following dates falls later:

- The last day of the month before you have both Medicare Part A and Part B, or

- The last day of your Medicare Part B Initial Enrollment Period.

If youre under 65 and eligible for Medicare due to disability, your IEP will vary depending on when your disability benefits started.

Recommended Reading: What Is The Cost Of Part D Medicare For 2020

Don’t Give Personal Information To Plan Callers

Medicare plans aren’t allowed to call you to enroll you in a plan, unless you specifically ask to be called. Also, plans should never ask you for financial information, including credit card or bank account numbers, over the phone.

No one should call you without your permission, or come to your home uninvited to sell Medicare products. Call 1-800-MEDICARE to report a plan that does this. Learn more about how to prevent Medicare fraud and abuse.

What Are The Requirements For Medicare Advantage Plans

If youre Medicare-eligible you can enroll in an Advantage plan in your area. Not all areas have Advantage plans so, youll want to check before you get your heart set on a policy.

Several Medicare Advantage enrollment periods exist. These are instances when youre eligible to change plans, such as the Annual Enrollment Period, the Medicare Advantage Open Enrollment Period, and during a Special Enrollment Period.

If you move out of the service area or the plan leaves Medicare, you can switch policies using Special Enrollment rights.

Further, if you have a Medigap plan and want to try a Medicare Advantage plan, you have eligibility for trial rights. You get to try the Advantage plan for up to 12 months.

Then, before the 12 months, if you decide the Advantage plan isnt right, you can switch back to Medigap. You must first see if your original policy is still available through your previous company.

If not, you can choose any policy of equal or lesser value with any company.

Don’t Miss: What Is The Cost Of Medicare Supplement Plan F

How To Switch Medicare Advantage Plans

If you want to change Medicare Advantage Plans, you can do so once a year, either during Medicare’s fall open enrollment period or the Medicare Advantage open enrollment period .

You also can change to Original Medicare during these periods, but it could be hard to get a Medicare Supplemental Insurance policy if you switch after the first year. Insurers are required to issue you Medigap policies only during your initial Medigap enrollment period , or if you switch out of your Medicare Advantage Plan in the first year. After that, insurers may deny you a Medigap policy if you have health problems, or they can require a waiting period before your preexisting conditions are covered.